Market Overview

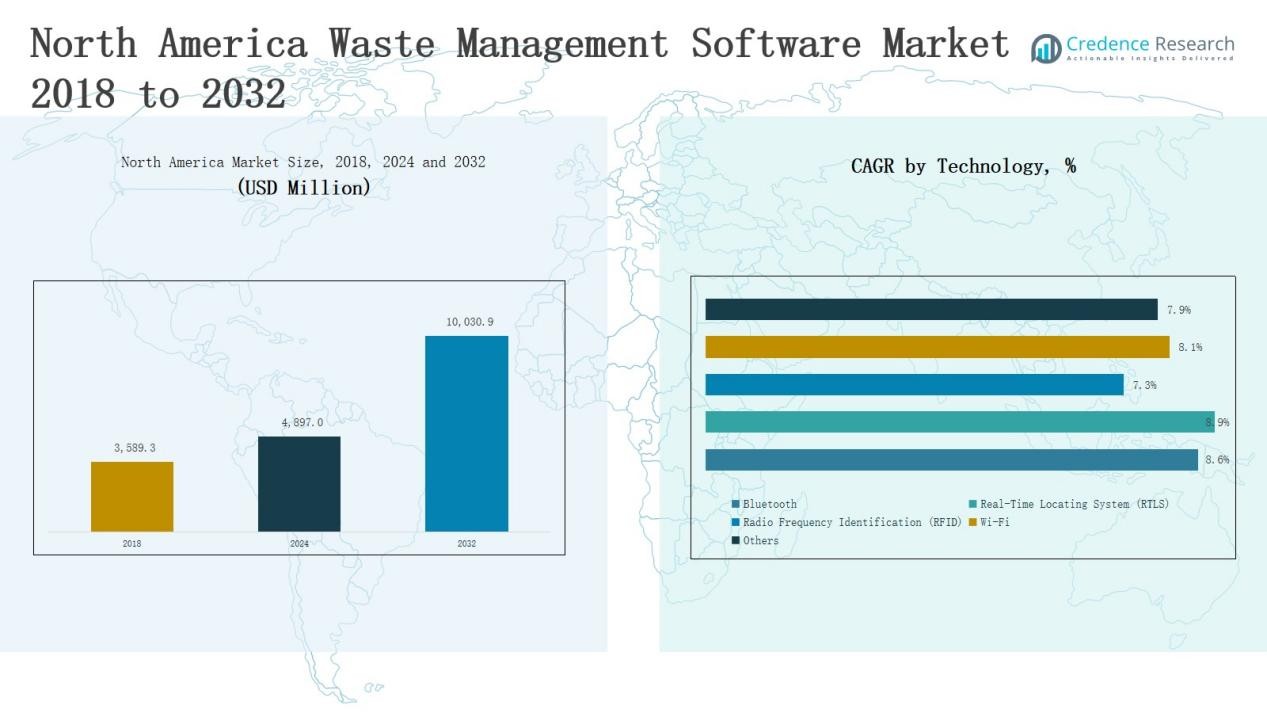

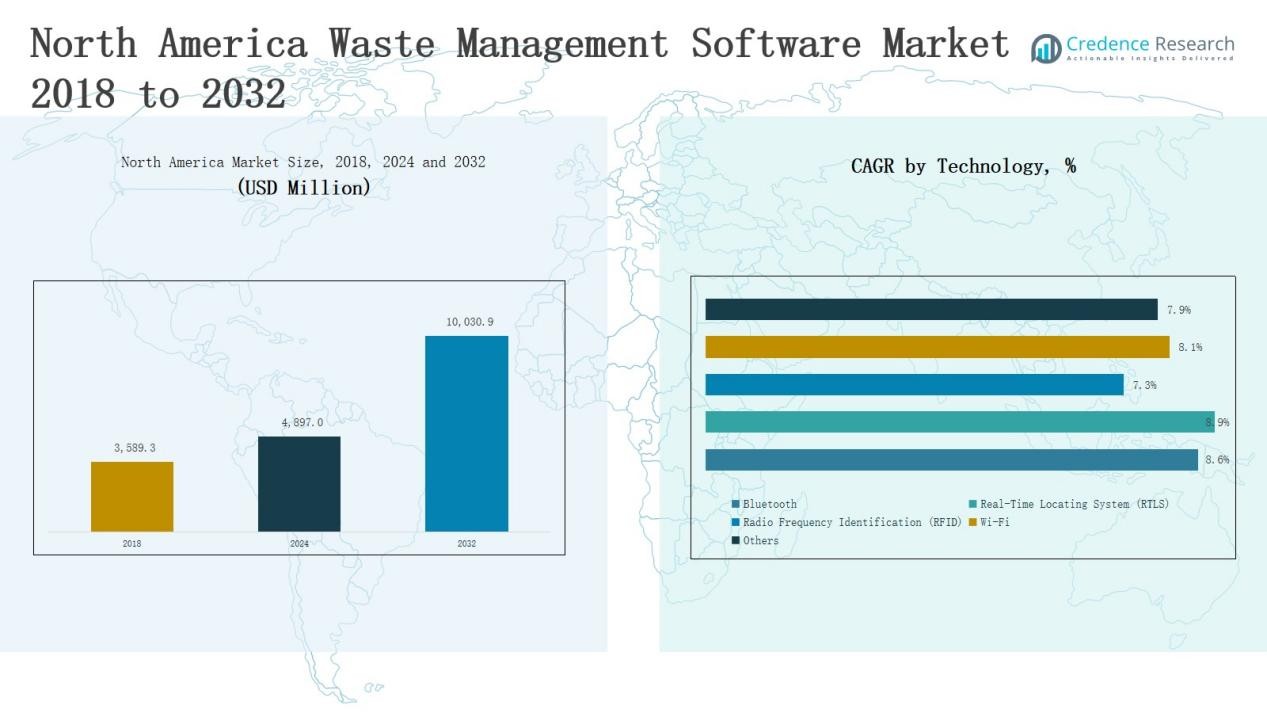

North America Waste Management Software Market size was valued at USD 3,589.3 million in 2018 to USD 4,897.0 million in 2024 and is anticipated to reach USD 10,030.9 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Waste Management Software Market Size 2024 |

USD 4,897.0 Million |

| North America Waste Management Software Market, CAGR |

9.5% |

| North America Waste Management Software Market Size 2032 |

USD 10,030.9 Million |

The North America Waste Management Software Market is shaped by a mix of global technology providers and regional specialists offering scalable and compliance-driven platforms. Key players include Waste Management, Inc., Republic Services, Waste Connections, Casella Waste Systems, GFL Environmental, Clean Harbors, Covanta Holding Corporation, Stericycle, Veolia Environnement S.A., SAP SE, Oracle Corporation, Wastebits, Soft-Pak Inc., WAM Software Inc., TRUX Route Management Systems, and Bigbelly Solar, Inc. These companies compete through cloud-based integration, IoT-enabled tracking, and sustainability-focused modules to meet rising regulatory and operational demands. The U.S. emerged as the leading region in 2024, holding 58% market share, supported by advanced infrastructure, strict environmental compliance, and widespread adoption of smart city waste management initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Waste Management Software Market grew from USD 3,589.3 million in 2018 to USD 4,897.0 million in 2024 and is projected to reach USD 10,030.9 million by 2032 at a CAGR of 9.5%.

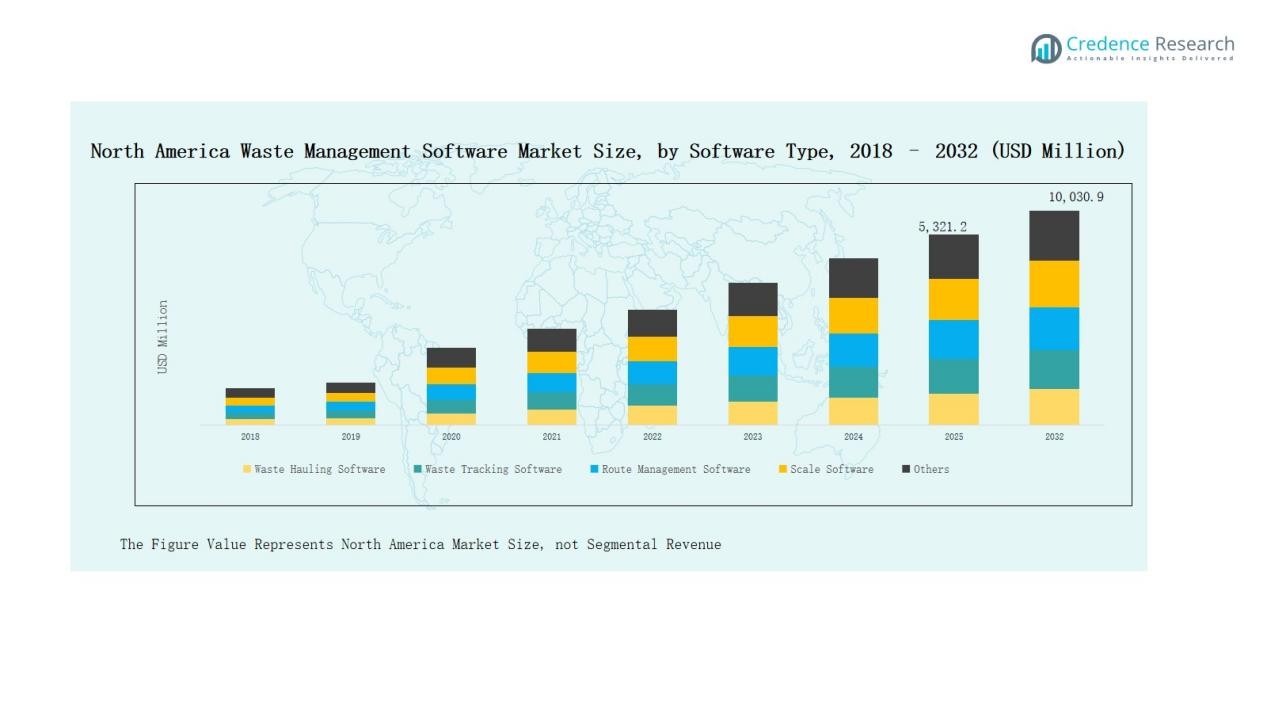

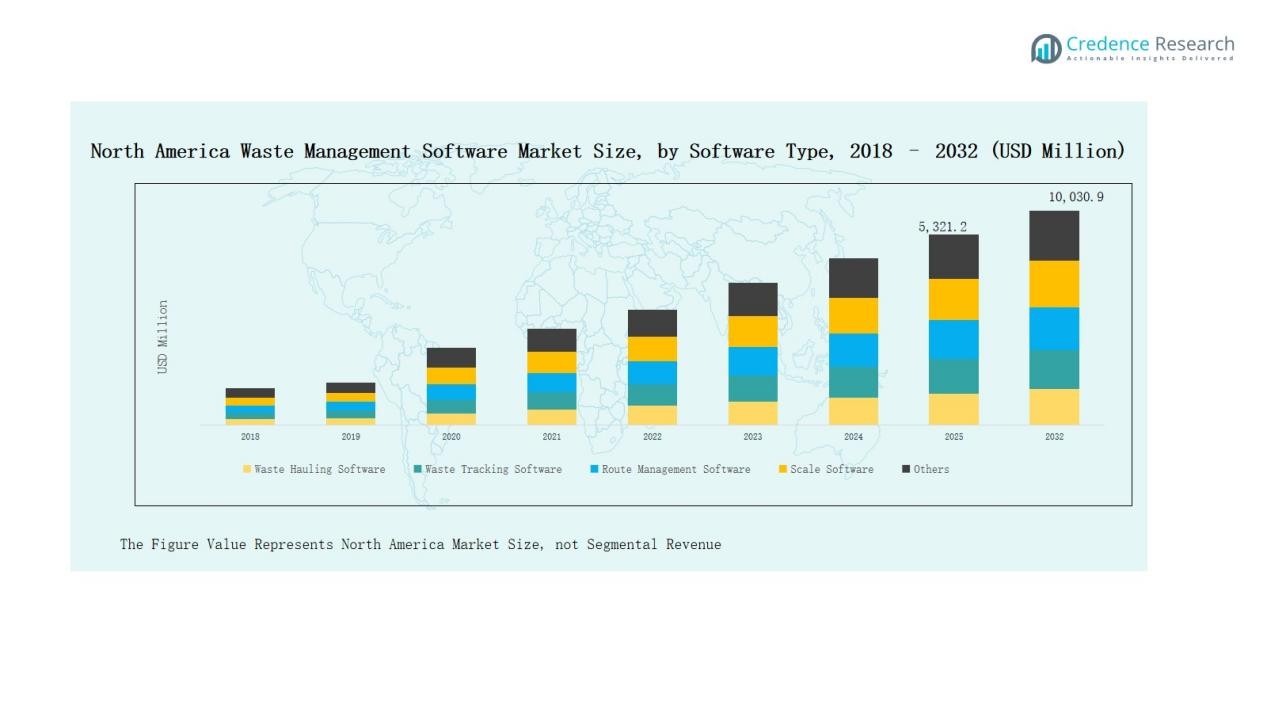

- The Waste Hauling Software segment dominated in 2024 with a 28% share, driven by demand for efficient collection scheduling, route optimization, and integration of automated billing and compliance tracking.

- The Municipal application segment led the market in 2024, holding 35% share, fueled by strict compliance requirements, urban population growth, and investments in smart city infrastructure.

- Cloud-Based Software accounted for the largest share in 2024 with 61%, supported by scalability, cost efficiency, IoT integration, and rising demand for flexible and remote operations.

- The U.S. led the regional market in 2024 with 58% share, followed by Canada with 25% and Mexico with 17%, reflecting differences in infrastructure maturity and adoption trends.

Market Segment Insights

By Software Type

The Waste Hauling Software segment dominated the North America Waste Management Software Market in 2024, holding a 28% revenue share. Its growth is driven by rising demand for efficient collection scheduling and route optimization across urban and municipal operations. Increasing adoption of digital platforms for automated billing, fleet management, and compliance tracking further strengthens its leadership. Vendors focus on cloud-based integration and IoT-enabled modules to enhance operational efficiency and reduce costs.

- For instance, Rubicon Technologies partnered with the City of Houston to deploy its RUBICONSmartCity™ software across more than 400 municipal collection vehicles, enhancing collection scheduling and reporting.

By Application

The Municipal segment led the market in 2024, accounting for 35% revenue share. Demand is fueled by strict regulatory compliance, growing urban populations, and the need for sustainable waste disposal systems. Municipal authorities increasingly adopt software for real-time monitoring, recycling compliance, and automated reporting. Investments in smart city infrastructure and data-driven decision-making further boost adoption in the public sector.

- For instance, Singapore’s National Environment Agency (NEA) rolled out a digital waste-tracking platform that mandates all licensed collectors to upload data on collection volumes, ensuring real-time compliance reporting.

By Component

The Cloud-Based Software segment captured the largest share in 2024, representing 61% of total revenue. This dominance is attributed to its scalability, cost efficiency, and accessibility across multiple locations. Cloud deployment supports integration with IoT, AI, and mobile platforms, enhancing real-time tracking and analytics. The trend toward remote operations and flexible infrastructure continues to shift user preference away from on-premise systems.

Key Growth Drivers

Regulatory Compliance and Sustainability Goals

Stringent environmental regulations in North America drive adoption of waste management software. Governments enforce stricter recycling, emissions control, and landfill diversion targets, pushing municipalities and enterprises to deploy digital solutions for compliance. Software platforms enable accurate data tracking, documentation, and reporting, minimizing risks of non-compliance and penalties. Rising focus on sustainability and circular economy practices further accelerates demand for recycling and waste tracking modules. These compliance-driven pressures ensure continuous investment in technology-based waste management solutions across the region.

- For instance, Rubicon Technologies partnered with Samsara to integrate fleet telematics with waste management software, helping U.S. haulers improve route efficiency and compliance reporting.

Smart City and Infrastructure Investments

Ongoing investments in smart city projects across North America significantly boost the adoption of waste management software. Cities prioritize digital platforms that enhance route optimization, real-time monitoring, and waste hauling efficiency. Advanced IoT-enabled solutions support smart bins, predictive maintenance, and fleet management, improving service quality. Municipalities partner with vendors to integrate waste management with urban infrastructure systems, enabling data-driven decision-making. These initiatives enhance operational efficiency while aligning with broader goals of reducing carbon emissions and promoting sustainable urban living.

- For instance, Winnipeg introduced FleetMind Solutions’ waste fleet management system that integrates on-board computing, RFID tagging, and GPS tracking to improve efficiency and accountability in municipal waste hauling operations.

Cloud-Based Integration and Digital Transformation

The rapid shift toward cloud-based deployment drives market growth in North America. Cloud platforms offer scalability, cost-effectiveness, and accessibility across multiple sites, making them highly attractive for enterprises and municipalities. Integration with AI, IoT, and mobile applications supports real-time waste tracking, predictive analytics, and automation. This digital transformation improves efficiency, reduces operational costs, and enhances compliance management. Growing demand for remote accessibility and flexible infrastructure further consolidates cloud-based solutions as the preferred deployment model in waste management operations.

Key Trends & Opportunities

IoT-Enabled Waste Management Solutions

The integration of IoT technologies represents a strong trend in North America’s waste management software market. Smart sensors embedded in bins and vehicles provide real-time data on waste levels, collection routes, and equipment performance. This enables predictive analytics, reducing inefficiencies and optimizing fleet operations. Vendors increasingly develop IoT-enabled platforms that support automated scheduling, dynamic routing, and sustainability reporting. The growing push for smart cities creates significant opportunities for providers of connected waste management solutions.

- For instance, in February 2025, BRE launched the “SmartWaste Scan” feature, which uses AI to automate administrative tasks for construction site waste and material reporting.

Expansion of Recycling and Circular Economy Practices

Rising emphasis on recycling and circular economy initiatives opens new opportunities for software vendors. Governments and enterprises focus on improving recycling rates and tracking material flows across industries. Waste management software supports compliance with recycling mandates, enables detailed material audits, and enhances reporting capabilities. Companies offering advanced recycling modules integrated with sustainability dashboards gain a competitive edge. The transition toward resource efficiency and zero-waste goals drives strong adoption of recycling-focused digital platforms.

- For instance, Microsoft introduced new circularity features within its Microsoft Cloud for Sustainability, enabling organizations to monitor waste generation and recycling metrics alongside carbon reporting.

Key Challenges

High Implementation and Integration Costs

Despite long-term benefits, the upfront cost of deploying waste management software remains a barrier. Small and mid-sized municipalities and enterprises often lack the budget for advanced systems. Expenses associated with integration, customization, and staff training add to financial strain. These high costs slow adoption in regions with limited resources or low digital maturity. Vendors face the challenge of offering cost-effective, modular solutions to broaden adoption across diverse end users.

Data Security and Privacy Concerns

The adoption of cloud-based and IoT-enabled platforms raises concerns over data security and privacy. Sensitive information on waste operations, municipal activities, and customer data requires robust protection. Cybersecurity threats and breaches could undermine trust in digital waste management systems. Enterprises and municipalities demand software with strong encryption, secure access controls, and compliance with data protection regulations. Vendors must continually strengthen cybersecurity measures to ensure safe adoption across the market.

Complexity of Integration with Legacy Systems

Many organizations in North America still operate legacy waste management systems that complicate integration with modern platforms. Migrating data, ensuring interoperability, and aligning workflows pose significant challenges. This complexity often leads to delays in adoption and increased costs. Vendors must provide flexible, interoperable solutions and offer technical support to facilitate smooth transitions. Overcoming integration hurdles is critical for enabling widespread adoption of advanced waste management software across industries and municipalities.

Regional Analysis

U.S.

The U.S. held the largest share of the North America Waste Management Software Market in 2024, accounting for 58%. Strong adoption stems from advanced infrastructure, large-scale municipal projects, and strict environmental regulations. Municipalities and private operators deploy digital platforms for compliance, recycling tracking, and route optimization. Cloud-based and IoT-integrated solutions dominate due to the country’s high digital maturity. The U.S. market continues to grow as smart city initiatives expand across major metropolitan areas. Vendors benefit from strong demand for scalable and regulatory-compliant platforms.

Canada

Canada captured 25% of the regional market share in 2024. It benefits from supportive government policies promoting sustainable practices and recycling compliance. Municipal authorities adopt software platforms to improve efficiency in collection, tracking, and reporting. The push for reducing landfill dependency fuels demand for digital waste monitoring tools. Canada’s investment in smart infrastructure further drives adoption of IoT and cloud-based solutions. The country remains a strong market for vendors offering sustainability-focused applications.

Mexico

Mexico accounted for 17% of the North America Waste Management Software Market in 2024. Growth is supported by rising urbanization, expanding manufacturing activities, and the need for improved municipal waste systems. Local governments invest in software for better compliance tracking and operational transparency. Vendors gain opportunities by introducing cost-effective, modular solutions suitable for developing urban centers. Cloud deployment is gaining traction due to its scalability and reduced infrastructure costs. Mexico continues to emerge as a growth-focused market within the region.

Market Segmentations:

By Software Type

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application

- Municipal

- Retail

- Manufacturing

- Healthcare

- Others

By Component

- Cloud-Based Software

- On-Premise Software

By Technology

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Country

Competitive Landscape

The North America Waste Management Software Market features a mix of established waste management companies, technology providers, and specialized software developers competing for market share. Leading players such as Waste Management, Inc., Republic Services, Waste Connections, and GFL Environmental integrate software solutions into broader waste handling and recycling services, strengthening their operational reach. Technology firms like SAP SE, Oracle Corporation, and Soft-Pak Inc. provide scalable, cloud-based platforms supporting compliance, tracking, and analytics. Niche providers, including Wastebits, TRUX Route Management Systems, and WAM Software, focus on tailored applications such as hauling, routing, and billing systems, catering to small and mid-sized operators. Competition centers on innovation, with IoT integration, AI-driven analytics, and cloud deployment becoming critical differentiators. Vendors pursue strategic partnerships with municipalities and private enterprises to expand adoption. The landscape is characterized by steady consolidation, digital transformation, and the rising importance of sustainability-focused modules in driving long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Wastebits

- Waste Management, Inc.

- Republic Services, Inc.

- Waste Connections, Inc.

- Casella Waste Systems, Inc.

- GFL Environmental Inc.

- Clean Harbors, Inc.

- Covanta Holding Corporation

- Advanced Disposal Services, Inc.

- Stericycle, Inc.

- Veolia Environnement S.A.

- Bigbelly Solar, Inc.

- Terracycle, Inc.

- SAP SE

- Oracle Corporation

- Soft-Pak Inc.

- WAM Software Inc.

- Waste Logics Software Limited

- TRUX Route Management Systems Inc.

Recent Developments

- In June 2025, Veolia North America acquired New England Disposal Technologies and New England MedWaste, gaining the state’s only permitted medical waste disposal facility and two of three household hazardous waste sites in Massachusetts.

- In July 2025, Goldman Sachs Alternatives signed a definitive agreement to acquire Liquid Environmental Solutions (LES), a Texas-based nonhazardous liquid waste management provider.

- In 2024, Impact Environmental Group acquired the Compactor Solutions Division of FleetGenius, LLC, broadening its waste equipment solutions portfolio.

- In April 2025, Valicor Environmental expanded its wastewater operations by acquiring Affordable Waste Management, further strengthening its service capabilities.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Application, Component, Tehcnology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IoT-enabled platforms will expand for real-time waste tracking and monitoring.

- Cloud-based deployment will strengthen as municipalities and enterprises seek scalability.

- Recycling software will gain traction with stricter circular economy and sustainability goals.

- Smart city initiatives will boost demand for route optimization and automated reporting tools.

- Integration of AI and machine learning will enhance predictive analytics in waste operations.

- Municipal applications will continue to dominate due to strong regulatory compliance requirements.

- Partnerships between technology providers and local governments will increase software penetration.

- Cybersecurity features will become central to cloud and IoT waste management platforms.

- Modular, cost-effective solutions will attract adoption among small and mid-sized operators.

- Vendors will focus on sustainability dashboards to support carbon reduction and green reporting goals.