Market Overview

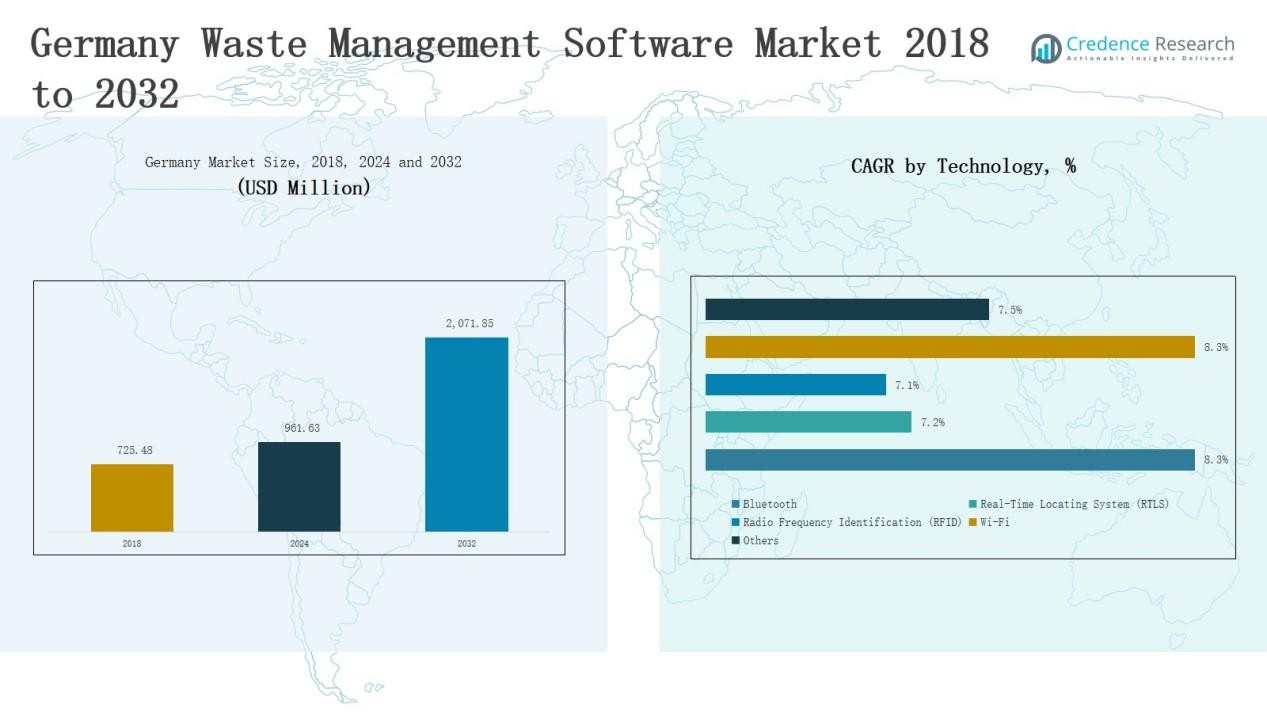

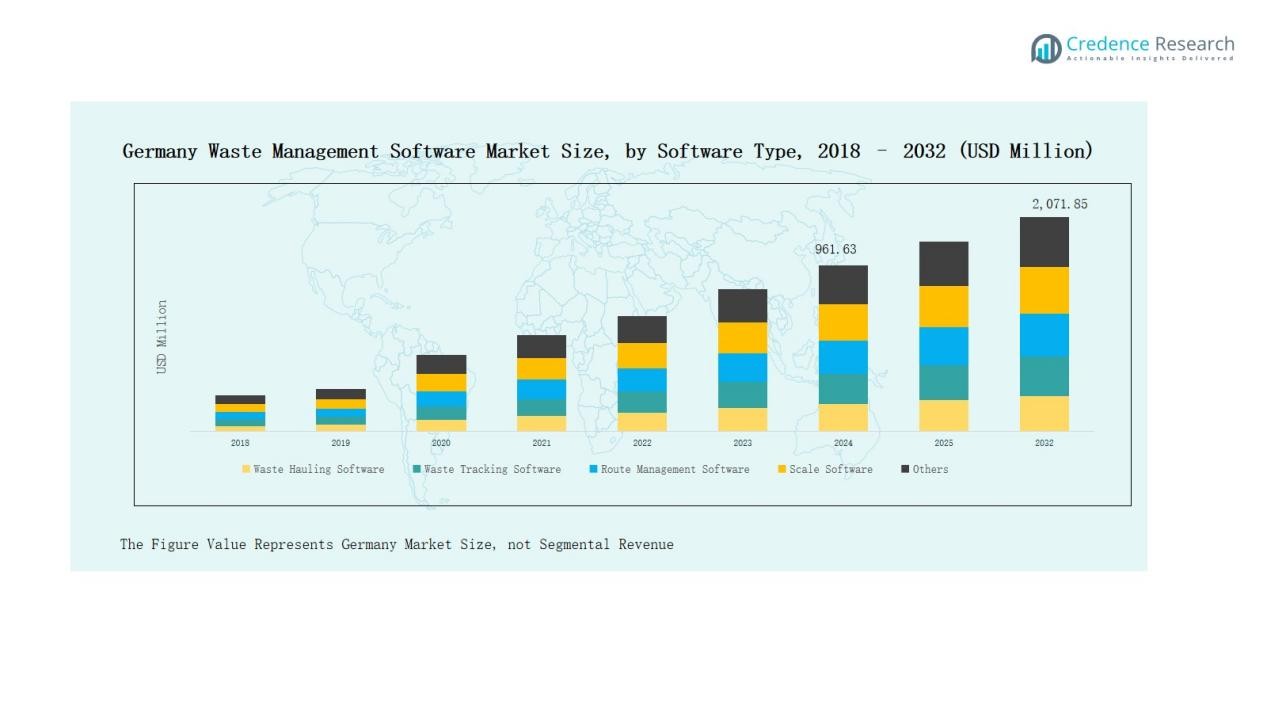

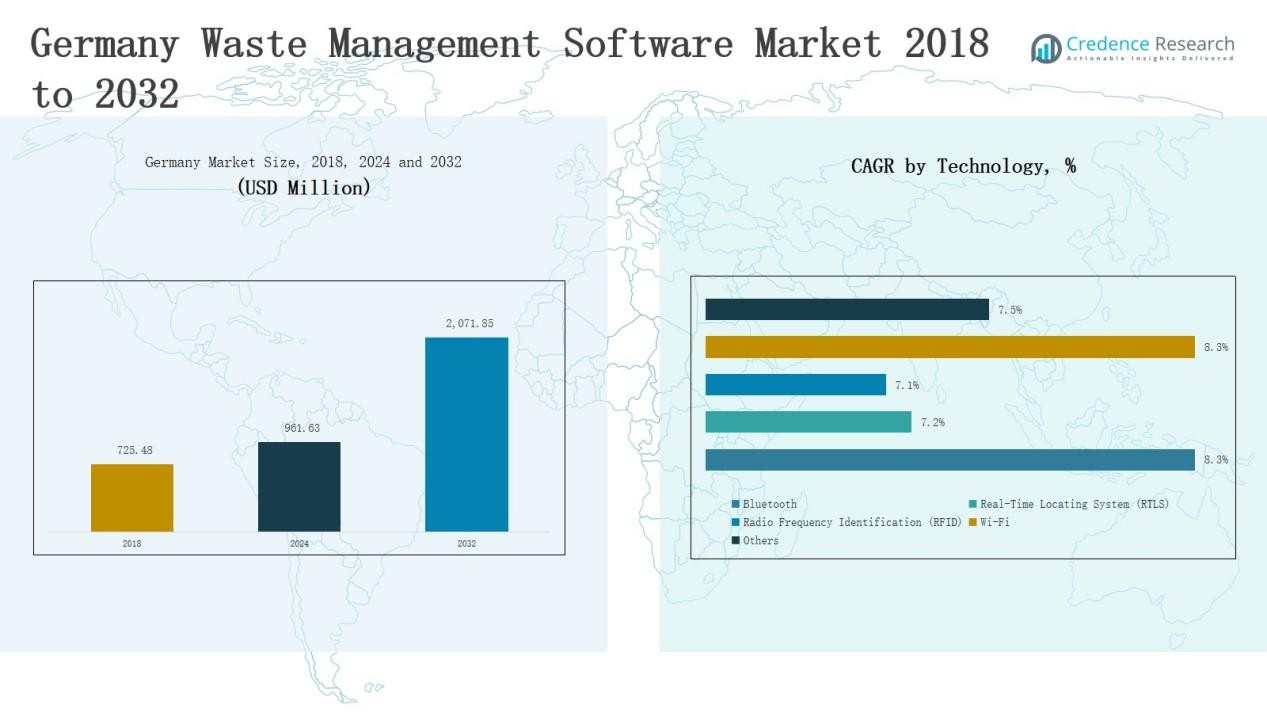

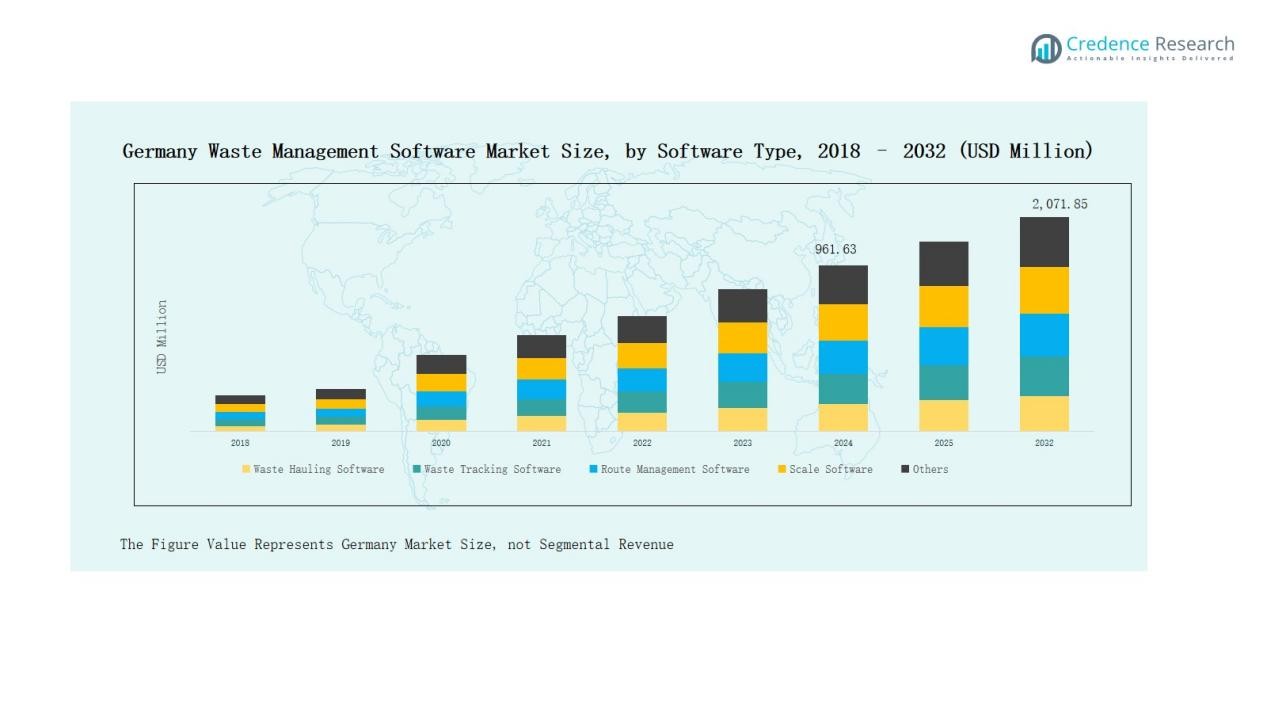

Germany Waste Management Software Market size was valued at USD 725.48 million in 2018 to USD 961.63 million in 2024 and is anticipated to reach USD 2,071.85 million by 2032, at a CAGR of 10.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Waste Management Software Market Size 2024 |

USD 961.63 Million |

| Germany Waste Management Software Market, CAGR |

10.07% |

| Germany Waste Management Software Market Size 2032 |

USD 2,071.85 Million |

The Germany Waste Management Software Market is characterized by a mix of established domestic firms and international solution providers delivering compliance-driven and technology-oriented platforms. Key players include CONWIN, Wastics, Dr. Ing. Wandrei (NSUITE), SSI SCHÄFER Plastics (DISPONDO), Lufthansa Industry Solutions (LEAP), Consist Software Solutions, all in one GmbH, c-trace GmbH, ÖKODATA GmbH, TEGOS GmbH, and 2R Software GmbH. These companies focus on route optimization, recycling compliance, cloud-based solutions, and IoT integration to enhance efficiency and sustainability. Among regional markets, Copenhagen leads with 42% share, supported by advanced recycling infrastructure, smart city projects, and strong municipal investments in digital platforms. This dominance highlights Copenhagen’s role as the hub for innovation and large-scale adoption of waste management software in Germany.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Waste Management Software Market grew from USD 725.48 million in 2018 to USD 961.63 million in 2024 and is projected to reach USD 2,071.85 million by 2032.

- Leading companies such as CONWIN, Wastics, Dr. Ing. Wandrei (NSUITE), SSI SCHÄFER Plastics, Lufthansa Industry Solutions, and others focus on compliance-driven, cloud-based, and IoT-enabled platforms.

- By software type, Waste Hauling Software dominates with 30% share, supported by optimized routing, automated scheduling, and RFID integration that improve efficiency and sustainability outcomes.

- By application, Municipal segment leads with 48% share, driven by EU regulations, recycling targets, landfill diversion initiatives, and smart city programs requiring advanced digital platforms.

- By component, Cloud-Based Software holds 65% share, offering scalability, real-time collaboration, enhanced security, and mobile access, making it central to Germany’s digital transformation in waste management.

Market Segment Insights

By Software Type

Waste Hauling Software holds the dominant 30% share in the Germany Waste Management Software Market. Its strong position is supported by widespread adoption among municipalities and private contractors seeking cost-effective collection systems. Features such as optimized routing, automated scheduling, and real-time tracking enhance operational efficiency and reduce fuel costs. Integration with RFID and route management solutions further improves accountability and compliance.

By Application

Municipal applications represent the largest segment, accounting for 48% share in the Germany Waste Management Software Market. Strict national and EU regulations push local authorities to adopt digital platforms for monitoring and compliance. Municipal demand is also reinforced by initiatives to improve recycling rates, landfill diversion, and resource recovery. Cloud-based solutions enable centralized data management and reporting for multiple districts. Smart city programs further encourage adoption of advanced waste tracking and collection optimization systems.

- For instance, the city of Rosenheim utilized Sensoneo’s smart waste sensors to monitor its paper waste bins. This deployment of 92 sensors resulted in an impressive average fill-level of 86% before collection, demonstrating the system’s effectiveness in optimizing collection routes and preventing overflowing bins.

By Component

Cloud-Based Software dominates the market with a 65% share in the Germany Waste Management Software Market. The segment’s strength arises from growing preference for scalable, subscription-based solutions that reduce upfront IT investment. Cloud platforms enable real-time collaboration, secure remote access, and integration with IoT-enabled devices. Providers highlight advantages such as automatic updates, enhanced cybersecurity, and mobile accessibility. German companies and municipalities increasingly prefer cloud deployment for agility and compliance with sustainability goals. The ongoing shift toward digital transformation and the expansion of SaaS offerings position cloud-based solutions as the central growth engine within the market.

- For intance, Remondis, which uses a cloud platform to manage real-time data from over 3,000 IoT sensors on its waste containers, improving collection efficiency.

Key Growth Drivers

Regulatory Pressure and Compliance

Germany’s strict environmental laws and EU directives drive adoption of waste management software. Regulations like the Verpackungsgesetz and Kreislaufwirtschaftsgesetz mandate accurate data reporting, recycling targets, and producer responsibility. Municipalities and enterprises rely on digital platforms to ensure compliance, avoid penalties, and manage documentation effectively. Software solutions offering automated reporting and real-time tracking meet these needs. As environmental policies tighten further, demand for robust, scalable solutions is expected to accelerate, making regulatory compliance a primary force shaping the market’s growth trajectory.

- For instance, AMCS completed its acquisition of Berlin-based Quentic in July 2022. The deal expanded compliance and waste-management software across Europe.

Smart City and Digitalization Initiatives

The expansion of smart city programs across German municipalities significantly fuels market growth. Cities integrate IoT-enabled solutions such as RFID, GPS tracking, and route optimization to enhance waste collection and recycling efficiency. Municipal authorities prioritize digitalization to improve sustainability outcomes, reduce carbon emissions, and increase operational transparency. Waste management software enables seamless integration of these technologies with centralized data platforms. Growing public funding and private partnerships for smart infrastructure projects ensure steady investment in digital tools, strengthening their role as a vital growth driver.

- For instance, in the Coburg district, Veolia Germany piloted AMCS Guided Navigation, digitalizing experienced drivers’ route knowledge across all staff. This reduced waste-collection time by 10–15 %, while boosting service quality and transparency

Rising Sustainability and Circular Economy Goals

Germany’s commitment to sustainability and circular economy practices is a major driver. National strategies emphasize waste reduction, recycling, and resource recovery. Software platforms support these goals by offering advanced analytics, recycling performance tracking, and lifecycle assessments. Organizations use these solutions to meet environmental, social, and governance (ESG) targets while improving efficiency. The focus on lowering carbon footprints and aligning with EU Green Deal objectives creates strong incentives. As businesses and municipalities intensify sustainability commitments, demand for waste management software aligned with circular economy goals continues to rise.

Key Trends & Opportunities

Cloud-Based Deployment and SaaS Growth

Cloud-based solutions are emerging as a dominant trend in the German market. Enterprises and municipalities prefer SaaS models for scalability, reduced upfront investment, and remote accessibility. Integration with IoT devices enables real-time monitoring and predictive analytics. Providers offering modular, subscription-based systems capitalize on this shift. The demand for mobile-enabled platforms is growing, creating opportunities for vendors to expand cloud-based service offerings. As data security standards improve, confidence in cloud adoption is expected to strengthen further, reinforcing this as both a trend and long-term opportunity.

- For instance, German railway operator Deutsche Bahn partnered with KONUX to deploy a SaaS solution that uses IoT sensors on railway tracks. This enables real-time monitoring and predictive analytics, allowing Deutsche Bahn to predict maintenance needs and improve operational efficiency.

Integration of Advanced Technologies

The integration of AI, machine learning, and predictive analytics into waste management software represents a clear opportunity. These technologies enhance route planning, enable real-time monitoring, and support automated compliance reporting. Adoption of RFID, Bluetooth, and Wi-Fi–based tracking systems further improves operational visibility. Vendors investing in AI-driven dashboards and advanced forecasting tools stand to capture higher value. As sustainability becomes a priority, advanced technology integration enables data-driven decisions, cost savings, and efficiency improvements, positioning technology adoption as a critical market trend and opportunity.

- For instance, companies like Suez have implemented a ‘Smart Waste’ solution that uses sensors in waste bins to trigger collection when they are full, leading to a 30% reduction in collection frequency in some pilot projects and reducing associated operational costs.

Key Challenges

High Implementation and Transition Costs

The upfront costs of adopting waste management software remain a key challenge. Smaller municipalities and mid-sized enterprises face budgetary constraints when investing in new digital platforms. Costs associated with licensing, system customization, and integration with existing infrastructure can delay adoption. Resistance from stakeholders due to cost considerations often limits the speed of digital transformation. Vendors need to offer flexible pricing models and phased implementation strategies to overcome this barrier and expand market penetration across cost-sensitive segments in Germany.

Data Security and Privacy Concerns

With increased reliance on cloud platforms and IoT devices, data security has become a significant concern. Municipalities and businesses manage sensitive information, including waste volumes, recycling metrics, and compliance data, which must meet stringent GDPR requirements. Any breaches or system failures can undermine trust and hinder adoption. Vendors must continuously invest in cybersecurity, encryption, and secure access frameworks. Addressing these concerns is essential for building long-term client confidence, particularly in highly regulated sectors like healthcare and municipal waste management.

Integration Complexity with Legacy Systems

Many organizations in Germany still rely on outdated or fragmented IT systems. Integrating modern waste management software with legacy platforms creates technical challenges, requiring significant customization and training. This slows implementation and increases costs. Compatibility issues also impact performance, creating reluctance to switch from older systems. Vendors offering smooth integration, comprehensive training, and customer support are more likely to succeed. Overcoming integration challenges remains crucial for accelerating software adoption and ensuring efficient system upgrades across municipalities and enterprises.

Regional Analysis

Copenhagen

Copenhagen accounts for 42% share of the Germany Waste Management Software Market. It invests heavily in digital waste tracking and route optimization to strengthen sustainability efforts. Municipal authorities adopt cloud-based platforms that improve operational efficiency and reduce emissions. Healthcare and retail industries in the region create additional demand by focusing on compliance with strict environmental standards. Vendors find opportunities in IoT-enabled solutions integrated with waste collection infrastructure. It benefits from circular economy practices that accelerate advanced software adoption across multiple applications.

Aarhus

Aarhus holds 28% share of the Germany Waste Management Software Market. The city emphasizes industrial and manufacturing waste streams, driving demand for recycling and scale management systems. Municipal bodies and enterprises show preference for cloud-based deployment due to its flexibility. Expanding logistics and retail sectors increase adoption of waste tracking and route management software. Public-private partnerships provide a favorable environment for software vendors seeking long-term growth. It sustains consistent demand from its industrial base, ensuring continued investment in digital platforms.

Odense

Odense represents 18% share of the Germany Waste Management Software Market. Adoption grows among mid-sized enterprises and municipalities seeking efficient, cost-effective solutions. Local governments prioritize recycling and reporting modules to meet environmental regulations. Businesses benefit from scalable platforms that simplify route planning and waste documentation. Vendors expand product offerings to support diverse users in the region. It emerges as a promising hub for software adoption, fueled by policy initiatives and rising sustainability commitments from local stakeholders.

Others

Other regions collectively contribute 12% share of the Germany Waste Management Software Market. These areas include smaller municipalities and industrial clusters with emerging demand for waste software platforms. Adoption focuses on cloud-based systems that offer scalability and easier compliance management. Demand also arises from sectors such as healthcare and retail with strict reporting needs. Vendors target these regions with modular and cost-effective solutions. It adds incremental growth, complementing the dominance of larger metropolitan areas in the national market.

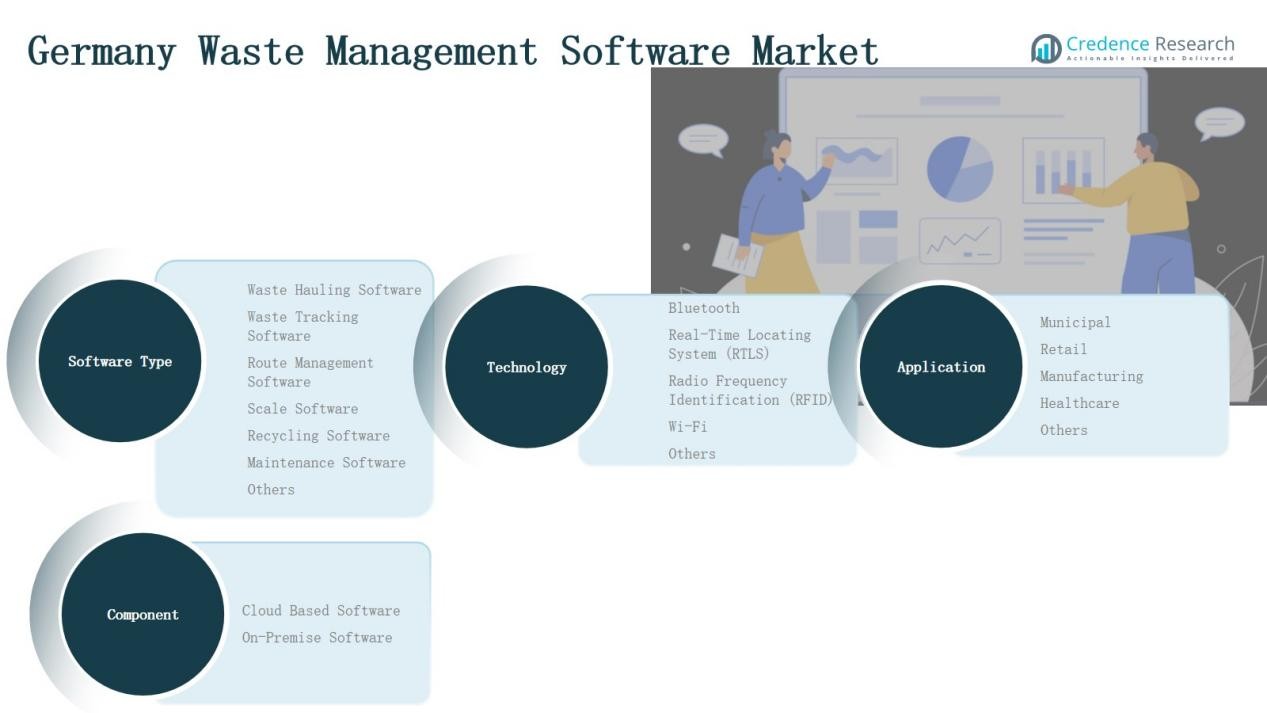

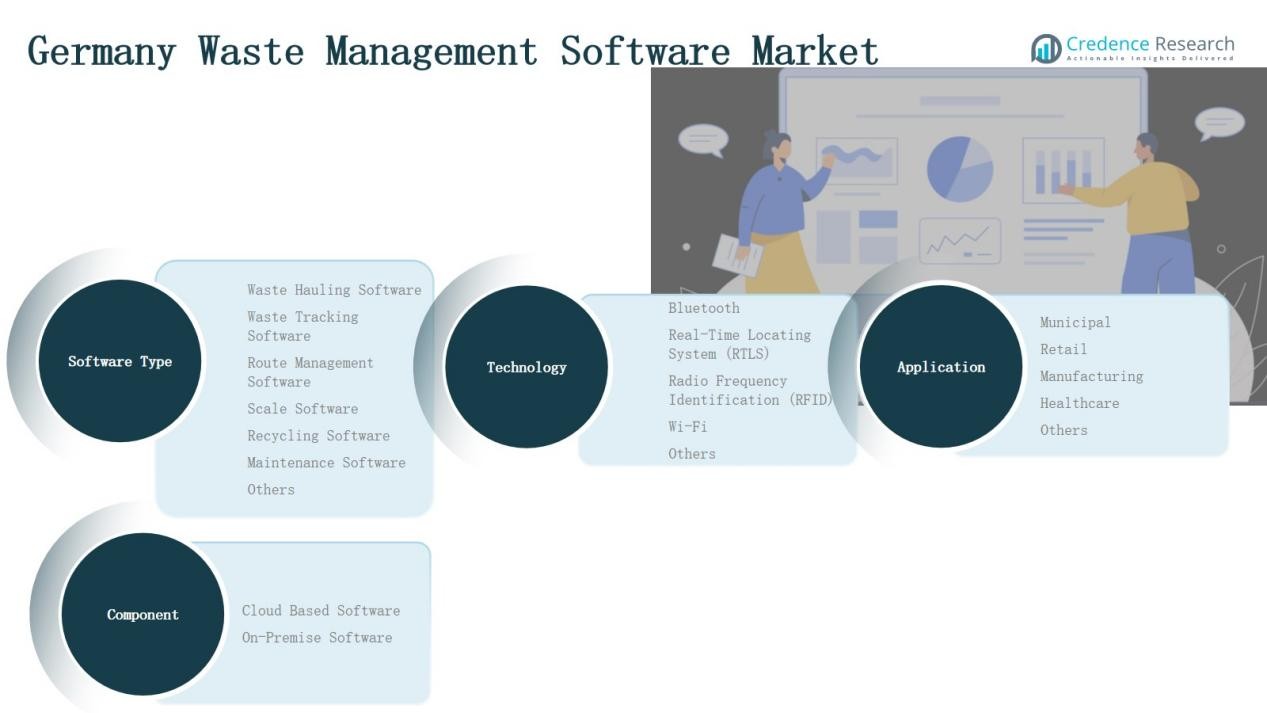

Market Segmentations:

By Software Type

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application

- Municipal

- Retail

- Manufacturing

- Healthcare

- Others

By Component

- Cloud-Based Software

- On-Premise Software

By Technology

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Region

- Copenhagen

- Aarhus

- Odense

- Others

Competitive Landscape

The Germany Waste Management Software Market features a diverse mix of local specialists and international providers competing on innovation, compliance solutions, and service quality. Key players such as CONWIN, Wastics, Dr. Ing. Wandrei (NSUITE), SSI SCHÄFER Plastics (DISPONDO), and Lufthansa Industry Solutions (LEAP) deliver tailored software platforms supporting route optimization, recycling compliance, and data management. Vendors increasingly focus on cloud-based offerings to address growing demand for scalability, mobility, and real-time reporting. Competition is also shaped by partnerships with municipalities and industrial clients, as public-private initiatives encourage digital adoption. Companies differentiate through integration of IoT, RFID, and analytics features, which enable efficient tracking and sustainability reporting. Continuous product upgrades, adherence to EU environmental regulations, and user-centric designs remain crucial factors in vendor success. The landscape is moderately fragmented, with established firms holding strong regional networks while emerging providers target niche applications such as maintenance and healthcare compliance solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- CONWIN

- Wastics

- Ing. Wandrei (NSUITE)

- SSI SCHÄFER Plastics (DISPONDO)

- Lufthansa Industry Solutions (LEAP)

- Consist Software Solutions

- all in one GmbH

- c-trace GmbH

- ÖKODATA GmbH

- TEGOS GmbH

- 2R Software GmbH

Recent Developments

- In August 2025, Remondis acquired A. Siemer Entsorgungs GmbH to expand its waste-management operations in Germany.

- In October 2024, TOMRA Systems ASA purchased an 80% stake in c-trace GmbH, a German provider of digital waste-management solutions, strengthening its AI-driven software and international expansion strategy.

- In June 2024, Wittmann Entsorgungswirtschaft GmbH adopted the AMCS Platform to improve efficiency with automation, analytics, and integrated transport management.

- In March 2025, Positive Carbon partnered with Transgourmet in Germany to deploy AI-powered food waste reduction technology at a rehabilitation centre.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Application, Component, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven analytics will improve predictive planning and enhance operational efficiency.

- Cloud-based deployment will expand further as municipalities and enterprises seek scalable solutions.

- Smart city initiatives will drive investment in real-time tracking and integrated waste platforms.

- Regulatory tightening will continue to push demand for compliance-focused digital solutions.

- Public-private partnerships will increase, enabling wider access to advanced waste management software.

- Integration with IoT devices will accelerate, supporting accurate monitoring and resource optimization.

- Municipalities will prioritize recycling modules to achieve higher circular economy targets.

- Vendors will focus on mobile-friendly platforms to enhance accessibility and workforce productivity.

- Cybersecurity enhancements will become critical to ensure trust in cloud and IoT systems.

- Competition will intensify as international providers enter and local firms expand capabilities.