Market Overview

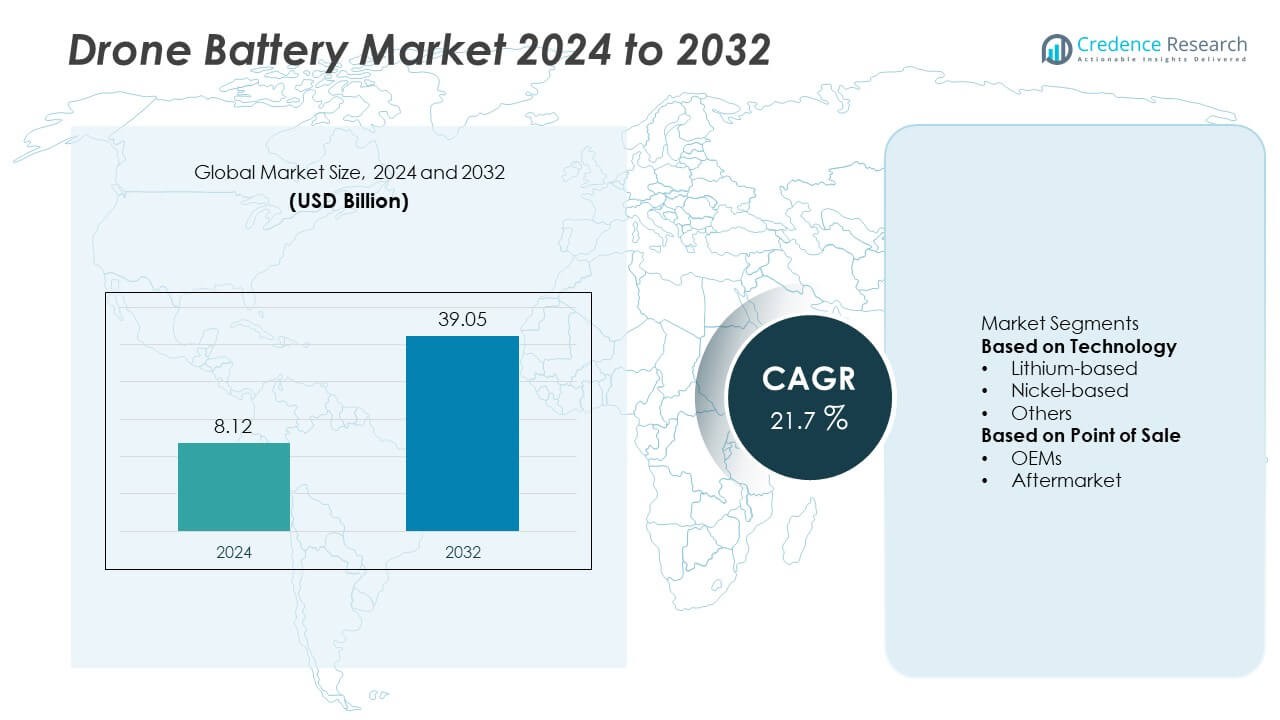

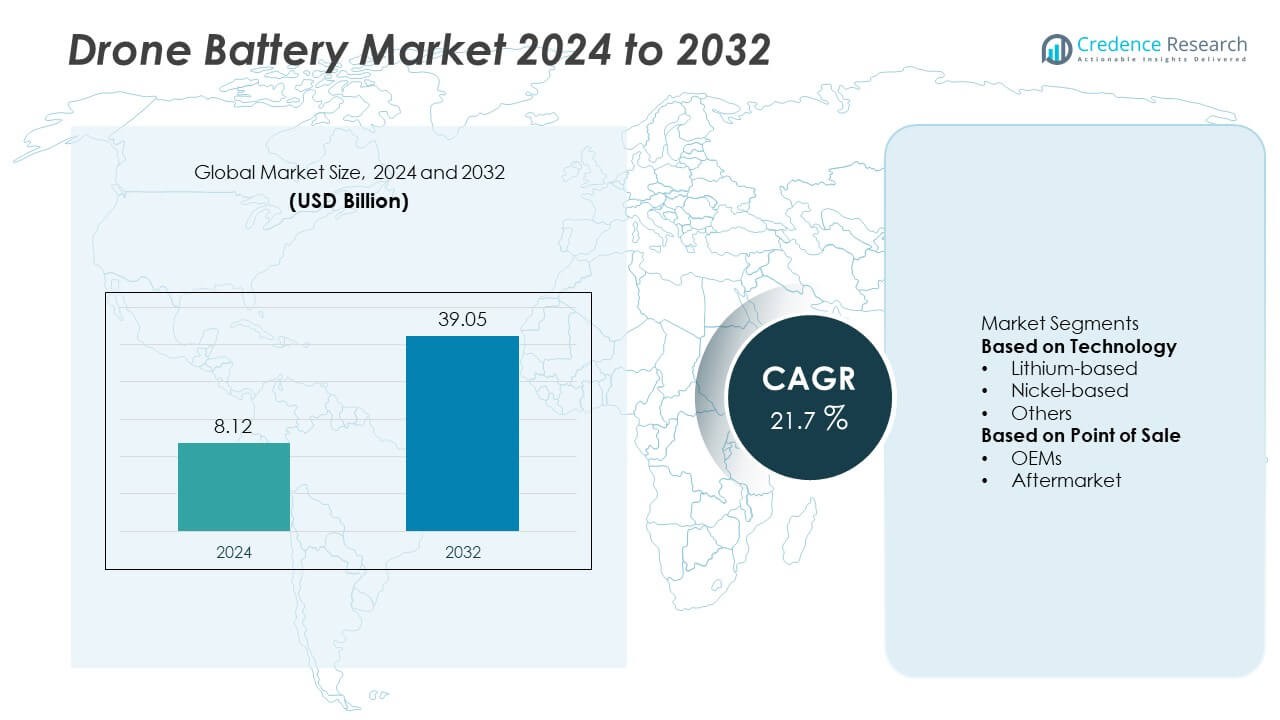

The global drone battery market was valued at USD 8.12 billion in 2024 and is projected to reach USD 39.05 billion by 2032, growing at a CAGR of 21.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Battery Market Size 2024 |

USD 8.12 Billion |

| Drone Battery Market, CAGR |

21.7% |

| Drone Battery Market Size 2032 |

USD 39.05 Billion |

The drone battery market is led by key players including SolidEnergy Systems, Intelligent Energy, Plug Power Inc, Sion Power, Doosan Mobility Innovation, Micromulticopter Aero Technology Co., Ltd., RRC Power Solutions, Oxis Energy Ltd, HES Energy Systems, and EaglePicher Technologies. These companies focus on developing lightweight, high-density, and long-endurance battery technologies to meet growing commercial and defense drone demands. Asia-Pacific emerged as the leading region with a 31% market share in 2024, driven by large-scale drone production and strong government support in China, Japan, and India. North America followed with a 33% share, supported by technological innovation and extensive adoption in logistics, surveillance, and military applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global drone battery market was valued at USD 8.12 billion in 2024 and is projected to reach USD 39.05 billion by 2032, growing at a CAGR of 21.7%.

- Growth is driven by rising demand for long-endurance drones and rapid adoption in logistics, defense, and agriculture. Lithium-based batteries dominated with a 78% share due to high energy density and lightweight design.

- Emerging trends include solid-state and hydrogen fuel cell innovations, along with swappable and fast-charging battery systems that enhance drone efficiency and flight duration.

- The market is moderately consolidated, with major players such as SolidEnergy Systems, Plug Power Inc, Intelligent Energy, and Doosan Mobility Innovation investing in advanced chemistries and sustainable manufacturing.

- Regionally, North America led with a 33% share, followed by Asia-Pacific at 31% and Europe at 27%, driven by strong drone manufacturing bases, defense investments, and regulatory support for commercial UAV applications.

Market Segmentation Analysis:

By Technology

The lithium-based segment dominated the drone battery market with a 78% share in 2024. This dominance is driven by the high energy density, lightweight design, and long discharge cycles of lithium-ion and lithium-polymer batteries. These batteries enable longer flight durations and faster charging, making them ideal for commercial and defense drone applications. Ongoing advancements in lithium-sulfur and solid-state technologies further enhance safety, performance, and energy efficiency. Manufacturers are investing in improved thermal management and higher voltage configurations to meet rising power demands in high-endurance drones.

- For instance, SolidEnergy Systems (now SES AI) did develop a lithium-metal battery achieving 450 Wh/kg, which enables extended drone flight times. The company has been providing these high-energy-density batteries for various applications, including drones.

By Point of Sale

The OEMs segment accounted for a 69% market share in 2024, leading the drone battery market. This leadership stems from large-scale integration of advanced batteries into newly manufactured drones for commercial, agricultural, and surveillance purposes. OEMs focus on custom battery solutions optimized for flight performance and weight efficiency. Rising drone production and fleet expansions by major manufacturers accelerate demand. The aftermarket segment is growing steadily as end users seek cost-effective replacements and upgraded batteries to extend drone lifespan and improve operational efficiency.

- For instance, DJI integrates 5,000 mAh high-voltage lithium-polymer batteries in its Mavic 3 series. This large capacity provides enough power to support an impressive flight time of up to 46 minutes on a single charge. The high-performance battery is a crucial component for capturing expansive aerial footage.

Key Growth Drivers

Rising Demand for Long-Endurance Drones

Growing adoption of drones in logistics, surveillance, and agriculture is increasing the need for long-endurance batteries. Lithium-ion and solid-state technologies are enabling extended flight times, improved payload capacity, and faster recharge cycles. Companies are focusing on lightweight materials and high energy density designs to enhance operational efficiency. The expansion of drone delivery networks and mapping services continues to accelerate investment in high-performance batteries with longer lifespans and improved safety features.

- For instance, Sion Power’s Licerion battery technology reached 500 Wh/kg, allowing drones to operate significantly longer than conventional lithium-ion systems used in commercial mapping and inspection applications.

Expansion of Commercial Drone Applications

Commercial drone adoption across sectors such as construction, energy, and defense is driving battery demand. Businesses require reliable, high-capacity power systems to support complex missions like infrastructure inspection and aerial mapping. Governments approving wider drone usage further support the commercial market. Battery manufacturers are partnering with drone OEMs to create customized solutions that deliver higher voltage and enhanced endurance, meeting growing operational expectations. This widespread commercial use fuels sustained growth across the global drone battery industry.

- For instance, Intelligent Energy introduced hydrogen fuel cell modules generating 2.4 kW of continuous power, enabling drones to operate for up to 3 hours on a single refuel.

Technological Advancements in Energy Storage

Continuous innovation in lithium-sulfur, solid-state, and graphene-based batteries is transforming drone performance. These new chemistries offer higher power density, lower charging time, and better temperature tolerance. Manufacturers are developing modular battery systems with smart monitoring for optimized flight safety. The integration of AI-based battery management systems enhances energy efficiency and predictive maintenance. These advances allow drones to operate in challenging environments, supporting new industrial and defense applications while significantly reducing power-related downtime.

Key Trends & Opportunities

Emergence of Swappable and Fast-Charging Batteries

The introduction of swappable battery systems is improving drone turnaround times for continuous missions. Commercial operators use these modular solutions to reduce downtime in delivery and surveillance tasks. Fast-charging technologies powered by advanced chargers and improved cooling mechanisms are further increasing operational efficiency. This trend creates opportunities for battery makers to design high-cycle, quick-recharge solutions tailored to industrial and logistics sectors.

- For instance, DJI developed its TB65 Intelligent Flight Battery with a 5880 mAh capacity, enabling rapid charging for its enterprise drones. Using a compatible battery station with a 220V power supply, two TB65 batteries can be charged from 20% to 90% in approximately 30 minutes. A full charge of two batteries under the same conditions takes around 60 minutes.

Growing Focus on Sustainable Battery Materials

Manufacturers are exploring eco-friendly materials and recycling processes to reduce the environmental impact of drone batteries. The shift toward cobalt-free lithium chemistries and bio-based electrolytes aligns with global sustainability goals. Companies investing in circular battery supply chains gain an advantage as environmental regulations tighten. This transition not only lowers production costs but also promotes long-term reliability and brand reputation in the evolving drone ecosystem.

- For instance, Panasonic Energy aims to achieve an increased volumetric energy density of 1,000 Wh/L in its lithium-ion batteries by 2031 and has developed technologies to significantly reduce the cobalt content in its nickel-based EV batteries.

Key Challenges

Safety Risks and Thermal Management Issues

Drone batteries face safety concerns such as overheating, short circuits, and potential fire hazards during high-load operations. Inadequate thermal management can reduce performance and battery lifespan. Manufacturers must incorporate advanced cooling, sensors, and protective casing to ensure flight safety. Balancing high energy density with stability remains a significant technical challenge, particularly for long-range and military-grade drones operating in extreme conditions.

High Cost and Limited Supply Chain for Advanced Materials

The production of high-capacity lithium and solid-state batteries involves expensive raw materials and complex manufacturing. Limited access to lithium, nickel, and graphene increases costs and affects scalability. Supply chain disruptions and geopolitical factors further impact battery availability and pricing. Companies are investing in local material sourcing and recycling initiatives to reduce dependency on critical imports and stabilize long-term production costs.

Regional Analysis

North America

North America held a 33% share of the drone battery market in 2024, driven by the rapid adoption of drones in defense, logistics, and agriculture. The United States leads regional growth due to strong military spending and expanding commercial drone applications. Companies such as Tesla Energy and Amprius Technologies focus on high-density lithium batteries to improve endurance and performance. Government initiatives supporting drone-based delivery and surveillance programs further boost demand. The region’s advanced R&D infrastructure and collaboration between OEMs and energy storage firms strengthen its leadership in innovation and battery optimization.

Europe

Europe accounted for a 27% share in 2024, supported by rising drone deployment for environmental monitoring, infrastructure inspection, and security operations. Countries like Germany, France, and the United Kingdom are investing heavily in renewable energy storage and electric aviation technologies. The European Union’s focus on sustainable battery manufacturing and recycling enhances regional competitiveness. Leading manufacturers are developing cobalt-free and solid-state batteries to align with the EU Battery Directive. Continuous innovation and the integration of eco-friendly technologies make Europe a key hub for advanced drone battery production and regulatory-driven growth.

Asia-Pacific

Asia-Pacific dominated with a 31% market share in 2024, led by strong manufacturing capabilities and rapid drone adoption across China, Japan, and India. China’s large-scale drone production ecosystem, supported by players such as DJI, fuels massive demand for lithium-based batteries. Government incentives for commercial drone usage in agriculture, logistics, and surveillance accelerate regional expansion. Japan’s investment in solid-state battery R&D and India’s drone policy reforms further strengthen growth. The presence of low-cost component suppliers and a skilled electronics workforce makes Asia-Pacific the key production center for drone battery technology worldwide.

Middle East & Africa

The Middle East & Africa region captured a 5% market share in 2024, driven by increasing drone applications in oilfield monitoring, border security, and smart city development. The UAE and Saudi Arabia are leading adopters, supported by strong government digitalization and defense initiatives. Investments in solar-powered charging infrastructure and high-temperature battery systems enhance operational reliability in harsh environments. African nations are exploring drones for agricultural spraying and delivery services, spurring local demand. Regional partnerships with global drone manufacturers are strengthening supply chains and improving battery availability for specialized applications.

Latin America

Latin America held a 4% share in the drone battery market in 2024, with Brazil and Mexico leading regional adoption. Expanding agricultural drone use for crop monitoring and spraying significantly drives battery demand. Governments are encouraging the use of UAVs for infrastructure inspection, mining, and disaster management. Regional suppliers focus on cost-effective lithium-ion solutions tailored for tropical climates. Growing partnerships with Asian and U.S. battery makers improve access to advanced technologies. Continued investments in industrial drone applications position Latin America as an emerging market for drone battery development and deployment.

Market Segmentations:

By Technology

- Lithium-based

- Nickel-based

- Others

By Point of Sale

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drone battery market features leading players such as SolidEnergy Systems, Intelligent Energy, Plug Power Inc, Sion Power, Doosan Mobility Innovation, Micromulticopter Aero Technology Co., Ltd., RRC Power Solutions, Oxis Energy Ltd, HES Energy Systems, and EaglePicher Technologies. These companies compete through advancements in lithium-sulfur, hydrogen fuel cell, and solid-state battery technologies. Innovation focuses on enhancing energy density, reducing weight, and improving thermal stability to extend drone flight duration and safety. Strategic partnerships between battery manufacturers and drone OEMs are rising to deliver customized power systems for industrial, defense, and logistics applications. Several firms are also investing in recycling initiatives and sustainable materials to meet global environmental standards. The market is witnessing consolidation as major players expand manufacturing capabilities and secure raw material supply chains. Continuous R&D and large-scale commercialization efforts position these companies at the forefront of the evolving drone battery ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SolidEnergy Systems

- Intelligent Energy

- Plug Power Inc

- Sion Power

- Doosan Mobility Innovation

- Micromulticopter Aero Technology Co., Ltd.

- RRC Power Solutions

- Oxis Energy Ltd

- HES Energy Systems

- EaglePicher Technologies

Recent Development

- In November 2024, DJI introduced the Power Expansion Battery 2000, a 2 kWh add-on for its Power 1000 station. This upgrade significantly enhances drone battery backup and field charging efficiency for extended outdoor or industrial drone operations.

- In June 2024, MaxAmps announced a new LiPo battery pack, the 9000XL 4S 14.8v, which is designed to provide enhanced performance and longer flight times for various UAV applications.

- In March 2024, Atomik RC launched new high-capacity LiPo batteries for hobby drones, aiming to boost performance and extend flight times

Report Coverage

The research report offers an in-depth analysis based on Technology, Point of Sale and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-capacity batteries will increase as drone flight ranges expand.

- Solid-state and lithium-sulfur batteries will replace conventional lithium-ion technologies.

- Hydrogen fuel cell systems will gain traction in long-endurance and industrial drones.

- OEM partnerships will strengthen to develop customized battery packs for diverse drone models.

- Recycling and sustainable material sourcing will become central to production strategies.

- AI-based battery management systems will enhance performance and safety monitoring.

- Miniaturized and lightweight designs will support the growth of small commercial drones.

- Government incentives and drone-friendly regulations will accelerate market adoption.

- Asia-Pacific will remain the main manufacturing hub, supported by innovation in China and Japan.

- Continuous R&D investments will drive improvements in energy density, charging speed, and thermal stability.