Market Overview:

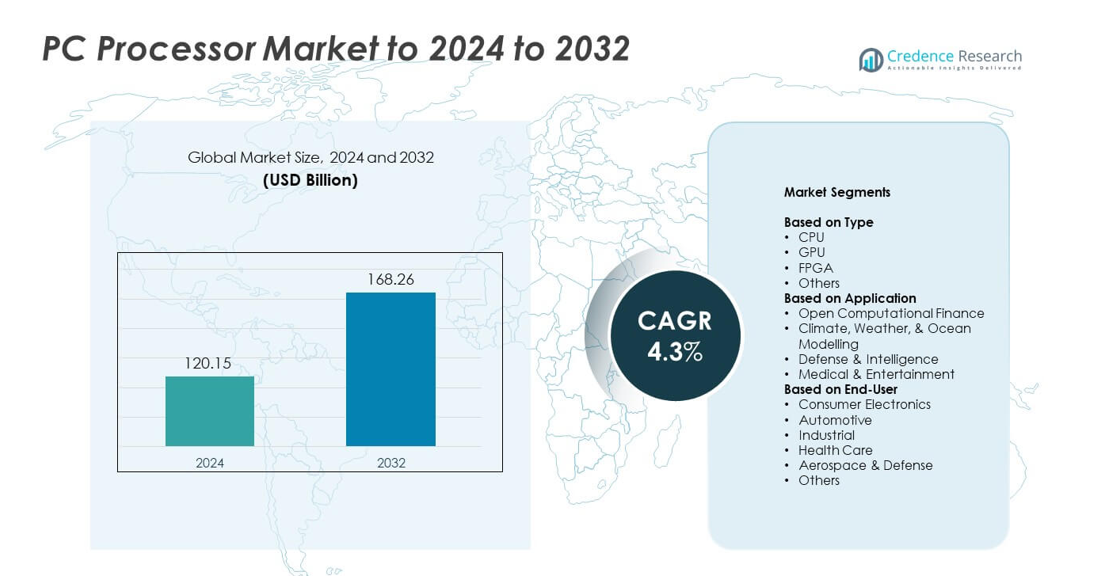

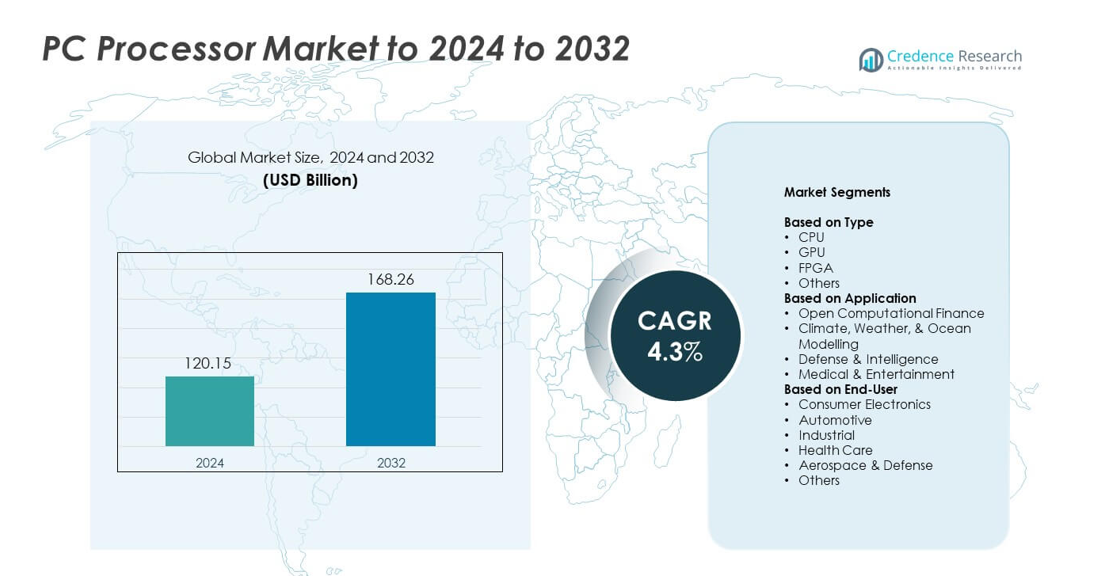

PC Processor Market size was valued USD 120.15 billion in 2024 and is anticipated to reach USD 168.26 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PC Processor Market Size 2024 |

USD 120.15 billion |

| PC Processor Market CAGR |

4.3% |

| PC Processor Market Size 2032 |

USD 168.26 billion |

The PC Processor Market is driven by leading companies such as Nvidia Corporation, Qualcomm Incorporated, Xilinx Inc, Alphabet Inc, Intel Corporation, Graphcore Ltd, TeraDeep Inc, and Advanced Micro Devices, each expanding advanced chip architectures for high-performance and energy-efficient computing. These players strengthen their position through AI-ready processors, improved integrated graphics, and faster multi-core designs. North America led the global market in 2024 with about 41% share, supported by strong demand for gaming PCs, enterprise systems, and AI-enabled laptops. Europe and Asia Pacific followed, driven by rising digital adoption, premium device upgrades, and expanding semiconductor production ecosystems.

Market Insights

- The PC Processor Market was valued at USD 120.15 billion in 2024 and is projected to reach USD 168.26 billion by 2032, growing at a CAGR of 4.3%.

- Strong demand for high-performance computing, gaming systems, and AI-enabled devices continues to drive processor adoption across consumer and enterprise segments.

- Market trends highlight rising use of energy-efficient architectures, integrated AI engines, and advanced multi-core designs, with CPUs holding about 69% share in 2024.

- Competition intensifies as global manufacturers invest in smaller nanometer nodes, improved thermal performance, and faster GPU acceleration to strengthen market presence.

- North America led the market with 41% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while consumer electronics remained the dominant end-user segment with about 54% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

CPU dominated the type segment in 2024 with about 69% share due to strong use in desktops, laptops, and workstations. CPU demand stayed high because leading PC brands rely on multi-core designs for faster processing and improved energy efficiency. GPU adoption grew quickly as gaming, AI workloads, and content creation gained traction across global markets. FPGA use increased in specialized computing tasks, but the scale remained smaller. Rising AI acceleration needs and improved integrated graphics continue to support overall type segment growth.

- For instance, AMD’s official 2024 specification sheet confirms the Ryzen 9 7950X has 16 cores, 32 threads, and a 5.7 GHz max boost, supporting high-performance desktop workloads.

By Application

Climate, weather, and ocean modelling led the application segment in 2024 with nearly 38% share due to heavy dependence on high-performance processors for large-scale simulations. Government agencies and research institutions used advanced multi-core chips to process real-time environmental data at higher accuracy. Open computational finance expanded as trading systems adopted low-latency processors. Medical and entertainment applications saw rising adoption driven by imaging, rendering, and VR workloads. Defense and intelligence needs continued to push demand for secure, high-speed computational processing.

- For instance, NVIDIA’s technical brief states that the A100 Tensor Core GPU delivers 19.5 teraflops FP32 performance and 312 teraflops tensor performance, enabling large-scale scientific and climate simulations.

By End-User

Consumer electronics remained the leading end-user segment in 2024 with about 54% share, supported by strong sales of laptops, desktops, tablets, and gaming systems. Users preferred higher-speed processors with improved thermal efficiency and integrated AI capabilities. The automotive sector grew due to rising demand for processors used in ADAS, infotainment, and autonomous functions. Industrial users adopted rugged processors for automation and control systems. Healthcare expanded with growing reliance on imaging and diagnostic systems, while aerospace and defense increased uptake for mission-critical computing.

Key Growth Drivers

Rising Demand for High-Performance Computing

Growing use of advanced software across gaming, AI workloads, and content creation boosts demand for high-performance PC processors. Users seek faster speeds, better multitasking, and improved graphics efficiency. Major PC brands deploy multi-core chips to support smooth execution of heavy applications. Expanding adoption of cloud gaming and professional editing tools also lifts processor upgrades. This trend strengthens the need for next-generation architectures with enhanced thermal management and power control.

- For instance, Apple’s M3 Max chip, confirmed in its 2024 specs, integrates 92 billion transistors and offers a 40-core GPU, supporting heavy compute and content-creation tasks.

Expansion of AI and Machine Learning Workloads

AI-driven applications across consumer and enterprise devices fuel higher processor adoption. Manufacturers develop chipsets with dedicated AI accelerators to handle image processing, predictive tasks, and real-time decision workflows. Developers rely on processors that support fast data transfer and low latency for training and inference tasks. Growing integration of AI in laptops, gaming rigs, and business desktops drives sustained demand. Rising interest in edge AI also boosts the requirement for advanced PC processing units.

- For instance, Qualcomm’s 2024 Snapdragon X Elite platform includes an NPU rated at 45 trillion operations per second (TOPS), enabling fast on-device AI processing.

Growth of Remote Work and Digital Productivity

Remote work adoption strengthens processor demand across laptops and desktop systems. Companies invest in devices with higher compute power to support collaboration, virtual meetings, and cloud platforms. Users rely on processors that offer stable performance for multitasking and virtualization. Education, small businesses, and creative professionals continue shifting toward performance-focused computing setups. This shift keeps the upgrade cycle active and drives consistent demand across mid-range and premium processor categories.

Key Trends and Opportunities

Shift Toward Energy-Efficient Chip Architectures

Energy-efficient processor designs gain strong traction as users prioritize longer battery life and reduced heat output. Manufacturers innovate with lower-nanometer process nodes that deliver faster performance with optimized power draw. This shift supports thin-and-light laptop adoption and benefits eco-focused device buyers. Rising demand for portable systems creates strong opportunities for efficient hybrid architectures and improved integrated GPU designs. Companies that advance performance-per-watt metrics gain a competitive advantage.

- For instance, TSMC’s official documentation and 2024 technology reports state that its original 3-nanometer (N3) process reduces power use by approximately 25–30% compared to the 5-nanometer (N5) node at equal performance, or offers a 10–15% increase in speed at the same power level.

Increasing Adoption of Integrated AI Capabilities

Integrated AI engines across modern processors create strong growth opportunities for PC makers. These chips enable faster image enhancement, voice recognition, and optimized performance tuning. Users rely on AI-enabled features for real-time automation and enhanced security. Device manufacturers promote AI-ready laptops for business, gaming, and everyday use. This trend accelerates the shift toward processors capable of on-device learning and advanced predictive processing.

- For instance, MediaTek’s 2024 Dimensity 9300 specification confirms an integrated AI engine (APU 790) capable of supporting large language models (LLMs) with up to 13 billion parameters in the original chip, with hardware and software capabilities that scale to support models of up to 33 billion parameters, running fully on-device.

Growing Opportunity in Specialized Processing Markets

Rising demand for processors tailored to specific workloads opens new growth opportunities. Segments such as gaming, simulation, robotics, healthcare imaging, and edge computing require optimized chip designs. Manufacturers focus on performance tuning, thermal control, and workload specialization. This shift helps brands expand their market reach across niche but fast-growing applications. The push for customization drives development of processors with enhanced stability and higher efficiency.

Key Challenges

High Manufacturing Costs and Complex Chip Fabrication

Advanced processor fabrication requires costly equipment, precision engineering, and continuous R&D investment. Shrinking nanometer processes increase production difficulty and raise capital expenditure. Companies face pressure to balance pricing with performance advancement. Supply chain fluctuations in semiconductor materials add further stress. These challenges limit rapid scaling and delay product launches in price-sensitive markets.

Global Supply Chain Disruptions and Component Shortages

The PC processor market faces risks from geopolitical tensions, wafer shortages, and logistics delays. Disruptions impact fabrication timelines and reduce the availability of high-performance chips. OEMs struggle to meet device production goals when processor supply becomes inconsistent. Longer lead times affect retail pricing and consumer upgrades. These challenges highlight the need for diversified manufacturing and resilient sourcing strategies.

Regional Analysis

North America

North America held about 41% share in 2024, driven by strong demand for high-performance desktops, gaming PCs, and enterprise workstations. The region benefits from advanced semiconductor design capabilities supported by leading players focusing on AI-ready chipsets and multi-core architectures. Growth in cloud services, software development, and remote work continues to lift processor upgrades across consumer and commercial systems. Expanding adoption of laptops with energy-efficient processors strengthens market momentum. Strong innovation ecosystems in the United States and Canada keep North America a leading hub for advanced processor deployment and early adoption of next-generation computing technologies.

Europe

Europe accounted for nearly 27% share in 2024, supported by rising adoption of premium laptops, gaming systems, and business computers. The region benefits from strong investments in digital transformation across enterprises, research institutions, and public sectors. Countries such as Germany, France, and the United Kingdom drive processor demand through advanced automation, cloud migration, and professional computing needs. Growth in AI applications, cybersecurity workloads, and edge computing strengthens processor requirements. Increasing preference for energy-efficient and thin-profile devices also supports steady processor upgrades across both consumer and commercial markets.

Asia Pacific

Asia Pacific captured around 24% share in 2024, driven by large-scale PC manufacturing, high consumer demand, and rapid technology adoption. Markets such as China, Japan, South Korea, and India fuel processor consumption across gaming, education, enterprise computing, and mobility devices. Strong semiconductor production capability in the region accelerates innovation and supply capacity. Rising adoption of AI-enabled laptops and advanced graphics processors strengthens demand. Expanding e-learning, digital work patterns, and growing middle-class spending continue to support long-term market growth in both entry-level and premium processor categories.

Latin America

Latin America held about 5% share in 2024, supported by growing purchases of laptops and entry-level desktops across education, home use, and small businesses. Economic recovery in major countries such as Brazil and Mexico fuels gradual improvement in PC adoption. Rising demand for online learning, remote work, and digital banking encourages upgrades to devices with better processing power. Adoption of gaming systems and content creation tools is increasing, though at a slower pace compared to advanced regions. Expanding e-commerce channels help improve processor availability across local markets.

Middle East and Africa

Middle East and Africa accounted for nearly 3% share in 2024, driven by rising digitalization, expanding IT infrastructure, and increasing adoption of performance-focused computing systems. Countries such as the UAE, Saudi Arabia, and South Africa lead demand for advanced processors used in business, education, and government applications. Growth in gaming communities, online content use, and cloud-based work platforms supports greater reliance on modern PCs. Despite price sensitivity in several markets, improving internet access and growing tech investments continue to strengthen long-term processor uptake across the region.

Market Segmentations:

By Type

By Application

- Open Computational Finance

- Climate, Weather, & Ocean Modelling

- Defense & Intelligence

- Medical & Entertainment

By End-User

- Consumer Electronics

- Automotive

- Industrial

- Health Care

- Aerospace & Defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PC Processor Market is shaped by major companies such as Nvidia Corporation, Qualcomm Incorporated, Xilinx Inc, Alphabet Inc, Intel Corporation, Graphcore Ltd, TeraDeep Inc, and Advanced Micro Devices. These players compete through rapid advancement in multi-core architectures, integrated AI engines, and energy-efficient chip designs that support growing demand across consumer and enterprise systems. Manufacturers focus on improving performance-per-watt, thermal efficiency, and GPU acceleration to meet rising workloads in gaming, content creation, and AI-driven applications. The market also sees strong investment in smaller nanometer process technologies to deliver faster speeds and lower latency. Partnerships with PC brands, cloud providers, and device OEMs help expand adoption across laptops, desktops, workstations, and edge computing devices. Growing R&D spending, competitive pricing strategies, and frequent product refresh cycles further intensify competition, keeping innovation at the center of long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Intel Corporation unveiled significant advancements at CES 2025, including the expansion of the Intel Core Ultra 200S desktop processor portfolio with new 65-watt and 35-watt models optimized for AI workloads.

- In 2025, Qualcomm Incorporated announced new Snapdragon X-series PC chips, including models with up to 8 cores, NPUs capable of 45 trillion operations per second, and GPUs optimized for AI and graphics performance.

- In 2024, Advanced Micro Devices, Inc. (AMD) introduced the 5th Gen AMD EPYC processors for AI, cloud, and enterprise application

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward processors designed with stronger AI and machine learning capabilities.

- Energy-efficient chip architectures will gain wider adoption across laptops and compact systems.

- Multi-core and hybrid designs will become standard for both consumer and enterprise devices.

- Demand for integrated GPUs will rise as gaming and content creation continue to expand.

- Edge computing growth will increase requirements for low-latency, high-performance processors.

- Advanced semiconductor fabrication nodes will improve performance-per-watt and reduce heat output.

- Cloud-based workloads will push enterprises to upgrade workstations with faster processing units.

- Security-focused processors will gain traction as cyber threats grow across digital platforms.

- Specialized processors for automotive and healthcare applications will create new revenue streams.

- AI-enhanced laptops and desktops will drive the next major upgrade cycle globally.