Market Overview

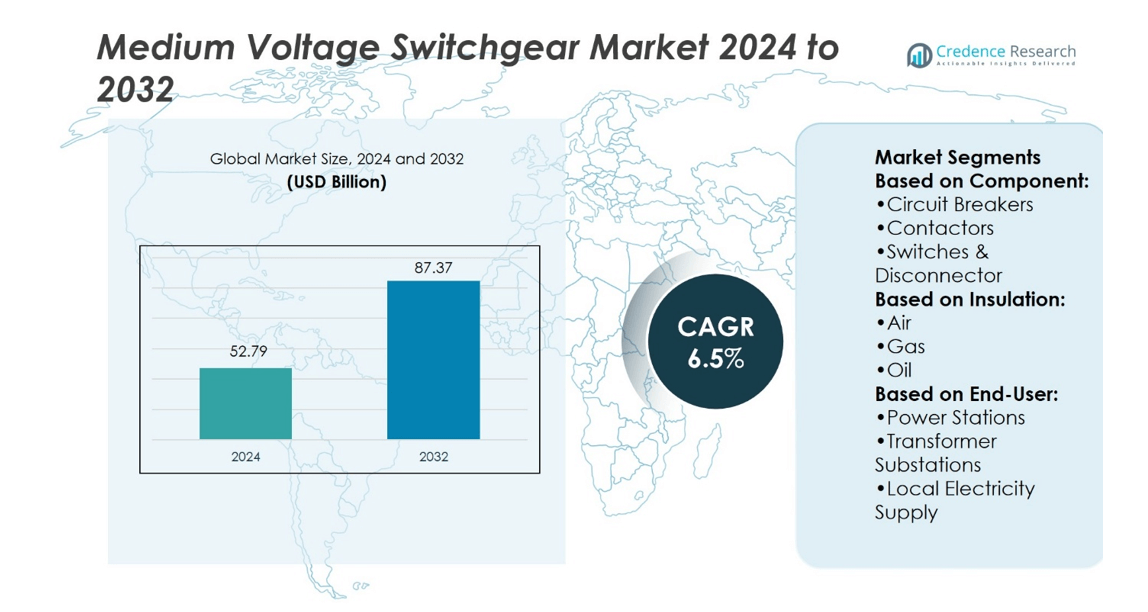

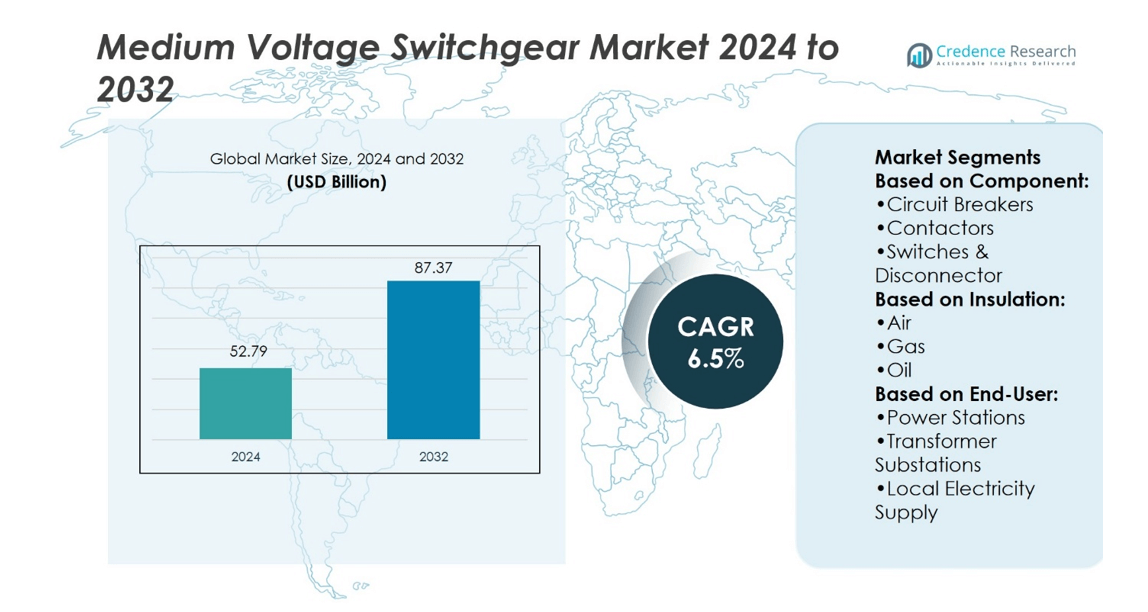

Medium Voltage Switchgear Market was valued at USD 52.79 billion in 2024 and is anticipated to reach USD 87.37 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Switchgear Market Size 2024 |

USD 52.79 billion |

| Medium Voltage Switchgear Market, CAGR |

6.5% |

| Medium Voltage Switchgear Market Size 2032 |

USD 87.37 billion |

The Medium Voltage Switchgear Market advances through strong drivers and evolving trends that reshape global demand. Rising investments in grid modernization, renewable integration, and urban electrification accelerate adoption of advanced switchgear solutions. Governments enforce strict environmental standards, prompting a shift toward SF₆-free and eco-friendly insulation technologies. Industries demand compact, modular, and digital-ready systems that improve reliability, enhance safety, and enable predictive maintenance. Smart grid expansion drives wider use of IoT-enabled monitoring and automation features. Growing renewable projects, industrial automation, and data center expansion further strengthen long-term opportunities, positioning medium voltage switchgear as a core element of next-generation power distribution networks.

North America holds a major share of the Medium Voltage Switchgear Market, driven by grid modernization and renewable energy projects, while Europe emphasizes sustainable, SF₆-free technologies under strict regulations. Asia-Pacific leads in growth with rapid urbanization, industrial expansion, and large-scale electrification programs. Latin America and the Middle East & Africa show steady demand through infrastructure development and renewable adoption. Key players shaping the competitive landscape include ABB, Eaton, General Electric, Hitachi, Fuji Electric, and Hyundai Electric.

Market Insights

- Medium Voltage Switchgear Market was valued at USD 52.79 billion in 2024 and is projected to reach USD 87.37 billion by 2032, at a CAGR of 6.5%.

- Rising demand from grid modernization, renewable integration, and urban electrification fuels adoption of advanced switchgear.

- Trends highlight a shift toward SF₆-free insulation, modular designs, and digital-ready systems with predictive maintenance.

- Competitive landscape features global players focusing on sustainability, compact design, and IoT-enabled monitoring solutions.

- High initial investment costs and regulatory compliance challenges remain key restraints for wider adoption.

- Regional analysis shows North America leading in modernization projects, Europe focusing on sustainable designs, and Asia-Pacific recording fastest growth with large-scale electrification.

- Latin America and the Middle East & Africa add steady opportunities through infrastructure upgrades and renewable expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Grid Modernization and Infrastructure Expansion

The Medium Voltage Switchgear Market grows strongly through continuous investment in power infrastructure. Governments allocate significant budgets to modernize aging grids and expand electrification programs. Urbanization and industrialization create steady demand for reliable distribution networks. Smart cities require advanced switchgear to manage higher load densities and integrate renewable power. It supports grid stability by ensuring efficient load management. Manufacturers respond by developing compact and flexible designs tailored for space-constrained environments.

- For instance, GE Vernova’s M-Tier medium-voltage switchgear is designed for renewable energy integration and supports voltages from 3.6 kV to 17.5 kV. Each compartment withstands a short-time current of 6 kA for one second, and with fuses, it can reach 50 kA, enabling protection in high-fault scenarios.

Growing Integration of Renewable Energy Sources in Power Distribution

The shift toward renewable energy sources accelerates the adoption of medium voltage switchgear. Solar, wind, and hydropower projects require efficient grid connection and advanced protection systems. The switchgear segment supports distributed energy integration by managing variability in generation. It provides fault detection, isolation, and reliable performance across hybrid power systems. Governments worldwide set ambitious targets for renewable deployment, driving consistent demand. The Medium Voltage Switchgear Market benefits directly from this transformation toward cleaner energy ecosystems.

- For instance, ABB’s UniGear ZS1 air-insulated switchgear for primary distribution handles up to 24 kV, 4,000 A, and 50 kA short-circuit current rating, all within a 500 mm wide compact footprint.

Increasing Emphasis on Safety, Reliability, and Regulatory Compliance

Safety and regulatory standards push utilities and industries to invest in upgraded switchgear. Modern solutions include arc-resistant enclosures, vacuum interrupters, and insulated busbars. It reduces risks of fire, electrical faults, and downtime in mission-critical facilities. Regulatory frameworks mandate adoption of eco-friendly insulating gases and energy-efficient designs. Compliance with international standards enhances confidence in equipment reliability. The Medium Voltage Switchgear Market reflects this trend through steady innovations that meet evolving safety norms.

Adoption of Smart Technologies and Digital Monitoring in Power Systems

The rise of smart grids promotes advanced switchgear equipped with IoT and digital monitoring. Utilities deploy intelligent devices that offer real-time diagnostics and predictive maintenance. It helps extend service life, reduce failures, and minimize operational costs. Integration of sensors and communication modules improves network visibility and control. Grid operators value automation for quick fault isolation and faster restoration. The Medium Voltage Switchgear Market embraces digital transformation, positioning smart switchgear as an essential component of next-generation power distribution.

Market Trends

Shift Toward Environmentally Friendly and Sustainable Switchgear Solutions

The Medium Voltage Switchgear Market reflects a clear move toward eco-friendly technology. Manufacturers replace SF₆ gas with alternative insulating mediums such as vacuum or air-based systems. It helps reduce greenhouse gas emissions while meeting international climate goals. Governments and regulators support green technologies through strict environmental standards. Industries respond by investing in sustainable switchgear designs for new projects. The trend strengthens the role of clean technology in long-term market growth.

- For instance, Fuji’s VC-V20A-1 24 kV air-insulated switchgear cuts installation area by 20% compared to its prior model rated at the same capacity (24 kV, 1,250 A) by optimizing insulation structure and circuit breaker layout.

Rising Preference for Modular and Compact Switchgear Designs

Modular and compact switchgear configurations are gaining importance across urban and industrial settings. The Medium Voltage Switchgear Market adapts to demand for equipment that fits in limited spaces. It reduces installation time and simplifies maintenance in modern facilities. Utilities prefer modular solutions for their scalability and ease of integration. Compact switchgear also enhances safety by reducing exposure to high-voltage parts. This trend ensures better flexibility in both retrofit and new installations.

- For instance, BHEL has specified and supplied 11 kV RMUs with 630 A load-break switches and vacuum circuit breakers (VCB). The inclusion of both switch types is common for protection and switching in these substations.

Growing Deployment of Digital and Smart Grid-Compatible Switchgear

Digitalization shapes the next phase of innovation in switchgear manufacturing. The Medium Voltage Switchgear Market incorporates IoT sensors, advanced control units, and predictive analytics. It improves fault detection, asset monitoring, and operational efficiency. Smart grid-compatible equipment supports real-time load balancing and automation. Utilities adopt digital switchgear to ensure faster fault isolation and reduced downtime. This trend highlights the increasing role of intelligent systems in power distribution networks.

Expansion of Switchgear Applications in Renewable Energy Projects

Renewable integration drives new applications for advanced switchgear. The Medium Voltage Switchgear Market supports solar farms, wind parks, and distributed power plants. It provides stable performance under fluctuating loads and challenging environmental conditions. Renewable developers seek durable, low-maintenance systems for remote and offshore locations. Hybrid switchgear with advanced protection features meets the needs of these projects. The trend establishes medium voltage switchgear as a backbone of clean energy infrastructure.

Market Challenges Analysis

High Costs of Advanced Technology and Installation Limit Widespread Adoption

The Medium Voltage Switchgear Market faces cost barriers in deploying advanced systems. Eco-friendly alternatives to SF₆, digital monitoring tools, and arc-resistant designs increase production expenses. It raises overall project costs for utilities and industrial customers. Smaller operators in developing regions often delay adoption due to limited budgets. Installation and maintenance of modern switchgear require specialized expertise, adding further expense. These financial hurdles slow market penetration of next-generation technologies.

Supply Chain Constraints and Rising Regulatory Pressures Create Operational Risks

Global supply chain disruptions affect timely delivery of switchgear components. The Medium Voltage Switchgear Market experiences delays in semiconductor parts, insulating materials, and specialty metals. It challenges manufacturers to meet project deadlines and contractual obligations. Regulatory pressures to reduce greenhouse gases push companies to redesign products at higher costs. Frequent revisions in safety and environmental standards create uncertainty for long-term planning. These combined pressures test the resilience and competitiveness of manufacturers worldwide.

Market Opportunities

Expanding Investments in Renewable Energy and Grid Modernization

The Medium Voltage Switchgear Market benefits from large-scale investment in renewable energy projects. Solar and wind farms require reliable medium voltage equipment to manage power integration. It enables grid operators to handle variable output and ensure stable supply. Governments fund modernization programs that replace aging infrastructure with advanced switchgear. Urban electrification projects create steady demand for compact and efficient systems. These opportunities highlight the essential role of switchgear in supporting sustainable power transitions.

Rising Demand for Smart Infrastructure and Industrial Automation

Smart infrastructure projects create new avenues for medium voltage switchgear deployment. The Medium Voltage Switchgear Market aligns with global demand for IoT-enabled systems and predictive analytics. It provides real-time monitoring, fault isolation, and reduced downtime in critical networks. Industrial automation expands the need for switchgear that ensures reliable power to robotics and advanced machinery. Data centers and transport systems add further opportunities through specialized high-capacity solutions. These developments strengthen the market’s long-term growth outlook.

Market Segmentation Analysis:

By Component

The Medium Voltage Switchgear Market divides into circuit breakers, contactors, switches and disconnectors, fuses, and others. Circuit breakers hold a leading role due to their ability to interrupt fault currents quickly and ensure reliable protection. It remains vital for power stations and industrial sites that demand continuous uptime. Contactors gain traction in automation environments where frequent switching operations are required. Switches and disconnectors play a critical role in isolating circuits during maintenance, enhancing safety and operational flexibility. Fuses maintain demand in smaller installations where low-cost protection is adequate. The “others” category includes hybrid solutions and protective relays that support evolving network requirements.

- For instance, Hitachi Energy’s EconiQ 420 kV SF₆-free circuit breaker achieved a 63 kA short-circuit interrupting rating in both GIS and dead-tank applications using a C4-FN/CO₂/O₂ gas mix.

By Insulation

Insulation type remains a defining factor in performance and sustainability. Air-insulated switchgear is widely adopted for standard applications where cost efficiency and simplicity matter. Gas-insulated switchgear provides compact size and high reliability in urban or high-voltage installations. It supports projects were space constraints limit equipment layout. Oil-insulated designs, though less common, serve in legacy networks and specific industrial environments. Vacuum insulation records strong adoption due to its eco-friendly profile and superior arc-quenching properties. The “others” category features advanced solid dielectric and hybrid materials, offering niche applications for specialized networks.

- For instance, E+I Engineering (now Vertiv) operates manufacturing facilities across Ireland, the USA, and UAE. The company offers customized indoor MV switchgear solutions rated for various voltages, including models for up to 15kV and IEC-rated models up to 40.5 kV.

By End User

End-user segments shape deployment strategies across utilities and industries. Power stations demand high-capacity switchgear that supports generation and transmission functions under heavy loads. The Medium Voltage Switchgear Market expands in transformer substations where equipment ensures grid stability and reliable distribution. Local electricity supply networks adopt medium voltage switchgear to enhance service quality and reduce outages. It helps utilities manage peak demand and improve resilience in urban grids. The “others” segment includes rail networks, data centers, and heavy industries requiring tailored protection and monitoring. These sectors drive demand for digital-ready, compact, and long-life solutions.

Segments:

Based on Component:

- Circuit Breakers

- Contactors

- Switches & Disconnector

Based on Insulation:

Based on End-User:

- Power Stations

- Transformer Substations

- Local Electricity Supply

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 28% share of the Medium Voltage Switchgear Market, supported by grid modernization initiatives and regulatory standards. The region invests heavily in upgrading aging distribution networks and adopting digital switchgear across utilities. It benefits from strong emphasis on renewable energy integration, particularly wind and solar, which require advanced medium voltage infrastructure. U.S. utilities deploy eco-friendly gas-free switchgear to meet sustainability mandates, while Canada advances hydroelectric projects that demand reliable equipment. It also records steady adoption of IoT-enabled monitoring systems, improving fault detection and operational efficiency. The industrial base in sectors such as oil and gas, manufacturing, and data centers adds further momentum. North America demonstrates strong adoption of compact, arc-resistant, and smart solutions, reinforcing its leadership position in high-value applications.

Europe

Europe represents 24% share of the Medium Voltage Switchgear Market, led by stringent environmental policies and renewable integration goals. The European Union supports rapid replacement of SF₆-based switchgear with sustainable alternatives, stimulating demand for vacuum and air-insulated systems. Germany, France, and the U.K. drive investments in wind farms, offshore grid connections, and energy-efficient substations. It also witnesses rapid deployment of digital-ready switchgear with predictive maintenance features. European manufacturers remain at the forefront of innovation, supplying compact and modular products to meet urban infrastructure challenges. Aging infrastructure across Eastern Europe adds further demand for replacements and upgrades. Europe’s focus on green energy and smart grid compatibility positions the region as a key hub for sustainable technology adoption.

Asia-Pacific

Asia-Pacific accounts for 34% share of the Medium Voltage Switchgear Market, making it the largest regional segment. Rapid urbanization and industrialization in China, India, and Southeast Asia drive significant expansion in electricity demand. Governments in the region fund large-scale infrastructure projects, including smart cities and transport electrification. It supports high demand for medium voltage switchgear across distribution networks, power stations, and industrial plants. China leads with massive renewable integration programs, while India focuses on electrification of rural and semi-urban areas. Japan and South Korea prioritize digital grid solutions, increasing deployment of IoT-based switchgear. Asia-Pacific continues to show strong growth potential with rising investments in mining, offshore wind, and industrial automation.

Latin America

Latin America secures 7% share of the Medium Voltage Switchgear Market, driven by urban electrification and renewable projects. Brazil and Mexico dominate demand through expansion of hydroelectric and solar capacities. It also records rising investment in grid reinforcement to improve reliability and reduce losses. Local electricity distribution utilities deploy medium voltage switchgear to handle peak loads in growing cities. Chile and Argentina invest in wind energy, creating steady opportunities for advanced switchgear adoption. The region faces budget constraints but attracts international partnerships to support technology transfer. Latin America represents an emerging market where cost-effective, durable, and flexible switchgear solutions gain preference.

Middle East & Africa

The Middle East & Africa region contributes 7% share of the Medium Voltage Switchgear Market, led by energy diversification and infrastructure expansion. GCC countries invest in high-capacity substations to support oil, gas, and industrial projects. It also witnesses strong demand from renewable projects, including solar farms in the UAE and wind power in Egypt. Africa records steady adoption of medium voltage switchgear through rural electrification and urban grid modernization programs. Mining sectors in South Africa and Zambia require durable systems capable of handling heavy-duty operations. Governments prioritize reliability and safety, supporting the adoption of advanced switchgear across utilities. The region emerges as a strategic growth market with increasing focus on energy security and sustainable infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Medium Voltage Switchgear Market include HD Hyundai Electric, General Electric, CG Power and Industrial Solutions, Hyosung Heavy Industries, Eaton, ABB, Fuji Electric, Bharat Heavy Electricals, Hitachi, and E + I Engineering. The Medium Voltage Switchgear Market is highly competitive, with global and regional manufacturers focusing on advanced technologies, sustainable designs, and digital integration. Companies differentiate their offerings through eco-friendly insulation solutions, compact modular systems, and IoT-enabled monitoring features. Competition intensifies as utilities and industries demand smart grid-ready switchgear capable of predictive maintenance and real-time fault detection. Manufacturers invest in research and development to replace traditional SF₆-based systems with alternatives that align with strict environmental regulations. Partnerships with utilities, governments, and industrial clients play a vital role in securing large-scale contracts across renewable projects, substations, and smart infrastructure developments. Pricing strategies, energy efficiency certifications, and after-sales services are increasingly important for maintaining customer loyalty and market presence. The market also sees strong momentum from mergers and acquisitions, which help expand portfolios and strengthen regional presence. Continuous innovation in digital monitoring, safety standards, and sustainable manufacturing practices defines the competitive landscape, positioning technologically advanced and environmentally responsible companies for long-term leadership.

Recent Developments

- In December 2024, RMC Switchgears announced plans to build a solar module manufacturing facility in Chaksu, Jaipur, Rajasthan. The facility will have an annual production capacity of 1 GWp of solar modules. It will set up the facility at Badodiya Village of Chaksu Tehsil in Jaipur.

- In October 2024, Mitsubishi announced the establishment of an advanced switchgear production facility in Western Pennsylvania. The company dedicated to this project to construct a factory that will simultaneously create 200 new positions.

- In June 2024, Siemens announced that it will be investing to expand its switchgear manufacturing plant in Frankfurt, Germany. The company inaugurated a new high-speed warehouse and expanded production area, which is expected to begin operations early in 2025.

- In May 2024, ABB has unveiled a state-of-the-art injection molding manufacturing facility in Evergem, Belgium, near Ghent, with an investment. This newly established site aims to meet the growing demand for secure, intelligent, and sustainable electrification solutions across Europe.

Report Coverage

The research report offers an in-depth analysis based on Component, Insulation, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with strong demand from renewable energy integration projects.

- Digital switchgear with IoT and predictive maintenance will see rapid adoption.

- Eco-friendly insulation alternatives to SF₆ gas will dominate new product development.

- Compact and modular designs will gain preference in urban infrastructure projects.

- Grid modernization programs worldwide will accelerate medium voltage switchgear deployment.

- Data centers and transport electrification will emerge as key end-user segments.

- Investments in rural electrification will support growth in developing economies.

- Industrial automation will increase demand for reliable and intelligent switchgear.

- Manufacturers will focus on sustainable production and energy-efficient technologies.

- Strategic collaborations and regional expansions will shape competitive positioning.