Market Overview

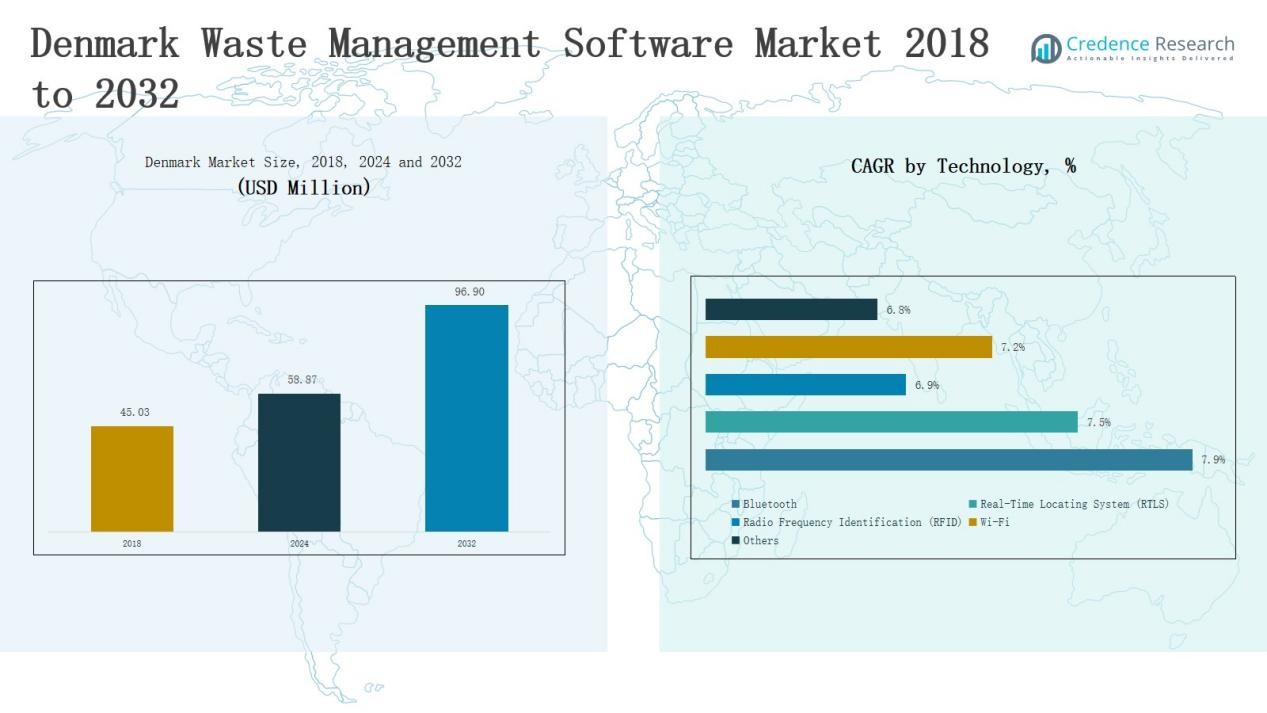

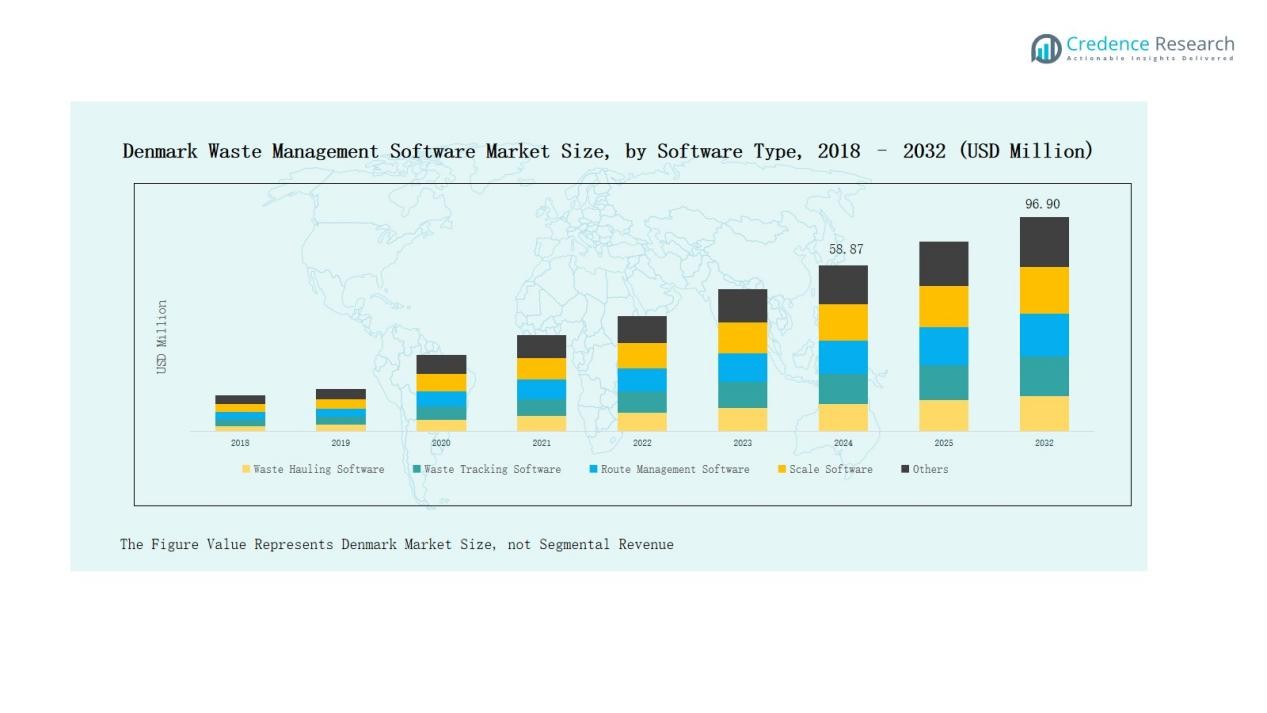

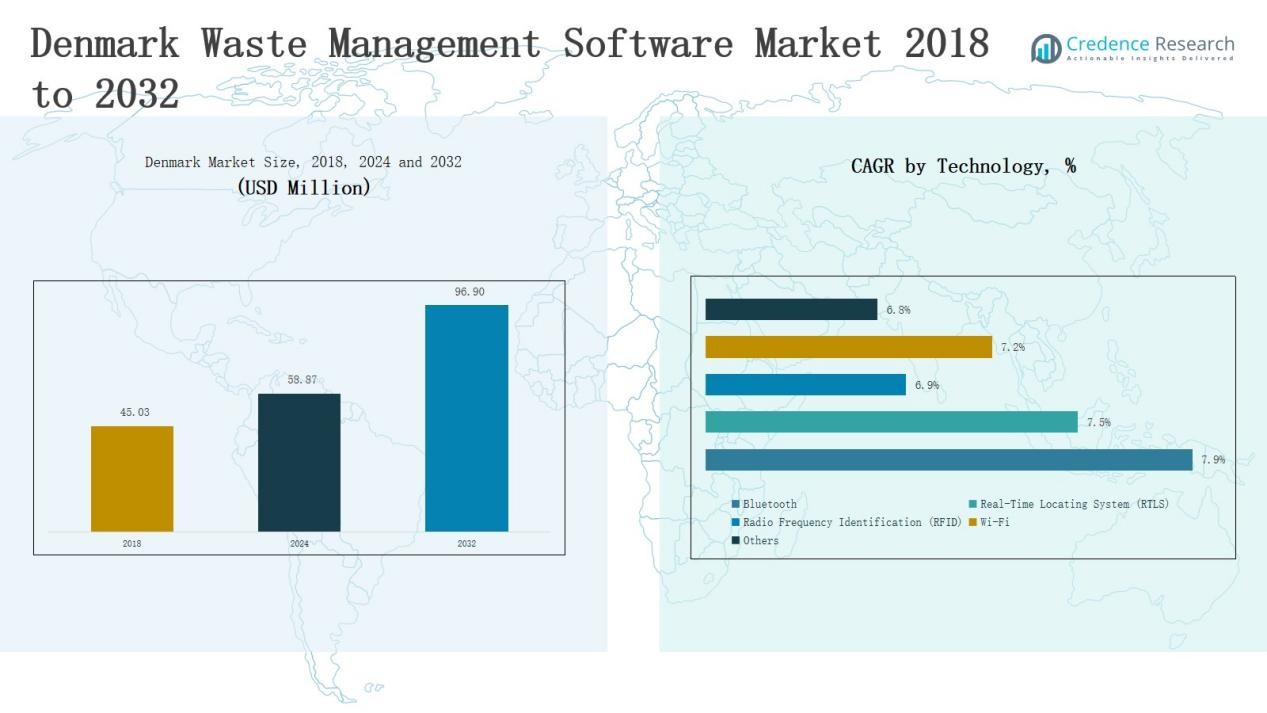

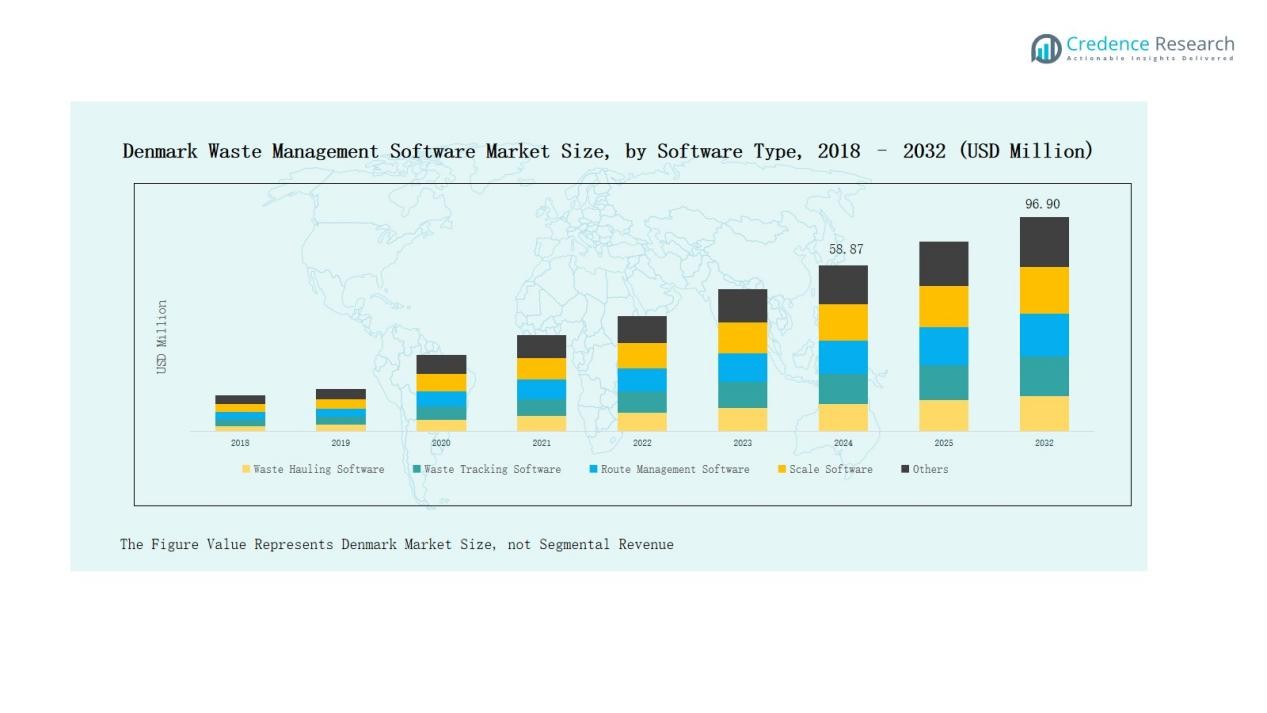

Denmark Waste Management Software Market size was valued at USD 45.03 million in 2018 to USD 58.87 million in 2024 and is anticipated to reach USD 96.90 million by 2032, at a CAGR of 6.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Denmark Waste Management Software Market Size 2024 |

USD 58.87 Million |

| Denmark Waste Management Software Market, CAGR |

6.43% |

| Denmark Waste Management Software Market Size 2032 |

USD 96.90 Million |

The Denmark Waste Management Software Market features prominent players such as EcoFacile, AMCS Group, SEE Forge, TRUX, WAM Software, Sequoia Waste Solutions, and DesertMicro, each competing through innovation, digital integration, and tailored solutions for municipalities and enterprises. These companies focus on expanding product portfolios with modules for route optimization, recycling, and compliance management, while strengthening market presence through strategic partnerships and cloud-based offerings. Copenhagen emerged as the leading region in 2024, accounting for 42% of the market share, driven by smart city initiatives, advanced recycling infrastructure, and strong municipal investments in digital waste management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Denmark Waste Management Software Market grew from USD 45.03 million in 2018 to USD 58.87 million in 2024 and will reach USD 96.90 million by 2032.

- Waste Hauling Software led by software type in 2024 with 26% share, supported by efficiency-focused adoption across municipal and private fleet operations.

- The municipal segment dominated applications with 38% share, driven by EU directives, sustainability programs, and rising demand for optimized collection and recycling processes.

- Cloud-Based Software commanded 63% share in 2024, highlighting strong preference for scalable, cost-efficient, and analytics-enabled platforms across enterprises and municipalities

- Copenhagen led the regional landscape with 42% share, supported by smart city initiatives, recycling infrastructure, and municipal investments in digital waste management systems.

Market Segment Insights

By Software Type

Waste Hauling Software dominated the Denmark Waste Management Software Market in 2024 with a 26% share. Its strong adoption is driven by the need to optimize collection schedules and reduce operational inefficiencies in municipal and private fleet operations. Route Management Software and Recycling Software followed closely, supported by Denmark’s smart city initiatives and circular economy goals. Waste Tracking Software adoption is rising as compliance with environmental regulations becomes stricter. Scale Software, Maintenance Software, and others collectively contributed to niche requirements across industries. Vendors focusing on integrating hauling modules with analytics tools gain competitive advantages in this segment.

- For instance, in April 2024, Sweco Danmark reported that its RenoWeb IT solution and RenoTrack haulier system were widely adopted by Danish municipalities to automate waste collection scheduling and track fleet status in real time, helping optimize municipal waste management operations.

By Application

The municipal segment led the Denmark Waste Management Software Market in 2024, commanding a 38% share. Growth is fueled by rising urban waste volumes, strict EU environmental directives, and government-led sustainability programs. Municipalities increasingly deploy route optimization, tracking, and recycling modules to meet recycling targets and reduce landfill dependency. Retail and manufacturing sectors contributed significantly, accounting for 21% and 18% shares, driven by compliance and operational efficiency needs. Healthcare applications held 13% share, emphasizing safe disposal of hazardous waste. Other applications represented 10%, mainly from smaller commercial users and institutions.

- For instance, in 2024, the Copenhagen municipality’s ongoing RAP24 initiative aimed to recycle 70% of municipal waste and cut emissions by 59,000 tons of CO2 per year, supported by programs that include the use of digitally monitored smart bins and route optimization for waste collection.

By Component

Cloud-Based Software was the dominant component in the Denmark Waste Management Software Market in 2024, holding a 63% share. Its leadership stems from scalability, lower upfront costs, and flexibility, making it the preferred choice for municipalities and private enterprises. Demand for SaaS platforms has accelerated due to real-time analytics, seamless integration, and remote accessibility. On-Premise Software accounted for 37% share, primarily used by organizations with higher data security concerns or legacy system dependencies. The steady shift toward cloud adoption highlights the market’s digital transformation focus, supported by Denmark’s investments in smart infrastructure and sustainability.

Key Growth Drivers

Rising Municipal Waste Volumes

The Denmark Waste Management Software Market is driven by increasing municipal waste generation across urban centers. Growing population density and stricter environmental policies create demand for efficient digital solutions. Municipal bodies rely on advanced software to improve collection routes, monitor waste volumes, and ensure regulatory compliance. Rising waste streams from households and commercial spaces strengthen the need for scalable, cloud-based platforms. The adoption of automated route management and tracking systems is accelerating as municipalities seek cost efficiency and sustainability in waste handling processes.

- For instance, Sensoneo offers an enterprise-grade smart waste management solution for cities and businesses globally, providing real-time bin monitoring and automated route optimization using cloud-based Microsoft Azure and supporting various IoT networks, including NB-IoT and LoRaWAN.

Stringent Environmental Regulations

Tightening EU and Denmark-specific waste directives push organizations to adopt advanced software platforms. Compliance with recycling targets, landfill reduction, and emissions control requires precise data management. Waste management software enables operators to track, document, and report activities in line with regulatory standards. Businesses, municipalities, and recyclers benefit from digital solutions that minimize compliance risks and penalties. Software systems supporting automated documentation and sustainability reporting are increasingly essential. This regulatory pressure is a major driver fueling investments in Denmark’s waste management technology landscape.

- For instance, the European Recycling Platform Denmark announced in August 2024 that it provides automated compliance and reporting services for producer responsibility regulations, including mandatory packaging quantity registration and documentation for local businesses to meet Denmark’s new requirements.

Demand for Operational Efficiency

Organizations across Denmark aim to reduce operational costs and optimize workflows in waste handling. Waste management software delivers real-time visibility into fleet operations, asset utilization, and recycling outcomes. Automated tools for scale management, route optimization, and equipment maintenance improve productivity while lowering expenses. Cloud-based platforms allow better resource allocation and quick decision-making through advanced analytics. Growing adoption among manufacturing, healthcare, and retail players highlights the demand for systems that streamline daily operations. This focus on efficiency significantly drives software adoption in the Danish market.

Key Trends & Opportunities

Expansion of Smart Waste Technologies

Smart city initiatives across Denmark are creating opportunities for software vendors. Integration of IoT-enabled bins, RFID tags, and sensors is expanding, enabling real-time monitoring of waste levels and collection needs. Software platforms that incorporate predictive analytics and automation align well with these developments. Companies investing in AI-powered route planning and IoT integration are positioned to capture new demand. This trend reflects Denmark’s push toward data-driven urban infrastructure and sustainable resource management, fostering growth opportunities for advanced waste management solutions.

- For instance, Copenhagen Municipality partnered with the technology company Nordsense to deploy IoT-enabled sensors in street-level waste bins to optimize collection schedules based on fill-level data.

Growth of Cloud-Based Platforms

The shift toward cloud deployment models is a defining trend in the Denmark Waste Management Software Market. Cloud solutions offer scalability, lower upfront costs, and remote accessibility, making them attractive to municipalities and private enterprises. Organizations increasingly prefer SaaS-based models for easy integration with existing systems. This transition also supports real-time updates, security, and flexibility for multi-site operations. Vendors offering tailored cloud-based waste management platforms can capture market share by addressing both small-scale operators and large enterprises seeking digital transformation.

- For instance, in August 2025, Tietoevry Tech Services partnered with COSMO CONSULT to deliver Microsoft Dynamics 365 ERP solutions enhanced with cloud capabilities, helping waste companies optimize complex material flows and digitalize operations across the Nordic region.

Key Challenges

High Implementation Costs

One of the primary challenges in the Denmark Waste Management Software Market is the significant upfront investment. Costs include licensing fees, infrastructure upgrades, and employee training. Smaller municipal bodies and SMEs often struggle to allocate budgets for comprehensive systems. The financial barrier slows adoption, particularly for advanced modules such as predictive analytics and real-time tracking. Vendors must offer flexible pricing models and scalable packages to overcome this issue and expand software adoption across Denmark’s diverse waste management ecosystem.

Integration with Legacy Systems

Many organizations in Denmark still rely on outdated IT systems, making integration complex. Connecting modern waste management software with legacy infrastructure often leads to compatibility issues and additional costs. This challenge affects the speed of deployment and may cause operational disruptions. Resistance to system overhauls among smaller operators also hinders adoption. Vendors need to prioritize interoperability and provide robust integration support to minimize disruptions. Ensuring smooth compatibility will be critical in driving long-term adoption across multiple industries.

Data Privacy and Security Concerns

With increasing digitization, safeguarding sensitive operational and consumer data is a growing concern. Waste management software involves real-time tracking, cloud storage, and IoT integration, all of which introduce cybersecurity risks. Breaches can expose confidential data, causing regulatory penalties and reputational damage. Denmark’s strict data protection framework adds another compliance burden for software providers. Vendors must invest in advanced security features, including encryption, access control, and regular audits, to ensure trust among municipalities

Regional Analysis

Copenhagen

Copenhagen accounts for 42% share of the Denmark Waste Management Software Market, supported by its strong smart city initiatives. The city invests heavily in digital waste tracking and route optimization to improve sustainability. Municipal authorities adopt cloud-based platforms to enhance operational efficiency and reduce emissions. Strong demand arises from healthcare and retail industries seeking compliance with strict environmental regulations. Vendors gain opportunities through IoT-enabled solutions integrated with waste collection infrastructure. Copenhagen’s commitment to circular economy practices further accelerates the adoption of advanced waste management software.

Aarhus

Aarhus holds 28% share of the Denmark Waste Management Software Market, with significant focus on industrial and manufacturing waste streams. The city promotes recycling technologies and advanced scale management systems to support regional sustainability goals. Municipal bodies and private enterprises prioritize cloud-based deployment for flexibility and scalability. Demand is growing for waste tracking and route management software, driven by expanding logistics and retail sectors. Aarhus encourages public-private partnerships, creating a favorable ecosystem for software vendors. Its industrial base ensures consistent demand for solutions that streamline compliance and efficiency.

Odense

Odense represents 18% share of the Denmark Waste Management Software Market, with rising adoption among mid-sized enterprises and local municipalities. The region invests in RFID-based tracking systems to enhance operational accuracy. Healthcare and retail segments are key adopters due to strict waste disposal norms. Vendors offering cost-effective, scalable platforms see strong demand among smaller organizations. The city’s sustainability policies encourage recycling software adoption, aligning with Denmark’s national targets. Odense continues to expand its digital infrastructure, creating new opportunities for waste management software providers.

Other Regions

Other regions collectively account for 12% share of the Denmark Waste Management Software Market, with growth driven by smaller municipalities and rural areas. Adoption remains slower due to limited budgets, but cloud-based solutions reduce barriers. Recycling and route optimization software see steady demand from regional operators aiming for cost efficiency. Vendors providing affordable and modular solutions can tap into these markets. Sustainability targets set by the government are pushing even smaller regions to adopt digital waste management tools. The expansion of infrastructure projects supports steady growth in these areas.

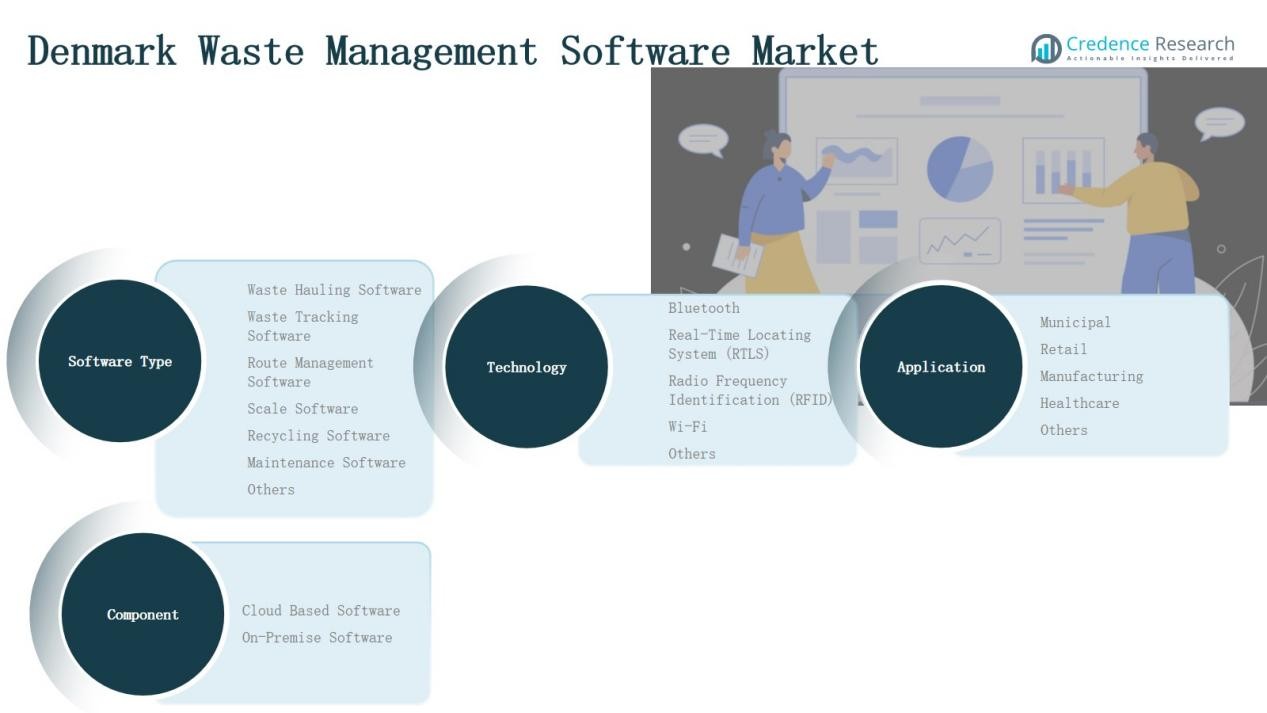

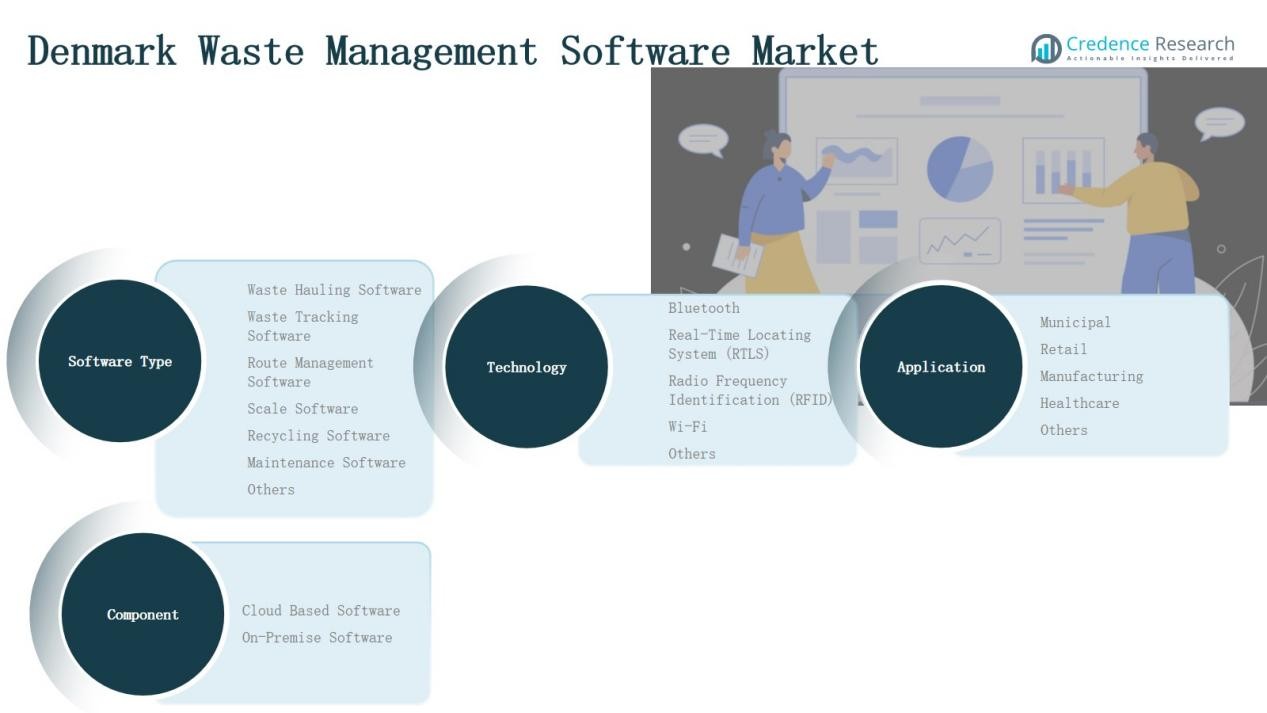

Market Segmentations:

By Software Type

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application

- Municipal

- Retail

- Manufacturing

- Healthcare

- Others

By Component

- Cloud-Based Software

- On-Premise Software

By Technology

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Region

- Copenhagen

- Aarhus

- Odense

- Other Regions

Competitive Landscape

The Denmark Waste Management Software Market is moderately consolidated, with a mix of global vendors and local players competing for market share. Key companies such as EcoFacile, AMCS Group, SEE Forge, TRUX, WAM Software, Sequoia Waste Solutions, and DesertMicro drive competition through product innovation and strategic partnerships. It is characterized by rising demand for cloud-based platforms and IoT-enabled solutions, pushing vendors to enhance scalability, interoperability, and security features. Companies focus on expanding product portfolios, offering specialized modules for waste hauling, route optimization, and recycling management. Local players strengthen their presence through tailored solutions designed for municipalities and SMEs, while international firms leverage strong financial capabilities and global experience. Strategic initiatives such as mergers, acquisitions, and collaborations are common as vendors aim to increase customer base and market penetration. Continuous investment in advanced analytics, automation, and compliance-focused features defines the competitive landscape in Denmark’s waste management software sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In August 2024, Seenons acquired Waste Group Denmark to expand its platform in Denmark. The deal strengthened Seenons’ European waste software footprint.

- In August 2025, Tietoevry Tech Services partnered with COSMO CONSULT for Nordic waste firms. The offer combines Dynamics 365 with COSMO Environmental Services for end-to-end workflows.

- In July 2025, Microsoft signed a long-term offtake with Gaia in Denmark. The CCS project will deliver about 2.95 million carbon removal credits from a waste-to-energy plant.

- In June 2025, Waste Group Denmark rebranded to Seenons Denmark. The move completed integration and aligned services on the Seenons digital platform.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Application, Technology, Component and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered analytics will enhance predictive waste collection planning.

- Cloud-based platforms will expand further across municipalities and private enterprises.

- Integration of IoT-enabled bins and RFID systems will become more widespread.

- Vendors will prioritize cybersecurity features to meet strict data protection rules.

- Recycling software demand will rise with stronger national circular economy goals.

- Partnerships between municipalities and software providers will strengthen market penetration.

- Healthcare and manufacturing sectors will drive adoption of compliance-focused solutions.

- Route optimization software will gain traction with smart city development projects.

- Local vendors will expand by offering cost-effective modular software packages.

- Sustainability reporting features will evolve as organizations seek transparent compliance tracking.