Market Overview

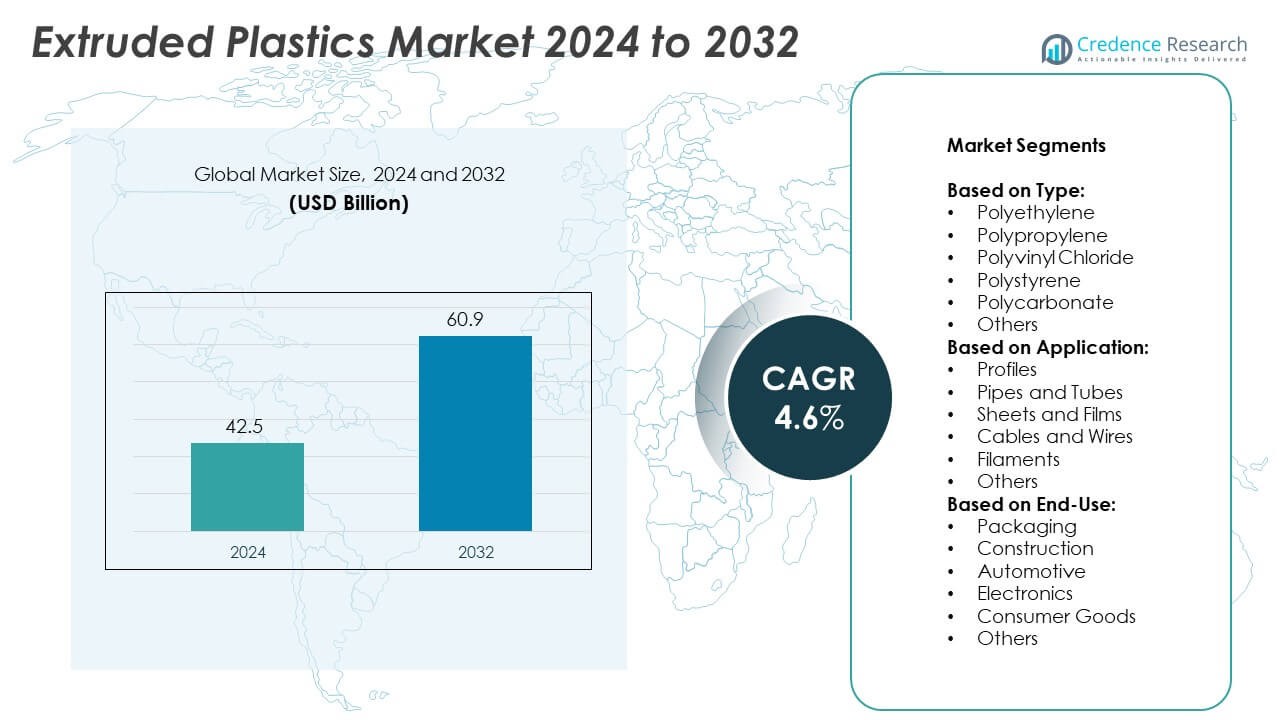

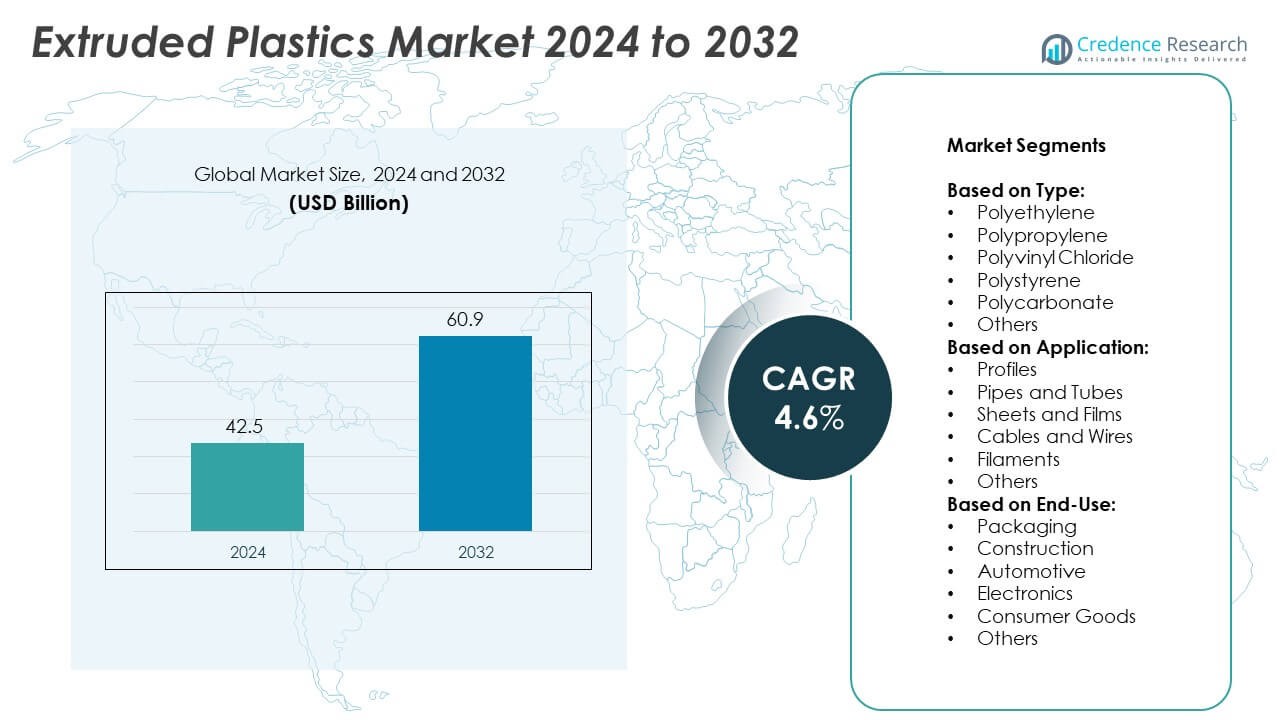

Extruded Plastics Market size was valued at USD 42.5 billion in 2024 and is anticipated to reach USD 60.9 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Extruded Plastics Market Size 2024 |

USD 42.5 Billion |

| Extruded Plastics Market, CAGR |

4.6% |

| Extruded Plastics Market Size 2032 |

USD 60.9 Billion |

The Extruded Plastics market grows steadily driven by strong demand in packaging, construction, and automotive sectors. Companies adopt recyclable and bio-based plastics to meet sustainability regulations and consumer expectations. Advanced extrusion technologies improve efficiency, product quality, and material customization across industries. Rising e-commerce and food consumption fuel packaging requirements, while infrastructure projects expand usage of pipes and profiles. Automotive and electronics manufacturers increase reliance on lightweight, durable materials. These combined drivers and trends position extruded plastics as a key growth industry globally.

The Extruded Plastics market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Asia-Pacific leads growth due to rapid industrialization, infrastructure expansion, and strong packaging demand. North America and Europe emphasize sustainability and technological advancements in extrusion processes. Latin America and the Middle East witness steady adoption through construction and automotive applications. Key players shaping the competitive environment include BASF SE, Dow Inc, SABIC, and LyondellBasell Industries N.V., each focusing on innovation and regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Extruded Plastics market size was USD 42.5 billion in 2024 and will reach USD 60.9 billion by 2032 at a CAGR of 4.6%.

- Strong demand in packaging, construction, automotive, and electronics sectors drives consistent market growth.

- Rising sustainability focus leads to greater use of recyclable and bio-based extruded plastics worldwide.

- Competition remains intense with global leaders investing in advanced extrusion technologies and strategic expansions.

- Regulatory pressures on single-use plastics create challenges, pushing manufacturers toward innovation and higher costs.

- Asia-Pacific leads growth supported by industrialization and infrastructure projects, while North America and Europe emphasize sustainability.

- Latin America and Middle East & Africa show steady growth potential through construction and automotive demand.

Market Drivers

Rising Demand from Packaging and Consumer Goods Sector

The Extruded Plastics market grows steadily due to rising consumption of packaging materials in food, beverages, and consumer goods. Companies prefer extruded plastics for their flexibility, lightweight properties, and durability. It provides enhanced barrier protection, supporting longer shelf life for perishable goods. E-commerce expansion also accelerates packaging requirements across regions. Single-use plastics regulations drive innovation toward recyclable and sustainable extruded solutions. Market participants respond with advanced materials that balance performance with compliance. This demand strengthens the market’s long-term growth path.

- For instance, In fiscal year 2024 (ending September 28, 2024), Berry Global reported $12.258 billion in net sales, marking a 3.21% decrease from 2023. While specific production tonnage for multilayer extruded films is not disclosed, the company noted positive organic volume growth driven partly by markets like food and beverage packaging

Expanding Use in Construction and Infrastructure Development

Infrastructure growth across emerging economies strongly drives the Extruded Plastics market. Pipes, profiles, siding, and insulation materials rely heavily on extrusion processes for cost efficiency and consistency. It ensures durability, weather resistance, and energy efficiency in modern construction projects. Rapid urbanization supports significant uptake of extruded plastic-based building materials. Governments emphasize sustainable construction practices, creating opportunities for eco-friendly alternatives. Construction firms value these products for ease of installation and long service life. The sector continues to anchor large-scale demand worldwide.

- For instance, In FY23, Amcor continued to advance its sustainable packaging solutions, with 90% of its global product portfolio designed to be recyclable, reusable, or compostable. By segment, 95% of its rigid packaging was considered recyclable by weight and 89% of its flexible packaging had a recycle-ready design. In efforts to meet evolving regulations and standards, Amcor also increased its purchase of recycled material by nearly 30% year-over-year.

Technological Advancements in Extrusion Processes

Innovation in manufacturing methods enhances productivity, efficiency, and sustainability across the Extruded Plastics market. Precision extrusion technologies improve surface quality and material strength. It supports customized product design for automotive, medical, and industrial applications. Advances in automation reduce costs while ensuring higher output consistency. Energy-efficient machinery lowers operational expenses for producers. Recycling integration within extrusion lines addresses environmental concerns while maintaining quality. These improvements strengthen the competitiveness of extruded plastics against traditional alternatives.

Growth in Automotive and Electrical Applications

The Extruded Plastics market benefits from rising adoption in automotive and electrical sectors. Automakers depend on lightweight extruded materials for fuel efficiency and emissions reduction. It provides durable wire coatings, tubing, and weather-resistant trims. Electrical and electronics manufacturers prefer extruded plastics for insulation, protection, and component housing. Expanding electric vehicle production drives significant need for specialized extruded components. The shift toward sustainable mobility intensifies reliance on engineered plastics. These applications continue to diversify and strengthen demand across industries.

Market Trends

Shift Toward Sustainable and Recyclable Materials

The Extruded Plastics market shows a strong shift toward eco-friendly and recyclable products. Companies invest in bio-based and recycled feedstock to meet stricter environmental standards. It supports circular economy initiatives that reduce plastic waste and improve resource efficiency. Demand for compostable packaging and green construction materials grows across regions. Government policies encourage adoption of biodegradable alternatives in consumer goods and packaging. This trend reshapes product innovation and production strategies across the supply chain. Sustainability continues to remain a defining focus for long-term growth.

- For instance, In 2024, REHAU significantly expanded its presence and manufacturing capacity in the Asia-Pacific region to support residential and commercial construction markets. This expansion was highlighted by strategic moves such as acquiring a 51% stake in Red Star Polymers in India, a manufacturer of PVC edge band tapes, in late 2024. As a result, REHAU India, which employed over 500 people.

Rising Integration of Advanced Extrusion Technologies

The Extruded Plastics market witnesses significant adoption of modern extrusion technologies that improve speed and efficiency. High-precision equipment allows manufacturers to produce complex shapes with consistent quality. It reduces material waste while supporting high-volume output. Digital monitoring systems enhance process control and predictive maintenance. Automation also minimizes energy consumption and labor costs. Producers integrate advanced recycling units within extrusion lines to achieve operational efficiency. This trend positions manufacturers for stronger global competitiveness.

- For instance, Georg Fischer Piping Systems achieved sales of CHF 2,066 million by the year 2023, contributing to the broader Georg Fischer Group’s total of CHF 4,026 million. The company supplied a wide array of PE and PP pipe solutions for water and sewage infrastructure projects globally, with its products valued for their long service life and ease of installation

Expanding Applications in Healthcare and Electronics

The Extruded Plastics market benefits from the growing role of plastics in healthcare and electronics. Demand for extruded tubing, catheters, and protective components rises due to medical device innovation. It ensures strength, flexibility, and biocompatibility for critical applications. Electronics manufacturers use extruded plastics for insulation, housing, and safety enclosures. The rapid growth of electric vehicles and renewable energy systems also boosts usage. Market participants focus on developing specialty plastics for advanced applications. This diversification strengthens long-term adoption across industries.

Globalization of Supply Chains and Regional Expansion

The Extruded Plastics market experiences strong regional expansion due to globalization of supply chains. Producers expand facilities closer to end-use markets to reduce logistics costs. It helps balance supply-demand gaps and ensures faster delivery cycles. Strategic alliances and mergers support entry into high-growth regions. Emerging economies in Asia-Pacific lead demand due to rapid industrialization and infrastructure projects. Established players also explore Latin America and Middle East markets for new opportunities. This trend accelerates global capacity growth and market penetration.

Market Challenges Analysis

Environmental Regulations and Sustainability Pressures

The Extruded Plastics market faces growing challenges from strict environmental regulations and sustainability concerns. Governments enforce bans and restrictions on single-use plastics, forcing companies to redesign materials and processes. It increases compliance costs and limits flexibility in product development. Public demand for eco-friendly alternatives also pushes manufacturers toward high-cost research and innovation. Recycling remains complex due to contamination and limited infrastructure in many regions. Market participants must balance affordability with sustainability, which creates financial and operational strain. The push for greener solutions continues to reshape the competitive landscape.

Volatile Raw Material Prices and Supply Chain Disruptions

The Extruded Plastics market struggles with volatile raw material prices and supply chain disruptions. Dependence on petrochemical derivatives exposes producers to fluctuations in crude oil and natural gas costs. It impacts profit margins and creates uncertainty in pricing strategies. Global supply chains also face delays due to trade restrictions, logistics bottlenecks, and geopolitical tensions. Small and medium-sized enterprises encounter greater risk, as they lack strong procurement leverage. Rising transportation costs further pressure margins across manufacturers. These challenges require adaptive sourcing strategies and stronger regional integration to stabilize supply and demand.

Market Opportunities

Adoption of Sustainable and High-Performance Materials

The Extruded Plastics market presents opportunities through the development of sustainable and high-performance materials. Companies invest in bio-based polymers and recyclable plastics to align with environmental regulations. It supports the demand for eco-friendly packaging and construction applications. High-performance plastics with enhanced strength, heat resistance, and durability gain traction in automotive, aerospace, and healthcare industries. Growing consumer awareness accelerates acceptance of greener alternatives. Manufacturers that deliver innovative, compliant materials capture strong competitive advantage. This trend opens pathways for long-term growth across global markets.

Expansion in Emerging Economies and Advanced Applications

The Extruded Plastics market gains opportunities from industrial growth and infrastructure expansion in emerging economies. Rapid urbanization and rising middle-class populations increase demand for housing, packaging, and consumer goods. It creates steady opportunities for pipes, profiles, and insulation materials. Expanding healthcare and electronics sectors also strengthen adoption of extruded plastics in tubing, enclosures, and protective components. The shift toward electric mobility enhances requirements for lightweight, durable, and specialized materials. Strategic investments in Asia-Pacific, Latin America, and Africa support wider market penetration. These regions become vital growth engines for global producers.

Market Segmentation Analysis:

By Type:

The Extruded Plastics market is segmented into polyethylene, polypropylene, polyvinyl chloride, polystyrene, polycarbonate, and others. Polyethylene holds strong demand due to its flexibility, chemical resistance, and use in films and packaging. Polypropylene offers high tensile strength and heat resistance, making it suitable for automotive and consumer goods. Polyvinyl chloride finds extensive use in pipes, profiles, and construction due to its durability. Polystyrene serves packaging and insulation needs with its lightweight and cost-efficient properties. Polycarbonate provides high impact strength for electronics and automotive components. Other specialty plastics target niche applications requiring advanced performance.

- For instance, NatureWorks made significant progress in the construction of its new integrated PLA manufacturing facility in Thailand, which will have an annual capacity of 75,000 tons and was announced to be in progress as of October 2023.

By Application:

The Extruded Plastics market includes profiles, pipes and tubes, sheets and films, cables and wires, filaments, and others. Profiles and pipes dominate due to infrastructure development and growing demand for reliable water and gas distribution systems. It supports long-term durability in construction projects. Sheets and films remain vital for packaging, labeling, and protective applications across industries. Cables and wires drive usage in electrical and electronics due to superior insulation properties. Filaments see expanding adoption in 3D printing and industrial manufacturing. Other applications reflect specialized demand in medical and aerospace segments.

- For instance, SABIC produced a total of 53.9 million metric tons of polymers and other chemical products. In line with its sustainability strategy and TRUCIRCLE™ portfolio, the company advanced its recycled materials programs in 2024 by announcing new partnerships for recycling and showcasing its sustainable solutions for industries like construction.

By End-Use:

The Extruded Plastics market serves packaging, construction, automotive, electronics, consumer goods, and others. Packaging leads with extensive use in food, beverage, and e-commerce supply chains. It ensures product protection and convenience, boosting global consumption. Construction ranks high with applications in pipes, profiles, insulation, and siding materials. Automotive uses extruded plastics for lightweighting, trims, and tubing to enhance efficiency. Electronics depend on extruded materials for insulation, connectors, and durable housings. Consumer goods utilize plastics in household items, appliances, and protective materials. Other end-uses reflect specialty applications in healthcare, energy, and agriculture.

Segments:

Based on Type:

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Polycarbonate

- Others

Based on Application:

- Profiles

- Pipes and Tubes

- Sheets and Films

- Cables and Wires

- Filaments

- Others

Based on End-Use:

- Packaging

- Construction

- Automotive

- Electronics

- Consumer Goods

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 28% share of the Extruded Plastics market in 2024. The region benefits from strong demand across packaging, automotive, and construction sectors. It sees consistent adoption of extruded plastics in food packaging, where consumer preference for convenience drives sales. Automotive manufacturers rely on lightweight extruded components to enhance fuel efficiency and comply with emission standards. The construction sector uses extruded pipes, profiles, and insulation for infrastructure and residential projects. Rising investments in recycling facilities further strengthen adoption of sustainable extruded plastics. Companies in the United States and Canada focus on advanced materials to maintain competitive advantage.

Europe

Europe represented 23% share of the Extruded Plastics market in 2024. The region’s growth is shaped by strict regulations promoting sustainability and circular economy initiatives. Packaging manufacturers lead adoption of recyclable and bio-based extruded plastics to meet regulatory compliance. The construction sector deploys extruded pipes, siding, and insulation materials to support energy-efficient buildings. Automotive industries in Germany, France, and Italy use lightweight extruded plastics for trims, tubing, and electrical insulation. It supports broader goals of reducing emissions and improving efficiency. Increasing innovation in bio-based polymers also reflects Europe’s focus on eco-friendly solutions. Regional producers invest heavily in R&D to expand sustainable product portfolios.

Asia-Pacific

Asia-Pacific held the largest share at 36% of the Extruded Plastics market in 2024. Rapid industrialization and urbanization in China, India, and Southeast Asia drive massive demand. The region witnesses strong growth in packaging due to expanding food, beverage, and e-commerce industries. Construction activity across urban centers fuels demand for pipes, profiles, and insulation products. It also sees rising adoption in electronics manufacturing, where extruded plastics serve as insulation and component housings. Automotive production, particularly in China and Japan, boosts requirements for lightweight extruded materials. Government initiatives supporting infrastructure development continue to elevate demand across industries. Asia-Pacific remains the dominant hub for both production and consumption.

Latin America

Latin America contributed 7% share of the Extruded Plastics market in 2024. Demand is driven by construction, packaging, and automotive sectors across Brazil, Mexico, and Argentina. Packaging manufacturers increase consumption of extruded films and sheets for food and consumer goods. The construction industry adopts extruded pipes and profiles to modernize urban infrastructure. It also supports regional housing projects with cost-effective materials. Automotive assembly plants in Mexico add to the demand for lightweight extruded plastics. Investment in renewable energy projects expands applications for extruded components. Regional producers focus on cost efficiency while gradually adopting sustainable production practices.

Middle East and Africa

The Middle East and Africa accounted for 6% share of the Extruded Plastics market in 2024. The construction sector forms the backbone of demand, supported by large-scale infrastructure projects. It drives strong consumption of extruded pipes, profiles, and insulation. Packaging applications grow due to rising consumer spending and retail sector expansion. Automotive markets in South Africa and Gulf countries also utilize extruded plastics for components and protective materials. The electronics sector begins to adopt extruded insulation products, though at a smaller scale compared to other regions. Producers invest in new facilities to meet regional needs and reduce import reliance. Government-backed industrialization programs sustain future demand potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape in the Extruded Plastics market features BASF SE, Dow Inc, LyondellBasell Industries N.V., SABIC, ExxonMobil Corporation, INEOS Group Holdings S.A, Formosa Plastics Corporation, Mitsubishi Chemical Holdings Corporation, TotalEnergies SE, Lanxess AG, Covestro AG, Eastman Chemical Company, Celanese Corporation, Solvay S.A, and Teijin Limited. These companies hold significant positions through diversified product portfolios, global manufacturing facilities, and strong research initiatives. The market is highly competitive, with players focusing on cost efficiency, sustainability, and advanced extrusion technologies to maintain leadership. Strategic investments in recycling and bio-based plastics production remain central to growth. Several producers strengthen regional presence by expanding capacity in Asia-Pacific and the Middle East to meet rising demand. Partnerships with packaging, construction, and automotive industries enhance customer reach and secure long-term supply agreements. Innovation in high-performance materials, including lightweight and durable grades, supports penetration into automotive and electronics markets. Competitive differentiation often relies on achieving lower production costs while meeting strict environmental standards. Companies invest in advanced automation and energy-efficient machinery to improve productivity and operational margins. Regulatory compliance, customer collaboration, and technology adoption will continue shaping competition across the industry. This dynamic environment ensures sustained innovation and strategic consolidation among global leaders.

Recent Developments

- In January 2025, BASF announced the planned sale of its Styrodur® extruded polystyrene insulation business, aiming to finalize the divestment by mid‑2025

- In 2025, LyondellBasell Industries N.V., Released 2024 Sustainability Report highlighting progress in circular and low-carbon solutions.

- In 2024, Dow expanded its REVOLOOP™ family with new grades to unlock more value in plastic waste and support circularity.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable and bio-based extruded plastics will increase due to sustainability goals.

- Packaging sector will remain the leading consumer supported by e-commerce and food industries.

- Construction industry will drive growth through pipes, profiles, and insulation applications.

- Automotive manufacturers will expand use of lightweight extruded plastics for efficiency and emission targets.

- Electronics sector will adopt more extruded insulation and protective components for advanced devices.

- Technological innovations in extrusion processes will improve efficiency and product quality.

- Asia-Pacific will continue leading consumption supported by industrialization and urban growth.

- Europe will push stronger adoption of eco-friendly materials under strict regulations.

- Companies will invest in recycling integration within extrusion lines to meet compliance.

- Strategic expansions in Latin America and Africa will open new regional opportunities.