Market Overview

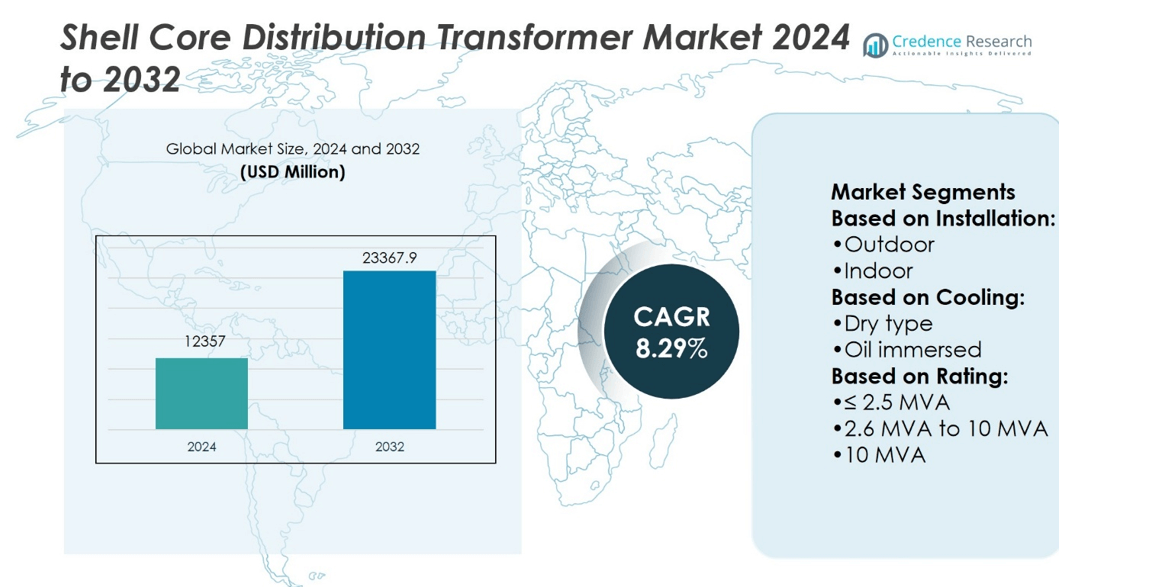

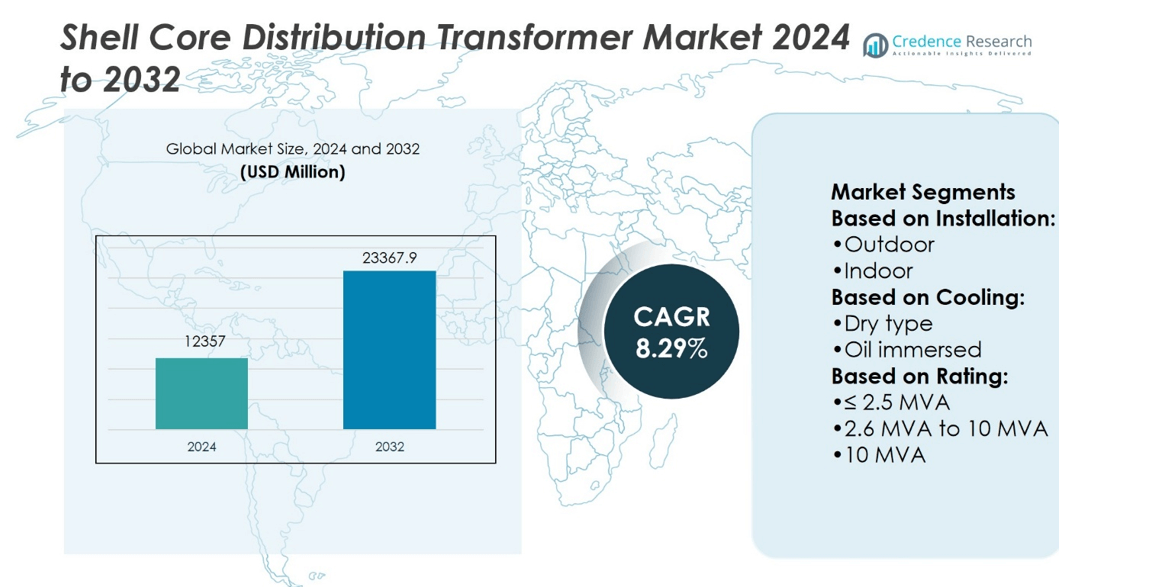

Shell Core Distribution Transformer Market size was valued at USD 12357 million in 2024 and is anticipated to reach USD 23367.9 million by 2032, at a CAGR of 8.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shell Core Distribution Transformer Market Size 2024 |

USD 12357 million |

| Shell Core Distribution Transformer Market, CAGR |

8.29% |

| Shell Core Distribution Transformer Market Size 2032 |

USD 23367.9 million |

The Shell Core Distribution Transformer Market grows through rising demand for efficient power distribution, driven by urbanization, industrial expansion, and renewable integration. Utilities invest in modern infrastructure to reduce energy losses and improve reliability. It benefits from stricter efficiency regulations and government-backed electrification programs. Digital monitoring solutions and smart grid compatibility emerge as key trends, supporting predictive maintenance and operational control. Compact designs gain adoption in urban and commercial spaces, while high-capacity models serve industrial facilities. The market advances with continuous innovation in materials, cooling methods, and flexible configurations that address diverse grid and consumer requirements.

The Shell Core Distribution Transformer Market shows strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads with large-scale electrification and industrial projects, while North America and Europe focus on modernization and efficiency regulations. Latin America and the Middle East & Africa expand through renewable integration and infrastructure development. Key players shaping competition include ABB, General Electric, Hitachi Energy, Eaton, Mitsubishi Electric, HYOSUNG Heavy Industries, CG Power, Elsewedy Electric, EMCO Limited, and Celme S.r.l.

Market Insights

- Shell Core Distribution Transformer Market size was valued at USD 12357 million in 2024 and is expected to reach USD 23367.9 million by 2032, at a CAGR of 8.29%.

- Rising demand for efficient power distribution supports growth through urbanization, industrial expansion, and renewable integration.

- Utilities invest in modern infrastructure upgrades to reduce energy losses and ensure grid reliability.

- Digital monitoring systems and smart grid compatibility emerge as major trends enhancing predictive maintenance and operational efficiency.

- Competition remains strong with global players focusing on innovation, while regional firms provide cost-effective and localized solutions.

- High production costs, raw material price volatility, and compliance with strict efficiency standards act as restraints to steady growth.

- Asia Pacific leads due to large-scale electrification and industrial projects, North America and Europe grow through modernization, while Latin America and the Middle East & Africa expand with renewable integration and infrastructure investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Reliable Power Distribution Across Urban and Rural Areas

The Shell Core Distribution Transformer Market benefits from rising electricity consumption in expanding cities and rural electrification projects. Governments invest heavily in infrastructure to ensure stable power supply for homes, industries, and services. Utilities prioritize transformers that can sustain high efficiency under fluctuating loads. It ensures minimal energy loss and enhances grid stability. Increasing electrification in developing regions drives consistent orders from public and private utilities. The market secures growth through essential support for power distribution networks.

- For instance, Hitachi Energy secured an order to supply 30 units of 765 kV, 500 MVA single-phase transformers to India’s Power Grid Corporation, strengthening ultra-high-voltage transmission capacity in key regions.

Technological Advancements in Transformer Design and Material Efficiency

Continuous innovations improve the performance and longevity of shell core distribution transformers. Manufacturers adopt advanced core materials that lower hysteresis and eddy current losses. It enhances efficiency while reducing operational costs for utilities. Compact shell core designs optimize cooling and durability under varying environmental conditions. Companies focus on higher load capacity with reduced noise and improved safety. The Shell Core Distribution Transformer Market advances through these material and design upgrades.

- For instance, EMCO Limited’s distribution transformer plant manufactures units up to 5,000 kVA at 33 kV class using computer-aided design and strict process controls, ensuring high quality in energy handling and build consistency.

Expanding Integration of Renewable Energy into National Grids

Renewable energy expansion strengthens the role of efficient distribution transformers. Wind and solar plants require stable grid integration, demanding equipment that handles fluctuating voltage levels. It supports smooth energy flow and prevents grid instability during peak loads. Utilities increasingly deploy shell core transformers with higher adaptability for variable generation. Their compact design makes installation feasible in both urban and remote renewable projects. The Shell Core Distribution Transformer Market aligns with clean energy transition goals.

Supportive Regulatory Frameworks and Utility Investments in Grid Modernization

Regulatory standards push utilities to adopt energy-efficient transformers with lower carbon footprints. It aligns with global climate goals and national energy policies. Utilities invest in modernizing aging grid infrastructure to meet rising demand. Smart grid development further accelerates deployment of advanced transformer designs. Strong compliance requirements create sustained demand across industrial, commercial, and residential segments. The Shell Core Distribution Transformer Market gains traction through supportive frameworks and modernization initiatives.

Market Trends

Growing Focus on Energy-Efficient Transformer Designs and Low-Loss Materials

The Shell Core Distribution Transformer Market reflects a clear move toward energy-efficient products. Utilities and industries prefer transformers that reduce power loss and improve grid reliability. It encourages manufacturers to adopt advanced amorphous steel and high-grade silicon steel cores. Compact shell designs support longer operational life with lower noise and reduced heat generation. Companies introduce models that comply with international energy-efficiency regulations. This trend drives steady upgrades of older infrastructure with modern, high-performance systems.

- For instance, CO₂ emissions by approximately 55% compared to conventional transformers, while achieving energy-saving criteria of around 150% for the EX-α series and 120% for the EX-β series.

Increasing Adoption of Smart Monitoring and Digital Solutions

Utilities and large consumers demand transformers that integrate smart monitoring technologies. The Shell Core Distribution Transformer Market benefits from digital solutions that provide real-time data on performance and faults. It enhances predictive maintenance, reducing downtime and extending asset life. Smart sensors and IoT-based platforms enable utilities to control load distribution with greater accuracy. Manufacturers deliver products compatible with advanced grid management systems. The trend strengthens the role of digitalization in distribution networks.

- For instance, Elsewedy Electric produces oil-distribution transformers with power ratings up to 15 MVA and voltages up to 36 kV, including models among the range of grid-mounted and eco-friendly variants.

Rising Deployment in Renewable and Decentralized Power Systems

The integration of renewable energy projects highlights new opportunities for shell core transformers. The Shell Core Distribution Transformer Market adapts to decentralized grids where smaller, efficient transformers play a crucial role. It supports voltage regulation in wind farms, solar parks, and hybrid energy plants. Compact units ensure reliable operation in remote and space-constrained locations. Flexible configurations allow utilities to expand capacity in line with variable renewable output. This trend underlines the importance of adaptable designs in the evolving power sector.

Expansion of Utility Investments in Grid Modernization Programs

Ongoing utility investments reinforce modernization efforts across transmission and distribution networks. The Shell Core Distribution Transformer Market aligns with government and private initiatives targeting reliable, efficient grids. It supports replacement of aging transformers with advanced models designed for high-capacity demand. Utilities allocate budgets for upgrading substations and integrating automation systems. The emphasis remains on long-term operational reliability and cost efficiency. This trend ensures stable demand across residential, commercial, and industrial segments.

Market Challenges Analysis

High Production Costs and Supply Chain Constraints Impacting Profitability

The Shell Core Distribution Transformer Market faces challenges due to high raw material costs. Core materials such as silicon steel and copper remain subject to volatile global pricing. It creates uncertainty for manufacturers and affects long-term supply agreements. Supply chain disruptions further complicate timely delivery of components and finished products. Rising freight costs and shortages of critical materials extend lead times for projects. Utilities often delay procurement when budgets tighten, reducing immediate demand. The industry must balance cost control with maintaining high technical performance.

Regulatory Pressures and Operational Limitations Affecting Market Growth

Stringent efficiency standards place pressure on manufacturers to redesign products frequently. The Shell Core Distribution Transformer Market must adapt to evolving environmental and safety regulations, which increase compliance costs. It requires continuous investment in R&D and certification processes. Installation challenges also arise in densely populated urban areas, where space constraints limit deployment. Operational limitations in handling overloads and ensuring fault tolerance add to technical hurdles. Utilities demand longer service life and reduced maintenance, which can strain design capabilities. These factors combine to create significant barriers for consistent market expansion.

Market Opportunities

Expansion of Renewable Energy Projects and Decentralized Power Networks

The Shell Core Distribution Transformer Market gains strong opportunities from global renewable energy adoption. Solar and wind projects require efficient distribution transformers to manage variable loads and stabilize power supply. It creates consistent demand for compact and high-capacity units suited for remote installations. Decentralized grids expand in developing regions, providing new prospects for localized power solutions. Shell core transformers support flexibility in these systems, ensuring voltage stability under diverse operating conditions. Government incentives for green energy accelerate procurement of advanced transformer designs, reinforcing long-term market growth.

Growing Investments in Smart Grid Infrastructure and Urban Electrification

Rapid urbanization and modernization of transmission infrastructure present new openings for manufacturers. The Shell Core Distribution Transformer Market aligns with utility projects that emphasize automation and grid reliability. It benefits from demand for smart-compatible transformers equipped with monitoring and fault detection systems. Expanding electrification in developing countries creates additional procurement channels for distribution equipment. Cities invest in advanced power networks to serve growing residential and industrial demand. These opportunities drive consistent adoption of shell core designs that combine efficiency, adaptability, and durability for modern grid needs.

Market Segmentation Analysis:

By Installation

The Shell Core Distribution Transformer Market divides into outdoor and indoor installations. Outdoor transformers hold a larger share due to their wide use in utilities, renewable projects, and industrial sites. It offers strong weather resistance and operates reliably under extreme environmental conditions. Outdoor units meet the needs of expanding grids in both rural and urban settings. Indoor transformers gain demand in commercial buildings, data centers, and manufacturing facilities where space and safety are critical. Their compact design supports reliable operations in enclosed environments. Both segments grow as utilities and industries balance resilience with safety requirements.

- For instance, Eaton’s DS-3 (single-phase) and DT-3 (three-phase) dry-type ventilated transformers range from 15 kVA up to 2,500 kVA, offering high efficiency that meets federal energy regulations for energy-saving performance.

By Cooling

The market segments into dry type and oil immersed transformers. Oil immersed transformers dominate because of their higher efficiency, better load handling, and long service life. It remains the preferred choice in high-capacity utility and industrial operations. Dry type transformers expand steadily due to their safer, fire-resistant design. They gain adoption in urban areas, hospitals, and high-rise buildings where safety standards are strict. Advances in resin encapsulation improve durability of dry type units. Both cooling methods support diverse operational needs across industries.

- For instance, ABB introduced the TRAFCOM sensor—a compact, wireless monitoring device that can be magnetically mounted onto any transformer in 15 minutes. It tracks temperature, humidity, surface heat, magnetic fields, vibration, acoustics, and partial discharge, enabling real-time condition monitoring across assets.

By Rating

The market by rating includes units of ≤2.5 MVA, 2.6 MVA to 10 MVA, and above 10 MVA. The ≤2.5 MVA category sees strong demand in rural electrification and small commercial projects. It supports reliable power supply for communities and small enterprises. The 2.6 MVA to 10 MVA segment grows rapidly with adoption in industrial plants, urban grids, and renewable energy projects. It balances capacity with efficiency, making it a preferred choice for mid-scale distribution. Units above 10 MVA serve large industrial facilities, utilities, and power-intensive sectors requiring robust performance. The Shell Core Distribution Transformer Market finds opportunities across all segments, with each category addressing distinct operational requirements.

Segments:

Based on Installation:

Based on Cooling:

Based on Rating:

- ≤ 2.5 MVA

- 6 MVA to 10 MVA

- 10 MVA

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 22% of the Shell Core Distribution Transformer Market. The region benefits from consistent utility investments in grid modernization programs across the United States and Canada. It focuses on upgrading aging distribution infrastructure to meet rising electricity consumption in residential, commercial, and industrial sectors. It also sees strong demand from renewable energy integration, particularly wind and solar installations across states like Texas, California, and Ontario. Regulatory standards such as U.S. Department of Energy efficiency mandates accelerate adoption of low-loss, high-performance transformers. Utilities prioritize digital monitoring solutions, creating demand for smart-enabled shell core units. The region maintains steady growth with a balance of modernization efforts and renewable energy targets.

Europe

Europe represents around 20% of the Shell Core Distribution Transformer Market. Strong energy-efficiency directives from the European Union encourage deployment of eco-friendly transformer designs. Countries including Germany, France, and the United Kingdom focus on upgrading networks with low-loss, high-capacity transformers. It sees growing replacement demand as utilities shift away from older oil-immersed units toward modern, compact alternatives. The rise of renewable integration, particularly offshore wind projects in the North Sea, drives large-scale adoption. Urban electrification initiatives in smart cities like Amsterdam and Paris expand opportunities for indoor installations. Europe sustains its position by aligning market growth with strict environmental regulations and smart grid initiatives.

Asia Pacific

Asia Pacific dominates with about 38% share of the Shell Core Distribution Transformer Market, making it the largest regional contributor. Rapid industrialization in China, India, and Southeast Asia fuels significant transformer demand. Expanding urban infrastructure and large-scale electrification programs in rural communities strengthen growth. It benefits from government-backed renewable projects, particularly solar power parks in India and wind farms in China. Manufacturing hubs adopt high-capacity transformers to ensure uninterrupted operations in automotive, steel, and electronics sectors. Compact shell core transformers gain traction in urban areas where space is limited. Asia Pacific secures leadership by combining industrial growth, renewable integration, and grid expansion.

Latin America

Latin America accounts for about 10% of the Shell Core Distribution Transformer Market. Countries such as Brazil, Mexico, and Chile invest heavily in renewable energy, creating consistent demand for distribution transformers. It supports integration of large solar and wind projects into national grids. Government reforms in power sectors encourage utility upgrades and modernization of transmission and distribution infrastructure. Rural electrification programs expand adoption of small and medium-rated transformers across remote communities. Urban centers like São Paulo and Mexico City adopt indoor units for commercial and residential growth. The region strengthens its role by aligning energy demand growth with renewable targets.

Middle East and Africa

The Middle East and Africa region holds approximately 10% share of the Shell Core Distribution Transformer Market. Major investments in power generation and distribution support infrastructure expansion across Gulf countries, South Africa, and Nigeria. It benefits from large-scale oil and gas projects that require high-capacity transformers. Solar energy initiatives, such as those in Saudi Arabia and the United Arab Emirates, expand demand for reliable distribution solutions. Utilities focus on reducing transmission losses in rapidly growing urban areas. It sees rising procurement of shell core designs for both outdoor and indoor applications. The region continues to progress as governments prioritize energy diversification and grid stability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi Energy Ltd.

- EMCO Limited

- Mitsubishi Electric Corporation

- Elsewedy Electric

- Eaton Corporation

- HYOSUNG HEAVY INDUSTRIES

- General Electric

- ABB

- CG Power & Industrial Solutions Ltd.

- Celme S.r.l.

Competitive Analysis

The Shell Core Distribution Transformer Market features include Hitachi Energy Ltd., EMCO Limited, Mitsubishi Electric Corporation, Elsewedy Electric, Eaton Corporation, HYOSUNG Heavy Industries, General Electric, ABB, CG Power & Industrial Solutions Ltd., and Celme S.r.l. The Shell Core Distribution Transformer Market remains highly competitive, shaped by continuous innovation and technological upgrades. Companies focus on enhancing efficiency, reducing energy losses, and meeting strict global standards for performance and safety. It drives investment in advanced materials, digital monitoring solutions, and compact transformer designs that align with modern grid requirements. Manufacturers strengthen their positions by expanding product portfolios, entering new markets, and forming strategic partnerships with utilities and industrial clients. Competition also centers on delivering cost-effective solutions for large-scale projects while maintaining high reliability and durability. The market reflects a balance between global leaders with broad networks and regional firms that provide specialized or localized offerings.

Recent Developments

- In November 2024, ABB launched the first digitally-integrated power transformer in the world; it will continue innovating electrification solutions. The sensor will enable sustainable power supply through performance monitoring that will provide resilient electric grids and manufacturers.

- In August 2024, CHINT, the global leader in smart energy solutions, is proud to offer the latest advancement in 750kV Ester Oil-Immersed Power Transformer for the 50th Session of CIGRE in Paris, France.

- In November 2023, Hitachi Energy unveiled Transformers featuring Transient Voltage Protection (TVP) Technology, safeguarding distribution transformers from transient voltage during switching events. This innovation ensures comprehensive protection for transformers and downstream magnetic equipment, boasting a flexible design adaptable to various network configurations and switching frequencies.

- In March 2023, GE Renewable Energy announced the deployment of its latest transformers for offshore wind projects, particularly for the Dogger Bank Wind Farm in the UK. These transformers are designed to handle the unique challenges of offshore energy production and distribution.

Report Coverage

The research report offers an in-depth analysis based on Installation, Cooling, Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with global grid modernization programs.

- Utilities will prefer energy-efficient designs that reduce power losses.

- Digital monitoring and IoT features will gain wider adoption.

- Renewable integration will drive demand for adaptable transformer models.

- Urban electrification will expand the need for compact indoor units.

- Industrialization in emerging economies will support high-capacity installations.

- Regulations will push manufacturers toward eco-friendly materials and designs.

- Investment in smart grids will accelerate advanced transformer deployment.

- Replacement of aging infrastructure will create steady market opportunities.

- Regional players will strengthen competitiveness through localized solutions.