Market Overview:

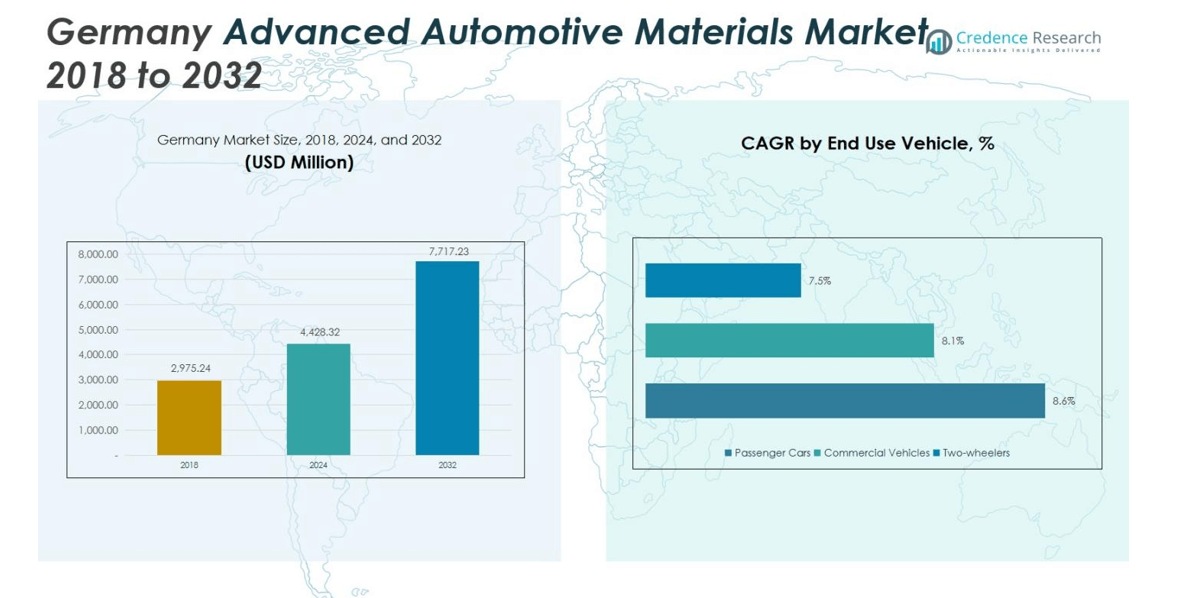

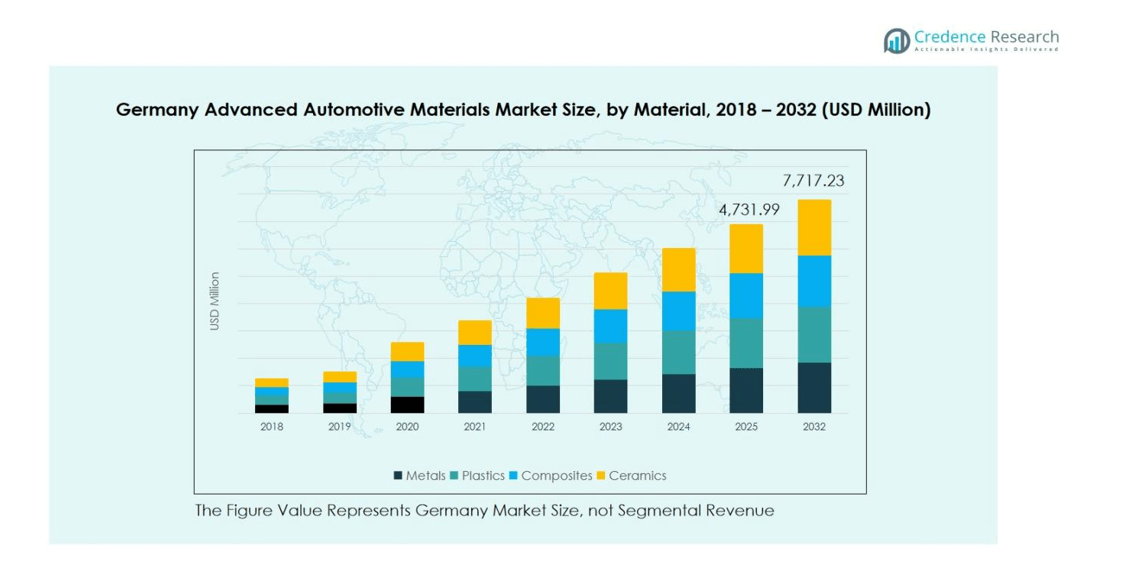

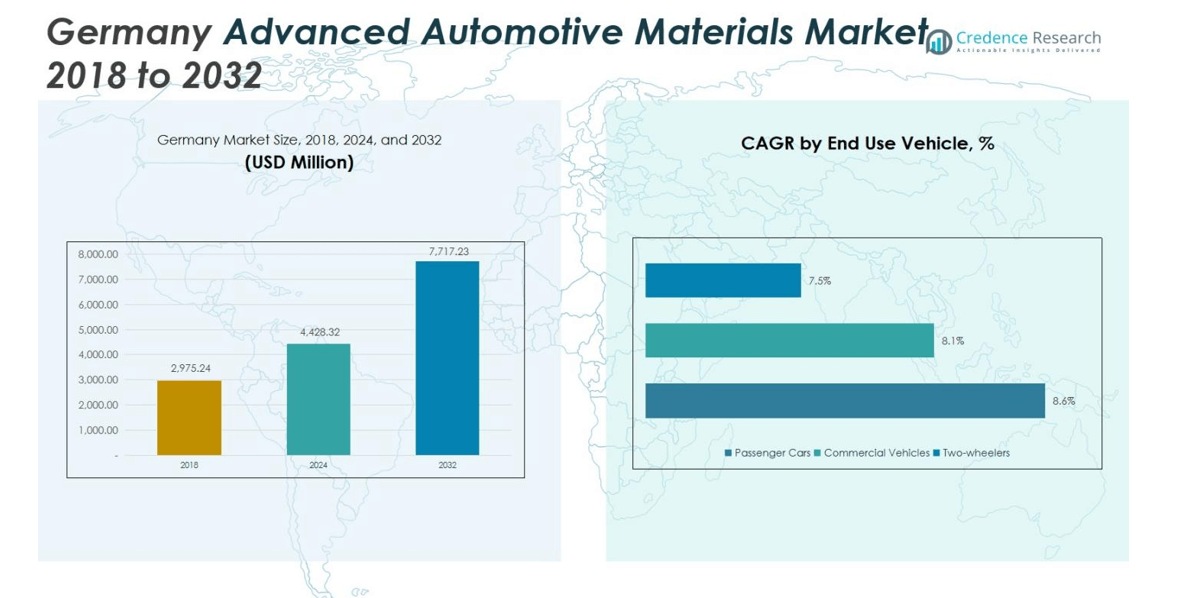

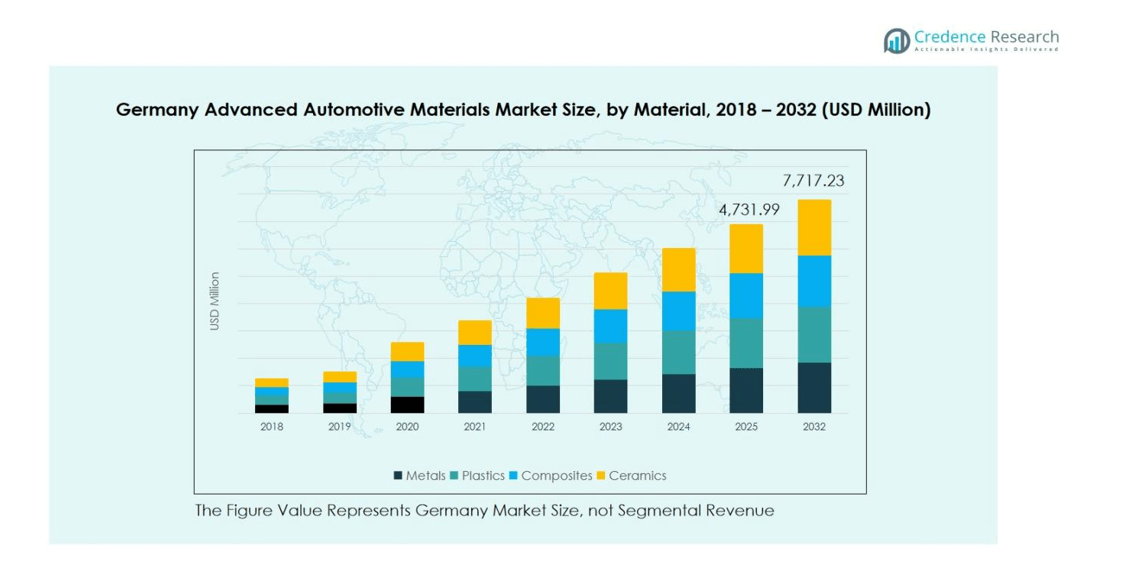

Germany Advanced Automotive Materials Market size was valued at USD 2,975.24 Million in 2018, increased to USD 4,428.32 Million in 2024, and is anticipated to reach USD 7,717.23 Million by 2032, at a CAGR of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Advanced Automotive Materials Market Size 2024 |

USD 4,428.32 Million |

| Germany Advanced Automotive Materials Market, CAGR |

7.1% |

| Germany Advanced Automotive Materials Market Size 2032 |

USD 7,717.23 Million |

The Germany Advanced Automotive Materials Market is led by key players including Covestro, Toray Industries, DuPont de Nemours, Evonik Industries, Wolverine Advanced Materials, Permali Gloucester, Mitsubishi Chemical Corporation, ArcelorMittal, and BASF. These companies focus on developing high-strength metals, advanced plastics, composites, and ceramics to meet the rising demand from passenger and commercial vehicles. Strategic initiatives such as product innovation, partnerships with OEMs, and investment in research and development enhance material performance, safety, and lightweighting capabilities. Bavaria emerges as the leading region in the market, holding 28% of the total share, driven by the presence of major automotive manufacturers like BMW and Audi, robust industrial infrastructure, and advanced research capabilities. The combination of strong regional industrial support and the proactive strategies of these top players positions Germany’s advanced automotive materials market for sustained growth and technological advancement.

Market Insights

- Germany Advanced Automotive Materials Market size was USD 4,428.32 Million in 2024 and is projected to reach USD 7,717.23 Million by 2032, growing at a CAGR of 7.1%.

- The market is driven by stringent emission regulations, rising electric vehicle adoption, and demand for lightweight, high-performance metals, plastics, composites, and ceramics across automotive applications.

- Key trends include the increasing focus on lightweighting and material substitution, integration of advanced materials in electric and autonomous vehicles, and innovations in high-performance composites and plastics.

- Competitive landscape is dominated by Covestro, Toray Industries, DuPont de Nemours, Evonik Industries, Wolverine Advanced Materials, BASF, Mitsubishi Chemical, and ArcelorMittal, focusing on product innovation, strategic partnerships, and R&D investments to enhance safety, durability, and fuel efficiency.

- Regionally, Bavaria leads with 28% share, followed by Baden-Württemberg at 24%, North Rhine-Westphalia 18%, Lower Saxony 15%, Hesse 10%, and other regions 5%, with metals holding 40% of material share and passenger cars capturing 55% of the end-use segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the Germany Advanced Automotive Materials Market, metals dominate the material segment, accounting for 40% of total market share in 2024. High-strength steel and aluminum alloys are widely used in vehicle manufacturing due to their excellent strength-to-weight ratio, contributing to improved fuel efficiency and crash safety. Plastics follow with a 28% share, driven by lightweighting and design flexibility. Composites (20%) and ceramics (12%) are gaining traction, supported by growing adoption in high-performance and electric vehicles. The primary drivers include government regulations on emissions, increasing demand for lightweight vehicles, and the need for improved durability and performance.

- For instance, BMW, in partnership with Bcomp, will integrate flax-based natural-fiber composite materials into series-production vehicles; replacing carbon-fibre composites with these materials can reduce CO₂-equivalent emissions during production by around 40%.

By Application

Within applications, structural components lead the market, representing 35% of the share, due to the critical role of advanced materials in chassis, frames, and load-bearing components. Body panels hold a 30% share, benefiting from materials like aluminum and composites that reduce vehicle weight. Interior components (20%) and electrical components (15%) are experiencing growth, supported by the rising adoption of plastics and composites to enhance aesthetics, safety, and electronic integration. Key drivers include regulatory pressure for fuel efficiency, consumer demand for high-performance vehicles, and lightweighting strategies across the automotive sector.

- For instance, Audi AG’s A8 uses its “Audi Space Frame” aluminium hybrid body: the body‐in-white weighs about 231 kg, roughly 40 % lighter than a comparable steel construction.

By End-Use Vehicles

Among end-use vehicles, passenger cars dominate, capturing 55% of the market, as manufacturers prioritize lightweight materials and safety features to meet consumer and regulatory expectations. Commercial vehicles follow with a 30% share, driven by durability, payload optimization, and operational efficiency. Two-wheelers hold a smaller 15% share, influenced by the growing electric two-wheeler segment and urban mobility trends. Drivers for all sub-segments include rising vehicle electrification, stringent emissions regulations, and increasing consumer preference for fuel-efficient, high-performance vehicles.

Key Growth Drivers

Stringent Emission Regulations Driving Lightweight Materials

Germany’s focus on reducing automotive emissions has accelerated the adoption of advanced materials, particularly lightweight metals and composites. Manufacturers are increasingly replacing traditional steel with high-strength aluminum and carbon fiber to enhance fuel efficiency and lower CO₂ output. This regulatory push is a critical driver for the market, encouraging innovation in materials that meet safety standards while reducing overall vehicle weight. The demand for eco-friendly and energy-efficient vehicles continues to expand, making emission compliance a central factor shaping material choices and production strategies.

- For instance, Mercedes-Benz integrated high-strength aluminum alloys in its EQS electric sedan’s body structure in 2023, improving aerodynamics and energy efficiency.

Rising Demand for Electric Vehicles (EVs)

The rapid growth of the EV segment in Germany is fueling the demand for advanced automotive materials. Lightweight metals, composites, and specialized plastics are essential to offset the weight of batteries, enhance vehicle range, and maintain performance. EV manufacturers prioritize materials that improve energy efficiency and structural integrity. Increasing government incentives for EV adoption, coupled with consumer preference for sustainable mobility, is driving investments in research and development of innovative materials, positioning the market for sustained growth over the forecast period.

- For instance, Volkswagen introduced aluminum-intensive body structures in its ID.4 model to enhance rigidity while maintaining low mass, contributing to longer driving ranges.

Focus on Vehicle Safety and Performance

Enhanced safety standards and consumer expectations for high-performance vehicles are encouraging the use of advanced materials across automotive applications. Materials such as high-strength steel, composites, and ceramics improve crashworthiness, rigidity, and durability. The integration of these materials in structural components, body panels, and interior parts enables automakers to deliver vehicles that meet regulatory safety requirements while enhancing comfort and handling. This focus on safety and performance is a consistent driver of material innovation and adoption in Germany’s automotive sector.

Key Trends & Opportunities

Trend of Lightweighting and Material Substitution

Automakers in Germany are increasingly adopting lightweighting strategies to improve fuel efficiency and meet environmental regulations. This trend drives substitution of traditional steel with aluminum, composites, and advanced plastics across vehicle segments. Lightweighting not only reduces emissions but also enhances vehicle performance and handling. With electric vehicles gaining prominence, manufacturers are further incentivized to integrate materials that balance weight, strength, and cost. The shift toward innovative material combinations offers opportunities for suppliers to expand their portfolios and collaborate closely with OEMs on tailored solutions.

- For instance, BMW has incorporated carbon fiber reinforced plastics (CFRP) in models like the i3 and i8, reducing vehicle weight by up to 250 kg compared to traditional steel-bodied cars while enhancing acceleration and driving dynamics.

Integration of Advanced Materials in Electric and Autonomous Vehicles

The convergence of electric and autonomous vehicle technologies presents significant opportunities for advanced material applications. Materials that provide high strength, thermal management, and reduced weight are critical for battery housings, sensors, and structural frameworks. Germany’s push toward smart mobility solutions amplifies this demand. Suppliers that offer innovative composites, ceramics, and high-performance plastics are well-positioned to benefit. The market can capitalize on the growing emphasis on lightweight, multifunctional components, which support longer EV ranges, improved safety, and enhanced autonomous driving capabilities.

- For instance, BASF introduced Ultramid® Advanced N in 2023 a polyphthalamide-based material engineered for EV battery systems and radar sensor brackets, offering superior heat resistance and mechanical strength.

Key Challenges

High Production Costs and Material Complexity

The adoption of advanced automotive materials is often constrained by high production costs and complex manufacturing requirements. Materials such as carbon fiber composites and specialized ceramics demand sophisticated processing techniques, increasing investment and operational expenses. This cost factor can limit widespread integration, particularly in mid-range vehicle segments. Additionally, the need for skilled labor and advanced machinery creates entry barriers for smaller manufacturers. Balancing material benefits with economic feasibility remains a key challenge for the German automotive materials market.

Recycling and Sustainability Challenges

While advanced materials improve vehicle performance, their recyclability and environmental impact pose challenges. Multi-material assemblies and composites complicate end-of-life recycling, potentially increasing waste management costs. Automakers and suppliers must develop sustainable production processes and recycling strategies to comply with regulations and consumer expectations. These challenges require innovation in material design, supply chain management, and circular economy practices. Addressing sustainability concerns is crucial for the market to maintain long-term growth, especially as Germany enforces stringent environmental and resource efficiency standards.

Regional Analysis

Bavaria

Bavaria holds a market share of 28% in the Germany Advanced Automotive Materials Market, driven by the presence of major automotive manufacturers such as BMW and Audi. The region’s robust automotive supply chain and advanced research infrastructure support high adoption of metals, composites, and plastics in vehicle manufacturing. Investment in lightweight materials for passenger cars and commercial vehicles is accelerating, while government incentives for emission reduction encourage innovation. The combination of strong industrial capabilities, skilled workforce, and focus on electric and autonomous vehicle development positions Bavaria as the leading region for advanced automotive materials adoption.

Baden-Württemberg

Baden-Württemberg accounts for 24% of the market, supported by the concentration of premium automakers including Mercedes-Benz and Porsche. The region emphasizes high-performance materials for structural components, body panels, and interior applications. Research and development activities in lightweighting and composites enhance material efficiency and vehicle safety. Government regulations on emissions and energy efficiency further drive adoption of advanced metals and plastics. The strong collaboration between OEMs, material suppliers, and research institutes accelerates technology transfer and innovation. Baden-Württemberg continues to be a critical hub for advanced automotive materials due to its technological expertise and high-end automotive manufacturing ecosystem.

North Rhine-Westphalia

North Rhine-Westphalia contributes 18% market share, benefiting from its extensive automotive supplier network and focus on commercial vehicle production. The region prioritizes durable metals, composites, and plastics for structural and electrical components. Investment in research on lightweighting and emission reduction supports growing adoption in both passenger and commercial vehicles. The local industrial ecosystem facilitates collaborations between suppliers and vehicle manufacturers to meet stringent safety and efficiency standards. Rising demand for electric commercial vehicles is expected to further boost advanced material integration, reinforcing North Rhine-Westphalia’s role as a significant contributor to Germany’s automotive materials market.

Lower Saxony

Lower Saxony represents 15% of the market, anchored by the presence of Volkswagen and associated suppliers. The region emphasizes high-strength metals and composites for passenger car platforms, body panels, and interior components. Advanced manufacturing processes and R&D initiatives focused on lightweighting and vehicle safety drive material adoption. Growing electric vehicle production and stringent emission norms encourage the integration of plastics and composites in structural and electrical applications. Lower Saxony’s established automotive ecosystem, combined with strong innovation support, positions it as a key region for advanced automotive materials development and deployment across multiple vehicle segments.

Hesse

Hesse contributes 10% of the market, driven by its industrial base supporting automotive parts manufacturing and engineering services. The region focuses on lightweight metals, plastics, and composites for structural and interior applications in passenger and commercial vehicles. Government incentives for sustainable mobility and emission reduction promote adoption of advanced materials. Collaboration between material suppliers and vehicle manufacturers enhances innovation in lightweighting, safety, and performance optimization. Hesse’s strategic location, combined with skilled workforce and research infrastructure, facilitates material development and supply chain efficiency, making it a growing contributor to Germany’s advanced automotive materials market.

Other Regions

Other regions, including Saxony, Rhineland-Palatinate, and Schleswig-Holstein, collectively account for 5% of the market. These regions benefit from niche automotive manufacturing, component production, and specialized research initiatives. Advanced materials such as high-strength metals, composites, and plastics are increasingly adopted in small-scale production and electric vehicle components. Supportive local policies and industrial collaborations further encourage material innovation. Although smaller in scale compared to Bavaria and Baden-Württemberg, these regions contribute to the overall growth of Germany’s advanced automotive materials market by supplying specialized components and supporting R&D for emerging technologies.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End-Use Vehicles

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

By Region

- Bavaria

- Baden-Württemberg

- North Rhine-Westphalia

- Lower Saxony

- Hesse

- Other Regions

Competitive Landscape

The competitive landscape of the Germany Advanced Automotive Materials Market features key players including Covestro, Toray Industries, DuPont de Nemours, Evonik Industries, Wolverine Advanced Materials, Permali Gloucester, Mitsubishi Chemical Corporation, ArcelorMittal, and BASF. These companies actively engage in product innovation, strategic partnerships, and expansion of production capabilities to strengthen their market position. Leading players focus on developing lightweight metals, high-performance plastics, composites, and ceramics to meet growing demand from passenger and commercial vehicle segments. Continuous investments in research and development enable them to enhance material performance, durability, and safety while complying with stringent emission and regulatory standards. Additionally, collaborations with OEMs and suppliers help accelerate technology adoption and customization of materials for electric and autonomous vehicles. Intense competition drives cost optimization, quality improvement, and innovation, ensuring sustained market growth in Germany’s advanced automotive materials sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Covestro

- Toray Industries, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries

- Wolverine Advanced Materials LLC

- Permali Gloucester Ltd.

- Mitsubishi Chemical Corporation

- ArcelorMittal

- BASF

- Other Key Players

Recent Developments

- In 2024, Toray Industries completed a polyphenylene sulfide expansion in South Korea, reinforcing its supply of advanced materials for automotive applications.

- In September 2025, Tata Technologies acquired ES-Tec GmbH, a German automotive engineering firm specializing in ADAS and e-mobility, for €75 million.

- In June 2025, Continental AG launched the Advanced Electronics & Semiconductor Solutions (AESS) division to develop automotive semiconductors, enhancing supply chain resilience and internal capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use, Mobility Capability and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow driven by increasing adoption of lightweight metals and composites.

- Rising production of electric vehicles will accelerate demand for advanced materials in structural and battery components.

- Innovations in high-performance plastics and composites will improve vehicle efficiency and durability.

- Strong regulatory focus on emission reduction and fuel efficiency will encourage lightweighting strategies.

- Expansion of autonomous vehicle technologies will create opportunities for multifunctional material applications.

- Collaboration between OEMs and material suppliers will foster customized solutions for vehicle safety and performance.

- Increased investment in research and development will drive material innovation and cost optimization.

- Growth in commercial vehicles will support demand for durable metals and composites.

- Rising focus on sustainability will promote recyclable and eco-friendly material adoption.

- Competitive advancements and strategic partnerships will shape the market landscape and encourage new product launches.