Market Overview:

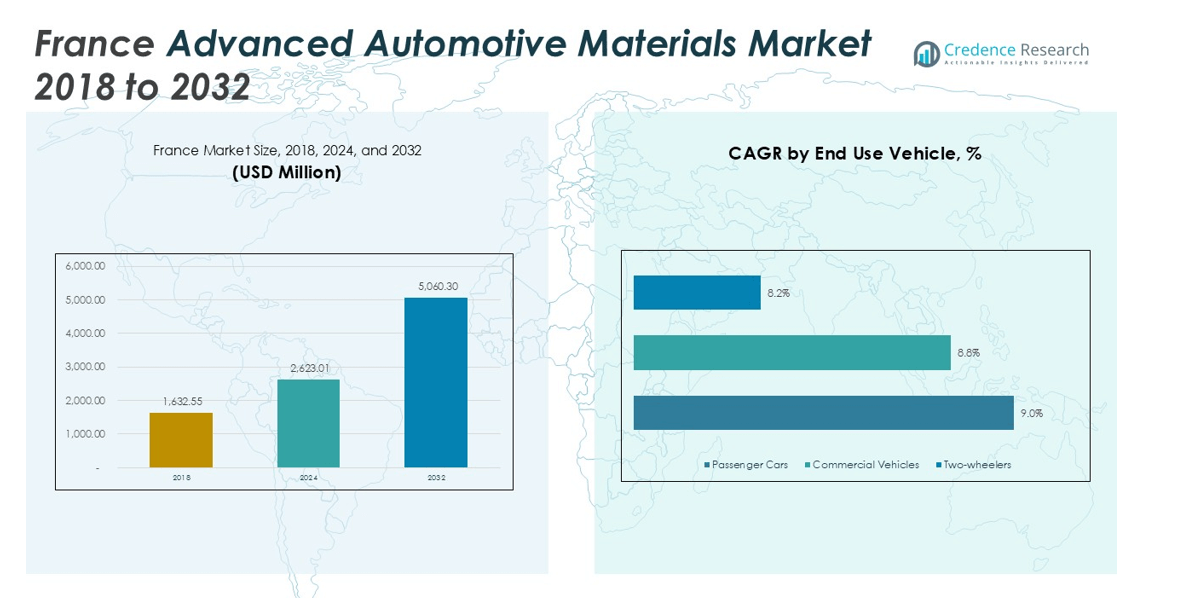

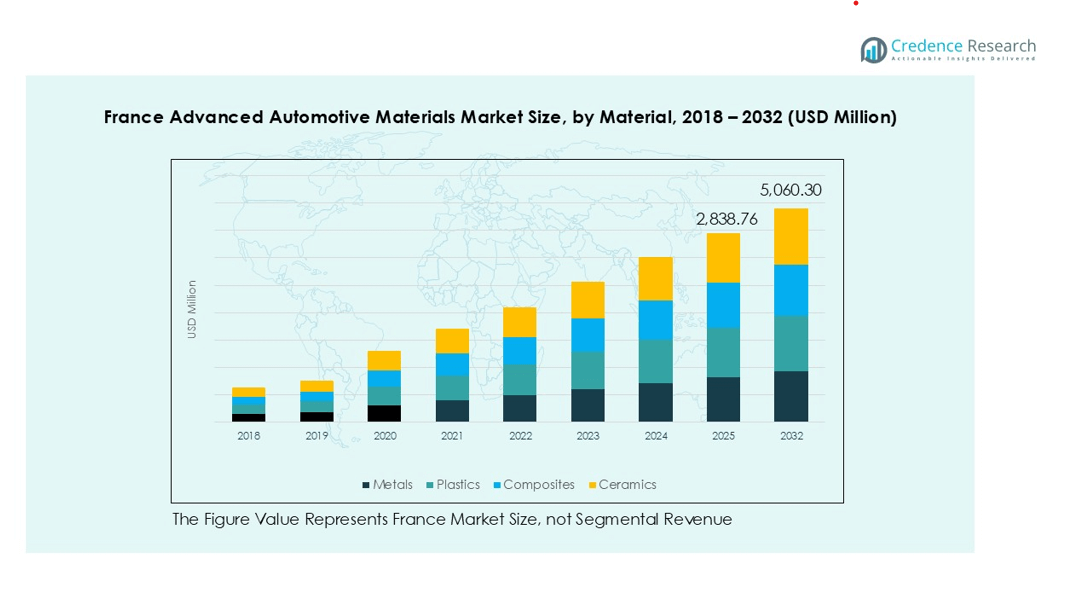

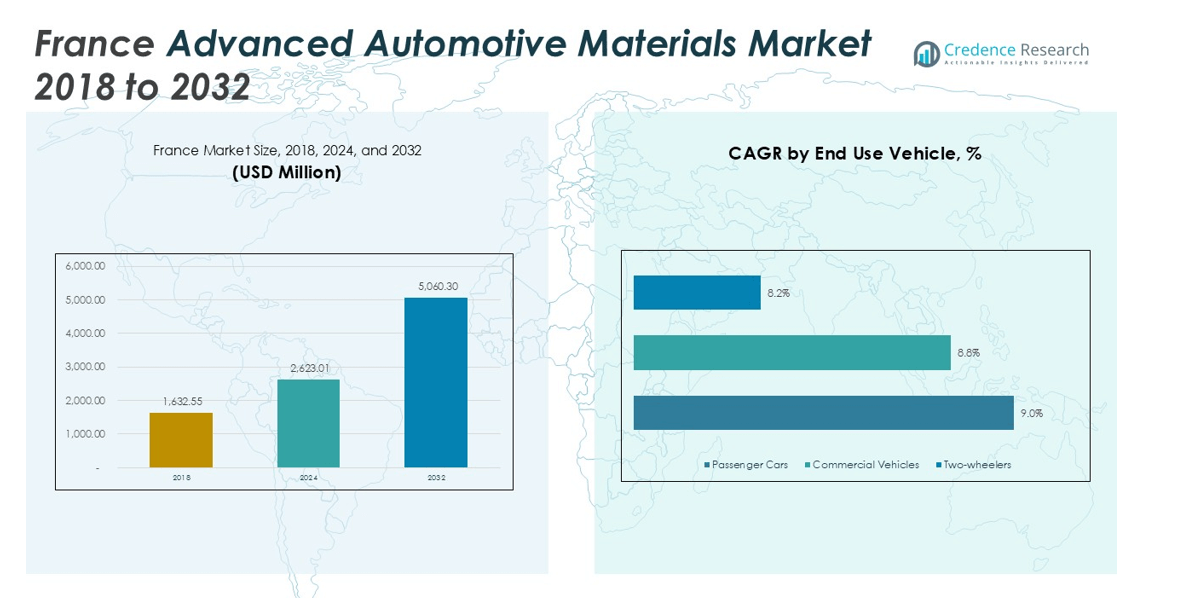

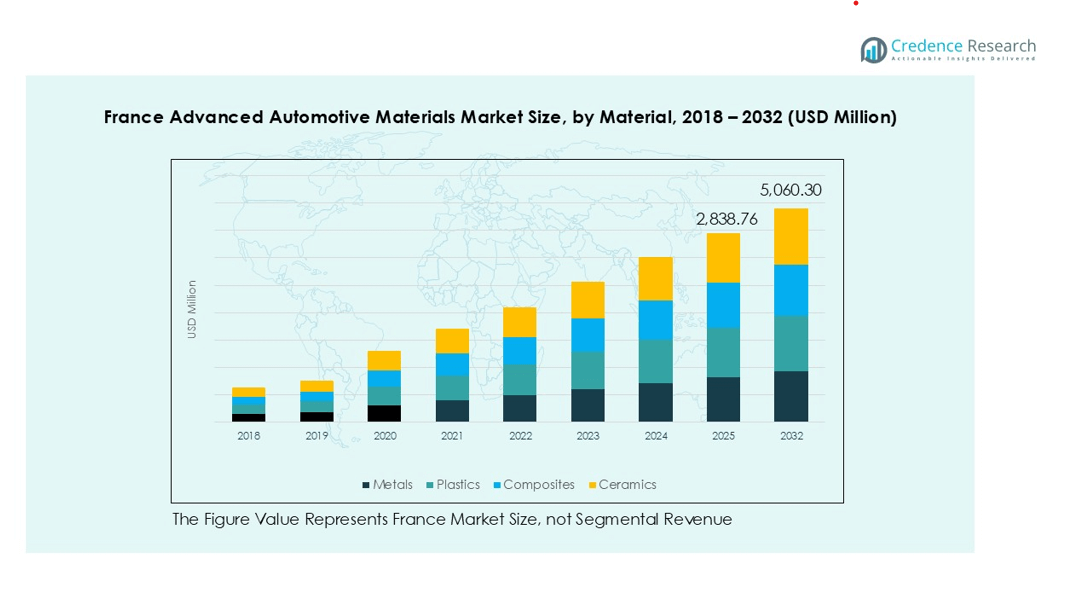

France Advanced Automotive Materials Market size was valued at USD 1,632.55 million in 2018, increasing to USD 2,623.01 million in 2024, and is anticipated to reach USD 5,060.30 million by 2032, growing at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Advanced Automotive Materials Market Size 2024 |

USD 2,623.01 million |

| France Advanced Automotive Materials Market, CAGR |

8.5% |

| France Advanced Automotive Materials Market Size 2032 |

USD 5,060.30 million |

The France Advanced Automotive Materials Market is dominated by key players such as Arkema, Toray Industries, DuPont de Nemours, Evonik Industries, BASF, ArcelorMittal, and Mitsubishi Chemical Corporation, who are actively investing in research, development, and production of high-performance metals, composites, and polymers. These companies focus on lightweight, durable, and sustainable materials to meet the growing demand from electric, hybrid, and conventional vehicles. Collaboration between OEMs and suppliers drives innovation, particularly in recyclable and bio-based materials, aligning with France’s environmental targets. Among regions, Northern France leads the market with a 32% share, benefiting from a strong industrial base, major automotive clusters, and R&D centers specializing in advanced materials. This region’s strategic location near Germany and Belgium also facilitates cross-border trade, making it a key hub for material innovation and production within the national market.

Market Insights

- The France Advanced Automotive Materials Market size was USD 2,623.01 Million in 2024 and is projected to reach USD 5,060.30 Million by 2032, growing at a CAGR of 8.5%.

- Rising demand for lightweight and fuel-efficient vehicles is driving the adoption of advanced metals, composites, and high-performance plastics across passenger cars and commercial vehicles.

- Key market trends include the integration of recyclable and sustainable materials, growth in electric and hybrid vehicle production, and increased use of advanced composites for structural components and body panels.

- The competitive landscape is led by Arkema, Toray Industries, DuPont de Nemours, Evonik Industries, BASF, ArcelorMittal, and Mitsubishi Chemical Corporation, focusing on innovation, partnerships, and expansion in advanced material manufacturing.

- Northern France dominates the regional market with a 32% share, followed by Western France at 21%, Central France at 18%, Southern France at 17%, and Eastern France at 12%, with metals leading the material segment at 48% share and structural components capturing 42% of applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material:

In the France Advanced Automotive Materials Market, metals hold the dominant position, accounting for 48% of the total market share. Their high strength-to-weight ratio, recyclability, and cost efficiency make them indispensable in structural and body applications. Advanced steel and aluminum alloys are increasingly used to enhance crash performance while reducing overall vehicle weight. The growing emphasis on lightweight vehicles to meet stringent European emission norms drives demand for advanced metals. Additionally, automakers are integrating more aluminum and high-strength steel to improve energy efficiency and durability.

- For instance, Constellium and Renault’s 2024 ISA3 R&D project supported by the France Relance program produced a lightweight aluminum door design that is 14% lighter than previous versions used in compact EVs.

By Application:

Among applications, structural components dominate the France Advanced Automotive Materials Market with 42% market share. These components form the backbone of vehicle architecture, where materials with superior mechanical strength and fatigue resistance are essential. The rise in electric and hybrid vehicle production is fueling the use of lightweight composites and metals in chassis, frames, and substructures. Manufacturers prioritize materials that ensure both rigidity and weight optimization, supporting improved fuel economy and extended battery range, thus driving sustained demand in this application segment.

- For instance, Röchling Automotive and Envalior collaborated to produce a hybrid thermoplastic composite roof crossmember for the Mercedes CLE convertible, made using glass fiber-reinforced Tepex dynalite and Durethan BKV50H2.0 PA6, replacing magnesium while maintaining strength and reducing mass.

By End-Use Vehicles:

Within end-use categories, passenger cars represent the leading segment, capturing 62% of the France Advanced Automotive Materials Market share. The dominance of this segment is attributed to strong consumer demand for fuel-efficient, high-performance, and eco-friendly vehicles. French automakers are incorporating advanced plastics, composites, and lightweight alloys to enhance vehicle dynamics and safety. The increasing production of electric passenger cars further accelerates the adoption of high-performance materials aimed at reducing vehicle weight and improving range efficiency, reinforcing this segment’s leadership position in the market.

Key Growth Drivers

Rising Demand for Lightweight Vehicles

The increasing demand for lightweight vehicles serves as a primary growth driver in the France Advanced Automotive Materials Market. Automakers are strategically reducing vehicle weight to enhance fuel efficiency and comply with strict European emission standards. Advanced materials such as aluminum alloys, carbon fiber composites, and reinforced plastics are increasingly replacing traditional steel components. This shift improves vehicle dynamics, fuel economy, and overall sustainability, aligning with the government’s environmental goals and supporting France’s transition toward cleaner mobility solutions.

- For instance, Renault’s 2025 Filante Record electric prototype integrates carbon fiber, aluminum, and high-strength Scalmalloy parts produced via 3D printing, enabling the car to weigh under 1,000 kilograms while maintaining structural rigidity and safety standards.

Expansion of Electric and Hybrid Vehicles

The rapid expansion of electric and hybrid vehicle production is significantly boosting demand for advanced automotive materials in France. Manufacturers are adopting lightweight metals and composites to improve battery performance, structural integrity, and overall energy efficiency. These materials enable longer driving ranges and better heat management in EVs. Government incentives for electric mobility and continuous investment in green technologies further accelerate the adoption of these materials, positioning France as a leading market for next-generation electric vehicle components.

- For instance, Stellantis, in partnership with France’s CEA, is developing next-generation battery cells using advanced chemistries designed to increase energy density, extend lifespan, and reduce the environmental footprint across models assembled in French plants under its Dare Forward 2030 strategy.

Technological Advancements in Material Innovation

Continuous innovation in material science is transforming the French automotive landscape. Research institutions and manufacturers are developing high-performance composites, nano-reinforced plastics, and corrosion-resistant alloys to enhance vehicle strength and durability. These innovations offer automakers the flexibility to design safer, more efficient vehicles while reducing manufacturing costs through improved processing technologies. The growing integration of additive manufacturing and advanced molding techniques is also driving scalability, making cutting-edge materials more viable for mass production.

Key Trends & Opportunities

Integration of Recyclable and Sustainable Materials

A major trend shaping the France Advanced Automotive Materials Market is the integration of recyclable and eco-friendly materials. Automakers are increasingly using bio-based polymers, recycled metals, and sustainable composites to meet France’s ambitious carbon reduction targets. These materials are especially popular in interior applications, replacing petroleum-based plastics with renewable alternatives. The trend reflects a broader move toward circular economy practices, as manufacturers prioritize materials that reduce environmental impact while maintaining high performance and aesthetic appeal.

- For instance, Citroën and BASF collaborated on the Citroën Oli, an electric concept car featuring a body made from recycled corrugated cardboard with fiberglass reinforcement, making it stronger than steel while being half the weight of traditional car bodies.

Growth in Advanced Composites Manufacturing

The development of advanced composite manufacturing presents a promising opportunity for the French market. With robust R&D capabilities and supportive government policies, France is becoming a hub for composite innovation. Advanced composites are gaining traction for their superior strength-to-weight ratio, corrosion resistance, and suitability for electric vehicle applications. Domestic suppliers are expanding production capacities to meet rising demand from both French and European automakers, strengthening the nation’s position as a key exporter of high-value automotive materials.

- For instance, Toray Carbon Fibers Europe S.A. is expanding its facility in southwest France to increase annual production of medium and high modulus carbon fibers to 6,000 metric tons in 2025, meeting rising demand from aerospace and automotive sectors.

Key Challenges

High Production and Processing Costs

One of the main challenges in the France Advanced Automotive Materials Market is the high cost of production and processing. Advanced materials such as carbon fiber composites and specialty alloys require expensive raw materials and sophisticated manufacturing processes. These costs restrict widespread adoption, particularly among smaller automakers. Despite clear performance and sustainability benefits, reducing production costs through technological innovation and process optimization remains essential for achieving large-scale market penetration.

Supply Chain and Raw Material Constraints

Supply chain vulnerabilities and raw material shortages pose ongoing challenges for market participants. Dependence on imported metals, polymers, and resins exposes manufacturers to global price fluctuations and logistical disruptions. Geopolitical tensions and international trade uncertainties further exacerbate these issues. To counter these risks, French automakers are investing in local sourcing, recycling initiatives, and strategic partnerships with material suppliers to ensure long-term supply stability and reduce dependence on external markets.

Regional Analysis

Northern France

Northern France accounts for 32% of the France Advanced Automotive Materials Market share, driven by its strong industrial base and the presence of major automotive manufacturing clusters. Cities such as Lille and Amiens serve as strategic hubs for material innovation, with several R&D centers focusing on lightweight metals and composites. The region benefits from proximity to Belgium and Germany, enhancing cross-border trade and technological exchange. Strong government support for clean mobility projects and partnerships between OEMs and suppliers continue to strengthen Northern France’s leadership in advanced automotive materials production.

Western France

Western France holds 21% of the market share, supported by its expanding automotive supply chain and strong research network. Regions such as Nantes and Rennes are emerging as centers for material engineering, particularly in advanced plastics and composites used in electric vehicles. The presence of major automotive component manufacturers contributes to the growing use of lightweight and sustainable materials. The region’s ports facilitate the import of raw materials and export of finished components, bolstering its role in France’s advanced automotive materials trade network.

Central France

Central France captures 18% of the national market share, driven by its balanced industrial ecosystem and growing focus on electric vehicle innovation. The region supports several mid-sized automotive component manufacturers and material suppliers catering to both domestic and international OEMs. Increasing investments in nanomaterials and polymer development are enhancing product performance and manufacturing efficiency. With supportive local policies promoting sustainability and digital manufacturing, Central France is positioning itself as a rising contributor to the country’s advanced automotive materials landscape.

Southern France

Southern France represents 17% of the market share, fueled by its strong aerospace and automotive synergy. Cities like Toulouse and Marseille contribute significantly through research in high-performance composites and lightweight alloys. The region’s universities and innovation clusters play a vital role in developing next-generation materials that meet strict environmental and safety standards. Additionally, Southern France benefits from its access to Mediterranean trade routes, which facilitates international collaboration and material imports, further strengthening its position within the advanced automotive materials market.

Eastern France

Eastern France accounts for 12% of the market share, leveraging its proximity to major European automotive hubs such as Germany and Switzerland. The region’s well-established automotive supply base focuses on high-strength steels, aluminum alloys, and engineering plastics. Strong collaborations between regional suppliers and European OEMs promote innovation and market integration. Eastern France’s industrial infrastructure and skilled workforce make it a critical contributor to France’s overall material development network, ensuring steady growth in the adoption of advanced materials for next-generation vehicles.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End-Use Vehicles

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

By Region

- Northern France

- Southern France

- Central France

- Western France

- Eastern France

Competitive Landscape

The competitive landscape of the France Advanced Automotive Materials Market is defined by the presence of major players such as Arkema, Toray Industries, DuPont de Nemours, Evonik Industries, BASF, ArcelorMittal, and Mitsubishi Chemical Corporation. These companies are actively investing in research and development to introduce high-performance materials that enhance vehicle efficiency, safety, and sustainability. Strategic collaborations between material suppliers and automakers are driving innovation in lightweight metals, composites, and advanced polymers. French manufacturers like Arkema lead in developing bio-based and recyclable materials aligned with national sustainability goals. Meanwhile, global players such as BASF and Toray Industries are expanding production capabilities to meet rising demand from electric and hybrid vehicle manufacturers. Continuous technological advancements, coupled with increasing competition from local and international suppliers, are fostering a dynamic market environment focused on product diversification, cost reduction, and environmentally responsible manufacturing practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema

- Toray Industries, Inc.

- DuPont de Nemours, Inc.

- Evonik Industries

- Wolverine Advanced Materials LLC

- Meyer France

- Mitsubishi Chemical Corporation

- ArcelorMittal

- BASF

- Others

Recent Developments

- On December 1, 2023, Arkema finalized the acquisition of a 54% stake in South Korea’s PI Advanced Materials (PIAM) from Glenwood Private Equity.

- On November 13, 2023, MATERI’ACT, a subsidiary of FORVIA, inaugurated its headquarters and R&D center in Villeurbanne, France. The center focuses on developing low-CO₂ footprint materials, aiming for a 70% recycled content in new automotive plastics by 2030.

- In June 2023, BASF and Avient Corporation collaborated to offer Ultason high-performance polymers in colored grades to the global market.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicle and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Advanced Automotive Materials Market will witness strong growth driven by increasing demand for lightweight and sustainable vehicles.

- Electric and hybrid vehicle expansion will significantly boost the adoption of advanced composites and high-strength metals.

- Automakers will continue to invest in bio-based and recyclable materials to meet France’s carbon neutrality goals.

- Integration of digital manufacturing technologies will enhance production efficiency and material precision.

- Collaboration between research institutions and automotive OEMs will accelerate innovation in advanced material science.

- Growing emphasis on circular economy practices will promote the recycling and reuse of automotive materials.

- Expansion of local supply chains will reduce dependency on imported raw materials and improve market stability.

- Increased government support for green mobility initiatives will drive material innovation and industrial transformation.

- Development of cost-effective processing techniques will make advanced materials more accessible to smaller manufacturers.

- France will strengthen its position as a European hub for advanced automotive material production and innovation.