Market Overview

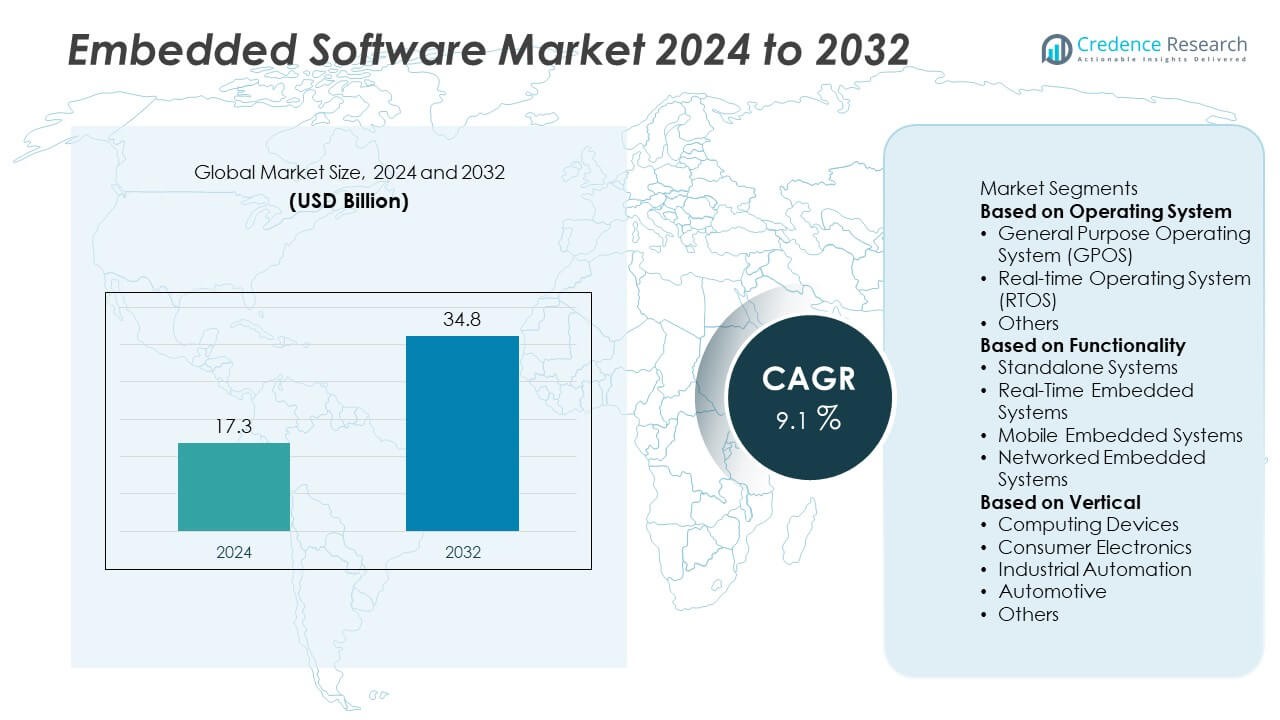

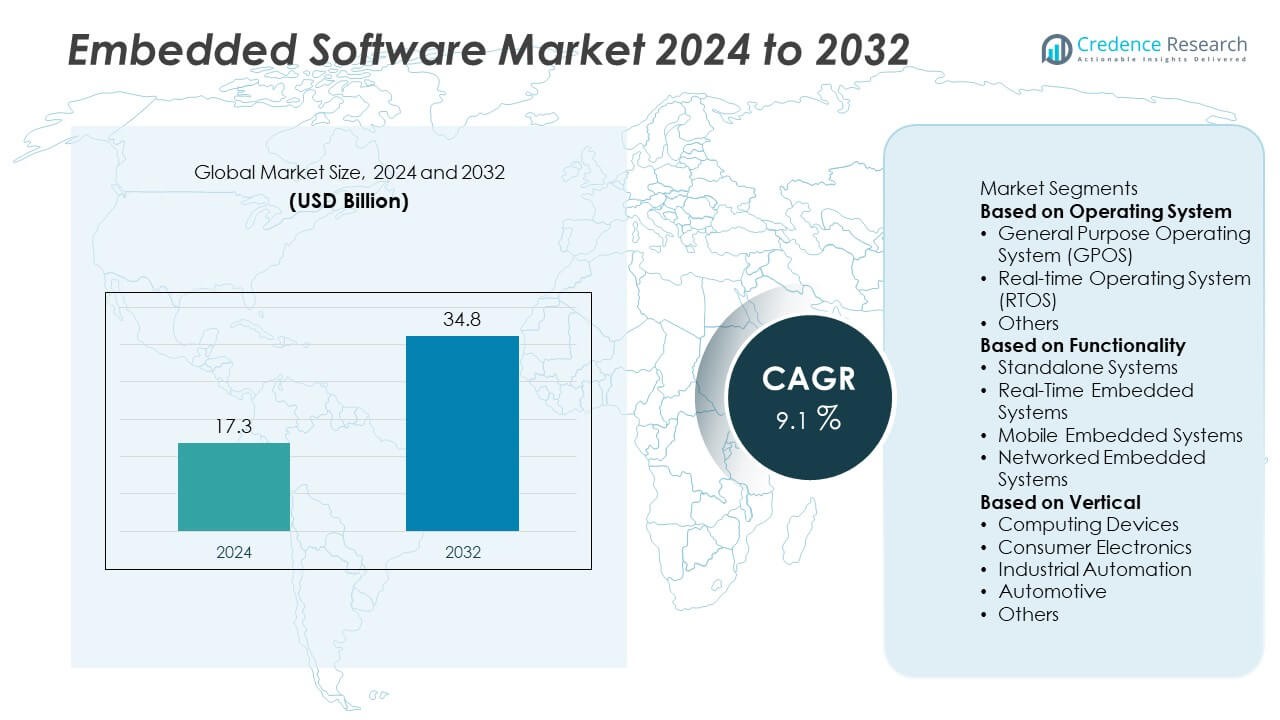

Embedded Software Market size was valued at USD 17.3 billion in 2024 and is anticipated to reach USD 34.8 billion by 2032, expanding at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded Software Market Size 2024 |

USD 17.3 Billion |

| Embedded Software Market, CAGR |

9.1% |

| Embedded Software Market Size 2032 |

USD 34.8 Billion |

The Embedded Software Market grows with rising demand across automotive, healthcare, consumer electronics, and industrial automation. Increasing adoption of connected vehicles, IoT-enabled devices, and smart medical equipment drives integration of advanced embedded platforms.

The Embedded Software Market demonstrates strong geographical diversity, with Asia-Pacific leading growth due to its large semiconductor manufacturing base, rising demand for consumer electronics, and expanding automotive production in China, Japan, South Korea, and India. North America shows steady expansion, supported by advanced technology adoption in automotive, aerospace, and defense industries, while Europe emphasizes industrial automation, healthcare innovation, and sustainable technologies. Latin America and the Middle East & Africa provide emerging opportunities with growing digital infrastructure and industrial development. Key players such as Intel Corporation, Microsoft, NXP Semiconductors, and Green Hills Software drive market competitiveness through innovation, partnerships, and product development. They focus on integrating artificial intelligence, IoT, and edge computing capabilities to enhance efficiency and performance across industries. Their strategies also include expanding global presence, strengthening cybersecurity features, and improving software compatibility with advanced hardware platforms, ensuring resilience and adaptability in fast-changing technology ecosystems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Embedded Software Market size was valued at USD 17.3 billion in 2024 and is projected to reach USD 34.8 billion by 2032, growing at a CAGR of 9.1%.

- Strong drivers include rising adoption of IoT devices, connected vehicles, and automation across industrial and healthcare applications.

- Market trends highlight the integration of AI, edge computing, and adaptive embedded operating systems that improve real-time performance and efficiency.

- Competitive landscape features companies such as Intel Corporation, Microsoft, NXP Semiconductors, and Green Hills Software, focusing on innovation, global expansion, and ecosystem partnerships.

- Key restraints include high development costs, shortage of skilled professionals, and challenges of meeting strict regulatory compliance in safety-critical industries.

- Asia-Pacific leads demand with strong manufacturing and consumer electronics adoption, while North America emphasizes aerospace, defense, and automotive applications.

- Europe strengthens growth with industrial automation and medical technologies, while Latin America and the Middle East & Africa provide opportunities through digital infrastructure and industrial expansion.

Market Drivers

Growing Adoption Across Automotive and Transportation Systems

The Embedded Software Market grows steadily with rising demand in the automotive sector. Modern vehicles integrate embedded software in infotainment, driver-assistance systems, and electric powertrain controls. It ensures safety, real-time communication, and efficient energy management. The rise of electric vehicles and autonomous driving strengthens reliance on embedded solutions. Automakers invest heavily in advanced software platforms to enhance user experience and comply with safety standards. This trend anchors automotive applications as a dominant driver of global growth.

- For instance, NXP’s S32 platform is a portfolio of processors and microcontrollers used by numerous automakers to develop software-defined vehicles (SDVs). It is used for vehicle networking, connectivity, ADAS, and electrification systems, with a focus on functional safety and security.

Expansion of Consumer Electronics and Smart Devices

Consumer electronics form a major growth pillar for the Embedded Software Market. Smartphones, tablets, wearables, and smart appliances rely on embedded software for functionality and interconnectivity. It supports seamless communication, device personalization, and enhanced security. Growing adoption of IoT-enabled devices in homes and offices amplifies demand. Rising disposable incomes and digital lifestyles in emerging economies accelerate integration across diverse applications. The need for high performance, compact, and energy-efficient devices drives continuous software upgrades.

- For instance, Apple’s S9 SiP in the Apple Watch Series 9 includes a CPU with 5.6 billion transistors and a four-core Neural Engine, enabling advanced on-device Siri processing and improved interaction speed.

Industrial Automation and Healthcare Applications Driving Demand

Industrial and healthcare sectors significantly contribute to the Embedded Software Market. Manufacturing facilities use embedded solutions in robotics, control systems, and monitoring equipment. It enables precision, predictive maintenance, and efficient operations in complex environments. Healthcare providers adopt embedded software for diagnostic tools, medical devices, and telemedicine platforms. The rising demand for accurate, connected, and user-friendly healthcare technologies reinforces growth. Expansion of smart factories and digital healthcare ecosystems strengthens long-term adoption.

Technological Advancements and Integration with Emerging Technologies

Innovation continues to fuel the Embedded Software Market through integration with AI, IoT, and machine learning. Advanced algorithms enhance real-time decision-making, automation, and connectivity. It enables smart applications across aerospace, defense, and consumer electronics. The growing role of embedded software in cybersecurity further expands opportunities. Research in cloud integration and edge computing enhances responsiveness and flexibility of embedded systems. These advancements ensure embedded software remains central to digital transformation initiatives worldwide.

Market Trends

Integration of Artificial Intelligence and Machine Learning

The Embedded Software Market shows a strong trend toward integration with AI and machine learning. These technologies enhance predictive analytics, automation, and real-time decision-making in embedded systems. It supports applications in automotive, robotics, and industrial automation where accuracy and speed are critical. AI-enabled software also drives advancements in voice recognition, image processing, and autonomous navigation. Vendors focus on developing adaptive solutions that evolve with user needs. This trend reinforces the role of embedded software in next-generation smart systems.

Growing Role of IoT and Connected Ecosystems

IoT adoption accelerates demand in the Embedded Software Market. Connected devices in homes, healthcare, and manufacturing rely on embedded platforms for communication and control. It ensures seamless data exchange across networks, enabling efficient operations and enhanced security. The proliferation of smart appliances, wearable devices, and connected industrial equipment boosts adoption. IoT-driven ecosystems expand opportunities for software updates and customization. This trend strengthens embedded software as a backbone of digital transformation.

Shift Toward Real-Time Operating Systems and Edge Computing

The growing importance of real-time performance shapes the Embedded Software Market. Industries demand real-time operating systems (RTOS) for mission-critical functions in aerospace, defense, and medical devices. It enables immediate responsiveness, reliability, and security in high-stakes applications. Integration with edge computing further enhances efficiency by processing data locally instead of relying on cloud systems. RTOS and edge solutions support low-latency communication in connected cars, industrial robotics, and healthcare tools. This trend ensures embedded software remains vital in advanced digital ecosystems.

Focus on Cybersecurity and Regulatory Compliance

Cybersecurity emerges as a dominant trend in the Embedded Software Market. Rising cyber threats across automotive, healthcare, and industrial sectors drive demand for secure embedded solutions. It requires robust encryption, authentication, and continuous monitoring features. Governments and regulators impose stricter compliance standards, compelling companies to upgrade security measures. Vendors invest in software designs that balance performance with advanced protection. This trend ensures trust, reliability, and wider acceptance of embedded technologies across industries.

Market Challenges Analysis

High Complexity and Rising Development Costs

The Embedded Software Market faces challenges from increasing complexity in design and development. Advanced applications in automotive, healthcare, and industrial automation demand multifunctional, high-performance software. It requires significant investment in research, testing, and skilled talent, which raises costs for vendors. Customization needs across industries further intensify the complexity, making scalability difficult. Smaller firms struggle to compete with established players due to limited resources. These cost pressures affect time-to-market and profitability, slowing growth in certain segments.

Cybersecurity Threats and Regulatory Compliance Pressure

Cybersecurity risks create a major challenge in the Embedded Software Market. Growing connectivity in vehicles, medical devices, and industrial systems exposes vulnerabilities that can compromise safety and data integrity. It forces companies to invest heavily in secure coding, encryption, and frequent updates. Meeting stringent regulatory standards across multiple regions increases compliance costs and slows product rollouts. Constantly evolving cyber threats demand continuous upgrades, adding further operational strain. These factors collectively create barriers for widespread adoption and long-term stability.

Market Opportunities

Expansion Across IoT, Automotive, and Healthcare Sectors

The Embedded Software Market presents strong opportunities in IoT, automotive, and healthcare industries. Smart homes, connected devices, and wearable technologies create sustained demand for efficient embedded platforms. It enables seamless connectivity and control across diverse digital ecosystems. Automotive applications, including electric vehicles and advanced driver-assistance systems, rely on embedded software to enhance safety and user experience. Healthcare adoption rises through diagnostic devices, patient monitoring, and telemedicine tools that require precision and reliability. Growing digitalization across these sectors secures embedded software as a vital enabler of innovation and growth.

Emergence of AI, Edge Computing, and Smart Automation

Rapid advancements in AI, edge computing, and automation create new growth prospects for the Embedded Software Market. Integration with AI supports adaptive, intelligent systems that optimize operations across industries. It drives adoption in robotics, industrial automation, and defense applications requiring real-time decision-making. Edge computing further expands opportunities by reducing latency and improving data security in connected systems. Smart factories and autonomous systems strengthen reliance on embedded platforms for efficiency and performance. These emerging technologies position embedded software at the core of global digital transformation strategies.

Market Segmentation Analysis:

By Operating System

The Embedded Software Market is segmented by operating system into real-time operating systems (RTOS), Linux, Windows, and others. RTOS holds a significant share because of its precision and ability to handle time-sensitive applications in automotive, aerospace, and industrial sectors. It ensures reliability and safety in mission-critical systems that demand consistent performance. Linux-based embedded platforms gain momentum with open-source flexibility and wide adoption across consumer electronics and IoT devices. Windows finds relevance in certain industrial and enterprise solutions, offering compatibility with existing IT systems. Other operating systems, including proprietary and lightweight platforms, serve niche applications where customization is essential. Each operating system category contributes to diversifying adoption across industries.

- For instance, Wind River’s VxWorks RTOS is a globally used, high-performance, and deterministic real-time operating system that powers billions of devices. Its latest versions can achieve sub-3 microsecond interrupt responses on specific hardware and support major processor architectures like ARM, RISC-V, and x86.

By Functionality

By functionality, the Embedded Software Market includes standalone and real-time systems. Standalone software is widely deployed in consumer electronics, home appliances, and smaller devices where performance demands are moderate. It offers cost efficiency and simplicity for mass-produced devices. Real-time systems dominate in automotive, defense, and industrial automation because of their ability to manage simultaneous processes without delays. It enables seamless performance in safety-critical environments such as autonomous driving and healthcare diagnostics. This segmentation highlights the growing reliance on real-time capabilities as industries advance toward automation and connected systems.

- For instance, QNX, owned by BlackBerry, is deployed in over 235 million vehicles globally, with its RTOS capable of handling ISO 26262 ASIL-D safety certification and processing thousands of signals per second in advanced driver-assistance systems.

By Vertical

By vertical, the Embedded Software Market covers automotive, healthcare, consumer electronics, industrial, aerospace and defense, and others. Automotive remains a dominant vertical, with rising integration in electric vehicles, infotainment systems, and ADAS solutions. It supports smarter driving experiences and ensures compliance with safety regulations. Healthcare adopts embedded software in diagnostic equipment, wearable monitors, and telemedicine platforms, where reliability is essential. Consumer electronics represent a fast-growing vertical driven by IoT-enabled devices, smartphones, and smart home solutions. Industrial applications emphasize automation, robotics, and control systems, while aerospace and defense focus on safety-critical missions requiring real-time precision. This broad vertical adoption strengthens embedded software as a foundation of digital transformation across global markets.

Segments:

Based on Operating System

- General Purpose Operating System (GPOS)

- Real-time Operating System (RTOS)

- Others

Based on Functionality

- Standalone Systems

- Real-Time Embedded Systems

- Mobile Embedded Systems

- Networked Embedded Systems

Based on Vertical

- Computing Devices

- Consumer Electronics

- Industrial Automation

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for a 30% share of the Embedded Software Market in 2024, supported by strong technological infrastructure and high adoption across industries. The United States leads the region with advanced integration of embedded systems in automotive, defense, consumer electronics, and industrial automation. It benefits from established semiconductor companies, significant R&D spending, and strong demand for autonomous and electric vehicles. Canada contributes through rising adoption of embedded solutions in healthcare devices, aerospace, and smart manufacturing systems. The region also plays a vital role in developing IoT ecosystems and AI-driven embedded applications. Continuous investment in cybersecurity solutions and compliance frameworks strengthens the reliability of embedded platforms. North America’s innovation-driven ecosystem ensures it remains a dominant region for long-term adoption.

Europe

Europe holds a 25% share of the Embedded Software Market, shaped by its strong automotive, industrial, and healthcare sectors. Germany, France, and the United Kingdom drive the majority of demand with high adoption of embedded solutions in electric vehicles, medical technologies, and industrial control systems. It benefits from strict regulatory frameworks, which push companies to adopt safe and efficient embedded platforms. Eastern European nations such as Poland and Hungary contribute to the market through expanding industrial bases and manufacturing growth. European automakers rely heavily on embedded software for ADAS, infotainment, and connected vehicle technologies. The region emphasizes sustainability, which supports development of energy-efficient systems and software for green mobility and industrial processes. Europe’s focus on compliance and innovation ensures stable and consistent growth across multiple verticals.

Asia-Pacific

Asia-Pacific dominates with a 33% share of the Embedded Software Market, making it the largest regional contributor. China leads with large-scale production of consumer electronics, smartphones, and connected vehicles that rely on embedded platforms. India shows rapid growth, driven by expanding automotive production, smart device adoption, and government-backed digitalization initiatives. Japan and South Korea contribute with advanced innovation in consumer electronics, medical devices, and automotive technologies. Southeast Asian countries including Vietnam, Thailand, and Indonesia enhance regional demand through growing manufacturing hubs and industrial automation. It benefits from a large consumer base and rising disposable incomes that accelerate the adoption of smart appliances and wearables. Asia-Pacific’s vast industrial growth, combined with its innovation capabilities, secures its leadership in the global market.

Latin America

Latin America represents a 6% share of the Embedded Software Market, supported by gradual adoption in consumer electronics, automotive, and healthcare sectors. Brazil leads with strong demand for embedded solutions in industrial automation, medical equipment, and automotive manufacturing. Mexico contributes through its robust automotive production base and rising use of embedded systems in smart devices and home appliances. Argentina, Chile, and Colombia show steady growth supported by industrial expansion and rising demand for connected technologies. Limited local R&D remains a challenge, but growing partnerships with global companies strengthen the regional ecosystem. Rising urbanization and digitalization across metropolitan centers fuel steady adoption, ensuring Latin America’s role as an emerging market.

Middle East & Africa

The Middle East & Africa hold a 6% share of the Embedded Software Market, supported by growing investments in smart cities, industrial automation, and healthcare technologies. The United Arab Emirates and Saudi Arabia dominate regional demand, focusing on embedded software for transportation systems, defense, and digital transformation projects. South Africa leads in the African market with adoption in industrial automation, automotive systems, and healthcare devices. Nigeria and Egypt contribute with rising demand for connected consumer electronics and infrastructure development. It benefits from rising foreign investments and government-backed initiatives promoting digital growth. Despite challenges in infrastructure, the region demonstrates rising opportunities through modernization and industrial diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Embedded Software Market includes Intel Corporation, Microsoft, NXP Semiconductors, Renesas Electronics Corporation, STMicroelectronics, Texas Instruments Incorporated, Siemens, Wind River Systems, Inc., Green Hills Software, and Microchip Technology Inc. These companies compete by leveraging strong R&D capabilities, broad product portfolios, and global distribution networks. The market is driven by demand for IoT, connected vehicles, and industrial automation, prompting players to invest heavily in real-time operating systems, AI integration, and cybersecurity features. Strategic collaborations with OEMs and technology partners enable faster adoption across automotive, healthcare, consumer electronics, and defense sectors. Many leading firms focus on developing scalable, adaptive software platforms that support edge computing and 5G-enabled devices, positioning themselves as key enablers of digital transformation. Regional expansion, compliance with safety standards, and advanced toolchains for debugging and optimization further strengthen their competitiveness. This dynamic environment reflects a balance of innovation, strategic partnerships, and domain expertise to secure long-term market leadership.

Recent Developments

- In July 2025, Renesas Electronics Corporation introduced the RA2T1 microcontroller group, optimized for single-motor control in devices like power tools and home appliances. These MCUs incorporate a 3-channel sample-and-hold function to concurrently detect three-phase BLDC motor currents, enhancing control precision for inverter drives.

- In June 2025, Wind River Systems, Inc. launched the Wind River Studio Developer Testing Suite, enabling embedded software teams to securely reserve shared physical or virtual test hardware, and run simulations via QEMU or Intel Simics, accelerating test cycles and reducing dependency on hardware availability.

- In March 2025, Wind River Systems, Inc. unveiled VxWorks 7 25.03, the latest RTOS release featuring modular architecture. It separates kernel from middleware and apps, offering single-nanosecond latency to meet stringent real-time requirements.

- In March 2024, NXP Semiconductors rolled out the S32 CoreRide platform, streamlining automotive software development by integrating partner software with NXP’s advanced chips for power management, data processing, and in-vehicle networking.

Report Coverage

The research report offers an in-depth analysis based on Operating System, Functionality, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for embedded software will rise with growth in IoT and connected devices.

- Automotive applications will expand with autonomous driving and advanced driver assistance systems.

- Industrial automation will increase reliance on real-time operating systems for efficiency.

- Healthcare devices will integrate more embedded software to support connected diagnostics.

- Cloud and edge computing will drive adoption of scalable embedded platforms.

- Cybersecurity requirements will push development of secure embedded software solutions.

- Artificial intelligence integration will strengthen embedded systems across consumer and industrial products.

- 5G networks will accelerate adoption in telecom, mobility, and smart city projects.

- Asia-Pacific will remain a dominant hub for production and innovation in embedded systems.

- Strategic partnerships among hardware and software providers will shape competitive positioning.