Market Overview

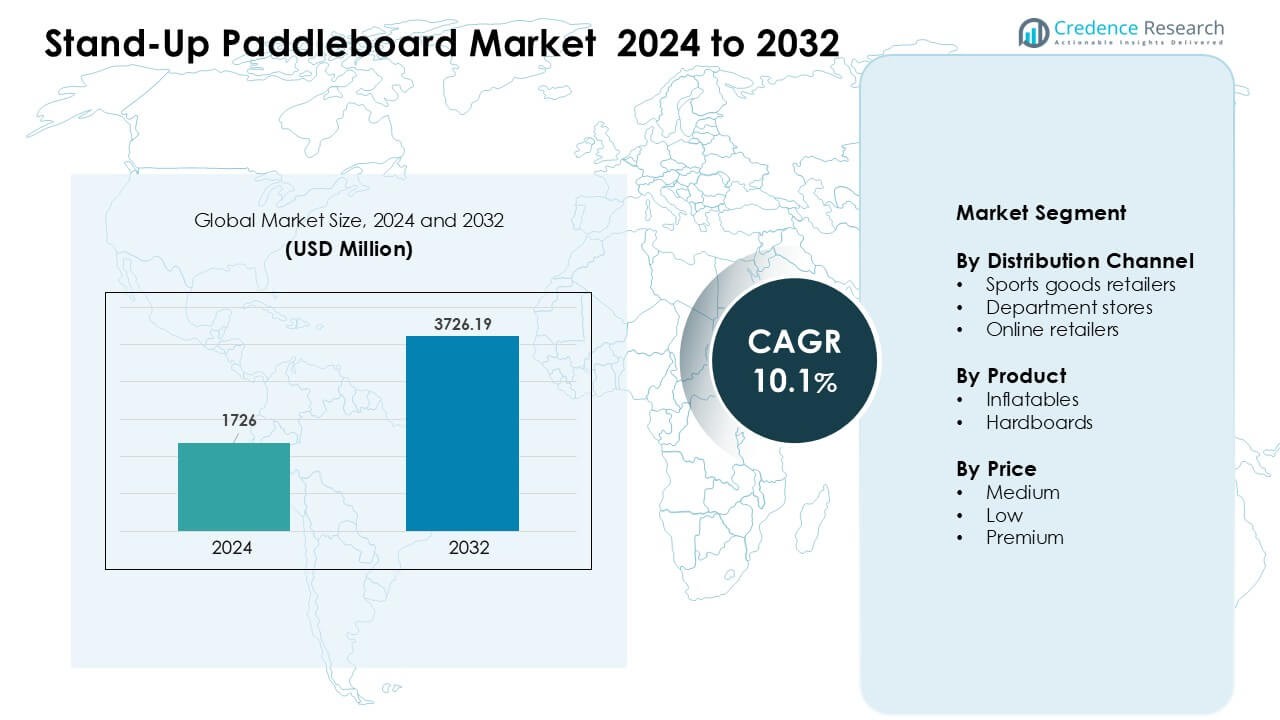

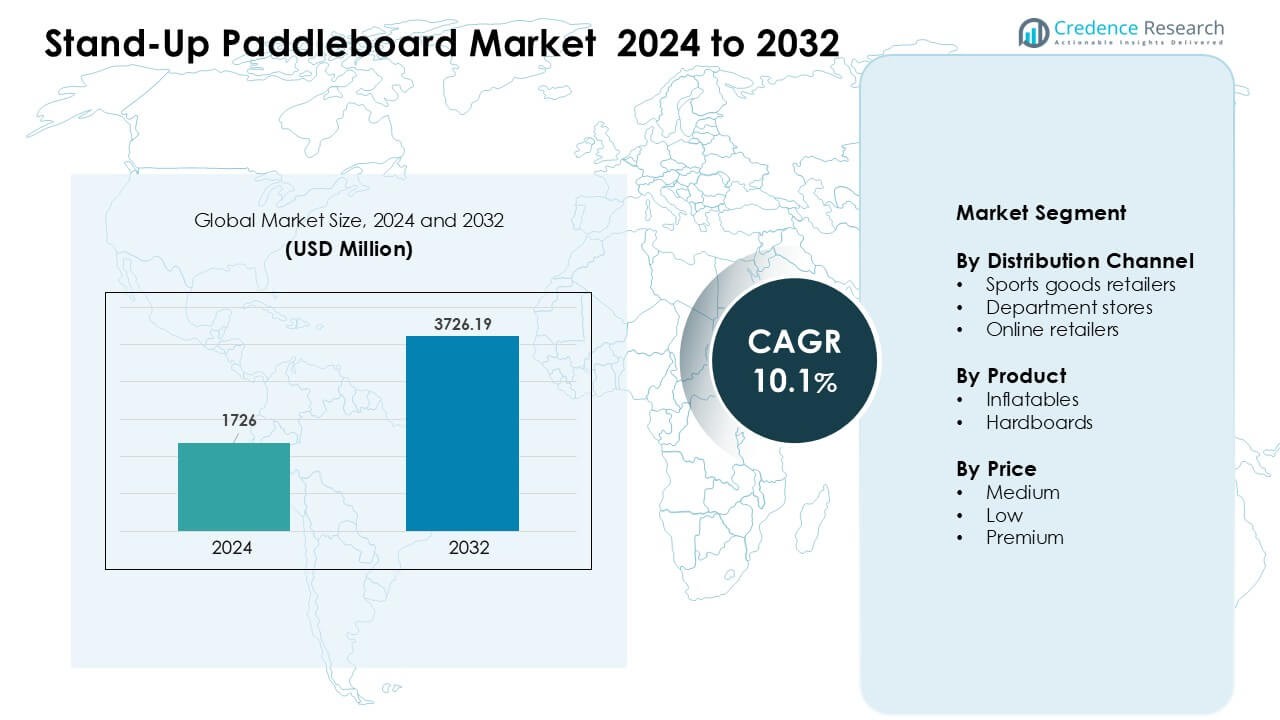

Stand-Up Paddleboard Market was valued at USD 1726 million in 2024 and is anticipated to reach USD 3726.19 million by 2032, growing at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stand-Up Paddleboard Market Size 2024 |

USD 1726 Million |

| Stand-Up Paddleboard Market, CAGR |

10.1% |

| Stand-Up Paddleboard Market Size 2032 |

USD 3726.19 Million |

The stand-up paddleboard market features strong competition from leading players such as LAIRDSTANDUP, Goodhill Co. Ltd., C4 Waterman, Mistral Red Dot Division B.V., Imagine Nation Sports LLC, Naish International, Cascadia Board Co., Boardworks Surf and Sup., Hobie Cat Co., and Aqua Leisure Recreation LLC. These companies focus on durable materials, improved inflatable technology, and wider distribution to serve both recreational and performance users. North America emerged as the leading region in 2024 with about 38% share, supported by high participation in outdoor sports, strong retail networks, and growing demand from fitness and tourism-based paddleboarding activities

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The stand-up paddleboard market was valued at USD 1726 million in 2024 and is projected to reach USD 19 million by 2032, growing at a CAGR of 10.1%.

- Demand grew as outdoor recreation, fitness activities, and tourism expanded, supporting higher adoption of inflatable and mid-price boards.

- Key trends include rising interest in SUP fitness, wider use in tourism rentals, and strong growth of inflatable boards, which held about 58% share in 2024.

- Leading players such as LAIRDSTANDUP, Naish International, Hobie Cat Co., and C4 Waterman strengthened competition through product innovation and enhanced distribution.

- North America led the market with around 38% share in 2024, driven by strong participation in water sports, while medium-price boards dominated the price segment with about 52% share.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Distribution Channel

Sports goods retailers dominated the distribution channel segment in 2024 with about 46% share. These stores gained strong traction due to wide product variety, in-store trials, and expert guidance for new buyers. Retailers also expanded premium stand-up paddleboard displays to attract adventure users and fitness enthusiasts. Department stores and online retailers grew at steady rates as rising e-commerce adoption encouraged buyers to compare models and access discounts. Online channels also gained momentum from faster delivery services and better exposure to inflatable designs.

- For instance, inflatable SUPs accounted for roughly 60% of board shipments worldwide in recent years reflecting strong online demand which suggests online channels are increasingly effective in pushing volume sales of portable boards.

By Product

Inflatables led the product segment in 2024 with nearly 58% share. Buyers preferred inflatable boards because the lightweight build, compact storage, and easy transport suited casual riders and travel users. Improved drop-stitch construction and durable PVC layers helped the category gain trust among beginners and rental operators. Hardboards maintained a steady niche among skilled paddlers who favored rigid designs for enhanced speed and wave performance. Demand for hardboards also grew in coastal training zones and surf schools that relied on stable, high-strength models.

- For instance, manufacturers report that inflatable SUP boards now make up approximately 60% of all board shipments globally, driven by improvements in drop‑stitch construction and reinforced PVC materials that offer rigidity comparable to rigid boards.

By Price

The medium-price range dominated the price segment in 2024 with around 52% share. Buyers favored this range due to a balanced mix of durability, stability, and feature value. Many mid-range models offered reinforced layers, better fins, and improved accessories, which appealed to new and intermediate paddlers. Low-price boards attracted budget users but faced concerns about shorter lifespan. Premium boards grew at a steady pace as performance athletes and frequent riders sought advanced materials such as carbon reinforcements and race-grade shapes.

Key Growth Drivers

Rising Outdoor Recreation Participation

Growing interest in outdoor recreation acts as a major driver for the stand-up paddleboard market. More people take part in water-based fitness, casual touring, and adventure sports, which lifts demand for versatile boards suited for lakes, rivers, and coastal regions. Many new users enter the category due to easy learning curves and minimal equipment needs. Fitness influencers and community clubs further promote paddleboarding as a full-body workout. Tourism operators add SUP rentals to attract young travelers, while family-oriented recreational spots expand board availability. Rising participation across age groups strengthens long-term market growth.

- For instance, inflatable SUP boards accounted for approximately 55% of all SUP product sales illustrating how accessible, easy‑to-use boards dominate demand as participation rises.

Advancements in Inflatable Board Technology

Technological progress in inflatable stand-up paddleboards drives adoption across both amateur and recreational users. Modern drop-stitch construction increases rigidity and stability, helping inflatable boards match the performance of many hardboards. Thicker PVC layers and reinforced seams improve durability, making inflatables ideal for transport, storage, and rental operations. Brands introduce lightweight pumps, adjustable paddles, and compact carrying kits to enhance convenience. These upgrades reduce traditional concerns about punctures or flexing and expand the customer base. Better performance at lower weight encourages fitness riders, beginners, and travelers to choose advanced inflatables.

- For instance, premium inflatable SUPs are designed to be inflated up to 12–15 PSI using drop‑stitch cores, providing rigidity comparable to hard boards while remaining compact when deflated a major improvement over earlier inflatable model.

Expanding E-Commerce Penetration

E-commerce growth plays a major role in expanding market reach and boosting sales of SUP boards. Online platforms allow buyers to compare designs, material quality, accessories, and price tiers with greater ease. Digital storefronts also highlight user reviews, which guide first-time buyers. Brands offer bundled kits and seasonal discounts, making online purchases more attractive. Faster delivery networks and improved logistics help ship large packages like inflatable boards efficiently. Social media campaigns further promote board features and lifestyle use cases, increasing awareness. Growing online penetration supports global access and broader consumer engagement.

Key Trends & Opportunities

Strong Shift Toward Fitness and Wellness Use

A rising trend in fitness-based paddleboarding shapes product demand and design choices. More consumers use SUP boards for yoga, cardio training, and low-impact workouts. This shift encourages brands to develop wider, more stable decks and textured surfaces that support balance and flexibility routines. Wellness resorts and community fitness programs also adopt SUP sessions as premium offerings. The trend aligns with growing interest in mindful exercise and outdoor routines. As fitness culture expands, demand for multi-purpose, stable, and comfort-focused boards increases.

- For instance, the application segment combining yoga, Pilates, and low-impact water workouts (specifically within the niche Stand-Up Paddle (SUP) Board market) is a rapidly expanding area, with a specific market analysis projecting an 11.2% annual growth rate (CAGR) for that niche application segment leading into 2030.

Growing Adoption in Tourism and Rentals

Tourism operators create attractive opportunities by integrating stand-up paddleboarding into coastal tours, lake resorts, and adventure packages. The activity draws both beginners and experienced travelers who seek accessible recreation. Rental businesses expand inflatable inventories due to easy transport and storage advantages. This sector also benefits from group bookings, event-based activities, and team-building packages. The rise of eco-tourism boosts interest in calm-water paddling, wildlife viewing, and scenic exploration. Tourism growth offers long-term volume potential for brands targeting commercial clients and leisure destinations.

Key Challenge

Limited Consumer Awareness in Emerging Regions

A key challenge for the market is the low awareness of paddleboarding in many developing regions. Limited exposure to water sports and fewer organized recreation facilities reduce adoption. High import duties and limited retail presence also restrict access to quality boards. Many buyers rely on low-quality alternatives due to price gaps, affecting user experience and retention. Without strong promotional activities or rental programs, new markets grow slowly. Brands must invest in regional education, demos, and partnerships to build familiarity and encourage first-time participation.

Seasonal Demand Fluctuations

Seasonality creates another major challenge for market stability. Paddleboarding depends heavily on warm-weather months, which causes strong sales peaks and sharp off-season drops. Retailers struggle with inventory planning, and manufacturers face inconsistent production cycles. Rental operators also experience reduced footfall during cooler periods. Regions with shorter summers face greater volatility, limiting year-round business models. Brands respond with product diversification, such as accessories and off-season training gear, but seasonality remains a core barrier to consistent growth.

Regional Analysis

North America

North America held the leading position in the stand-up paddleboard market in 2024 with around 38% share. Strong participation in outdoor sports, high spending on recreational gear, and widespread access to lakes and coastal zones supported demand across the United States and Canada. Inflatable boards gained strong momentum as travel users preferred portable designs. Retailers also expanded premium and fitness-focused models to match rising interest in SUP yoga and adventure touring. Tourism hubs, rental operators, and surf schools further strengthened regional sales, making North America the most established and mature market.

Europe

Europe accounted for about 29% share in 2024, driven by strong recreational culture and growing adoption of water sports across Germany, France, Spain, and the UK. Many buyers favored mid-range inflatable boards that suited river paddling, leisure touring, and fitness routines. Coastal tourism in the Mediterranean region boosted rental demand, while active lifestyle trends helped expand participation among younger groups. Retail chains widened product portfolios, and online platforms gained traction for comparison-based shopping. Stable infrastructure for sports clubs and training centers also supported Europe’s steady and diverse market growth.

Asia-Pacific

Asia-Pacific captured nearly 24% share in 2024 as interest in paddleboarding rose across China, Australia, Japan, and Southeast Asia. Expanding beach tourism, rising middle-class recreation spending, and greater awareness through social media fueled adoption. Inflatable boards dominated due to lower price points and easy storage in urban homes. Australia remained a strong hub for professional and fitness paddlers, while emerging markets saw rapid growth from rental and resort activities. Local brands increased competition with affordable designs, strengthening Asia-Pacific’s position as one of the fastest-growing regions.

Latin America

Latin America held close to 5% share in 2024, supported by increasing water sports engagement across Brazil, Mexico, and Chile. Coastal tourism and outdoor culture helped rentals and guided tours gain traction. Inflatables performed well due to portability and suitability for diverse water conditions. However, limited specialty retail presence and higher import duties slowed wider adoption. Growing e-commerce access and social media promotion encouraged more first-time buyers. As tourism infrastructure improves, Latin America shows potential for steady long-term expansion in the stand-up paddleboard market.

Middle East & Africa

The Middle East & Africa region accounted for about 4% share in 2024, driven by rising interest in leisure sports across the UAE, South Africa, and coastal resort areas. Warmer climates and growing tourism supported demand for recreational boards and resort-based rentals. The segment grew mainly through inflatables, as they suited travel and storage needs. Limited local production and higher product costs restricted rapid expansion. Awareness programs and water sport events helped attract younger consumers. As beach tourism and leisure investments rise, the region is expected to record gradual market growth.

Market Segmentations:

By Distribution Channel

- Sports goods retailers

- Department stores

- Online retailers

By Product

By Price

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The stand-up paddleboard market shows strong competition among key players such as LAIRDSTANDUP, Goodhill Co. Ltd., C4 Waterman, Mistral Red Dot Division B.V., Imagine Nation Sports LLC, Naish International, Cascadia Board Co., Boardworks Surf and Sup., Hobie Cat Co., and Aqua Leisure Recreation LLC. These companies focus on innovative materials, enhanced stability, and upgraded inflatable technologies to meet rising demand from beginners and recreational users. Premium brands target performance riders with race-oriented and surf-specific designs, while mid-range players expand value-driven board packages. Many firms strengthen online sales, partner with influencers, and support rental operators with reinforced commercial models. Competition continues to intensify as brands adopt sustainable materials, improve durability, and widen distribution across retail and e-commerce channels.

Key Player Analysis

Recent Developments

- In August 2025, GearJunkie named the Boardworks SHUBU Riptide 10’6″ its best budget standup paddleboard. The review highlighted strong tracking, plush full-length deck padding, and comfortable carry handles. This recognition supports Boardworks’ positioning in value-focused inflatable SUPs.

- In January 2025, A Technavio report profiled Hobie Cat Co. as a key stand-up paddleboard vendor. The analysis listed Hobie among major brands steering global SUP market growth. Hobie’s Mirage Eclipse and iEclipse pedal boards support this positioning in performance-oriented stand-up segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Distribution Channel, Product, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for inflatable boards will rise as portability and durability improve further.

- Fitness-based paddleboarding will grow as more users adopt SUP yoga and workouts.

- Tourism operators will expand rental fleets to meet rising leisure participation.

- Premium performance boards will gain traction among competitive and skill-focused paddlers.

- E-commerce platforms will drive higher sales through bundled kits and targeted promotions.

- Sustainable materials and eco-friendly manufacturing will become central to brand strategies.

- Smart accessories such as GPS-enabled paddles may enhance user experience.

- Emerging regions will show stronger adoption as awareness and retail presence increase.

- Partnerships with resorts, clubs, and training centers will support commercial demand.

- Product diversification across shapes, sizes, and skill levels will strengthen market reach.

Market Segmentation Analysis:

Market Segmentation Analysis: