Market Overview

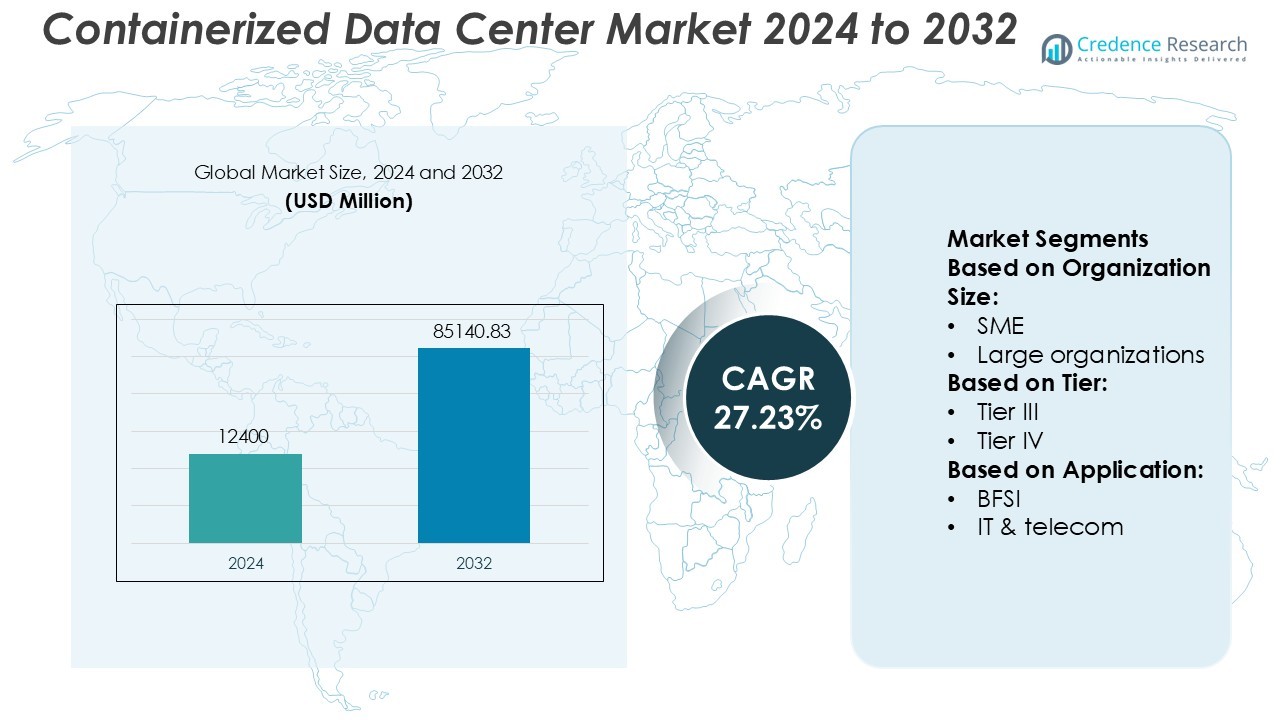

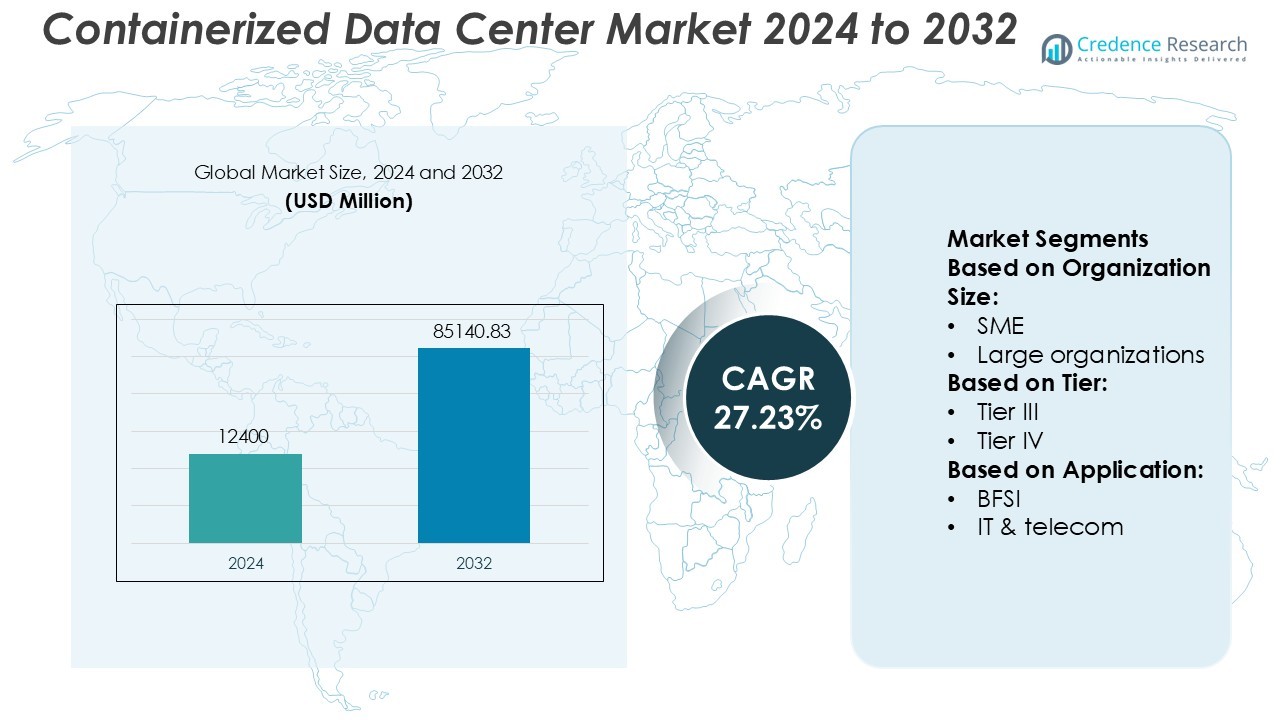

Containerized Data Center Market size was valued USD 12400 million in 2024 and is anticipated to reach USD 85140.83 million by 2032, at a CAGR of 27.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Containerized Data Center Market Size 2024 |

USD 12400 Million |

| Containerized Data Center Market, CAGR |

27.23% |

| Containerized Data Center Market Size 2032 |

USD 85140.83 Million |

The containerized data center market is shaped by leading technology vendors that focus on modular deployment, efficient power usage, and fast installation. Key companies include Fujitsu Limited, Huawei Technologies Co., Ltd., Schneider Electric SE, Hewlett Packard Enterprise, Delta Electronics, Inc., Eaton Corporation, Rittal GmbH & Co. KG, Atos SE, Etix Everywhere, and Fuji Electric Co., Ltd. These players invest in advanced cooling, AI-enabled monitoring, and scalable rack configurations to support 5G, edge computing, and hybrid cloud environments. North America leads the market with 34% share, driven by strong cloud adoption, high digital infrastructure spending, and ongoing telecom modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Containerized Data Center Market size was valued at USD 12400 million in 2024 and is projected to reach USD 85140.83 million by 2032, registering a CAGR of 27.23%.

- Rapid shift toward scalable, modular infrastructure and growing data traffic drives adoption across BFSI, telecom, healthcare, and industrial sectors, while 5G rollouts increase edge deployments.

- Vendors compete through energy-efficient cooling, AI-enabled monitoring, quick deployment models, and customizable rack densities, strengthening their position in high-density computing environments.

- High initial procurement and integration costs, along with security and compliance challenges in distributed sites, remain key restraints for price-sensitive enterprises.

- North America holds the leading regional position with a 34% share, followed by Europe at 28% and Asia-Pacific at 24%, while large enterprises remain the dominant segment due to higher investment capacity and strong demand for low-latency, high-density operations.

Market Segmentation Analysis:

By Organization Size

Large organizations hold the dominant share in the containerized data center market. These enterprises manage extensive workloads, multi-region data operations, and strict uptime needs. Containerized designs support fast deployment, modular scaling, and edge computing, which helps large firms expand capacity without long construction timelines. High adoption within cloud service providers, global telecom operators, and hyperscale companies continues to push demand. SMEs are adopting at a steady pace due to lower upfront investment and easy installation, but their share remains smaller compared to large enterprises that prioritize high-density computing and advanced security features.

- For instance, Huawei Technologies Co., Ltd. launched its FusionModule2000 smart modular data center, which supports an IT load of up to 310 kilowatts per module (depending on the specific configuration).

By Tier

Tier III containerized data centers account for the highest market share. Companies prefer Tier III because it offers fault tolerance, concurrent maintenance, and higher availability than Tier I and II facilities while remaining cost-effective compared to Tier IV systems. Enterprises in cloud, banking, and telecom rely on Tier III setups to balance reliability and budget. Tier IV adoption is growing in defense and mission-critical workloads due to full fault tolerance and maximum uptime. However, higher cost limits Tier IV penetration, keeping Tier III as the leading configuration across global deployments.

- For instance, HPE’s Modular Data Center (MDC) containers incorporate direct liquid-cooling technology that reduces overall energy consumption by about 20% and enables deployment timelines as short as 6 months instead of 18 months.

By Application

The IT & telecom segment dominates the market with the largest share. Telecom operators, cloud platforms, and data service providers use modular data centers to support 5G rollout, edge computing, and rising data consumption. Rapid deployment and scalable rack capacity help operators maintain low latency and expand into underserved regions. BFSI and healthcare are increasing adoption to support secure data storage and regulatory compliance. Government and industrial sectors follow as they modernize on-premise and remote facilities, yet IT & telecom remains the primary growth engine due to continuous network expansion.

Key Growth Drivers

Rapid Demand for Scalable IT Infrastructure

Enterprises are shifting from traditional data center models to modular, plug-and-play deployments due to rising data workloads and storage needs. Containerized data centers offer faster installation, reduced construction costs, and flexible expansion capabilities. Growing adoption of cloud computing, digital services, and big data analytics drives enterprises to deploy scalable and mobile data infrastructure. Many organizations prefer standardized modules that reduce deployment timelines from months to weeks. This demand accelerates adoption across BFSI, telecom, and government sectors, boosting global market growth.

- For instance, Fuji Electric Co., Ltd. delivers containerized power systems equipped with uninterruptible power supply units rated up to 2,000 kVA, supporting high-density IT loads in modular data centers.

Rising Edge Computing Adoption

The rise of IoT devices, autonomous systems, and real-time data applications is increasing demand for edge computing. Containerized data centers support low-latency processing by being deployed closer to end users or industrial locations. Telecom operators use modular units to strengthen 5G rollouts and reduce network congestion. Edge deployments also improve storage efficiency, cybersecurity, and service reliability in remote sites. Manufacturing, healthcare, and retail companies are adopting on-site micro data centers, directly contributing to market expansion and accelerating investments in prefabricated IT infrastructure.

- For instance, Eaton Corporation supplies modular power systems for edge data centers using its 93PM UPS platform, which supports power ratings up to 200 kilowatts per enclosure and provides battery runtime extensions through lithium-ion modules rated at 40 kilowatt-hours each.

Need for Energy-Efficient and Green Data Solutions

Growing emphasis on carbon reduction and operational sustainability is driving adoption of energy-efficient modular data centers. Prefabricated units include advanced cooling systems, optimized power usage effectiveness (PUE), and renewable integration. Companies reduce energy losses by designing smaller, controlled environments rather than large fixed facilities. Governments and large enterprises prefer containerized formats due to compliance with green building standards. Reduced CAPEX and OPEX further encourage adoption. These solutions also support recycling, standardization, and quick hardware replacement, making them attractive for environmentally focused IT modernization strategies.

Key Trends & Opportunities

Integration of AI-Enabled Monitoring and Automation

Artificial intelligence and analytics are being integrated to automate monitoring, thermal management, and fault detection. Smart systems enhance uptime, optimize cooling, and reduce energy consumption through predictive maintenance. Vendors are offering remote management tools that support real-time troubleshooting across distributed sites. Automated orchestration helps enterprises scale workloads efficiently, creating revenue opportunities for solution providers. The growing use of data center infrastructure management (DCIM) software enhances lifecycle management, supports multi-site operations, and reduces manpower requirements, expanding adoption among telecom and hyperscale operators.

- For instance, Rittal RiMatrix S Standard Container, Article No. DK 7998.506. The container is designed as a standardized, containerized data center solution for outdoor siting.

Expansion of Prefabricated Micro Data Centers

Micro data centers are gaining traction in locations with poor infrastructure, disaster-prone zones, and high-density urban regions. Organizations deploy small containerized units near branch offices, factories, and retail hubs to improve data processing speed. These compact solutions deliver high computing capacity in limited space, creating adoption opportunities in oil & gas, mining, and energy sectors. Prefabrication allows faster delivery, predictable performance, and reduced civil engineering requirements. Global enterprises view micro data centers as cost-effective alternatives to full-scale construction, driving future growth.

- For instance, Vertiv Group Corp. supplies the Vertiv™ SmartMod™ prefabricated micro data center, with the standard model supporting IT loads up to 90 kilowatts per module and the SmartMod™ MAX version supporting up to 180 kilowatts.

Rising Investments in 5G and Hybrid Cloud Deployments

The rollout of 5G networks requires distributed and edge-optimized compute systems. Telecom providers use modular data centers to support network densification and reduce latency. Hybrid cloud adoption is also accelerating demand for on-premise containerized units that operate alongside public cloud platforms. Global IT spending on latency-sensitive applications, media streaming, and AI services increases implementation of modular systems. This trend opens revenue opportunities for hardware integrators, cooling system manufacturers, and cloud service providers.

Key Challenges

High Initial Procurement and Integration Costs

Although containerized data centers reduce long-term operating costs, the initial investment remains high. Hardware procurement, rugged container fabrication, and advanced cooling systems add to capital expenditure. Small organizations face budget constraints when adopting prefabricated infrastructure. Integration challenges also appear when connecting modular units with legacy systems, power supplies, or on-site network infrastructure. These factors slow adoption in low-income regions and price-sensitive industries, creating a financial barrier for widespread deployment.

Cybersecurity and Compliance Concerns

Distributed deployments increase risk exposure due to multiple access points and remote locations. Securing physical and virtual infrastructure becomes complex without centralized control. Organizations must invest in advanced encryption, firewall systems, and real-time monitoring to prevent breaches. Compliance with data protection regulations and government policies further raises operational costs. Vendors must provide strong access controls and threat detection to build customer confidence. Without effective governance and security frameworks, enterprises hesitate to adopt large-scale modular data center networks.

Regional Analysis

North America

North America leads the containerized data center market with 34% share, driven by strong cloud adoption, hyperscale data center expansion, and rapid 5G infrastructure development. The U.S. hosts major cloud providers, telecom operators, and defense agencies that prefer modular deployments for faster setup and improved efficiency. Rising data traffic, IoT usage, and demand for edge computing support further market penetration. Energy-efficient modular units are gaining traction due to sustainability goals and strict data compliance policies. Canada and the U.S. continue investing in AI-enabled data centers and hybrid cloud environments, strengthening the region’s dominance across commercial and government sectors.

Europe

Europe holds 28% share of the containerized data center market, supported by strict energy regulations, renewable energy investments, and demand for sustainable digital infrastructure. Countries like Germany, the U.K., and the Nordics deploy modular facilities to reduce carbon footprint and meet data localization requirements. Telecom providers are expanding 5G rollouts, boosting edge computing deployments across enterprise and industrial environments. Growing smart city projects and public digital services increase need for scalable and mobile data capacity. The region’s strong manufacturing base and automation initiatives also drive adoption of prefabricated micro data centers in factories and logistics hubs.

Asia-Pacific

Asia-Pacific accounts for 24% share and represents the fastest-growing regional market due to rising digital transformation, large population-driven data consumption, and rapid cloud adoption. China, India, Japan, and Southeast Asia are witnessing strong demand for edge computing in retail, telecom, and IT services. Regional governments support data center investments through tax incentives and data localization mandates. Telecom operators deploy modular units to support 5G coverage and real-time processing. Expanding e-commerce, fintech, and online entertainment also drive large deployments. The region’s increasing need for low-cost, scalable data infrastructure will continue accelerating market growth.

Latin America

Latin America holds 7% share, supported by improving network infrastructure, rising enterprise cloud transition, and growth of data-intensive sectors such as BFSI, telecom, and e-commerce. Brazil and Mexico are leading adopters, where enterprises prefer containerized formats due to limited traditional data center availability and high construction costs. Mobile data growth and digital banking drive demand for edge computing and energy-efficient solutions. However, economic constraints and slow 5G expansion limit large-scale deployments. The market is gradually improving as hyperscale cloud providers expand regional footprints through modular and prefabricated facilities.

Middle East & Africa

The Middle East & Africa region captures a 7% share, supported by smart city initiatives, government digitalization, and expansion of telecom infrastructure. The UAE, Saudi Arabia, and South Africa are early adopters, using modular solutions for low-latency computing and remote site operations. Harsh climate conditions make containerized units attractive due to advanced cooling and mobility advantages. Data localization laws and growing cybersecurity requirements encourage local data storage. Despite strong interest, high capital expenditure and limited skilled workforce affect market pace. Investments in 5G, mining, oil & gas, and defense create long-term growth opportunities.

Market Segmentations:

By Organization Size:

By Tier:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the containerized data center market includes Fujitsu Limited, Etix Everywhere, Huawei Technologies Co., Ltd., Delta Electronics, Inc., Schneider Electric SE, Hewlett Packard Enterprise (HPE), Rittal GmbH & Co. KG, Fuji Electric Co., Ltd., Eaton Corporation, and Atos SE. The containerized data center market focuses on advanced modular designs, energy-efficient power systems, and remote monitoring capabilities. Vendors are developing prefabricated and micro data center units that support 5G, edge computing, and hybrid cloud environments. Companies invest in smart automation, AI-enabled controls, and low-PUE cooling technologies to reduce operating costs and improve uptime. Strategic partnerships with telecom providers, cloud platforms, and government agencies help expand adoption across urban and remote areas. Manufacturers also emphasize faster deployment, scalability, and customization to meet rising data traffic and latency-sensitive applications in sectors such as BFSI, healthcare, and industrial operations.

Key Player Analysis

Recent Developments

- In January 2025, DXN, an Australian manufacturer of containerized data centers, launched a liquid-cooled module. The company this week announced the launch of a high-performance computing (HPC) AI direct-to-chip liquid cooling pod.

- In August 2024, NVIDIA Corporation partner Sustainable Metal Cloud (SMC), a Singapore-based AI cloud provider, to offer HyperCubes, containerized Nvidia GPU servers utilizing immersion cooling technology. These servers can reduce energy consumption by 50% compared to traditional air-cooled systems. SMC also claims that this solution is 28% more cost-effective than competing liquid-cooling options.

- In July 2024, Vertiv Group Corp. introduced the Vertiv MegaMod CoolChip, a prefabricated modular (PFM) data center solution for efficient and reliable AI computing. Equipped with liquid cooling, this solution is adaptable to the platforms of major AI compute providers and can be scaled to meet specific customer needs.

- In February 2024, Mavin announced to deploy a containerized Powercube data center at the Global Centre of Rail Excellence (GCRE) in Onllwyn, South Wales. This prefabricated unit, tailored for rail testing, will facilitate data analysis for the facility’s rail tracks, focusing on rolling stock and infrastructure testing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Organization Size, Tier, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for modular and prefabricated data centers will rise as enterprises prefer faster deployment and reduced construction work.

- Edge computing adoption will increase containerized installations near users to support low-latency applications and real-time analytics.

- Telecom operators will expand modular data centers to strengthen 5G infrastructure and network capacity.

- Hybrid cloud strategies will drive investment in on-premise modular units to support data control, compliance, and workload distribution.

- Energy-efficient cooling and power systems will gain traction as organizations target sustainability and lower operating costs.

- AI-based monitoring and automation will improve uptime, predictive maintenance, and resource optimization.

- Micro data centers will witness strong demand in retail, manufacturing, healthcare, and remote industrial sites.

- Government digitalization programs and data localization rules will boost deployment of secure modular facilities.

- Vendors will offer more customizable, multi-rack and high-density designs to meet growing compute needs.

- Partnerships with hyperscale cloud providers, telecom firms, and IT integrators will accelerate global market expansion.