Market Overview

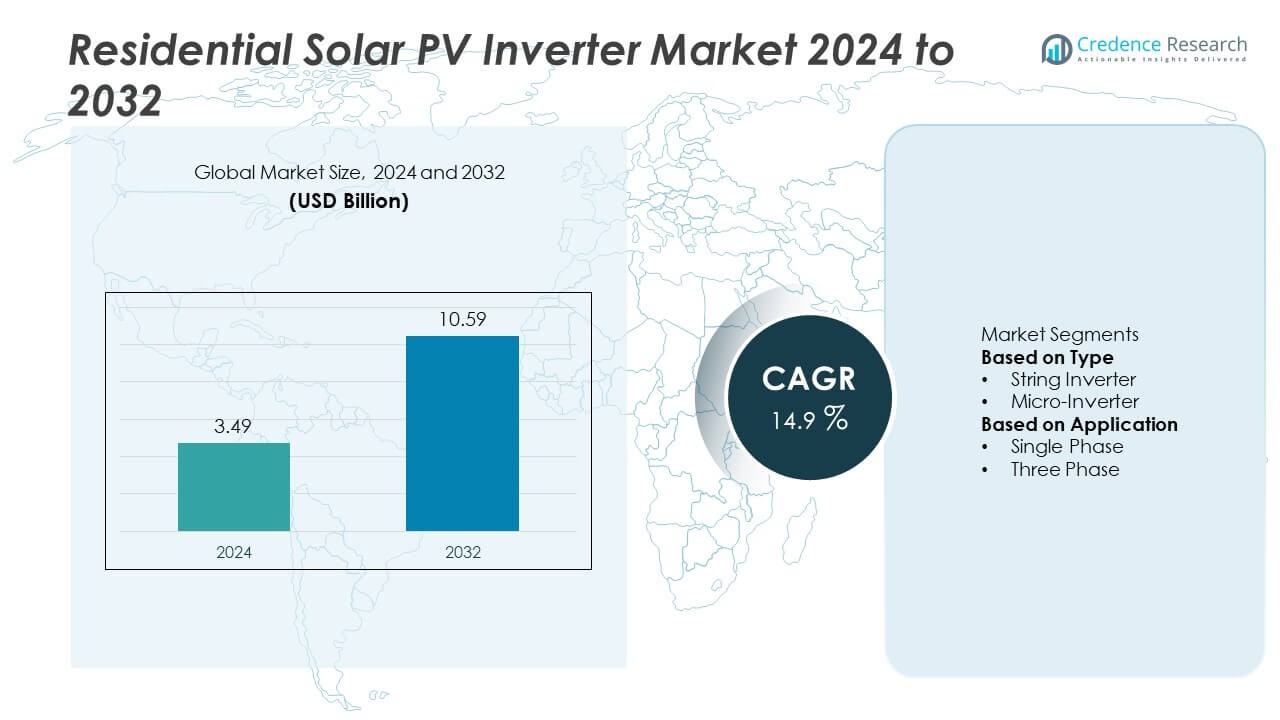

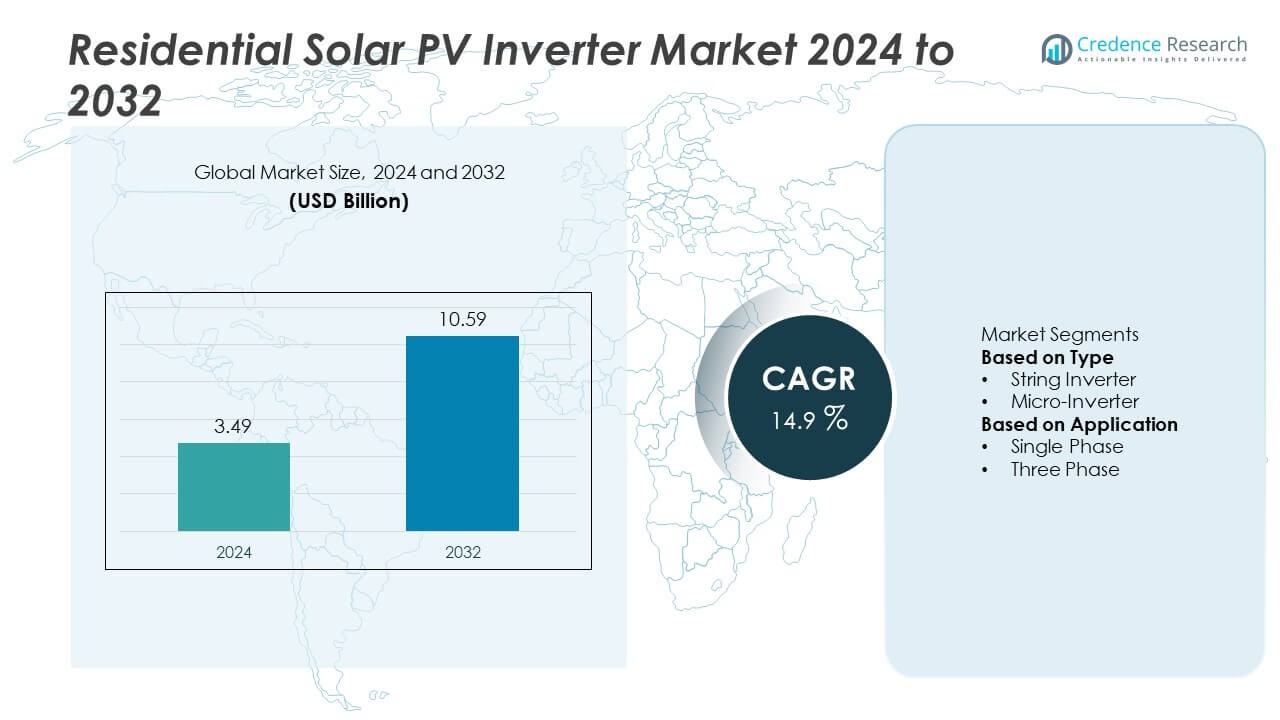

The global Residential Solar PV Inverter market was valued at USD 3.49 billion in 2024 and is projected to reach USD 10.59 billion by 2032, growing at a CAGR of 14.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Solar PV Inverter Market Size 2024 |

USD 3.49 Billion |

| Residential Solar PV Inverter Market, CAGR |

14.9% |

| Residential Solar PV Inverter Market Size 2032 |

USD 10.59 Billion |

The Residential Solar PV Inverter market is dominated by leading players such as SMA Solar Technology AG, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Sungrow Power Supply Co., Ltd., Enphase Energy Inc., FIMER S.p.A., Delta Electronics, Inc., Schneider Electric SE, Growatt New Energy Technology Co., Ltd., and Ginlong (Solis) Technologies Co., Ltd. These companies lead through innovation in string, hybrid, and micro-inverter technologies that enhance energy efficiency and grid integration. Europe held the largest share of 30% in 2024, supported by strong renewable adoption and supportive policy frameworks, followed by North America with 34% and Asia Pacific with 28%, where rapid residential solar growth and technological advancements are driving substantial market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global residential solar PV inverter market was valued at USD 3.49 billion in 2024 and is projected to reach USD 10.59 billion by 2032, growing at a CAGR of 14.9% during 2025–2032.

- Growing residential rooftop solar installations and government subsidies for clean energy adoption are driving market growth worldwide.

- Rising demand for hybrid and smart inverters with battery storage compatibility represents a key technological trend in the industry.

- Leading companies such as SMA Solar Technology, Huawei, SolarEdge, and Enphase Energy dominate through innovation, global distribution, and efficiency-focused product portfolios.

- North America held 34%, followed by Europe at 30% and Asia Pacific at 28%, while the string inverter segment captured 67% share in 2024, supported by high efficiency, cost-effectiveness, and increasing adoption in residential rooftop solar systems.

Market Segmentation Analysis:

By Type

The string inverter segment held a 67% share in 2024, emerging as the leading type due to its cost-effectiveness and suitability for small to medium residential solar systems. These inverters efficiently convert DC power from multiple panels into AC, offering simplified installation and easy maintenance. Their high reliability and compatibility with modern photovoltaic modules make them ideal for rooftop solar setups. The micro-inverter segment is growing rapidly, supported by rising adoption in households seeking module-level performance monitoring and improved energy yield in shaded or complex roof structures.

- For instance, SMA Solar Technology AG launched the Sunny Boy 3.0–6.0 series string inverter with a maximum input voltage of 600 V and efficiency reaching 97.5%. The unit integrates ShadeFix optimization and WLAN-based monitoring, enabling real-time performance tracking for residential arrays up to 6 kW capacity.

By Application

The single-phase segment accounted for a 64% share in 2024, dominating the residential solar PV inverter market. Its prevalence stems from widespread use in standalone homes and small residential units connected to low-voltage grids. Single-phase inverters provide high efficiency, compact design, and lower installation costs, making them suitable for typical household power needs. Meanwhile, the three-phase segment is gaining traction in large villas and residential complexes with higher load requirements, driven by demand for balanced power distribution and enhanced grid stability.

- For instance, Growatt New Energy Technology Co., Ltd. introduced its MIN 2500–6000 TL-X series single-phase inverter featuring dual MPPT inputs and a maximum efficiency of 98.4%. The system supports WiFi & 4G connectivity for cloud-based diagnostics and is designed for homes with power demands between 2.5 kW and 6 kW, ensuring efficient grid integration.

Key Growth Drivers

Rising Adoption of Rooftop Solar Systems

Increasing residential solar installations are a major driver of the market. Homeowners are investing in rooftop systems to reduce electricity bills and gain energy independence. Government subsidies, net metering policies, and renewable energy incentives further accelerate adoption. String and micro-inverters play a crucial role in ensuring maximum power conversion and grid compatibility. Growing environmental awareness and favorable feed-in tariffs continue to enhance the deployment of solar PV inverters in residential applications worldwide.

- For instance, SolarEdge Technologies Inc. deployed its HD-Wave inverter platform with a peak efficiency of 99%, integrating power optimizers for module-level control. The system supports panel capacities up to 400 W per module and allows monitoring of each panel via its mySolarEdge app, improving household energy generation and self-consumption performance.

Technological Advancements in Inverter Efficiency

Continuous innovation in inverter design and power electronics is boosting system performance and reliability. Modern inverters now offer higher energy yields through advanced maximum power point tracking (MPPT) technology and hybrid compatibility with battery storage systems. The integration of AI-based monitoring and IoT-enabled smart features enables real-time diagnostics and predictive maintenance. These improvements enhance inverter efficiency, lower maintenance costs, and support long-term system durability, driving wider adoption in residential solar installations.

- For instance, Huawei Technologies Co., Ltd. introduced its FusionSolar SUN2000-3KTL-L1 inverter, which has dual MPPT inputs. The maximum DC input voltage is 600 V, and the model achieves up to 98.3% conversion efficiency.

Government Policies and Financial Incentives

Supportive policies and incentives remain key growth enablers for the residential solar inverter market. Governments across regions are implementing solar rebates, tax credits, and low-interest financing programs to encourage household solar adoption. Initiatives such as the U.S. Investment Tax Credit (ITC) and Europe’s Renewable Energy Directive significantly reduce the upfront costs of installations. This policy-driven financial support, coupled with carbon reduction targets, continues to expand the global market for residential solar PV inverters.

Key Trends & Opportunities

Integration of Energy Storage and Hybrid Inverters

The growing use of hybrid solar inverters that combine PV and battery storage capabilities represents a major trend. Homeowners increasingly prefer hybrid systems for energy independence and backup power during grid outages. These inverters optimize power flow between the grid, panels, and batteries, improving overall system efficiency. The integration of lithium-ion storage and advanced energy management software creates opportunities for manufacturers to deliver intelligent, flexible solutions for modern smart homes.

- For instance, Sungrow Power Supply Co., Ltd. launched its SH10RT hybrid inverter rated at 10 kW, designed for residential solar-plus-storage applications. The system supports battery capacity up to 30 kWh and achieves 97.9% conversion efficiency. It features integrated EMS (Energy Management System) for automatic load shifting and grid-feed optimization under varying generation conditions.

Digitalization and Smart Monitoring Solutions

Digital transformation is reshaping inverter operations through IoT connectivity and cloud-based platforms. Smart inverters now enable real-time monitoring, fault detection, and remote performance analysis via mobile or web applications. This trend enhances transparency, reduces downtime, and improves energy management for end users. Growing interest in data-driven solar performance optimization provides manufacturers with opportunities to introduce AI-enabled diagnostic features and remote service capabilities.

- For instance, Enphase Energy Inc. developed its IQ Gateway monitoring platform that collects performance data from up to 600 microinverters per system. The platform transmits data every five minutes to the Enphase Cloud, allowing users to track individual module performance, detect faults automatically, and receive predictive maintenance alerts through its Enlighten app.

Key Challenges

High Initial Installation and Equipment Costs

Despite falling solar panel prices, inverter systems still account for a significant portion of total installation costs. Advanced technologies like hybrid or micro-inverters increase initial investment, which can deter budget-conscious homeowners. In regions with limited subsidies, long payback periods remain a concern. Manufacturers face the challenge of balancing cost reduction with efficiency improvements to enhance market penetration in cost-sensitive economies.

Complex Grid Integration and Regulatory Compliance

Varying grid standards and interconnection regulations across countries pose operational challenges for inverter manufacturers. Compliance with grid codes, voltage limits, and safety certifications requires continuous product adaptation. Frequent regulatory changes, especially in emerging markets, increase product testing and approval costs. Ensuring seamless integration with evolving smart grid infrastructure while maintaining performance reliability remains a key barrier to widespread market expansion.

Regional Analysis

North America

North America held the largest market share of 34% in 2024, driven by strong solar adoption in the U.S. and Canada. Federal incentives such as the Investment Tax Credit (ITC) and state-level rebate programs continue to boost residential installations. Homeowners increasingly favor string and hybrid inverters integrated with battery storage systems for energy independence. Technological advancements and declining inverter prices further strengthen demand. The presence of major solar solution providers and a well-established grid infrastructure support sustained market growth across the region.

Europe

Europe accounted for 30% of the global market in 2024, supported by ambitious renewable energy targets and high rooftop solar penetration. Countries such as Germany, the U.K., and Italy lead adoption due to favorable feed-in tariffs and government incentives for residential solar systems. Increasing focus on carbon neutrality and grid modernization encourages the use of efficient, smart inverters. The integration of hybrid systems and energy storage solutions is gaining traction, particularly in regions transitioning toward self-consumption models and decentralized power generation.

Asia Pacific

Asia Pacific captured a 28% market share in 2024, emerging as the fastest-growing region for residential solar PV inverters. Rapid urbanization, rising electricity costs, and strong government support for rooftop solar installations drive regional growth. China, Japan, and India are major contributors due to widespread policy backing and declining system costs. Local manufacturing initiatives and technological innovation in inverter design strengthen the regional supply chain. Increasing consumer awareness of renewable energy benefits continues to expand the adoption of high-efficiency solar inverter systems.

Latin America

Latin America represented a 5% share of the global market in 2024, led by growing solar adoption in Brazil, Mexico, and Chile. Government-led renewable energy programs and tax incentives for distributed generation are fueling residential installations. Favorable climate conditions and the expansion of financing options encourage homeowners to invest in solar PV systems. The demand for efficient and affordable string inverters is increasing as the region advances toward sustainable energy diversification and greater energy independence.

Middle East & Africa

The Middle East & Africa accounted for a 3% share in 2024, supported by growing solar infrastructure investments and declining photovoltaic costs. Countries such as the UAE, Saudi Arabia, and South Africa are promoting rooftop solar systems under national renewable energy goals. The increasing adoption of hybrid and off-grid inverter systems caters to areas with unstable power supply. Supportive government policies, along with initiatives to improve residential electrification, are expected to drive steady growth in the coming years.

Market Segmentations:

By Type

- String Inverter

- Micro-Inverter

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Residential Solar PV Inverter market is defined by leading players such as SMA Solar Technology AG, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Sungrow Power Supply Co., Ltd., Enphase Energy Inc., FIMER S.p.A., Delta Electronics, Inc., Schneider Electric SE, Growatt New Energy Technology Co., Ltd., and Ginlong (Solis) Technologies Co., Ltd. These companies compete through advanced inverter technologies, strong global distribution networks, and continuous innovation in hybrid and energy storage-compatible systems. Enphase and SolarEdge lead in micro- and power-optimizer solutions, while Huawei and Sungrow dominate string inverter technologies. Manufacturers are focusing on improving conversion efficiency, enhancing connectivity, and integrating AI-based monitoring to meet evolving residential energy needs. Strategic alliances, regional expansions, and product diversification remain key competitive strategies, as companies aim to strengthen their market presence amid rising demand for smart, sustainable, and high-efficiency residential solar solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SMA Solar Technology AG

- Huawei Technologies Co., Ltd.

- SolarEdge Technologies Inc.

- Sungrow Power Supply Co., Ltd.

- Enphase Energy Inc.

- FIMER S.p.A.

- Delta Electronics, Inc.

- Schneider Electric SE

- Growatt New Energy Technology Co., Ltd.

- Ginlong (Solis) Technologies Co., Ltd.

Recent Developments

- In August 2025, Enphase announced software availability to expand its IQ 7 solar system compatibility in additional markets, enhancing its global footprint.

- In December 2024, Enphase Energy Inc. released its residential power-control product enabling homeowners to expand microinverter systems without upgrading the home electrical panel.

- In 2024, Huawei Technologies Co., Ltd. launched its brand-new FusionSolar smart PV+ESS residential solution featuring its 4T (Watt/Bit/Heat/Battery) convergence strategy, integrating all-scenario inverter, storage and monitoring modules in one package.

- In May 2023, Huawei introduced its next-generation FusionSolar all-scenario smart PV residential solution at the Shanghai event, reinforcing its commitment to renewables and home-energy systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global demand for residential solar PV inverters will continue rising with expanding rooftop installations.

- String inverters will remain dominant, while hybrid inverters with battery storage integration will gain momentum.

- AI-enabled monitoring and digital connectivity will enhance system efficiency and predictive maintenance.

- Falling inverter costs and improved conversion efficiency will accelerate adoption in emerging economies.

- Government policies and renewable energy incentives will continue driving residential solar growth globally.

- Manufacturers will focus on compact, smart, and energy-efficient inverter designs for home systems.

- Partnerships with energy storage and battery solution providers will strengthen competitive advantage.

- Europe and North America will remain key markets, while Asia Pacific will witness the fastest growth.

- Grid modernization and decentralized power generation will create new integration opportunities for inverter makers.

- Sustainability goals and carbon reduction targets will continue to shape future product development strategies.