Market Overview

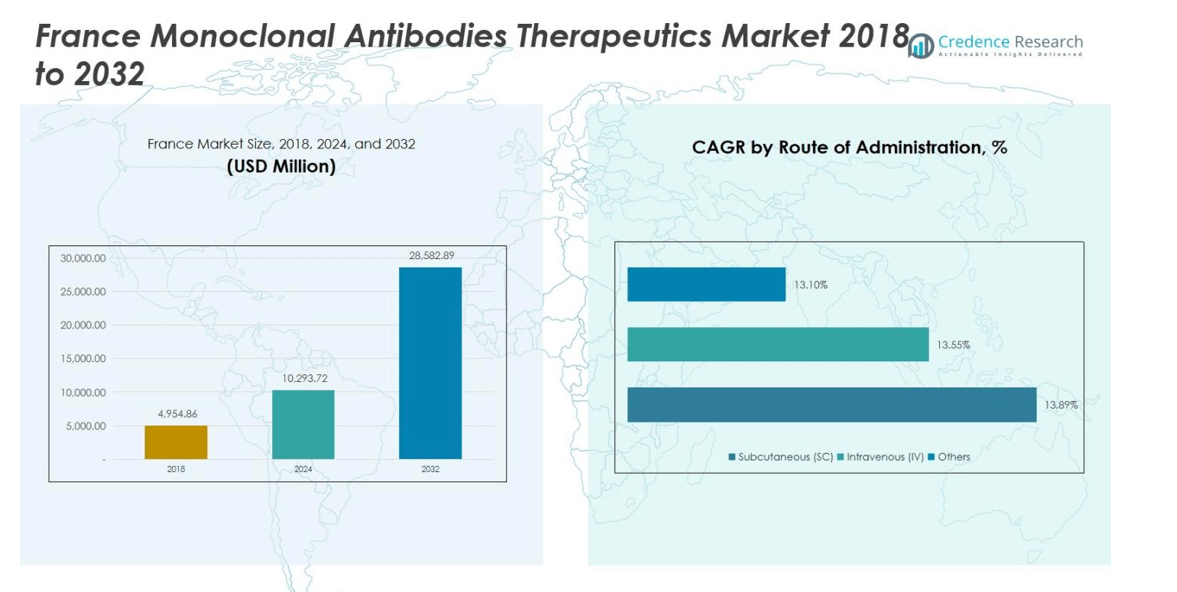

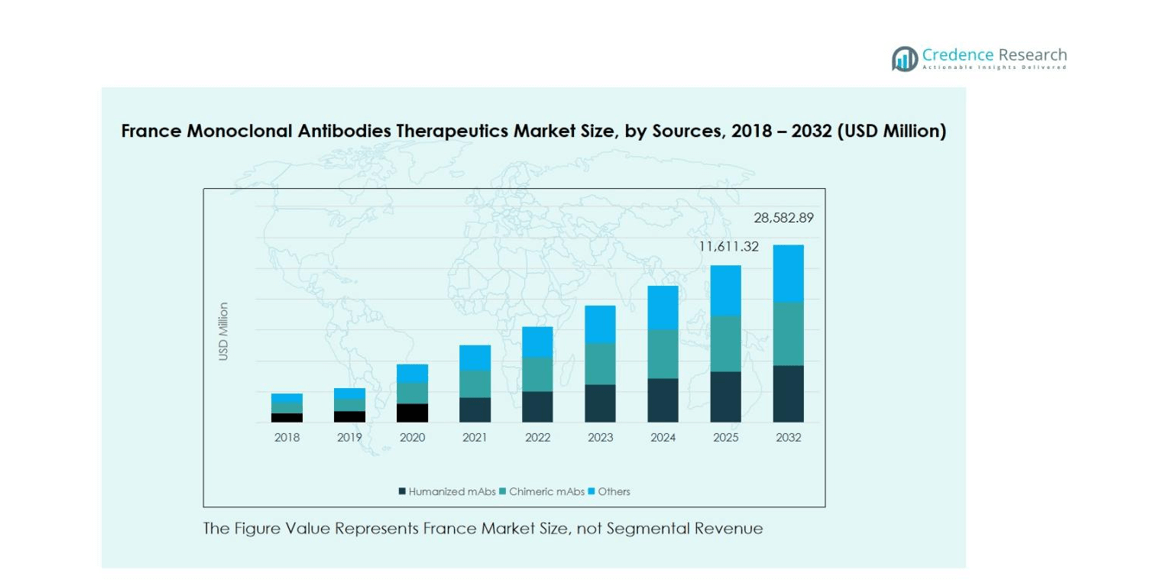

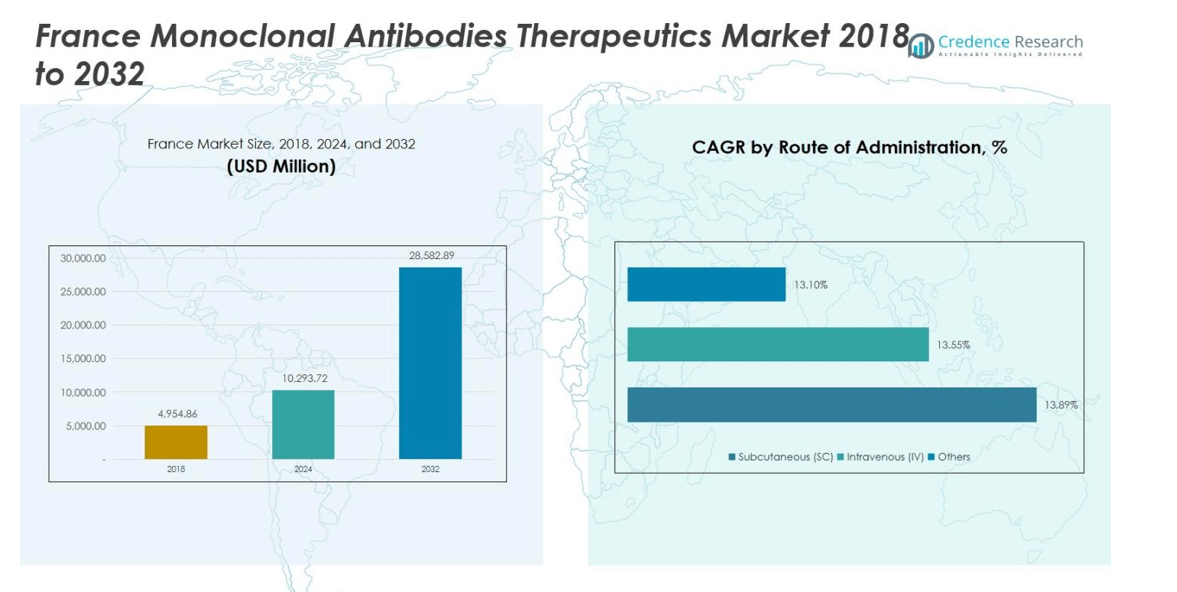

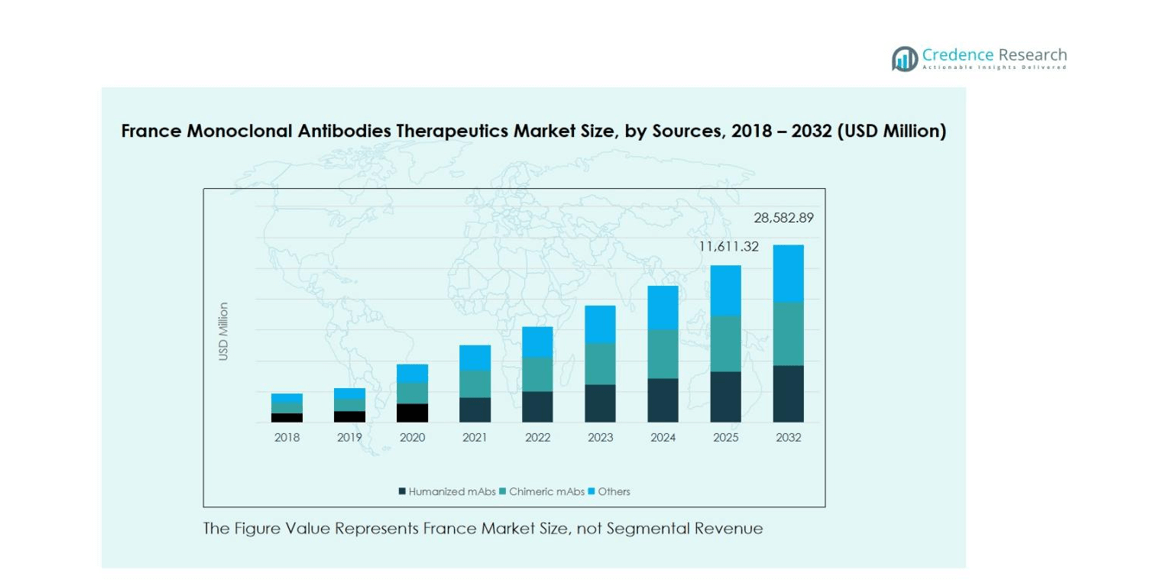

France Monoclonal Antibodies Therapeutics Market was valued at USD 4,954.86 million in 2018 and reached USD 10,293.72 million in 2024. It is projected to grow further, reaching USD 28,582.89 million by 2032, registering a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Monoclonal Antibodies Therapeutics Market Size 2024 |

USD 10,293.72 million |

| France Monoclonal Antibodies Therapeutics Market, CAGR |

13.6% |

| France Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 28,582.89 million |

The France Monoclonal Antibodies Therapeutics Market is highly competitive, with leading players including F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, AstraZeneca, and Amgen Inc. These companies are driving market growth through robust R&D, innovative product launches, and strategic collaborations with local hospitals and research institutes. Their focus on humanized and bispecific antibodies for oncology, autoimmune, and inflammatory diseases strengthens market positioning. Regionally, Île-de-France dominates the market with a 40% share, supported by a concentration of hospitals, research centers, and pharmaceutical headquarters. Provence-Alpes-Côte d’Azur follows with an 18% share, benefiting from specialized clinics and growing biologics adoption. Auvergne-Rhône-Alpes holds 15%, while Occitanie and Nouvelle-Aquitaine account for 10% and 9%, respectively. The remaining regions collectively contribute 8%, reflecting steady adoption and expansion opportunities across France’s monoclonal antibodies therapeutics landscape.

Market Insights

- The France Monoclonal Antibodies Therapeutics Market was valued at USD 4,954.86 million in 2018 and is projected to reach USD 28,582.89 million by 2032, growing at a CAGR of 13% during the forecast period.

- Humanized mAbs dominate the market with a 55% share, driven by high efficacy, reduced immunogenicity, and strong adoption in oncology and autoimmune treatments, while Chimeric mAbs account for 30% and other types share 15%.

- Oncology leads the therapeutic area segment with 45% market share, followed by autoimmune and inflammatory diseases at 25%, while infectious, cardiovascular, neurological, and other diseases collectively hold 30%.

- By route of administration, subcutaneous delivery commands 60% of the market due to patient convenience and home-based therapy adoption, intravenous delivery accounts for 35%, and other routes hold 5%.

- Regionally, Île-de-France dominates with 40%, Provence-Alpes-Côte d’Azur holds 18%, Auvergne-Rhône-Alpes 15%, Occitanie 10%, Nouvelle-Aquitaine 9%, and other regions collectively contribute 8%, reflecting steady adoption and growth opportunities across France.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

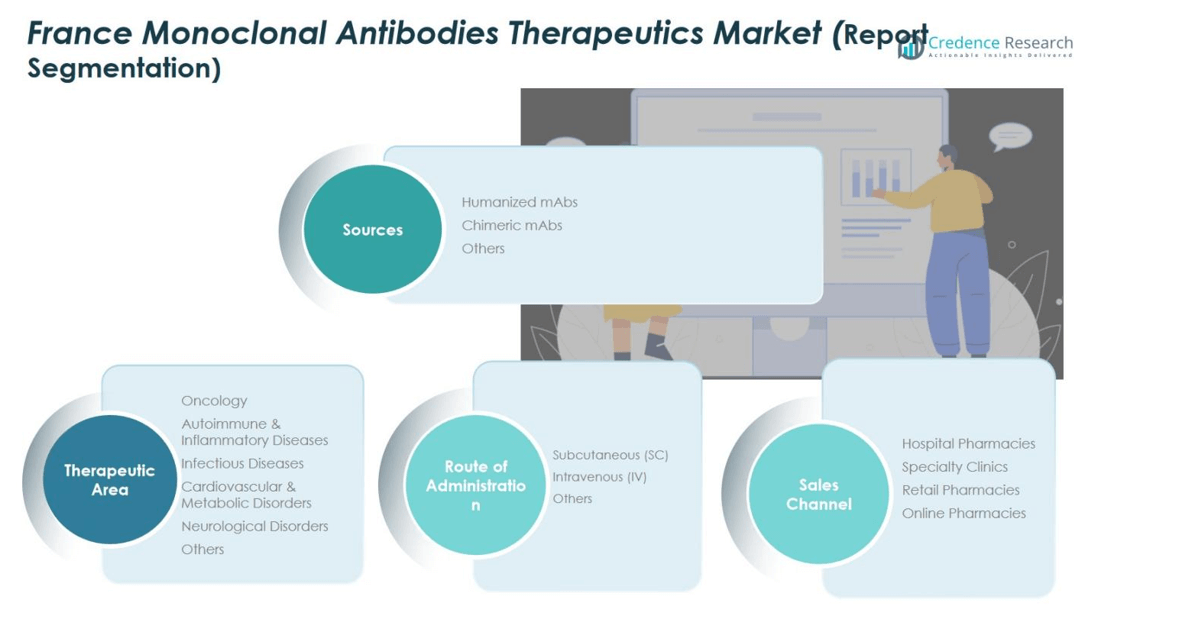

Market Segmentation Analysis:

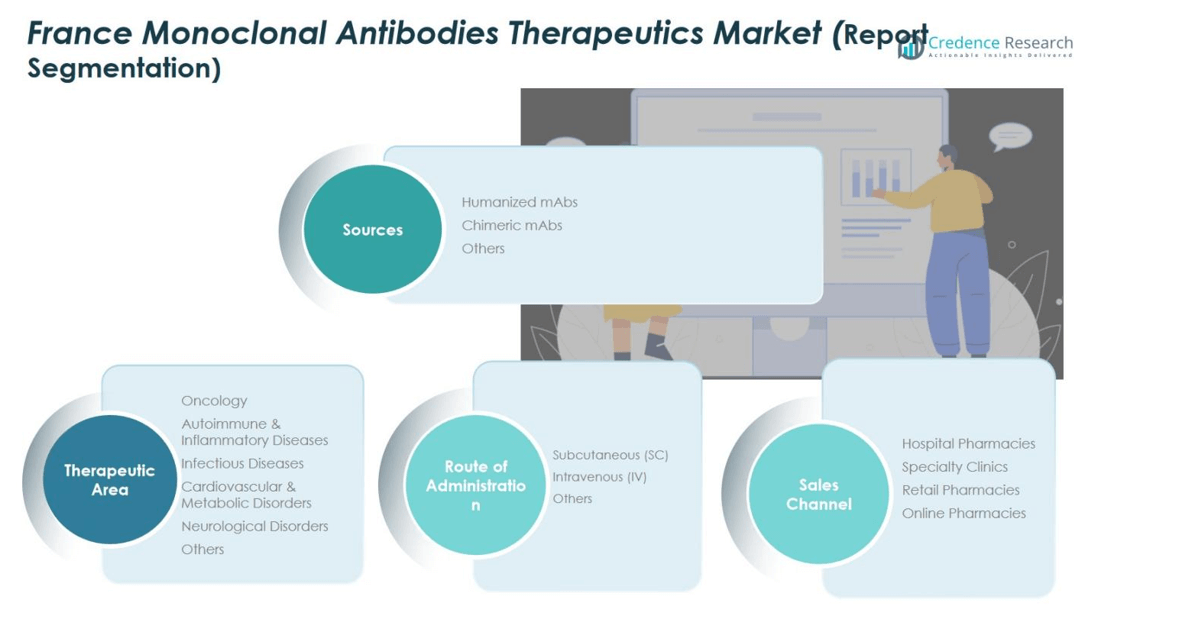

By Sources:

The France monoclonal antibodies therapeutics market is segmented into Humanized mAbs, Chimeric mAbs, and Others. Humanized mAbs dominate the market, accounting for 55% of the share, driven by their higher efficacy, reduced immunogenicity, and strong adoption in oncology and autoimmune treatments. Chimeric mAbs hold around 30% of the market, primarily used for inflammatory and infectious conditions. The remaining 15% is shared by other mAb types. The increasing prevalence of chronic diseases, coupled with advancements in antibody engineering and a rising focus on targeted therapies, continues to propel growth across all sources.

- For instance, trastuzumab (Herceptin), a humanized monoclonal antibody developed by Genentech, targets the HER2 receptor and is widely used in France for treating HER2-positive breast cancer, significantly improving patient outcomes in oncology.

By Therapeutic Area:

The therapeutic area segment includes Oncology, Autoimmune & Inflammatory Diseases, Infectious Diseases, Cardiovascular & Metabolic Disorders, Neurological Disorders, and Others. Oncology remains the dominant sub-segment, representing 45% of the market, fueled by the high incidence of cancers and strong clinical demand for targeted therapies. Autoimmune & inflammatory diseases hold about 25% of the market, driven by chronic disease prevalence and increasing biologic adoption. Infectious and other disease areas collectively account for 30%. Strong R&D pipelines and growing patient awareness continue to expand market opportunities across all therapeutic areas.

- For instance, Jazz Pharmaceuticals received FDA approval in October 2025 for lurbinectedin (Zepzelca) combined with atezolizumab (Tecentriq by Genentech) for treating specific cancers, highlighting advancements in targeted cancer therapies.

By Route of Administration:

The market by route of administration is categorized into Subcutaneous (SC), Intravenous (IV), and Others. Subcutaneous administration leads the market with 60% share, owing to patient convenience, reduced hospital visits, and ease of self-administration. Intravenous delivery accounts for 35%, preferred in hospital settings for acute treatments requiring controlled infusion. Other routes comprise 5% of the market. The shift toward home-based therapies, increasing patient preference for minimally invasive options, and ongoing development of long-acting formulations are key drivers supporting the subcutaneous segment’s growth.

Key Growth Drivers

Rapid Growth in Oncology and Chronic Disease Treatments

The rising incidence of cancer and chronic diseases in France drives demand for monoclonal antibodies. Oncology treatments, in particular, require highly targeted therapies, positioning mAbs as the preferred choice. Increasing patient populations for autoimmune and inflammatory disorders further bolster adoption. Healthcare providers are embracing advanced biologics to improve clinical outcomes, while ongoing clinical trials and approval of novel mAbs expand treatment options. This high medical need continues to propel growth across multiple therapeutic areas.

- For instance, Igyxos Biotherapeutics is advancing IGX12, a first-in-class monoclonal antibody enhancing follicle stimulating hormone efficacy, supported by a €5.7 million French government grant to accelerate Phase 2 clinical trials.

Advancements in Antibody Engineering and Biologics Development

Technological innovations in antibody design, including humanized and bispecific antibodies, are accelerating market expansion. Enhanced efficacy, reduced immunogenicity, and targeted delivery improve treatment outcomes and patient compliance. Heavy investment in research and development by pharmaceutical companies, coupled with partnerships and collaborations between biotech firms and academic institutions, ensures a continuous flow of innovative therapies. These advancements strengthen market penetration and reinforce France’s position as a leading hub for biologics development.

- For instance, Biocytogen has developed a fully human antibody library using transgenic mice, facilitating the rapid discovery of humanized antibodies with high specificity and reduced immunogenicity in therapeutic applications.

Government Support and Reimbursement Policies

Favorable healthcare policies, funding, and reimbursement frameworks significantly support market growth in France. Regulatory initiatives encourage innovation and expedite market entry for monoclonal antibody therapies. Public healthcare coverage for oncology and chronic disease treatments enhances patient access to high-cost biologics. Additionally, government-backed clinical research initiatives, infrastructure investment, and early access programs reduce time-to-market for new therapies, creating a conducive environment for domestic and international players to expand their market presence.

Key Trends & Opportunities

Trend of Home-Based and Self-Administered Therapies

The market is witnessing a shift toward home-based and self-administered monoclonal antibody treatments, especially via subcutaneous delivery. Patients increasingly prefer convenient, minimally invasive therapies that reduce hospital visits. Pharmaceutical companies are responding with auto-injectors and prefilled devices, supporting adherence and improving quality of life. Integration with telemedicine and remote monitoring strengthens this trend, opening new growth avenues for patient-centric solutions and home-based treatment models.

- For instance, Regeneron Pharmaceuticals has advanced subcutaneous monoclonal antibody formulations allowing shorter administration times and easier patient use compared to intravenous infusions.

Expansion of Targeted and Personalized Therapies

Precision medicine is reshaping the monoclonal antibodies landscape in France, emphasizing treatments tailored to individual patient profiles. Biomarker-driven therapy selection enhances efficacy and reduces adverse effects, driving clinician and patient adoption. Companies are investing in companion diagnostics and stratified approaches to support personalized treatment plans. This trend not only improves patient outcomes but also creates opportunities for novel mAbs addressing unmet medical needs, expanding the market for targeted and highly specific therapies.

- For instance, Roche Diagnostics recently secured FDA approval for its PATHWAY® anti-HER2/neu antibody test, enabling identification of breast cancer patients eligible for targeted HER2-ultralow therapies like ENHERTU®.

Key Challenges

High Treatment Costs and Pricing Constraints

Monoclonal antibody therapies involve significant costs, limiting accessibility for some patients and exerting pressure on healthcare budgets. Pricing regulations and reimbursement restrictions can slow adoption, particularly for newly launched therapies with premium pricing. Payers increasingly demand pharmacoeconomic evidence to justify therapy selection. Balancing innovation with affordability remains a critical challenge, affecting market penetration and overall growth in France.

Complex Manufacturing and Regulatory Challenges

The production of monoclonal antibodies requires sophisticated processes, rigorous quality control, and strict regulatory compliance. Manufacturing bottlenecks, supply chain disruptions, and extended approval timelines can delay product launches. Companies must invest in advanced facilities and skilled workforce to maintain consistency and meet safety standards. These operational and regulatory complexities increase costs and pose barriers for new entrants, making them a persistent challenge for market participants.

Regional Analysis

Île-de-France

Île-de-France dominates the monoclonal antibodies therapeutics market, holding a 40% share, driven by the high concentration of hospitals, research institutes, and pharmaceutical headquarters in Paris and surrounding areas. The presence of advanced healthcare infrastructure, clinical trial centers, and skilled medical professionals supports rapid adoption of innovative therapies. Oncology and autoimmune treatments are particularly prominent, fueled by growing patient populations and government healthcare initiatives. Strong investment in R&D and continuous launch of novel monoclonal antibody products further reinforce the region’s market leadership. The region remains a focal point for both domestic and international companies seeking market expansion.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur contributes 18% of the French monoclonal antibodies therapeutics market, driven by growing healthcare access and adoption of advanced biologics in oncology and chronic disease management. The region benefits from several specialized hospitals and clinical research centers facilitating patient access to novel therapies. Rising awareness of autoimmune and inflammatory disorders, coupled with government healthcare support, fuels demand. Pharmaceutical companies are increasingly targeting this region for product launches and clinical trials. Expansion of specialty clinics and enhanced distribution networks further support market growth, positioning Provence-Alpes-Côte d’Azur as a key contributor in the French mAbs therapeutics landscape.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes holds 15% of the monoclonal antibodies therapeutics market in France, supported by advanced healthcare infrastructure and growing investment in R&D facilities. Hospitals and specialty clinics are actively adopting monoclonal antibody treatments for oncology and autoimmune indications. Regional government initiatives to improve patient access to biologics and promote clinical trials enhance market penetration. Increased collaborations between biotech firms and local research institutes drive innovation, while patient demand for targeted therapies continues to rise. The combination of strong medical expertise and strategic distribution channels ensures steady growth, making Auvergne-Rhône-Alpes a significant contributor to the overall French market.

Occitanie

Occitanie accounts for 10% of the monoclonal antibodies therapeutics market, driven by the expansion of healthcare services in both urban and semi-urban areas. Rising incidence of chronic diseases, especially cancer and autoimmune disorders, increases the adoption of monoclonal antibody therapies. Regional hospitals and specialty clinics are strengthening their biologics programs, supported by government initiatives that facilitate access to innovative treatments. Local pharmaceutical partnerships and clinical trial activities further encourage market growth. Patient awareness campaigns and improvements in healthcare infrastructure enhance therapy adoption rates, positioning Occitanie as an emerging market within France’s monoclonal antibodies therapeutics sector.

Nouvelle-Aquitaine

Nouvelle-Aquitaine contributes 9% of the French monoclonal antibodies therapeutics market, with growth fueled by increasing prevalence of oncology and inflammatory disorders. Hospitals and specialty clinics are expanding biologics offerings, supported by regional healthcare policies that encourage access to advanced therapies. The region benefits from investments in clinical research centers and partnerships between biotech firms and local institutions. Rising patient awareness, coupled with adoption of subcutaneous and intravenous therapies, strengthens the market. Distribution networks are improving to ensure broader therapy availability, enabling steady growth and establishing Nouvelle-Aquitaine as a key regional player in monoclonal antibodies therapeutics.

Other Regions

The remaining regions, including Brittany, Hauts-de-France, Grand Est, Centre-Val de Loire, and Normandy, collectively hold 8% of the market. These regions are witnessing gradual adoption of monoclonal antibody therapies due to expanding hospital infrastructure and specialty clinics. Growth is driven by increasing awareness of oncology, autoimmune, and infectious diseases, alongside regional government initiatives supporting patient access to biologics. Collaboration with pharmaceutical companies for clinical trials and educational programs enhances therapy penetration. Although smaller in market share, these regions offer potential for expansion through improved distribution networks, rising patient demand, and increased investment in targeted therapies.

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- l Île-de-France

- l Provence-Alpes-Côte d’Azur

- l Auvergne-Rhône-Alpes

- l Occitanie

- l Nouvelle-Aquitaine

- Others

Competitive Landscape

The competitive landscape of the France monoclonal antibodies therapeutics market features key players such as F. Hoffmann-La Roche Ltd, Sanofi, Abbvie Inc., Bristol Myers Squibb Company, AstraZeneca, and Amgen Inc. Companies are focusing on innovation, strategic collaborations, and product portfolio expansion to strengthen their market positions. R&D investments in next-generation humanized and bispecific antibodies are driving differentiation, while approvals of novel therapies in oncology, autoimmune, and inflammatory diseases enhance competitive advantage. Firms are also leveraging partnerships with local hospitals and research institutes to accelerate clinical trials and improve market access. Pricing strategies, manufacturing capabilities, and regulatory compliance remain critical for maintaining leadership. Overall, the market is highly dynamic, with established multinational players and emerging biotech firms actively competing to capture a growing share of France’s monoclonal antibodies therapeutics sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Sanofi

- Abbvie Inc.

- Bristol Myers Squibb Company

- Pierre Fabre S.A

- AstraZeneca

- Amgen Inc.

- Eli Lilly and Company

- Regeneron Pharmaceuticals Inc.

- Johnson & Johnson Services, Inc.

Recent Developments

- In October 2, 2025, Igyxos Biotherapeutics received a €5.7 million grant from the French government under the France 2030 program to accelerate the development of its first-in-class monoclonal antibody targeting infertility.

- In 2025, Amgen Inc. advanced its BiTE (bispecific T-cell engager) technology, which links patients’ T-cells to cancer cells, enabling targeted immune responses.

- In June 2025, Bristol Myers Squibb (BMS) and BioNTech entered a collaboration valued at up to US$ 11.1 billion to co-develop and commercialize BNT327, a bispecific antibody targeting two cancer cell receptors simultaneously.

Report Coverage

The research report offers an in-depth analysis based on Sources, Therapeutic Area, Route of Administration, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to expand steadily, driven by rising cancer and chronic disease prevalence.

- Increasing adoption of humanized and bispecific antibodies will fuel growth across therapeutic areas.

- Government support and reimbursement policies will continue to enhance patient access to therapies.

- Technological advancements in antibody engineering will improve efficacy and reduce side effects.

- Expansion of subcutaneous and home-based delivery methods will boost patient convenience and adherence.

- Personalized and targeted therapies will gain traction, creating opportunities in precision medicine.

- Strategic collaborations, partnerships, and clinical trials will accelerate product development.

- Specialty clinics and hospital pharmacies will remain major distribution channels, supporting market reach.

- Growing awareness and early diagnosis of autoimmune and inflammatory diseases will drive demand.

- Regulatory approvals for novel monoclonal antibody therapies will sustain long-term market growth.