Market overview

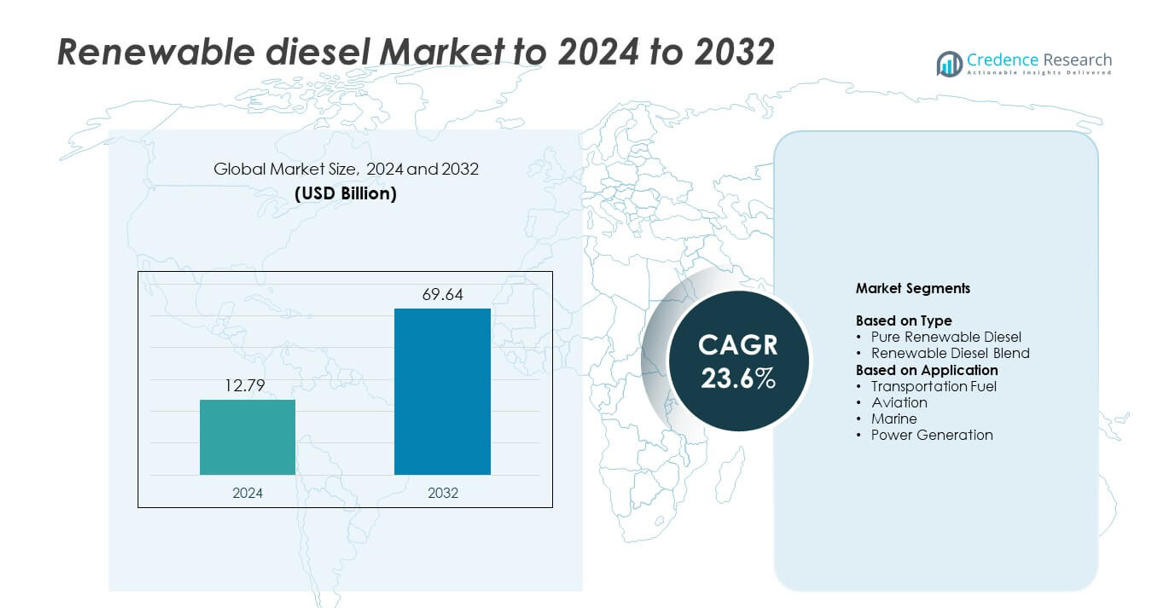

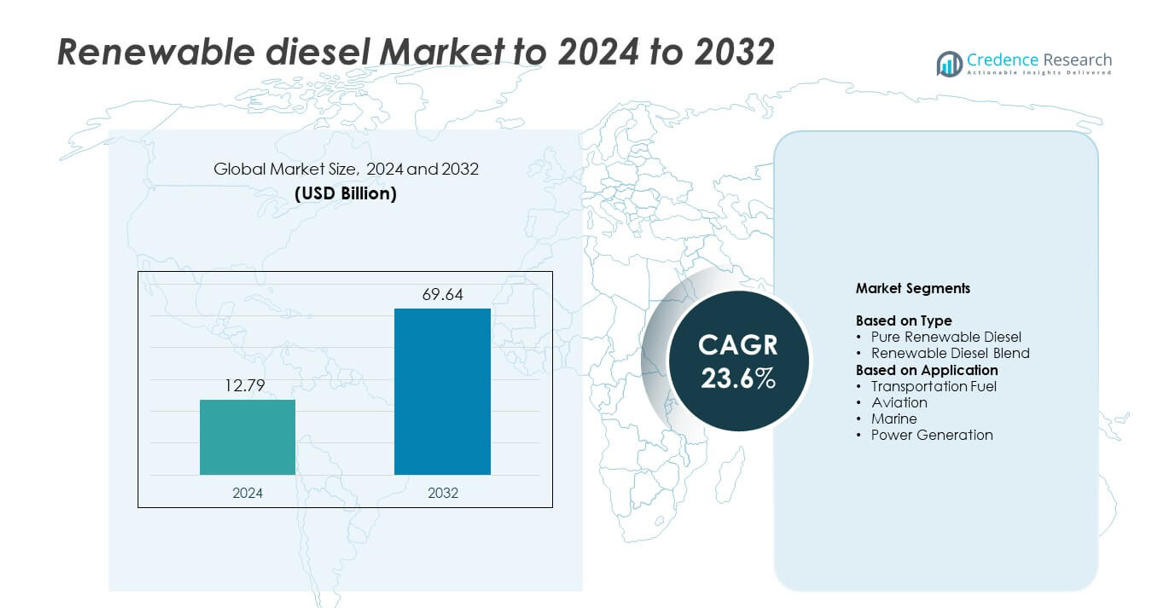

The renewable diesel market size was valued at USD 12.79 billion in 2024 and is anticipated to reach USD 69.64 billion by 2032, growing at a CAGR of 23.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Renewable Diesel Market Size 2024 |

USD 12.79 billion |

| Renewable Diesel Market, CAGR |

23.6% |

| Renewable Diesel Market Size 2032 |

USD 69.64 billion |

The renewable diesel market is led by key players such as Neste Oyj, Marathon Petroleum Corporation, TotalEnergies SE, Eni S.p.A., Valero + Diamond Green Diesel JV, Repsol, Diamond Green Diesel (DGD), and Vegas Renewable Diesel. These companies dominate through large-scale refinery conversions, advanced hydrotreatment technologies, and strong supply chain integration. Strategic investments in sustainable feedstocks and capacity expansion projects further strengthen their market presence. Regionally, North America emerged as the leading market with a 39% share in 2024, driven by supportive clean fuel standards and growing renewable fuel adoption in transportation and aviation sectors

.Market Insights

- The renewable diesel market was valued at USD 12.79 billion in 2024 and is projected to reach USD 69.64 billion by 2032, growing at a CAGR of 23.6%.

- Growth is fueled by rising demand for low-carbon fuels, government mandates promoting clean energy, and expanding availability of renewable feedstocks such as used cooking oil and animal fats.

- The market is witnessing trends like refinery conversions, increased use of hydrogenation technologies, and adoption in aviation and marine sectors for decarbonization.

- Competitive intensity is high, with major energy companies investing in large-scale renewable fuel plants, improving refining efficiency, and securing long-term feedstock supply chains.

- North America led with a 39% share in 2024, followed by Europe with 32% and Asia-Pacific with 21%, while pure renewable diesel held the dominant 63% segment share due to its superior performance and compatibility with existing diesel infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Pure renewable diesel dominated the market with a 63% share in 2024, driven by its compatibility with existing diesel engines and superior performance compared to biodiesel. The segment benefits from higher energy density, lower carbon emissions, and full substitution capability for petroleum diesel without blending. Increasing adoption in fleet operations and logistics industries supports growth. Governments promoting low-carbon fuel standards in the U.S. and Europe further accelerate demand, while advancements in hydrotreatment processes enhance production efficiency and fuel quality for large-scale commercial use.

- For instance, Neste Oyj operates renewable products refineries across three continents and, following the completion of the Rotterdam expansion in 2027, will increase its annual nameplate capacity for renewable products from the current approximately 5.5 million tons to 6.8 million tons.

By Application

Transportation fuel accounted for the leading 58% market share in 2024, supported by the growing shift toward cleaner mobility solutions. Renewable diesel’s drop-in capability allows seamless integration into existing fuel infrastructure, making it suitable for heavy-duty trucks, buses, and public transport fleets. Expanding government incentives for low-emission vehicles and corporate sustainability commitments drive demand. The aviation segment is also gaining momentum due to rising adoption of sustainable aviation fuels, encouraged by international emissions reduction targets and airline decarbonization initiatives.

- For instance, Marathon Petroleum Corporation operates the Martinez Renewables facility in California, a 50/50 joint venture with Neste. The facility has a total nameplate capacity of approximately 730 million gallons per year, with the output split between the two partners.

Key Growth Drivers

Rising Adoption of Low-Carbon Fuels

Global efforts to reduce greenhouse gas emissions are boosting renewable diesel adoption across transportation and logistics. Governments in North America and Europe are implementing carbon reduction targets and clean fuel programs that favor renewable diesel over conventional fuels. Its compatibility with existing diesel engines enables immediate decarbonization without infrastructure changes. This policy-driven shift positions renewable diesel as a leading alternative in meeting sustainability goals and energy transition mandates.

- For instance, TotalEnergies SE completed the conversion of its La Mède refinery in 2019, turning it into France’s first biorefinery with a production capacity of 500,000 metric tons of biofuels per year.

Expansion of Renewable Feedstock Availability

The growing availability of sustainable feedstocks such as used cooking oil, animal fats, and vegetable oils is driving renewable diesel production. Companies are investing in advanced refining technologies to optimize feedstock conversion efficiency. Agricultural diversification and waste collection networks are strengthening global supply chains. The increased feedstock supply ensures consistent production and supports large-scale commercialization, improving market stability and reducing dependence on fossil-derived sources.

- For instance, Enilive (an Eni company) operates the Gela biorefinery, which processes approximately 736,000 metric tons of biomass per year, with over 85% of its feedstock being waste and residues such as used cooking oil, animal fats, and agri-industry by-products

Strategic Investments and Capacity Expansion

Oil refiners and biofuel producers are expanding renewable diesel capacity to meet rising demand. Major energy companies are converting traditional refineries into renewable fuel facilities, leveraging existing infrastructure for cost efficiency. Partnerships between governments and private firms support large-scale projects in the U.S., Europe, and Asia. These investments strengthen supply capabilities and enhance technological innovation, accelerating renewable diesel’s penetration in commercial transport and aviation sectors.

Key Trends & Opportunities

Integration with Aviation and Marine Sectors

The aviation and marine industries are emerging as new growth areas for renewable diesel. Airlines and shipping companies are testing renewable fuels to comply with global emission standards. Blending mandates and carbon offset programs are promoting adoption, while technology advancements allow compatibility with existing engines. The shift toward sustainable aviation fuel (SAF) and renewable marine diesel presents significant opportunities for producers to diversify their customer base.

- For instance, Chevron Renewable Energy Group is an active supplier of sustainable aviation fuel (SAF) and renewable diesel, supporting commercial aviation’s decarbonization goals, while BP (which integrated its aviation division Air bp in 2023) distributes SAF capable of reducing lifecycle emissions by up to 80% through its supply chain and partnerships

Development of Advanced Hydrogenation Technologies

Hydrotreatment and co-processing innovations are improving renewable diesel yield and quality. Refineries are integrating hydrogen-based refining processes that enhance efficiency and reduce byproduct waste. These advancements enable the use of diverse feedstocks and improve scalability, helping producers achieve cost competitiveness. Continuous R&D in catalyst optimization and process automation offers long-term opportunities for refining flexibility and higher returns on renewable fuel production.

- For instance, Phillips 66 deployed next-generation hydrogenation at its Rodeo facility, achieving a renewable diesel output capacity of 800 million gallons per year, improving process yield through optimized catalyst systems.

Key Challenges

Feedstock Supply Constraints

Limited and uneven availability of sustainable feedstocks remains a key challenge for market growth. The competition between renewable diesel and biodiesel producers for used cooking oil and animal fats increases procurement costs. Seasonal variations in agricultural supply also impact raw material consistency. To overcome this issue, producers are focusing on developing non-food-based feedstocks and waste-derived alternatives to maintain stable production and pricing structures.

High Production and Conversion Costs

The renewable diesel market faces cost challenges due to high capital investment and complex refining processes. Hydrogenation and upgrading technologies require significant energy inputs, raising operational expenses. Smaller producers often struggle to achieve economies of scale, limiting market entry. Ongoing research in process optimization and government funding for biofuel projects aim to reduce costs, but achieving long-term price parity with petroleum diesel remains a major barrier.

Regional Analysis

North America

North America dominated the renewable diesel market with a 39% share in 2024, supported by strong policy frameworks such as the U.S. Renewable Fuel Standard and California’s Low Carbon Fuel Standard. The region benefits from major production facilities in the U.S. and Canada, driven by investments from energy companies converting refineries to renewable operations. Growing adoption of renewable fuels in transportation fleets and aviation further boosts demand. Continuous support through tax incentives, carbon credits, and government-backed biofuel programs enhances the regional supply chain and accelerates large-scale commercial deployment.

Europe

Europe held a 32% market share in 2024, driven by stringent emission regulations and renewable energy directives promoting bio-based fuels. Countries such as Finland, Sweden, and the Netherlands lead production through advanced hydrotreatment technologies. The European Union’s Fit for 55 initiative and carbon neutrality goals encourage the replacement of fossil-based diesel with renewable alternatives. Demand is strong in the transport and aviation sectors as companies seek to meet sustainability targets. Ongoing R&D efforts and cross-border partnerships continue to strengthen regional capacity and feedstock diversification.

Asia-Pacific

Asia-Pacific accounted for 21% of the renewable diesel market in 2024, fueled by rising energy demand and growing investments in sustainable fuels across China, Japan, and Singapore. Governments are introducing mandates to reduce dependency on imported petroleum and promote renewable fuel blending. Major refineries in Southeast Asia are expanding renewable diesel capacity using palm oil, algae, and waste-based feedstocks. The region’s rapid industrialization and increasing commercial transport activities create strong consumption potential. Continuous technological collaborations and policy incentives are expected to enhance regional production capabilities in the coming years.

Latin America

Latin America captured a 5% market share in 2024, supported by abundant agricultural resources and emerging biofuel policies. Brazil and Argentina are leading producers due to their established biodiesel industries and access to feedstocks like soybean oil. Government initiatives promoting renewable energy and carbon reduction drive regional investment. However, limited refining infrastructure and inconsistent policy enforcement slow widespread adoption. Ongoing collaborations between domestic and international energy companies are helping to expand renewable diesel production and improve export opportunities to North American and European markets.

Middle East & Africa

The Middle East & Africa held a 3% market share in 2024, with growth emerging from renewable energy diversification strategies. Countries such as the UAE and South Africa are investing in bio-refineries to reduce reliance on fossil fuels. Government-driven sustainability programs and partnerships with global energy firms are fostering pilot-scale renewable diesel projects. Limited feedstock availability and high production costs currently restrain growth, but ongoing research into non-edible and waste-based feedstocks is expected to enhance regional competitiveness and long-term potential in the renewable fuel sector.

Market Segmentations:

By Type

- Pure Renewable Diesel

- Renewable Diesel Blend

By Application

- Transportation Fuel

- Aviation

- Marine

- Power Generation

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The renewable diesel market is led by major players including Neste Oyj, Marathon Petroleum Corporation, TotalEnergies SE, Eni S.p.A., Valero + Diamond Green Diesel JV, Repsol, Diamond Green Diesel (DGD), and Vegas Renewable Diesel. The competitive landscape is defined by large-scale refinery conversions, feedstock optimization, and technological innovation in hydrogenation and co-processing. Companies are focusing on expanding renewable fuel capacity through joint ventures, acquisitions, and strategic partnerships to meet global demand. Increasing government incentives for low-carbon fuels and growing adoption in transportation and aviation sectors are driving competition. Participants are also investing heavily in waste-derived and non-edible feedstocks to secure sustainable raw material supply. Integration of digital monitoring, process automation, and energy-efficient refining systems enhances production efficiency and emission performance. The market shows consolidation trends as global energy firms strengthen vertical integration, ensuring control over feedstock sourcing, refining operations, and downstream distribution in the renewable energy value chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Neste Oyj

- Maratho

- TotalEnergies SE

- n Petroleum Corporation

- TotalEnergies SE

- Eni S.p.A.

- Valero + Diamond Green Diesel JV

- Repsol

- Diamond Green Diesel (DGD)

- Vegas Renewable Diesel

Recent Developments

- In 2024, Diamond Green Diesel (DGD), a joint venture that includes Valero and Darling Ingredients, began supplying sustainable aviation fuel (SAF) to Florida.

- In 2024, Repsol Spanish-based energy company launched its Nexa 100% Renewable Diesel at service stations.

- In 2024, Neste partnered with Colonial Oil to enhance the availability of renewable diesel in the southeastern U.S. through distribution in Savannah, Georgia.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Renewable diesel demand will continue to rise with global emission reduction commitments.

- Governments will expand policy incentives and blending mandates to support clean fuel adoption.

- Advancements in hydrotreatment and co-processing will improve production efficiency.

- Feedstock diversification using waste oils and non-edible crops will strengthen supply stability.

- Aviation and marine industries will increasingly adopt renewable diesel for decarbonization goals.

- Oil refineries will accelerate conversion to renewable fuel production facilities.

- Strategic partnerships will drive large-scale capacity expansion across major regions.

- Technology integration will lower production costs and enhance fuel quality.

- Asia-Pacific will emerge as a key growth hub with new refinery investments.

- Renewable diesel will play a central role in achieving global net-zero energy transition targets.