Market Overview

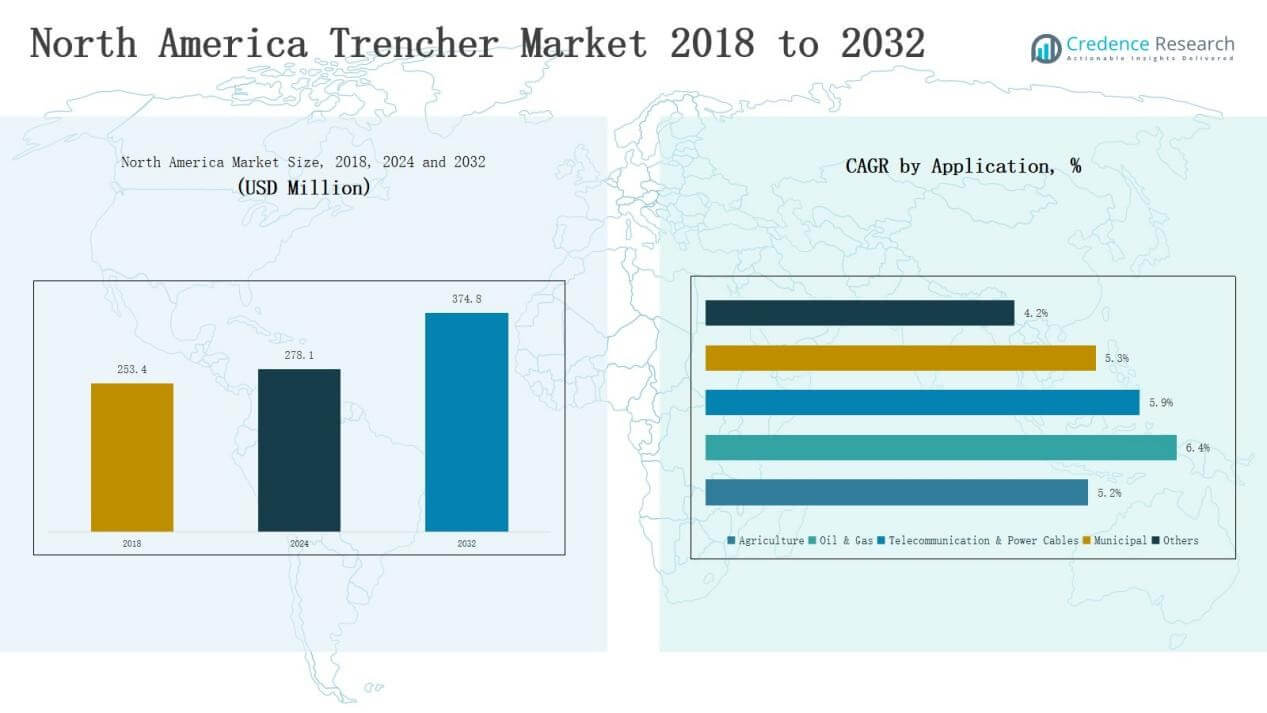

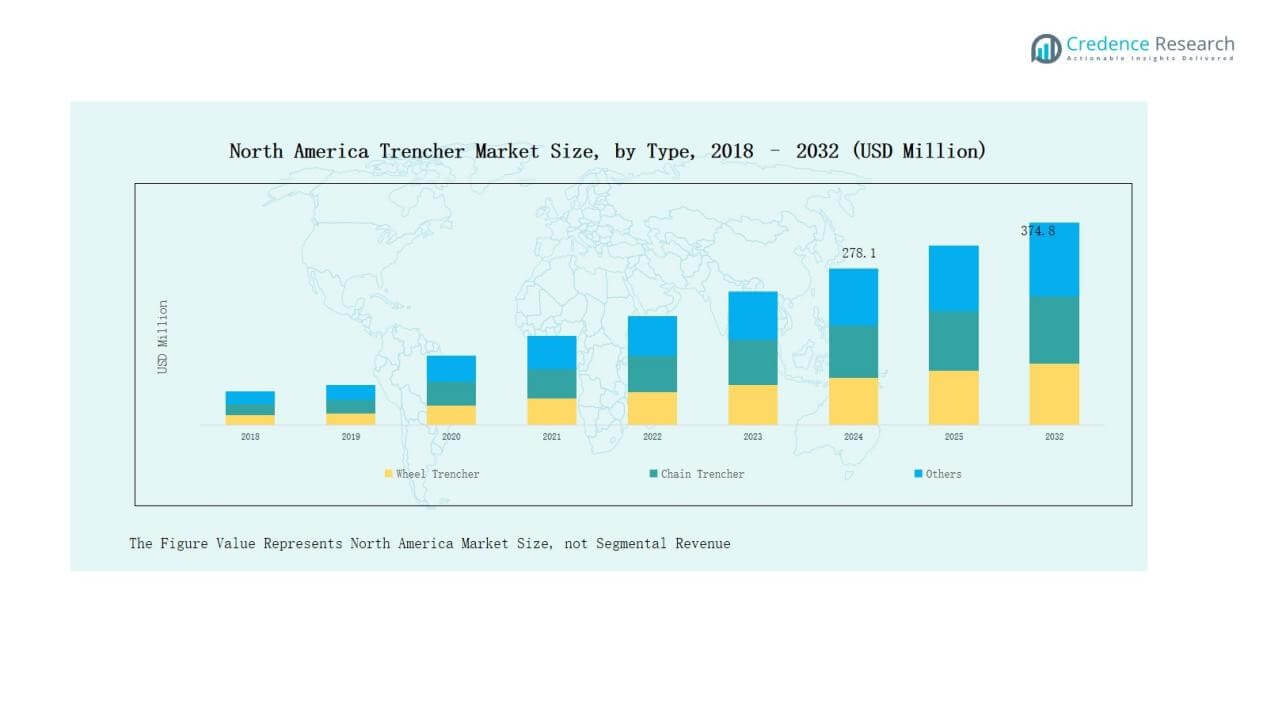

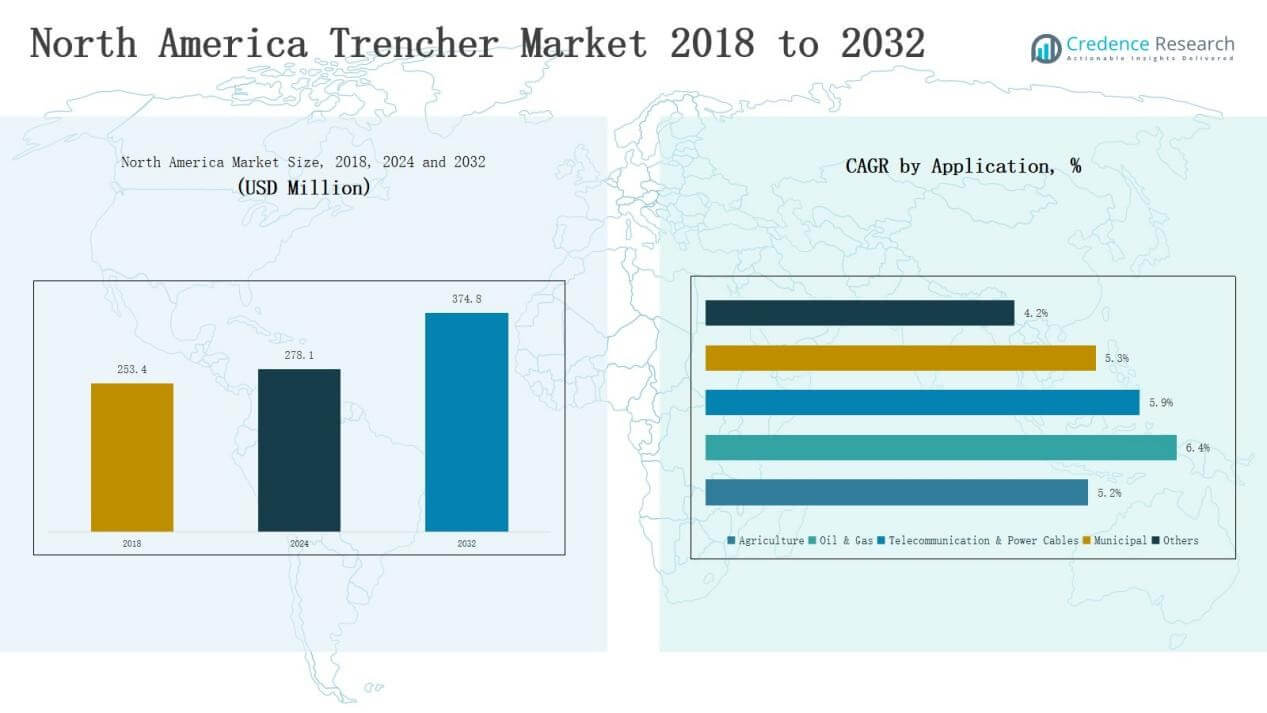

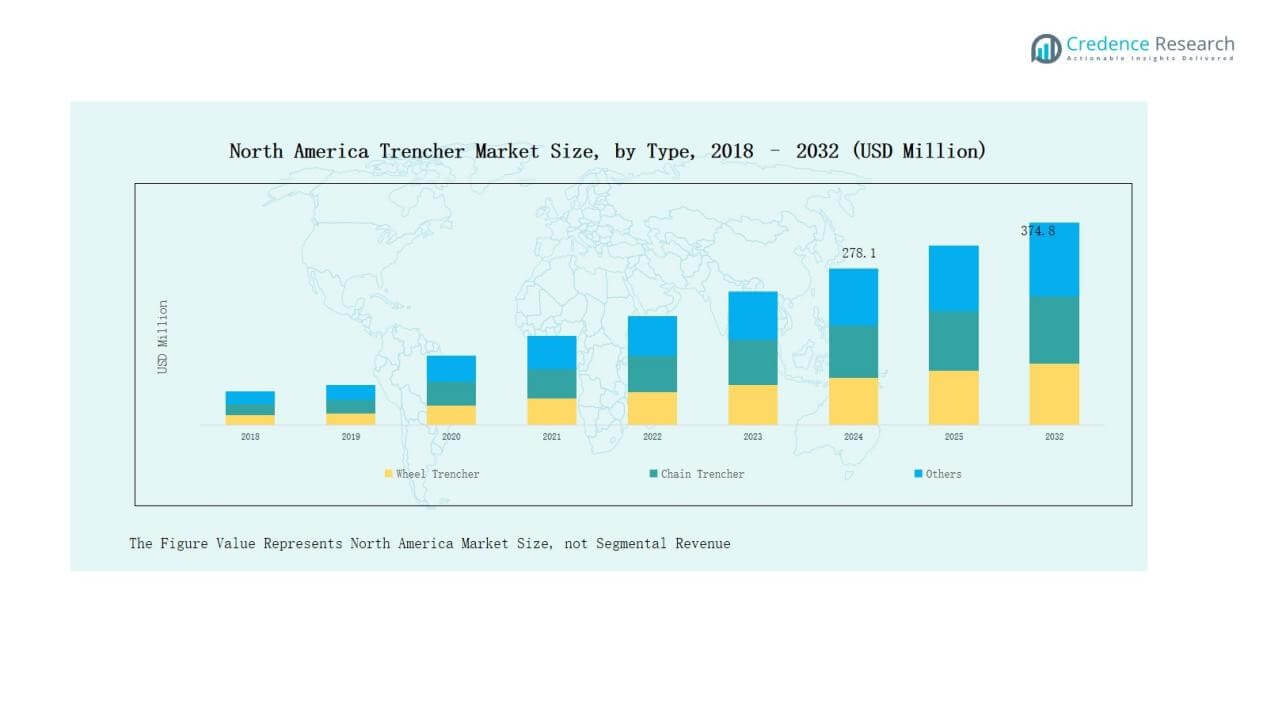

North America Trencher Market size was valued at USD 253.4 million in 2018 to USD 278.1 million in 2024 and is anticipated to reach USD 374.8 million by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Trencher Market Size 2024 |

USD 278.1 Million |

| North America Trencher Market, CAGR |

3.9% |

| North America Trencher Market Size 2032 |

USD 374.8 Million |

The North America Trencher Market is shaped by leading companies such as Ditch Witch, Vermeer Corporation, TESMEC S.p.A, The Toro Company, and Barreto Manufacturing, Inc., supported by regional players like Wolfe Equipment, Cleveland Trencher Company, Inc., and EZ-Trench, LLC. These firms compete through wide product portfolios, advanced automation features, and strong after-sales networks, while international players such as Inter-Drain Sales BV, UNAC SAS, and Shandong Gaotang Xinhang Machinery Co. Ltd. expand their presence through localized strategies. The United States leads the market with 66% share in 2024, driven by large-scale infrastructure upgrades, broadband expansion, and significant agricultural mechanization, making it the strongest regional hub for trencher demand.

Market Insights

- The North America Trencher Market grew from USD 253.4 million in 2018 to USD 278.1 million in 2024 and is projected to reach USD 374.8 million by 2032 at a CAGR of 3.9%.

- Key players include Ditch Witch, Vermeer Corporation, TESMEC S.p.A, The Toro Company, and Barreto Manufacturing, Inc., supported by regional players like Wolfe Equipment, Cleveland Trencher Company, Inc., and EZ-Trench, LLC.

- By type, wheel trenchers lead with 48% share in 2024, followed by chain trenchers at 37% and other types at 15%, driven by diverse applications across sectors.

- By application, telecommunication and power cables hold 41% share in 2024, agriculture follows at 25%, oil and gas at 15%, municipal projects at 13%, and others at 6%.

- By region, the U.S. dominates with 66% share in 2024, while Canada holds 20% and Mexico 14%, reflecting balanced demand supported by infrastructure, agriculture, and telecom investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Wheel trenchers dominate the North America Trencher Market with 48% share in 2024, driven by their efficiency in cutting through tough soils and suitability for large-scale urban and rural infrastructure projects. Chain trenchers follow with 37% share, primarily used in agriculture and utility applications where precision and adaptability are essential. Other types account for 15%, serving specialized or niche operations. Demand for wheel trenchers is reinforced by their reliability in telecom and municipal projects across the region.

- For instance, Ditch Witch’s heavy-duty wheel trenchers have been used in multiple U.S. city broadband expansion projects, supporting efficient trenching for underground telecom cables.

By Application

The telecommunication and power cables segment leads with 41% share in 2024, supported by heavy investments in broadband and 5G network expansion. Agriculture holds 25%, where trenchers assist in irrigation and drainage systems across large farmlands. Oil and gas contributes 15%, reflecting the sector’s reliance on trenchers for pipeline installations. Municipal projects secure 13%, driven by infrastructure upgrades, while other uses hold 6%. The rapid growth of telecom cabling projects sustains the segment’s leadership.

- For instance, in 2025, AT&T announced it had already expanded its fiber network to more than 30 million consumer and business locations, ahead of schedule.

By Sales Channel

The distribution channel accounts for 63% share in 2024, supported by dealers’ extensive service networks, financing options, and availability of spare parts. Direct channels hold 37%, mainly used by large contractors and public sector procurement. Distribution dominates as regional dealers provide maintenance, operator training, and local support, making trenchers more accessible for smaller contractors. Direct sales remain relevant for high-value purchases, especially in oil, gas, and large municipal projects across the region.

Market Overview

Key Growth Drivers

Infrastructure Expansion and Urbanization

Ongoing investments in urban infrastructure and utility networks strengthen demand for trenchers in North America. Large-scale roadworks, municipal upgrades, and fiber optic cabling projects require efficient trenching solutions to meet deadlines. Wheel trenchers dominate in metropolitan areas due to their cutting efficiency and suitability for dense soils. Rapid population growth and city expansions across the U.S. and Canada further amplify the need for reliable trenching equipment. Continuous government funding into smart city programs ensures sustained opportunities for the market.

- For instance, Mastenbroek Limited launched its Bulldog utility trencher designed for dense urban areas in North America, featuring an 8-liter Volvo engine and a conveyor system that enhances spoil deposition in confined spaces.

Broadband and 5G Deployment

The rollout of 5G and broadband networks is a central growth driver across the region. Telecom operators rely heavily on trenchers to install underground cables with minimal surface disruption. In 2024, the telecommunication and power cables segment held 41% share, highlighting its strong contribution. Compact and automated trenchers play a key role in increasing efficiency for fiber optic installations. North America’s aggressive digital infrastructure programs, particularly in the U.S., fuel steady demand. This trend ensures sustained adoption of trenching equipment.

Agricultural Mechanization and Efficiency

Agriculture remains a significant driver, particularly in the U.S. Midwest and parts of Canada. Farmers adopt trenchers to improve irrigation, drainage, and soil management efficiency. Chain trenchers, with a 37% share in 2024, are widely used due to their adaptability in soft soils and large farmlands. Rising food demand and emphasis on sustainable farming practices further support mechanization. Growing investments in advanced agricultural tools also create demand for durable trenching machinery. This driver ensures consistent growth beyond urban infrastructure projects.

- For instance, in China’s tea gardens, an automatic depth-adjusting double spiral trenching and fertilizing machine has been developed that integrates trenching, fertilizer application, and mulching in a single operation, significantly improving fertilizer application efficiency while maintaining consistent trench depth.

Key Trends & Opportunities

Adoption of Eco-Friendly Trenching Equipment

Sustainability is becoming a priority in North America’s construction and utility sectors. Manufacturers are introducing trenchers with reduced emissions, hybrid technologies, and lower noise levels. These align with stricter environmental regulations and contractors’ sustainability goals. Demand is particularly strong in urban areas where compliance requirements are stringent. Firms that invest in greener trenching solutions stand to capture rising opportunities. This trend highlights a clear shift toward environmentally responsible construction equipment in the region.

- For instance, Vermeer’s microtrenchers deliver narrow, shallow cuts ideal for urban fiber optic projects, reducing surface disruption and emissions while enabling faster installations, as seen in their successful deployment by B Comm Constructors in Austin, Texas.

Integration of Automation and Smart Technologies

Automation is transforming the North America Trencher Market, with GPS, telematics, and advanced guidance systems becoming standard features. These technologies increase accuracy, reduce downtime, and lower operating costs. Contractors prefer trenchers that minimize manual labor and ensure consistent performance in large projects. Adoption is strongest in telecom and municipal applications, where precision and efficiency are critical. Companies offering innovative, tech-enabled trenchers will gain a competitive edge. This opportunity aligns with the region’s push for digital transformation in construction.

- For instance, Titan GPS offers fleet management solutions that track equipment location, engine hours, and operating status in real-time, reducing downtime and fuel costs for construction fleets.

Key Challenges

High Equipment and Ownership Costs

The high cost of purchasing trenching machines limits adoption among small contractors and farmers. Maintenance, spare parts, and operator training add further financial strain. Distribution channels help address accessibility, but affordability remains a barrier. Contractors with limited budgets often rely on rentals, reducing long-term equipment sales. This challenge creates significant hurdles for market expansion, particularly in rural and small-scale applications.

Shortage of Skilled Operators

Operating trenchers requires technical knowledge and safety training, yet the region faces a shortage of skilled workers. The construction and agriculture sectors report difficulties in hiring qualified operators. This shortage slows project execution and reduces the efficiency of trenching equipment. Companies must invest in training programs to bridge this skills gap. Without addressing operator availability, equipment adoption will remain constrained in several industries.

Competitive Market Pressure

North America hosts several global and regional trencher manufacturers, creating a highly competitive environment. Players compete on pricing, technology, and service quality, which reduces profit margins. Smaller firms often struggle to match the R&D investments and after-sales networks of larger companies. Price sensitivity among contractors intensifies the challenge. The competitive environment forces manufacturers to balance cost-effective solutions with innovative features, shaping long-term market dynamics.

Regional Analysis

U.S.

The United States dominates the North America Trencher Market with 66% share in 2024. It benefits from large-scale infrastructure upgrades, 5G expansion, and broadband investments that drive steady demand. Strong adoption of wheel trenchers is evident in both urban and rural projects due to their efficiency in handling varied soil conditions. Agriculture also contributes significantly, with trenchers supporting irrigation and drainage systems in major farming regions. Oil and gas pipeline projects reinforce steady use across industrial sectors. It remains the largest market, with growth supported by diverse applications and strong dealer networks.

Canada

Canada holds 20% share in 2024, supported by investments in municipal utilities, telecommunication networks, and agricultural modernization. The country emphasizes sustainable construction practices, which increases interest in eco-friendly trenching equipment. Demand is particularly strong in rural areas, where trenchers are essential for farming and drainage. Urban centers also drive growth through smart city projects and broadband expansion. Distribution networks remain critical, helping small contractors and farmers access equipment. It is expected to sustain balanced growth across multiple sectors.

Mexico

Mexico accounts for 14% share in 2024, influenced by rising urbanization and infrastructure development. Public sector investments in roads, municipal utilities, and power cable installations strengthen demand. Agriculture continues to be a key application, with trenchers supporting irrigation in large farming areas. Growing industrial and energy projects also expand opportunities for equipment adoption. Distribution channels dominate, helping expand reach among regional contractors. It represents a developing market with strong potential for growth in both urban and rural applications.

Market Segmentations:

By Type

- Wheel Trencher

- Chain Trencher

- Other Types

By Application

- Agriculture

- Oil & Gas

- Telecommunication & Power Cables

- Municipal

- Others

By Sales Channel

- Direct Channel

- Distribution Channel

By Region

Competitive Landscape

The North America Trencher Market is highly competitive, with global leaders and regional players focusing on technology, efficiency, and after-sales support. Key companies such as Ditch Witch, Vermeer Corporation, TESMEC S.p.A, The Toro Company, and Barreto Manufacturing, Inc. dominate through wide product portfolios and robust dealer networks. Specialized firms including Wolfe Equipment, Cleveland Trencher Company, Inc., and EZ-Trench, LLC strengthen the landscape by targeting niche segments with compact and cost-effective models. International players like Inter-Drain Sales BV, UNAC SAS, and Shandong Gaotang Xinhang Machinery Co. Ltd. expand presence through partnerships and localized strategies. Companies are emphasizing automation, eco-friendly trenchers, and hybrid technologies to align with North America’s infrastructure and environmental goals. Price competition remains strong, but firms with advanced technology integration, strong financing options, and reliable service capabilities hold a competitive advantage. This dynamic environment ensures constant innovation and steady market evolution across applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Ditch Witch

- Vermeer Corporation

- TESMEC S.p.A

- Wolfe Equipment

- Barreto Manufacturing, Inc.

- Cleveland Trencher Company, Inc.

- Inter-Drain Sales BV

- EZ-Trench, LLC

- Port Industries

- UNAC SAS

- The Toro Company

- Guntert & Zimmerman Const. Div., Inc.

- Mastenbroek Limited

- Shandong Gaotang Xinhang Machinery Co. Ltd.

Recent Developments

- In August 2025, Ditch Witch, a division of The Toro Company, sold its Trencor business and the American Augers auger boring product line. Michael Byrne Manufacturing acquired the auger line, while the buyer of Trencor remains undisclosed.

- In February 2025, Ditch Witch introduced the C3E, the industry’s first electric walk-behind trencher. Powered by an advanced electric motor, it can trench up to 3 feet deep and 6 inches wide through up to 1,000 feet of clay on a single charge.

- In July 2025, NKT selected Helix Robotics Solutions Limited as its partner to operate the new T3600 subsea trencher, which is planned to be operational in 2027.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Wheel trenchers will continue leading demand across large-scale infrastructure and municipal projects.

- Telecom and 5G expansion will drive sustained trenching requirements across urban and suburban regions.

- Agriculture will adopt more trenchers to improve irrigation and drainage efficiency.

- Eco-friendly trenching equipment will gain traction under stricter environmental regulations.

- Automation and GPS integration will enhance precision and operational efficiency for contractors.

- Distribution channels will remain dominant due to strong dealer networks and financing support.

- Oil and gas pipeline projects will reinforce demand for heavy-duty trenching equipment.

- Canada and Mexico will show rising adoption with ongoing urbanization and modernization projects.

- Competition will intensify as global leaders and regional firms expand product portfolios.

- Technology-enabled trenchers will become a key differentiator in securing long-term market growth.