Market Overview:

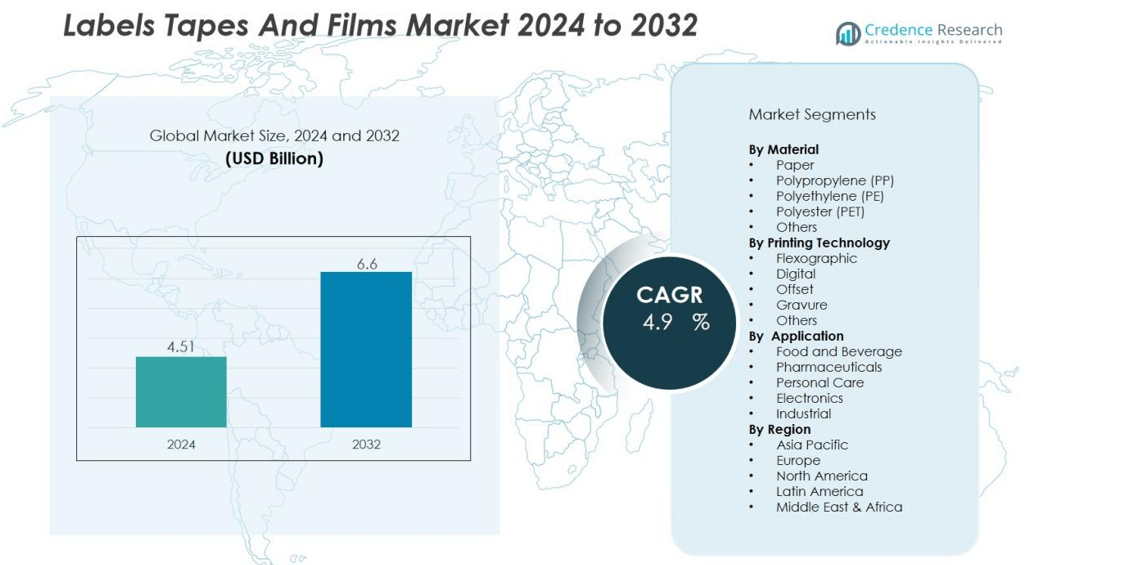

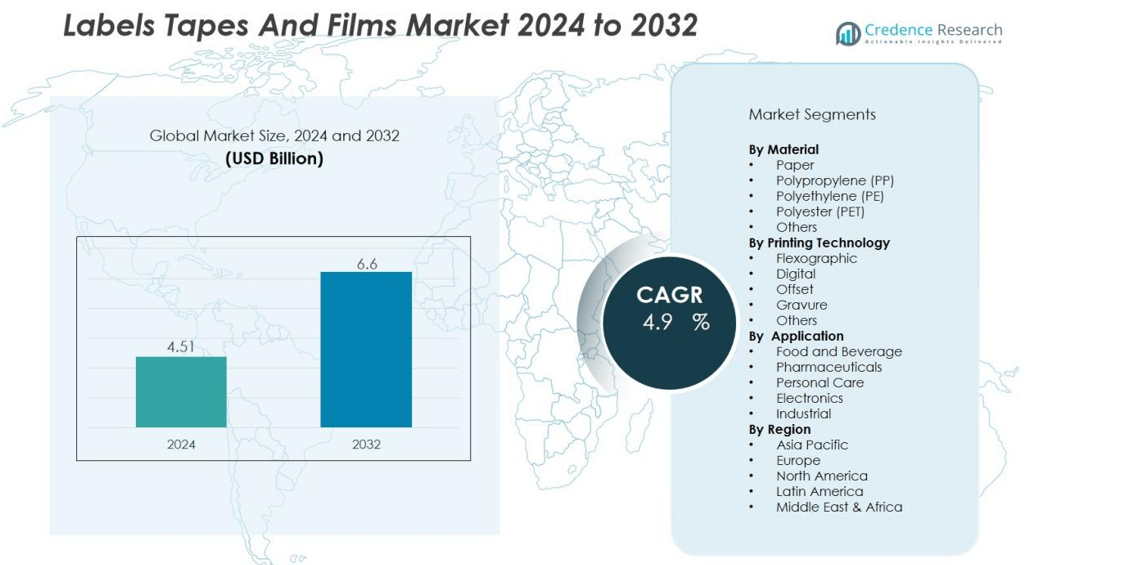

The labels tapes and films market size was valued at USD 4.51 billion in 2024 and is anticipated to reach USD 6.6 billion by 2032, at a CAGR of 4.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Labels Tapes and Films Market Size 2024 |

USD 4.51 billion |

| Labels Tapes and Films Market, CAGR |

4.9% |

| Labels Tapes and Films Market Size 2032 |

USD 6.6 billion |

Key drivers shaping the market include the rising need for product protection, brand promotion, and enhanced shelf appeal. Innovations in material science, such as eco-friendly films, biodegradable tapes, and smart labels with RFID or QR code integration, are accelerating adoption. Increasing regulatory compliance in packaging and labeling, along with growing automation in manufacturing, further supports market growth. Demand for sustainable and recyclable materials is also encouraging companies to invest in advanced solutions that reduce environmental impact.

Regionally, North America leads the market due to advanced packaging infrastructure, strong manufacturing base, and high adoption of innovative labeling solutions. Europe follows with steady growth, supported by stringent labeling regulations and sustainability initiatives. Asia-Pacific is expected to record the fastest growth, driven by rapid industrialization, expanding e-commerce, and rising consumption in countries such as China, India, and Japan. Latin America and Middle East & Africa are gradually expanding, supported by rising packaging investments and retail modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The labels, tapes, and films market was valued at USD 4.51 billion in 2024 and is projected to reach USD 6.6 billion by 2032, at a CAGR of 4.9%.

- The market is driven by the rising need for product protection, brand promotion, and enhanced shelf appeal.

- Innovations in materials, such as eco-friendly films, biodegradable tapes, and smart labels with RFID or QR codes, are accelerating adoption.

- Regulatory compliance in packaging and labeling, along with growing manufacturing automation, supports market growth.

- Demand for sustainable and recyclable materials encourages companies to invest in environmentally friendly solutions.

- North America leads with 32% share due to advanced manufacturing, retail sectors, and high adoption of innovative labeling technologies.

- Europe holds 28% and Asia-Pacific 25% share, driven by regulatory standards, industrial expansion, e-commerce growth, and rising consumer markets.

Market Drivers:

Growing Demand for Efficient Packaging and Product Protection Across Industries:

The labels, tapes, and films market is driven by the rising need for secure and durable packaging solutions. Industries such as food and beverages, pharmaceuticals, and electronics require materials that protect products during transportation and storage. It ensures product integrity while maintaining consumer trust. Companies are increasingly adopting high-performance tapes and films to prevent damage, contamination, and tampering. The need for reliable labeling solutions also supports market expansion.

- For instance, 3M’s Performance Flatback Paper Masking Tape 2525 offers a strong adhesive strength of 69 oz/inch and a temperature resistance up to 250°F, meeting high durability and protection standards required in industrial packaging applications.

Increasing Adoption of Smart and Intelligent Labeling Technologies:

The market growth is influenced by the integration of smart labels and films with QR codes, barcodes, and RFID technologies. It enables real-time tracking, inventory management, and anti-counterfeiting measures. Retailers and manufacturers benefit from enhanced operational efficiency and better supply chain visibility. Rising adoption of digital and interactive labels strengthens demand for technologically advanced tapes and films. Companies invest in innovations that improve traceability and consumer engagement.

- For instance, Avery Dennison Corporation offers innovative RFID inlays and smart labels that improve traceability solutions, serving over 50 countries globally with robust RFID-enabled product lines.

Focus on Sustainability and Eco-Friendly Materials in Packaging:

Demand for sustainable solutions accelerates market growth. It encourages the use of recyclable, biodegradable, and compostable films and tapes. Regulatory pressure and consumer preference for environmentally responsible products drive adoption. Manufacturers in the labels, tapes, and films market develop materials that reduce carbon footprint without compromising performance. Eco-friendly packaging solutions also enhance brand reputation and consumer loyalty.

Expansion of E-Commerce and Retail Sectors Driving Packaging Requirements:

Rapid growth of e-commerce platforms increases the need for protective and branded packaging solutions. It creates demand for high-quality labels and films that withstand shipping conditions. Retailers focus on packaging that enhances shelf appeal and ensures compliance with labeling standards. The labels, tapes, and films market benefits from this trend, with manufacturers offering customized solutions to meet specific sector requirements. Rising online retail activity further fuels market demand.

Market Trends:

Rising Adoption of Advanced and Smart Packaging Solutions in the Industry:

The labels, tapes, and films market is witnessing a significant shift toward advanced and smart packaging solutions. It incorporates technologies such as RFID, QR codes, and NFC-enabled labels that improve supply chain visibility and product authentication. Companies increasingly use interactive and digital labels to enhance customer engagement and provide product information. The trend supports better inventory management, reduces counterfeiting, and ensures regulatory compliance. Flexible and high-performance films that resist heat, moisture, and mechanical stress are gaining popularity. Manufacturers focus on innovation to meet the evolving demands of retail, pharmaceuticals, and electronics sectors.

- For instance, ScanTrust IoT provides unique QR codes and 2D barcodes integrated with an IoT platform, enabling logistics companies to track product authenticity, monitor distribution, and reduce counterfeiting risks in real-time, ensuring full supply chain transparency.

Growing Focus on Sustainability and Eco-Conscious Packaging Materials:

Sustainability is a key trend driving the labels, tapes, and films market. It encourages the development of recyclable, biodegradable, and compostable films and tapes. Companies prioritize environmentally responsible packaging to meet regulatory requirements and satisfy consumer preferences. Lightweight and energy-efficient materials are increasingly adopted to reduce carbon footprint in production and transportation. Eco-friendly labels and tapes also help brands enhance their market reputation and attract environmentally conscious customers. The trend stimulates research and development of new materials that combine sustainability with durability and performance.

- For instance, N.A.P., a Slovakian label design and printing company, switched from a 25 μm PP25 overlaminate to Avery Dennison’s AD RDX PP19 self-wound overlaminate at 19 μm thickness, reducing material usage by 6 μm per sheet.

Market Challenges Analysis:

High Raw Material Costs and Supply Chain Volatility Affecting Market Profitability:

The labels, tapes, and films market faces challenges from rising raw material prices, including polymers, adhesives, and specialty resins. It increases production costs and affects profit margins for manufacturers. Supply chain disruptions and fluctuations in availability of key materials further complicate production planning. Companies must manage inventory efficiently and seek alternative suppliers to maintain continuity. Volatile material costs can slow market growth and create pricing pressures. Manufacturers often invest in process optimization and cost-efficient sourcing strategies to mitigate these risks.

Stringent Regulatory Compliance and Technical Standard Requirements Limiting Market Flexibility:

Regulatory pressure poses a challenge for the labels, tapes, and films market, especially in food, pharmaceuticals, and electronics sectors. It requires adherence to strict labeling, safety, and environmental standards. Non-compliance can result in fines, recalls, and reputational damage. The need for certifications and quality approvals increases operational complexity. Companies must continuously update materials and processes to meet evolving standards. This regulatory burden can slow product launches and limit innovation flexibility. Continuous monitoring and compliance management remain critical to sustain market operations.

Market Opportunities:

Expanding E-Commerce and Retail Sectors Offering Growth Potential for Innovative Packaging Solutions:

The labels, tapes, and films market presents significant opportunities due to the rapid growth of e-commerce and modern retail. It creates demand for protective, visually appealing, and functional packaging that enhances brand visibility. Customized labels and films that improve shipping durability and product presentation are increasingly sought by retailers. Companies can leverage this trend to develop innovative, sector-specific solutions. Integration of smart labeling technologies provides further opportunities to improve supply chain tracking and customer engagement. Rising online retail activity across Asia-Pacific and North America offers strong market expansion potential. Manufacturers that invest in adaptable and high-performance solutions can capture new revenue streams.

Adoption of Sustainable and Eco-Friendly Materials Driving Market Expansion Opportunities:

Sustainability initiatives open new avenues for the labels, tapes, and films market. It encourages development of biodegradable, recyclable, and compostable materials that align with environmental regulations and consumer expectations. Demand for low-carbon, energy-efficient packaging solutions is increasing globally. Companies can differentiate through eco-friendly innovations without compromising product performance. Governments and industry bodies promoting sustainable packaging further support adoption. This trend allows manufacturers to strengthen brand reputation while accessing environmentally conscious markets. Investment in research and development of green materials offers long-term growth opportunities.

Market Segmentation Analysis:

By Material:

The labels, tapes, and films market is segmented by material into paper, polypropylene (PP), polyethylene (PE), polyester (PET), and others. It shows high demand for synthetic films such as PP and PET due to durability, chemical resistance, and moisture protection. Paper-based materials maintain popularity in eco-friendly and cost-sensitive applications. Manufacturers focus on developing biodegradable and recyclable options to meet sustainability requirements. Material selection influences product performance, shelf life, and application suitability.

- For instance, Toyobo introduced SC836-20, a 20-micrometer-thick PET film with excellent recyclability and APR recognition, aiding sustainability goals while maintaining label functionality across global markets.

By Printing Technology:

The market segments by printing technology include flexographic, digital, offset, gravure, and others. It demonstrates rapid adoption of digital printing due to flexibility, shorter lead times, and customization capabilities. Flexographic printing remains preferred for large-scale production, especially in food and beverage packaging. Gravure and offset printing serve specialized applications requiring high-resolution graphics and color accuracy. Companies invest in advanced printing solutions to improve efficiency, quality, and compliance with regulatory standards.

- For instance, MPS Systems B.V., a Netherlands-based company, has installed over 750 automated flexographic and hybrid printing presses worldwide, boosting productivity and real-time operation optimization through its MPSConnect platform.

By Application:

Key applications in the labels, tapes, and films market include food and beverage, pharmaceuticals, personal care, electronics, and industrial sectors. It experiences strong growth in food and beverage due to protective packaging and branding needs. Pharmaceutical and healthcare applications demand high-performance, tamper-evident, and compliant labels. Electronics and industrial sectors require durable films and tapes for insulation, protection, and assembly. Manufacturers tailor products to meet sector-specific performance, regulatory, and aesthetic requirements.

Segmentations:

By Material:

- Paper

- Polypropylene (PP)

- Polyethylene (PE)

- Polyester (PET)

- Others

By Printing Technology:

- Flexographic

- Digital

- Offset

- Gravure

- Others

By Application:

- Food and Beverage

- Pharmaceuticals

- Personal Care

- Electronics

- Industrial

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America holds a 32% market share in the labels, tapes, and films market, driven by advanced manufacturing and retail sectors. It benefits from high adoption of innovative labeling technologies and automated packaging systems. The region demonstrates strong demand across food and beverage, pharmaceuticals, and electronics industries. Companies focus on developing high-performance and smart labels to meet regulatory and consumer requirements. Rising e-commerce and stringent quality standards support consistent growth. Manufacturers invest in R&D and supply chain optimization to maintain competitiveness. Demand for eco-friendly and sustainable materials is also increasing in the region.

Europe:

Europe commands a 28% market share in the labels, tapes, and films market, influenced by strict labeling regulations and environmental standards. It drives adoption of recyclable, biodegradable, and compostable materials across industries. Countries like Germany, France, and the UK demonstrate high demand in pharmaceuticals, food packaging, and automotive sectors. Manufacturers leverage innovative films and tapes to ensure product protection and compliance. Growing awareness of smart packaging technologies enhances opportunities for interactive labels. Companies focus on energy-efficient production and sustainable materials. Investment in advanced printing and coating solutions strengthens the market position.

Asia-Pacific:

Asia-Pacific accounts for a 25% market share in the labels, tapes, and films market, driven by industrial expansion and growing consumer markets in China, India, and Japan. It experiences rapid growth in e-commerce, retail, and packaged goods sectors. Manufacturers increasingly adopt flexible and high-performance materials to meet rising demand. Smart labeling solutions and protective films gain popularity in supply chain and logistics operations. Investment in modern packaging infrastructure supports market development. Governments encourage sustainable practices, boosting demand for eco-friendly solutions. Rising urbanization and consumption trends continue to drive market expansion,

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Henkel AG

- Mactac

- tesa SE

- Intertape Polymer Group

- 3M

- Nitto Denko Corporation

- Scotch

- Max Adhesives

- Sika AG

- Brady Corporation

- R Tape Corporation

- Dongguan Chuangfu Adhesive Products

Competitive Analysis:

The labels, tapes, and films market is highly competitive, driven by innovation, product quality, and global distribution capabilities. It features established players including Henkel AG, Mactac, tesa SE, Intertape Polymer Group, 3M, Nitto Denko Corporation, Scotch, and Max Adhesives. These companies maintain leadership through diversified product portfolios and strong R&D investments. It experiences continuous technological advancements, such as high-performance films, smart labels, and eco-friendly solutions, which intensify competition. Strategic collaborations, mergers, and partnerships further strengthen market positions. Regional expansion and customer-focused solutions remain key strategies to capture market share. Manufacturers emphasize sustainability, customization, and digital printing technologies to differentiate products. It also faces price pressures due to raw material cost fluctuations and growing demand for cost-efficient solutions. Continuous innovation and efficient supply chain management are critical for sustaining competitiveness and addressing evolving consumer and regulatory requirements in the market.

Recent Developments:

- In January 2025, Henkel AG launched Smartwash™ Technology, an AI-driven, cartridge-based detergent dosing system at CES 2025, introducing Persil® and Somat® Smartwash products for the European market.

- In March 2025, Mactac announced a sales and distribution partnership with Chemical Concepts to provide local distribution of popular adhesive tapes in North America.

- In May 2023, Mactac acquired Canadian roll label distributor Label Supply, expanding their footprint in Canada.

Report Coverage:

The research report offers an in-depth analysis based on Material, Printing Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The labels, tapes, and films market will witness increased adoption of smart labels integrated with RFID, QR codes, and NFC technologies.

- Sustainable and eco-friendly materials will drive innovation and attract environmentally conscious consumers.

- E-commerce growth will continue to create demand for protective, durable, and visually appealing packaging solutions.

- Manufacturers will invest in high-performance films and tapes that resist heat, moisture, and mechanical stress.

- Automation and digital printing technologies will enhance production efficiency and enable customized labeling solutions.

- Expansion in emerging markets, particularly in Asia-Pacific and Latin America, will present new growth opportunities.

- Integration of interactive and digital labels will improve supply chain visibility and product authentication.

- Regulatory compliance and quality standards will encourage the development of advanced, certified materials.

- Collaboration between material suppliers and packaging manufacturers will foster innovation and product differentiation.

- Increasing consumer focus on product aesthetics, safety, and traceability will drive demand for versatile labeling and film solutions.