Market Overview

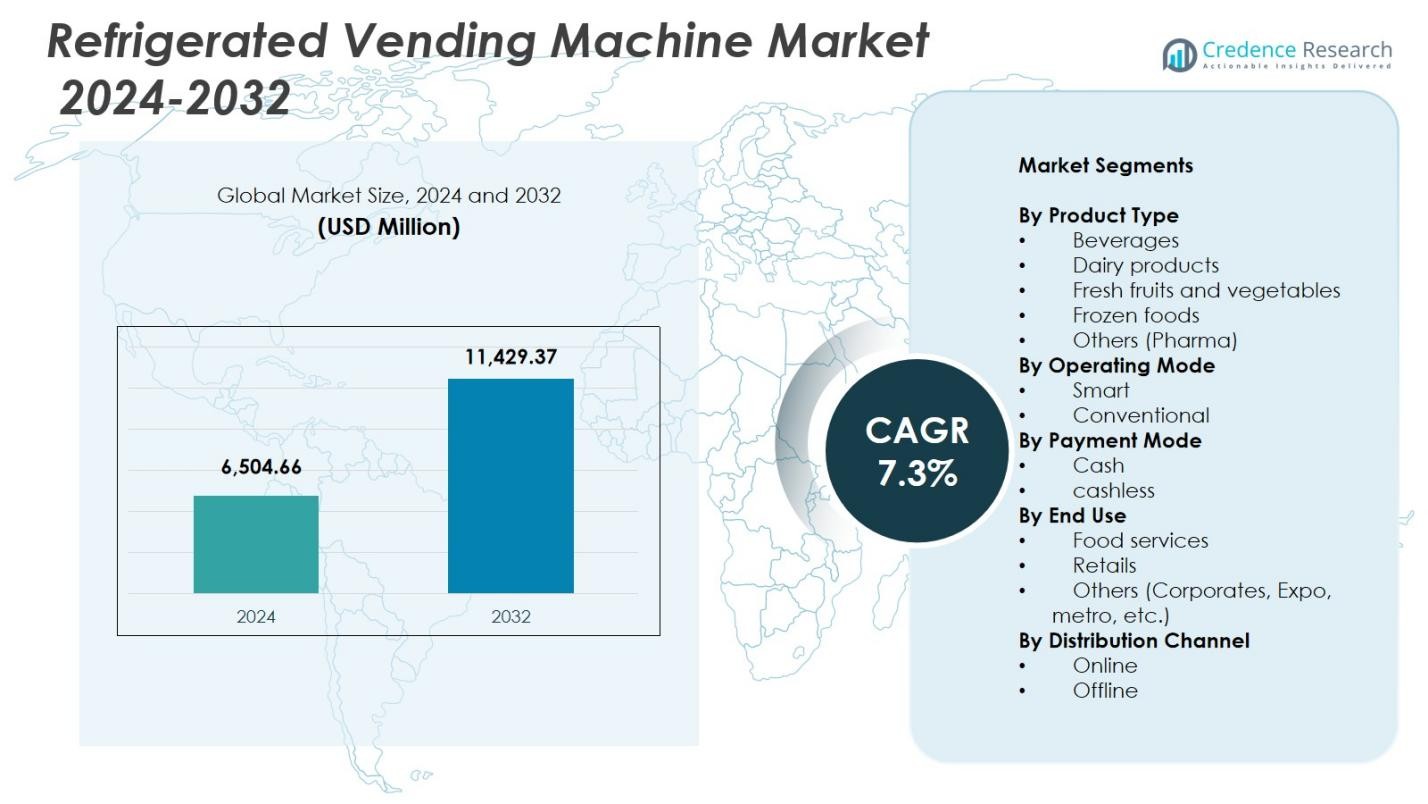

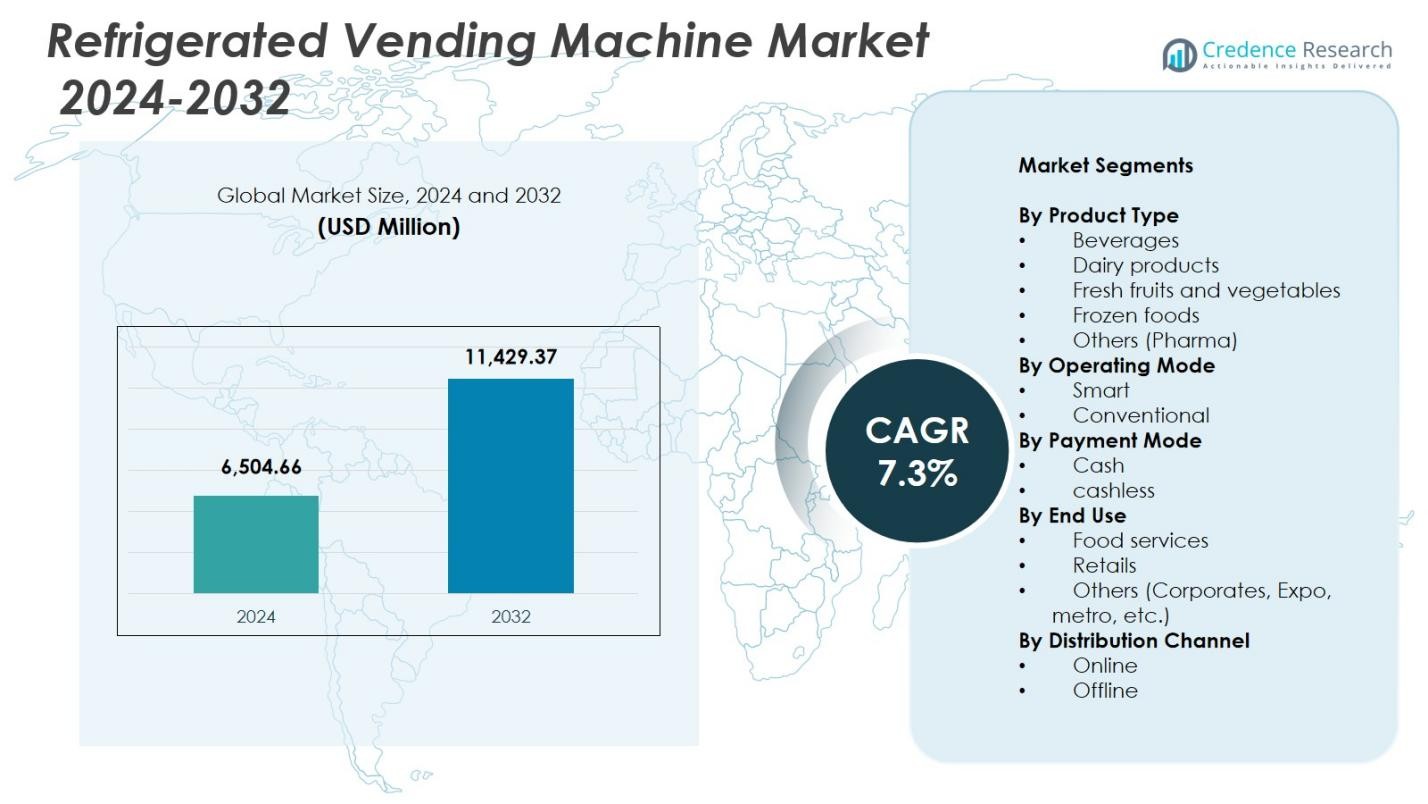

Refrigerated Vending Machine Market size was valued at USD 6,504.66 million in 2024 and is anticipated to reach USD 11,429.37 million by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Refrigerated Vending Machine MarketSize 2024 |

USD 6,504.66 Million |

| Refrigerated Vending Machine Market, CAGR |

7.3% |

| Refrigerated Vending Machine Market Size 2032 |

USD 11,429.37 Million |

Refrigerated Vending Machine Market is shaped by the presence of leading manufacturers such as Rockwell Industries, Crane Merchandising, Azkoyen, Fuji Electric, FAS International, Bharat Refrigerations, Rheavendors, Dover, Heatcraft Worldwide Refrigeration, and Bianchi Vending, each contributing through technological innovation and diversified product portfolios. These players focus on advanced cooling systems, smart connectivity features, and cashless payment integration to meet rising demand for fresh and temperature-sensitive consumables across commercial environments. Regionally, North America led the market with a 34.6% share in 2024, supported by strong digital infrastructure, early adoption of smart vending systems, and widespread placement across high-traffic locations. Europe and Asia-Pacific followed as key growth centers driven by regulatory compliance, urban expansion, and increasing retail automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Refrigerated Vending Machine Market reached USD 6,504.66 million in 2024 and is set to grow at a CAGR of 7.3% through 2032.

- Strong market drivers include rising demand for fresh, chilled, and ready-to-consume products along with rapid adoption of IoT-enabled smart vending technologies across commercial spaces.

- Key trends highlight expanding use of cashless payment systems, micro-market installations, and increasing deployment of refrigerated units for dairy, beverages, frozen foods, and pharma, with beverages holding a 8% share in 2024.

- Major players such as Rockwell Industries, Crane Merchandising, Azkoyen, Fuji Electric, and others focus on advanced cooling technologies, AI-based monitoring, and modular machine formats to strengthen their market position.

- Regionally, North America led with 6%, followed by Europe at 28.3% and Asia-Pacific at 26.1%, while Latin America and the Middle East & Africa recorded emerging demand driven by retail modernization and digital payment expansion.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

The beverages segment dominated the Refrigerated Vending Machine Market with a 41.8% share in 2024, driven by rising demand for ready-to-drink beverages, expanding placement of vending machines in transit hubs, and continuous product rotation that ensures high sales velocity. Operators increasingly prioritize beverage vending due to strong margins, minimal spoilage risk, and flexible SKU assortment covering soft drinks, juices, energy drinks, and functional beverages. Meanwhile, dairy products and fresh produce segments are growing steadily as nutritional convenience trends strengthen, while frozen foods and pharma items benefit from improved cooling technologies and enhanced temperature-controlled dispensing systems.

- For instance, SandenVendo America’s G-Drink HC machines vend cans, PET bottles, and glass-bottled chilled drinks using R290 refrigerant and no-drop ejection for gentle handling across 6 levels.

By Operating Mode:

The smart segment held the largest share of 58.4% in 2024, reflecting rapid adoption of IoT-enabled vending machines offering remote monitoring, dynamic inventory management, automated temperature control, and predictive maintenance. Operators increasingly favor smart systems to minimize operational downtime, enhance product freshness, and optimize energy usage. Growing integration of AI for demand forecasting and personalized product recommendations further accelerates adoption. Conventional machines retain relevance in cost-sensitive locations but continue to lose share as businesses prioritize data-driven automation and enhanced consumer experience, reinforcing the market transition toward smart refrigerated vending solutions.

- For instance, Farmer’s Fridge deploys IoT-enabled refrigerated kiosks that monitor inventory levels and temperature in real time to ensure food safety, while algorithms analyze purchasing preferences to optimize restocking and reduce waste.

By Payment Mode:

The cashless segment led the market with a 62.7% share in 2024, supported by rising consumer preference for digital transactions, including NFC payments, mobile wallets, QR-based systems, and prepaid cards. Cashless-enabled vending machines significantly improve transaction speed, reduce maintenance associated with cash handling, and enhance security against cash-related losses. Retailers increasingly deploy cashless systems in high-footfall areas to improve throughput and user convenience. Cash payment machines maintain a presence in rural and semi-urban settings; however, the widespread shift toward contactless and digital-first payment ecosystems continues to strengthen the dominance of cashless refrigerated vending solutions.

Key Growth Drivers

Rising Demand for On-the-Go Fresh and Healthy Consumables

Growing consumer preference for fresh, chilled, and nutritious food options significantly boosts demand for refrigerated vending machines. Increasing workplace mobility, expansion of public transport networks, and the shift toward convenient meal and beverage formats strengthen adoption across corporate offices, airports, malls, and educational institutions. The ability to dispense temperature-sensitive items such as dairy, fresh fruits, and ready-to-eat meals enhances value for operators and encourages retailers to diversify offerings. This consumer-driven shift supports sustained market expansion and drives higher machine placement density across urban centers.

Advancements in IoT-Enabled Smart Vending Technologies

Technological innovation plays a critical role in accelerating market growth as IoT connectivity, AI-driven analytics, and real-time monitoring improve machine performance and operational efficiency. Smart vending systems enable automated temperature control, predictive maintenance, contactless payments, and dynamic product management, reducing downtime and energy use. These enhancements increase profitability for operators while improving customer experience through seamless transactions and personalized offerings. The integration of cloud-based platforms further allows multi-location oversight, making smart refrigerated vending machines attractive for large-scale deployments.

- For instance, Coca-Cola integrates AI into its smart vending machines to analyze real-time transaction patterns and sales data, enabling dynamic product recommendations and automated inventory adjustments based on location-specific demand.

Expansion of Cashless and Contactless Payment Infrastructure

Widespread adoption of digital payment ecosystems strongly drives the uptake of refrigerated vending machines equipped with cashless systems. Mobile wallets, NFC-enabled cards, and QR-based payments enhance convenience and minimize transaction time, directly improving user satisfaction. Retailers and operators benefit from reduced cash handling costs, lower theft risks, and improved financial tracking. As governments and financial institutions promote digital transactions, vending machine operators accelerate the transition to cashless models, supporting broader market penetration and enabling machines to operate efficiently in high-traffic, digitally oriented environments.

- For instance, Gantner integrates its GV6 RFID/NFC reader into MDB-enabled refrigerated snack and drink vending machines, allowing users to tap wristbands or cards for pre-loaded credit purchases of cold drinks without carrying cash.

Key Trends & Opportunities

Growth of Automated Retail and Micro-Market Ecosystems

Automated retail models are expanding rapidly, creating new opportunities for refrigerated vending machines as part of micro-markets in offices, hospitals, logistics hubs, and residential complexes. These unmanned retail formats rely heavily on intelligent vending systems to provide 24/7 access to fresh foods, beverages, and specialized items. Enhanced merchandising flexibility, reduced labor dependence, and compatibility with cashless platforms strengthen appeal. As companies seek scalable, low-maintenance retail solutions, refrigerated vending machines emerge as core infrastructure supporting the evolution of self-service commerce.

- For instance, REDYREF deployed its Smart Food Fridge in Austin’s Hartland City Club office building, partnering with Royal Blue Grocery to stock fresh meals, snacks, and beverages for workers.

Increasing Adoption in Healthcare, Pharma, and Specialty Applications

Emerging applications in pharmaceuticals and healthcare offer new growth avenues for refrigerated vending machines designed to store temperature-sensitive products such as diagnostic kits, vaccines, and OTC medications. Hospitals, clinics, and pharmacies increasingly deploy automated dispensing systems to improve product accessibility while ensuring stringent temperature compliance. This trend aligns with rising demand for controlled dispensing, traceability, and after-hours availability. Manufacturers leveraging advanced cooling technologies and compliance-driven designs are well-positioned to capitalize on this expanding niche market.

- For instance, IMT Vending’s pharmacy machines employ compressor refrigeration for 2–8°C storage of vaccines and insulin, featuring redundant sensors, alarms, and continuous logging to prevent temperature excursions.

Key Challenges

High Initial Investment and Maintenance Costs

Despite strong market potential, the high capital cost of refrigerated vending machines poses a significant barrier for small and medium operators. Advanced cooling systems, IoT modules, and smart payment technologies increase upfront expenses and elevate long-term maintenance requirements. Frequent servicing, energy consumption, and component replacements further add to operational costs. These financial hurdles slow adoption in cost-sensitive regions and limit machine deployment density. Overcoming this challenge requires cost-optimized designs, leasing models, and improved energy-efficient systems that lower lifetime ownership costs.

Stringent Temperature Compliance and Operational Reliability Issues

Maintaining consistent cooling performance remains a critical challenge, especially in machines dispensing perishable food items. Fluctuations in temperature, humidity, or compressor performance can lead to product spoilage, regulatory non-compliance, and customer dissatisfaction. Operational disruptions caused by hardware failures or inadequate monitoring further impact revenue and brand reliability. As regulatory frameworks tighten around food safety and consumer protection, manufacturers must enhance system reliability through real-time monitoring, improved insulation, and robust cooling technologies to ensure consistent product quality.

Regional Analysis

North America

North America dominated the Refrigerated Vending Machine Market with a 34.6% share in 2024, driven by strong adoption of smart retail technologies, widespread digital payment infrastructure, and high demand for ready-to-consume chilled products across workplaces, educational campuses, and transit hubs. The region benefits from rapid expansion of automated retail formats and continuous upgrades in IoT-enabled vending solutions. Growing health-conscious consumer behavior further boosts demand for fresh food vending. The presence of established manufacturers and strong investment in advanced refrigeration technologies continue to reinforce the market’s leadership in the region.

Europe

Europe accounted for a 28.3% share in 2024, supported by stringent food safety regulations that encourage adoption of advanced refrigerated vending machines capable of maintaining consistent temperature control. High consumer preference for healthy, organic, and freshly chilled products enhances machine placement across corporate offices, train stations, and healthcare facilities. The region’s rapid shift toward cashless ecosystems strengthens demand for digital-enabled units. Additionally, sustainability-focused innovations such as energy-efficient compressors and eco-friendly refrigerants align with regulatory priorities, accelerating upgrades and new installations across key European markets.

Asia-Pacific

Asia-Pacific captured a 26.1% share in 2024, driven by urbanization, growing retail automation, and rising disposable incomes across major economies such as China, Japan, South Korea, and India. Expanding commercial infrastructure including malls, airports, and tech parks creates strong demand for refrigerated vending solutions offering fresh and convenient food access. The region’s fast-growing digital payments ecosystem, coupled with government-led smart city initiatives, accelerates the adoption of AI- and IoT-enabled machines. Increasing deployment of vending systems for dairy, beverages, and fresh produce further strengthens Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America held an overall market share of 6.4% in 2024, supported by expanding retail modernization efforts and growing interest in automated convenience solutions in urban areas. Countries such as Brazil, Mexico, and Chile are witnessing rising demand for chilled beverage and snack vending machines across transport terminals, universities, and commercial buildings. Improved acceptance of digital payments and gradual infrastructure upgrades enhance operational efficiency. However, cost sensitivity and variable economic conditions slow large-scale deployments, though long-term potential remains strong as operators increasingly adopt smart and energy-efficient refrigerated vending systems.

Middle East & Africa

The Middle East & Africa region accounted for a 4.6% share in 2024, reflecting growing adoption of vending machines in hospitality, airports, and healthcare environments. Rising urban development and expansion of premium commercial spaces in the UAE, Saudi Arabia, and South Africa support demand for refrigerated vending units capable of delivering beverages, dairy items, and specialty products. Increasing penetration of cashless payments and strong tourism growth further stimulate installations. Despite challenges related to high equipment costs and energy requirements, the region continues to show steady growth driven by modernization initiatives and rising consumer preference for convenient chilled products.

Market Segmentations:

By Product Type

- Beverages

- Dairy products

- Fresh fruits and vegetables

- Frozen foods

- Others (Pharma)

By Operating Mode

By Payment Mode

By End Use

- Food services

- Retails

- Others (Corporates, Expo, metro, etc.)

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Refrigerated Vending Machine Market features a diverse set of global and regional players, including Rockwell Industries, Crane Merchandising, Azkoyen, Fuji Electric, FAS International, Bharat Refrigerations, Rheavendors, Dover, Heatcraft Worldwide Refrigeration, and Bianchi Vending. Competitive analysis shows that leading manufacturers focus heavily on technological differentiation, offering IoT-enabled machines with real-time monitoring, advanced cooling systems, and integrated cashless payment capabilities. Companies increasingly invest in energy-efficient refrigeration technologies and AI-driven inventory management to enhance operational performance and reduce lifecycle costs. Strategic partnerships with retail chains, corporate facilities, hospitals, and transportation hubs support market expansion and improve deployment density. Product diversification into fresh food, frozen items, and pharmaceutical dispensing strengthens competitive positioning. Moreover, players emphasize modular designs, improved temperature control, and remote diagnostics to enhance reliability and user experience. Collectively, these strategies enable vendors to meet rising demand for intelligent, secure, and convenient refrigerated vending solutions across global markets.

Key Player Analysis

- Rockwell Industries

- Crane Merchandising

- Azkoyen

- Fuji Electric

- FAS International

- Bharat Refrigerations

- Rheavendors

- Dover

- Heatcraft Worldwide Refrigeration

- Bianchi Vending

Recent Developments

- In March 2025, Wendor unveiled a new range of smart vending machines and smart lockers at the AAHAR 2025 expo in New Delhi.

- In January 2025, Elanpro acquired a 41% stake in Wendor, strengthening its footprint in AI- and IoT-powered refrigerated vending solutions.

- In February 2025, RedyRef Interactive deployed an RFID-enabled “Smart Food Fridge” refrigerated vending machine at a commercial club in Hartland City, offering pre-packaged meals, snacks, and beverages with a contactless “Tap, Take, Go” payment and inventory tracking system.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operation Mode, Payment Mode, End Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand for fresh, chilled, and ready-to-consume products increases across urban locations.

- Adoption of IoT-enabled and AI-powered vending machines will accelerate, enhancing operational efficiency and product quality.

- Cashless and contactless payment integration will become a standard feature across most newly installed refrigerated vending units.

- Energy-efficient refrigeration technologies will gain prominence as operators seek lower operating costs and sustainability compliance.

- Healthcare and pharmaceutical dispensing applications will expand, creating new revenue opportunities for manufacturers.

- Micro-markets and automated retail ecosystems will drive higher deployment of advanced refrigerated vending systems.

- Machine reliability, remote monitoring, and predictive maintenance will emerge as critical competitive differentiators.

- Customizable machine formats and modular designs will support broader use cases across commercial environments.

- Emerging economies will play a significant role in market expansion as retail automation accelerates.

- Partnerships between vending operators and food brands will strengthen product diversity and enhance consumer engagement.

Market Segmentation Analysis:

Market Segmentation Analysis: