Market Overview

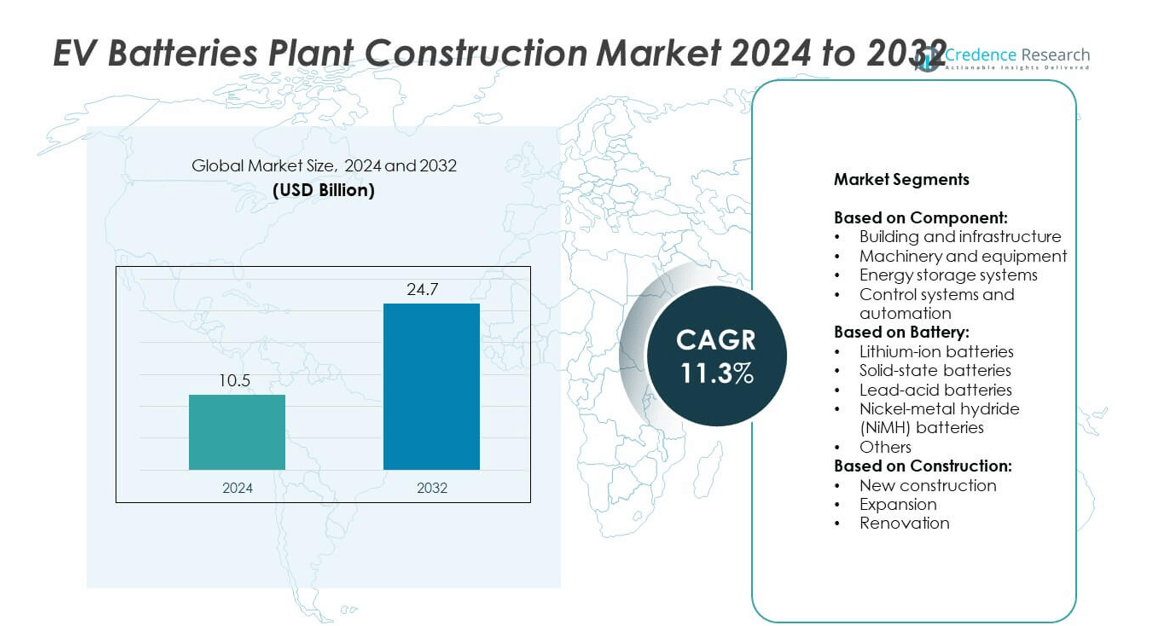

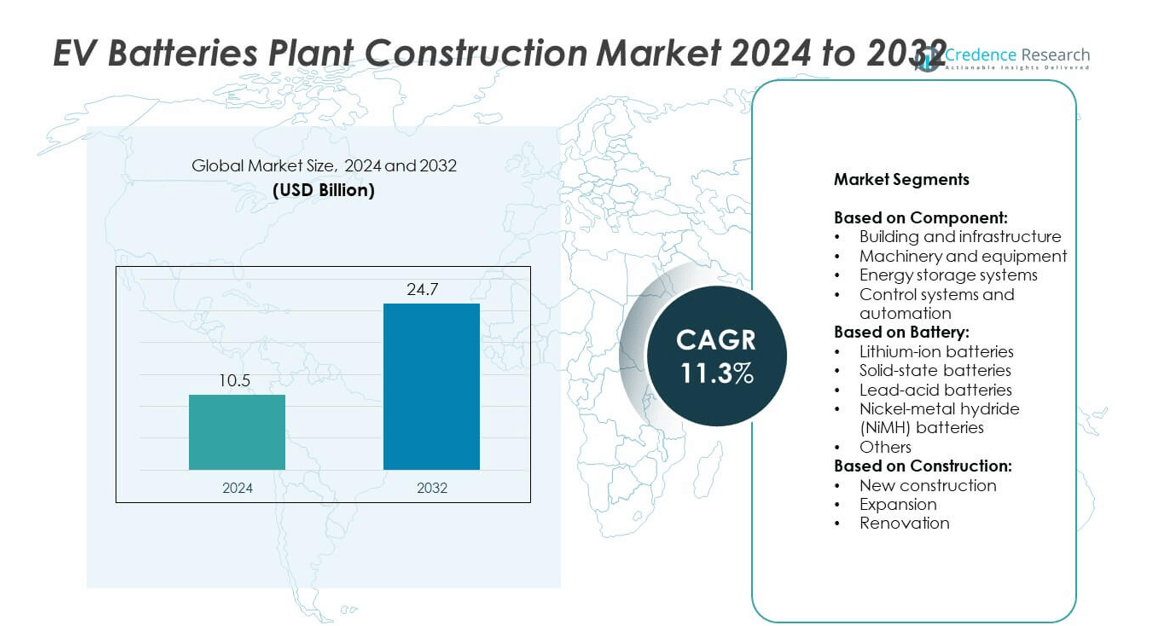

EV Batteries Plant Construction Market size was valued at USD 10.5 billion in 2024 and is anticipated to reach USD 24.7 billion by 2032, at a CAGR of 11.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EV Batteries Plant Construction Market Size 2024 |

USD 10.5 billion |

| EV Batteries Plant Construction Market, CAGR |

11.3% |

| EV Batteries Plant Construction Market Size 2032 |

USD 24.7 billion |

The EV Batteries Plant Construction market grows with rising electric vehicle demand, regional manufacturing policies, and strong government incentives. Automakers and battery producers invest in gigafactories to secure supply chains and meet clean energy targets. The market benefits from Industry 4.0 adoption, including automation, digital twins, and AI-based controls. It also reflects a shift toward sustainable construction practices and multi-chemistry production lines. Emerging technologies like solid-state batteries drive demand for customized plant designs and advanced infrastructure planning.

Asia-Pacific leads the EV Batteries Plant Construction market with strong manufacturing capacity and established supply chains. North America is expanding rapidly due to policy incentives and rising EV production targets. Europe shows steady growth driven by sustainability goals and regional supply strategies. Latin America and Middle East & Africa present emerging opportunities linked to raw material access and green energy investments. Key players shaping the global market landscape include Bechtel, Turner, Fluor, and AECOM, known for their large-scale industrial construction expertise.

Market Insights

- The EV Batteries Plant Construction market was valued at USD 10.5 billion in 2024 and is projected to reach USD 24.7 billion by 2032, growing at a CAGR of 11.3%.

- Rising demand for electric vehicles and government subsidies for battery localization are key market drivers.

- Companies are focusing on automation, modular layouts, and AI-based monitoring in new plant designs.

- Global construction leaders compete by offering turnkey gigafactory solutions tailored to high-capacity battery production.

- High capital investment, raw material supply constraints, and skilled labor shortages limit project execution speed.

- Asia-Pacific leads the market due to established supply chains, while North America and Europe grow with policy support.

- Firms like Bechtel, Turner, and Fluor dominate large-scale projects across North America, Europe, and Asia-Pacific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Global Investments in Electric Vehicle Production and Infrastructure Expansion

Surging global demand for electric vehicles is driving major capital investments in battery plant construction. Governments in Europe, Asia-Pacific, and North America continue to allocate billions to electrification goals. These initiatives require a reliable supply chain of lithium-ion and solid-state batteries. The EV Batteries Plant Construction market benefits from these long-term policy frameworks. Original equipment manufacturers and battery producers are building gigafactories to meet rising EV output targets. It reflects the growing urgency to establish regional self-sufficiency in battery manufacturing.

- For instance,Tesla has indeed continued to invest in the facility since its operations began. In early 2024, the company started a significant expansion that includes new facilities for producing 4680 battery cells and the Tesla Semi.

Favorable Government Policies and Incentives Supporting Localized Battery Production

National policies are increasingly aligned to support battery manufacturing close to end-use markets. The U.S. Inflation Reduction Act and EU Green Deal allocate subsidies and tax credits for battery plant developers. These incentives reduce capital risks for companies investing in domestic capacity. The EV Batteries Plant Construction market gains momentum from local sourcing requirements and emissions-linked regulations. It also supports energy security goals by reducing import reliance. Countries are competing to attract battery supply chain investments.

- For instance, AESC secured £1 billion in funding to build a second gigafactory in Sunderland, UK, expected to supply up to 15.8 GWh of batteries annually—enough for around 300,000 electric vehicles—and create over 1,000 jobs

Strong Demand for Energy Storage Systems in Renewable Integration and Grid Stability

Rising adoption of renewable energy is fueling demand for energy storage infrastructure. Battery plants are being scaled up not only for EVs but also for stationary storage. This dual-use potential strengthens the case for building versatile battery production hubs. The EV Batteries Plant Construction market is expanding into utility-scale storage applications. It enables better grid balancing and enhances reliability of solar and wind energy systems. Developers target regions with growing grid modernization programs.

Technological Advancements in Battery Chemistries and Manufacturing Efficiency

Progress in battery technologies is improving energy density, charge cycles, and thermal stability. Companies are transitioning to high-nickel, cobalt-free, and solid-state formulations. These changes demand new factory configurations and specialized production lines. The EV Batteries Plant Construction market evolves to accommodate these innovations. Automation, AI-based quality control, and dry electrode processing are reshaping construction requirements. It fosters competitive differentiation through manufacturing agility and product flexibility.

Market Trends

Rising Strategic Collaborations Between Automakers and Battery Manufacturers to Secure Supply Chains

Global automakers are forming joint ventures with battery producers to ensure long-term supply security. These partnerships enable direct investment in battery plant construction and localized manufacturing. Companies like Ford-SK On and Stellantis-LG Energy are launching co-owned gigafactories. The EV Batteries Plant Construction market benefits from these long-term, co-financed projects. It reflects a shift toward vertical integration and risk mitigation. Companies aim to reduce logistics complexity and protect against raw material disruptions.

- For instance, Ford and SK Innovation’s BlueOval SK joint venture plans to produce 129 GWh of battery cells annually from three plants. Two twin plants in Kentucky will each produce 43 GWh annually, while a third plant in Tennessee, also planned for 43 GWh, has had its start of production delayed until at least 2027

Rapid Shift Toward Regionalized Battery Production Driven by Trade Policy and Logistics

Battery manufacturers are prioritizing regional manufacturing strategies to comply with trade rules and cut transportation costs. Demand is growing for plants located closer to automotive assembly hubs. Europe and the U.S. are becoming key locations due to clean energy mandates and local sourcing requirements. The EV Batteries Plant Construction market is seeing a geographic diversification of capacity. It reduces overreliance on Asia-Pacific supply networks. This trend strengthens national control over critical energy infrastructure.

- For instance, LG Energy Solution operates Europe’s largest EV battery factory near Wrocław, Poland, with an annual production capacity of approximately 86 GWh as of late 2024. With this capacity, the company has set a goal to produce up to one million EV batteries per year, supplying major European car manufacturers

Integration of Automation and Digital Twins to Enhance Plant Efficiency and Output

Modern battery factories are adopting Industry 4.0 technologies to optimize production processes. Digital twins, AI-driven monitoring, and robotics enable real-time control and predictive maintenance. It leads to higher throughput and fewer defects in battery production. The EV Batteries Plant Construction market reflects these demands with highly automated layouts. Companies invest in scalable, flexible lines to adapt to evolving chemistries. This trend supports cost reduction and faster time to market.

Sustainable Construction Practices and Green Certification Gaining Importance

Sustainability has become central to new battery plant development. Companies aim for LEED certifications, zero-emission operations, and recycled material use. These practices align with corporate ESG goals and government clean-tech mandates. The EV Batteries Plant Construction market adopts energy-efficient designs and closed-loop water systems. It helps firms reduce their environmental footprint while attracting public and private funding. Green construction becomes a standard rather than a differentiator.

Market Challenges Analysis

High Capital Investment Requirements and Long Construction Timelines Hinder Rapid Expansion

Building large-scale battery plants demands substantial capital investment, often exceeding hundreds of millions per site. Developers face long planning, permitting, and procurement cycles before operations begin. This slows capacity growth and delays time-to-market for new technologies. The EV Batteries Plant Construction market struggles with aligning investor confidence and project timelines. It must also navigate inflation in raw materials, equipment, and labor. These financial barriers create entry challenges for smaller players.

Supply Chain Constraints and Skilled Labor Shortages Disrupt Project Execution

Shortages in key materials such as lithium, nickel, and graphite affect construction timelines and output projections. Delays in equipment imports or local approvals further complicate execution. It increases the risk of cost overruns and contractual penalties. The EV Batteries Plant Construction market also faces a limited pool of specialized engineers and technicians. Scaling technical teams across regions proves difficult amid rising global demand. Workforce development becomes a strategic priority for long-term growth.

Market Opportunities

Surging Demand for Energy Storage Across Emerging Markets Creates New Expansion Prospects

Emerging economies are scaling investments in electric mobility and grid modernization. Countries in Southeast Asia, Latin America, and the Middle East are allocating resources toward domestic battery production. These markets present untapped demand for localized battery plants. The EV Batteries Plant Construction market can capitalize on favorable land availability, low-cost labor, and government incentives. It enables companies to diversify geographically and reduce dependence on mature markets. First-movers in these regions gain competitive advantage through early infrastructure control.

Next-Generation Battery Technologies Drive Demand for Specialized Manufacturing Facilities

Solid-state, sodium-ion, and lithium-sulfur batteries require customized manufacturing environments. Companies leading these technologies are initiating new plant designs tailored to unique process needs. It opens opportunities for construction firms to deliver purpose-built facilities with advanced controls. The EV Batteries Plant Construction market gains from this shift toward specialized gigafactories. It supports companies investing in pilot lines and early commercial-scale operations. Innovation in battery chemistries will continue to create demand for adaptive construction solutions.

Market Segmentation Analysis:

By Component:

Building and infrastructure holds a dominant share of the EV Batteries Plant Construction market due to the scale and complexity of gigafactory development. Companies prioritize land acquisition, structural layouts, and cleanroom environments to support battery manufacturing. Machinery and equipment follows closely, driven by automation, precision assembly tools, and material handling systems. Energy storage systems play a growing role, particularly in plants integrating on-site renewable energy for self-consumption. It helps stabilize operations and align with sustainability goals. Control systems and automation gain traction as factories implement Industry 4.0 frameworks for higher efficiency and reduced human error.

- For instance, Exyte constructed a facility in Arnstadt with Europe’s largest dry room—over 130,000 m² built by more than 1,000 workers—serving a leading battery manufacturer.

By Battery:

Lithium-ion batteries lead all segments due to wide adoption across EVs and energy storage systems. Most new facilities are tailored to support lithium-ion cell production at high volumes. Solid-state batteries are emerging rapidly, backed by investments from global automakers and energy firms. The EV Batteries Plant Construction market is adapting to new technical requirements for solid-state chemistry, including dry room control and advanced material handling. Lead-acid batteries retain relevance in certain backup and industrial vehicle applications but occupy a smaller construction share. Nickel-metal hydride (NiMH) batteries serve hybrid vehicles and remain niche, while the “Others” category includes newer chemistries under early-stage development.

- For instance, Panasonic Energy’s Kansas plant officially began mass production of lithium-ion battery cells in July 2025. The facility spans approximately 300 acres (1.2 million m²) and features a building of about 4.7 million ft² (440,000 m²). While the Kansas factory is new, Panasonic’s global operations had cumulatively supplied approximately 19 billion cells powering around 3.7 million electric vehicles as of March 2025, with no vehicle recalls linked to its automotive batteries to date.

By Construction:

New construction dominates due to rising demand for greenfield battery production sites in North America, Europe, and Asia-Pacific. It reflects the need for custom-designed plants capable of housing evolving technologies. Expansion projects are also significant, driven by capacity scaling of existing factories to meet long-term supply agreements. It enables companies to leverage current infrastructure while minimizing downtime. Renovation remains limited but important for retrofitting older facilities to accommodate next-generation batteries or automation upgrades. Each construction type supports different strategic objectives, from rapid entry to long-term technological adaptation.

Segments:

Based on Component:

- Building and infrastructure

- Machinery and equipment

- Energy storage systems

- Control systems and automation

Based on Battery:

- Lithium-ion batteries

- Solid-state batteries

- Lead-acid batteries

- Nickel-metal hydride (NiMH) batteries

- Others

Based on Construction:

- New construction

- Expansion

- Renovation

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for a 31.8% share of the global EV Batteries Plant Construction market in 2024. The region is witnessing significant activity due to the U.S. Inflation Reduction Act, which encourages local battery production through tax incentives and grants. Major automakers and battery manufacturers have announced multiple gigafactory projects in the U.S. and Canada to align with sourcing requirements for EV subsidies. Companies such as Tesla, General Motors, Ford, and LG Energy Solution are heavily investing in large-scale plants, particularly in Michigan, Tennessee, Ohio, and Ontario. It also reflects efforts to reduce dependence on Asian imports and secure domestic supply chains for lithium-ion and solid-state batteries. The U.S. Department of Energy has allocated funding to support energy storage infrastructure and advanced manufacturing hubs. This policy alignment creates a stable environment for construction firms and equipment providers operating across the battery manufacturing ecosystem.

Europe

Europe held a 28.6% share of the EV Batteries Plant Construction market in 2024, backed by strong regulatory support and climate goals. The European Union is aggressively promoting domestic battery production through the European Battery Alliance and other funding mechanisms. Countries such as Germany, France, Sweden, and Hungary are leading in gigafactory development, supported by both public-private investments and green industrial strategies. The demand is driven by automakers transitioning to EV-only production lines and seeking regional battery supply to avoid cross-border trade complexities. Europe is also advancing in solid-state battery technologies, creating demand for new construction formats tailored to high-density chemistries. The push for circular battery economies—focusing on recycling and sustainable input materials—also influences how battery plants are being designed and constructed. Local authorities prioritize environmental certifications and energy-efficient practices, further shaping construction standards across the region.

Asia-Pacific

Asia-Pacific captured a 34.2% share, maintaining the lead in the EV Batteries Plant Construction market. China continues to dominate global battery production and remains a key driver of new plant construction. The country supports national champions such as CATL, BYD, and CALB with favorable policies, large-scale industrial parks, and integrated supply chains. South Korea and Japan also contribute significantly, with companies like Samsung SDI, LG Energy Solution, and Panasonic investing in plant upgrades and overseas expansions. India is emerging with growing domestic demand and government incentives under the PLI (Production Linked Incentive) scheme. It enables construction of local cell manufacturing hubs to meet internal EV goals. Asia-Pacific benefits from an established supplier ecosystem, cost-effective skilled labor, and access to critical battery materials, making it an ideal location for both greenfield and expansion projects. Regional players are advancing in automation and integrating AI into plant design, which further enhances output capacity and operational flexibility.

Latin America

Latin America accounted for a 3.2% share of the global EV Batteries Plant Construction market in 2024. The region is still in the early stages of battery plant development but holds significant potential due to its vast reserves of lithium and other battery minerals. Countries like Chile, Argentina, and Brazil are attracting foreign investments aimed at upstream processing and local cell production. While current construction activity is limited compared to other regions, plans are underway to build vertically integrated facilities that connect raw material extraction with battery manufacturing. This strategy aims to create added value within the region and reduce export dependency on unprocessed materials. Governments are introducing incentives to stimulate industrial development, infrastructure upgrades, and renewable energy integration—all of which support battery plant feasibility. Latin America is well-positioned to grow its share with rising EV adoption and international interest in securing diversified mineral sources.

Middle East & Africa

Middle East & Africa held a 2.2% market share in 2024, representing a nascent but promising landscape for battery plant construction. The region is exploring opportunities to position itself as a downstream hub by leveraging solar power abundance and emerging free trade zones. Countries such as the UAE, Saudi Arabia, Morocco, and South Africa are laying the groundwork for battery ecosystem development, including material processing and assembly units. Africa’s lithium and cobalt resources have caught the attention of global stakeholders aiming to localize production closer to extraction points. Pilot projects and joint ventures are under discussion to establish modular battery production lines in select zones. Although construction volumes remain low, growing EV policies, green energy targets, and trade partnerships with Europe and Asia create favorable long-term prospects. Infrastructure limitations and policy alignment still pose challenges, but with strategic investment, the region could see stronger market entry over the next decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bechtel

- Turner

- Barton Malow

- Fluor

- AECOM

- Yates

- Clayco

- Jacobs

- Walbridge

- Gray

Competitive Analysis

Leading players in the EV Batteries Plant Construction market include Bechtel, Turner, Barton Malow, Fluor, AECOM, Yates, Clayco, Jacobs, Walbridge, and Gray. These companies compete by offering specialized construction solutions tailored to the unique demands of battery manufacturing. Their strategies focus on fast-track project delivery, advanced cleanroom integration, and modular plant designs. Several firms have built strong partnerships with automakers and battery producers to deliver large-scale gigafactories across North America, Europe, and Asia-Pacific. Firms with global engineering capacity and a track record in industrial construction maintain a competitive edge. They leverage digital twin technologies, AI-enabled project management tools, and integrated EPC services to reduce cost and time overruns. Players with experience in energy and manufacturing sectors are adapting to battery-specific requirements such as dry room installation, safety protocols, and high-density power distribution. Regional offices and local workforce networks enhance speed of mobilization and compliance with environmental and labor standards. The market rewards firms that can offer turnkey solutions with high technical accuracy, scalability, and sustainability alignment. Competitive dynamics will continue to intensify as new entrants seek to capture opportunities driven by EV demand and regional localization goals. Existing leaders focus on innovation, safety, and execution quality to retain market position.

Recent Developments

- In June 2025, AESC halted construction on its South Carolina EV battery plant, citing policy and market uncertainty.

- In May 2023, Jacobs secured a contract for an EV battery plant expansion, targeting advanced manufacturing projects

- In 2023, Panasonic Energy selected a Turner–Yates joint venture to construct its EV battery manufacturing facility in De Soto, Kansas.

Report Coverage

The research report offers an in-depth analysis based on Component, Battery, Construction and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising EV adoption and government-backed localization targets.

- Companies will prioritize regional manufacturing to meet trade compliance and reduce supply risks.

- Solid-state battery plant construction will accelerate due to new vehicle platform launches.

- Automation and AI-based process control will become standard features in new facilities.

- Public-private partnerships will increase to support infrastructure development and workforce training.

- New gigafactories will be designed for multi-chemistry flexibility and modular expansions.

- Countries with critical minerals will attract vertically integrated construction projects.

- ESG goals will influence plant design, favoring low-emission and energy-efficient operations.

- Equipment providers will offer customized, turnkey construction solutions for fast-track deployment.

- Market competition will intensify among global construction firms with battery-sector specialization.