Market Overview

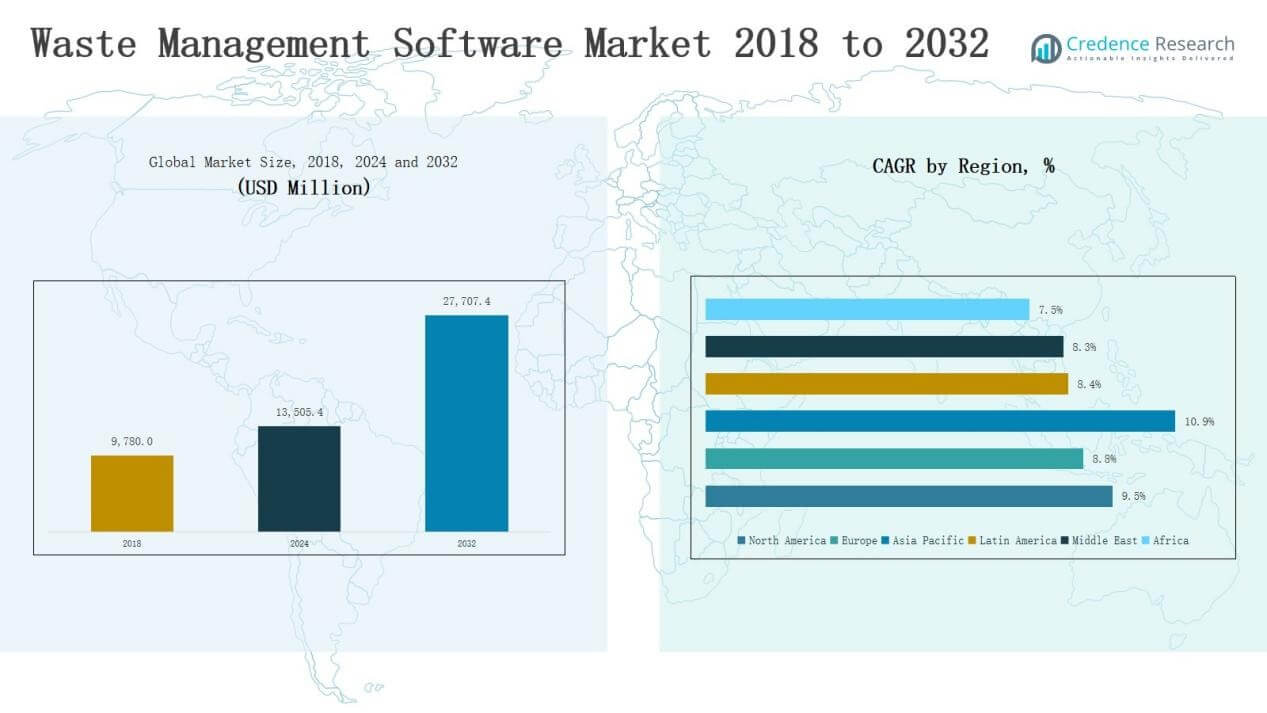

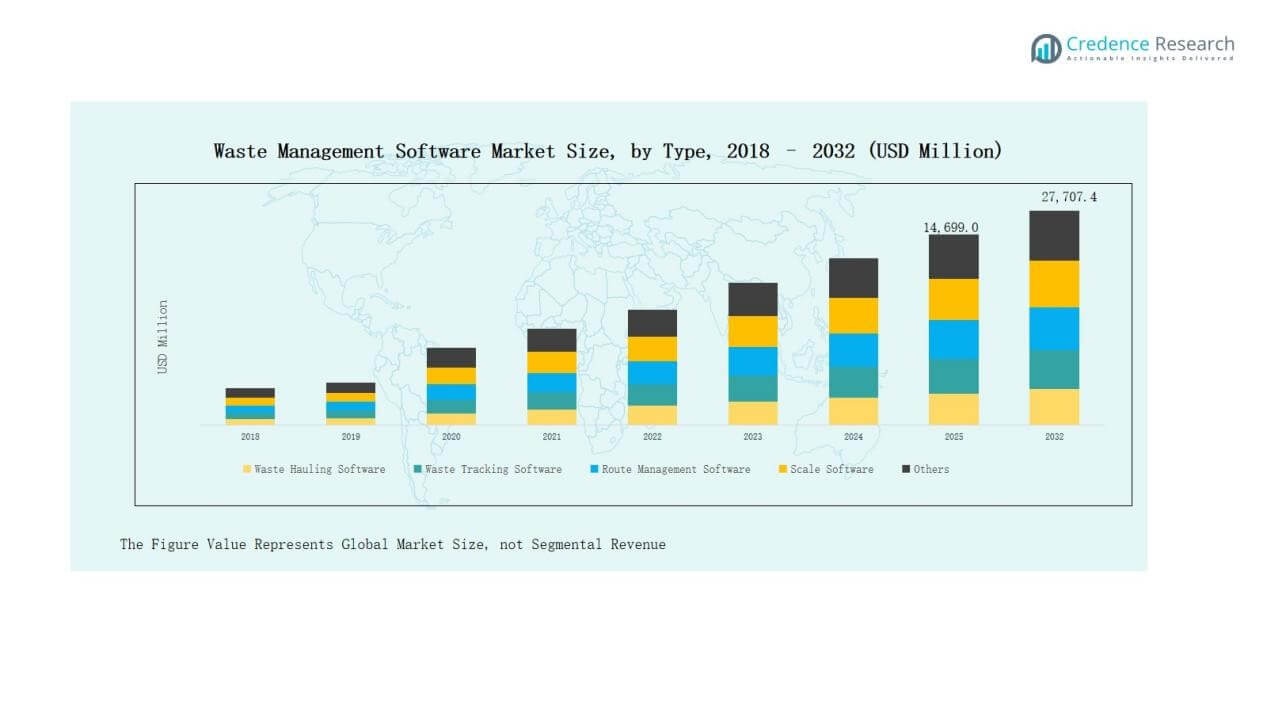

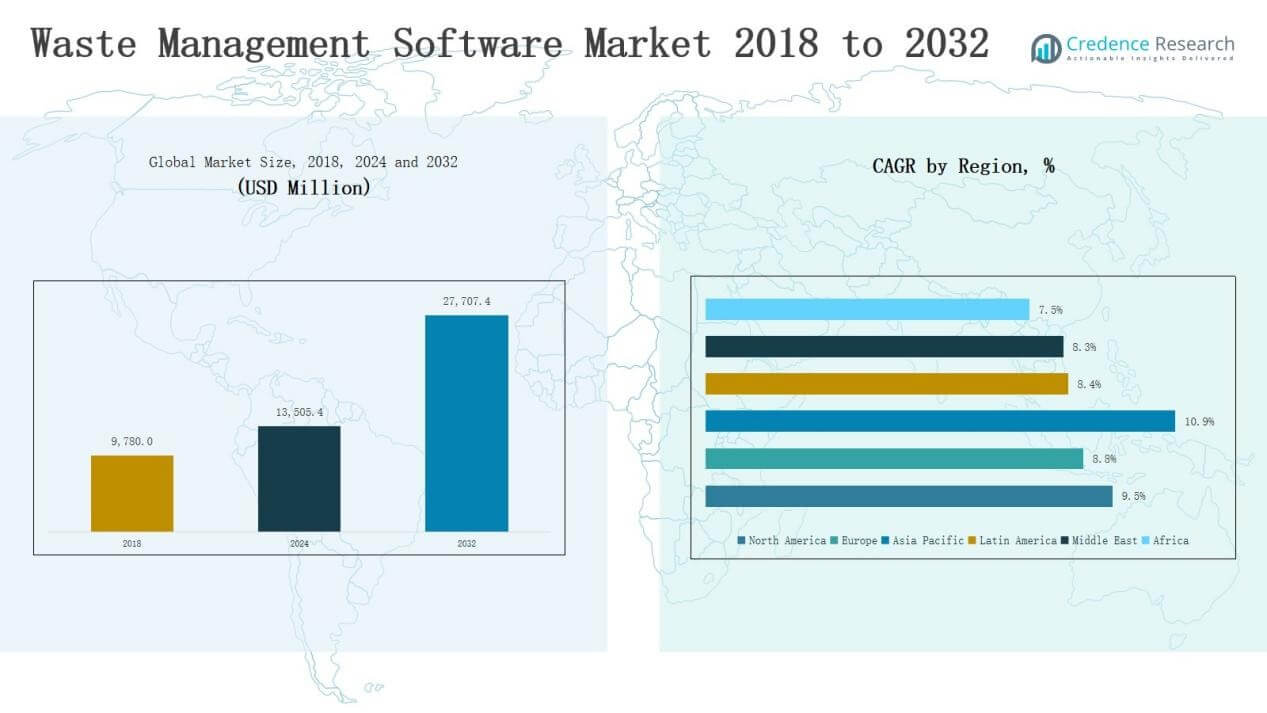

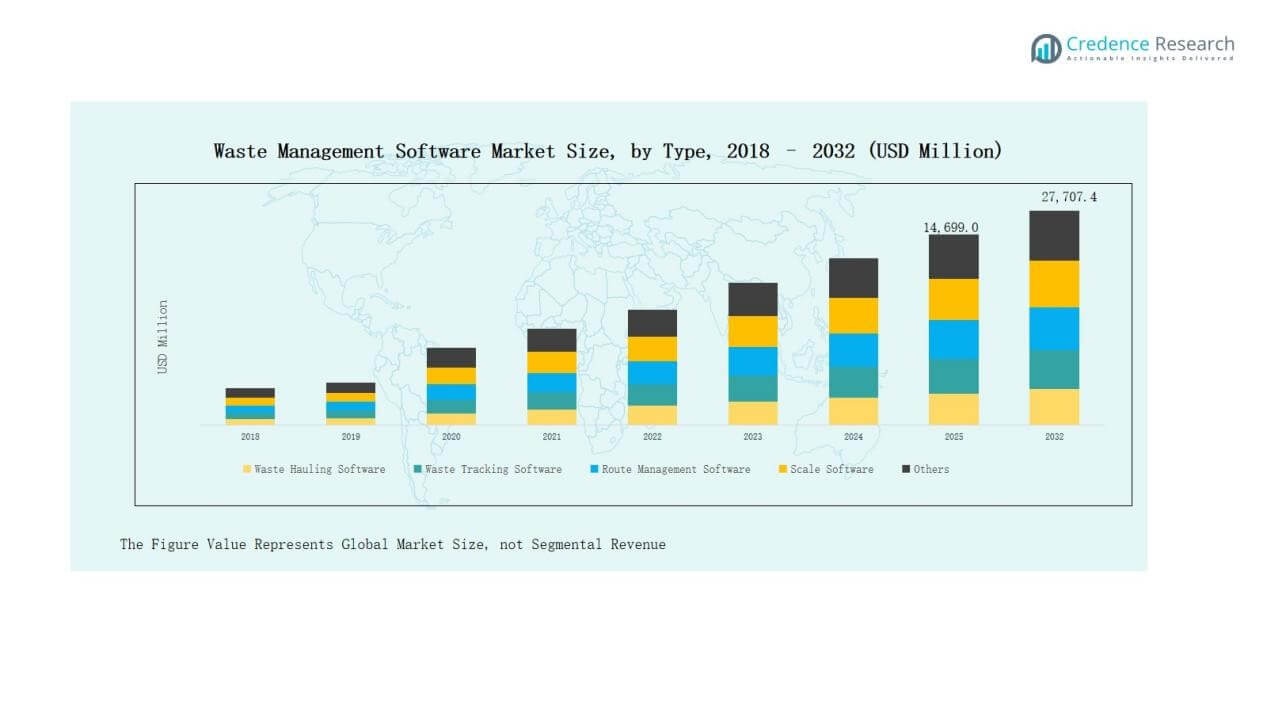

Waste Management Software Market size was valued at USD 9,780.0 million in 2018 to USD 13,505.4 million in 2024 and is anticipated to reach USD 27,707.4 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waste Management Software Market Size 2024 |

USD 13,505.4 Million |

| Waste Management Software Market, CAGR |

9.5% |

| Waste Management Software Market Size 2032 |

USD 27,707.4 Million |

The Waste Management Software Market is shaped by established players such as Wastebits, AMCS Group, TRUX, WAM Software, Sequoia Waste Solutions, SEE Forge, Thoughtful Systems, DesertMicro, SFS Chemical Safety, and Delta Equipment Systems, Inc. These companies compete through advanced product portfolios, cloud-based solutions, and integration with IoT and RFID technologies to improve efficiency and compliance. Strategic partnerships with municipalities, industrial operators, and healthcare providers strengthen their market presence, while smaller vendors focus on cost-effective and niche applications. North America leads the global market with a 36% share in 2024, driven by early technology adoption, strong regulatory frameworks, and large-scale municipal projects.

Market Insights

- The Waste Management Software Market grew from USD 9,780.0 million in 2018 to USD 13,505.4 million in 2024, and is expected to reach USD 27,707.4 million by 2032.

- Leading players include Wastebits, AMCS Group, TRUX, WAM Software, Sequoia Waste Solutions, SEE Forge, Thoughtful Systems, DesertMicro, SFS Chemical Safety, and Delta Equipment Systems, Inc.

- Waste hauling software leads with 28% share in 2024, while cloud-based solutions dominate the component segment with 63% share, reflecting a strong digital transformation trend.

- The municipal application segment holds the highest share at 41% in 2024, supported by increasing adoption of digital platforms for collection efficiency, compliance, and reduced operational costs.

- North America leads with 36% share in 2024, followed by Europe at 28% and Asia Pacific at 22%, with APAC expected to grow the fastest at 9% CAGR.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Software Type

Waste hauling software leads the market with a 28% share in 2024, driven by the growing need for optimized logistics and automated billing solutions in waste collection services. Route management software follows closely, supported by rising demand for efficient fleet scheduling in urban areas. Recycling software also shows strong momentum as governments enforce stricter sustainability and circular economy policies. The segment continues to evolve with scale and tracking software providing enhanced transparency in landfill management and waste monitoring.

By Application

The municipal segment dominates with a 41% share in 2024, as city authorities increasingly adopt digital tools to streamline collection, improve compliance, and reduce operational costs. Manufacturing follows, propelled by strict regulations on industrial waste handling and reporting. Healthcare emerges as a growing segment, reflecting higher adoption of tracking solutions for hazardous waste. Retail and other commercial applications also support growth due to rising emphasis on compliance and eco-friendly practices.

- For instance, New York City’s Department of Sanitation deployed smart waste bins equipped with sensors from Bigbelly, which helped reduce the frequency of waste collections. The manufacturer reports that its technology can reduce collection trips by as much as 80%, which, in turn, cuts fuel use.

By Component

Cloud-based software accounts for a 63% share in 2024, making it the dominant component segment. The shift is driven by its scalability, real-time data access, and cost-efficiency, which strongly appeal to both public and private operators. On-premise solutions retain relevance in organizations with strict data security policies, though their adoption is slowing. The continued preference for cloud deployment highlights the industry’s move toward digital transformation and integrated waste management systems.

- For instance, Google Cloud’s deployment with Veolia has enabled AI-driven waste tracking and optimization across multiple regions, allowing more accurate forecasting and recycling efficiency.

Market Overview

Key Growth Drivers

Rising Urbanization and Waste Volumes

The increasing pace of urbanization worldwide is leading to higher municipal solid waste generation, creating significant pressure on waste collection and disposal systems. Cities face challenges in managing growing waste volumes while maintaining efficiency and compliance with environmental standards. Waste management software addresses these needs by optimizing route planning, enhancing collection monitoring, and improving reporting systems. Municipal authorities and private operators increasingly adopt these solutions to streamline operations and reduce costs, making urban waste growth a key driver of market expansion.

- For instance, Rubicon Technologies partnered with the City of Houston in 2022 to integrate its RUBICONSmartCity platform, enabling real-time tracking of over 390 city waste and recycling trucks and improving route efficiency.

Stringent Environmental Regulations

Governments are tightening environmental regulations related to waste disposal, recycling, and emissions, compelling organizations to adopt digital solutions. Compliance requirements such as waste tracking, documentation, and hazardous material handling create strong demand for advanced management platforms. Waste management software ensures accuracy in reporting and reduces compliance risks, while enabling organizations to align with sustainability goals. Industries such as manufacturing and healthcare are particularly focused on these solutions to meet regulatory standards. This regulatory push continues to fuel software adoption across multiple sectors.

- For instance, in 2018, the U.S. Environmental Protection Agency (EPA) launched its electronic Manifest (e-Manifest) system, requiring companies nationwide to digitally track hazardous waste shipments, which has accelerated the adoption of waste management platforms.

Digital Transformation in Waste Management

The industry is undergoing a digital transformation, with increasing investment in cloud-based platforms, IoT integration, and data analytics. Organizations seek greater operational visibility and control through real-time tracking, predictive maintenance, and automated billing. Waste management software enables integration with RFID tags, GPS systems, and mobile applications, improving accuracy and efficiency. The adoption of digital solutions reduces manual errors and enhances customer service, making technology transformation one of the most influential growth drivers shaping the competitive landscape.

Key Trends & Opportunities

Integration of IoT and Smart Sensors

The adoption of IoT and smart sensor technologies is transforming waste management into a more data-driven and predictive system. Sensors embedded in bins provide real-time information on fill levels, enabling optimized collection schedules and reducing unnecessary trips. When combined with waste management software, these technologies improve efficiency, cut fuel costs, and lower carbon emissions. This trend presents opportunities for vendors to integrate advanced IoT solutions into their platforms, positioning them as essential partners in the shift toward smart city infrastructure.

- For instance, Bridgera implemented an IoT-based system providing real-time analytics to waste management teams, streamlining operations and enhancing the experience for both residents and collection drivers.

Growth in Recycling and Circular Economy Initiatives

Global emphasis on recycling and circular economy policies is generating new opportunities for specialized waste management solutions. Recycling-focused software supports better tracking of recyclable materials, ensures regulatory compliance, and improves profitability for recycling operators. Governments and corporations are investing heavily in recycling programs to reduce landfill dependency. This creates strong demand for digital platforms that can optimize material recovery and reporting processes. Vendors offering tailored recycling solutions are well-positioned to capture growth as sustainability becomes a priority worldwide.

- For instance, in 2024, Microsoft announced an update to its Cloud for Sustainability platform that helps companies track, manage, and report material recovery data in real time.

Key Challenges

High Implementation and Integration Costs

The adoption of waste management software often involves significant initial costs for licensing, training, and system integration. Smaller municipalities and private operators face budgetary constraints that limit adoption despite the long-term benefits. The complexity of integrating software with existing infrastructure and hardware, such as GPS and RFID, further raises expenses. These financial barriers slow adoption, particularly in developing regions, where cost sensitivity is high. Vendors must address affordability and scalability to expand their customer base effectively.

Data Security and Privacy Concerns

As cloud-based platforms dominate the market, data security and privacy concerns have become critical challenges. Waste management software stores sensitive information related to municipalities, industries, and consumer operations. Breaches or unauthorized access could result in regulatory penalties and reputational damage. Organizations in sectors like healthcare and manufacturing are especially cautious about adopting cloud-based platforms due to compliance risks. Ensuring robust cybersecurity measures and adherence to data protection laws is essential for vendors to maintain trust and expand adoption.

Resistance to Technology Adoption

Despite the benefits, many organizations and municipalities remain hesitant to shift from traditional practices to digital waste management systems. Resistance often arises from lack of awareness, limited technical expertise, or concerns about operational disruptions during transition. In some regions, workforce training and cultural barriers further slow implementation. This reluctance reduces the speed of market penetration for new solutions. Vendors must invest in awareness campaigns and provide seamless onboarding processes to overcome adoption resistance and unlock growth potential.

Regional Analysis

North America

North America dominates the Waste Management Software Market with a 36% share in 2024, supported by advanced infrastructure and early adoption of digital technologies. The market is projected to grow from USD 4,897.0 million in 2024 to USD 10,030.9 million by 2032, reflecting a CAGR of 9.5%. Strong regulatory frameworks, large-scale municipal projects, and increasing use of cloud-based platforms drive growth. The U.S. leads the region due to extensive waste volumes and smart city initiatives. Canada and Mexico follow with rising investments in automation and recycling-focused software.

Europe

Europe holds a 28% share in 2024, reaching USD 3,821.7 million, and is expected to climb to USD 7,452.0 million by 2032 at a CAGR of 8.8%. The region benefits from strict environmental regulations and circular economy policies, pushing municipalities and private operators to adopt advanced waste management solutions. Countries such as Germany, the UK, and France lead adoption due to established recycling frameworks. Cloud-based software demand is increasing rapidly, supported by EU-driven sustainability goals and investments in smart infrastructure.

Asia Pacific

Asia Pacific accounts for a 22% share in 2024, with revenues growing from USD 3,023.1 million in 2024 to USD 6,911.1 million by 2032 at the fastest CAGR of 10.9%. Rapid urbanization, expanding industrial bases, and government investments in smart waste management systems are fueling adoption. China, Japan, and India are key growth engines due to rising waste volumes and strict regulations on industrial and hazardous waste. Emerging economies in Southeast Asia further contribute, adopting cloud-based and IoT-integrated software to modernize collection and disposal systems.

Latin America

Latin America represents a 6% share in 2024, valued at USD 815.6 million, and is forecast to reach USD 1,548.3 million by 2032 at a CAGR of 8.4%. The region is increasingly focused on modernizing its waste management systems, with Brazil and Argentina driving software adoption. Growth is supported by urban expansion, improved recycling initiatives, and government efforts to upgrade municipal infrastructure. However, limited budgets in smaller cities remain a barrier. Vendors targeting affordable, cloud-based solutions are well-positioned to capture opportunities in this region.

Middle East

The Middle East captures a 5% share in 2024, with revenues of USD 572.5 million, projected to grow to USD 1,078.0 million by 2032 at a CAGR of 8.3%. GCC countries lead the market due to strong investments in smart city projects and infrastructure modernization. Waste tracking and route optimization software are in high demand to manage rising urban waste volumes. Israel and Turkey also contribute to regional adoption, supported by regulatory compliance needs and sustainability programs. Growing emphasis on eco-friendly practices creates long-term opportunities for vendors.

Africa

Africa holds a 3% share in 2024, valued at USD 375.5 million, and is projected to expand to USD 687.2 million by 2032 at a CAGR of 7.5%. South Africa leads the regional market, followed by Egypt, driven by initiatives to improve municipal waste management systems. Adoption is gradually increasing as governments and private operators invest in digital solutions to address rising waste volumes and compliance requirements. However, high implementation costs and limited technical expertise slow adoption. Cloud-based, low-cost platforms are expected to play a crucial role in unlocking growth in Africa.

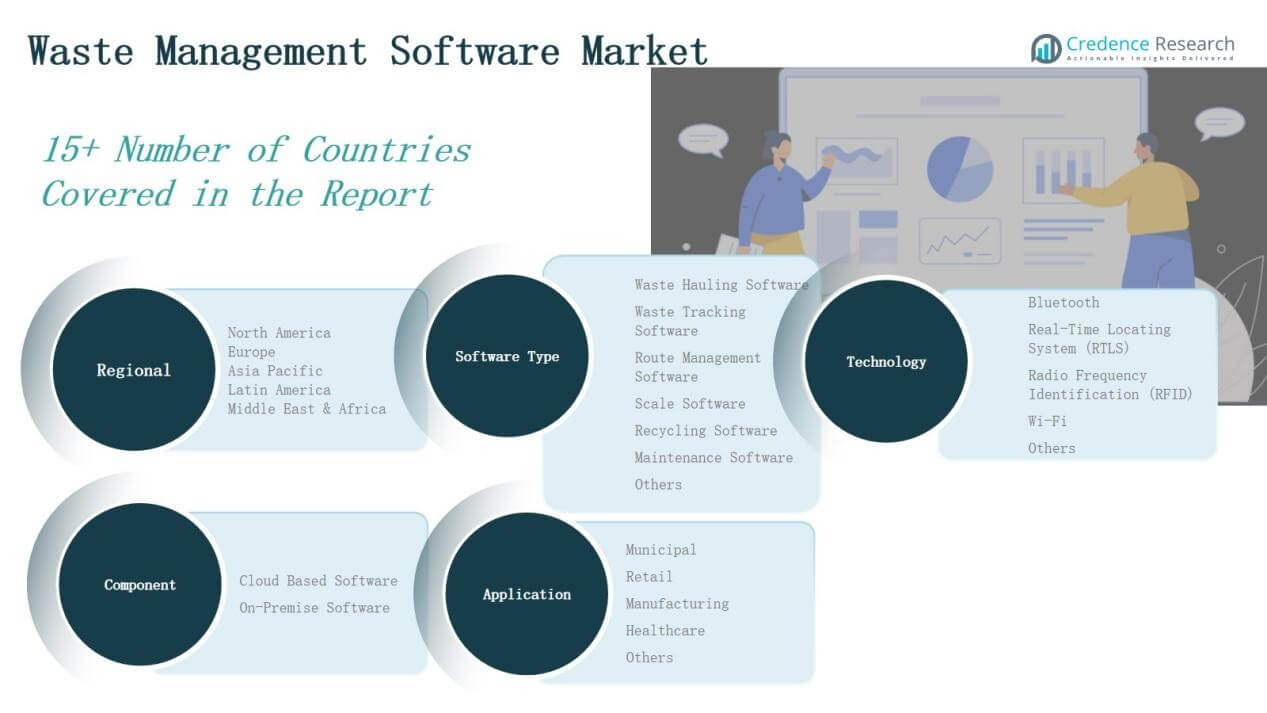

Market Segmentations:

By Software Type

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application

- Municipal

- Retail

- Manufacturing

- Healthcare

- Others

By Component

- Cloud-Based Software

- On-Premise Software

By Technology

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Waste Management Software Market features a mix of global leaders and regional providers competing through technology innovation, service reliability, and customer-centric solutions. Key players such as Wastebits, AMCS Group, TRUX, WAM Software, and Sequoia Waste Solutions strengthen their positions with comprehensive product portfolios covering waste hauling, tracking, and recycling management. Cloud-based offerings, integration with IoT and RFID, and mobile-enabled platforms are central to competitive differentiation. Companies also focus on partnerships with municipalities, industrial clients, and private waste operators to expand adoption. Smaller vendors such as SEE Forge, Thoughtful Systems, and DesertMicro emphasize cost-effective solutions tailored for niche markets. Mergers, acquisitions, and product upgrades remain common strategies to extend geographic presence and improve scalability. With rising demand for compliance-driven and eco-friendly solutions, competition continues to intensify, prompting players to invest in advanced analytics, route optimization, and sustainability-focused features to maintain long-term market relevance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Wastebits

- AMCS Group

- SEE Forge

- TRUX

- WAM Software, Inc.

- Thoughtful Systems, Inc.

- Sequoia Waste Solutions

- DesertMicro

- SFS Chemical Safety

- Delta Equipment Systems, Inc.

Recent Developments

- In October 2024, Tomra Systems ASA acquired C-trace GmbH, a German provider of digital waste-management solutions, to strengthen its waste management software capabilities and expand its digital sustainability offerings.

- In May 2025, AMCS Groupcompleted two strategic acquisitions. The company acquired Selected Interventions(London-based) and Mandalay Technologies (Australia-based), expanding its software and data capabilities.

- In May 2025, WasteLinq(Houston-based waste management software firm) introduced a free versionof its digital platform for waste generators. This move helps broaden access to modern waste software tools.

- In July 2025, the Solid Waste Association of North America (SWANA)entered a corporate partnership with Paradigm Software, L.L.C.®. The goal is to advance safety and tech in waste and resource management, with SWANA sponsoring safety awards and events supported by Paradigm’s software suite.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Application, Component, Technology, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of cloud-based platforms will continue to expand across all regions.

- Municipalities will increasingly rely on digital tools to streamline waste collection.

- Recycling-focused software will gain momentum due to circular economy initiatives.

- Integration of IoT devices and smart sensors will enhance real-time monitoring.

- AI-driven analytics will support predictive maintenance and route optimization.

- Healthcare and manufacturing sectors will adopt advanced tracking for hazardous waste.

- Partnerships between software providers and municipal governments will strengthen.

- Mobile-enabled solutions will see higher usage among small and mid-sized operators.

- Cybersecurity measures will become a critical focus in cloud deployments.

- Emerging economies will adopt affordable and scalable platforms to modernize operations.