Market Overview

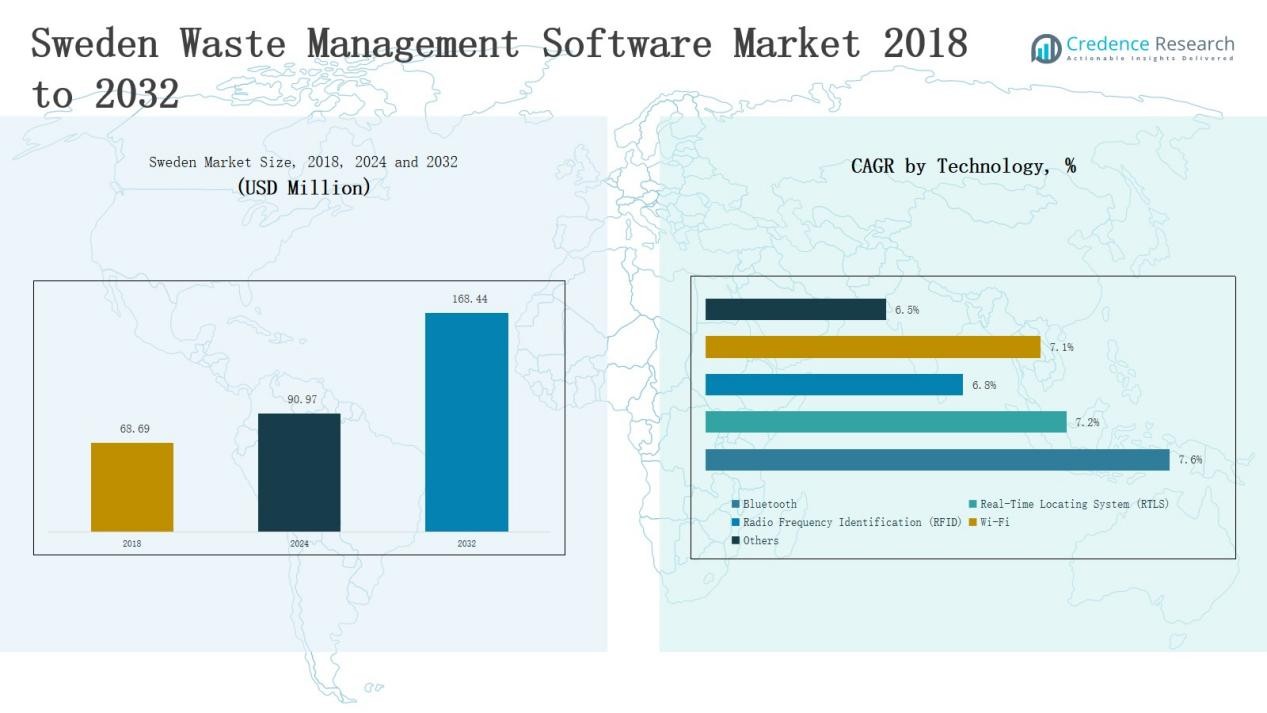

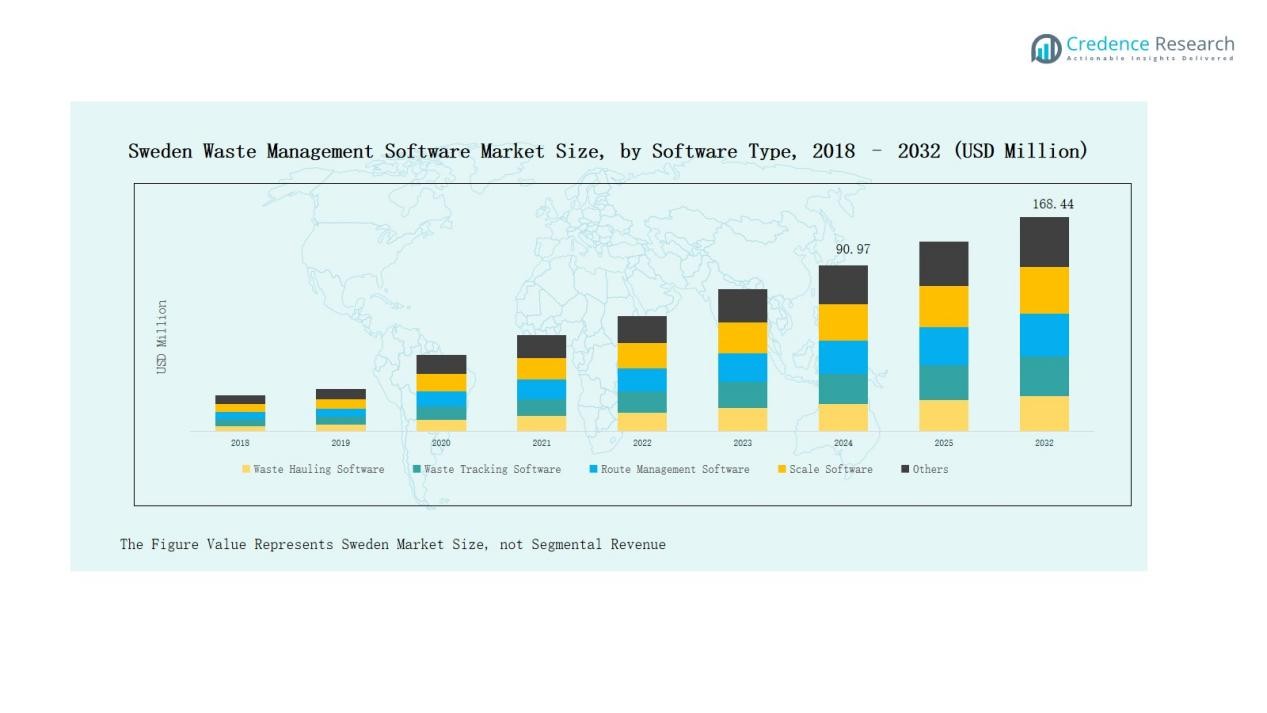

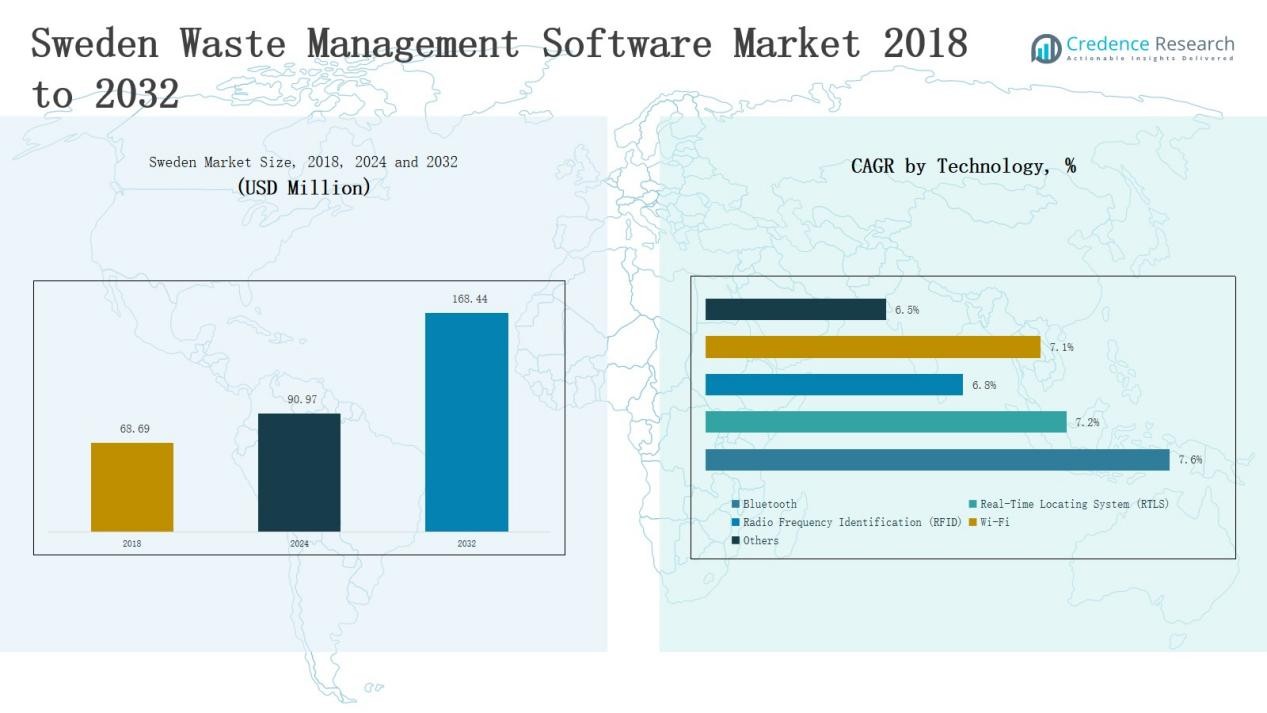

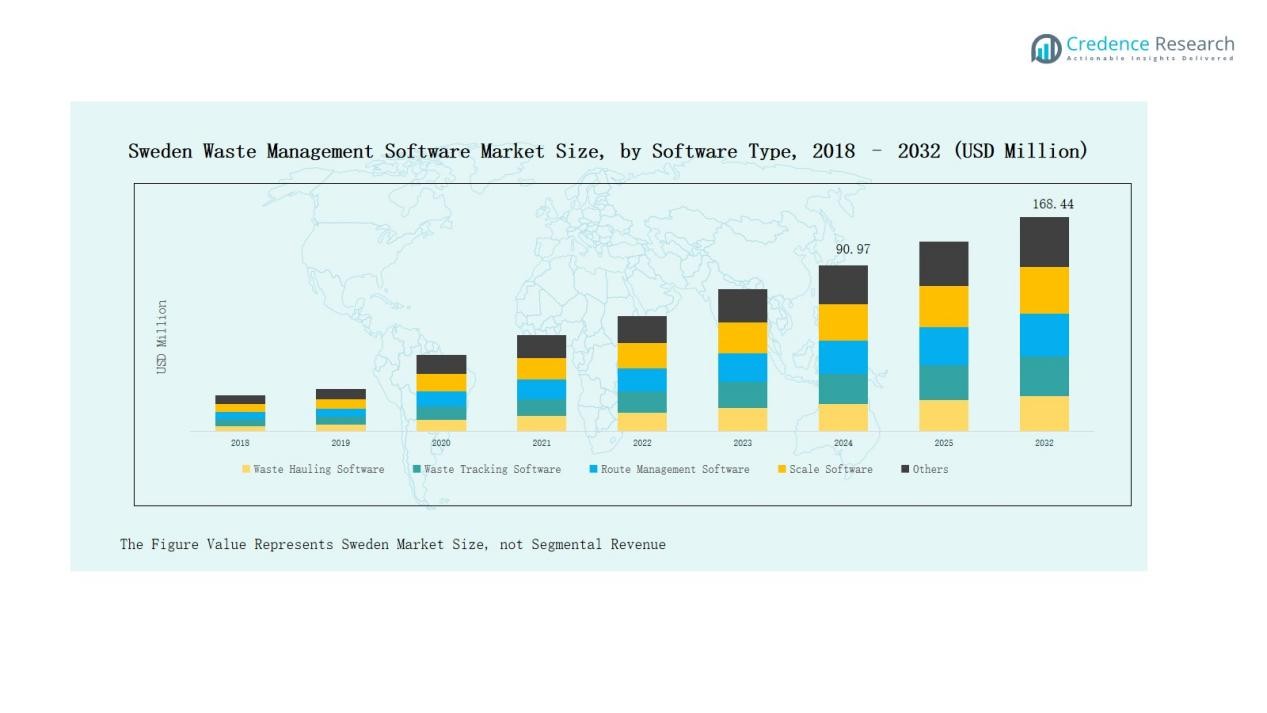

Sweden Waste Management Software Market size was valued at USD 68.69 million in 2018 to USD 90.97 million in 2024 and is anticipated to reach USD 168.44 million by 2032, at a CAGR of 8.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sweden Waste Management Software Market Size 2024 |

USD 90.97 Million |

| Sweden Waste Management Software Market, CAGR |

8.01% |

| Sweden Waste Management Software Market Size 2032 |

USD 168.44 Million |

The Sweden Waste Management Software Market is shaped by key players such as EcoFacile, AMCS Group, SEE Forge, TRUX, WAM Software, Sequoia Waste Solutions, DesertMicro, SFS Chemical Safety, and Delta Equipment Systems, Inc. These companies compete through cloud-based deployment, IoT integration, and compliance-driven platforms that support recycling, route optimization, and real-time waste tracking. Vendors strengthen their market presence with municipal partnerships and enterprise-focused solutions aligned with Sweden’s circular economy goals. Stockholm emerged as the leading region in 2024, holding 39% share, supported by advanced digital infrastructure, smart city projects, and strong municipal investments in sustainable waste management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sweden Waste Management Software Market grew from USD 68.69 million in 2018 to USD 90.97 million in 2024 and is projected to reach USD 168.44 million by 2032, expanding at a CAGR of 8.01%.

- Key players include EcoFacile, AMCS Group, SEE Forge, TRUX, WAM Software, Sequoia Waste Solutions, DesertMicro, SFS Chemical Safety, and Delta Equipment Systems, competing through cloud-based deployment, IoT integration, and compliance-driven solutions.

- The municipal segment led in 2024 with a 44% share, supported by strict EU directives and strong adoption of digital platforms, followed by retail, manufacturing, and healthcare sectors.

- Cloud-based software dominated with 62% share in 2024, driven by scalability, cost efficiency, and integration with IoT, while on-premise deployment retained niche demand for data control.

- Stockholm emerged as the leading region with 39% share, followed by Gothenburg at 27%, Malmö at 19%, and other regions collectively holding 15%, highlighting concentrated growth in major urban centers.

Market Segment Insights

By Application

The municipal segment led the Sweden Waste Management Software Market in 2024 with a 44% share. Its dominance is supported by strong adoption of digital solutions for urban waste tracking, route optimization, and recycling compliance. Government initiatives promoting circular economy practices and strict EU waste directives further drive municipal demand. Retail followed with notable uptake as businesses seek to streamline waste documentation and meet sustainability targets. Manufacturing and healthcare sectors also show steady growth due to compliance requirements and rising focus on cost efficiency.

- For instance, Norrköping Municipality, through its municipal company Nodra, is developing a digital waste management system to enhance municipal waste reporting and documentation in line with EU recycling targets.

By Component

Cloud-based software accounted for the largest share in 2024, holding 62% of the market. The preference is driven by scalability, cost efficiency, and integration with IoT-enabled devices. Municipalities and enterprises favor cloud deployment to improve accessibility and real-time data tracking. On-premise software retained relevance, particularly among organizations prioritizing data control and regulatory compliance. However, the trend continues to shift toward cloud solutions due to Sweden’s advanced digital infrastructure and strong emphasis on sustainability-focused platforms.

- For instance, Microsoft Sweden expanded its Azure cloud data centers in the Stockholm region to provide low-latency cloud services with renewable energy integration.

By Technology

Radio Frequency Identification (RFID) emerged as the dominant technology in 2024 with a 38% market share. Its leadership stems from wide adoption in waste collection and recycling facilities for automated bin tracking and compliance reporting. Real-Time Locating Systems (RTLS) and Bluetooth gained traction for route management and asset monitoring in urban areas. Wi-Fi-enabled solutions supported smart city projects, offering connectivity for large-scale deployments. Other technologies contributed to niche applications, but RFID remained the preferred choice due to accuracy, cost-effectiveness, and regulatory alignment.

Key Growth Drivers

Strong Government Regulations and Circular Economy Initiatives

Sweden’s commitment to EU waste directives and national sustainability targets drives software adoption. Municipal authorities invest heavily in digital solutions to meet recycling goals, landfill reduction, and emission control. Waste management software helps track, report, and optimize operations in compliance with strict regulations. The push toward a circular economy compels municipalities and enterprises to adopt advanced tools, ensuring efficiency and accountability. This regulatory environment positions compliance-driven platforms as essential for maintaining transparency and minimizing penalties across industries.

- For instance, Malmö Municipality expanded its use of Sweden-based software provider Bintel’s digital monitoring system, which uses smart sensors and AI analytics to optimize waste collection routes and reduce emissions.

Rising Demand for Smart City Integration

The country’s growing smart city projects significantly accelerate waste management software adoption. Urban regions implement digital waste tracking, route optimization, and IoT-enabled solutions to improve sustainability. Cloud-based platforms integrated with RFID and Wi-Fi technologies enable municipalities to automate collection and reduce operational costs. Public-private collaborations further enhance adoption, as vendors align products with municipal digitalization strategies. This focus on smart infrastructure not only drives operational efficiency but also strengthens Sweden’s role as a leader in sustainable urban development.

- For instance, WasteHero, a Denmark‑based provider operating in Swedish municipalities, deployed IoT‑enabled sensors and route optimization platforms in Malmö to lower fuel consumption and improve collection efficiency.

Expanding Enterprise Adoption Across Industries

Beyond municipalities, enterprises in retail, healthcare, and manufacturing increasingly adopt waste management software. These sectors require precise compliance documentation, cost optimization, and sustainability reporting. Cloud-based systems support scalability and seamless integration into enterprise operations. Retailers use digital tools to monitor waste streams, while healthcare facilities deploy compliance-driven solutions for hazardous waste. Manufacturing companies prioritize route management and recycling software to align with environmental regulations. This expanding adoption across industries diversifies demand and establishes long-term growth opportunities for vendors.

Key Trends & Opportunities

Shift Toward Cloud-Based and IoT-Enabled Platforms

Cloud-based solutions dominate due to flexibility, scalability, and real-time integration with IoT devices. Enterprises and municipalities rely on these systems to track and optimize waste collection processes efficiently. The trend reflects Sweden’s advanced digital infrastructure and demand for smart, connected waste systems. Vendors invest in integrating RFID, Bluetooth, and Wi-Fi technologies to expand software capabilities. This creates opportunities for developing intelligent platforms tailored to large-scale deployments, especially within municipalities driving sustainability initiatives and industrial users seeking compliance.

- For instance, Sweden’s Envac Group upgraded its smart waste collection system in Stockholm with cloud-based monitoring and RFID-enabled bins to improve route efficiency and cut emissions.

Rising Focus on Data Analytics and Sustainability Reporting

A growing trend in Sweden involves leveraging advanced analytics for waste stream monitoring and sustainability reporting. Organizations increasingly depend on platforms that provide predictive insights, regulatory compliance dashboards, and automated documentation. This shift creates opportunities for vendors to enhance software with AI-driven analytics and reporting tools. By addressing the rising demand for accurate and transparent data, companies position themselves as strategic partners for enterprises and municipalities. The emphasis on analytics reinforces Sweden’s leadership in environmentally responsible waste management.

- For instance, Stena Recycling AB deployed AI-powered sorting and analytics platforms to improve plastic and metal recovery rates across their Swedish operations, reducing landfill dependency and ensuring regulatory compliance through automated reporting dashboards.

Key Challenges

High Implementation and Integration Costs

Despite benefits, high upfront costs for software implementation and integration limit adoption. Smaller municipalities and mid-sized enterprises often struggle to justify investments in advanced digital platforms. Ongoing expenses, including staff training and system upgrades, add further challenges. Vendors must offer cost-effective models, such as subscription-based cloud solutions, to address affordability. Without reducing these financial barriers, adoption growth may remain restricted, particularly among organizations with constrained budgets.

Data Privacy and Cybersecurity Concerns

As cloud-based and IoT-enabled platforms expand, data privacy and cybersecurity risks rise. Sensitive information related to municipal operations, enterprise waste streams, and compliance reporting must remain secure. Cyberattacks or data breaches could undermine trust in digital platforms and slow adoption. Vendors face the challenge of embedding advanced security protocols, encryption, and regulatory compliance into their solutions. Addressing these concerns is critical for building confidence among municipalities and enterprises investing in digital waste management systems.

Resistance to Digital Transition

Some municipalities and enterprises remain hesitant to replace traditional waste management methods with software-driven platforms. Resistance often stems from limited technical expertise, fear of disruption, or preference for manual systems. This challenge is particularly evident in smaller towns or conservative organizations where awareness of digital benefits is low. Vendors must focus on awareness campaigns, pilot projects, and technical support to ease transition. Overcoming this reluctance is necessary to ensure broader adoption across Sweden’s diverse waste management ecosystem.

Regional Analysis

Stockholm

Stockholm accounted for 39% share of the Sweden Waste Management Software Market in 2024. The region leads due to advanced digital infrastructure, strong smart city projects, and strict environmental regulations. Municipal authorities invest in IoT-enabled platforms for route optimization, waste tracking, and recycling compliance. Enterprises in healthcare and retail sectors adopt software solutions to meet sustainability and reporting standards. The dominance of cloud-based deployment in Stockholm reflects the city’s digital maturity and openness to innovation. It remains the primary hub for vendors seeking large-scale adoption.

Gothenburg

Gothenburg held 27% share of the Sweden Waste Management Software Market in 2024. The region demonstrates strong adoption of recycling and scale software due to its industrial base. Manufacturing companies drive demand for compliance-focused solutions that manage waste streams efficiently. Municipalities emphasize sustainable waste processing and rely on cloud-based platforms for operational efficiency. Vendors benefit from partnerships with local enterprises and public authorities. It continues to strengthen its role as a secondary growth hub supported by industrial expansion and sustainability policies.

Malmö

Malmö represented 19% share of the Sweden Waste Management Software Market in 2024. The city focuses on smart waste management initiatives aligned with its climate-neutral ambitions. Municipal adoption of RFID-enabled systems supports accurate tracking and recycling documentation. Retail and healthcare industries increase their reliance on waste tracking and compliance software. The region’s investment in cloud infrastructure enables broader adoption among mid-sized enterprises. It provides growth opportunities for vendors offering cost-effective, scalable digital platforms.

Other Regions

Other regions collectively contributed 15% share of the Sweden Waste Management Software Market in 2024. Smaller municipalities and enterprises drive gradual adoption, often constrained by budget and awareness challenges. Vendors face opportunities to expand through subscription-based and affordable software models. Adoption trends are shaped by compliance needs and EU-aligned waste regulations. Demand is rising in rural and semi-urban areas where traditional methods are being replaced by digital solutions. It remains a fragmented but steadily expanding segment of the market.

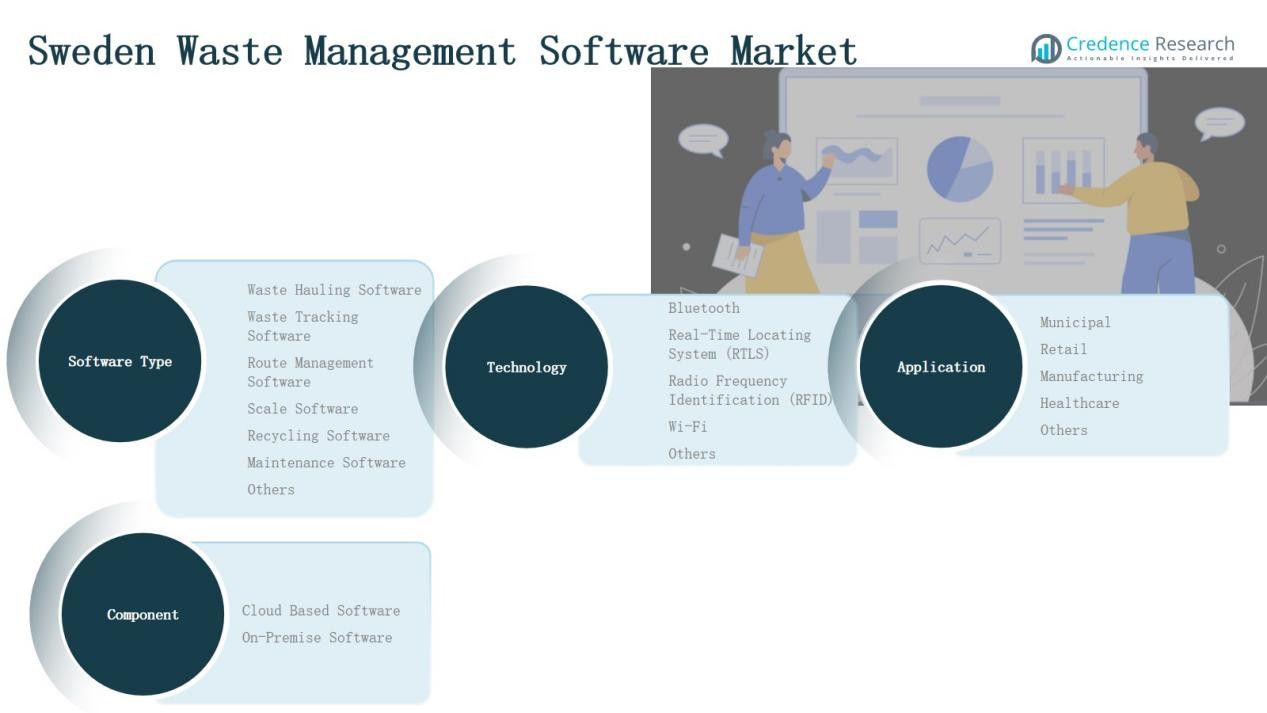

Market Segmentations:

By Software Type

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application

- Municipal

- Retail

- Manufacturing

- Healthcare

- Other

By Component

- Cloud-Based Software

- On-Premise Software

By Technology

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Region

- Stockholm

- Gothenburg

- Malmö

- Other Regions

Competitive Landscape

The Sweden Waste Management Software Market is characterized by a mix of domestic and international players delivering compliance-focused and technology-driven solutions. Companies such as EcoFacile, AMCS Group, SEE Forge, TRUX, WAM Software, Sequoia Waste Solutions, DesertMicro, SFS Chemical Safety, and Delta Equipment Systems, Inc. actively compete through product innovation and strategic partnerships. Vendors prioritize cloud-based deployment and IoT integration, enabling municipalities and enterprises to improve waste tracking, recycling compliance, and operational efficiency. The market demonstrates a high level of customization, with software modules designed for specific applications such as route management, hazardous waste handling, and sustainability reporting. Players also strengthen their positions through collaborations with municipalities and enterprise clients, aligning with Sweden’s strong push toward digitalization and circular economy practices. Intense competition fosters continuous upgrades in platforms, particularly focusing on RFID, real-time data analytics, and mobile accessibility, ensuring long-term growth and broader adoption across urban and industrial regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- EcoFacile

- AMCS Group

- SEE Forge

- TRUX

- WAM Software, Inc.

- Sequoia Waste Solutions

- DesertMicro

- SFS Chemical Safety

- Delta Equipment Systems, Inc.

Recent Developments

- In April 2025, Boliden, IVL, and Ericsson launched a collaboration using Ericsson’s Connected Recycling SaaS platform in Sweden. The solution tracks e-waste flows, enabling better traceability of copper and precious metals across the recycling chain.

- In July 2025, Stadler Anlagenbau GmbH, together with Stockholm Vatten och Avfall (SVOA), introduced a fully automated municipal solid waste sorting plant in Stockholm. The system processes up to 50 tons per hour, recovering organics, plastics, and metals while reducing incineration and emissions.

- In August 2024, EQT Private Equity (Stockholm) acquired a majority stake in AMCS, a global waste and recycling software provider. AMCS offers cloud-based, AI-powered software for planning, performance, safety, and sustainability in waste management.

- In June 2025, EQT AB (Sweden) entered exclusive negotiations to acquire Waga Energy, a France-based landfill gas-to-renewable natural gas (RNG) technology provider.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Application, Component, Tehcnology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Municipal authorities will continue driving adoption through digital waste tracking and compliance solutions.

- Cloud-based platforms will expand further as enterprises and municipalities seek scalability and cost efficiency.

- RFID technology will remain central for automated tracking and accurate recycling documentation.

- Data analytics and AI integration will grow to support predictive insights and sustainability reporting.

- Smart city projects will accelerate demand for IoT-enabled waste management platforms.

- Healthcare and retail sectors will strengthen adoption due to rising compliance and reporting needs.

- Vendors will introduce subscription-based models to attract small and mid-sized enterprises.

- Cybersecurity and data protection features will become critical in vendor offerings.

- Public-private partnerships will increase to support large-scale implementation and infrastructure upgrades.

- Regional adoption will expand beyond major cities, driven by EU-aligned regulations and awareness campaigns.