Market Overview

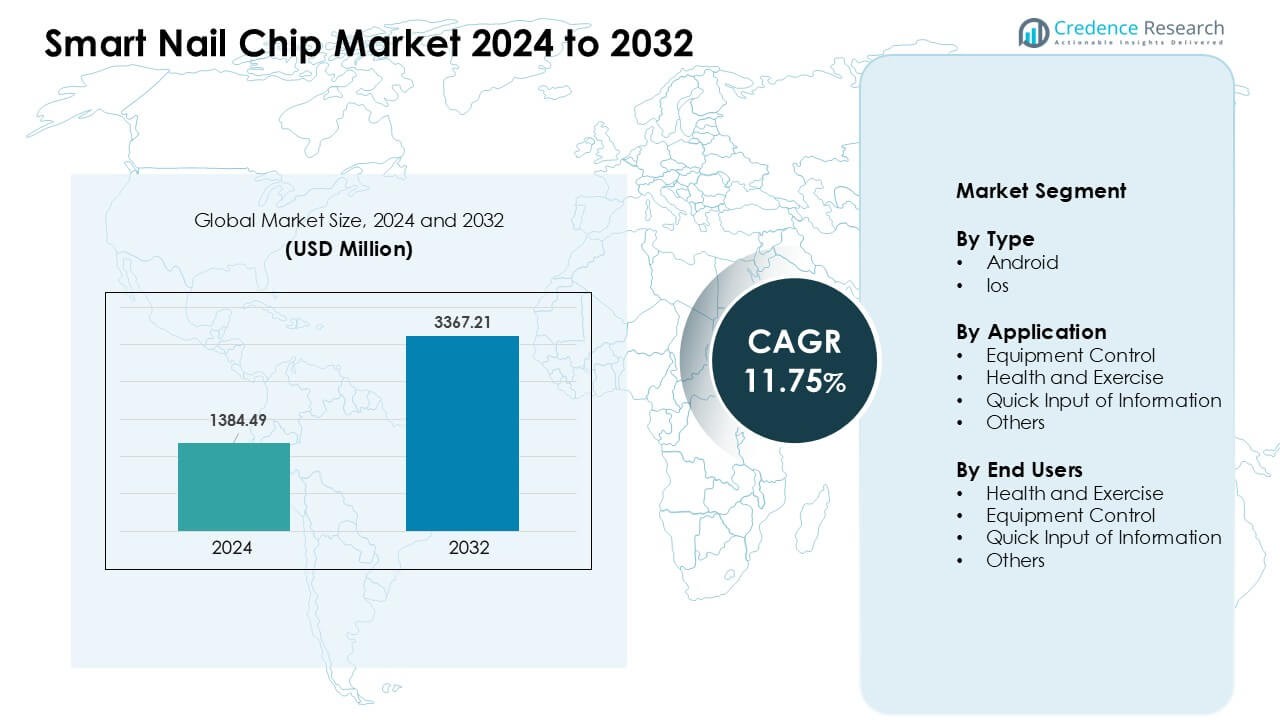

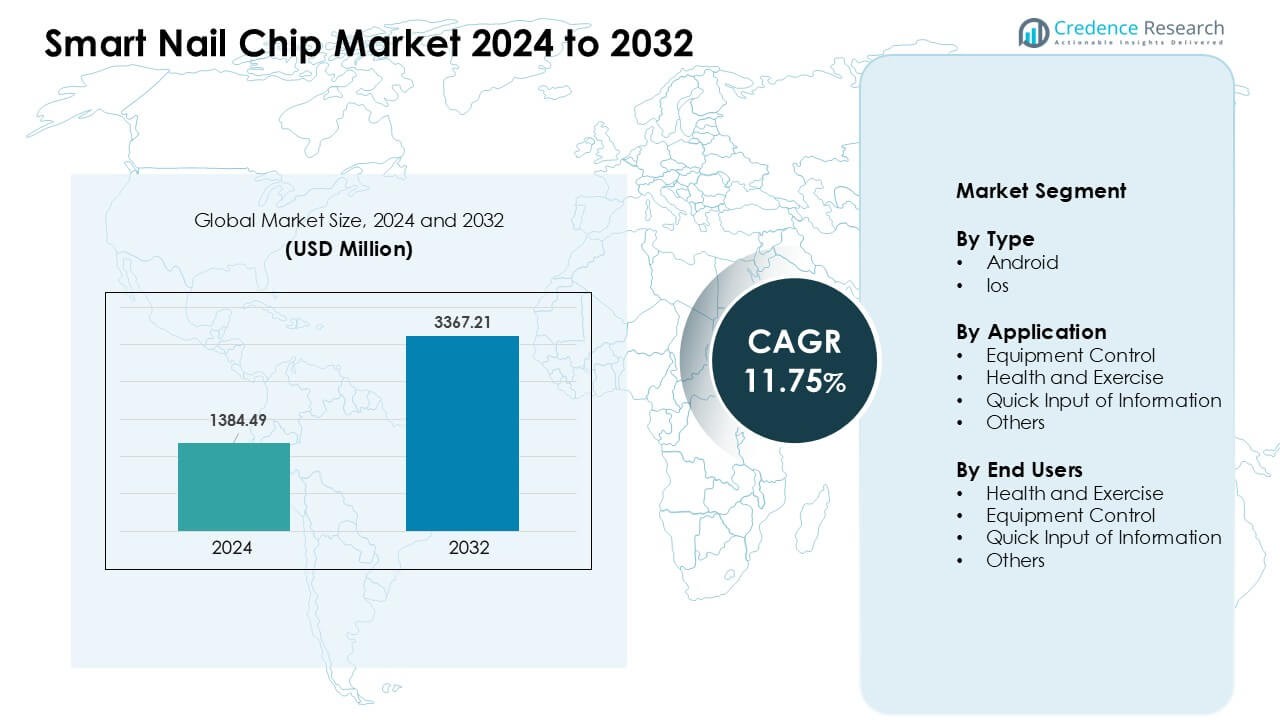

Smart Nail Chip Market was valued at USD 1,384.49 million in 2024 and is anticipated to reach USD 3367.21 million by 2032, growing at a CAGR of 11.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Nail Chip Market Size 2024 |

USD 1,384.49 Million |

| Smart Nail Chip Market, CAGR |

11.75% |

| Smart Nail Chip Market Size 2032 |

USD 3367.21 Million |

The Smart Nail Chip Market is shaped by key players such as Harperton, Jakckom, Revlon, Goddez Bling Bitz, Smart Chip, Indigo-Deals, Stamped Marketing, and Tago. These companies compete through advanced gesture features, secure pairing, and fashion-tech integrations that appeal to fitness users, smart home buyers, and style-driven consumers. North America led the global market in 2024 with about 38% share, supported by high smartphone use, strong interest in contactless control, and early adoption across gyms, offices, and connected homes. This regional advantage helps drive ongoing innovation and faster acceptance of smart wearable technology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Nail Chip Market reached USD 1,384.49 million in 2024 and is projected to hit USD 21 million by 2032 at a CAGR of 11.75%.

- Rising demand for contactless interaction and gesture-based control drives adoption, with Android holding about 61% share due to wider compatibility and lower integration cost.

- Fashion-tech designs and wellness-focused features shape emerging trends as users seek stylish, lightweight, and functional wearable tools for fitness, quick input, and automation.

- Key players such as Harperton, Jakckom, Revlon, Goddez Bling Bitz, Smart Chip, Indigo-Deals, Stamped Marketing, and Tago compete through app optimization, secure pairing, and IoT partnerships.

- North America led the market with nearly 38% share in 2024, while equipment control remained the top application segment with about 37% share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Android held the dominant share in 2024 with about 61% of the Smart Nail Chip Market. Android captured strong demand because developers offered wider device support, lower integration cost, and flexible APIs for chip pairing. Brands targeted fitness users and gadget buyers with easy app links and open-source tools. IOS grew at a steady pace due to high adoption in premium phones and strong security layers. Growth in both platforms came from rising mobile use, higher interest in gesture input, and broader retail access.

- For instance, iOS grew at a steady pace due to high adoption in premium phones and strong security layers. Growth in both platforms came from rising mobile use.

By Application

Equipment controlled the application segment in 2024 with nearly 37% share. Users chose this function because smart nail chips enabled fast, touch-free control of doors, devices, and personal gadgets. Demand rose in offices, gyms, and home automation due to rising interest in gesture-based access. Health and exercise followed as chips supported activity tracking and comfort-focused features. Quick information input gained traction among teens and creators. Growth across the segment came from rising digital habits and expanding wearable ecosystems.

- For instance, Smart Chip Switzerland AG one of the companies publicly launching fingernail‑based chips rolled out its product in about 100 locations across Switzerland and Germany, enabling contactless payments and secure entry to physical access points such as buildings or vehicles.

By End Users

Health and exercise users held the largest share in 2024 with about 35% in the Smart Nail Chip Market. Fitness groups adopted smart nail chips for simple gesture logging, exercise tracking, and contactless machine control. Adoption increased in gyms and wellness centers as smart wearables expanded. Equipment control users grew due to rising smart home devices and workplace automation. Quick input users gained interest from students and digital creators. Segment growth came from rising health focus, growing contactless needs, and better app support across platforms.

Key Growth Drivers

Rising Adoption of Contactless Interaction

Demand for contactless engagement keeps rising as users shift toward safer and faster digital actions. Smart nail chips support tap-based control, instant authentication, and quick device pairing, which boosts their use in public spaces, gyms, offices, and transport systems. Growing interest in gesture control also supports wearables that blend style with utility. Brands promote these chips as simple tools for access, fitness tracking, and information exchange. Wider smartphone use and stronger app ecosystems help more people adopt this technology. These factors push steady growth in regions with high digital readiness.

- For instance, Smart Chip Switzerland AG recently began rolling out its fingernail‑based NFC chip at over 100 locations across Switzerland and Germany offering contactless payments and contact‑data sharing directly via a fingernail.

Expansion of Fitness and Wellness Ecosystems

Fitness users drive major growth as smart nail chips link body motion and daily activity to mobile apps. Gyms and wellness centers use these chips for logging workouts, controlling machines, and tracking progress. The wellness shift among young users strengthens adoption because chips offer comfort, low weight, and hands-free actions. Brands highlight health insights and quick data input as key benefits. Rising interest in personalized fitness plans and biometric tools helps the market expand. The trend matches stronger digital routines and broader health awareness across major regions.

- For instance, researchers behind picoRing a battery‑free smart ring technology demonstrated a prototype ring weighing only 1.5 grams that supports thumb-to-finger interactions like pressing, sliding, or scrolling.

Integration with Smart Home and IoT Platforms

Smart homes and IoT networks create steady demand for easy and secure device control. Smart nail chips support door access, appliance activation, and routine automation with simple gestures. Growth rises as consumers add more connected devices and seek seamless control without bulky wearables. Chip makers work with IoT brands to offer smooth pairing and faster commands. These efforts improve user comfort and strengthen trust in gesture-based control. Strong adoption in urban homes and offices pushes long-term demand, especially where smart housing projects keep expanding.

Key Trends & Opportunities

Rise of Fashion-Tech Hybrid Designs

Smart nail chips now merge style and function, which attracts younger buyers seeking personalized looks. Fashion brands explore nail-art designs that hide the chip while keeping gesture features. This trend grows as users want wearables that look natural rather than bulky. Social media spreads these designs faster, boosting interest among students and creators. The fusion of beauty and tech supports wider retail adoption and fresh product lines. This shift encourages device makers to form new partnerships with the fashion industry.

- For instance, Smart Chip Switzerland AG one of the pioneers in fingernail‑applied chips offers a chip that, after application, can be covered with regular gel polish or manicure treatment and still function, making it virtually indistinguishable from ordinary manicured nails.

Strong Growth in Gesture-Based Control Ecosystems

Gesture control gains momentum as users prefer quick, screen-free interaction. Smart nail chips fit this shift because they enable precise and fast gestures without the need for large sensors. Developers improve gesture libraries to support tasks like access control, fitness tracking, and messaging shortcuts. Demand grows in offices, gyms, and connected homes due to rising digital automation. The trend also supports better accessibility for users who want minimal device handling.

- For instance, research from Georgia Institute of Technology demonstrated a wearable ring‑and‑wristband system (called FingerPing) capable of recognizing 22 different micro‑finger gestures, enabling users to control text input or app commands with simple hand/finger movements showing how small, discreet wearables can deliver rich gesture‑based control.

Expansion Into Healthcare and Assistive Tech

Healthcare and assistive tech offer strong opportunities as smart nail chips help track motion, support reminders, and aid people with limited hand mobility. Hospitals and clinics test them for patient monitoring and safe access control. Wellness apps also use these chips for habit logging and gentle activity tracking. These features help expand the market into a new user group. Growing interest in remote care and simple digital tools supports adoption across medical settings.

Key Challenges

Limited Awareness and Early-Stage Adoption

Many users still lack awareness of smart nail chip functions, which slows early adoption. Buyers often view the product as niche or cosmetic rather than a practical control tool. Retail presence also remains limited, especially in developing regions. The need for proper app pairing and basic setup adds small barriers for first-time users. These issues reduce market speed despite strong interest from tech-savvy groups. Wider education, simple demos, and social campaigns can help reduce these gaps.

Privacy and Security Concerns

Smart nail chips handle access control and quick data actions, which raises user concerns about safety. People worry about unauthorized scans or improper data use. Weak encryption or poor app security can lower trust and restrict adoption. Developers must improve secure pairing, user permissions, and clear data rules. These steps help users feel safe with gesture-based control and contactless actions. Strong security also supports broader use in offices, smart homes, and healthcare settings.

Regional Analysis

North America

North America held the leading position in the Smart Nail Chip Market in 2024 with about 38% share. Adoption stayed strong due to high use of smartphones, wider interest in contactless control, and early use of gesture-based wearables. Fitness users and smart home buyers drove most demand as brands promoted quick pairing and secure access tools. Tech-focused consumers in the US and Canada supported early trials in gyms, offices, and retail spaces. Strong retail networks and active fashion-tech partnerships helped the region keep its lead as new app features improved user engagement.

Europe

Europe accounted for nearly 27% share in 2024, driven by strong interest in wellness devices and rising digital access systems across homes and workplaces. Countries like Germany, the UK, and France adopted gesture-based control for automation, fitness tracking, and secure entry points. Demand increased as fashion brands introduced nail-art designs with embedded chips, pushing broader style-tech adoption. EU data rules encouraged safer designs, which improved user trust. Growing investment in IoT infrastructure and steady rollout of smart facilities helped the region maintain a solid growth path.

Asia-Pacific

Asia-Pacific captured about 29% share in 2024, supported by large smartphone users, strong urbanization, and wider interest in smart accessories. China, Japan, and South Korea drove early adoption with strong tech culture and active beauty-tech trends. Demand rose among young buyers who preferred wearable tools for fitness, quick input, and automation tasks. Expanding smart home projects and strong local manufacturing boosted supply. Growing fashion-tech collaborations and rising digital payments strengthened long-term potential. The region’s fast innovation cycle helped new chip designs reach the market quickly.

Latin America

Latin America held around 4% share in 2024, with gradual adoption driven by growing smartphone penetration and rising interest in low-cost wearable tools. Brazil and Mexico led demand due to expanding fitness communities and early smart home upgrades. Retail awareness remained limited, yet social media trends helped attract young buyers. Local brands tested affordable chip-based gesture tools for gyms and entertainment venues. Economic shifts slowed adoption in some areas, but steady urban growth and rising digital habits supported slow but stable market expansion.

Middle East & Africa

The Middle East & Africa region accounted for about 2% share in 2024, mainly supported by early smart home integration in Gulf countries. The UAE and Saudi Arabia led adoption as consumers sought premium contactless controls and high-tech wellness tools. Awareness stayed lower across Africa, yet urban centers showed interest in simple gesture-based devices. Fitness clubs and gated communities began testing chip-enabled access systems. Limited retail presence and higher costs slowed wider penetration. However, expanding digital infrastructure and rising lifestyle upgrades support long-term opportunity across the region.

Market Segmentations:

By Type

By Application

- Equipment Control

- Health and Exercise

- Quick Input of Information

- Others

By End Users

- Health and Exercise

- Equipment Control

- Quick Input of Information

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Smart Nail Chip Market includes active players such as Harperton, Jakckom, Revlon, Goddez Bling Bitz, Smart Chip, Indigo-Deals, Stamped Marketing, and Tago. These companies compete by improving chip size, gesture accuracy, and seamless pairing with Android and IOS devices. Many brands work with nail-art designers, gyms, and IoT device makers to boost visibility and expand use cases in fitness, automation, and quick-input tasks. Firms also enhance app interfaces and security layers to build stronger user trust. Product launches, stylish designs, and affordable variants help widen market reach, while online retail platforms support rapid adoption and keep competition intense across global markets.

Key Player Analysis

- Harperton

- Jakckom

- Revlon

- Goddez Bling Bitz

- Smart Chip

- Indigo-Deals

- Stamped Marketing

- Tago

Recent Developments

- In 2025, Harperton nail clipper set was again highlighted in consumer product rankings (for example, a Strategist guide on best nail clippers), reinforcing Harperton position in premium nail-grooming tools, but there is still no publicly reported launch of an electronic or NFC-based smart nail chip product from the brand.

- In October 2025, Smart Chip Switzerland AG publicly announced the commercial launch / availability of its fingernail-applied Smart Chip in Germany and Switzerland (press release dated October 24, 2025). The company describes the chip as an ultra-thin, fingernail-applied device that can be used for contactless payments and sharing contact data, with additional use-cases planned. Media coverage reporting the product availability appeared in October 2025.

- In 2025, Revlon’s nail tools and clippers, including the Revlon Deluxe Nail Clipper and manicure kits, continued to feature in independent buyer guides and market reports, keeping the brand prominent in nail-care hardware; however, Revlon has not announced a dedicated NFC smart nail chip and remains focused on traditional tools plus digital try-on for nail colors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as contactless interaction becomes a standard part of daily routines.

- Fashion-tech integration will expand, making smart nail chips more appealing to style-focused users.

- Gesture-control accuracy will improve, enabling smoother interaction across devices.

- Fitness and wellness applications will grow as consumers seek lightweight digital tracking tools.

- Smart home and IoT adoption will strengthen chip use for access and automation tasks.

- Security features will gain focus as buyers look for safer pairing and data protection.

- Partnerships between tech firms and beauty brands will increase product visibility.

- Costs will decline as manufacturing efficiency improves and adoption widens.

- Retail expansion through online platforms will boost global accessibility.

- Emerging regions will show faster growth as awareness and digital infrastructure improve.

Market Segmentation Analysis:

Market Segmentation Analysis: