Market Overview

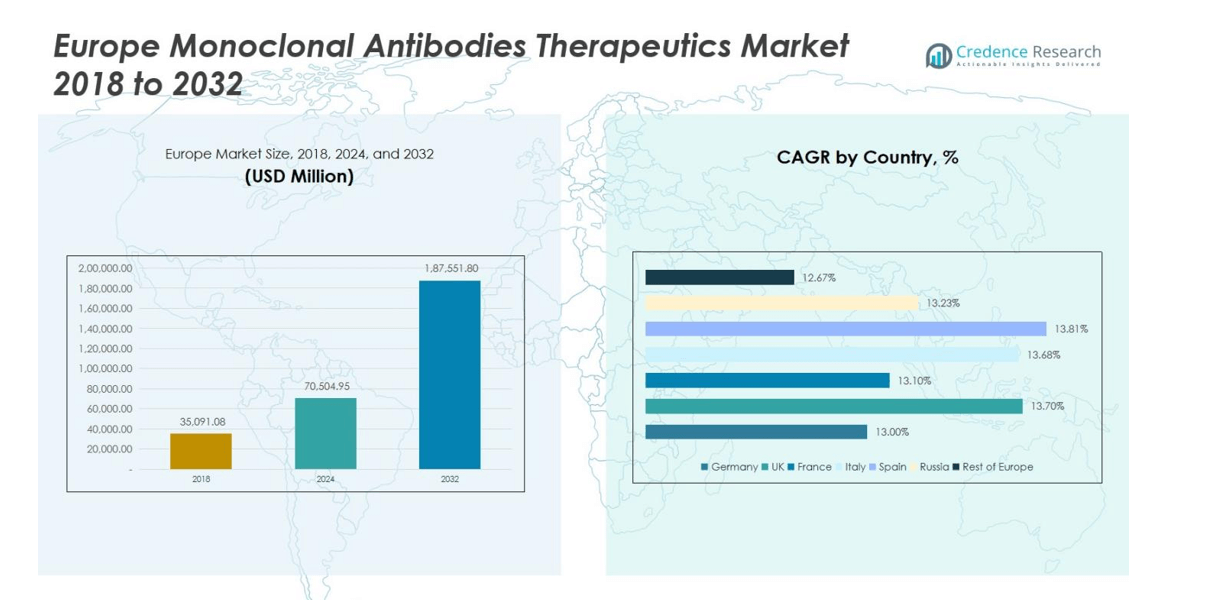

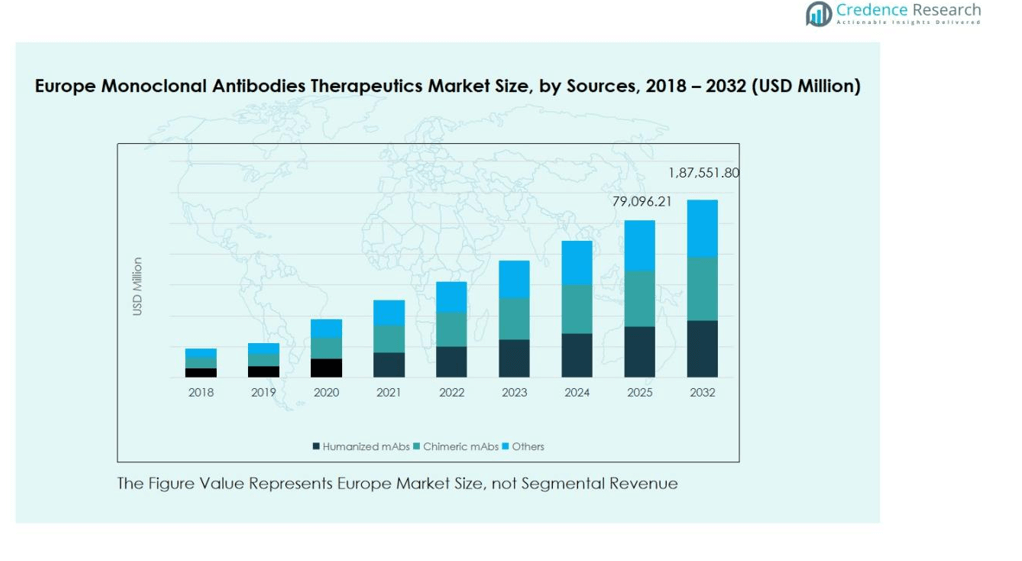

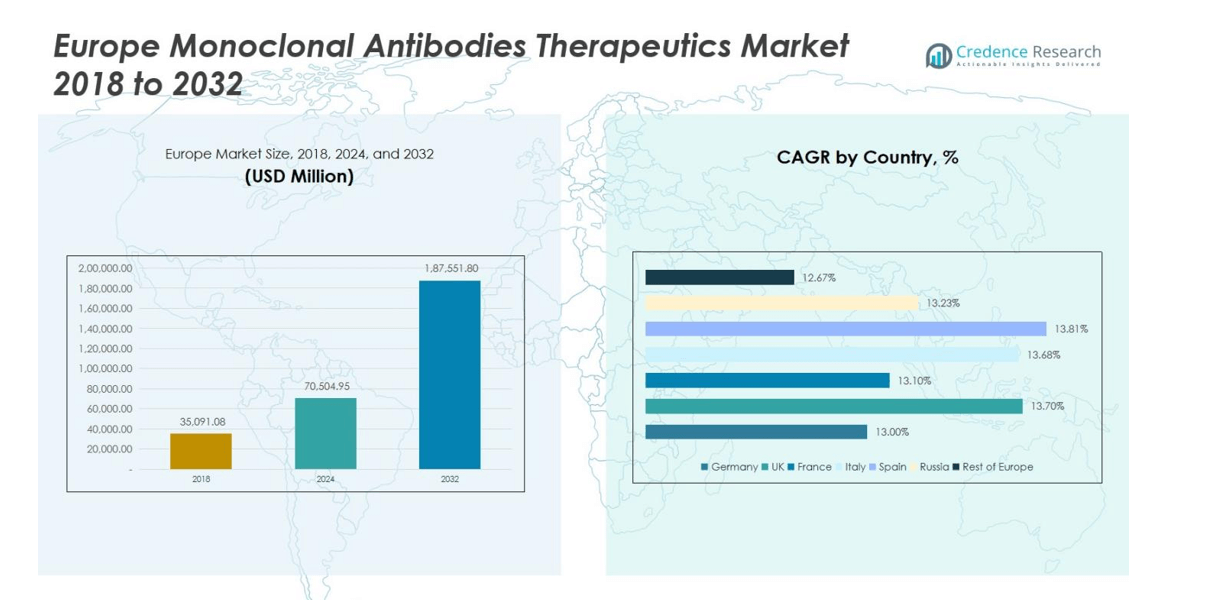

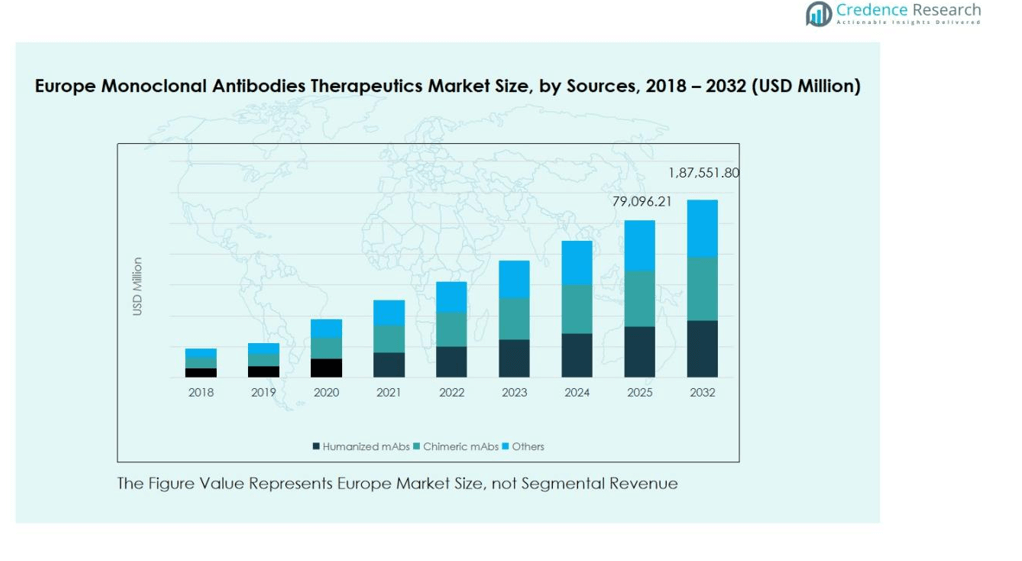

Europe Monoclonal Antibodies Therapeutics Market size was valued at USD 35,091.08 million in 2018, grew to USD 70,504.95 million in 2024, and is anticipated to reach USD 187,551.80 million by 2032, at a CAGR of 12.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Monoclonal Antibodies Therapeutics Market Size 2024 |

USD 70,504.95 million |

| Europe Monoclonal Antibodies Therapeutics Market, CAGR |

12.9% |

| Europe Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 187,551.80 million |

The Europe Monoclonal Antibodies Therapeutics Market is dominated by leading players including F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies leverage robust R&D capabilities, strategic collaborations, and diverse product portfolios to maintain competitive advantage and drive innovation in humanized, bispecific, and biosimilar therapies. Germany emerges as the leading regional market, accounting for 22% of the Europe Monoclonal Antibodies Therapeutics Market, followed by the United Kingdom with 18% and France with 15%. High adoption of biologics, supportive reimbursement policies, and strong clinical research infrastructure in these regions reinforce market growth. Strategic partnerships, technology advancements, and expanding therapeutic applications further strengthen the position of these key players, ensuring continued leadership across Europe’s monoclonal antibodies therapeutics landscape.

Market Insights

- The Europe Monoclonal Antibodies Therapeutics Market was valued at USD 70,504.95 Million in 2024 and is projected to reach USD 187,551.80 Million by 2032, growing at a CAGR of 12.9%.

- Rising prevalence of cancer, autoimmune, and inflammatory diseases across Europe is driving demand for targeted monoclonal antibody therapies, supported by government initiatives and advanced healthcare infrastructure.

- Key trends include the growing adoption of subcutaneous and self-administered therapies, development of biosimilars, and advancements in antibody engineering, enhancing patient convenience and accessibility.

- The market is highly competitive, led by players such as F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb, and Novartis AG, who leverage R&D investments, strategic collaborations, and innovative product portfolios.

- Regionally, Germany leads with 22% market share, followed by the UK (18%) and France (15%), while humanized mAbs dominate the sources segment with a 55% share, reflecting strong therapeutic adoption in oncology and autoimmune diseases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sources

The Europe monoclonal antibodies therapeutics market is primarily segmented into humanized mAbs, chimeric mAbs, and others. Humanized mAbs dominate the market, accounting for approximately 55% of the regional revenue share, driven by their enhanced efficacy and reduced immunogenicity compared to chimeric antibodies. The growing adoption of humanized antibodies in oncology and autoimmune therapies further supports their strong demand. Chimeric mAbs, contributing around 30% of the market, remain relevant due to established therapeutic use, while other sources, including fully murine and novel engineered antibodies, occupy the remaining 15%, driven by niche applications and ongoing clinical research.

- For instance, Danish biotechnology firm Genmab’s Fc-engineered antibody epcoritamab (TEPKINLY) received European Commission approval in 2023 for relapsed diffuse large B-cell lymphoma, reflecting innovation in antibody design and engineering.

By Therapeutic Area

Oncology leads the therapeutic area segment in Europe, capturing nearly 48% of the market share, fueled by the rising prevalence of cancer and advancements in targeted therapies. Autoimmune and inflammatory diseases follow with a 22% share, supported by increasing incidences of rheumatoid arthritis and multiple sclerosis, driving monoclonal antibody adoption. Infectious diseases account for 12%, benefitting from pandemic-related research and therapy development. Cardiovascular & metabolic disorders and neurological disorders collectively contribute about 15%, while other therapeutic areas hold the remaining 3%, reflecting emerging applications in rare and chronic conditions.

- For instance, natalizumab is a licensed monoclonal antibody effectively reducing relapse rates in multiple sclerosis and significantly improving patients’ quality of life by limiting disease progression.

By Route of Administration

The market is classified into subcutaneous (SC), intravenous (IV), and other administration routes. Subcutaneous administration dominates with a 60% market share, favored for its convenience, reduced hospital visits, and patient compliance, particularly in chronic therapies. Intravenous administration accounts for 35%, primarily used in hospital settings for high-dose or infusion-required treatments. Other routes, including intramuscular and novel delivery systems, contribute the remaining 5%, driven by innovation in drug delivery technologies and patient-centric therapy models that aim to enhance accessibility and adherence.

Key Growth Drivers

Rising Prevalence of Chronic and Life-Threatening Diseases

The increasing incidence of cancer, autoimmune disorders, and infectious diseases across Europe is a primary driver for the monoclonal antibodies therapeutics market. Healthcare providers are adopting mAbs due to their targeted action and improved patient outcomes, particularly in oncology and autoimmune therapies. Government initiatives promoting early diagnosis and personalized treatments further stimulate demand. The growing disease burden, along with advancements in diagnostics, ensures a consistent requirement for effective therapeutic interventions, driving robust market expansion during the forecast period.

- For instance, the European Pharmacopoeia Commission concluded its pilot phase on mAbs by establishing standardized monographs for infliximab and adalimumab, two widely used therapies for autoimmune conditions like rheumatoid arthritis and Crohn’s disease, ensuring consistent quality across multi-source products in Europe.

Technological Advancements in Antibody Engineering

Innovations in antibody engineering, including humanized, bispecific, and antibody-drug conjugates, are accelerating market growth in Europe. These technologies enhance efficacy, reduce side effects, and expand the therapeutic potential of mAbs across multiple disease areas. Continuous R&D investment by pharmaceutical leaders is enabling next-generation therapies. Adoption of advanced manufacturing techniques and biosimilar development improves accessibility and cost-effectiveness, further encouraging wider clinical use. These advancements strengthen the competitive landscape and drive sustained revenue growth.

- For instance, Sanofi developed the antibody-drug conjugate (ADC), tusamitamab ravtansine (formerly SAR408701), for non-small cell lung cancer (NSCLC). However, in December 2023, Sanofi announced it was discontinuing the development program after the drug failed to meet its primary endpoint in a Phase III trial.

Favorable Government Policies and Reimbursement Support

Supportive government initiatives and reimbursement frameworks across Europe are boosting monoclonal antibody adoption. National healthcare systems increasingly cover innovative biologics, ensuring broader patient access to expensive therapies. Policies promoting early intervention, personalized medicine, and fast-track approvals for breakthrough drugs also encourage uptake. Public-private partnerships in clinical research enhance the availability of novel therapies. Regulatory and financial support reduce barriers for both patients and manufacturers, creating a favorable environment for market expansion and innovation.

Key Trends and Opportunities

Shift Towards Subcutaneous and Self-Administered Therapies

A significant trend is the growing preference for subcutaneous and self-administered monoclonal antibody therapies. Patients and healthcare providers favor less invasive, convenient administration methods that reduce hospital visits and improve treatment adherence. Development of prefilled syringes, auto-injectors, and home-delivery models supports this shift. This trend opens opportunities for manufacturers to innovate in patient-centric delivery systems, expand outpatient therapy adoption, and optimize healthcare resource utilization, ultimately enhancing the overall market potential.

- For instance, Eisai launched LEQEMBI IQLIK (lecanemab-irmb) in August 2025, a subcutaneous auto-injector that delivers 360 mg/1.8 mL for Alzheimer’s disease, providing a convenient at-home alternative to intravenous infusion models.

Expansion of Biosimilars and Cost-Effective Solutions

The rise of biosimilars in Europe is creating substantial market opportunities by offering cost-effective alternatives to branded monoclonal antibodies. Increased competition from biosimilars is driving pricing flexibility and improving patient accessibility. Regulatory support for biosimilar approvals, along with growing acceptance among healthcare providers, enhances adoption rates. This trend also incentivizes pharmaceutical companies to invest in biosimilar development and distribution, fostering market expansion while addressing affordability concerns for chronic and high-cost therapies.

- For instance, in Italy, Abiogen Pharma and mAbxience announced a strategic license deal in 2025 to develop and market a biosimilar candidate, reflecting active investment and expansion in the biosimilar market.

Key Challenges

High Cost of Monoclonal Antibody Therapies

The high cost of monoclonal antibody therapies remains a major challenge in Europe. These therapies often involve complex manufacturing processes and extensive R&D investment, limiting access for patients in certain healthcare systems. Even with reimbursement policies, affordability issues can restrict widespread adoption, particularly for chronic treatments. Cost constraints also impact healthcare budgets, potentially slowing new therapy introductions and creating pressure on manufacturers to balance pricing with profitability, which may affect market growth trajectories.

Stringent Regulatory and Approval Processes

Strict regulatory requirements for approval of monoclonal antibodies pose challenges for market players. Lengthy clinical trials, rigorous safety evaluations, and compliance with European Medicines Agency (EMA) guidelines can delay product launches and increase development costs. Manufacturers must navigate complex regulatory pathways, which can hinder timely commercialization of innovative therapies. These regulatory hurdles limit the pace of market expansion and require significant investment in compliance, potentially affecting the introduction of new products and slowing overall market growth.

Regional Analysis

Germany

Germany represents a significant share of the Europe monoclonal antibodies therapeutics market, accounting for 22% of the regional revenue. The country’s advanced healthcare infrastructure, high adoption of biologics, and strong R&D ecosystem drive demand. Rising prevalence of cancer and autoimmune diseases, coupled with government support for innovative therapies, fuels market growth. Leading pharmaceutical companies actively invest in clinical trials and partnerships within Germany to expand their product portfolios. The presence of advanced diagnostic facilities and increasing patient awareness further strengthens the market, establishing Germany as a key contributor to Europe’s overall monoclonal antibody therapeutics revenue.

United Kingdom

The United Kingdom captures 18% of the Europe monoclonal antibodies therapeutics market, driven by a growing demand for oncology and autoimmune therapies. The country benefits from robust healthcare policies, reimbursement frameworks, and rapid adoption of biosimilars. Strong research infrastructure and collaborations between academic institutions and pharmaceutical companies support the development of innovative monoclonal antibodies. Increasing patient awareness, coupled with the expansion of outpatient therapy options such as subcutaneous administration, contributes to market growth. The UK’s strategic focus on personalized medicine and biologics adoption solidifies its role as a major regional market in Europe.

France

France holds a 15% share of the Europe monoclonal antibodies therapeutics market, supported by a well-established healthcare system and favorable reimbursement policies. The growing prevalence of chronic diseases, particularly cancer and autoimmune disorders, drives demand for monoclonal antibodies. Strong government support for innovative biologics, coupled with active clinical research and partnerships by leading pharmaceutical companies, promotes market expansion. The adoption of biosimilars and patient-centric administration methods, such as subcutaneous injections, further enhance accessibility. France’s combination of advanced infrastructure, research expertise, and progressive healthcare policies establishes it as a key contributor to Europe’s monoclonal antibodies therapeutics revenue.

Italy

Italy accounts for 12% of the Europe monoclonal antibodies therapeutics market, propelled by increasing prevalence of oncology and autoimmune disorders. Expanding healthcare infrastructure and government initiatives to support access to biologics drive market adoption. Pharmaceutical companies actively invest in research collaborations and clinical trials to strengthen their local presence. The adoption of biosimilars and patient-friendly therapies, including home-administered subcutaneous formulations, contributes to growth. Italy’s regulatory support for innovative therapies and increasing patient awareness enhance market potential, positioning the country as an important contributor to Europe’s overall monoclonal antibodies therapeutics market.

Spain

Spain contributes 10% to the Europe monoclonal antibodies therapeutics market, supported by growing demand for oncology and autoimmune therapies. The country benefits from healthcare reforms that encourage biologics adoption and reimbursement for advanced treatments. Pharmaceutical companies invest in research, partnerships, and local manufacturing to expand product availability. Rising patient awareness and increased focus on outpatient therapy options, such as subcutaneous injections, further support market growth. Spain’s combination of favorable regulatory frameworks, strong clinical research initiatives, and expanding biologics adoption drives its contribution to Europe’s overall monoclonal antibodies therapeutics market revenue.

Russia

Russia represents 8% of the Europe monoclonal antibodies therapeutics market, with growth fueled by increasing prevalence of chronic diseases and rising demand for advanced therapies. Government initiatives to improve access to biologics, coupled with expanding healthcare infrastructure in urban areas, drive adoption. Pharmaceutical companies focus on clinical trials, collaborations, and local manufacturing to strengthen market presence. The gradual introduction of biosimilars and patient-centric therapies, including subcutaneous administration, enhances accessibility. Russia’s strategic investments in healthcare development and growing awareness of monoclonal antibody treatments position it as an emerging contributor to Europe’s monoclonal antibodies therapeutics market.

Rest of Europe

The rest of Europe accounts for 15% of the regional monoclonal antibodies therapeutics market, including countries such as the Netherlands, Belgium, Switzerland, and Nordic nations. Market growth is driven by rising prevalence of cancer, autoimmune, and infectious diseases, coupled with increasing adoption of biologics and supportive healthcare policies. Investment in clinical research, collaborations, and biosimilar development by pharmaceutical companies strengthens market presence across these countries. Expansion of outpatient therapy options, such as subcutaneous administration, enhances patient compliance. These factors collectively contribute to a growing monoclonal antibodies therapeutics market across smaller European countries, supporting overall regional revenue.

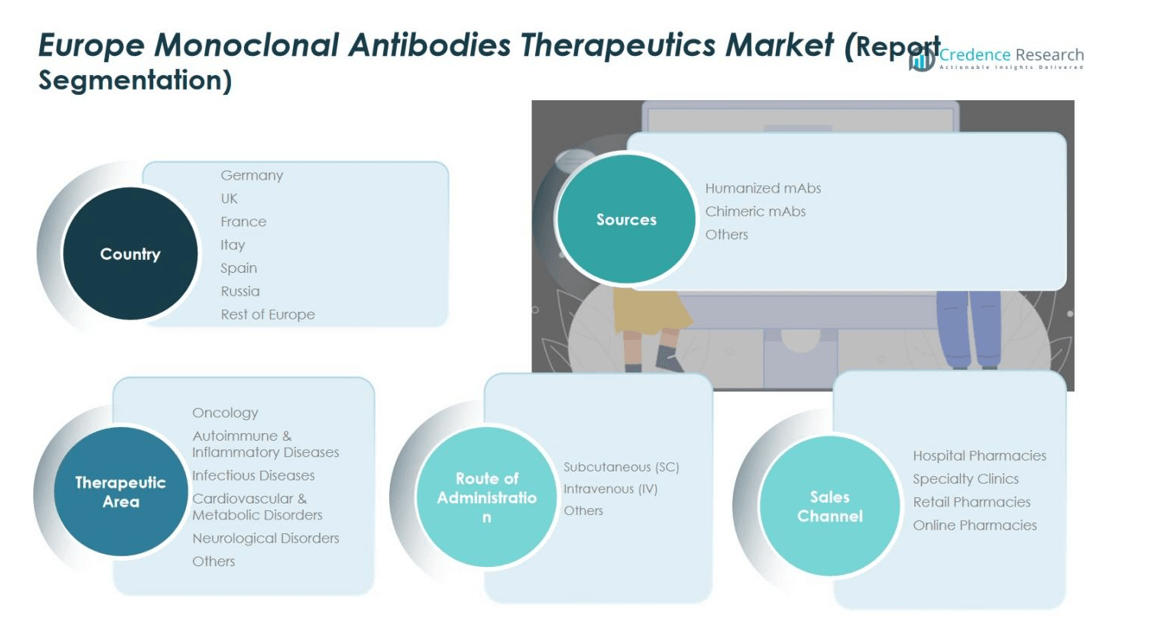

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe monoclonal antibodies therapeutics market is dominated by key players including F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies leverage extensive R&D capabilities, strategic collaborations, and robust product portfolios to strengthen their market presence. Competition is driven by continuous innovation in humanized and bispecific antibodies, the introduction of biosimilars, and expansion into emerging therapeutic areas. Companies focus on enhancing manufacturing capacities, improving drug delivery technologies, and entering partnerships to accelerate product launches. Market players also implement strategic pricing, patient-centric approaches, and reimbursement support to increase adoption across Europe. The combination of advanced research, regulatory compliance, and proactive market strategies maintains intense competition while driving overall market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Sanofi

- Abbvie Inc.

- Bristol Myers Squibb Company

- Novartis AG

- AstraZeneca

- Amgen Inc.

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson Services, Inc.

- Other Key Players

Recent Developments

- On October 22, 2025, Ipsen announced the acquisition of French biotech company ImCheck Therapeutics for up to €1 billion. This strategic move aims to enhance Ipsen’s oncology pipeline with ImCheck’s next-generation immuno-oncology therapies, including a potential first-in-class anti-BTN3A monoclonal antibody for acute myeloid leukaemia.

- In 2025, AstraZeneca received a recommendation for the approval of Tezspire (tezepelumab) in the European Union for the treatment of chronic rhinosinusitis with nasal polyps, expanding its therapeutic indications.

- In 2025, SunRock Biopharma and Chime Biologics announced a strategic collaboration to advance the development of SRB5, an anti-CCR9 monoclonal antibody.

- In October 2025, Ipsen acquired ImCheck Therapeutics, a French biotechnology company specializing in next-generation immuno-oncology therapies, in a deal valued at up to EUR 1 billion.

Report Coverage

The research report offers an in-depth analysis based on Sources, Therapeutic Area, Route of Administration, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand due to rising prevalence of cancer and autoimmune diseases across Europe.

- Increasing adoption of humanized and bispecific monoclonal antibodies will drive therapeutic innovation.

- Growth of biosimilars will enhance patient access and improve affordability of biologic therapies.

- Advances in subcutaneous and self-administered formulations will increase patient compliance and convenience.

- Expanding research and development activities by key pharmaceutical players will accelerate novel drug introductions.

- Government support and favorable reimbursement frameworks will sustain adoption across healthcare systems.

- Strategic collaborations, mergers, and partnerships will strengthen market presence and competitive positioning.

- Integration of digital health technologies will improve treatment monitoring and personalized therapy approaches.

- Emerging applications in infectious and rare diseases will create new revenue streams.

- Continuous technological advancements and regulatory support will underpin long-term market growth.