Market Overview

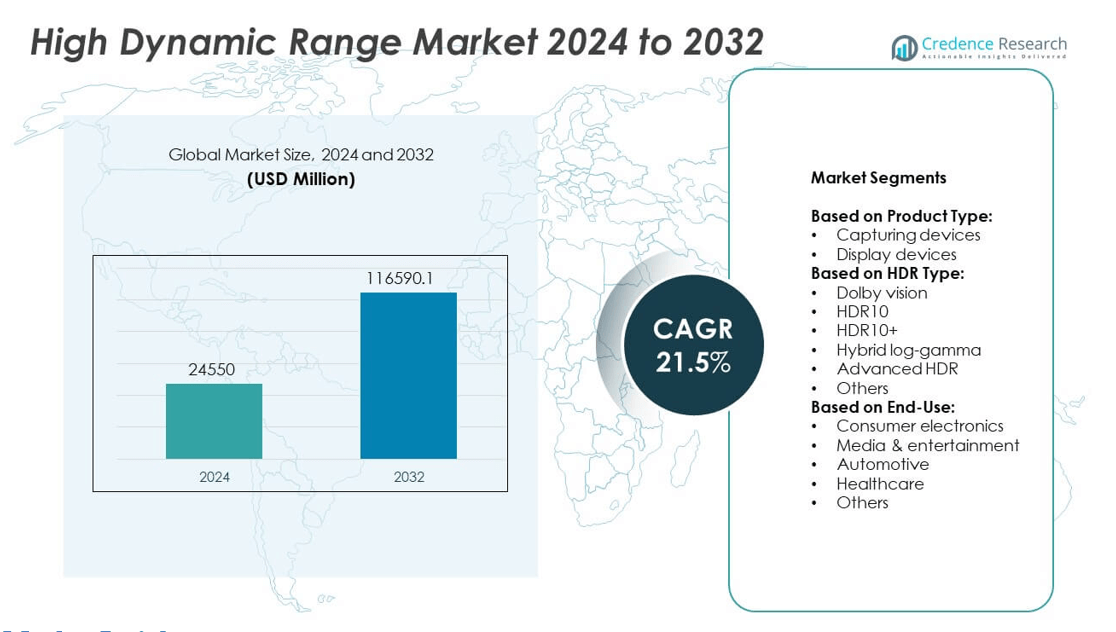

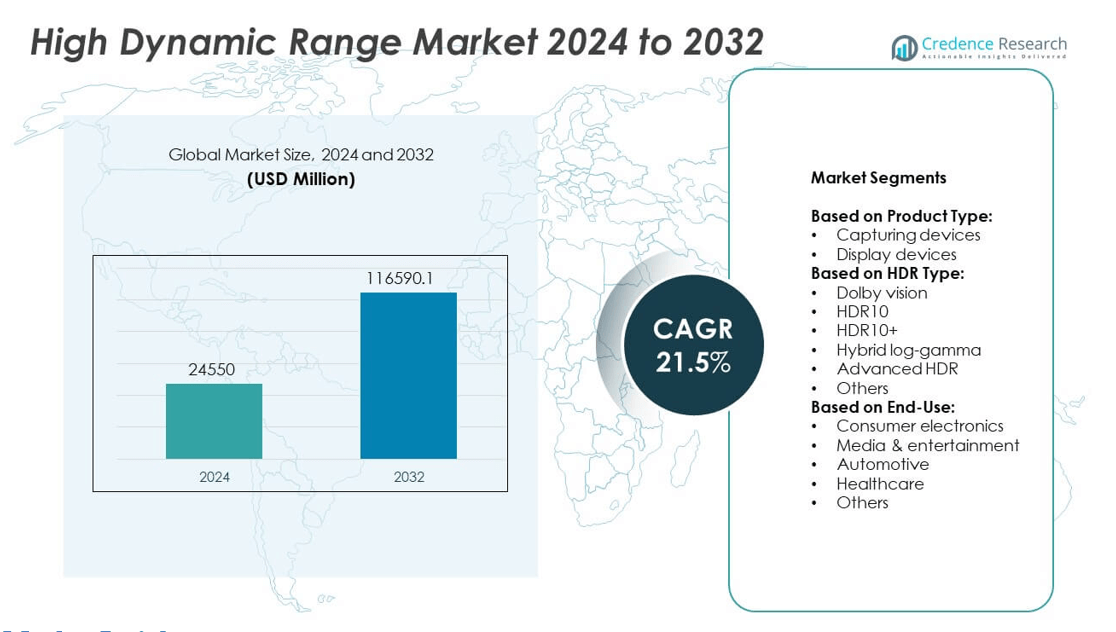

The High Dynamic Range (HDR) market size was valued at USD 24,550 million in 2024 and is expected to reach USD 116,590.1 million by 2032. The market is projected to grow at a CAGR of 21.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Dynamic Range (HDR) Market Size 2024 |

USD 24,550 million |

| High Dynamic Range (HDR) Market, CAGR |

21.5% |

| High Dynamic Range (HDR) Market Size 2032 |

USD 116,590.1 million |

The High Dynamic Range market grows through rising demand for superior visual quality and immersive viewing experiences. It benefits from increasing adoption in consumer electronics, media, automotive, and healthcare applications. Technological advancements, including Dolby Vision and HDR10+, enhance content clarity and color accuracy. Manufacturers invest in innovative display and capturing devices to meet evolving consumer expectations. Growing integration of HDR in smartphones, televisions, and professional equipment drives market expansion. It also gains traction due to streaming services and digital content evolution.

The High Dynamic Range market shows strong adoption across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads in technological innovation and early adoption, while Asia-Pacific expands through industrial growth and increasing consumer electronics demand. Europe focuses on efficiency and premium displays. Key players driving competition include Apple Inc., Samsung Electronics, Sony Corporation, and Canon. These companies invest in product innovation, partnerships, and content integration to strengthen their market position globally and meet diverse regional demands.

Market Insights

- The High Dynamic Range market was valued at USD 24,550 million in 2024 and is projected to reach USD 116,590.1 million by 2032, growing at a CAGR of 21.5%.

- Rising demand for enhanced visual experiences across consumer electronics, media, automotive, and healthcare drives market growth.

- Technological trends include adoption of Dolby Vision, HDR10, HDR10+, hybrid log-gamma, and advanced HDR formats in displays and capturing devices.

- Key players such as Apple Inc., Samsung Electronics, Sony Corporation, Canon, LG Display, Nikon, Omnivision, Olympus, Fujifilm, and Casio focus on product innovation and strategic collaborations to strengthen market positions.

- Market restraints include high implementation costs, compatibility issues across devices, and lack of standardization in HDR content.

- North America leads in adoption due to early technology integration, Europe expands through premium displays, Asia-Pacific grows from industrial and consumer electronics demand, and Latin America and MEA show gradual uptake.

- Continuous innovation in display and capturing technologies, content integration, and streaming platforms provides opportunities for new entrants and expansion into emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Advanced Consumer Electronics

The High Dynamic Range market grows with the increasing use of smartphones, televisions, and cameras supporting HDR technology. Consumers demand sharper visuals, deeper contrasts, and lifelike colors in everyday devices. Manufacturers respond by embedding HDR in mid-range and premium products to capture a larger audience. It creates a push for continuous hardware improvements and higher image processing capabilities. HDR-enabled televisions and displays also dominate sales in emerging economies. This adoption accelerates with falling product prices and rising disposable incomes worldwide.

- For instance, the Samsung QN90B Neo QLED TV, introduced in 2022, features Neo QLED technology that enhances HDR performance. While some versions of the TV can technically reach a peak brightness of over 2,000 nits in specific test scenarios, the achievable brightness varies by screen size and picture settings.

Expanding Applications in Media and Entertainment

Film studios, gaming companies, and streaming platforms drive strong demand for HDR integration. The industry values the improved color accuracy and brightness that enhance user immersion. It improves content quality across cinema, OTT platforms, and gaming consoles. HDR-supported content libraries grow rapidly with investments from global streaming leaders. The technology enables more realistic visual storytelling, meeting modern viewer expectations. The High Dynamic Range market benefits from the push toward immersive entertainment experiences.

- For instance, LG Electronics has consistently improved its OLED Evo panel technology to increase brightness for HDR content. This has been achieved through innovations like Micro Lens Array (MLA) and refined panel structures, with newer generations of OLED Evo offering significant brightness gains over earlier models, far exceeding the older 20% figure.

Strong Integration in Automotive and Healthcare Sectors

Automotive manufacturers adopt HDR in advanced driver-assistance systems and infotainment displays. It ensures better visibility under varying light conditions, improving safety and performance. Healthcare companies integrate HDR in medical imaging tools for sharper scans and diagnostics. It supports precision in surgical procedures and advanced visualization needs. The demand expands across hospitals adopting digital solutions for patient care. The High Dynamic Range market grows beyond consumer electronics into life-critical applications.

Technological Advancements and Industry Collaborations

Continuous innovation in HDR standards and display technologies strengthens its market penetration. Companies introduce HDR10+, Dolby Vision, and hybrid log-gamma to improve viewing performance. It drives compatibility across platforms and ensures better user accessibility. Partnerships between hardware makers and content providers expand HDR-enabled ecosystems. The collaboration fosters unified standards, enhancing content delivery and device adoption. The High Dynamic Range market secures growth momentum through advanced product development and cross-industry alignment.

Market Trends

Growing Demand for HDR-Enabled Streaming Services

The High Dynamic Range market sees rapid growth from expanding streaming platforms delivering HDR content. Viewers expect enhanced picture quality and more immersive entertainment on both TVs and mobile devices. Global players invest heavily in HDR-supported libraries to attract and retain subscribers. It improves customer satisfaction by delivering richer colors and sharper contrasts. Content creators align production with HDR standards to meet platform requirements. The trend accelerates with rising broadband penetration and affordable subscription models.

- For instance, Netflix has continuously expanded its HDR library. In March 2025, Netflix announced the expansion of its HDR options to include HDR10+, a technology that dynamically enhances picture quality for a more immersive viewing experience. The Canon EOS R5 camera, released in 2020, supports its own HDR PQ format, which enhances cinematic-quality footage.

Increased Adoption of HDR in Gaming Ecosystems

Gaming consoles and high-performance PCs integrate HDR to enhance player experience. It delivers greater realism through improved contrast ratios and lifelike visual effects. Game developers design titles optimized for HDR compatibility across platforms. E-sports and online gaming platforms expand their adoption of HDR-ready devices. The High Dynamic Range market gains strong traction from this surge in demand. It transforms gaming into a more immersive and competitive industry segment.

- For instance, Microsoft’s Xbox Series X supports HDR10 with up to 10-bit color depth and peak brightness of 1,000 nits, offering more vibrant visuals. Game developers design titles optimized for HDR compatibility across platforms

Advancement of Display Technologies in Consumer Devices

Manufacturers launch OLED, QLED, and MicroLED displays with integrated HDR features. These innovations provide sharper visuals and higher peak brightness levels. It fuels consumer upgrades toward advanced televisions, monitors, and smartphones. Device makers focus on improving energy efficiency alongside superior image reproduction. The availability of HDR across mid-tier devices broadens market reach. The High Dynamic Range market benefits from continuous improvements in display engineering.

Expansion into Professional and Industrial Applications

HDR adoption grows in fields such as broadcasting, advertising, and design visualization. It ensures improved accuracy in creative workflows requiring precise color reproduction. Broadcasters shift toward HDR-supported equipment to meet global transmission standards. Professional studios invest in advanced editing tools with HDR compatibility. Industrial visualization also leverages HDR for product design and simulation tasks. The High Dynamic Range market expands its footprint into professional ecosystems beyond consumer-focused devices.

Market Challenges Analysis

High Cost of Implementation and Limited Consumer Awareness

The High Dynamic Range market faces challenges from the high cost of compatible devices and production. Premium displays, advanced cameras, and HDR-enabled infrastructure require significant investment. It limits adoption in price-sensitive markets where affordability remains a priority. Many consumers also lack awareness of the technical differences between HDR and standard formats. This gap reduces willingness to pay more for HDR-enabled devices. Companies must invest in education and marketing to highlight the benefits of enhanced visual performance.

Standardization Issues and Compatibility Barriers Across Platforms

Multiple HDR formats, including HDR10, HDR10+, Dolby Vision, and hybrid log-gamma, create confusion. It complicates adoption for manufacturers, content providers, and end-users. Lack of universal compatibility across devices and platforms reduces user experience consistency. Broadcasters and studios face extra costs to support varied standards. This slows content production and impacts wider HDR penetration. The High Dynamic Range market requires stronger collaboration among industry leaders to establish unified frameworks.

Market Opportunities

Expansion Through Growth in Streaming and Gaming Industries

The High Dynamic Range market holds strong opportunities in streaming and gaming ecosystems. Global streaming platforms continue investing in HDR content libraries to capture wider audiences. It drives adoption of HDR-ready televisions, smartphones, and tablets across developed and emerging regions. Gaming studios release titles optimized for HDR, improving realism and competitiveness. The rise of cloud gaming also enhances demand for HDR-supported devices. These sectors create long-term opportunities for manufacturers, service providers, and content creators.

Adoption Across Professional and Industrial Applications

Healthcare, automotive, and broadcasting industries present new growth avenues for HDR technology. It improves medical imaging accuracy, enabling clearer diagnostics and advanced surgical visualization. Automotive firms adopt HDR displays in advanced driver-assistance systems for better clarity in dynamic environments. Broadcasters embrace HDR standards to enhance live transmissions and meet regulatory demands. Creative industries use HDR to improve color grading and production quality. The High Dynamic Range market expands its potential by serving professional sectors beyond consumer electronics.

Market Segmentation Analysis:

By Product Type:

Capturing devices and display devices define the scope of the High Dynamic Range market. Capturing devices, including cameras and smartphones, integrate HDR to enhance image quality with sharper contrasts and vibrant colors. It helps professionals and consumers achieve improved visual clarity, driving higher adoption rates. Display devices hold the larger share, led by televisions, monitors, and projectors with built-in HDR technology. Growing demand for immersive entertainment and premium display experiences strengthens this segment’s position. Manufacturers focus on OLED, QLED, and MicroLED technologies to meet rising consumer expectations.

- For instance, Sony’s PlayStation 5 enables HDR gaming in a large and growing library of titles, delivering a vibrant and lifelike range of colors when paired with an HDR-compatible TV.

By HDR Type:

The market divides into Dolby Vision, HDR10, HDR10+, hybrid log-gamma, advanced HDR, and others. HDR10 remains widely adopted because of its open standard and compatibility across devices. It attracts strong adoption by TV makers and content providers seeking universal reach. Dolby Vision offers superior brightness and dynamic tone mapping, appealing to premium product categories. HDR10+ emerges as a cost-effective alternative, improving scene-by-scene performance with lower licensing requirements. Hybrid log-gamma gains momentum in broadcasting applications due to live transmission needs. Advanced HDR solutions target specialized industries requiring precision image reproduction.

- For instance, LG introduced its OLED Evo G3 TV in 2023, which used Micro Lens Array technology to achieve a significantly higher peak brightness for HDR content than previous generations. While peak brightness varied depending on the screen size and picture mode, with some measurements approaching or exceeding 2,000 nits in Vivid HDR mode, the G3 delivered a marked improvement in HDR performance over earlier OLEDs.

By End-Use:

Consumer electronics lead with mass adoption of HDR-enabled televisions, smartphones, and gaming devices. The High Dynamic Range market benefits strongly from this demand as consumers prioritize better visual quality. Media and entertainment companies adopt HDR for cinema, OTT platforms, and gaming ecosystems. Automotive firms integrate HDR in infotainment displays and safety systems, ensuring clarity under varying light conditions. Healthcare providers rely on HDR in imaging systems for accurate diagnostics and surgical visualization. Other sectors, including design, advertising, and industrial applications, expand adoption to support professional requirements. It establishes HDR as a versatile technology across both consumer and enterprise domains.

Segments:

Based on Product Type:

- Capturing devices

- Display devices

Based on HDR Type:

- Dolby vision

- HDR10

- HDR10+

- Hybrid log-gamma

- Advanced HDR

- Others

Based on End-Use:

- Consumer electronics

- Media & entertainment

- Automotive

- Healthcare

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The High Dynamic Range market in North America holds a significant share, accounting for 28% of the global market. Strong consumer demand for premium televisions, smartphones, and gaming consoles drives this growth. It benefits from widespread availability of HDR content through streaming platforms and broadcast networks. The region houses major content creators and technology providers investing in Dolby Vision and HDR10 adoption. Gaming ecosystems further accelerate the market, with consoles and high-performance PCs supporting advanced HDR features. North America also leads in professional HDR applications, including media production, healthcare imaging, and automotive displays. Continuous innovation in display technologies and strong purchasing power support steady market expansion.

Europe

Europe captures 22% of the High Dynamic Range market, reflecting steady adoption across consumer and professional sectors. It demonstrates high penetration of HDR-enabled televisions, monitors, and cameras in households and offices. It benefits from regulatory support for energy-efficient displays and adherence to HDR broadcasting standards. Media and entertainment companies in the region increasingly integrate HDR in film, streaming, and live events. Automotive and healthcare sectors adopt HDR to improve in-vehicle infotainment systems and diagnostic imaging solutions. Technology providers focus on localized content and device compatibility, supporting consistent market growth. Investments in OLED and QLED displays further strengthen Europe’s position in the global HDR ecosystem.

Asia Pacific

Asia Pacific dominates the High Dynamic Range market with a 35% share, driven by rapid urbanization, growing middle-class populations, and rising disposable incomes. It experiences strong adoption of consumer electronics, including smartphones, televisions, and gaming devices, integrated with HDR technologies. Content providers expand HDR-supported libraries to meet increasing demand for high-quality media. It benefits from significant investments in display manufacturing, particularly in countries like China, Japan, and South Korea. E-sports and cloud gaming further boost HDR adoption in the region. Professional sectors, including automotive, healthcare, and advertising, increasingly implement HDR solutions to enhance visual quality and operational efficiency. Continuous technological innovation ensures the region remains a leading contributor to global market growth.

Latin America

Latin America accounts for 8% of the global High Dynamic Range market. Consumer electronics adoption grows steadily, driven by affordable HDR-enabled TVs and smartphones. Streaming platforms expand their presence, offering HDR content to attract subscribers across urban and semi-urban regions. It faces challenges in affordability and infrastructure but shows potential through gradual adoption of premium devices. Automotive and media industries explore HDR applications to improve safety displays and content production quality. Local technology providers collaborate with global brands to introduce HDR-compatible devices. Growing awareness and gradual infrastructure improvements support steady market expansion in Latin America.

Middle East and Africa

The High Dynamic Range market in the Middle East and Africa contributes 7% to the global share. It shows increasing adoption in consumer electronics, particularly high-end televisions and smartphones in urban centers. It benefits from investments in luxury media content, gaming platforms, and broadcasting technologies. Professional sectors, including healthcare and advertising, gradually implement HDR for enhanced visual quality. Market growth remains influenced by infrastructure development, economic conditions, and rising digital literacy. Technology companies focus on educating consumers and improving device compatibility. Continuous investments in HDR-supported infrastructure strengthen the region’s market presence and long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sony Corporation

- Canon

- Apple Inc

- Olympus Corp.

- Samsung Electronics Co., Ltd

- Casio Computer Co., Ltd.

- Fujifilm Holding Corporation

- LG Display Co., Ltd

- Omnivision Technologies

- Nikon Corporation

Competitive Analysis

Key players in the High Dynamic Range market include Apple Inc., Canon, Nikon Corporation, Samsung Electronics Co., Ltd, LG Display Co., Ltd, Omnivision Technologies, Olympus Corp., Sony Corporation, Fujifilm Holding Corporation, and Casio Computer Co., Ltd. These companies focus on continuous innovation to maintain competitive advantage and strengthen market presence. They invest in research and development to enhance display quality, optimize imaging sensors, and improve HDR content compatibility. Product differentiation through advanced technologies such as Dolby Vision, HDR10+, and hybrid HDR formats helps them capture premium consumer segments. Strategic partnerships with content providers, gaming platforms, and broadcasting networks expand their ecosystem and increase adoption of HDR-enabled devices. Companies prioritize geographic expansion in high-growth regions, including Asia Pacific and Latin America, to maximize market reach. Operational efficiency and supply chain optimization allow these players to maintain cost competitiveness while delivering high-quality products. Continuous monitoring of emerging trends in AI, gaming, and professional imaging enables them to respond swiftly to evolving market demands. Customer-focused innovations, including user-friendly software and hardware integration, enhance brand loyalty. Aggressive marketing campaigns and after-sales support further consolidate their leadership position. The competitive landscape remains dynamic, with emphasis on technological advancements, product diversification, and strategic collaborations to drive long-term growth.

Recent Developments

- In 2024, Samsung Electronics rolled out the Galaxy S24 series, featuring Dynamic AMOLED 2X displays that support HDR10+, providing vibrant visuals. These models introduced the “Galaxy AI” experience with features like real-time translation, an AI-powered camera system, and the “Circle to Search” function, which integrates a new way of discovering information on the go

- In 2024, Canon launched the EOS C400, a new addition to its CINEMA EOS SYSTEM series of video production equipment. Designed for high mobility and featuring an expanded array of interfaces, the camera is poised to deliver superior visual quality for broadcasts and live video production. The EOS C400 incorporates a 6K full-frame sensor, providing the ability to capture high-quality footage with a shallow depth of field and stunning bokeh.

- In March 2024, Fujifilm India introduced the Instax Mini 99 instant camera, the newest member of its Instax series of analog instant cameras. This model instantly produces physical prints of captured images, continuing the tradition of delivering immediate photo gratification.

Report Coverage

The research report offers an in-depth analysis based on Product Type, HDR Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The High Dynamic Range market will expand due to growing demand for superior visual experiences.

- Consumer electronics, including TVs and smartphones, will drive consistent market growth.

- Content creators will increasingly adopt HDR standards for film, streaming, and gaming.

- Automotive and healthcare sectors will integrate HDR for enhanced display quality and safety.

- Advances in OLED, QLED, and micro-LED technologies will support wider HDR adoption.

- Cloud gaming and virtual reality will create new opportunities for immersive HDR content.

- Emerging regions will show gradual adoption, increasing global market penetration.

- Technology providers will focus on improving HDR compatibility across devices and platforms.

- Professional sectors will utilize HDR for precision imaging, diagnostics, and media production.

- Continuous innovation in display design and content delivery will sustain long-term market growth.