Market Overview:

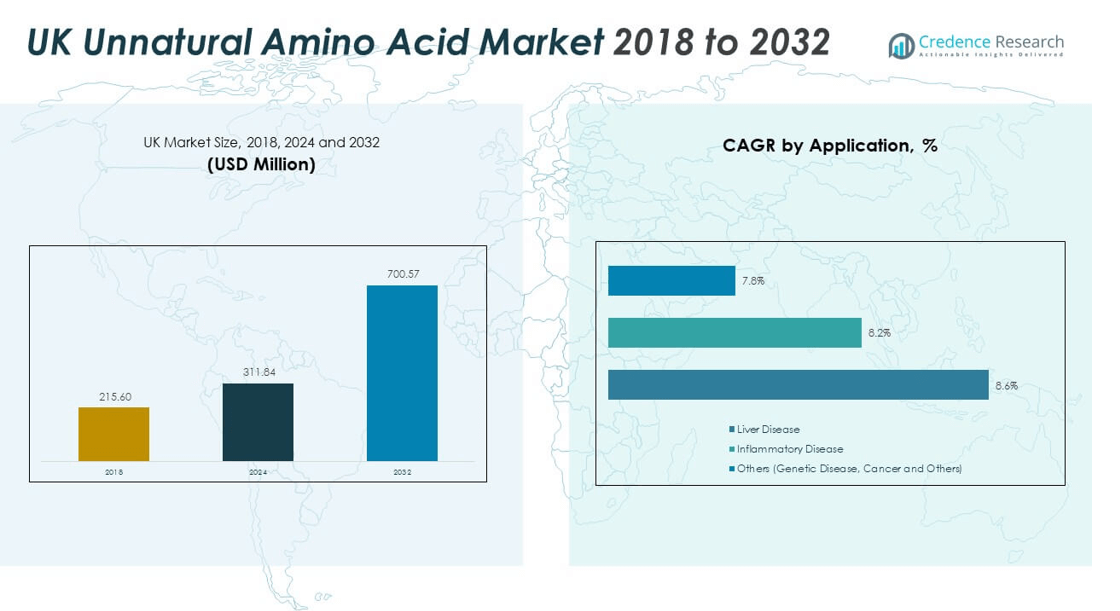

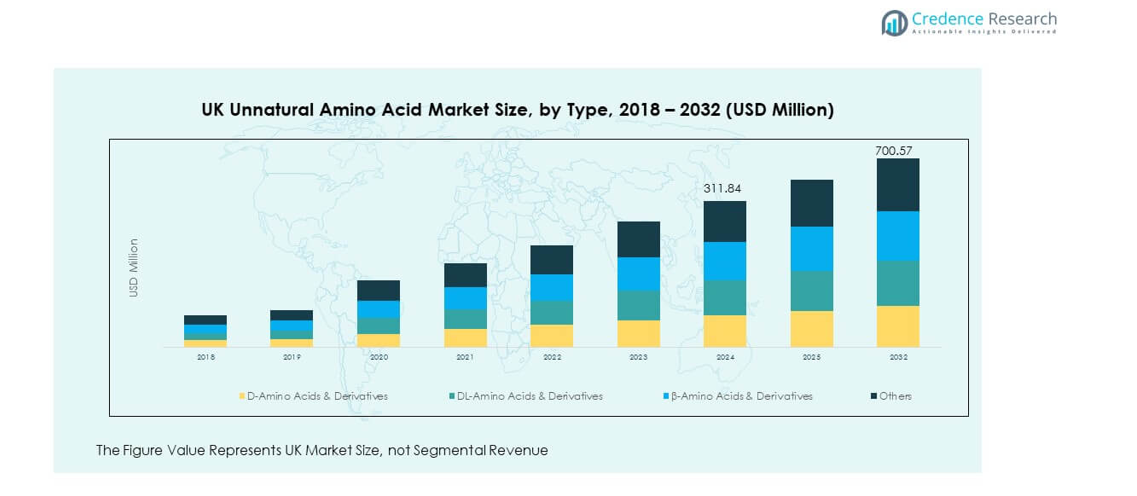

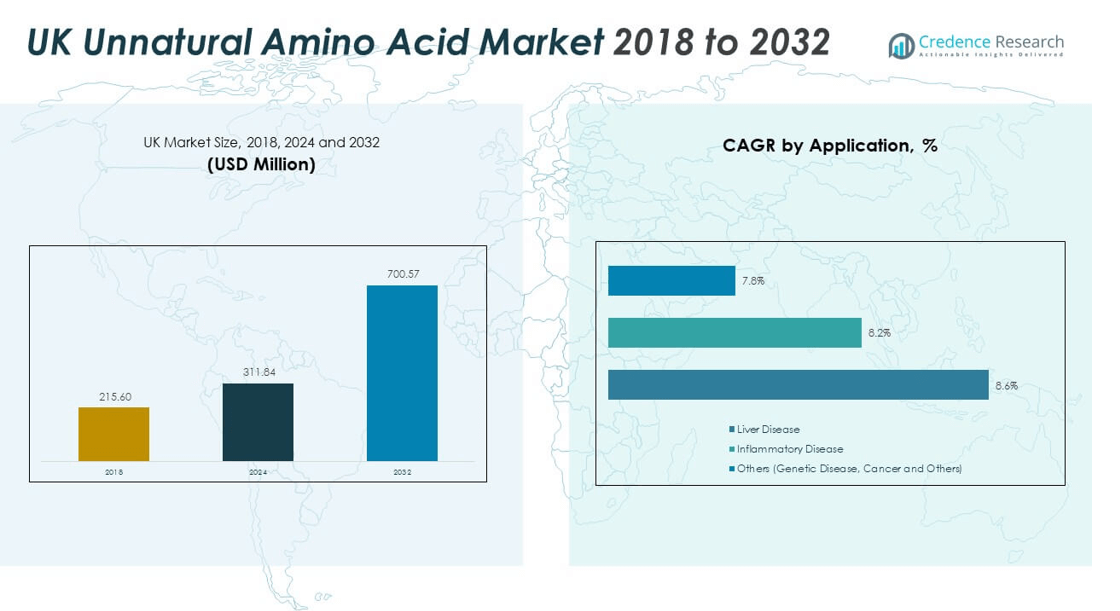

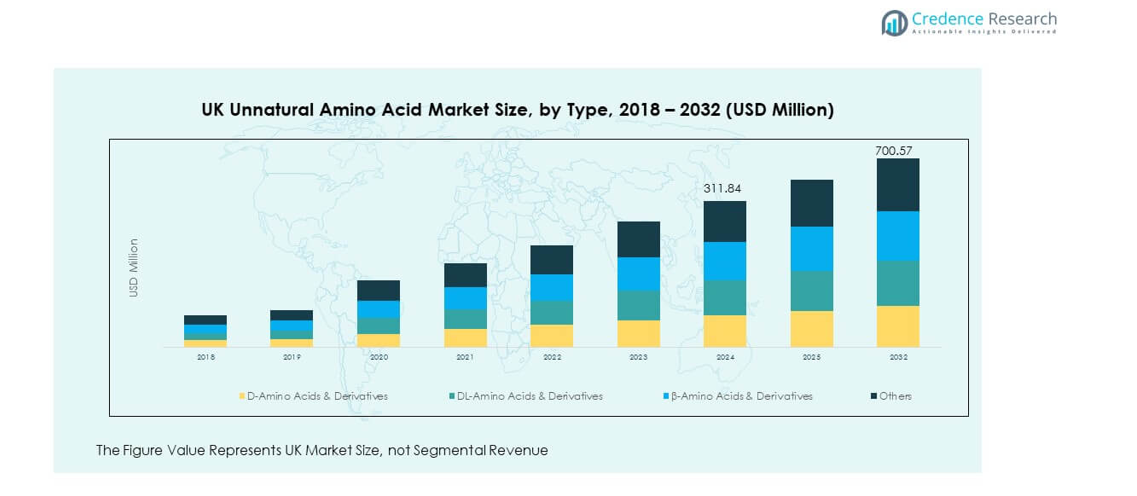

The UK Unnatural Amino Acid Market size was valued at USD 215.60 million in 2018 to USD 311.84 million in 2024 and is anticipated to reach USD 700.57 million by 2032, at a CAGR of 10.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Unnatural Amino Acid Market Size 2024 |

USD 311.84 million |

| UK Unnatural Amino Acid Market, CAGR |

10.45% |

| UK Unnatural Amino Acid Market Size 2032 |

USD 700.57 million |

The market is witnessing strong growth driven by rising demand for precision medicine and advanced therapeutic solutions. Expanding research in genetic disorders and oncology treatments is boosting reliance on specialized amino acid derivatives. Pharmaceutical companies are investing heavily in R&D to integrate these compounds into novel biologics, enzyme engineering, and drug discovery. Furthermore, the growing role of computational biology and AI-driven drug design is enhancing efficiency, reducing costs, and encouraging broader adoption across healthcare and industrial biotechnology applications.

Regionally, the UK plays a leading role within Europe due to its advanced pharmaceutical research ecosystem and strong academic-industry collaborations. Germany and France also hold notable positions, driven by expanding biologics manufacturing and innovation in protein engineering. Meanwhile, emerging European economies are showing increasing adoption as healthcare infrastructure strengthens and biotechnology investment rises. This balance between established leaders and emerging contributors positions the UK market as both a hub of innovation and a catalyst for regional expansion.

Market Insights:

- The UK Unnatural Amino Acid Market was valued at USD 215.60 million in 2018, reached USD 311.84 million in 2024, and is projected to achieve USD 700.57 million by 2032, growing at a CAGR of 10.65%.

- England leads with 62% share, supported by its strong pharmaceutical base, advanced research hubs, and clinical trial infrastructure, making it the center of market expansion.

- Scotland holds 18% share, ranking second, driven by biotechnology clusters and university-led research, while Wales and Northern Ireland collectively account for 20%, supported by niche research initiatives.

- England remains the fastest-growing region with its dominant share, benefiting from investments in biologics, precision medicine, and industry-academia collaborations that accelerate commercialization.

- D-amino acids and derivatives accounted for the largest segmental share at 34%, followed by DL-amino acids and derivatives with 27%, while β-amino acids and others together covered the remaining distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Importance of Personalized Medicine and Targeted Therapeutic Approaches

The UK Unnatural Amino Acid Market is benefiting from the expanding role of personalized medicine in modern healthcare. Tailored therapies require precise molecular modifications, and unnatural amino acids provide unique structural advantages to support this requirement. Pharmaceutical companies are prioritizing these compounds to improve drug efficacy and minimize adverse reactions. It supports the development of advanced biologics and therapies for rare diseases. Precision medicine initiatives across research institutes are aligning with government-backed health programs, further strengthening adoption. Rising patient demand for customized treatment is motivating investments in specialized amino acid platforms. Research pipelines across oncology, genetic disorders, and autoimmune diseases are increasingly dependent on these compounds. The growing acceptance of molecularly designed solutions makes the market a focal point in therapeutic innovation.

Growing Pharmaceutical Research and Increasing Biologics Adoption

The demand for biologics is expanding across global and regional pharmaceutical markets, driving a higher need for specialized building blocks. The UK Unnatural Amino Acid Market is positioned strongly due to the country’s robust research ecosystem. Biotech firms and academic institutions are leading collaborations to improve biologics performance using advanced amino acid derivatives. It enables scientists to enhance stability, extend half-life, and modify functions of therapeutic proteins. Rising healthcare expenditure is supporting faster integration of these innovations into clinical pipelines. Investors are backing biotech startups, fueling stronger competition and broader exploration of amino acid applications. The government’s focus on strengthening the biopharmaceutical sector creates a favorable ecosystem for adoption. These dynamics are sustaining a steady flow of R&D activity across biologics and enzyme-based drugs.

- For instance, Amgen achieved significant clinical advances by engineering Aranesp® (darbepoetin alfa) approved in the UK since 2001 with amino acid modifications that extend its serum half-life approximately 3-fold compared to conventional epoetin alfa, resulting in less frequent dosing for patients with anemia.

Expanding Role of Computational Biology and Artificial Intelligence

The integration of artificial intelligence and computational biology is changing how unnatural amino acids are applied in drug discovery. The UK Unnatural Amino Acid Market is gaining momentum as researchers adopt data-driven methods for molecule design. It allows precise modeling of protein interactions, accelerating the identification of promising therapeutic candidates. AI-supported platforms reduce research timelines while cutting overall development costs. Pharmaceutical firms are embedding computational tools in their R&D operations to capture these advantages. Academic institutions are partnering with AI-driven companies to scale innovation cycles. These collaborations are not only improving efficiency but also broadening application areas across healthcare and biotechnology. With digital technologies shaping discovery, market players are expanding their portfolios at an unprecedented pace.

Increasing Industrial Applications Beyond Healthcare and Biotechnology

While healthcare dominates adoption, industrial biotechnology is also shaping new opportunities for growth. The UK Unnatural Amino Acid Market benefits from rising demand for enzyme modification in sectors such as food processing and materials science. It supports the development of more efficient enzymes that enhance product performance and sustainability. Companies are testing these compounds in enzyme engineering to create cost-efficient industrial solutions. Growing interest in green chemistry practices encourages firms to replace traditional inputs with bio-based alternatives. These applications align with global sustainability goals and corporate commitments to reduce environmental impact. Industrial R&D facilities are exploring pilot projects to validate new use cases. By diversifying into non-healthcare sectors, market participants reduce dependence on pharmaceutical cycles. This expansion strengthens resilience while widening the scope of commercial potential.

- For instance, researchers at University College London (UCL) Biochemical Engineering, in collaboration with UK and international partners, published in August 2022 a review of site-specific incorporation of non-natural amino acids into industrial enzymes, directly improving enzyme properties such as stability, specificity, and substrate range for chemical manufacturing and biocatalysis projects at UCL’s pilot demonstration facilities.

Market Trends

Expanding Research Collaborations Between Academia and Industry

The UK Unnatural Amino Acid Market is shaped by a strong network of academic-industry collaborations. Leading universities are working with pharmaceutical firms to accelerate research breakthroughs. It helps translate basic scientific discoveries into commercially viable solutions. Partnerships are enabling the joint development of novel compounds that enhance therapeutic pipelines. Public funding initiatives are supporting these alliances, ensuring continuity of advanced research programs. Startups are also participating, bringing agility and innovation into collaborative projects. Shared intellectual property agreements are becoming more common, ensuring balanced benefits for both partners. These collaborations foster innovation and reduce barriers to large-scale commercialization of new molecules.

- For example, the University of Manchester collaborated with No7 Beauty Company over 15 years to develop the novel peptide blend Pepticology™, used in the No7 Future Renew skincare line. That range launched in March 2023, built on research into skin aging and repair, and stands as No7’s most successful product launch to date.

Rising Investment in Next-Generation Protein Engineering Technologies

Global pharmaceutical companies are expanding investments into advanced protein engineering platforms, and the UK ecosystem is well-positioned. The UK Unnatural Amino Acid Market gains momentum from its role in protein modification research. It supports precision editing of protein structures to enhance therapeutic performance. Companies are allocating resources to improve protein stability and efficiency through targeted amino acid substitutions. Research programs are focusing on scalable solutions that fit commercial drug production standards. Investment strategies emphasize both cost efficiency and functional improvements in biologics. Collaborative projects with contract manufacturing organizations are ensuring smooth translation into mass production. This emphasis on advanced protein engineering ensures continuous demand for specialized amino acids.

Growing Influence of Sustainability in Biotech Development Practices

Sustainability is shaping decisions across life sciences and biotechnology industries. The UK Unnatural Amino Acid Market reflects this trend as companies adopt bio-based production methods. It reduces reliance on traditional chemical synthesis, aligning with environmental commitments. Firms are exploring renewable inputs and green chemistry principles to improve production efficiency. Investors are showing preference for companies integrating sustainability into product pipelines. Regulatory encouragement for eco-friendly solutions reinforces these transitions within the industry. Research bodies are promoting the adoption of cleaner and safer production technologies. Industrial applications beyond pharmaceuticals are particularly influenced by sustainability requirements. This integration strengthens the long-term positioning of the market within a resource-conscious economy.

Emergence of Startups Driving Agile Innovation Cycles

Startups are playing a crucial role in redefining growth pathways for this market. The UK Unnatural Amino Acid Market benefits from these smaller players, who introduce agility and fresh perspectives. It allows rapid experimentation and testing of new applications without heavy corporate bureaucracy. Venture capital funding is accelerating the rise of these niche innovators. Many startups are collaborating with larger firms to scale successful models. Their presence ensures healthy competition and promotes continuous technological advancement. Investors view these firms as strategic enablers of disruptive change in the sector. Academic incubators and innovation clusters are nurturing new entrants with resources and expertise. Together, these efforts create a dynamic innovation environment that supports long-term growth.

- For example, constructive Bio, a UK-based startup spun out from the MRC Laboratory of Molecular Biology in 2022, is developing a synthetic genome platform to reprogram the genetic code and incorporate non-natural amino acids into proteins. Its technology aims to create new classes of enzymes, pharmaceuticals, and biomaterials, extending applications across therapeutics and bio-manufacturing.

Market Challenges Analysis

High Production Costs and Limited Commercial Scalability

The UK Unnatural Amino Acid Market faces challenges due to high production costs and complex synthesis methods. Specialized equipment and technical expertise increase capital requirements, slowing down adoption. It remains difficult for smaller firms to scale production while maintaining cost efficiency. The lack of standardized manufacturing protocols further complicates commercialization. Limited scalability creates uncertainty for companies planning long-term investments. High costs often lead to selective adoption by only larger pharmaceutical firms. This imbalance restricts participation by startups with promising innovations. The gap between research progress and industrial scalability continues to limit wider accessibility.

Regulatory Complexity and Intellectual Property Constraints

The regulatory environment is another obstacle shaping industry dynamics. The UK Unnatural Amino Acid Market experiences hurdles from stringent compliance requirements across healthcare and biotechnology. It forces companies to invest heavily in validation and testing. Lengthy approval processes delay product launches and reduce investor confidence. Intellectual property issues also slow collaboration, as companies guard discoveries to secure competitive advantage. Disputes over patents often disrupt partnerships between research institutions and industry. Smaller firms find it difficult to navigate this complex legal environment without significant resources. Regulatory barriers combined with intellectual property disputes slow market momentum. These challenges underscore the importance of policy clarity and supportive frameworks.

Market Opportunities

Expanding Therapeutic Applications Across Oncology and Genetic Disorders

The UK Unnatural Amino Acid Market has opportunities in expanding therapeutic applications for oncology and rare genetic disorders. It enables the development of drugs that address unmet clinical needs through precise molecular modifications. Pharmaceutical companies are investing heavily to integrate these compounds into their next-generation pipelines. Academic research is producing evidence supporting the efficacy of these compounds in complex conditions. Increased patient demand for targeted therapies aligns well with these developments. Collaborations between global pharma firms and local research institutions strengthen the momentum. It encourages faster translation of research into practical treatments. These factors collectively open substantial opportunities for healthcare-focused innovation.

Rising Role of Industrial Biotechnology and Green Chemistry Practices

Industrial biotechnology presents new growth avenues for companies working with amino acid derivatives. The UK Unnatural Amino Acid Market benefits from increasing corporate focus on sustainable production practices. It supports the use of bio-based compounds in enzyme engineering, food processing, and advanced materials. Companies are exploring cost-efficient industrial applications that reduce reliance on synthetic alternatives. Green chemistry principles align with both regulatory expectations and consumer preferences. Pilot projects in multiple sectors confirm the versatility of unnatural amino acids beyond healthcare. Firms leveraging this trend can diversify revenue streams and secure resilience against sector-specific risks. These opportunities highlight a broader industrial relevance for future expansion.

Market Segmentation Analysis:

By type the UK Unnatural Amino Acid Market is segmented by type into D-amino acids and derivatives, DL-amino acids and derivatives, β-amino acids and derivatives, and others. D-amino acids and derivatives hold a strong presence due to their use in pharmaceutical synthesis and therapeutic research. DL-amino acids and derivatives are gaining traction for their role in developing biologics and enzyme engineering. β-amino acids and derivatives are expanding steadily, supported by their structural advantages in protein modification. Other specialized categories contribute to niche research applications and experimental drug development.

- For example, A 2024 study in Chembiochem (Wiley‑VCH) authored by Hayato Araseki et al. describes an enzyme cascade system that converts L‑amino acids into their D‑isomers such as D‑phenylalanine and three D‑tryptophan derivatives with enantiomeric purity exceeding 99 % (ee > 99 %) at a preparative scale (> 100 mg).

By application, the UK Unnatural Amino Acid Market is divided into liver disease, inflammatory disease, and others including genetic disease and cancer. Liver disease therapies represent a significant share, supported by the demand for targeted treatments. Inflammatory disease applications are expanding with ongoing studies into immune-related pathways. It also finds broader adoption across genetic disease and cancer research, where precision medicine approaches rely on tailored amino acid integration. These application areas reinforce the role of unnatural amino acids in advanced therapeutic development.

By end-use, the market is further segmented by end-use into pharmaceutical and others such as biotechnological companies, research laboratories, and academic institutes. Pharmaceutical companies dominate due to large-scale drug discovery initiatives and investments in biologics. Research laboratories and academic institutes contribute significantly by driving early-stage innovation and proof-of-concept studies. It ensures a steady pipeline of research that translates into commercial applications. Together, these end-use segments sustain strong growth and establish a foundation for continuous market expansion.

- For instance, Bachem, a key supplier to the UK pharmaceutical and peptide research market, manufactures a comprehensive portfolio of Fmoc-protected unnatural amino acid derivatives—servicing large pharmaceutical companies with GMP-grade supply for commercial drug discovery as well as universities and R&D laboratories for early-stage innovation.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-Use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

Regional Analysis:

England holds the dominant position in the UK Unnatural Amino Acid Market with a share of 62%, driven by its strong pharmaceutical base and advanced research ecosystem. London and Cambridge serve as leading hubs, housing top pharmaceutical companies, contract research organizations, and academic institutions. It benefits from substantial government support for biotechnology and clinical trials. The presence of established players and a vibrant startup ecosystem further strengthens innovation cycles. England’s healthcare infrastructure and investment in precision medicine create consistent demand. This dominance positions the region as the center of development and commercialization for unnatural amino acids.

Scotland accounts for 18% of the market, supported by its growing biotechnology clusters and expanding university-led research programs. Edinburgh and Glasgow are at the forefront of innovation, with academic institutions leading projects on protein engineering and amino acid derivatives. It is also supported by government-backed initiatives to promote life sciences and biotech startups. Scotland’s contribution reflects a balanced mix of early-stage research and applied development in healthcare. Collaboration between universities and industry is boosting its visibility in global biotechnology networks. The region shows increasing potential for growth in both therapeutic and industrial applications.

Wales and Northern Ireland together represent 20% of the market, with Cardiff and Belfast serving as focal points of activity. Wales has been investing in pharmaceutical and biotechnology research infrastructure, while Northern Ireland is promoting academic-industry partnerships to strengthen life sciences. It benefits from niche research into genetic disease and drug development supported by university collaborations. These regions may not match the scale of England or Scotland but are steadily growing their influence. Their focus on specialized research projects and regional funding initiatives ensures a complementary role within the national landscape. Collectively, they contribute to diversifying the innovation base across the UK.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AstraZeneca

- GlaxoSmithKline

- Almac Group

- Bachem

- Pepceuticals Ltd

- Sygnature Discovery

- Domainex Ltd

- NovaBiotics Ltd

- Cyclacel Pharmaceuticals (UK base)

- PhoreMost Ltd (Cambridge)

- Isogenica Ltd

Competitive Analysis:

The UK Unnatural Amino Acid Market features a competitive landscape shaped by global pharmaceutical leaders, regional biotech firms, and specialized research-driven companies. AstraZeneca and GlaxoSmithKline play pivotal roles with large R&D investments and strong biologics portfolios. It benefits from their ability to integrate advanced amino acid derivatives into drug development pipelines. Almac Group and Bachem strengthen the market with contract manufacturing and custom synthesis expertise. Smaller firms such as Pepceuticals Ltd, Sygnature Discovery, and Domainex Ltd bring agility and niche innovations that complement the larger players. The market also includes emerging biotech firms like NovaBiotics Ltd, Cyclacel Pharmaceuticals, PhoreMost Ltd, and Isogenica Ltd, which contribute by developing targeted therapies and expanding protein engineering capabilities. Competition is based on innovation speed, product quality, and successful regulatory approvals. It fosters collaboration between academic institutions and industry players to accelerate research and commercialization. Strategic moves such as mergers, acquisitions, and regional expansions are common across the competitive landscape. Companies are also investing in sustainability and green chemistry approaches to align with industry-wide shifts. This dynamic mix of established players and innovative startups creates a balanced environment where competition drives both technological advancement and long-term market growth.

Recent Developments:

- In September 2025, Enlaza Therapeutics entered a collaboration with Vertex Pharmaceuticals, centered on its War-Lock platform that incorporates non-natural amino acids to create covalent-acting protein drugs. The partnership aims to develop immune therapies for autoimmune diseases and improve treatment conditioning for sickle cell disease and thalassemia, with USD 45 million upfront and up to USD 2 billion in potential milestones.

- In July 2025, AstraZeneca announced a $50 billion investment to expand its US-based manufacturing and R&D capabilities by 2030. This expansion includes establishing a Virginia facility dedicated to cutting-edge drug substances such as peptides and small molecules—crucial for advancing APIs and biopharmaceutical manufacturing, indirectly supporting innovations in unnatural amino acids.

- In June 2025, AstraZeneca announced a major AI-powered drug discovery partnership with CSPC Pharmaceutical Group, with a focus on novel oral therapies for chronic diseases. While the collaboration primarily targets China, this marks AstraZeneca’s heightened global investment and expansion of its R&D footprint for innovative therapies that may eventually include unnatural amino acid technologies in their platform, reflecting ongoing global movement toward advanced peptide and amino acid-based drugs.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

- In June 2025, BASF SE reinforced its footprint in North America’s biopharmaceutical sector by inaugurating a new Good Manufacturing Practice (GMP) Solution Center in Wyandotte, Michigan. The facility, launched on June 17, 2025, is dedicated to advancing pharmaceutical ingredient quality, collaborative product development, and production innovation, thereby strengthening BASF’s ability to serve the growing demand for high-quality excipients and bioprocessing ingredients in the unnatural amino acid market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Unnatural Amino Acid Market will expand through increasing applications in precision medicine.

- Growth in biologics and targeted therapies will create stronger demand across pharmaceutical pipelines.

- Academic-industry collaborations will accelerate innovation and shorten the pathway to commercialization.

- Artificial intelligence integration will refine drug discovery and improve efficiency in research processes.

- Sustainability will influence production methods, with bio-based approaches gaining prominence in manufacturing.

- Expansion into industrial biotechnology will diversify revenue streams beyond pharmaceutical applications.

- Investment in protein engineering will enhance therapeutic performance and broaden clinical adoption.

- Startups will play a critical role in driving agile innovation and competitive disruption.

- Regional growth will remain centered in England, with Scotland and others steadily increasing their presence.

- Strategic mergers and partnerships will shape competition and foster long-term industry resilience.