Market Overview:

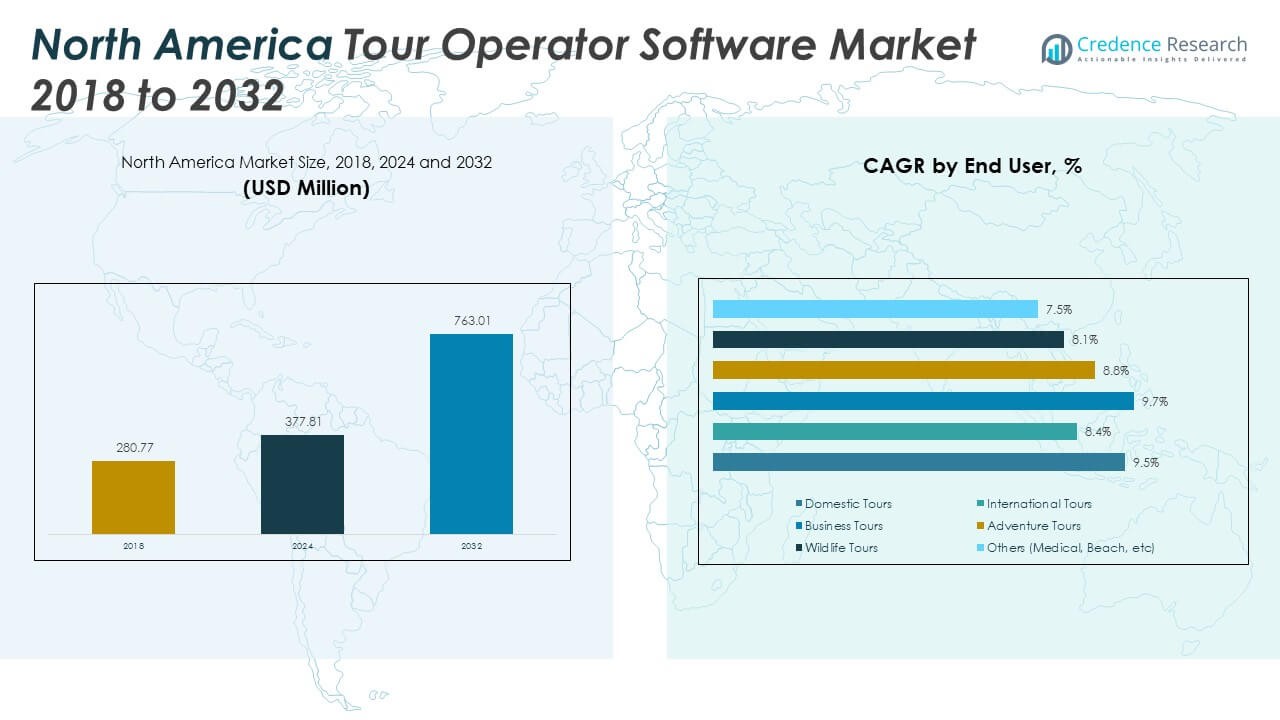

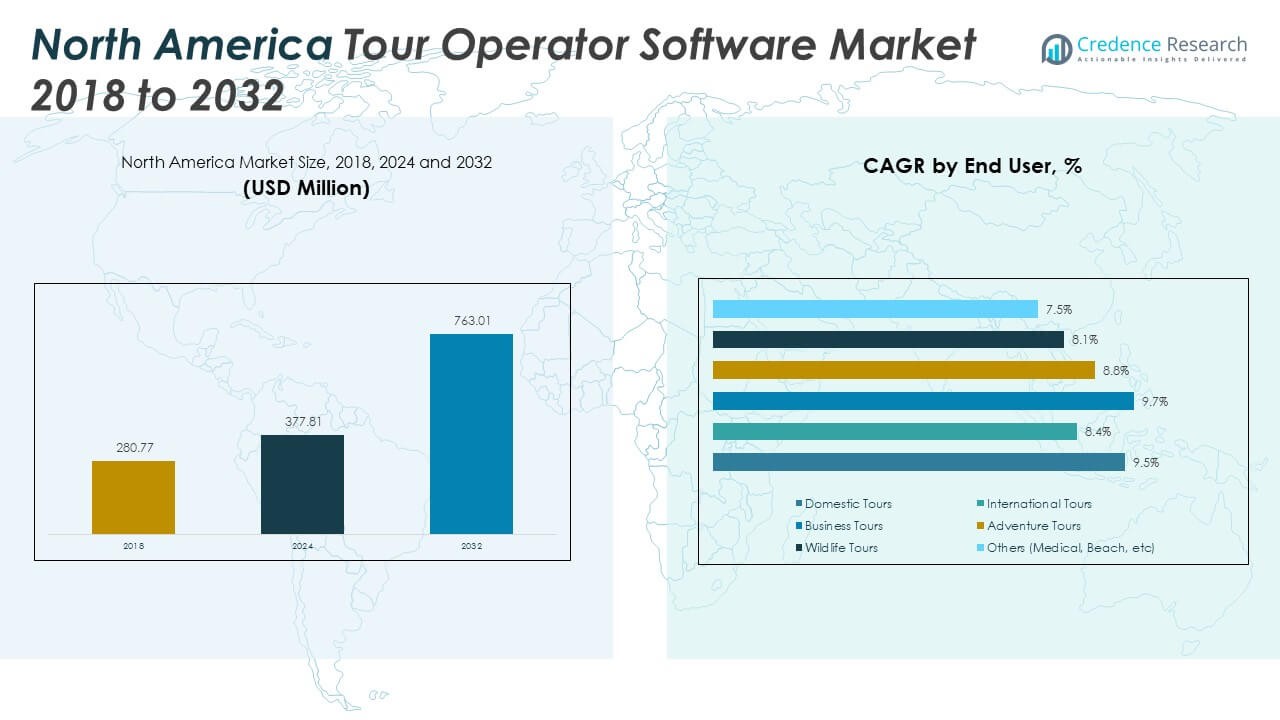

The North America Tour Operator Software Market size was valued at USD 280.77 million in 2018 to USD 377.81 million in 2024 and is anticipated to reach USD 763.01 million by 2032, at a CAGR of 9.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Tour Operator Software Market Size 2024 |

USD 377.81 Million |

| North America Tour Operator Software Market, CAGR |

9.26% |

| North America Tour Operator Software Market Size 2032 |

USD 763.01 Million |

The market growth is fueled by rising demand for automation, cloud integration, and data-driven travel planning. Tour operators are adopting digital platforms to streamline booking, payments, and itinerary management, improving customer experiences and operational efficiency. The increasing use of AI and predictive analytics supports real-time updates and personalized travel solutions. Additionally, the growing preference for mobile-based services enables travelers to book, modify, and track itineraries seamlessly. These factors collectively enhance competitiveness and accelerate digital transformation in the regional tour operator software landscape.

Geographically, the United States holds the largest share due to advanced technological adoption and the strong presence of leading players. Canada is emerging as a significant market, driven by increasing tourism activities and government initiatives to promote digital adoption in the travel sector. Mexico is also gaining traction, supported by the rapid growth of online travel agencies and a rising middle-class population seeking packaged tours. This mix of mature and emerging markets makes North America a dynamic region for tour operator software expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The North America Tour Operator Software Market was valued at USD 280.77 million in 2018, reached USD 377.81 million in 2024, and is projected to attain USD 763.01 million by 2032, registering a CAGR of 9.26%.

- The United States (68%), Canada (20%), and Mexico (12%) hold the top regional shares. The U.S. dominates due to advanced digital adoption, Canada benefits from tourism-focused policies, and Mexico thrives on rising online travel platforms.

- Mexico, with its 12% share, is the fastest-growing region. Drivers include a rising middle class, growing cultural tourism, and adoption of mobile-enabled booking systems.

- By component, software accounted for nearly 65% of the market share in 2024, driven by demand for booking automation, AI, and digital platforms.

- The services segment contributed about 35%, reflecting the importance of integration support, technical assistance, and customized deployments for operators.

Market Drivers:

Growing demand for digital booking platforms and integrated automation tools:

The North America Tour Operator Software Market is expanding due to rapid adoption of digital booking systems. Tour operators seek efficient automation tools that minimize manual errors and reduce operational costs. Customer preference for instant online bookings and secure payment gateways strengthens demand. It is supporting real-time itinerary updates, enhancing user satisfaction. Integration of advanced CRM solutions ensures seamless customer engagement across multiple channels. Operators benefit from centralized platforms that streamline reservations, vendor management, and invoicing. A shift toward cloud-based services enhances accessibility and flexibility for small and large businesses. This combination drives the market toward sustained growth.

Increasing influence of AI-driven personalization and predictive analytics:

Artificial intelligence tools are shaping customer experiences in travel planning. The North America Tour Operator Software Market benefits from AI adoption that improves personalized travel recommendations. Predictive analytics enable operators to forecast demand trends and optimize pricing strategies. It provides data-backed insights that support better resource allocation and service design. Enhanced personalization increases loyalty, as travelers expect tailored options that suit their preferences. Automated chatbots and virtual assistants improve communication and reduce response time. Integration of these tools delivers cost savings for operators while strengthening customer satisfaction. Continuous innovation in AI ensures long-term adoption across regional operators.

- For instance, Expedia Group stores over 70 petabytes of traveler data on AWS and applies AI-driven models to generate hundreds of billions of predictions annually, enabling personalized recommendations and real-time pricing optimization across its platforms.

Rising importance of mobile-first platforms for modern travelers:

Mobile applications are central to the evolving customer journey. The North America Tour Operator Software Market is growing as travelers demand mobile-first services. It allows users to manage bookings, receive alerts, and customize itineraries with ease. A mobile-first approach also supports multilingual interfaces that target diverse demographics. Travel businesses improve their competitive positioning by offering seamless app experiences. Enhanced security within mobile payment systems builds trust among digital users. The convenience of mobile access enables real-time support, which strengthens operator reputation. Travel operators invest heavily in mobile integration to meet customer expectations and stay competitive.

Expanding role of cloud integration in enabling scalability and data security:

Cloud-based infrastructure supports flexibility, scalability, and strong data protection in the regional market. The North America Tour Operator Software Market is experiencing growth through cloud adoption by both startups and established firms. It enables cost-effective deployment without significant capital investment. Businesses benefit from automatic updates, reduced maintenance burdens, and simplified access. Enhanced cloud security reassures operators handling sensitive customer data. Cloud systems also integrate easily with third-party APIs, ensuring smooth multi-platform usage. Tour operators rely on cloud for disaster recovery and continuity of operations. Growing emphasis on secure, agile systems ensures steady adoption across the region.

- For instance, Amadeus holds ISO 27001 certification with annual audits and operates a 24/7 Security Operations Center, while its cloud infrastructure supports peak processing of over 100,000 transactions per second with availability levels reaching 99.99%.

Market Trends:

Adoption of immersive technologies to enhance virtual travel experiences:

The North America Tour Operator Software Market is witnessing the inclusion of immersive features such as VR and AR. It helps customers visualize destinations before booking tours. These tools create engaging experiences that improve confidence in travel purchases. Operators integrate 3D simulations for hotel rooms, activities, and attractions. Virtual experiences support premium sales by allowing customers to explore before committing. AR-driven applications offer live navigation and local guides during trips. The trend creates a strong advantage for businesses targeting digitally inclined travelers. Continuous evolution of immersive tools keeps the market aligned with modern customer expectations.

Integration of blockchain for secure transactions and transparent operations:

Blockchain technology is being used to improve transparency and trust in the travel ecosystem. The North America Tour Operator Software Market incorporates blockchain solutions to reduce fraud and increase accountability. It ensures secure payment processing and prevents manipulation of travel contracts. Immutable records provide transparency between tour operators, partners, and customers. Loyalty programs and smart contracts benefit from blockchain reliability. The system reduces dependency on intermediaries, lowering transaction costs. Operators that adopt blockchain improve their global competitiveness and customer trust. This trend is gaining momentum as digital security concerns continue to rise.

- For instance, Winding Tree partnered with Lufthansa Group to pilot a blockchain-based B2B travel distribution platform aimed at providing decentralized access to airline offerings, though the project faced adoption challenges and Winding Tree ceased operations in 2024.

Increasing adoption of data-driven sustainability and eco-conscious practices:

Sustainability is a growing priority for travelers and tour operators alike. The North America Tour Operator Software Market reflects this shift with digital tools promoting eco-friendly practices. It tracks carbon footprints and helps operators design sustainable travel packages. Reporting dashboards provide transparency to environmentally conscious customers. Businesses improve brand perception by offering carbon offset options. Demand for eco-certified tours motivates software providers to integrate green modules. Operators focusing on sustainability appeal strongly to millennial and Gen Z travelers. This trend continues to reshape travel planning in alignment with global environmental goals.

Growth of API-driven ecosystems for cross-industry collaboration:

Cross-industry partnerships are becoming central to modern travel services. The North America Tour Operator Software Market embraces API-driven ecosystems connecting airlines, hotels, and local service providers. It creates a unified booking experience with real-time inventory updates. API connections support personalized travel bundles across multiple industries. Operators enhance customer satisfaction by offering comprehensive packages. Collaboration expands revenue opportunities through integrated ticketing and payments. Streamlined interoperability enables smoother operations across regions. The trend highlights the industry’s movement toward connected, customer-centric platforms.

- For example, Sabre’s Open Platform APIs grant access to more than 400 airlines and 1.3 million hotels worldwide, enabling integrated travel content delivery across multiple service categories via a unified system.

Market Challenges Analysis:

High implementation costs and complexities limit adoption for smaller operators:

The North America Tour Operator Software Market faces barriers due to the high cost of implementation. Smaller operators struggle with upfront expenses required for advanced digital tools. It often discourages full adoption, leading to reliance on outdated systems. Integration with existing platforms can be complex, demanding skilled IT resources. Data migration issues create additional risks during deployment. Maintenance costs for premium features burden small to mid-sized businesses. Limited technical knowledge also delays adoption among traditional tour operators. This challenge slows overall growth despite strong digital demand in the market.

Rising concerns regarding cybersecurity threats and data privacy regulations:

Data protection remains a major concern across the travel technology industry. The North America Tour Operator Software Market is under pressure to comply with strict privacy regulations. It handles sensitive information including payment details and traveler identification. Cybersecurity threats expose businesses to risks of breaches and reputational damage. Complex regulatory requirements increase compliance costs for operators. Failure to secure customer trust limits adoption of digital platforms. Continuous monitoring and investment in cybersecurity infrastructure are necessary. Growing customer awareness makes privacy protection an essential factor for competitive success.

Market Opportunities:

Increasing role of AI-powered personalization in travel planning:

The North America Tour Operator Software Market offers significant opportunities through advanced personalization. It enables operators to design customized packages aligned with individual preferences. AI-driven insights help predict customer needs and boost satisfaction. Smart recommendations enhance upselling of premium services. Travel businesses strengthen loyalty programs using personalization strategies. Automated planning tools save time and improve convenience for travelers. A focus on tailored experiences positions operators for competitive growth. These factors create strong opportunities across the evolving digital travel ecosystem.

Expansion potential in emerging markets across regional tourism hubs:

The North America Tour Operator Software Market finds opportunities in expanding regional tourism hubs. It benefits from increasing travel activity in secondary cities and rural destinations. Governments promote tourism diversification to attract more international visitors. Local operators adopt software to scale operations and reach wider audiences. Online travel agencies support emerging regions with strong digital presence. Investment in infrastructure drives adoption of new technology tools. These trends create opportunities for software providers targeting underdeveloped markets. Expansion into these hubs strengthens overall market potential.

Market Segmentation Analysis:

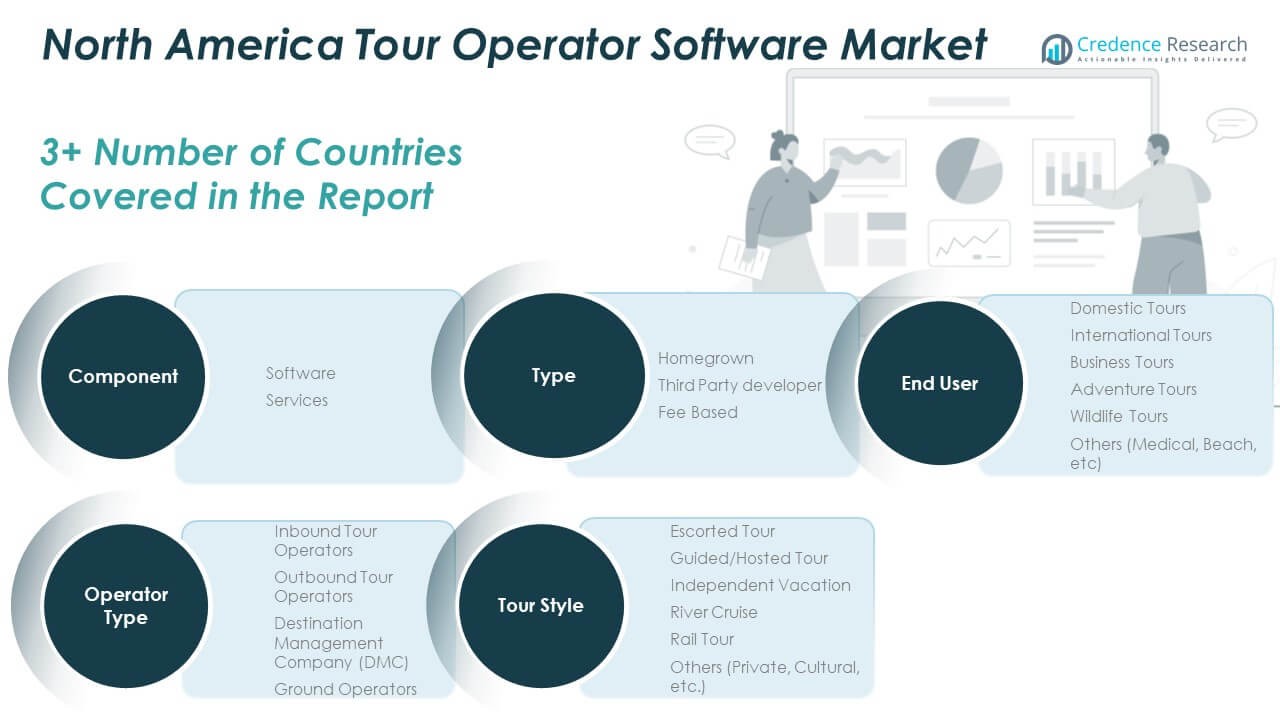

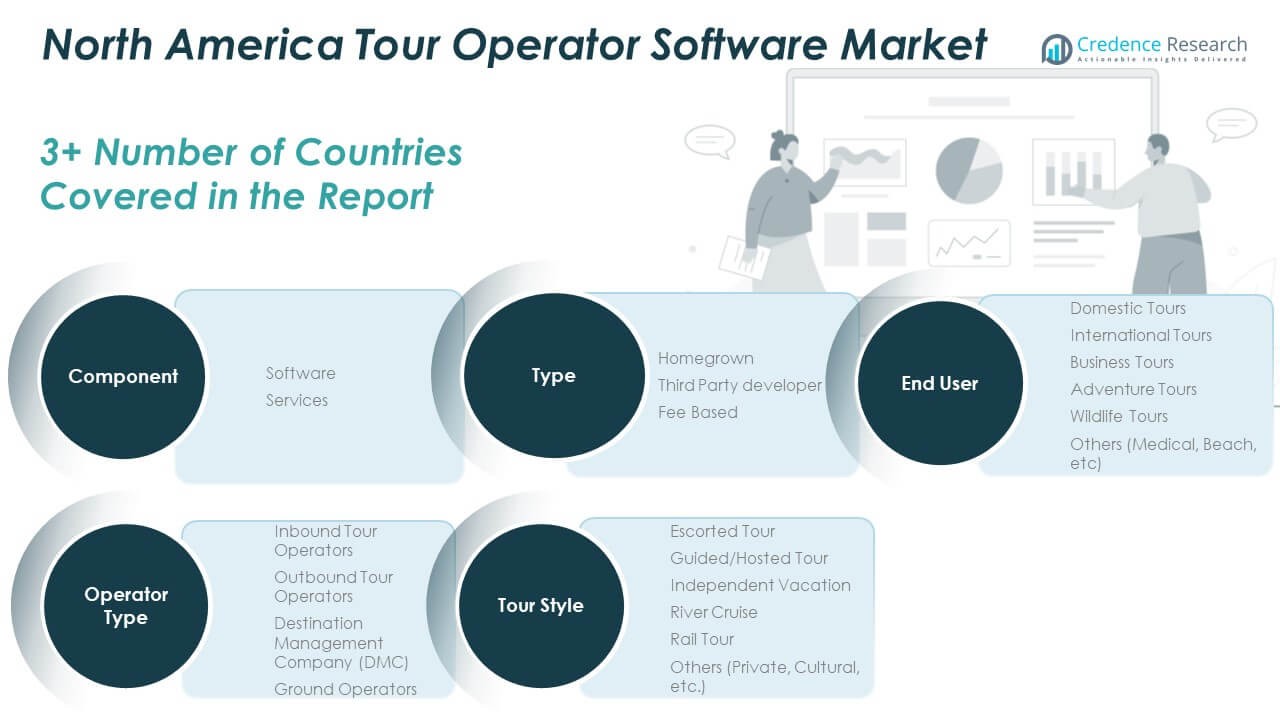

The North America Tour Operator Software Market is structured across diverse segments, reflecting the evolving needs of operators and travelers.

By type, homegrown solutions cater to smaller businesses with customized tools, while third-party developers provide scalable platforms that serve mid to large operators. Fee-based models are gaining traction due to predictable revenue structures and value-added features. This diversity creates competitive differentiation across the regional market.

- For instance, Bookeo supports over 40,000 active users across more than 120 countries using its booking platform,

By component, software remains the dominant segment, driving efficiency in booking, payments, and resource management. Services complement this by offering implementation support, integration, and technical assistance. Operators increasingly rely on comprehensive service packages to maximize the utility of software investments.

By operator type, inbound operators capture growth from international tourism, while outbound operators serve travelers seeking experiences abroad. Destination management companies and ground operators provide critical logistics and local expertise that strengthen the ecosystem.

- For example, Bonotel Exclusive Travel acts as a luxury-focused inbound travel distributor, providing electronic distribution to its network of international tour operators and hotel partners

By tour style, escorted and guided tours remain prominent for structured travel, while independent vacations appeal to younger demographics seeking flexibility. River and rail tours are expanding due to demand for unique, experiential travel. Niche segments such as cultural and private tours add further variety.

By end user, domestic tours dominate in volume, reflecting strong local travel activity, while international tours attract high-value customers. Business tours, adventure tours, and wildlife tours represent growing niches that diversify revenue streams. It is evident that segmentation across type, component, operator, tour style, and end user provides multiple avenues for growth and strategic investment.

Segmentation:

By Type

- Homegrown

- Third Party Developer

- Fee Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

The United States dominates the North America Tour Operator Software Market with a market share of 68%. Strong adoption of advanced digital platforms, combined with the presence of leading software providers, drives growth. The country benefits from high consumer demand for packaged travel, supported by robust technological infrastructure. Operators leverage AI, predictive analytics, and mobile-first platforms to offer personalized travel experiences. Business tours and international packages remain strong contributors to the segment. It continues to be the innovation hub, where software integration with AR, VR, and blockchain enhances competitiveness across the industry.

Canada holds a market share of 20%, supported by steady growth in domestic tourism and government initiatives to promote digital adoption in the travel sector. Canadian operators are increasingly shifting to cloud-based platforms that simplify booking and itinerary management. The rising appeal of sustainable travel and eco-friendly tours encourages adoption of digital systems that can track environmental impact. Operators focus on improving cross-border travel services that integrate seamlessly with U.S. and international itineraries. It demonstrates strong potential in niche markets such as adventure and wildlife tours. Growing investments in regional connectivity also fuel the adoption of modern tour operator software.

Mexico accounts for 12% of the regional market, showing strong momentum in the adoption of online travel booking platforms. Rising middle-class income levels and a growing appetite for international and cultural tours drive software demand. Tour operators in Mexico are adopting mobile-enabled systems to expand accessibility and improve user engagement. The rise of online travel agencies further supports software integration across local businesses. It reflects increasing reliance on digital platforms to manage inbound tourism, particularly from the U.S. and Canada. The country’s vibrant cultural tourism sector creates unique opportunities for software providers to tap into an expanding customer base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ker & Downey

- Greaves Tours

- Jacada Travel

- DuVine Cycling + Adventure Co.

- Classic Journeys

- Quasar Expeditions

- Black Tomato

- Nesaza

- Lemax

- Intuitive Systems

Competitive Analysis:

The North America Tour Operator Software Market is characterized by strong competition among established providers and emerging innovators. Leading companies such as Lemax, Intuitive Systems, and Jacada Travel focus on expanding product portfolios to address diverse operator needs. Specialized players like DuVine Cycling + Adventure Co., Classic Journeys, and Quasar Expeditions emphasize niche travel segments supported by digital tools. It highlights a blend of large-scale software developers and boutique operators leveraging technology to strengthen customer engagement and operational efficiency. Companies compete on pricing models, product flexibility, and integration capabilities with third-party systems. Fee-based and subscription models gain traction, offering predictable revenue streams while supporting customization. Cloud-based deployments remain a focal point for scalability and security, helping players win contracts across small and mid-sized businesses. Strong emphasis is placed on AI-driven personalization, blockchain-enabled transparency, and mobile-first experiences. It drives operators to adopt platforms that ensure faster response times, accurate itinerary management, and seamless payments. Strategic moves such as mergers, acquisitions, and regional expansions remain vital for competitive positioning.

Recent Developments:

- In July 2025, Ker & Downey continued to strengthen its position as a leading luxury tour operator, maintaining its recognition as a top safari and travel specialist, though no significant new product launch or acquisition within the software market segment has been identified this year.

- In February 2025, Black Tomato made headlines by deploying a new AI-driven travel “Feelings Engine” to curate trip recommendations, advancing the use of machine learning for itinerary personalisation in North America.

Report Coverage:

The research report offers an in-depth analysis based on Type, Component, Operator Type, Tour Style and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Tour Operator Software Market will see stronger adoption of AI-powered personalization enhancing customer experiences.

- Cloud-based platforms will expand further, offering scalability, security, and seamless integration for operators.

- Mobile-first solutions will dominate as travelers prefer real-time booking and itinerary management through apps.

- Blockchain adoption will increase, improving transaction transparency and reducing fraud across the travel ecosystem.

- Sustainable travel tools will gain traction, enabling operators to design eco-conscious packages with measurable impact.

- API-driven ecosystems will support cross-industry partnerships, creating unified experiences for travelers across services.

- Niche travel segments such as cultural, adventure, and wildlife tours will drive software innovation.

- Cybersecurity investments will intensify to protect sensitive customer data and ensure regulatory compliance.

- Regional players will focus on customized offerings, supporting smaller operators entering the digital landscape.

- Strategic mergers, acquisitions, and product launches will shape competitive positioning across the market.