Market Overview:

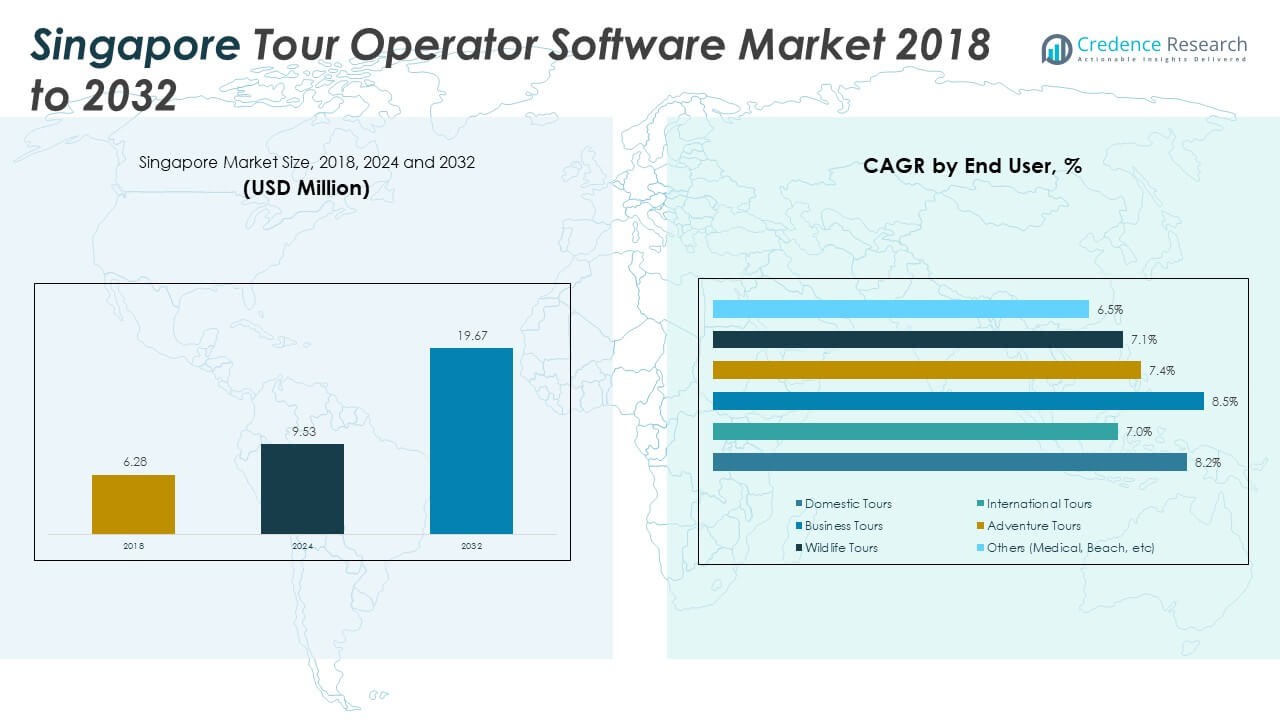

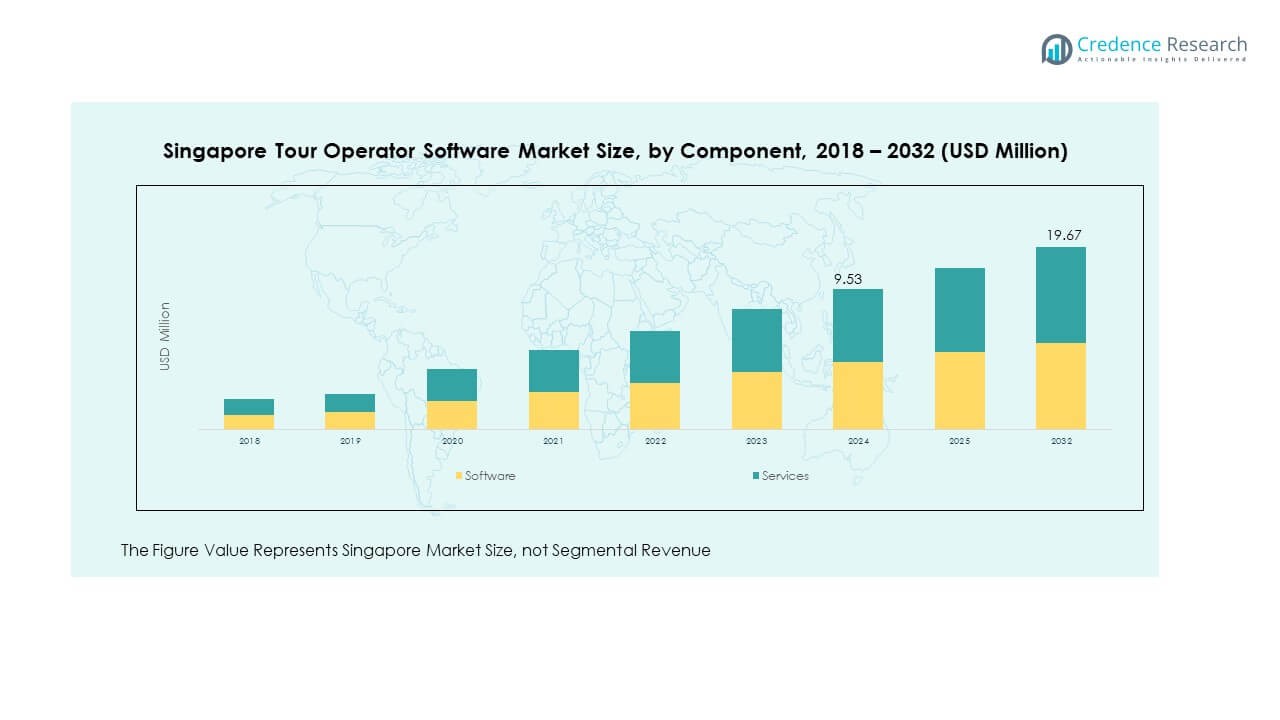

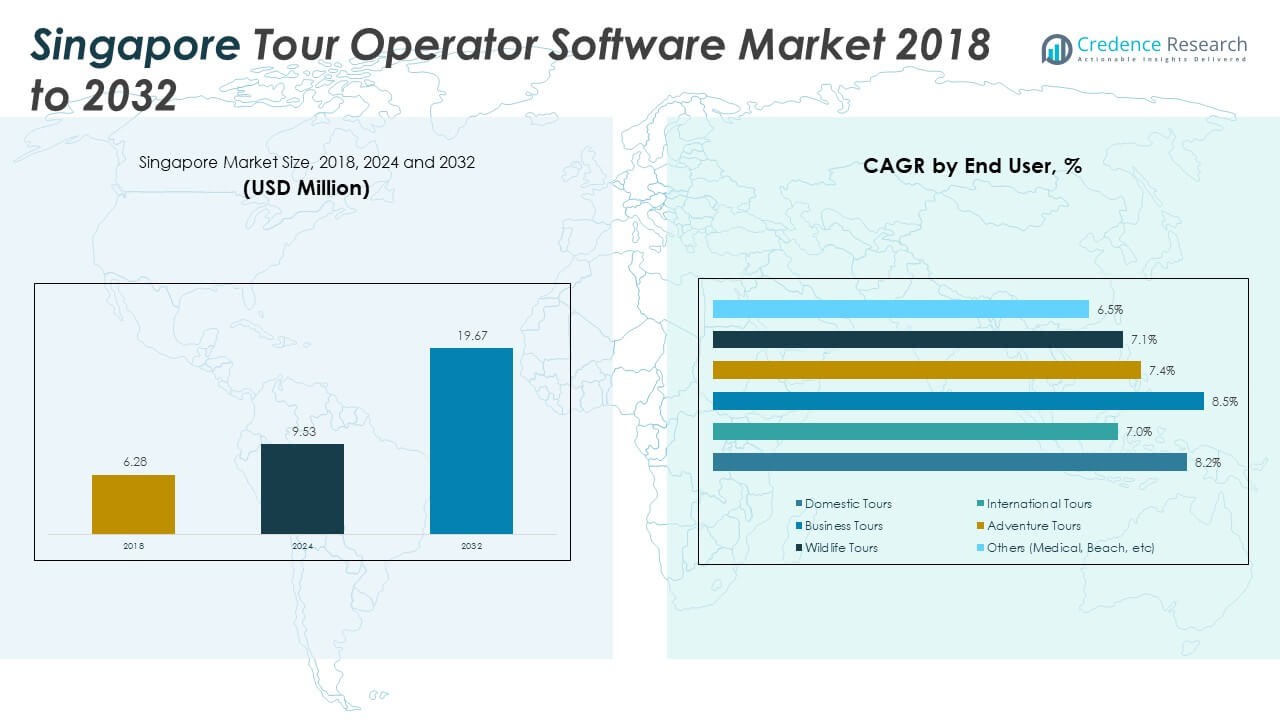

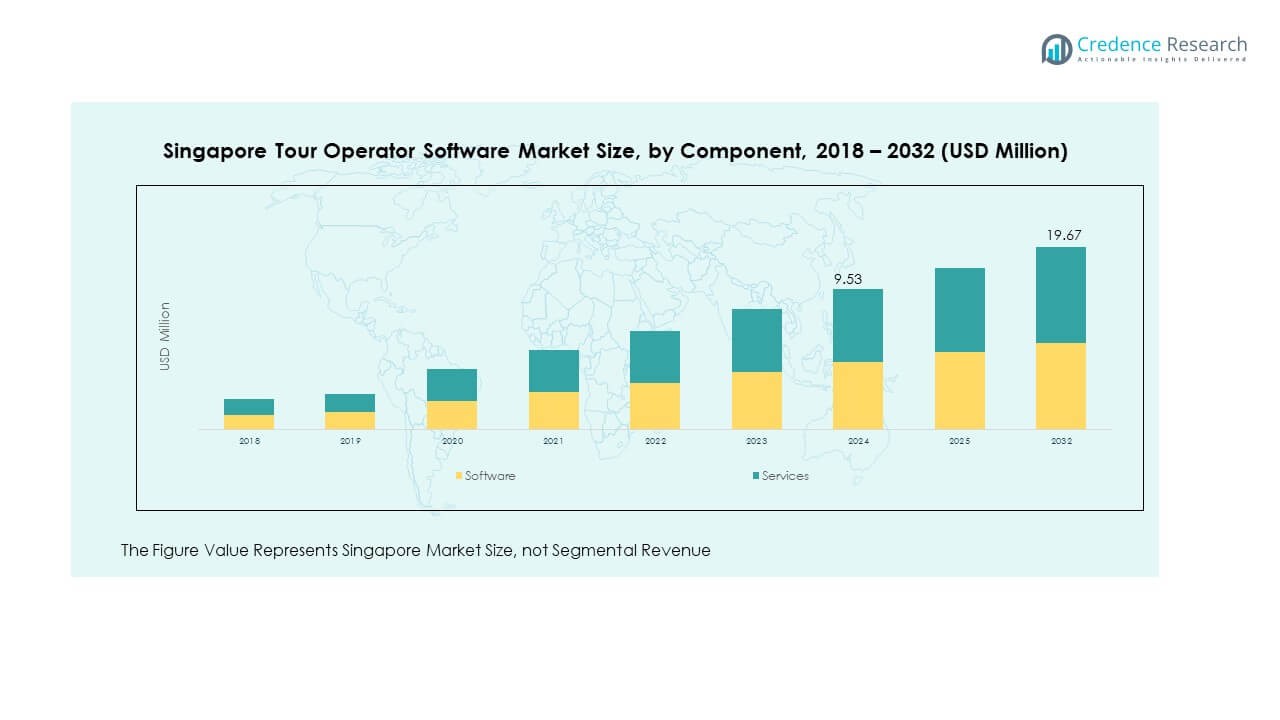

The Singapore Tour Operator Software Market size was valued at USD 6.28 million in 2018 to USD 9.53 million in 2024 and is anticipated to reach USD 19.67 million by 2032, at a CAGR of 9.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Singapore Tour Operator Software Market Size 2024 |

USD 9.53 Million |

| Singapore Tour Operator Software Market, CAGR |

9.49% |

| Singapore Tour Operator Software Market Size 2032 |

USD 19.67 Million |

Growth in this market is supported by the rising demand for seamless booking experiences and digital transformation in the tourism sector. Travel agencies are adopting integrated platforms that simplify operations, from itinerary management to real-time communication. Increased consumer preference for personalized travel services also contributes to the steady rise in demand.

The market shows strong prospects within Southeast Asia, where Singapore acts as a tourism hub. Its advanced infrastructure, regulatory support, and strategic location encourage adoption of software solutions by both domestic and international operators. Emerging players across Asia are leveraging Singapore as a gateway, strengthening the region’s competitive edge.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Singapore Tour Operator Software Market was valued at USD 6.28 million in 2018, reached USD 9.53 million in 2024, and is projected to hit USD 19.67 million by 2032, growing at a CAGR of 9.49%.

- Asia Pacific held the largest share at 41%, driven by Singapore’s hub role and regional tourism expansion. North America followed with 27% due to advanced digital adoption, while Europe accounted for 22%, supported by strong cultural and heritage tourism demand.

- The Middle East is the fastest-growing region with a 5% share, fueled by government investments in smart tourism and luxury travel services.

- In 2024, software accounted for around 58% of the market, reflecting its core role in booking, scheduling, and customer management.

- Services contributed about 42% in 2024, supported by rising demand for customization, training, and integration support among operators.

Market Drivers:

Rising Digital Adoption and Integrated Service Platforms:

The Singapore Tour Operator Software Market benefits from rising digitalization in travel services. Operators use cloud-based solutions to improve booking efficiency and customer management. Automation reduces administrative workload and boosts accuracy in reservations. Demand for real-time itinerary updates strengthens reliance on digital platforms. Integration with payment gateways streamlines transactions for both businesses and travelers. Mobile compatibility makes software more accessible to consumers and agents. Customization features also appeal to operators seeking differentiation. It remains a core driver for growth in this industry.

- For instance, Demand for real-time itinerary updates is met by platforms like Trip.com’s Trip.Planner, which offers AI-powered travel concierge services with real-time transport integration and flexible itinerary management for over 20 million geo-tagged points of interest. Integration with payment gateways streamlines transactions, and mobile compatibility further increases software accessibility for both consumers and travel agents.

Demand for Personalized and Seamless Travel Experiences:

Consumers prefer flexible travel arrangements that meet individual needs. The Singapore Tour Operator Software Market leverages this demand through AI-enabled personalization. Tools suggest tailored packages based on traveler preferences. Operators provide curated services with the support of analytics-driven insights. Seamless communication features enhance customer engagement before, during, and after trips. Real-time itinerary management builds trust and convenience. These capabilities attract both large agencies and independent operators. Personalization keeps the market dynamic and competitive.

- For example, Singapore Airlines uses AI-powered platforms to personalize communications before, during, and after trips, enhancing customer engagement and increasing ancillary revenue by maximizing offers tailored to passenger preferences.

Strategic Role of Tourism in Singapore’s Economy:

Singapore’s tourism industry contributes significantly to its economy. The Singapore Tour Operator Software Market grows as operators adopt advanced solutions to stay competitive. Government support for digital adoption reinforces the trend. Tourists expect efficient service delivery, encouraging businesses to adopt reliable platforms. The city’s position as a regional travel hub increases pressure on operators to deliver world-class services. Inbound and outbound tours benefit equally from these solutions. Investments in smart tourism strengthen the ecosystem. This creates a favorable environment for software adoption.

Expansion of Regional and Global Partnerships:

Collaboration between software providers and tour operators enhances growth. The Singapore Tour Operator Software Market expands as firms form alliances to improve reach. Integrations with airlines, hotels, and transport services ensure smooth traveler experiences. Operators partner with technology companies to upgrade features like AI chatbots or data analytics. Global players target Singapore due to its strategic location. Local firms also expand through partnerships, gaining international exposure. Such collaborations raise competitiveness and improve market adoption.

Market Trends:

Emergence of Cloud-Based and Mobile-First Solutions:

The Singapore Tour Operator Software Market reflects the shift toward cloud-first strategies. Cloud platforms allow operators to scale operations quickly and securely. Mobile-first solutions cater to younger travelers who prefer booking through smartphones. Cloud hosting also ensures cost efficiency for small operators. Remote accessibility empowers travel consultants to manage bookings anywhere. Subscription-based models are gaining traction for affordability. Regular software updates improve adaptability in a fast-changing market. It remains a vital trend shaping the sector.

- For instance, Mobile-first solutions specifically address younger travellers’ preference for smartphone bookings, while cloud hosting ensures cost efficiency and remote accessibility, empowering travel consultants to manage bookings anywhere.

Growing Influence of Artificial Intelligence and Data Analytics:

AI-driven solutions are redefining the Singapore Tour Operator Software Market. Operators apply predictive analytics to identify customer behavior trends. AI chatbots enhance communication and reduce response times. Data insights allow providers to improve package recommendations. Operators refine marketing campaigns with AI-driven targeting. Machine learning optimizes pricing strategies for seasonal demand. Automation through AI reduces errors and saves costs. This trend strengthens the market’s efficiency and innovation capacity.

- For instance, AI chatbots enhance communication and reduce response times, while data insights improve package recommendations and optimize marketing campaigns via targeted approaches. Machine learning supports dynamic pricing adjustments aligned with seasonal demand, and automation reduces errors and costs, strengthening efficiency and innovation capacity.

Increased Focus on Customer-Centric Interfaces and UX Design:

User experience is becoming central to the Singapore Tour Operator Software Market. Platforms adopt intuitive interfaces that simplify navigation for operators and travelers. Personalized dashboards offer clear visibility of bookings and itineraries. Multi-language support enhances inclusivity for global travelers. Operators emphasize faster load times and responsive layouts. Self-service portals empower customers to manage bookings independently. High-quality UX reduces drop-off rates in online booking processes. This trend ensures loyalty and customer satisfaction.

Rise of Sustainable Tourism and Eco-Friendly Travel Solutions:

Sustainability is influencing the Singapore Tour Operator Software Market. Operators integrate eco-friendly features such as carbon footprint calculators. Customers seek transparency on sustainable travel options. Platforms highlight green-certified hotels and low-emission transport options. Governments encourage eco-tourism through supportive policies. Operators use software to track sustainability metrics. Reports on eco-friendly practices boost brand value. This trend positions the market as both innovative and responsible.

Market Challenges Analysis:

High Costs of Implementation and Maintenance:

The Singapore Tour Operator Software Market faces cost-related challenges. Smaller operators struggle with expenses linked to advanced software deployment. Subscription fees, integration costs, and staff training increase financial burdens. Some firms delay adoption due to unclear ROI. Legacy systems require complex upgrades for compatibility. High implementation costs restrict widespread adoption. Price-sensitive operators in emerging sectors remain hesitant. It creates barriers for inclusive market growth.

Data Security and Integration Complexities:

Security risks pose challenges in the Singapore Tour Operator Software Market. Operators handle sensitive traveler data requiring strict protection. Cyberattacks and breaches undermine trust in digital platforms. Compliance with data privacy laws adds operational pressure. Integration with multiple service providers complicates software adoption. Disruptions occur when systems are incompatible. Firms need advanced security features, which raise costs. These hurdles affect scalability and adoption rates.

Market Opportunities:

Expansion into Niche Tourism Segments and Personalized Services:

The Singapore Tour Operator Software Market holds opportunities in niche tourism. Operators target adventure, cultural, and luxury tours with specialized packages. Software enables personalization, improving customer satisfaction. Analytics-driven insights help agencies capture emerging trends. Niche offerings attract diverse customer bases. Personalized solutions strengthen competitiveness in a crowded market. Demand for tailored packages creates room for innovation. Operators leveraging these tools gain a strategic edge.

Growth Through Regional Expansion and Digital Tourism Hubs:

The Singapore Tour Operator Software Market benefits from regional expansion opportunities. Singapore’s position as a travel hub supports software adoption across Asia. Firms explore cross-border collaborations with neighboring countries. Digital platforms facilitate easier management of regional operations. Governments promote smart tourism initiatives, creating fertile ground for expansion. Regional players gain exposure to international markets through Singapore. This enhances scalability and brand recognition. Opportunities in regional growth remain significant.

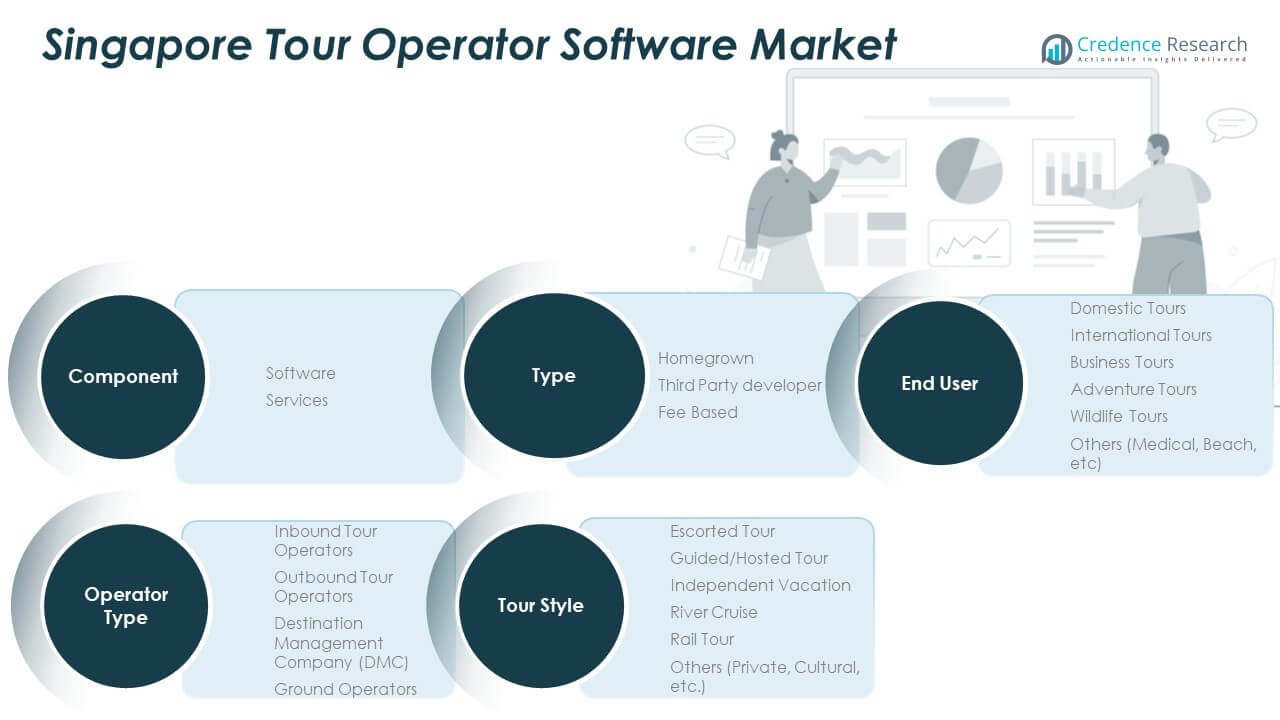

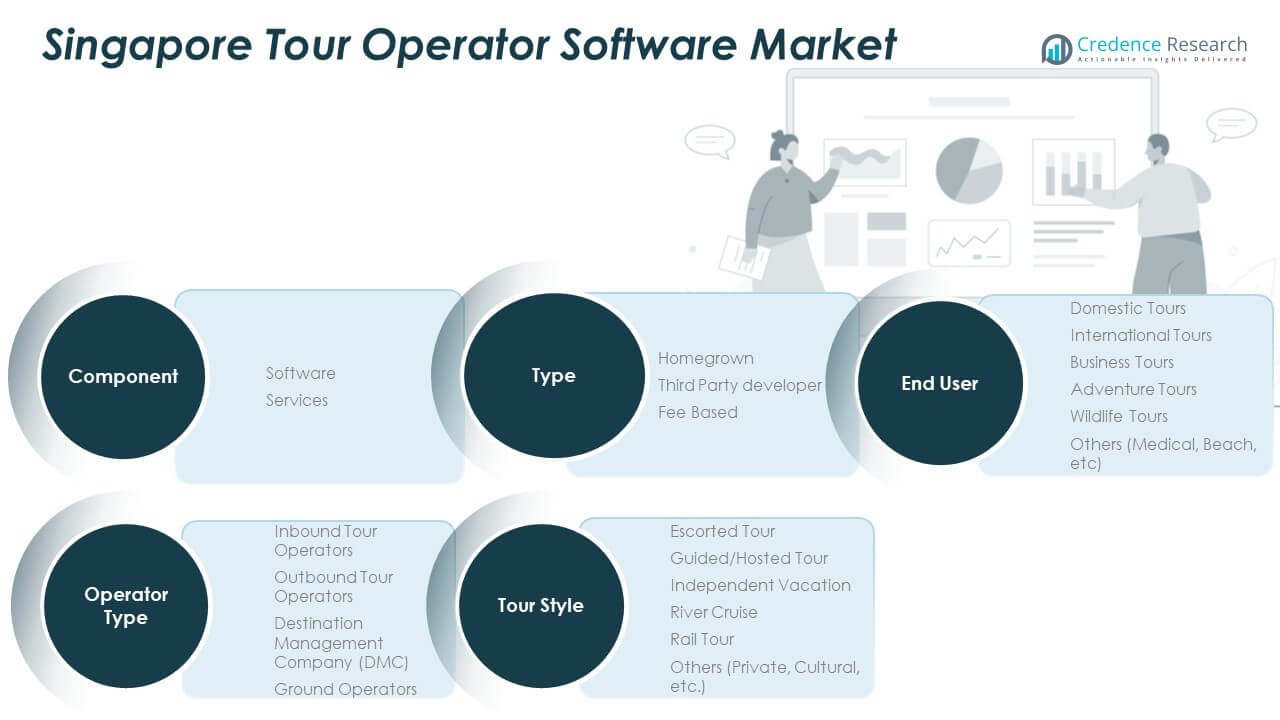

Market Segmentation Analysis:

Type and Component

The Singapore Tour Operator Software Market shows strong differentiation across type and component categories. Homegrown platforms appeal to local operators who value tailored solutions and cultural adaptability. Third-party developers dominate with advanced features and international integration, serving both large and mid-size agencies. Fee-based models attract established operators requiring premium functions such as AI-driven analytics and automated workflows. By component, software remains the backbone of the market due to its role in booking, scheduling, and management. Services complement software by offering customization, training, and technical support, helping agencies optimize performance and user adoption.

- For instance, homegrown platforms favored by local operators for tailored cultural adaptability, while third-party developers provide advanced features and international integrations suitable for large and mid-size agencies. Fee-based models attract established operators requiring premium functions such as AI analytics and automated workflows.

Operator Type

Operator type defines much of the market structure. Inbound operators rely on advanced platforms to manage growing tourist inflows into Singapore. Outbound operators depend on cross-border integrations with airlines, hotels, and other travel services. Destination Management Companies (DMCs) require detailed coordination features to handle large group itineraries and corporate tours. Ground operators benefit from software that improves real-time scheduling, transport management, and cost tracking. Each operator type drives different software adoption needs, ensuring diverse growth within the market.

Tour Style

Tour style segmentation highlights the variety of customer expectations that shape the Singapore Tour Operator Software Market. Escorted and guided tours demand platforms that simplify group management and itinerary customization. Independent vacation packages rely heavily on flexible booking systems and personalization features. River cruises and rail tours are emerging segments that need specialized scheduling tools for transport and activity management. Private and cultural tours require systems that support niche itinerary planning and customer engagement. This segmentation demonstrates the wide adaptability of modern tour operator software.

End User

End users define the ultimate demand in the Singapore Tour Operator Software Market. Domestic tours remain steady, driven by short-stay and weekend packages. International tours dominate in scale, supported by Singapore’s global tourism hub status. Business tours generate consistent demand for streamlined booking and payment features. Adventure and wildlife tours appeal to niche travelers, creating opportunities for operators to diversify. Other categories, such as cultural and educational tours, are expanding as experiential travel gains popularity. Software solutions adapt across these segments, enhancing flexibility and market reach.

Segmentation

By Type

- Homegrown

- Third Party Developer

- Fee Based

By Component

By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Central Tourism Districts

The Singapore Tour Operator Software Market is most active in central tourism districts such as Marina Bay, Orchard, and Sentosa. These areas attract high inbound tourist volumes, creating strong demand for digital booking and itinerary management platforms. Operators use advanced software to streamline services, manage large groups, and integrate with hotels and attractions in these regions. The concentration of premium hotels and entertainment hubs supports adoption of advanced platforms. Strong infrastructure and connectivity in the central district provide a natural advantage. It positions this area as the core contributor to the market’s revenue share.

Secondary Business and Cultural Hubs

Secondary hubs such as Bugis, Chinatown, and Little India hold a notable share in the Singapore Tour Operator Software Market. These regions combine cultural heritage tourism with rising business travel demand. Operators in these areas adopt software to manage both domestic and inbound visitors seeking personalized experiences. Features like multilingual support and real-time itinerary updates gain importance due to the diverse traveller base. Small and medium tour agencies here prefer affordable, scalable software options. The mix of business, leisure, and cultural appeal strengthens adoption trends. It ensures sustainable growth beyond the city’s central tourism core.

Emerging Regional Growth Spots

Emerging areas such as Jurong and Changi Airport zones show rising demand for tour operator solutions. Changi acts as a key international gateway, where operators require integrated platforms to manage high outbound and inbound flows. Jurong, with its growing commercial and leisure developments, supports adoption for business and family travel packages. Demand for software in these zones is tied to expanding infrastructure and tourism-related investments. The government’s push for smart nation initiatives further accelerates software penetration. These emerging spots may capture a growing share over the forecast period. It reflects the market’s ability to expand beyond established tourist districts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Trawex

- TBO Holidays (TBO.com)

- TravelCarma (Avani Travel Technologies)

- QuadLabs Technologies

- Amadeus IT Group

- Sabre Corporation

- Lemax

- Open Destinations

- TrekkSoft

- FareHarbor

Competitive Analysis:

The Singapore Tour Operator Software Market reflects a highly competitive structure with global and regional firms. Key players such as Amadeus IT Group, Sabre Corporation, and Trawex hold strong positions due to diverse portfolios and global reach. Local companies strengthen competitiveness through tailored solutions that suit Singapore’s market conditions. It benefits from innovation in cloud platforms, AI-enabled services, and customer experience tools. Price competitiveness and value-added services influence market dynamics. Operators seek reliable providers offering integration, scalability, and support. It ensures sustained competition and innovation in this market.

Recent Developments:

- On September 2, 2025, TBO Holidays announced its acquisition of Classic Vacations, a prominent US-based luxury travel company, for $125 million. This move is set to strengthen TBO’s platform for premium outbound and luxury travel distribution, combining technology-driven inventory with Classic Vacations’ vast advisor network.

- In July 2025, QuadLabs partnered with Kanoo Travel to launch “eo,” a next-generation corporate travel management platform. This strategic tie-up leverages QuadLabs’ technology to simplify travel booking and management for business clients, and the new solution was highlighted in both regional and international showcases.

- In the Asia-Pacific region, including Singapore, Amadeus announced the launch of a new digital media solution for destinations and airlines on March 26, 2025. Additionally, Amadeus signed a landmark partnership with Google in May 2025 to drive cloud-based operations and AI innovations in the travel industry. Another notable event is Amadeus’ acquisition of Voxel and WCC’s HERMES platform in April 2025 to strengthen end-to-end travel technology offerings.

- On March 4, 2025, Sabre Corporation entered a multi-year strategic collaboration with digital services provider Coforge to accelerate its product innovation roadmap, particularly deploying new AI-powered solutions for travel partners globally. Sabre also renewed its technology agreement with Singapore Airlines in June 2024 to enhance network planning and operational optimization, cementing its position in the Singapore travel technology sphere.

- On June 23, 2025, Open Destinations received a strategic investment from Insight Partners to accelerate growth and technology development for its reservation and ERP solutions, used widely by global tour operators including those with operations in Singapore. The investment is expected to boost both product innovation and market expansion in Southeast Asia.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of niche and luxury tourism segments.

- Stronger focus on cloud-native and mobile-first software.

- Partnerships between global and regional operators.

- Increased adoption of AI-driven personalization.

- Growth in cross-border collaborations across Asia Pacific.

- Rising investment in smart tourism initiatives.

- Higher demand for sustainability-focused travel solutions.

- Stronger cybersecurity integration within platforms.

- Expansion into untapped markets like Africa and Latin America.

- Continued innovation in customer-centric interfaces.