Market Overview

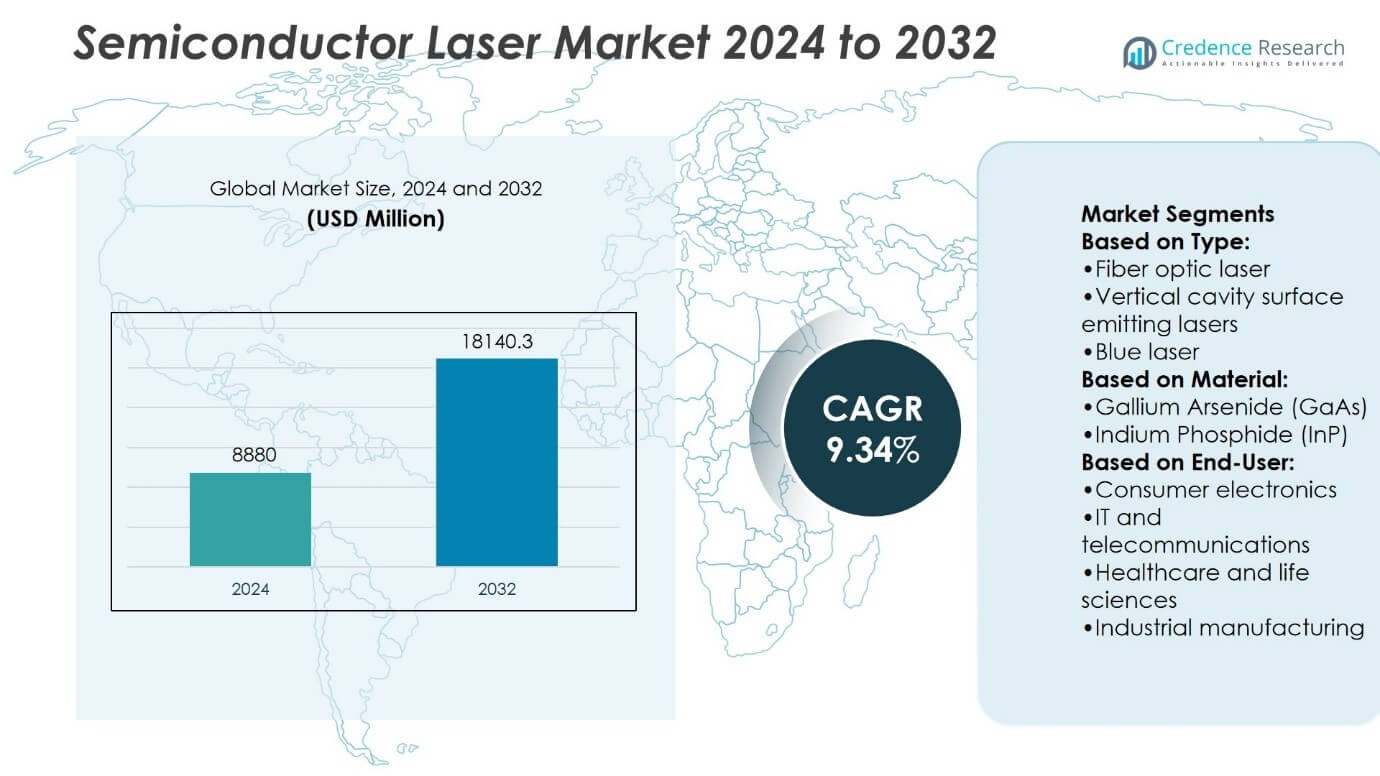

Semiconductor Laser Market size was valued at USD 8880 million in 2024 and is anticipated to reach USD 18140.3 million by 2032, at a CAGR of 9.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Laser Market Size 2024 |

USD 8880 million |

| Semiconductor Laser Market, CAGR |

9.34% |

| Semiconductor Laser Market Size 2032 |

USD 18140.3 million |

The Semiconductor Laser Market is driven by rising demand for high-speed data transmission, precision manufacturing, and advanced healthcare applications. It benefits from growing adoption in telecommunications, consumer electronics, and industrial automation. Innovations in gallium nitride, indium phosphide, and silicon photonics enhance efficiency, output power, and reliability. Trends include miniaturization, energy-efficient designs, and integration with smart devices and IoT systems. Increasing use in medical diagnostics, lidar, and automotive safety solutions expands market potential. Continuous R&D and digitalization across industries strengthen adoption, while sustainable and low-power solutions further support market growth, positioning semiconductor lasers as critical next-generation technologies.

The Semiconductor Laser Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads with advanced adoption in telecommunications and healthcare, while Asia-Pacific grows rapidly due to electronics manufacturing and industrial automation. Europe focuses on energy-efficient and high-performance solutions. Latin America and the Middle East & Africa present emerging opportunities. Key players driving innovation include Nichia Corporation, Osram Opto Semiconductors, Coherent Inc., ROHM Semiconductor, Sharp Corporation, Sumitomo Electric Industries, IPG Photonics Corporation, Hamamatsu Photonics, TRUMPF GmbH + Co. KG, and Mitsubishi Electric.

Market Insights

- Semiconductor Laser Market size was valued at USD 8880 million in 2024 and is expected to reach USD 18140.3 million by 2032, at a CAGR of 9.34%.

- Rising demand for high-speed data transmission, precision manufacturing, and advanced healthcare applications drives the market.

- Trends include miniaturization, energy-efficient designs, and integration with IoT and smart devices.

- Continuous innovations in gallium nitride, indium phosphide, and silicon photonics improve efficiency, output power, and reliability.

- Challenges include high manufacturing costs, complex fabrication processes, and material limitations that restrict adoption in some sectors.

- North America leads the market with strong adoption in telecommunications and healthcare, while Asia-Pacific grows rapidly due to electronics and industrial automation. Europe focuses on energy-efficient solutions, and Latin America and the Middle East & Africa present emerging opportunities.

- Key players innovating in the market include Nichia Corporation, Osram Opto Semiconductors, Coherent Inc., ROHM Semiconductor, Sharp Corporation, Sumitomo Electric Industries, IPG Photonics Corporation, Hamamatsu Photonics, TRUMPF GmbH + Co. KG, and Mitsubishi Electric.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand in Optical Communication and Data Transmission

The Semiconductor Laser Market grows significantly due to the surge in optical communication networks. Fiber optic systems rely on laser technology to provide high-speed data transmission. Increasing adoption of 5G and cloud computing drives network expansion. It ensures reliable connectivity in both long-haul and short-range applications. Telecom operators deploy advanced laser modules to boost bandwidth efficiency. Growing traffic from video streaming and IoT also fuels adoption.

- For instance, Hamamatsu Photonics offers a variety of light sources and laser modules for industrial and medical applications. For example, the LC8 is a UV spot light source that utilizes a mercury-xenon lamp and is primarily used for industrial applications like UV curing.

Expanding Role in Medical and Healthcare Applications

Healthcare technologies strengthen demand for semiconductor lasers across various treatments. It powers precise surgical procedures in ophthalmology, dermatology, and oncology. Minimally invasive therapies use laser systems for targeted interventions with reduced recovery times. Diagnostic devices integrate compact laser modules to improve imaging accuracy. Rising prevalence of chronic diseases drives hospitals to adopt advanced laser platforms. It enhances both patient outcomes and operational efficiency in medical centers.

- For instance, ROHM Semiconductor develops a range of high-precision laser diodes, including some for laser printing applications. For example, they offer blue-violet lasers (operating at wavelengths like 405 nm) and other diodes, including red ones. All are engineered for high performance.

Strong Growth in Industrial Manufacturing and Material Processing

The Semiconductor Laser Market benefits from widespread use in industrial applications. Cutting, welding, and marking processes use high-power laser systems for precision and speed. It helps manufacturers reduce waste while improving product quality. Automated production lines adopt compact laser modules for greater efficiency. The electronics sector deploys lasers for micromachining of delicate components. Demand for cost-effective and energy-efficient manufacturing methods continues to expand adoption.

Increasing Adoption in Consumer Electronics and Automotive Technologies

Consumer devices rely heavily on semiconductor lasers for improved performance. It enables high-resolution printing, optical storage, and gesture recognition systems. Automotive industries integrate laser technology into lidar for advanced driver-assistance systems. Laser headlights and sensor systems improve vehicle safety and efficiency. Demand for electric and autonomous vehicles accelerates laser deployment. The combination of mobility innovation and consumer demand drives sustained market growth.

Market Trends

Rising Integration with Optical Communication Networks

The Semiconductor Laser Market experiences strong momentum through its integration in optical communication. Telecom operators adopt laser modules to improve network speed and reduce latency. It supports cloud computing, 5G expansion, and data center interconnects. Compact laser systems enable more efficient data traffic handling. Enterprises rely on laser-based optical links to meet growing connectivity needs. The trend continues as demand for seamless communication accelerates globally.

- For instance, Nichia’s NDB7K75 laser diode is a high-power blue laser diode with a dominant wavelength of 450 nm, delivering 3.5 W output power for applications such as high-intensity lighting and industrial processing.

Increasing Miniaturization and Compact Design Focus

Manufacturers focus on miniaturized designs that deliver high output in smaller formats. The Semiconductor Laser Market reflects this shift with products suited for portable and embedded devices. It enhances consumer electronics, medical diagnostics, and industrial tools. Compact modules improve energy efficiency while lowering operational costs. Integration into mobile and wearable devices highlights the growing demand for compactness. Smaller designs with higher precision remain a defining trend in this sector.

- For instance, IPG Photonics’ YLR-3000-SM fiber laser delivers 3,000 W continuous-wave output at 1,064 nm with a beam quality of M² < 1.1, supporting precision cutting, welding, and additive manufacturing.

Strong Emergence of Advanced Automotive Applications

Automotive innovation drives new uses for laser technology. The Semiconductor Laser Market supports lidar, laser headlights, and advanced sensor systems. It enables higher safety standards in autonomous and electric vehicles. High-power lasers provide reliable detection in complex driving environments. Automakers increasingly integrate compact laser systems into driver assistance platforms. This trend positions semiconductor lasers as vital in future mobility solutions.

Expanding Role in Healthcare and Life Sciences

Medical technology embraces lasers for both therapeutic and diagnostic uses. The Semiconductor Laser Market reflects rising adoption in ophthalmology, oncology, and dermatology. It improves treatment precision while minimizing recovery time for patients. Diagnostic imaging platforms rely on compact laser modules for higher accuracy. Hospitals demand reliable and cost-efficient solutions to address chronic conditions. Growing reliance on laser-enabled devices marks a lasting trend in healthcare adoption.

Market Challenges Analysis

High Manufacturing Costs and Technical Complexity

The Semiconductor Laser Market faces challenges from high production costs and technical demands. Fabrication requires advanced materials, precise processes, and costly equipment. It increases the price of finished products, limiting adoption in cost-sensitive industries. Smaller companies often struggle to compete with established players due to capital constraints. Complex assembly of laser diodes and modules adds to design difficulties. Maintaining consistent output across large-scale manufacturing remains a significant barrier.

Limited Lifespan and Performance Reliability Issues

Device lifespan and reliability pose hurdles for wider adoption. The Semiconductor Laser Market must address concerns over heat management and degradation of laser diodes. It reduces efficiency when operated continuously under high power. Failure rates increase in harsh industrial and automotive environments. Users demand longer operational life and stable performance across varying conditions. Continuous investment in material innovation and thermal management remains essential to overcome these limitations.

Market Opportunities

Expansion in Emerging Applications and Industries

The Semiconductor Laser Market offers strong opportunities through emerging applications. Rapid adoption of lidar in autonomous vehicles creates demand for compact, high-power systems. It supports industrial automation by enabling precision cutting, welding, and additive manufacturing. Consumer electronics integrate laser modules into augmented reality and biometric systems, expanding market reach. Growing investments in defense technology also highlight opportunities for advanced laser solutions. Expanding adoption across diverse industries strengthens the long-term growth outlook.

Advancements in Healthcare and Communication Technologies

Healthcare innovation opens significant opportunities for semiconductor lasers. The Semiconductor Laser Market benefits from their use in diagnostics, surgical treatments, and therapeutic devices. It enables higher precision in minimally invasive procedures across oncology and ophthalmology. Optical communication networks also create potential with rising global data traffic. Telecom operators demand laser modules that improve bandwidth and energy efficiency. Continuous innovation in both healthcare and communication sectors positions semiconductor lasers for sustained opportunity.

Market Segmentation Analysis:

By Type

The Semiconductor Laser Market is segmented by fiber optic lasers, vertical cavity surface emitting lasers (VCSELs), blue, red, green, infrared, and others. Fiber optic lasers lead demand due to their use in data transmission and communication networks. It provides high efficiency and long-distance performance. VCSELs grow in adoption for their compact size and integration in consumer devices, sensors, and automotive applications. Blue and green lasers see increasing use in medical imaging, displays, and precision manufacturing. Red lasers maintain presence in consumer electronics and barcode scanners, while infrared lasers dominate defense, industrial, and communication applications.

- For instance, The Coherent Monaco 1035 industrial laser, for example the Monaco 1035-40-40 model, delivers an average output power of 40 W at its center wavelength of 1035±5 nm. Stating the wavelength as a rounded 1030 nm is acceptable because it falls within the manufacturer’s specified tolerance range of 1030–1040 nm

By Material

Material choice defines performance and application diversity. Gallium Arsenide (GaAs) supports widespread use in consumer electronics and optical communication devices due to its high electron mobility. Indium Phosphide (InP) dominates telecommunication lasers for long-haul fiber optic systems with reliable high-frequency performance. Gallium Nitride (GaN) drives adoption in high-power blue and green lasers, particularly for medical devices, lighting, and display technology. It enables superior thermal stability in demanding environments. Silicon Photonics emerges as a strong trend in integrated optics, enhancing data transfer within compact chips. Each material segment reflects ongoing innovation to meet power, efficiency, and miniaturization demands.

- For instance, Sharp develops various blue-violet laser diodes, such as the GH04W10A2GC, which delivers high output power at 405 nm for applications like optical data storage and medical devices. These diodes are integrated into optical systems engineered for specific performance parameters like beam divergence and operating efficiency.

By End User

End-user segmentation highlights strong diversity in applications. Consumer electronics remain a core driver with lasers embedded in smartphones, AR/VR systems, and optical storage. The Semiconductor Laser Market benefits from telecom adoption, where IT and telecommunications require reliable, high-speed optical transmission for expanding 5G and cloud infrastructure. Healthcare and life sciences leverage semiconductor lasers for diagnostic imaging, laser surgery, and minimally invasive treatments, driving demand for precision modules. Industrial manufacturing represents a fast-growing segment where lasers power cutting, welding, and additive manufacturing systems. It delivers higher precision and productivity, aligning with automation and smart factory initiatives.

Segments:

Based on Type:

- Fiber optic laser

- Vertical cavity surface emitting lasers

- Blue laser

Based on Material:

- Gallium Arsenide (GaAs)

- Indium Phosphide (InP)

Based on End-User:

- Consumer electronics

- IT and telecommunications

- Healthcare and life sciences

- Industrial manufacturing

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Semiconductor Laser Market, accounting for nearly 32% of the global market. The region benefits from advanced adoption of optical communication systems, driven by investments in 5G networks and data centers. It also witnesses strong demand from the healthcare sector, where semiconductor lasers are widely used in surgical and diagnostic applications. Industrial manufacturing across aerospace and automotive industries further supports adoption, especially in precision welding and cutting systems. Key U.S. and Canadian technology companies continue to integrate lasers into consumer electronics, AR/VR platforms, and defense applications. It positions North America as a leading hub for innovation and commercialization of semiconductor laser technologies.

Europe

Europe represents approximately 25% of the Semiconductor Laser Market share, supported by a robust manufacturing base and strong research in photonics. The region shows notable adoption in automotive applications, where semiconductor lasers enable lidar systems, laser headlights, and advanced driver assistance platforms. Germany and France play critical roles in advancing laser technology for industrial and medical use. It also benefits from strict environmental regulations, encouraging adoption of energy-efficient laser systems in factories. Universities and R&D centers across the region contribute to advances in GaN- and InP-based lasers. Europe’s growing healthcare sector and focus on advanced diagnostics also drive wider acceptance of semiconductor laser systems.

Asia-Pacific

Asia-Pacific leads the global Semiconductor Laser Market with the largest share at 34%, driven by its expansive electronics and telecommunications industries. China, Japan, South Korea, and Taiwan dominate production and integration of lasers into consumer electronics and optical communication systems. It benefits from large-scale manufacturing capacity and cost-efficient supply chains. Demand from automotive industries in Japan and China boosts adoption of laser-based sensing and lidar. Rising investments in smart factories, coupled with strong government support for advanced manufacturing, strengthen Asia-Pacific’s position. The healthcare sector, particularly in Japan and India, continues to expand laser adoption for treatments and diagnostics. With strong demand across industrial, telecom, and consumer applications, Asia-Pacific remains the growth leader.

Latin America

Latin America holds a smaller yet growing portion of the Semiconductor Laser Market, accounting for about 5% of the global share. Brazil and Mexico lead adoption, supported by expanding automotive manufacturing and telecommunications networks. Healthcare institutions in the region are increasingly integrating semiconductor lasers for diagnostic and therapeutic applications. Industrial manufacturing shows interest in cost-efficient laser solutions for cutting, marking, and packaging. It also benefits from the rise of digital connectivity and cloud adoption in major urban centers. Though limited by infrastructure and investment levels, Latin America demonstrates strong potential for future expansion of semiconductor laser technologies.

Middle East & Africa

The Middle East & Africa contributes nearly 4% of the Semiconductor Laser Market share, with demand concentrated in industrial, healthcare, and defense applications. The Gulf region invests heavily in advanced healthcare systems, adopting semiconductor lasers for minimally invasive procedures. Industrial sectors in countries like the UAE and Saudi Arabia show rising use of laser-based processing systems. South Africa represents a key hub for telecom adoption of optical networks powered by lasers. It also witnesses interest in defense applications, where lasers are explored for security and sensing. While the overall market base is small, the region shows consistent growth opportunities through modernization programs and infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TRUMPF GmbH + Co. KG

- Hamamatsu Photonics

- ROHM Semiconductor

- Mitsubishi Electric

- Nichia Corporation

- IPG Photonics Corporation

- Sumitomo Electric Industries

- Coherent Inc.

- Sharp Corporation

- Osram Opto Semiconductors

Competitive Analysis

The Semiconductor Laser Market features players including Nichia Corporation, Osram Opto Semiconductors, Coherent Inc., ROHM Semiconductor, Sharp Corporation, Sumitomo Electric Industries, IPG Photonics Corporation, Hamamatsu Photonics, TRUMPF GmbH + Co. KG, and Mitsubishi Electric. The Semiconductor Laser Market is highly competitive, shaped by continuous innovation and rapid technology adoption. Companies focus on expanding product lines across visible, infrared, and fiber laser categories to meet demand in telecom, industrial, healthcare, and automotive applications. Strong emphasis on miniaturization and energy efficiency drives investment in advanced materials and integrated photonics. Competition intensifies as firms adopt strategies such as joint ventures, mergers, and patent development to strengthen market positioning. Research and development remain central, with priority given to enhancing output power, thermal stability, and device lifespan. Global players also target regional expansions, establishing manufacturing and distribution networks close to end-user industries. Intense rivalry encourages consistent advancements, ensuring semiconductor lasers remain critical to communication, automation, and next-generation electronics.

Recent Developments

- In August 2025, Hamamatsu Photonics is accelerating the development of ultra-high-speed cameras and high-sensitivity detectors utilizing advanced semiconductor laser technology, projecting completion within 2025–2027, aimed at healthcare and scientific research sectors.

- In June 2025, Nichia Corporation announced its participation in Laser World of Photonics 2025 in Munich to showcase next-generation semiconductor laser technologies, highlighting innovations in high-brightness, high-efficiency lasers for industrial and medical uses.

- In May 2025, Mitsubishi Electric announced ongoing efforts to enhance profitability and productivity in their semiconductor laser and device business, with capital investments planned toward advanced manufacturing and new product development in 2025.

- In January 2025, ROHM Semiconductor announced the development of a 1kW class high-power infrared laser diode (RLD8BQAB3) designed for LiDAR applications, featuring an 8-channel array and clear glass cap for enhanced emission, marking a significant advancement in automotive sensing technology.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-speed optical communication will continue to drive adoption.

- Miniaturized and energy-efficient designs will gain stronger acceptance in consumer electronics.

- Healthcare will expand use in diagnostic imaging and minimally invasive surgeries.

- Industrial manufacturing will rely more on lasers for precision cutting and welding.

- Automotive adoption will grow with lidar, laser headlights, and safety systems.

- Research in gallium nitride and indium phosphide will improve performance and durability.

- Integration with silicon photonics will accelerate in data centers and telecom networks.

- Defense and aerospace will increase procurement of high-power laser systems.

- Smart factories will adopt laser-enabled automation for higher productivity.

- Expanding AR, VR, and wearable devices will boost use of compact laser modules.