Market Overview:

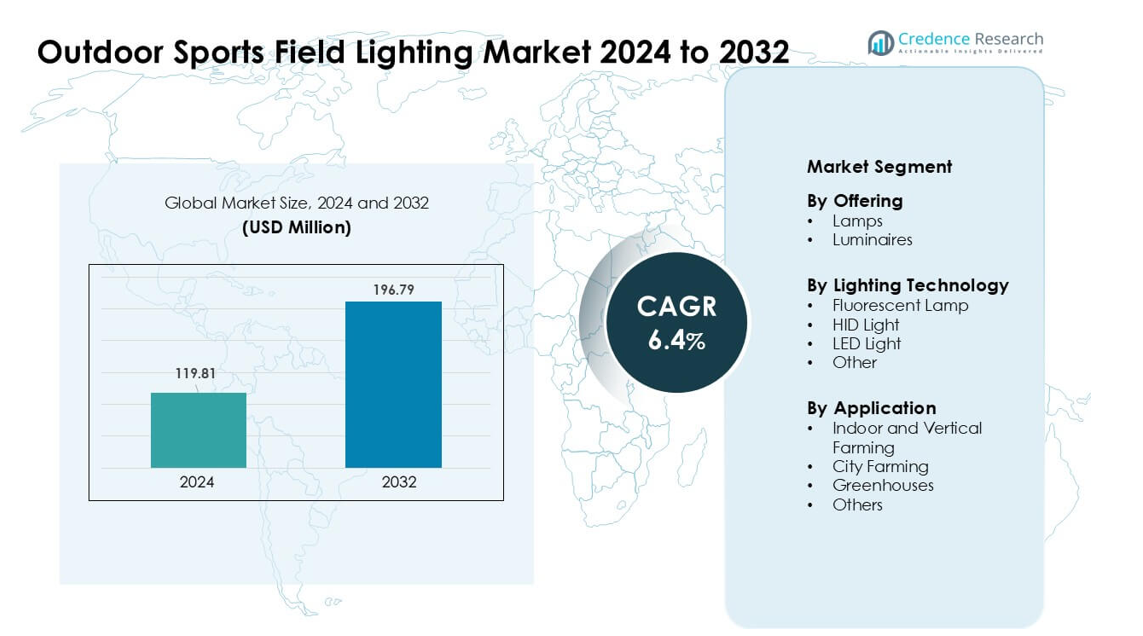

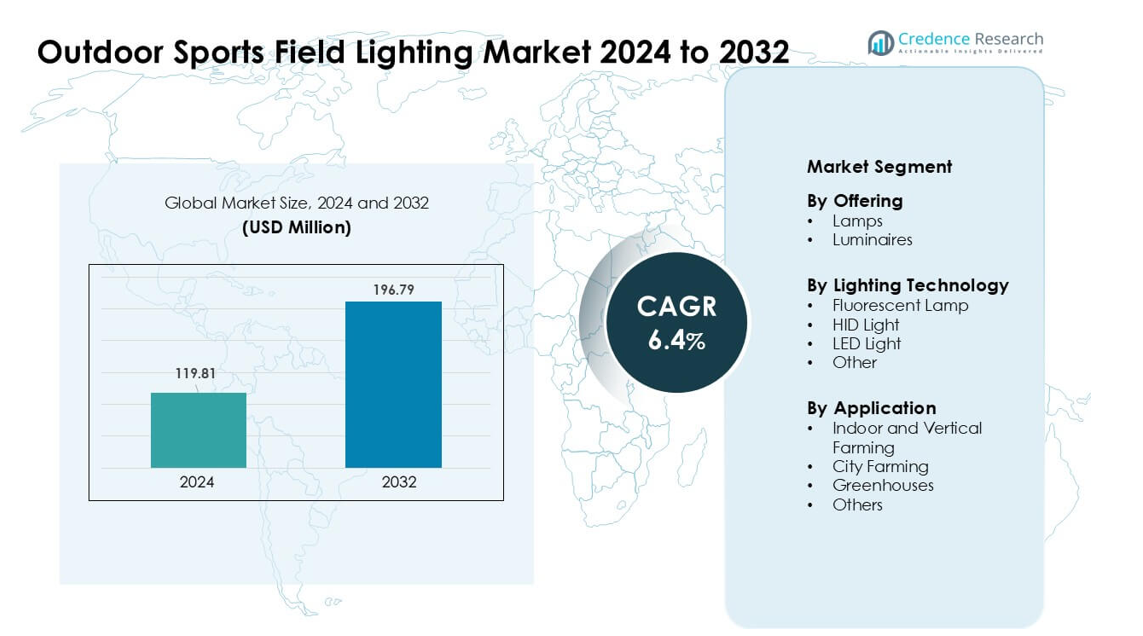

Outdoor Sports Field Lighting Market was valued at USD 119.81 million in 2024 and is anticipated to reach USD 196.79 million by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Outdoor Sports Field Lighting Market Size 2024 |

USD 119.81 million |

| Outdoor Sports Field Lighting Market, CAGR |

6.4% |

| Outdoor Sports Field Lighting Market Size 2032 |

USD 196.79 million |

The outdoor sports field lighting market is led by major companies such as Hubbell Inc, Panasonic Corporation, Osram, Thorn Lighting, GE Lighting, Eaton Corporation, Cree Inc, Acuity Brands Inc, Philips Lighting, and Schneider Electric. These players focus on high-efficiency LED luminaires, advanced optics, and smart control systems to meet the growing demand for durable, energy-saving lighting across stadiums, schools, and community sports fields. They compete through technological upgrades, broad product portfolios, and partnerships with municipal and sports infrastructure projects. North America remained the leading region in 2024 with 38% share, driven by strong adoption of LED retrofits and continuous investment in modern sports facilities.

Market Insights

- The Outdoor Sports Field Lighting Market was valued at USD 119.81 million in 2024 and is projected to reach USD 196.79 million by 2032, growing at a 6.4% CAGR.

- Rising demand for energy-efficient LED luminaires drives strong adoption across stadiums, school grounds, and community sports fields, with luminaires leading the offering segment at about 63% share.

- LED technology dominates with nearly 72% share, supported by trends such as smart lighting integration, adaptive beam control, and broadcast-ready illumination standards.

- Competition is shaped by key players offering high-performance and durable lighting systems, while higher installation and retrofit costs continue to restrain upgrades in budget-restricted facilities.

- North America leads the market with around 38% share, followed by Europe at 30% and Asia-Pacific at 24%, supported by large-scale infrastructure investments and rapid LED transition.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

Luminaires dominated the outdoor sports field lighting market in 2024 with about 63% share, driven by strong demand for integrated fixtures designed for stadiums, arenas, and open-field installations. Sports authorities preferred luminaires because they provide higher lumen output, longer service life, and better uniformity across large playing surfaces. Modern luminaires also support smart controls, dimming, and remote monitoring, which help clubs reduce energy consumption and improve lighting precision for televised events. Lamps held a smaller share due to limited efficiency and shorter operational life compared to advanced fixture-based solutions.

- For instance, Musco Sports Lighting offers a TLC-LED floodlight luminaire (model TLC-LED-1200EP) that delivers 136,000 lumens at 5700 K and maintains full photometric performance for over 81,000 operating hours, per its official datasheet.

By Lighting Technology

LED light technology led the market in 2024 with nearly 72% share, supported by its superior energy efficiency, long lifespan, and high-quality illumination suitable for professional and community sports fields. Stadium operators increasingly adopted LED systems to meet international sporting standards for brightness, glare reduction, and flicker-free performance during high-speed broadcasts. Growing focus on reducing energy costs accelerated LED upgrades, especially in municipal and school facilities. HID lights and fluorescent lamps continued to decline due to higher maintenance requirements, while other technologies maintained niche use in low-budget installations.

- For instance, Philips ArenaVision LED floodlights used in numerous international stadiums comply with HDTV broadcasting standards by delivering uniform pitch illumination with high-quality optics and flicker-free light output.

By Application

Greenhouses held the largest share in 2024 at around 46%, driven by increased adoption of controlled lighting systems to support crop growth, improve yield, and maintain production consistency year-round. Commercial growers preferred advanced outdoor field-grade lighting solutions because they deliver stable intensity and targeted spectrum control for plant development. City farming and indoor farming grew steadily as urban agriculture expanded, while other applications such as research and small-scale production held smaller shares. Rising awareness of energy-efficient lighting and climate-resilient cultivation methods continued to support demand across all application segments.

Key Growth Drivers:

Rising Demand for Energy-Efficient and High-Performance Lighting

Growing global focus on energy savings and performance consistency drives strong adoption of advanced lighting systems across outdoor sports fields. Stadiums, municipal grounds, and school sports complexes increasingly replace legacy HID and fluorescent systems with high-efficiency LED solutions that cut power consumption by up to 60–70% while delivering superior brightness and uniformity. Sports authorities prefer LED luminaires because they minimize glare, improve athlete visibility, and support high-speed broadcast needs with flicker-free output. Many government and city councils also promote energy-efficient upgrades through incentives and sustainability mandates, pushing facilities to invest in long-lasting systems with reduced maintenance requirements. These factors collectively accelerate LED retrofits and new installations across recreational and professional sports infrastructures.

- For instance, when Musco Sports Lighting retrofitted a large-scale stadium from HID to LED, they reported that the new LED system reduced energy consumption by about 80% compared to the previous HID setup.

Expansion of Sports Infrastructure and Night-Time Sporting Events

Growing investments in sports infrastructure worldwide significantly boost demand for advanced field lighting systems. Countries promoting national tournaments, community sports programs, and athletic development initiatives continue building or upgrading stadiums, multi-purpose grounds, and open sports facilities. Night-time sporting events have seen a sharp rise as clubs and organizers seek higher audience engagement, flexible scheduling, and improved event revenue. This shift requires lighting systems with precise illumination levels that meet international standards for football, cricket, hockey, and athletics. Improved durability, wider beam control, and better color rendering encourage operators to adopt modern luminaires that enhance player performance and spectator experience. As more regions promote grassroots and professional sports, lighting upgrades remain a key priority.

- For instance, stadium lighting guides show that LED floodlights replacing older metal-halide fixtures require fewer fixtures overall to achieve the same or better light coverage across a field, thanks to the directional beam control and high efficacy of LED luminaires.

Growing Integration of Smart Lighting and IoT-Based Control Solutions

Smart lighting technologies are becoming a major growth driver as venues adopt digital control systems to improve efficiency and management. Modern outdoor sports lighting now integrates IoT capabilities, sensors, and centralized dashboards that allow operators to adjust brightness, schedule lighting cycles, and monitor energy usage in real time. Adaptive controls help reduce operational costs by dimming lights during low-activity periods and optimizing output based on specific sports requirements. Remote monitoring also minimizes downtime by detecting faults early and reducing on-site maintenance. These capabilities align with the global push for smart cities, where automated infrastructure enhances sustainability and safety across public spaces. As facility owners seek better control and reduced lifecycle costs, IoT-enabled lighting systems gain rapid acceptance.

Key Trends & Opportunities:

Shift Toward LED Retrofits and Sustainable Lighting Initiatives

A strong market trend is the rapid shift toward LED retrofits, driven by sustainability goals and growing restrictions on high-emission technologies. LED upgrades offer long operational life, lower heat output, and enhanced environmental performance, making them a preferred solution for stadiums and outdoor arenas. Many countries now encourage carbon-efficient infrastructure, creating an opportunity for manufacturers to offer eco-friendly lighting with recyclable materials and reduced energy footprints. Additionally, sports clubs aim to meet international sustainability certifications, pushing them toward low-impact lighting. This trend continues to create significant business opportunities for suppliers offering high-efficiency LED luminaires and retrofit kits optimized for sports environments.

- For instance, LEDVANCE lists a FLOODLIGHT MAX sports luminaire line that delivers between 78,000 and 164,000 lumens with a lifespan of up to 100,000 hours (L70) under IP66/IP67-rated housing making it suitable for heavy-duty outdoor stadium use with minimal maintenance.

Adoption of Adaptive Lighting for Broadcast-Quality Sports Events

High-quality broadcasting requirements create new opportunities for manufacturers offering precision illumination technologies. Sports events streamed in 4K and 8K resolution require lighting systems that ensure color accuracy, flicker-free output, and consistent intensity across the field. This demand drives innovation in advanced optics, beam-shaping technologies, and lighting controls that meet strict broadcast standards. Adaptive lighting also helps regulate glare and shadows, improving the visual experience for players and viewers. As streaming platforms and sports broadcasters scale up global coverage, stadiums and clubs continue investing in lighting systems that support professional-grade video production, opening lucrative growth avenues.

- For instance, AEON advertises a line of “flicker-free” stadium luminaires that maintain stable output even under dimming and deliver temporal stability suitable for high-speed cameras (e.g. for slow-motion replays), as well as spatial optics designed to keep glare low (UGR < 19) helping ensure glare control and color fidelity required in broadcast environments.

Growth of Community Sports and Multi-Purpose Recreational Facilities

Community sports programs and mixed-use recreational spaces present a growing opportunity for the lighting industry. Urban regions continue to invest in public athletic facilities to support health, fitness, and youth sports participation. These facilities need affordable yet durable lighting solutions that deliver uniform illumination for football, cricket, basketball, and athletics. Manufacturers offering modular lighting systems and cost-effective LED arrays gain strong traction in this segment. The expansion of community sports enhances demand for easy-to-install luminaires, solar-powered outdoor lighting, and low-maintenance fixtures, creating a robust pipeline for long-term growth.

Key Challenges:

High Installation and Retrofit Costs

Despite the strong benefits of LED and smart lighting systems, high upfront installation and retrofit costs remain a major challenge for many sports facilities. Upgrading from HID or metal halide fixtures requires new mounting structures, electrical systems, and control units, which increase project expenses. Smaller clubs, schools, and community grounds often face budget limitations, delaying modernization plans. Although LED systems reduce long-term operating costs, the initial capital requirement slows adoption in developing regions. This challenge continues to limit large-scale upgrades, especially in facilities not supported by government funding or sponsorships.

Technical Complexity and Compliance with Sports Lighting Standards

Outdoor sports fields must meet strict lighting standards set by national and international sports bodies, making compliance a complex task. Achieving uniform brightness, proper vertical and horizontal illumination, and controlled glare requires precise system design and technical expertise. Many facilities struggle to meet these specifications without professional planning, leading to delays or costly redesigns. The growing integration of smart controls adds another layer of complexity for operators unfamiliar with digital systems. Ensuring compliance across multiple sports formats further challenges facility managers. These issues slow adoption and create demand for specialized installation and consultancy support.

Regional Analysis:

North America

North America held the leading position in the outdoor sports field lighting market in 2024 with about 38% share, supported by strong investments in stadium upgrades, community sports infrastructure, and high school and collegiate athletic programs. The region’s adoption of LED and smart lighting systems accelerated as cities prioritized energy efficiency and sustainability. Professional sports leagues demanded broadcast-ready illumination, driving replacement of legacy HID systems. Government funding for recreational facilities and rising participation in night-time sports further boosted installations across football, baseball, and soccer fields. Technological innovation from major lighting manufacturers strengthened regional dominance.

Europe

Europe accounted for nearly 30% share in 2024, driven by strict energy regulations and widespread adoption of high-efficiency LED luminaires across sports arenas and public athletic grounds. The region’s commitment to carbon-reduction targets encouraged clubs and municipalities to modernize lighting infrastructure with durable, low-emission solutions. Major football stadiums continued implementing advanced beam-control and glare-reduction technologies to support elite match standards. Growth was also fueled by rising night-time community sports participation, especially in the United Kingdom, Germany, France, and the Nordic countries. Public–private partnerships and EU sustainability programs further supported upgrade initiatives.

Asia-Pacific

Asia-Pacific captured around 24% share in 2024 and remained the fastest-growing region due to expanding sports infrastructure, increasing urban population, and rising government investments in recreational facilities. China, India, Japan, and Australia upgraded stadiums and outdoor fields to host domestic leagues and international tournaments. Rapid adoption of LED lighting was driven by lower operating costs, improved durability, and wide availability of local manufacturers offering cost-effective solutions. Growing interest in community sports and school athletics also stimulated demand. Smart city programs across major Asian countries further encouraged deployment of intelligent lighting systems.

Latin America

Latin America represented roughly 5% share in 2024, supported by steady upgrades in football stadiums and municipal sports fields across Brazil, Argentina, Mexico, and Colombia. Regional governments increased focus on sports development, creating demand for energy-efficient lighting in community and semi-professional facilities. Adoption of LED systems rose as operators sought longer life cycles and reduced maintenance. However, budget constraints and uneven infrastructure development limited large-scale modernization. Growing private investment in sports complexes and training academies is expected to support future lighting projects across the region.

Middle East & Africa

The Middle East & Africa accounted for about 3% share in 2024, driven by selective but high-value investments in major sports venues, especially in the Gulf countries. The region upgraded lighting systems to meet global standards for international sports events hosted in Qatar, UAE, and Saudi Arabia. Hot climate conditions increased demand for durable outdoor luminaires with thermal management capabilities. Africa showed gradual adoption as governments developed stadiums and youth sports programs. However, economic and infrastructure challenges slowed widespread installation. Despite this, the region remains an emerging opportunity for LED and solar-powered sports lighting solutions.

Market Segmentations:

By Offering

By Lighting Technology

- Fluorescent Lamp

- HID Light

- LED Light

- Other

By Application

- Indoor and Vertical Farming

- City Farming

- Greenhouses

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The outdoor sports field lighting market features a competitive landscape shaped by established global manufacturers and rapidly advancing LED technology providers. Leading companies such as Hubbell Inc, Panasonic Corporation, Osram, Thorn Lighting, GE Lighting, Eaton Corporation, Cree Inc, Acuity Brands Inc, Philips Lighting, and Schneider Electric focus on developing high-efficiency luminaires with superior beam control, long lifespan, and reduced maintenance needs. These players strengthen competitiveness through continuous innovation in smart lighting, adaptive controls, and IoT-enabled monitoring systems tailored for stadiums and recreational fields. Many companies expand reach by forming partnerships with sports authorities, municipal bodies, and EPC contractors to secure large-scale installation projects. Product differentiation centers on energy performance, optical precision, and environmental sustainability. Manufacturers also invest in rugged outdoor designs that meet global sports lighting standards and withstand harsh weather conditions. Growing emphasis on digital lighting ecosystems further intensifies competition among major suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In April 2025, Cree Lighting and Lumileds launched a 1900K/50CRI low-blue outdoor LED option. The new color is offered across popular outdoor luminaires and supports more night-friendly exterior projects.

- In October 2024, Osram / ams OSRAM (Germany): ams OSRAM launched the OSCONIQ® C 3030 LED (announced Oct 29, 2024) — a high-intensity, thermally efficient LED series targeted at outdoor and stadium luminaires (engineered for high drive currents, long service life and broadcast-grade color performance), signalling Osram’s product push into next-generation LED packages for stadium/high-mast lighting.

- In February 2024, Panasonic Corporation (Japan): Panasonic posted a new stadium case study for Hanshin Koshien Stadium (LED upgrade) describing bespoke LED solutions (custom 2050K + 5700K mixes for atmosphere), 4K/8K broadcast-compatible color reproduction and DMX-based control of 756 stadium lights to enable pixel-style effects and dynamic fan lighting. This highlights Panasonic’s focus on broadcast-quality spectral tuning and show-lighting features for sports venues.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Lighting Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- LED-based sports lighting systems will continue to replace older HID and fluorescent fixtures.

- Smart and connected lighting controls will see wider adoption across stadiums and community fields.

- Energy-efficiency goals will push facilities to invest in long-life, low-maintenance luminaires.

- Broadcast-quality illumination standards will drive upgrades in professional and semi-professional venues.

- Solar-powered outdoor sports lighting solutions will gain traction in cost-sensitive regions.

- Multi-sport and community recreation complexes will create steady demand for modular lighting systems.

- Climate-resilient and weather-proof luminaires will become essential in harsh outdoor environments.

- Government funding for public sports infrastructure will accelerate modernization projects.

- Manufacturers will expand IoT-enabled features for real-time monitoring and remote diagnostics.

- Standardization of lighting requirements for global tournaments will influence future product designs.