Market Overview

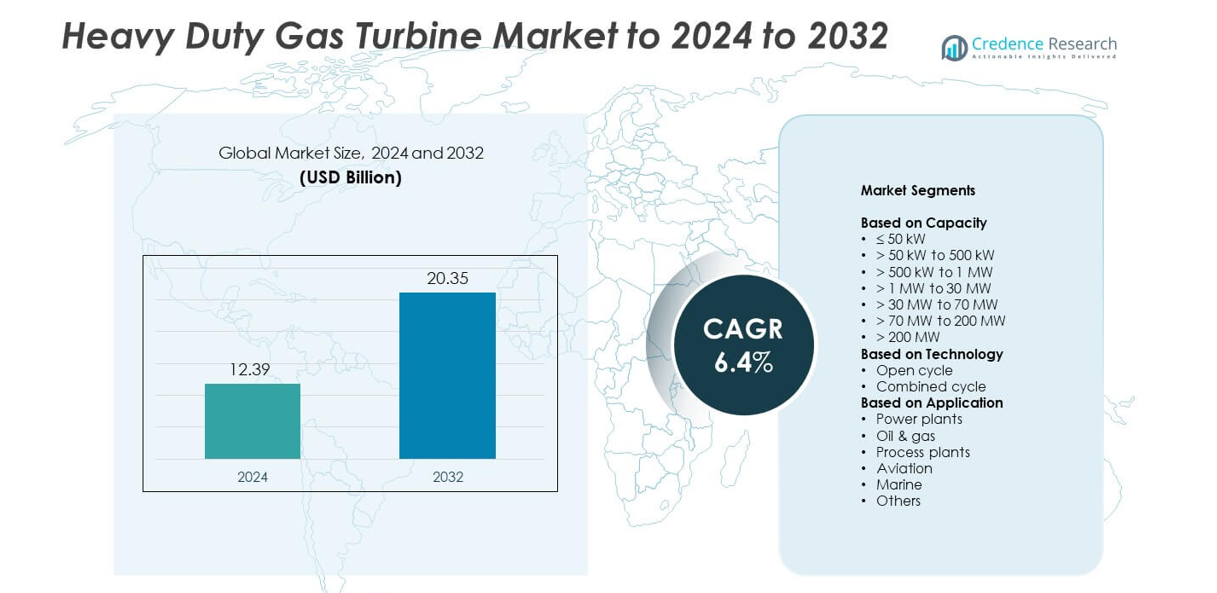

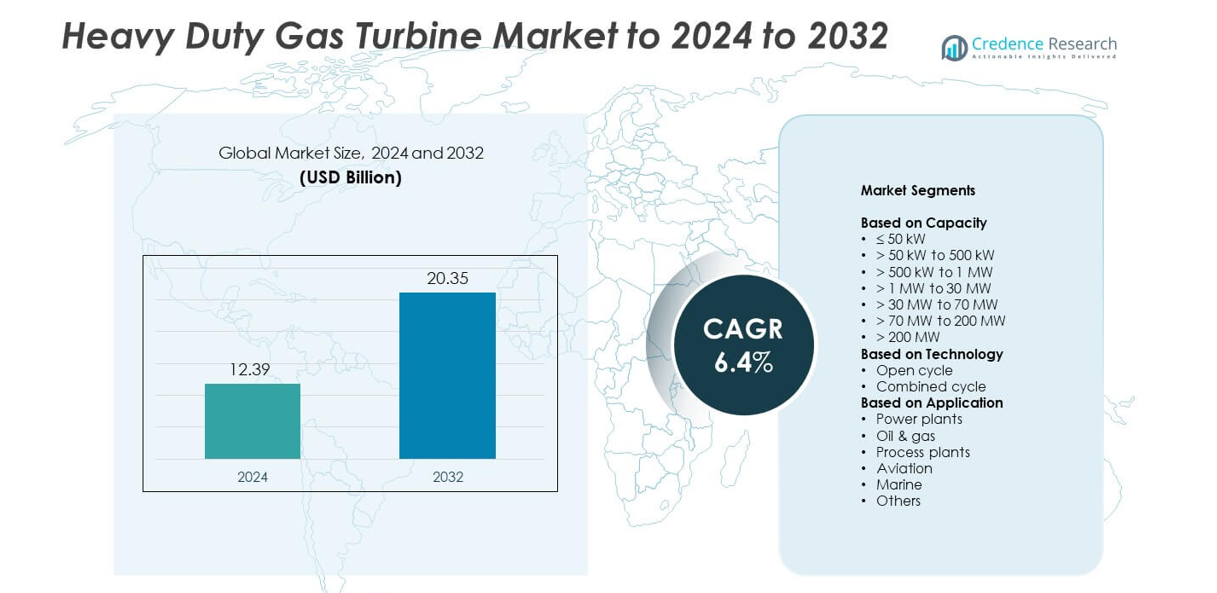

The Heavy Duty Gas Turbine Market size was valued at USD 12.39 billion in 2024 and is anticipated to reach USD 20.35 billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heavy Duty Gas Turbine Market Size 2024 |

USD 12.39 billion |

| Heavy Duty Gas Turbine Market, CAGR |

6.4% |

| Heavy Duty Gas Turbine Market Size 2032 |

USD 20.35 billion |

The heavy-duty gas turbine market is characterized by strong competition among leading players such as GE Vernova, Siemens Energy, Mitsubishi Heavy Industries, Rolls Royce, Baker Hughes, Wartsila, and MAN Energy Solutions. These companies focus on enhancing turbine efficiency, developing hydrogen-compatible systems, and integrating digital monitoring technologies to meet global decarbonization goals. Strategic collaborations and R&D investments are enabling advancements in combined-cycle and hybrid turbine models. Regionally, North America led the global market with a 34% share in 2024, supported by large-scale power plant modernization and increasing demand for flexible, low-emission energy generation solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The heavy-duty gas turbine market was valued at USD 12.39 billion in 2024 and is projected to reach USD 20.35 billion by 2032, growing at a CAGR of 6.4%.

- Rising electricity demand, modernization of power infrastructure, and the global shift toward cleaner energy sources are driving market growth.

- The market is witnessing trends such as integration of hydrogen fuel, digital turbine monitoring, and increased adoption of combined-cycle systems for higher efficiency.

- Competition remains intense, with leading manufacturers focusing on R&D, hybrid system development, and efficiency improvements to strengthen market presence.

- North America led with 34% share in 2024, followed by Asia Pacific at 29% and Europe at 27%, while the >200 MW capacity segment dominated with 41% share due to large-scale power plant installations.

Market Segmentation Analysis:

By Capacity

The >200 MW segment dominated the heavy-duty gas turbine market with around 41% share in 2024. This dominance is attributed to growing demand for large-scale combined-cycle power plants and grid stability projects. Utilities and independent power producers prefer high-capacity turbines for improved thermal efficiency and reduced operating costs. These turbines are widely used in baseload and peak load applications due to their reliability and fuel flexibility. Increasing energy demand in industrial and urban regions further boosts installations of high-capacity gas turbines globally.

- For instance, Mitsubishi Power’s M501JAC gas turbine, an advanced air-cooled version of the J-series, delivers a simple-cycle output of 453 MW at a 60 Hz frequency and a combined-cycle output of 664 MW in a one-on-one configuration.

By Technology

The combined cycle segment held the largest share of about 67% in 2024, driven by its superior efficiency and lower carbon emissions. Combined cycle systems utilize waste heat from the gas turbine to produce additional electricity through steam turbines, improving overall plant performance. The segment benefits from the transition toward cleaner energy sources and reduced reliance on coal-based power. Government incentives promoting low-emission technologies and grid modernization projects continue to support strong growth in combined cycle turbine adoption across major regions.

- For instance, Siemens Energy’s SGT5-9000HL at Keadby 2 hit 64.18% combined-cycle efficiency and 849.45 MW.

By Application

Power plants accounted for the leading market share of nearly 63% in 2024, fueled by increasing global electricity demand and replacement of aging coal plants. Heavy-duty gas turbines serve as core components for combined-cycle and open-cycle power generation, offering high operational efficiency and faster startup times. Investments in grid expansion, renewable integration, and distributed generation have further accelerated demand. In addition, advancements in turbine materials and digital control systems have enhanced reliability, making gas turbines a preferred choice for modern power infrastructure.

Key Growth Drivers

Rising Global Electricity Demand

Growing electricity consumption across industrial and residential sectors is a major driver of the heavy-duty gas turbine market. Governments are expanding power infrastructure to meet the surging demand for reliable and cleaner energy. Gas turbines offer quick startup, flexible load handling, and higher efficiency compared to coal-based plants. Rapid urbanization and industrialization in emerging economies such as India and China further accelerate new capacity additions, strengthening the demand for high-output gas turbines.

- For instance, Doosan Enerbility’s DGT6-300H.S2 offers 380 MW simple-cycle and >63% combined-cycle efficiency. Ramp rate reaches 50 MW/min.

Shift Toward Cleaner Energy Sources

The ongoing global transition toward low-carbon power generation fuels demand for gas turbines as a cleaner alternative. Many countries are phasing out coal plants to meet emission reduction targets under the Paris Agreement. Gas turbines, especially combined-cycle variants, emit significantly lower CO₂ and offer better operational efficiency. Utilities are investing in these systems to balance renewable energy variability, making them an essential component in hybrid and flexible power generation networks.

- For instance, Ansaldo Energia’s GT36 is qualified to co-fire 50% hydrogen and supports ~800 MW CCGT projects.

Technological Advancements in Turbine Efficiency

Continuous advancements in turbine design, materials, and digital monitoring have improved efficiency and durability. Modern turbines now operate at higher firing temperatures and use advanced cooling systems to boost output. Integration of predictive maintenance and AI-based diagnostics minimizes downtime and extends operational life. Manufacturers are also developing hydrogen-compatible models, supporting decarbonization goals. These innovations are enhancing performance, lowering lifecycle costs, and creating new opportunities for modernization projects worldwide.

Key Trends & Opportunities

Integration of Hydrogen and Hybrid Systems

Growing emphasis on decarbonization is driving the integration of hydrogen-fueled and hybrid gas turbine systems. Turbine manufacturers are developing flexible units capable of running on natural gas-hydrogen blends, aligning with future zero-emission goals. Governments and utilities are funding pilot projects to accelerate hydrogen infrastructure development. This transition presents major opportunities for next-generation turbines optimized for cleaner fuel compatibility and long-term sustainability.

- For instance, Baker Hughes’ NovaLT12 can burn up to 30% hydrogen today, with programs toward 100%.

Expansion of Distributed and Decentralized Power Generation

The rise of distributed generation systems is creating new opportunities for smaller capacity heavy-duty turbines. These units support industrial facilities, data centers, and remote areas requiring stable on-site power. Their quick installation, modular design, and ability to integrate with renewable systems make them attractive for flexible energy solutions. Increasing focus on grid resilience and localized generation further enhances market potential for medium-capacity turbines.

- For instance, Solar Turbines’ Titan 130 package provides 16,530 kWe, suiting modular, distributed power deployments.

Key Challenges

High Initial Investment and Maintenance Costs

Heavy-duty gas turbines involve significant upfront capital costs and complex installation requirements. Maintenance expenses remain high due to advanced materials, precision components, and specialized servicing needs. Many small utilities and independent producers hesitate to adopt them without strong government incentives. The high cost barrier limits penetration in developing regions despite long-term efficiency benefits, slowing overall market adoption.

Volatility in Natural Gas Supply and Prices

Fluctuating natural gas prices and supply chain disruptions pose major challenges for turbine operators. Price instability directly impacts operating costs and long-term project viability. Political tensions and uneven gas infrastructure availability across regions add further risk. These uncertainties often delay investments in new gas-based power projects, particularly in markets dependent on imported fuels, affecting overall growth momentum.

Regional Analysis

North America

North America held the largest share of around 34% in the heavy-duty gas turbine market in 2024. The growth is driven by increasing investments in combined-cycle power plants and the replacement of aging coal-fired facilities. The United States leads regional demand due to strong natural gas availability and government support for low-emission technologies. Technological advancements in high-efficiency turbines and digital monitoring systems are further enhancing market expansion. Canada also contributes steadily, supported by industrial power generation projects and cross-border grid integration initiatives promoting clean and reliable energy generation.

Europe

Europe accounted for nearly 27% of the global heavy-duty gas turbine market in 2024, led by ongoing decarbonization initiatives and gas-based power transitions. The United Kingdom, Germany, and France are advancing combined-cycle and hydrogen-ready turbine installations to meet emission targets. The European Green Deal and growing renewable integration are fueling modernization of gas turbine fleets. Industrial facilities across Western and Northern Europe continue adopting gas turbines for backup and cogeneration applications. Increasing replacement of coal plants and expansion of flexible gas infrastructure support sustained regional market demand.

Asia Pacific

Asia Pacific captured about 29% share of the global heavy-duty gas turbine market in 2024, driven by rapid industrialization and growing electricity demand. China, India, and Japan remain key contributors due to large-scale infrastructure projects and gas-fired plant development. The region’s transition toward cleaner energy sources and grid reliability improvement supports strong turbine deployment. Government initiatives promoting LNG imports and hybrid power systems further boost the market. Expanding industrial power generation and urban development programs across Southeast Asia add momentum to regional market growth.

Middle East & Africa

The Middle East & Africa region held nearly 6% share in the heavy-duty gas turbine market in 2024. Abundant natural gas reserves in Saudi Arabia, the UAE, and Qatar continue to drive turbine installation for power and desalination plants. Ongoing energy diversification programs are encouraging adoption of advanced turbines for cleaner generation. In Africa, increasing electrification efforts and industrial growth are gradually expanding gas-based power generation. Rising investment in combined-cycle projects across the GCC supports regional market stability and long-term development potential.

Latin America

Latin America accounted for around 4% share of the global heavy-duty gas turbine market in 2024. Brazil and Mexico are leading the region’s growth with growing investments in gas-based thermal plants and energy diversification. Increasing demand for efficient power generation in urban and industrial sectors supports market expansion. Policy reforms promoting private energy investment are further accelerating adoption. Combined-cycle installations are gaining traction, driven by government initiatives to enhance grid reliability and reduce carbon emissions. Rising natural gas infrastructure development underpins long-term growth prospects across the region.

Market Segmentations:

By Capacity

- ≤ 50 kW

- > 50 kW to 500 kW

- > 500 kW to 1 MW

- > 1 MW to 30 MW

- > 30 MW to 70 MW

- > 70 MW to 200 MW

- > 200 MW

By Technology

- Open cycle

- Combined cycle

By Application

- Power plants

- Oil & gas

- Process plants

- Aviation

- Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The heavy-duty gas turbine market features a highly competitive landscape, with leading players such as GE Vernova, Siemens Energy, Mitsubishi Heavy Industries, Rolls Royce, Baker Hughes, Wartsila, MAN Energy Solutions, Doosan, Bharat Heavy Electricals, Harbin Electric, Kawasaki Heavy Industries, Solar Turbines, Ansaldo Energia, Capstone Green Energy, Vericor, Flex Energy Solutions, Nanjing Turbine and Electric Machinery, and Destinus Energy competing for global dominance. Competition is driven by technological innovation, efficiency optimization, and lower lifecycle costs. Companies are focusing on developing hydrogen-compatible and hybrid turbine systems to meet stricter emission regulations. Strategic partnerships, R&D investments, and digital integration are strengthening service portfolios and performance reliability. Expansion into emerging markets with strong energy demand further enhances growth opportunities. Manufacturers are prioritizing advanced materials, automation, and predictive analytics to improve output and durability. The ongoing transition toward decarbonization and grid modernization continues to shape competitive strategies and long-term positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Vernova

- Siemens Energy

- Mitsubishi Heavy Industries

- Rolls Royce

- Baker Hughes

- Wartsila

- MAN Energy Solutions

- Doosan

- Bharat Heavy Electricals

- Harbin Electric

- Kawasaki Heavy Industries

- Solar Turbines

- Ansaldo Energia

- Capstone Green Energy

- Vericor

- Flex Energy Solutions

- Nanjing Turbine and Electric Machinery

- Destinus Energy

Recent Developments

- In 2023, Siemens Energy Delivered two SGT-800 gas turbines and a battery energy storage system for a combined heat and power plant in Leipzig, Germany.

- In 2023, GE’s HA-class turbines surpassed two million operating hours globally, demonstrating advancements in high-efficiency, low-emission technology.

- In 2023, Kawasaki Heavy Industries Launched the world’s first 1.8 MW class, 100% hydrogen-fueled, dry-combustion gas turbine cogeneration system.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for cleaner and efficient power generation.

- Combined-cycle gas turbines will remain the preferred technology for high-efficiency operations.

- Integration of hydrogen fuel capabilities will drive next-generation turbine designs.

- Digital monitoring and predictive maintenance will enhance operational reliability.

- Replacement of aging coal and steam plants will create strong retrofit opportunities.

- Asia Pacific will continue leading growth due to rapid industrialization and infrastructure projects.

- Utilities will invest in flexible turbines to balance renewable power fluctuations.

- Manufacturers will focus on low-emission, hybrid, and hydrogen-ready models.

- Government initiatives supporting gas-based generation will strengthen market stability.

- Strategic collaborations and R&D in turbine materials will improve performance and lifespan.