Market Overview:

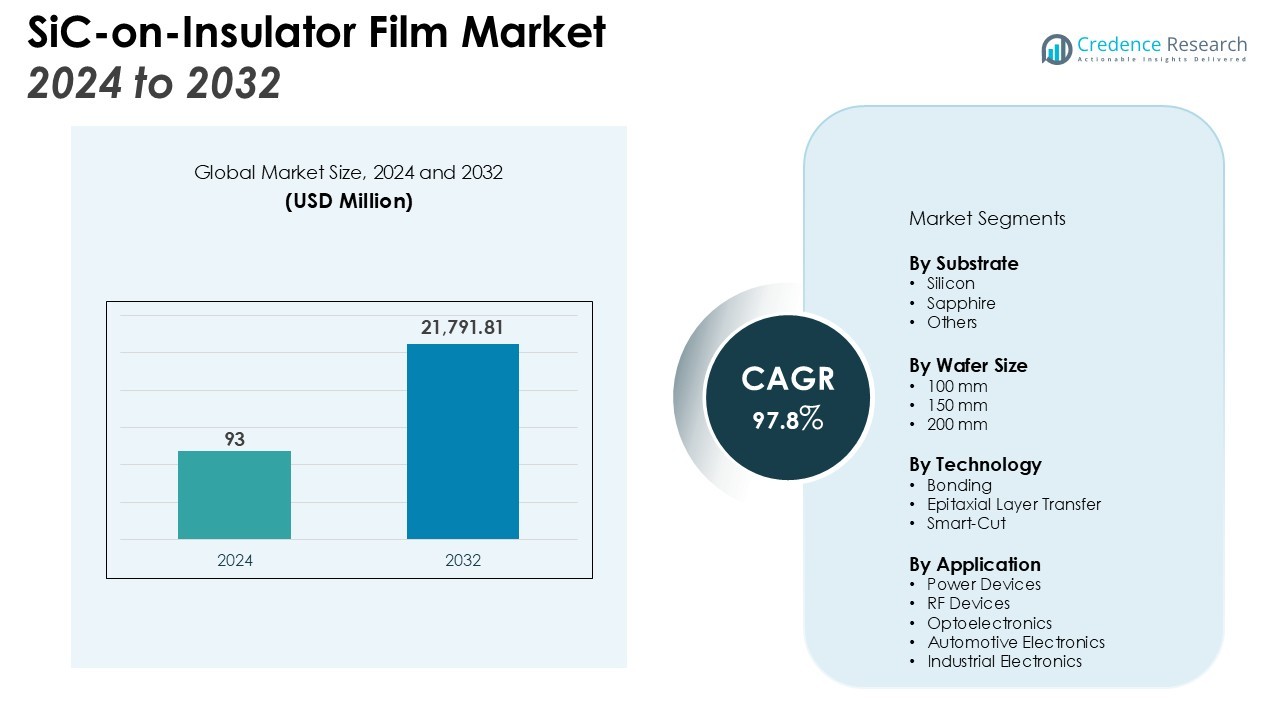

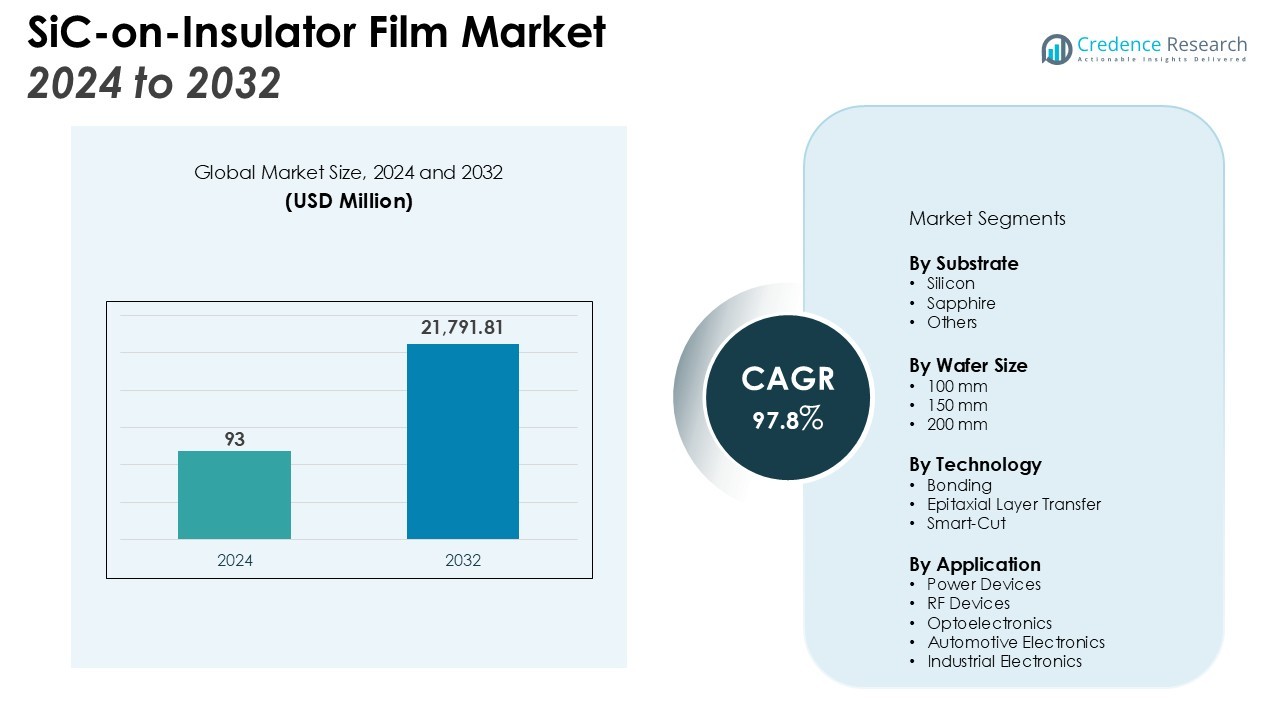

The SiC-on-Insulator Film Market size was valued at USD 93 million in 2024 and is anticipated to reach USD 21,791.81 million by 2032, at a CAGR of 97.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| SiC-on-Insulator Film Market Size 2024 |

USD 93 Million |

| SiC-on-Insulator Film Market, CAGR |

97.8% |

| SiC-on-Insulator Film Market Size 2032 |

USD 21,791.81 Million |

The market is experiaencing strong momentum due to rising demand for energy-efficient power conversion systems and electric vehicles. SiC-on-Insulator films provide superior thermal conductivity and high-voltage performance, helping reduce energy losses while supporting compact device design. Ongoing advancements in wafer processing and cost-effective manufacturing methods are accelerating adoption. Government incentives aimed at clean technologies and industrial automation are further strengthening market expansion. As industries continue to pursue higher efficiency and power density, SiC-on-Insulator films are becoming increasingly essential.

North America currently holds a leading position, supported by advanced semiconductor research, a strong electric vehicle sector, and established fabrication capabilities. Asia-Pacific is witnessing rapid growth, fueled by industrial expansion in China, Japan, and South Korea, where demand for high-performance materials is rising. Europe maintains steady progress, driven by renewable energy projects and modernization of industrial systems. Meanwhile, India and Southeast Asia are emerging as promising growth markets, supported by infrastructure development and government initiatives to promote green technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The SiC-on-Insulator Film Market was valued at USD 93 million and is forecast to reach USD 21,791.81 million by 2032, registering a CAGR of 97.8%.

- Rising demand for energy-efficient power systems and electric vehicles is driving large-scale adoption.

- Superior thermal conductivity and high-voltage performance enable compact designs while reducing energy losses.

- Advancements in wafer processing and automation technologies are lowering production costs and improving scalability.

- Government incentives promoting renewable energy, smart grids, and industrial automation are reinforcing market expansion.

- North America holds 38% share, supported by advanced research, EV adoption, and strong fabrication infrastructure.

- Asia-Pacific with 34% share and Europe with 20% share are accelerating growth, while India and Southeast Asia present emerging opportunities through infrastructure and clean energy initiatives.

Market Drivers:

Rising Demand for Energy-Efficient Power Systems

The SiC-on-Insulator Film Automation Market is driven by the need for energy-efficient solutions in power systems. Industries are under pressure to reduce losses and improve performance in high-voltage applications. The material’s superior thermal conductivity supports compact system designs while maintaining reliability. It allows manufacturers to meet strict energy regulations without compromising efficiency. This factor strengthens adoption across multiple industrial sectors.

- For instance, STMicroelectronics and Soitec are cooperating on future 200mm SiC substrate manufacturing, the transition from 150mm to 200mm wafers delivers 1.8 to 1.9 times more chips per wafer.

Growing Adoption in Electric Vehicles and Mobility Solutions

Electric vehicles require high-performance semiconductors to handle fast charging, extended range, and reliable power conversion. The SiC-on-Insulator Film Automation Market addresses these needs by enabling higher switching speeds and lower heat generation. Automakers see it as a pathway to improve battery life and charging infrastructure. Its role in supporting next-generation mobility solutions is becoming critical. This demand is expected to accelerate production and deployment.

- For instance, Bosch developed its SMG 230 electric motor for 800-volt systems, which delivers 80 kilowatts more power than a comparable 400-volt machine while maintaining the same weight.

Advancements in Semiconductor Fabrication Technologies

Ongoing improvements in wafer processing and automation systems are lowering production costs. The SiC-on-Insulator Film Automation Market benefits from these advancements, which expand scalability and commercial availability. It helps producers achieve consistent film quality, essential for high-performance applications. Automation integration ensures higher throughput and precision in semiconductor manufacturing. These developments create a favorable environment for market growth.

Government Incentives and Industrial Modernization

Policies promoting renewable energy, smart grids, and industrial automation are reinforcing adoption. The SiC-on-Insulator Film Automation Market aligns with these initiatives by providing efficient and sustainable materials. Governments see it as a strategic enabler for cleaner technologies and advanced infrastructure. Industries adopting automation solutions find added value in its efficiency and durability. These trends ensure long-term growth opportunities for the market.

Market Trends:

Integration of SiC-on-Insulator Films into Next-Generation Power Electronics

The SiC-on-Insulator Film Automation Market is witnessing a steady shift toward integration within next-generation power electronics. Industries are increasingly adopting these films for high-voltage, high-frequency applications where silicon falls short. It supports compact system designs without compromising durability, making it vital for electric vehicles, aerospace, and renewable energy systems. Growing demand for fast-charging infrastructure is encouraging wider deployment of these materials in automotive supply chains. Semiconductor firms are investing in scaling production to meet this surge. It is also becoming central to achieving higher energy density in automated manufacturing processes, reflecting its expanding utility across multiple sectors.

- For instance, in September 2024, Resonac Corporation and Soitec signed an agreement to jointly develop 200mm silicon carbide (SiC) bonded substrates to improve the production efficiency for power semiconductors used in electric vehicles and industrial equipment.

Automation Advancements Driving Cost Efficiency and Quality Improvements

Automation technology is reshaping the production process of SiC-on-Insulator films, improving precision and reducing waste. The SiC-on-Insulator Film Automation Market benefits from automated wafer inspection, alignment, and film deposition, which ensure consistent quality. It allows manufacturers to handle high-volume production while lowering operational costs. Global players are strengthening capacity expansion projects to meet rising demand from industrial and automotive users. It is increasingly tied to government-backed initiatives for cleaner energy technologies, which further accelerates adoption. These automation-driven improvements establish a foundation for sustainable market growth and competitive differentiation in the semiconductor industry.

- For instance, in February 2019, Soitec and Simgui enhanced their partnership to increase the annual production capacity of 200mm SOI wafers at Simgui’s Shanghai facility from 180,000 to 360,000 units to serve the growing global market.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The SiC-on-Insulator Film Automation Market faces a significant challenge in managing high production costs linked to complex fabrication methods. It requires advanced wafer processing equipment, specialized substrates, and strict quality control, which increase overall expenses. Small and mid-sized companies struggle to adopt these films due to limited budgets and high entry barriers. The lack of cost-effective large-scale manufacturing technologies slows wider adoption across industries. It also limits accessibility in price-sensitive regions, where low-cost alternatives remain dominant. This cost challenge creates pressure on suppliers to balance innovation with affordability.

Limited Supply Chain and Technical Barriers to Adoption

The SiC-on-Insulator Film Automation Market is also challenged by a restricted supply chain and technical complexities. It depends heavily on a few established material providers, creating risks of shortages and price volatility. Industries adopting the technology often face integration issues due to limited expertise and standardization gaps. It requires skilled labor and specialized knowledge to ensure reliability in end-use applications. Delays in scaling up production capacity can restrict timely delivery for high-demand sectors. It also raises concerns among buyers regarding long-term supply security, making supply chain diversification a critical need.

Market Opportunities:

Expanding Role in Electric Vehicles and Renewable Energy Systems

The SiC-on-Insulator Film Automation Market presents strong opportunities in electric vehicles and renewable energy adoption. It enables efficient power conversion and supports compact, high-performance designs, making it attractive for EV manufacturers. Rising investment in fast-charging infrastructure and grid modernization will further boost its relevance. Renewable energy projects require reliable, durable materials for solar inverters and wind energy systems, creating sustained demand. It also enhances performance in aerospace and defense applications, where high efficiency and resilience are critical. These expanding use cases strengthen long-term growth prospects for global suppliers.

Advancements in Automation and Global Manufacturing Expansion

The SiC-on-Insulator Film Automation Market benefits from advancements in automation that improve scalability and reduce production costs. It creates opportunities for semiconductor producers to meet high-volume demand with consistent quality. Governments promoting clean energy and advanced manufacturing are opening pathways for investment in new facilities. Expanding production capacity in Asia-Pacific and North America strengthens the market’s global reach. It also supports partnerships between technology providers and automotive, aerospace, and industrial companies. This trend positions the market for accelerated adoption and competitive growth across multiple sectors.

Market Segmentation Analysis:

By Substrate

The SiC-on-Insulator Film Automation Market is segmented by substrate into silicon, sapphire, and other advanced materials. Silicon-based substrates dominate due to cost efficiency and compatibility with existing semiconductor processes. Sapphire substrates find demand in high-frequency and optoelectronic applications, offering superior thermal stability. It is expected that ongoing R&D will expand the use of alternative substrates, supporting aerospace and renewable energy industries.

- For instance, a micro-ring resonator device was demonstrated on a 4H-silicon carbide-on-insulator (4H-SiCOI) platform, achieving an intrinsic quality factor of 66,000.

By Wafer Size

The market is divided into 100 mm, 150 mm, and 200 mm wafer sizes. The 150 mm wafers hold the largest share due to their balance of performance and production cost. Growth in 200 mm wafers is accelerating with rising demand for larger, more efficient devices in industrial automation and electric vehicles. It supports scalability and throughput, strengthening applications in power electronics. The 100 mm wafers continue to serve niche and research-focused applications.

- For instance, STMicroelectronics manufactured its first 200mm silicon carbide (SiC) bulk wafers, which provide nearly double the usable area for chip production compared to 150mm wafers.

By Technology

The market is segmented into bonding, epitaxial layer transfer, and smart-cut techniques. Bonding is widely adopted due to its reliability and established practices in semiconductor production. Epitaxial layer transfer is gaining traction in high-quality thin-film applications where performance is critical. Smart-cut technology offers precision and scalability, making it suitable for advanced semiconductor manufacturing. It is expected that these technologies will improve efficiency, reduce costs, and open new opportunities for adoption across industries.

Segmentations:

By Substrate

By Wafer Size

By Technology

- Bonding

- Epitaxial Layer Transfer

- Smart-Cut

By Application

- Power Devices

- RF Devices

- Optoelectronics

- Automotive Electronics

- Industrial Electronics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Leadership in North America

North America accounted for 38% of the global SiC-on-Insulator Film Automation Market. The region leads due to advanced semiconductor research and a well-established technology ecosystem. Significant investments in electric vehicles, renewable energy infrastructure, and aerospace applications support strong adoption. It is further strengthened by collaborations between research institutions and semiconductor producers to enhance automation in manufacturing. Government policies promoting clean energy and industrial modernization also drive demand. The presence of leading technology firms ensures innovation and capacity expansion in the region.

Rapid Growth Across Asia-Pacific Economies

Asia-Pacific held 34% of the global SiC-on-Insulator Film Automation Market. Growth is driven by expanding industrialization and high demand for power electronics across key economies. China, Japan, and South Korea dominate due to strong automotive and electronics manufacturing capabilities. It benefits from increasing investments in automation and smart manufacturing programs. Regional governments prioritize renewable energy development, which raises demand for efficient semiconductor solutions. The availability of skilled labor and cost-effective production strengthens Asia-Pacific’s position in the global market.

Steady Expansion in Europe and Emerging Opportunities Elsewhere

Europe captured 20% of the global SiC-on-Insulator Film Automation Market. Growth is supported by renewable energy deployment, industrial automation, and strict energy efficiency regulations. Germany, France, and the UK remain central markets due to strong R&D investments. It gains support from sustainability-driven initiatives that encourage advanced materials adoption. Meanwhile, India and Southeast Asia are creating opportunities through infrastructure development and clean energy expansion. It is expected that growing demand from these regions will diversify the global market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sicoxs Corporation (Japan)

- Wolfspeed Inc. (U.S.)

- SICC Co., Ltd. (China)

- Soitec (France)

- MTI Corporation (U.S.)

- Hebei Synlight Semiconductor Co., Ltd. (China)

- Xiamen Powerway Advanced Material Co. Ltd (China)

- GlobalWafers Co. Ltd. (Taiwan)

- Ceramicforum Co. Ltd. (Japan)

- Coherent Corporation (U.S.)

Competitive Analysis:

The SiC-on-Insulator Film Automation Market features a competitive landscape shaped by established semiconductor manufacturers and emerging innovators. Leading companies focus on expanding production capabilities, improving wafer quality, and reducing costs through automation. It is driven by strong demand from automotive, industrial, and renewable energy sectors, pushing firms to strengthen research partnerships and scale advanced technologies. Strategic collaborations between technology developers and fabrication facilities are common, supporting consistent supply and faster commercialization. Companies are also investing in smart-cut and epitaxial layer transfer methods to enhance precision and efficiency. Regional players in Asia-Pacific are expanding their presence, supported by government-backed initiatives and cost advantages, while North America and Europe maintain strength through advanced R&D and established infrastructure. The market remains competitive, with firms prioritizing product innovation, partnerships, and capacity expansion to capture growth opportunities in high-performance semiconductor applications.

Recent Developments:

- In June 2025, Soitec announced a strategic partnership with CEA-Leti to enhance the security of integrated circuits by leveraging its FD-SOI technology to embed features that protect against tampering.

- In August 2025, SICC Co., Ltd. signed a memorandum of understanding (MOU) with Toshiba Electronic Devices & Storage Corp. to collaborate on improving the quality of silicon carbide power semiconductor wafers and to ensure a stable supply for Toshiba.

- In January 2025, Motion Technology, Inc. (MTI) launched the AutoFry MTI-40E PRO, a ventless kitchen appliance featuring a built-in oil filtration system.

Report Coverage:

The research report offers an in-depth analysis based on Substrate, Wafer Size, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The SiC-on-Insulator Film Automation Market will expand with rising demand for energy-efficient power electronics.

- It will gain traction in electric vehicles as automakers adopt advanced materials for improved performance.

- Adoption will accelerate in renewable energy systems, including solar inverters and wind turbines.

- It will strengthen its role in aerospace and defense applications that require durability and high reliability.

- Advancements in wafer processing and smart-cut technology will improve scalability and reduce production costs.

- It will benefit from government policies promoting industrial automation and clean energy initiatives.

- Regional growth will intensify in Asia-Pacific due to strong manufacturing capacity and skilled labor availability.

- North America will maintain leadership through advanced R&D and collaborations in semiconductor innovation.

- Europe will continue steady adoption driven by energy efficiency regulations and sustainability initiatives.

- It will evolve into a critical enabler of next-generation semiconductor devices, creating opportunities across automotive, industrial, and electronic sectors.