Market Overview

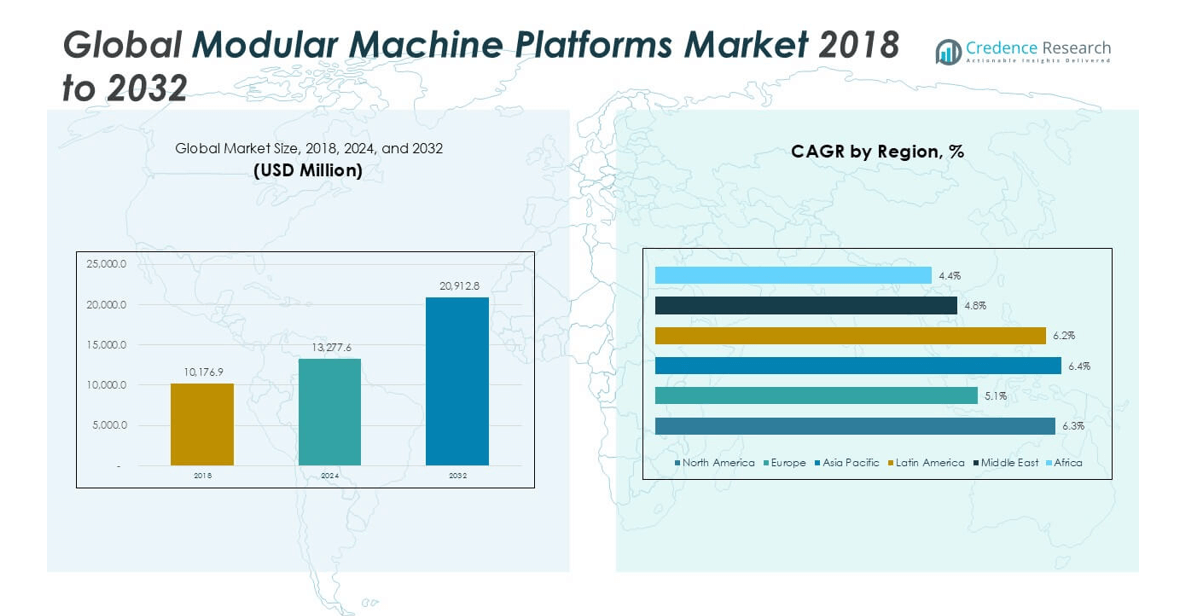

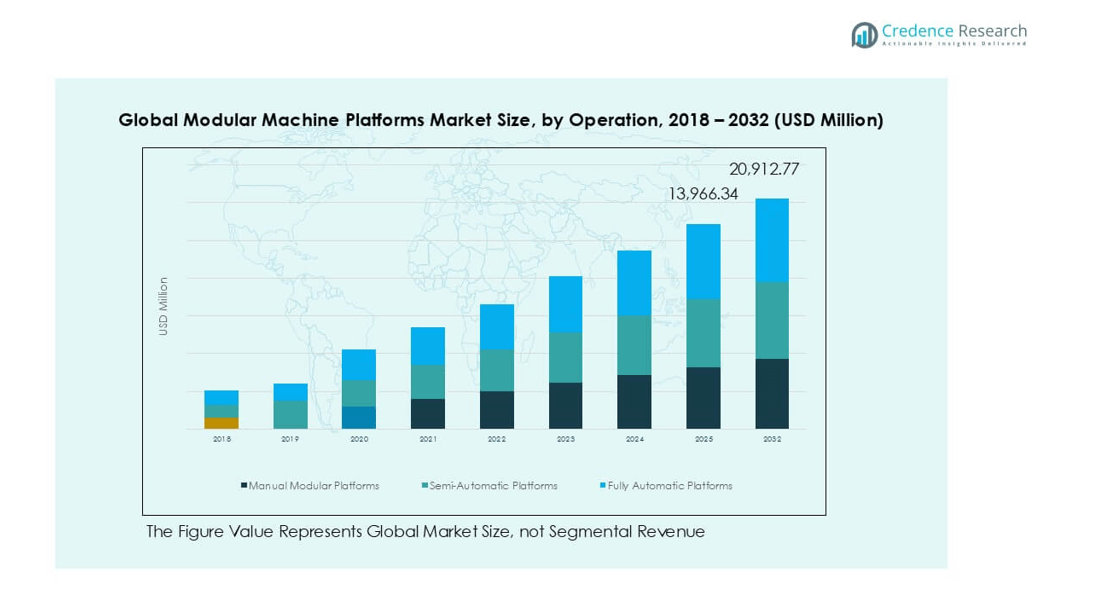

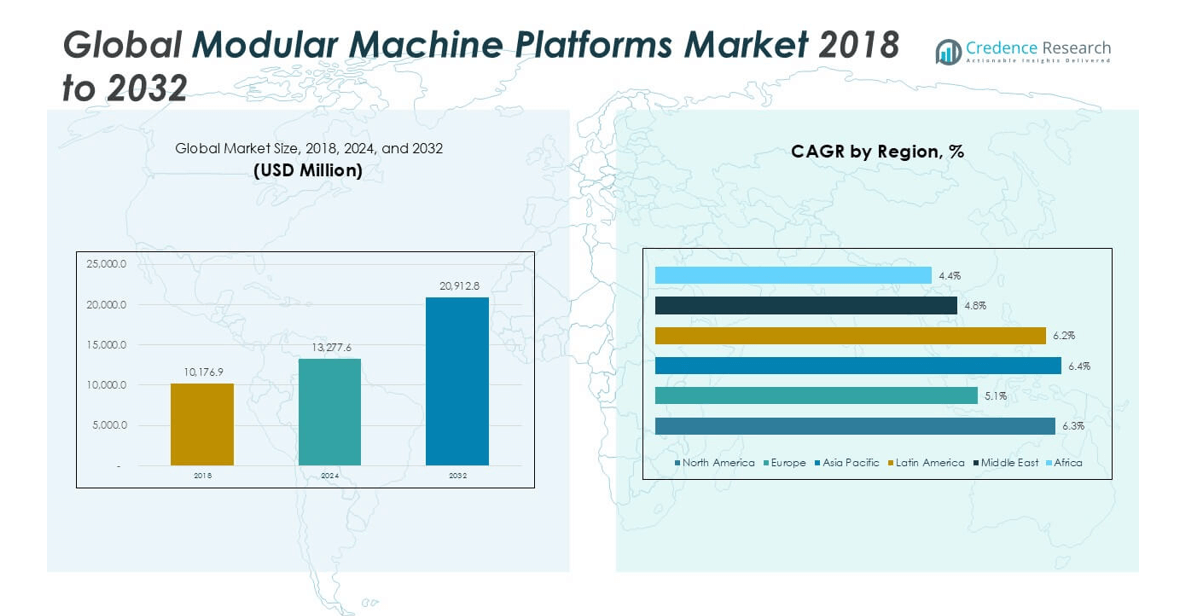

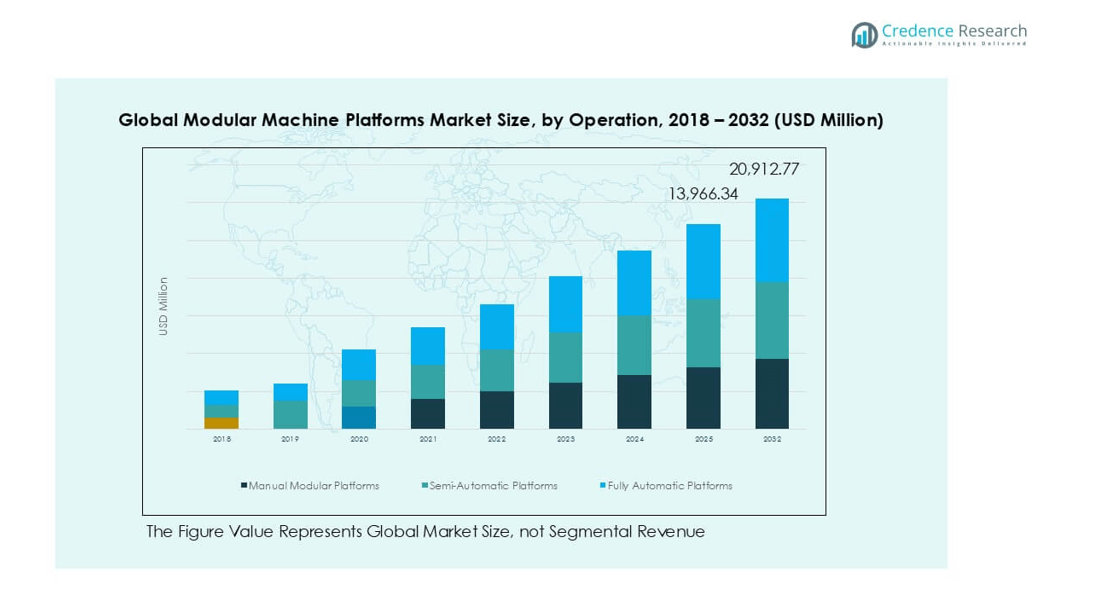

Global Modular Machine Platforms market size was valued at USD 10,176.9 million in 2018 to USD 13,277.6 million in 2024 and is anticipated to reach USD 20,912.8 million by 2032, at a CAGR of 5.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Machine Platforms Market Size 2024 |

USD 13,277.6 million |

| Modular Machine Platforms Market, CAGR |

5.94% |

| Modular Machine Platforms Market Size 2032 |

SD 20,912.8 million |

The Global Modular Machine Platforms market features strong competition among ABB Ltd., Rockwell Automation, Mitsubishi Electric Corporation, Bosch Rexroth, KUKA AG, Beckhoff Automation, B&R Industrial Automation, Festo AG & Co. KG, ATS Automation, and Schunk GmbH. These players lead through broad modular portfolios and automation expertise. Asia Pacific leads the market with an exact share of 36%, driven by large-scale manufacturing in China, Japan, and South Korea. Europe follows with a 28% share, supported by advanced industrial automation adoption. North America holds a 24% share, backed by automotive and electronics manufacturing strength. Leading companies maintain regional dominance through strong service networks, flexible platforms, and continuous technology upgrades.

Market Insights

- The market was valued at USD 10,176.9 million in 2018 and reached USD 13,277.6 million in 2024. It is projected to reach USD 20,912.8 million by 2032, growing at a CAGR of 5.94%. Asia Pacific holds 36% share, Europe 28%, and North America 24%.

- Demand rises due to flexible and scalable manufacturing needs. Modular assembly systems hold the largest product share. Automotive and electronics sectors drive adoption. Manufacturers prefer reduced downtime and faster line reconfiguration.

- Key trends include reconfigurable manufacturing systems and Industry 4.0 integration. Flexible modular platforms dominate the modularity segment. Packaging and assembly remain leading applications due to high SKU variation.

- Competition remains moderate with global players focusing on standardized modules. Companies compete on system compatibility, automation integration, and lifecycle cost efficiency. Strong service networks support customer retention.

- High integration complexity restrains adoption for smaller manufacturers. Capital cost sensitivity slows uptake in emerging regions. Africa and the Middle East together hold under 6% share but show gradual growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

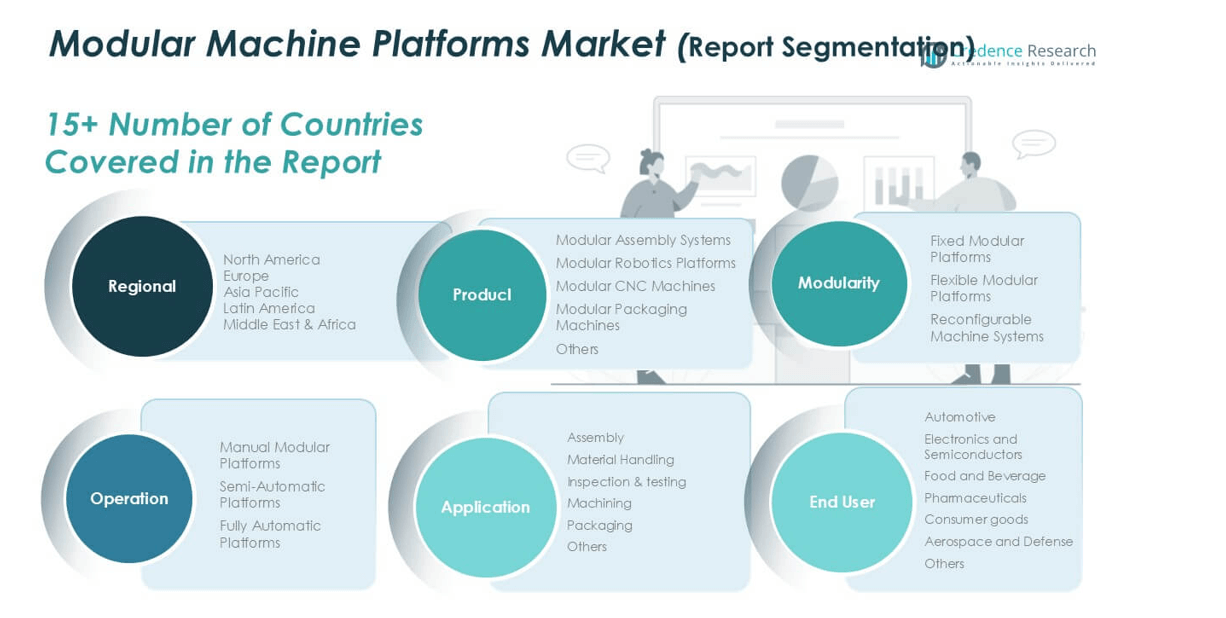

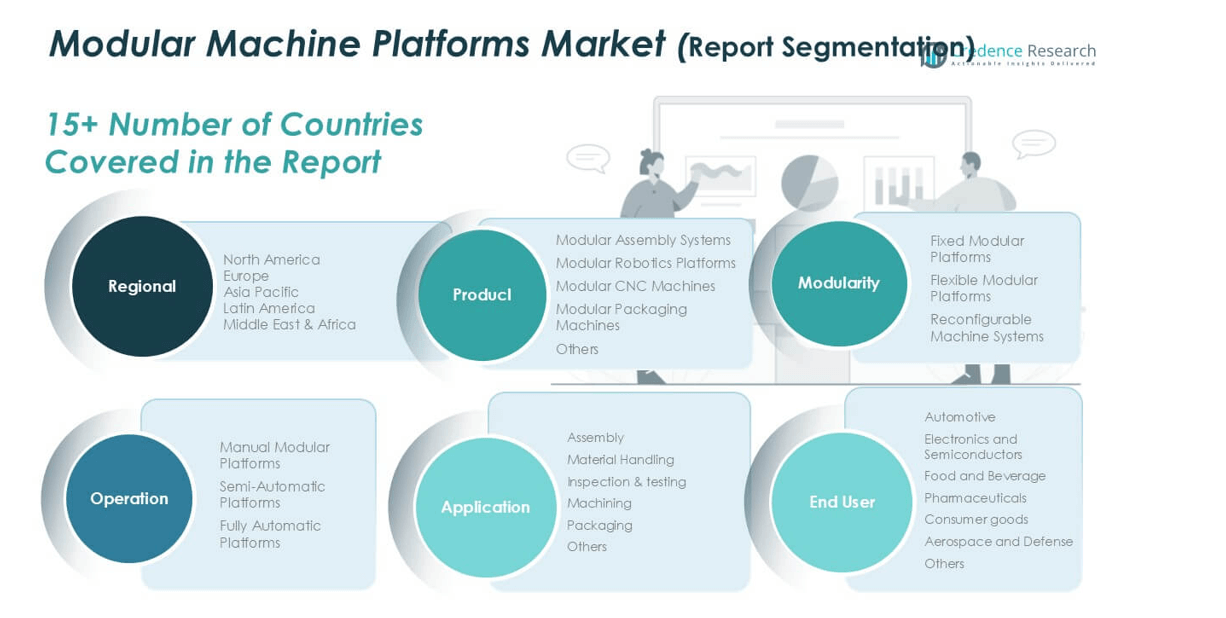

Market Segmentation Analysis:

By Product

The Product segment shows strong adoption across modular assembly systems, robotics platforms, CNC machines, and packaging machines. Modular Assembly Systems dominate this segment, accounting for the largest market share. Manufacturers favor these systems due to fast changeovers, standardized modules, and reduced downtime. Automotive and electronics plants rely on modular assembly for high-volume, repeatable tasks. Modular Robotics Platforms follow, driven by flexible automation needs. Modular CNC Machines gain traction in precision machining. Demand grows as factories seek scalable platforms that lower integration cost and support rapid production line upgrades.

- For instance, Bosch Rexroth’s TS 2plus modular transfer system supports loads up to 240 kg per workstation and conveyor speeds of up to 18 m/min (or up to 180 m/min with the optional TS 2 Booster linear motor components), enabling rapid line reconfiguration.

By Modularity

The Modularity segment highlights clear preference patterns among fixed, flexible, and reconfigurable platforms. Flexible Modular Platforms hold the dominant market share due to adaptability across product variants. These platforms support frequent layout changes without major hardware replacement. Electronics, consumer goods, and packaging plants drive demand for flexibility. Reconfigurable Machine Systems show steady growth, supported by mass customization trends. Fixed Modular Platforms remain relevant in stable, high-volume operations. The segment benefits from rising focus on production agility, shorter product life cycles, and reduced capital reinvestment needs.

- For instance, MAG IAS (now FFG Europe & Americas) manufactures highly flexible, reconfigurable machining systems designed to minimize production disruption through modular components, fast tool changes, and rapid setup times.

By Application

The Application segment reflects broad usage across assembly, material handling, inspection, machining, and packaging operations. Assembly represents the leading application, holding the highest market share. Manufacturers deploy modular platforms to streamline multi-step assembly tasks. Packaging follows closely, driven by SKU diversity and automation upgrades. Material handling adoption rises with warehouse automation trends. Inspection and testing benefit from modular sensor integration. Machining applications grow steadily in precision industries. Growth drivers include demand for efficient workflows, consistent quality output, and scalable automation across diverse manufacturing environments.

Key Growth Drivers

Rising Demand for Flexible and Scalable Manufacturing

Manufacturers increasingly demand flexible production systems to manage product variety. Modular machine platforms support fast line changes and scalable capacity. These platforms allow module replacement without full system redesign. Automotive and electronics sectors drive this shift strongly. Shorter product life cycles increase the need for rapid reconfiguration. Modular platforms reduce downtime during upgrades. They also lower capital risk during demand uncertainty. Plants expand capacity in phases instead of full investments. This approach improves return on capital. Standardized modules simplify engineering and commissioning. Companies respond faster to customer-specific orders. The driver remains strong across discrete manufacturing industries. Flexibility becomes a core competitiveness factor. Modular systems align well with lean manufacturing goals. This demand sustains long-term adoption across global production facilities.

- For instance, the Bosch Rexroth TS 2plus modular conveyor system supports workstation loads up to 240 kg and conveyor speeds of up to 150 m/min (3 m/s), enabling rapid line scaling without full rebuilds.

Accelerating Industrial Automation and Smart Factory Adoption

Industrial automation continues expanding across global manufacturing sites. Modular machine platforms integrate easily with automated environments. These platforms support robotics, sensors, and control systems. Manufacturers deploy them to improve throughput consistency. Smart factories require modular layouts for data-driven optimization. Modular machines simplify integration with MES and PLC systems. Automation investments favor systems with upgrade paths. Modular designs extend equipment life cycles. Labor shortages further accelerate automation demand. Companies seek machines that adapt without heavy retraining. Modular platforms reduce complexity during automation expansion. Industries prioritize predictable performance and uptime. This driver gains strength across both developed and emerging economies. Automation strategies increasingly depend on modular machine architectures.

- For instance, Siemens SIMATIC S7-1500 modular PLCs support up to 32 local modules and manage thousands of I/O points within one controller, enabling scalable automation expansion.

Cost Efficiency and Reduced Time-to-Market

Cost control remains a priority for manufacturing operations. Modular machine platforms lower engineering and installation costs. Reusable modules reduce custom design requirements. Faster deployment shortens production ramp-up time. Manufacturers launch products more quickly with modular systems. Reduced commissioning time improves operational readiness. Maintenance teams benefit from standardized spare parts. This reduces inventory and service costs. Modular upgrades avoid full machine replacement. Capital efficiency improves across long-term operations. The driver supports adoption among mid-sized manufacturers. Cost predictability attracts contract manufacturers. Time-to-market pressure strengthens this driver across competitive industries. Modular platforms deliver measurable operational savings.

Key Trends & Opportunities

Growth of Reconfigurable Manufacturing Systems

Reconfigurable manufacturing gains attention across high-mix production environments. Modular machine platforms form the foundation for this trend. Manufacturers adjust capacity and functions on demand. This supports mass customization strategies. Reconfigurable systems reduce dependency on dedicated equipment. Industries adopt these systems for volatile demand patterns. Aerospace and electronics show strong interest. Modular platforms enable fast functional retooling. Software-driven controls enhance reconfiguration speed. This trend opens opportunities for advanced module suppliers. OEMs develop plug-and-play machine units. The opportunity aligns with digital manufacturing roadmaps. Reconfigurable systems improve asset utilization. Adoption expands as customization demand rises globally.

- For instance, the principles of reconfigurable manufacturing systems (RMS), a field explored by companies like MAG IAS (now part of FFG Werke), allow for rapid function changes in theory, often using modular designs.

Integration with Digital and Industry 4.0 Technologies

Digital integration shapes future modular machine designs. Platforms now support real-time monitoring and analytics. Sensors embed directly into modular units. This improves predictive maintenance capabilities. Manufacturers gain better equipment visibility. Modular platforms simplify digital retrofitting. Data-driven optimization improves productivity outcomes. Industry 4.0 strategies favor modular architectures. OEMs offer smart modules with built-in connectivity. This trend creates value-added upgrade opportunities. End users prefer future-ready equipment. Digital compatibility extends machine relevance. The opportunity supports long-term service revenues. Modular platforms become central to smart factory ecosystems.

Key Challenges

High Initial System Integration Complexity

Despite benefits, integration complexity challenges adoption. Modular platforms still require careful system engineering. Compatibility issues arise across vendors. Customization needs increase integration effort. Smaller manufacturers face skill gaps. Software and hardware alignment adds complexity. Integration timelines may extend unexpectedly. This increases project risk perception. Lack of universal standards limits interchangeability. End users hesitate without proven integrators. Training requirements increase during early deployment. The challenge affects first-time adopters most. Vendors address this through standardized interfaces. Integration complexity remains a restraint on faster penetration.

Capital Cost Sensitivity in Price-Constrained Markets

Modular machine platforms often carry higher upfront costs. Price-sensitive markets delay adoption decisions. Smaller factories prioritize basic automation solutions. Return expectations vary across regions. Budget constraints limit investment flexibility. Modular benefits require long-term planning. Short-term cost focus reduces acceptance. Financing access affects purchasing behavior. Emerging markets show slower uptake. OEM pricing strategies influence demand patterns. Cost comparison with conventional machines impacts decisions. This challenge persists despite lifecycle savings. Vendors respond with phased deployment models. Capital sensitivity continues shaping market adoption rates.

Regional Analysis

North America

North America held a strong market share in 2018, valued at USD 2,408.87 million. The region accounted for roughly 24% of global revenue that year. Advanced automation adoption supported steady growth. The market reached USD 3,211.65 million in 2024 and is projected to reach USD 5,203.10 million by 2032. The region is expected to grow at a CAGR of 6.3%. Automotive, aerospace, and electronics manufacturing drive demand. Manufacturers favor modular platforms for flexibility and productivity. High investment capacity and early technology adoption sustain regional leadership.

Europe

Europe represented a significant market share of about 28% in 2018, with a value of USD 2,815.94 million. Strong industrial bases in Germany, France, and Italy support demand. The market grew to USD 3,509.45 million in 2024. It is projected to reach USD 5,182.18 million by 2032, registering a CAGR of 5.1%. Focus on smart manufacturing and energy efficiency supports adoption. Modular platforms help European manufacturers meet customization needs. Regulatory emphasis on productivity and sustainability further strengthens long-term growth across the region.

Asia Pacific

Asia Pacific dominated the global market in 2018 with the largest share of around 36%. The market was valued at USD 3,630.09 million that year. Rapid industrialization and factory expansion drive strong demand. The market reached USD 4,868.69 million in 2024. It is forecast to reach USD 7,946.85 million by 2032, growing at a CAGR of 6.4%. China, Japan, and South Korea lead adoption. Electronics and automotive manufacturing fuel growth. Cost-efficient production and capacity expansion remain key regional drivers.

Latin America

Latin America accounted for nearly 7.5% of global market share in 2018, with a value of USD 758.18 million. The market expanded to USD 1,001.70 million in 2024. It is expected to reach USD 1,604.01 million by 2032, registering a CAGR of 6.2%. Manufacturing modernization supports growth. Automotive and consumer goods industries adopt modular platforms steadily. Companies focus on flexible production to manage demand shifts. Gradual automation investment and regional industrial development sustain positive long-term prospects.

Middle East

The Middle East held a modest market share of about 3.3% in 2018, valued at USD 328.71 million. The market reached USD 403.26 million in 2024. It is projected to reach USD 581.38 million by 2032, growing at a CAGR of 4.8%. Industrial diversification programs drive adoption. Manufacturing growth outside oil sectors supports demand. Modular platforms appeal due to scalability and lower long-term costs. Government-backed industrial zones improve investment activity. The region shows steady but moderate expansion over the forecast period.

Africa

Africa accounted for roughly 2.3% of the global market in 2018, with a value of USD 235.09 million. The market increased to USD 282.81 million in 2024. It is expected to reach USD 395.25 million by 2032, at a CAGR of 4.4%. Growth remains gradual due to limited automation penetration. Industrial development initiatives support adoption. Food processing and basic manufacturing lead demand. Modular platforms attract interest for phased investment capability. Infrastructure improvements and policy support gradually strengthen regional market presence

Market Segmentations:

By Product

- Modular Assembly Systems

- Modular Robotics Platforms

- Modular CNC Machines

- Modular Packaging Machines

- Others

By Modularity

- Fixed Modular Platforms

- Flexible Modular Platforms

- Reconfigurable Machine Systems

By Application

- Assembly

- Material Handling

- Inspection and Testing

- Machining

- Packaging

- Others

By End User Type

- Automotive

- Electronics and Semiconductors

- Food and Beverage

- Pharmaceuticals

- Consumer Goods

- Aerospace and Defense

- Others

By Operation

- Manual Modular Platforms

- Semi-Automatic Platforms

- Fully Automatic Platforms

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Modular Machine Platforms market remains moderately consolidated. Leading players focus on modular architecture depth and system compatibility. Companies compete through flexible platform design and automation integration. Strong portfolios cover assembly, robotics, and motion control modules. Market leaders invest in standardized interfaces to reduce integration complexity. Strategic partnerships support turnkey project delivery. Firms expand software capabilities to enhance machine intelligence. Product differentiation relies on scalability and lifecycle cost benefits. Global players leverage strong service networks for customer retention. Regional firms compete on customization and pricing flexibility. Continuous product upgrades sustain competitive positioning. Vendors target automotive, electronics, and packaging sectors. Competitive intensity increases with smart factory adoption. Innovation and system reliability define long-term success. The market rewards suppliers offering fast deployment and upgrade paths.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB Ltd.

- ATS Automation

- B&R Industrial Automation

- Beckhoff Automation

- Bosch Rexroth

- Festo AG & Co. KG

- Mitsubishi Electric Corporation

- KUKA AG

- Rockwell Automation

- Schunk GmbH

Recent Developments

- In 2024, Rockwell Automation announced plans to increase its presence in India by expanding its technology workforce and opening more factories, including a new plant in Tamil Nadu.

- In 2024, Bosch Rexroth presented its vision for the future of automation at SPS 2024, highlighting open, modular solutions and a Linux-based operating system that fosters co-creation and partner integration. The company emphasized the importance of openness and collaboration in developing comprehensive automation solutions.

Report Coverage

The research report offers an in-depth analysis based on Product, Modularity, Application, End User Type, Operation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of flexible and reconfigurable machine architectures.

- Manufacturers will prioritize modular platforms to support product diversity.

- Automation expansion will strengthen demand across assembly and packaging operations.

- Integration with digital manufacturing systems will become standard practice.

- Demand from automotive and electronics sectors will remain strong.

- Modular robotics platforms will gain higher deployment across factories.

- Companies will focus on reducing system integration complexity.

- Emerging economies will increase investment in modular production lines.

- Service, upgrade, and retrofit offerings will grow in importance.

- Competition will intensify around scalability, reliability, and lifecycle efficiency.