Market Overview

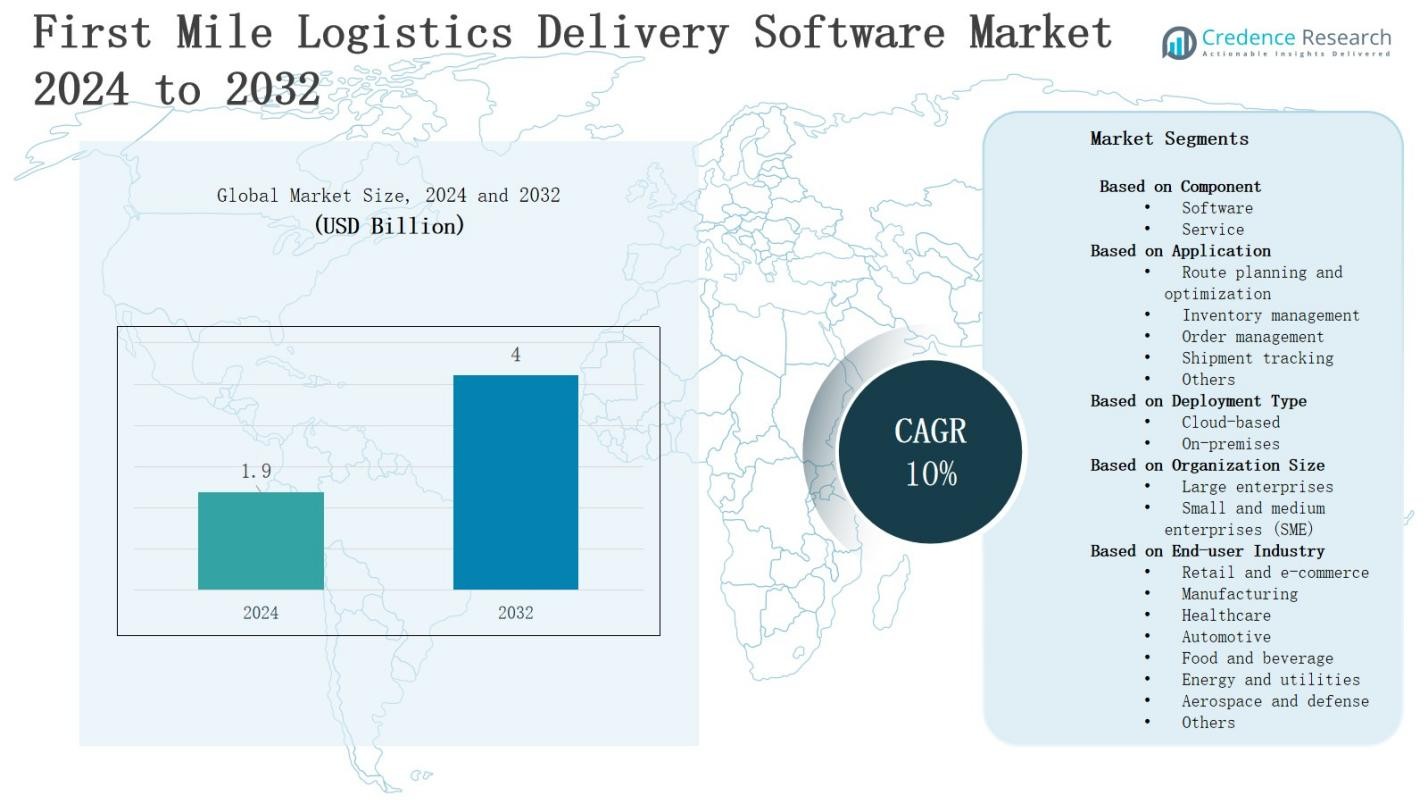

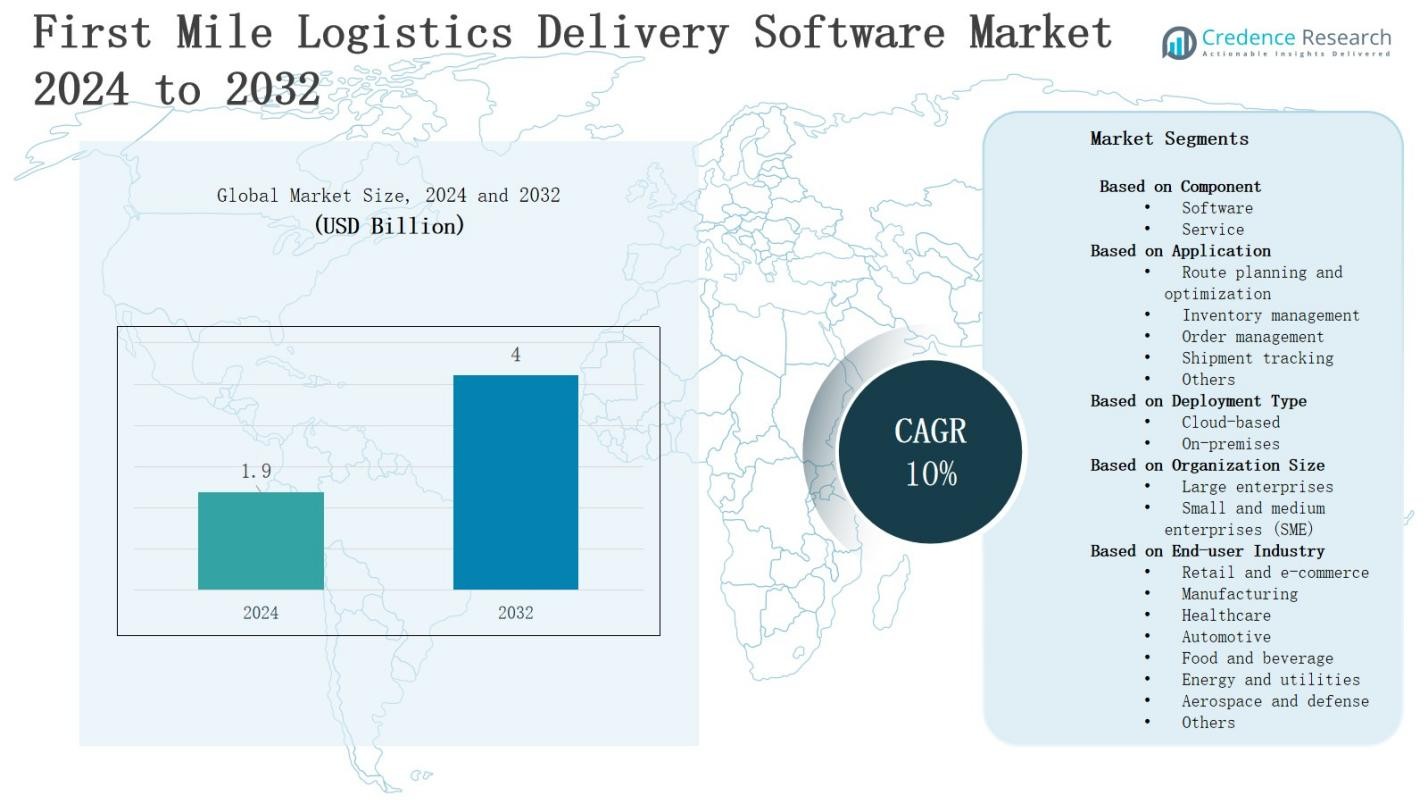

The First Mile Logistics Delivery Software Market is projected to grow from USD 1.9 billion in 2024 to USD 4.0 billion by 2032, registering a 10% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| First Mile Logistics Delivery Software Market Size 2024 |

USD 1.9 Billion |

| First Mile Logistics Delivery Software Market, CAGR |

10% |

| First Mile Logistics Delivery Software Market Size 2032 |

USD 4.0 Billion |

Market drivers for the First Mile Logistics Delivery Software Market include rising e-commerce volumes, demand for faster order fulfillment, and pressure to reduce transportation costs. Companies adopt these solutions to streamline dispatching, optimize routes, and improve real-time visibility. Growing focus on sustainability and emissions reduction also accelerates adoption. Trends shaping the market include integration of AI and machine learning for predictive logistics, cloud-based deployment for scalability, and adoption of IoT sensors to enhance tracking accuracy. Increasing reliance on mobile applications and API-driven ecosystems further strengthens efficiency, enabling enterprises to improve customer satisfaction and remain competitive in dynamic supply chains.

The first mile logistics delivery software market shows diverse growth across regions, with North America holding the largest share, followed by Europe and Asia Pacific. Latin America, the Middle East, and Africa contribute smaller but expanding portions driven by digital adoption and e-commerce growth. It remains competitive with key players such as Oracle Corporation, SAP SE, Trimble Transportation, E2open, Epicor Software Corporation, Blue Yonder, Descartes Systems Group, Kinaxis, ShipBob, and Shipsy, all focusing on innovation, cloud integration, and sustainable logistics solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The first mile logistics delivery software market is projected to grow from USD 1.9 billion in 2024 to USD 4.0 billion by 2032, at a 10% CAGR.

- Software held 68% share in 2024, dominating the market due to automation, analytics, and tracking capabilities, while services with 32% supported integration, customization, and long-term operational efficiency.

- Route planning and optimization led applications with 34% share, followed by shipment tracking at 26%, inventory management at 18%, order management at 15%, and others collectively accounting for 7%.

- Cloud deployment dominated with 71% share in 2024, driven by scalability, mobile access, and lower costs, while on-premises solutions retained 29% share, serving industries with strict security needs.

- Regionally, North America held 34% share, Europe 27%, Asia Pacific 22%, Latin America 8%, Middle East 5%, and Africa 4%, with growth driven by e-commerce expansion and digital transformation.

Market Drivers

commerce Expansion and Demand for Faster Fulfillment

The first mile logistics delivery software market benefits strongly from the rapid expansion of e-commerce. Online retailers prioritize fast and reliable order fulfillment to maintain competitiveness. It enables businesses to manage rising shipment volumes effectively while keeping delivery timelines shorter. Consumer preference for same-day and next-day deliveries increases pressure on logistics operations. The software streamlines scheduling, improves route accuracy, and reduces errors. Companies adopt advanced platforms to enhance operational agility and meet evolving customer expectations.

- For instance, in June 2024, E2open introduced an appointment scheduling API in its transportation management platform to reduce lead times and centralize scheduling among supply chain partners, improving operational efficiency.

Operational Efficiency and Cost Reduction Goals

Enterprises in the first mile logistics delivery software market seek solutions that minimize costs and maximize efficiency. Fuel prices and labor expenses raise the need for streamlined processes. It helps optimize dispatching, reduce idle time, and improve asset utilization. Automated systems lower dependency on manual operations while minimizing costly mistakes. Businesses benefit from predictive planning tools that reduce overall operational waste. This efficiency focus ensures improved profitability and long-term sustainability across competitive logistics environments.

Sustainability and Regulatory Compliance Pressure

Growing environmental regulations and sustainability mandates influence the first mile logistics delivery software market significantly. Companies face strict emissions reduction targets and stricter compliance requirements. It assists operators in adopting eco-friendly practices, including optimized routing and reduced fuel consumption. Integration with electric vehicle fleets and green logistics strategies becomes critical. Businesses adopt advanced analytics to monitor carbon footprints and meet reporting standards. This shift strengthens alignment with global climate goals while enhancing brand reputation in key markets.

Technology Integration and Digital Transformation

Digitalization plays a central role in the growth of the first mile logistics delivery software market. Businesses increasingly integrate AI, IoT, and cloud-based systems to enhance performance. It supports real-time tracking, predictive maintenance, and intelligent decision-making. Mobile platforms extend accessibility for drivers and managers, improving coordination. API-driven ecosystems enable seamless connectivity across partners and systems. The shift toward advanced technology adoption strengthens competitive positioning and ensures long-term resilience in evolving supply chains worldwide.

- For instance, Trimble Transportation has implemented AI-driven predictive supply chain analytics to improve real-time tracking and optimize dispatch decisions.

Market Trends

Adoption of Artificial Intelligence and Machine Learning

The first mile logistics delivery software market experiences strong momentum with the adoption of artificial intelligence and machine learning. These technologies enhance demand forecasting, predictive route planning, and shipment prioritization. It allows companies to manage dynamic order volumes and improve delivery accuracy. Machine learning algorithms reduce operational bottlenecks by identifying inefficiencies early. Businesses deploy AI to optimize driver allocation and reduce idle capacity. This shift strengthens decision-making, improves overall efficiency, and ensures competitive advantage in fast-moving logistics environments.

- For instance, Pickrr integrated AI and machine learning in its platform to analyze over 50 parameters for courier partner selection, significantly reducing delivery failures and improving logistics efficiency.

Integration of Internet of Things and Real-Time Tracking

The first mile logistics delivery software market witnesses rapid integration of IoT devices for enhanced visibility. Real-time data from connected sensors improves tracking accuracy and provides actionable insights. It enables managers to monitor fleet performance and cargo conditions consistently. IoT-driven alerts help prevent disruptions by signaling delays or equipment issues early. Enhanced visibility fosters transparency across stakeholders, including retailers and customers. Companies invest heavily in IoT platforms to ensure accountability and improve delivery reliability across global supply chains.

- For instance, DHL employs IoT sensors in its vehicles and containers to monitor real-time conditions such as temperature, humidity, and vibration, ensuring product integrity in sectors like pharmaceuticals and food.

Expansion of Cloud-Based Platforms and Mobile Accessibility

The first mile logistics delivery software market gains traction from cloud-based platforms that enhance scalability and flexibility. Companies adopt these solutions to manage distributed operations efficiently. It allows real-time access to dispatch data, driver schedules, and performance metrics through mobile applications. Cloud platforms reduce infrastructure costs while enabling seamless updates and system integrations. Mobile accessibility improves workforce coordination and empowers field teams. This widespread adoption ensures enterprises achieve higher operational agility and adapt quickly to changing logistics demands.

Focus on Sustainability and Green Logistics Solutions

The first mile logistics delivery software market aligns with global sustainability initiatives through green logistics solutions. Businesses adopt digital platforms to optimize routes and minimize fuel consumption. It enables integration with electric vehicle fleets, supporting emissions reduction strategies. Sustainability-focused analytics provide insights on carbon footprints and compliance reporting. Companies increasingly view eco-friendly logistics as both a regulatory requirement and brand differentiator. This trend accelerates software adoption, ensuring organizations align operations with long-term environmental goals while strengthening stakeholder trust worldwide.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The first mile logistics delivery software market faces significant barriers from high implementation costs and integration challenges. Small and medium enterprises struggle to allocate budgets for advanced platforms, limiting adoption. It requires considerable investment in infrastructure, training, and ongoing maintenance. Legacy systems often create compatibility issues, slowing digital transformation efforts. Businesses face difficulties in aligning multiple software modules with existing logistics operations. These factors create delays in deployment timelines and restrict widespread penetration, particularly in cost-sensitive regions.

Data Security Concerns and Skill Gaps in Workforce

The first mile logistics delivery software market encounters obstacles from rising data security concerns and limited skilled professionals. Increasing dependence on real-time data raises exposure to cyber risks and breaches. It demands strong encryption, compliance with international standards, and continuous monitoring to safeguard sensitive information. Many companies also face shortages of trained personnel to manage advanced analytics and digital tools. Limited technical expertise restricts optimization potential and creates operational bottlenecks. These challenges hinder smooth scaling of software-driven logistics strategies across industries.

Market Opportunities

Growth in E-commerce and Emerging Markets

The first mile logistics delivery software market holds strong opportunities from rapid e-commerce growth and expansion in emerging economies. Rising online retail demand drives the need for efficient order pickups, dispatching, and tracking. It supports businesses in scaling operations to handle increasing shipment volumes across diverse regions. Emerging markets with expanding digital infrastructure present attractive growth potential. Companies that deliver cost-effective, localized solutions gain faster adoption. This creates long-term opportunities for software vendors to expand presence and strengthen customer bases.

Advancements in Technology and Sustainable Solutions

The first mile logistics delivery software market benefits from opportunities tied to advanced technologies and sustainability goals. Artificial intelligence, IoT, and predictive analytics enable higher operational efficiency and smarter decision-making. It enhances route optimization, real-time visibility, and fleet utilization for enterprises. Growing emphasis on green logistics supports integration with electric vehicles and emissions monitoring tools. Organizations adopting such platforms improve compliance and brand reputation. Vendors focusing on eco-friendly and tech-driven solutions position themselves favorably in future logistics landscapes.

Market Segmentation Analysis:

Based on Component

In the first mile logistics delivery software market, the software segment accounted for 68% share in 2024, making it the dominant component. The demand is fueled by rising need for automation, advanced analytics, and real-time tracking features that streamline logistics operations. It enables businesses to manage dispatching, inventory, and compliance from unified platforms. The service segment, holding 32% share, supports customization, integration, and maintenance, which remain vital for enterprises seeking long-term operational efficiency and system reliability.

- For instance, in February 2024, Shipsy launched its first mile logistics solutions on AWS Marketplace, offering features such as transportation management, route optimization, fuel consumption management, and multi-courier support to improve first mile operations.

Based on Application

The route planning and optimization segment led with 34% share in 2024, establishing itself as the largest application in the first mile logistics delivery software market. Rising pressure to cut fuel costs, reduce delays, and improve driver productivity drives adoption. It enhances delivery accuracy and shortens fulfillment timelines. Shipment tracking held 26% share, supported by demand for real-time visibility, while inventory management captured 18%. Order management accounted for 15%, and others collectively represented 7% of the market.

- For instance, UPS reported that its ORION route optimization system helped save over 100 million miles driven annually, reducing fuel use and cutting CO₂ emissions by approximately 100,000 metric tons.

Based on Deployment Type

The first mile logistics delivery software market is dominated by the cloud-based segment, which held 71% share in 2024. Cloud platforms offer scalability, lower upfront investment, and ease of integration across distributed operations. It allows enterprises to ensure accessibility through mobile devices and achieve faster system updates. The on-premises segment, with 29% share, continues to serve organizations prioritizing strict data security and complete control over infrastructure, particularly in industries with sensitive compliance requirements.

Segments:

Based on Component

Based on Application

- Route planning and optimization

- Inventory management

- Order management

- Shipment tracking

- Others

Based on Deployment Type

Based on Organization Size

- Large enterprises

- Small and medium enterprises (SME)

Based on End-user Industry

- Retail and e-commerce

- Manufacturing

- Healthcare

- Automotive

- Food and beverage

- Energy and utilities

- Aerospace and defense

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America held 34% share of the first mile logistics delivery software market in 2024, driven by strong e-commerce penetration and established digital infrastructure. Retailers and logistics companies in the region adopt advanced platforms to meet demand for faster deliveries. It benefits from wide integration of AI and cloud-based solutions that enhance transparency and operational control. The U.S. leads the adoption with large investments in automation. Cross-border trade further supports software demand. Growing sustainability regulations encourage adoption of eco-friendly logistics software across industries.

Europe

Europe accounted for 27% share of the first mile logistics delivery software market in 2024, supported by strict regulatory frameworks and sustainability targets. Companies in the region prioritize compliance with emissions standards and circular economy practices. It drives adoption of software that optimizes routes and reduces environmental impact. Strong e-commerce growth across Germany, the UK, and France strengthens demand. Widespread use of IoT-enabled tracking tools increases visibility and efficiency. Logistics providers increasingly adopt cloud deployment models for scalability and integration.

Asia Pacific

Asia Pacific held 22% share of the first mile logistics delivery software market in 2024, fueled by expanding e-commerce activity and rising urbanization. Companies in China, India, and Japan invest in advanced solutions to handle growing shipment volumes. It supports rapid adoption of mobile and cloud-based platforms for real-time delivery management. Governments in the region promote digitalization to improve logistics efficiency. Local startups drive innovation with cost-effective platforms. Increased consumer preference for fast and reliable deliveries strengthens the regional market.

Latin America

Latin America represented 8% share of the first mile logistics delivery software market in 2024, supported by digital transformation in retail and logistics. Brazil and Mexico lead adoption due to strong e-commerce growth and expanding delivery networks. It enables businesses to overcome inefficiencies in transportation infrastructure through route optimization and tracking. Rising middle-class consumption fuels online retail expansion. Cloud-based platforms are gaining traction among SMEs seeking scalable solutions. Investments in logistics technology strengthen operational efficiency across regional markets.

Middle East

The Middle East captured 5% share of the first mile logistics delivery software market in 2024, driven by growing retail modernization and e-commerce penetration. Countries such as the UAE and Saudi Arabia invest heavily in digital logistics platforms. It supports demand for real-time tracking and inventory visibility in fast-expanding trade hubs. The region’s strategic location as a logistics center fuels adoption. Cloud platforms enable scalability for enterprises operating across borders. Sustainability initiatives further encourage adoption of advanced route optimization systems.

Africa

Africa accounted for 4% share of the first mile logistics delivery software market in 2024, with growth supported by gradual digital adoption and rising e-commerce activity. South Africa and Nigeria emerge as leading adopters due to increasing urban demand. It helps enterprises overcome infrastructure inefficiencies through digital tracking and optimized dispatching. SMEs benefit from affordable cloud solutions. Regional governments encourage investments in digital trade platforms. Market expansion is strengthened by mobile accessibility, enabling wider reach across fragmented logistics networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Blue Yonder

- Epicor Software Corporation

- Descartes Systems Group

- ShipBob

- Kinaxis

- SAP SE

- Oracle Corporation

- Shipsy

- Trimble Transportation

- E2open

Competitive Analysis

The first mile logistics delivery software market is characterized by strong competition among global technology providers and specialized logistics software firms. Oracle Corporation and SAP SE dominate with comprehensive enterprise solutions that integrate logistics modules with broader ERP platforms. Trimble Transportation and E2open focus on supply chain visibility, predictive analytics, and real-time shipment management, appealing to large logistics networks. Epicor Software Corporation and Blue Yonder provide scalable platforms with advanced route optimization and inventory tracking features. Descartes Systems Group strengthens its presence with cloud-based offerings and global logistics network connectivity, while Kinaxis emphasizes planning and demand forecasting capabilities. ShipBob and Shipsy target e-commerce and mid-market enterprises with user-friendly, agile platforms that streamline dispatch and improve transparency. It remains highly competitive as vendors differentiate through AI-driven optimization, IoT integration, and sustainability-focused tools. Partnerships, acquisitions, and continuous product upgrades define growth strategies, while customer-centric models and cloud deployment flexibility support wider adoption. The market reflects consolidation trends and rising innovation investments aimed at meeting the complex requirements of global logistics players.

Recent Developments

- In August 2025, FirstMile, ACI Logistix, and Sendle announced a strategic merger to establish the FAST Group, combining technology and infrastructure to strengthen first-mile logistics services for e-commerce shippers.

- In February 2024, Shipsy launched its logistics solutions on AWS Marketplace. These solutions include transportation management, route optimization and planning, fuel consumption optimization, first mile pickup, multi-courier management, and on-demand delivery management.

- In June 2024, E2open introduced an appointment scheduling API within its transportation management solution to improve efficiency and collaboration among supply chain partners, reducing manual work and lead times.

- In 2024, CEVA Logistics teamed up with Almajdouie Logistics to improve first-mile delivery services. This partnership enhanced logistics efficiency and expanded service capabilities.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Deployment Type, Organization Size, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing e-commerce demand will drive stronger adoption of advanced first mile logistics delivery software solutions.

- Cloud-based platforms will expand further, offering scalability and faster integration for global logistics operations.

- Artificial intelligence will optimize route planning, predictive demand forecasting, and dynamic shipment allocation efficiency.

- IoT integration will strengthen real-time visibility, asset monitoring, and proactive issue resolution across logistics networks.

- Mobile applications will gain traction, enhancing driver coordination, dispatch accuracy, and real-time performance management.

- Sustainability initiatives will push adoption of eco-friendly logistics platforms integrated with electric vehicle fleets.

- Data security measures will become critical, encouraging stronger encryption and compliance-focused digital infrastructure adoption.

- SMEs will increasingly adopt affordable software solutions to improve operational efficiency and customer satisfaction.

- Strategic partnerships between logistics providers and software vendors will drive innovation and regional market expansion.

- Emerging markets will experience rapid growth, supported by urbanization, digital adoption, and expanding retail ecosystems.