Market Overview

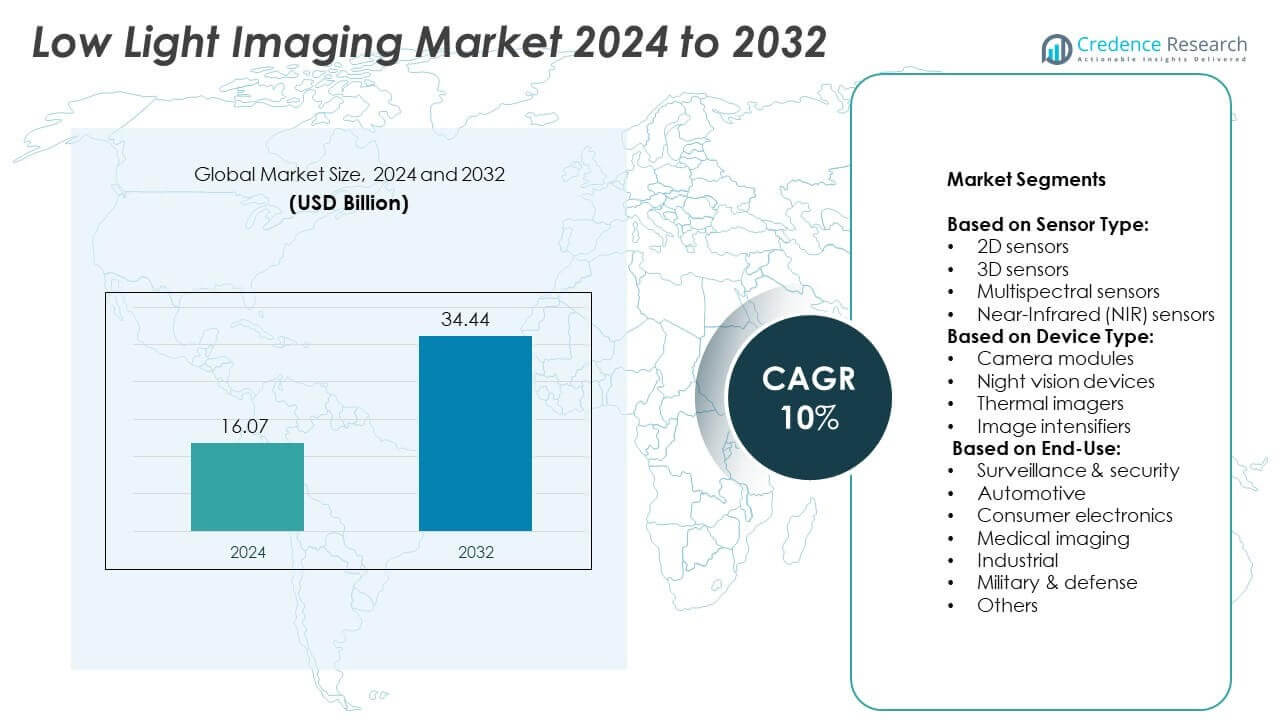

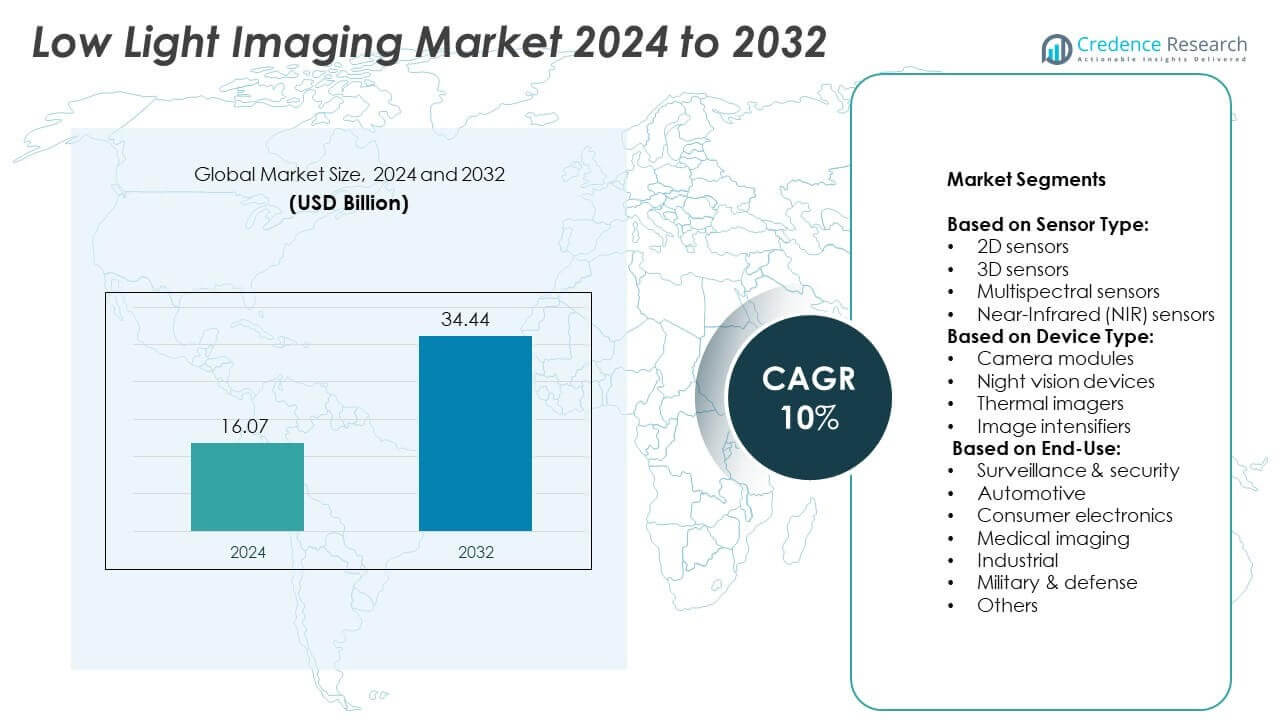

The Low Light Imaging Market size was valued at USD 16.07 billion in 2024 and is anticipated to reach USD 34.44 billion by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Light Imaging Market Size 2024 |

USD 16.07 Billion |

| Low Light Imaging Market, CAGR |

10% |

| Low Light Imaging Market Size 2032 |

USD 34.44 Billion |

The Low Light Imaging market grows through rising demand in surveillance, automotive safety, and medical diagnostics. Governments invest in smart infrastructure, while automakers integrate night vision into ADAS systems. Healthcare sectors adopt low light sensors for precision imaging in endoscopy and surgery. Technological advancements in CMOS, NIR, and AI-based sensors improve performance in dark environments. Compact, energy-efficient designs expand usage in smartphones, wearables, and drones. This alignment of innovation and application drives steady market expansion across industrial and consumer sectors.

North America leads the Low Light Imaging market with strong adoption in defense, surveillance, and automotive sectors. Europe follows with advanced automotive and medical imaging applications, while Asia-Pacific shows rapid growth driven by electronics and urban security investments. Latin America and the Middle East & Africa witness gradual adoption through public safety and industrial upgrades. Key players operating across these regions include OMNIVISION, STMicroelectronics, Teledyne FLIR, and Sony Semiconductor Solutions, each contributing to product innovation and global market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Low Light Imaging market was valued at USD 16.07 billion in 2024 and is projected to reach USD 34.44 billion by 2032, growing at a CAGR of 10%.

- Rising demand from surveillance, automotive safety, and medical diagnostics drives market growth across both developed and emerging economies.

- AI-enabled imaging, compact sensor design, and integration of NIR and multispectral technologies shape major industry trends.

- Leading players include OMNIVISION, STMicroelectronics, Sony Semiconductor Solutions, Teledyne FLIR, and BAE Systems, focusing on innovation and strategic partnerships.

- High sensor costs, complex calibration requirements, and inconsistent performance in extreme low-light conditions act as key restraints.

- North America leads the market with strong defense and automotive integration, followed by Europe with advanced healthcare and security systems.

- Asia-Pacific emerges as the fastest-growing region due to rapid urbanization, rising electronics demand, and increasing government investment in surveillance infrastructure.

Market Drivers

Expansion of Surveillance and Security Applications Across Public and Private Sectors

Rising demand for surveillance in public safety, smart cities, and private infrastructure drives growth. Government investments in homeland security and border control enhance adoption of low light imaging solutions. Airports, railways, and urban areas rely on advanced cameras for threat detection in poor lighting. Commercial facilities and residential zones also integrate night vision and thermal imaging for property monitoring. The Low Light Imaging market benefits from broader deployment of these systems in fixed and mobile units. It supports continuous surveillance regardless of time or lighting condition.

- For instance, Axis Communications’ Lightfinder 2.0 cameras can capture full-color video in challenging low-light conditions, with some models, like the AXIS P3265-LVE, achieving a minimum illumination of 0.1 lux in color. The technology improves color reproduction, reduces noise, and increases the light sensitivity of the image sensor.

Integration of Low Light Imaging in Automotive Safety and Driver Assistance Systems

Automotive manufacturers embed low light sensors in ADAS features to improve road safety at night. Night vision cameras assist drivers by detecting pedestrians, animals, and objects in low-visibility areas. It strengthens driver confidence and minimizes accidents during fog, dusk, or rural driving. Luxury and electric vehicles increasingly use infrared and near-infrared cameras to meet safety standards. The Low Light Imaging market gains traction from rising consumer demand for safer, tech-enabled driving experiences. Regulatory bodies also support such innovations with strict safety mandates.

- For instance, For many years, FLIR Systems supplied the thermal imaging cameras for BMW’s Night Vision system, which was capable of detecting heat-emitting objects such as pedestrians at distances of up to 300 meters, significantly farther than standard headlights. While FLIR’s PathFindIR cameras were used in older systems, other suppliers like Autoliv have also been involved. Current Teledyne FLIR technology is focused on contributing thermal sensors to Advanced Driver Assistance Systems (ADAS) in many modern vehicles.

Growing Adoption in Medical Imaging and Diagnostics for Enhanced Clinical Accuracy

Medical institutions adopt low light imaging in fluorescence microscopy, endoscopy, and in vivo imaging. These solutions enhance sensitivity, enabling better diagnosis with minimal radiation exposure. It supports early detection of cancer, vascular disorders, and neurological conditions. Clinics and hospitals prefer CMOS and CCD sensors for real-time imaging in minimally lit environments. The Low Light Imaging market expands with advancements in bioimaging and increased focus on personalized care. Demand rises from research labs and diagnostic centers seeking precision and non-invasive methods.

Increased Usage in Industrial Automation and Quality Inspection Under Low Visibility

Manufacturing facilities deploy low light imaging to maintain productivity in challenging lighting environments. These systems enable continuous inspection of components on high-speed production lines. It ensures defect detection, even in night shifts or low-light workspaces. Robotics and automation systems use night vision to operate in dim or enclosed areas. The Low Light Imaging market strengthens through need for reliable quality control and operational efficiency. Integration with AI boosts detection accuracy and lowers inspection time.

Market Trends

Emergence of AI-Integrated Imaging Systems for Real-Time Low-Light Enhancements

Manufacturers integrate AI algorithms with low light sensors to improve image clarity and object recognition. These systems adapt to changing lighting conditions and automatically enhance dark scenes. It enables real-time analysis for surveillance, automotive, and industrial applications. AI also supports predictive insights in imaging workflows, increasing operational efficiency. The Low Light Imaging market evolves through the growing synergy between AI, edge computing, and smart sensors. Companies invest in AI-ready camera modules to deliver adaptive performance in complex environments.

- For instance, Hamamatsu Photonics’ ORCA-Fusion BT sCMOS camera achieves 0.7 electrons readout noise, enabling ultra-sensitive live-cell imaging.

Shift Toward Compact, Energy-Efficient, and Wearable Imaging Devices

End-users seek smaller, battery-efficient imaging modules suitable for drones, wearables, and mobile devices. Manufacturers respond with miniaturized low light sensors that offer high resolution and low power consumption. It meets the demand for portable and lightweight surveillance and medical imaging equipment. Military and law enforcement agencies prefer compact gear for mobility in low-visibility operations. The Low Light Imaging market gains momentum with rising innovation in device form factors. Growth continues as industries favor wearable and embedded sensor technologies.

- For instance, Basler AG’s ace 2 Pro cameras, which use advanced CMOS sensor technology from Sony, offer various specifications depending on the model. Some models, such as the a2A1920-160umPRO with a Sony IMX392 sensor, achieve frame rates up to 160 fps via USB 3.0. These cameras feature high sensitivity for low-light applications, with certain sensors optimized for high performance in near-infrared (NIR) ranges. These cameras are suited for demanding industrial environments and offer a compact design of 29 mm x 29 mm.

Wider Deployment of Near-Infrared (NIR) and Multispectral Imaging Technologies

Demand increases for NIR and multispectral sensors that operate beyond visible light. These technologies support applications in agriculture, medical diagnostics, and environmental monitoring. It allows for imaging through fog, smoke, and biological tissues with higher accuracy. Researchers and product developers explore new spectral ranges for better scene interpretation. The Low Light Imaging market expands with sensor customization and spectrum versatility. Advanced material science contributes to improved sensitivity in multiple wavelength bands.

Rising Use of CMOS Sensors Over CCD for Low Light and High-Speed Applications

CMOS sensors offer higher speed, lower cost, and better integration with digital systems than CCDs. Manufacturers choose CMOS for low light cameras in consumer electronics and automotive safety features. It supports fast frame rates and real-time data processing with minimal noise. Integration with SOCs and FPGA-based platforms further boosts CMOS sensor utility. The Low Light Imaging market benefits from this shift toward scalable, power-efficient sensor designs. This trend aligns with growing demand for smart, compact, and high-speed imaging solutions.

Market Challenges Analysis

High Production Costs and Complexity of Advanced Low Light Imaging Technologies

Development of low light imaging devices involves high material and integration costs. Advanced sensors like EMCCD, sCMOS, and NIR modules require precision engineering and specialized fabrication. It limits adoption among price-sensitive sectors such as small-scale surveillance and consumer electronics. Maintenance costs and calibration requirements also raise long-term ownership expenses. The Low Light Imaging market faces challenges in balancing cost and performance while meeting user expectations. Manufacturers must reduce prices without sacrificing sensitivity, speed, or durability.

Performance Limitations in Extreme Environments and Light-Starved Conditions

Low light imaging systems often struggle with image noise and reduced resolution in ultra-dark settings. Harsh weather, fog, or rapid motion can degrade visual clarity and sensor output. It affects real-time analysis in military, transportation, and industrial use cases. Inconsistent performance in varying conditions limits trust and scalability of deployments. The Low Light Imaging market encounters setbacks in maintaining stable performance across diverse lighting scenarios. Continued R&D is required to overcome sensor limitations and improve accuracy in uncontrolled environments.

Market Opportunities

Expansion in Smart Cities and Infrastructure Modernization Projects Globally

Governments and city planners invest in intelligent infrastructure that relies on advanced surveillance systems. These projects require 24/7 imaging capabilities, including in dim or no-light environments. It creates opportunities for thermal cameras, image intensifiers, and NIR solutions. The Low Light Imaging market benefits from integration into traffic monitoring, public safety, and smart building systems. Urban areas in Asia-Pacific, Europe, and North America deploy these technologies to enhance visibility and safety. Suppliers can expand through public-private partnerships focused on smart city upgrades.

Emerging Demand in Space Exploration, Underwater, and Scientific Research Applications

Space agencies, oceanographers, and research institutions need imaging tools that perform under low-light or no-light conditions. Deep-sea exploration, planetary missions, and astronomy rely on ultra-sensitive imaging systems. It opens opportunities for scientific-grade sensors with high dynamic range and low noise. The Low Light Imaging market sees new demand from academic institutions and R&D labs focused on extreme condition studies. Manufacturers can target niche sectors with customized sensor modules for research tools. These segments support high-margin sales through low-volume, high-specification equipment.

Market Segmentation Analysis:

By Sensor Type:

2D sensors dominate due to their low cost and strong performance in basic imaging applications. These sensors support high volumes in smartphones, webcams, and surveillance systems. 3D sensors gain traction in automotive and robotics where depth mapping is critical for navigation and safety. Multispectral sensors address niche demands in agriculture, environmental monitoring, and medical diagnostics. Near-Infrared (NIR) sensors show rapid growth due to their use in security, biometric authentication, and medical imaging. The Low Light Imaging market benefits from sensor diversification aligned with sector-specific needs.

- For instance, Hikvision’s DarkFighterX cameras use a dual-sensor design and bi-spectral fusion technology to capture and combine visible-light and infrared images, enabling full-color, high-definition video in ultra-low-light conditions. Some models, such as those used for large-scale applications, can achieve sharp, full-color imaging at illumination levels as low as 0.0002 lux, with AI features included in some variants. The technology is designed to simulate the human eye’s ability to perceive both brightness and color, producing brighter, clearer images than conventional cameras

By Device Type:

Camera modules lead the segment with widespread use in mobile devices, smart homes, and vehicles. They integrate well with CMOS and AI-based systems, supporting compact, multi-functional designs. Night vision devices remain important in law enforcement, wildlife monitoring, and defense where visibility at night is essential. Thermal imagers are essential in fire detection, machine diagnostics, and perimeter surveillance due to their heat-sensing capabilities. Image intensifiers find use in aviation, tactical systems, and scientific research that require ultra-low light visibility. It offers versatile device options to match varied operational environments.

- For instance, Sony’s IMX585 CMOS sensor, which is built on STARVIS 2 technology, features a pixel array of 3840 x 2160 (4K resolution) and a pixel size of 2.9 µm x 2.9 µm. The sensor is designed for applications like security cameras and AI image processing, delivering high sensitivity, a dynamic range of 88 dB in single exposure mode, and low power consumption. It can achieve a maximum frame rate of 60 frames per second at 12 bits.

By End-Use:

Surveillance and security represent the largest end-use, driven by government and commercial infrastructure upgrades. These systems operate around the clock, demanding clear imaging in dark or low-visibility areas. Automotive follows with increased adoption of night vision and parking assist systems that enhance driver safety. Consumer electronics leverage low light imaging in smartphones and AR/VR headsets to improve user experience. Medical imaging uses it in procedures like endoscopy and tissue diagnostics where light exposure is limited. Industrial applications span inspection, robotics, and automation under challenging lighting conditions. Military and defense continue to rely on high-sensitivity imaging for night missions and situational awareness. It meets diverse needs across safety, diagnostics, and mobility sectors.

Segments:

Based on Sensor Type:

- 2D sensors

- 3D sensors

- Multispectral sensors

- Near-Infrared (NIR) sensors

Based on Device Type:

- Camera modules

- Night vision devices

- Thermal imagers

- Image intensifiers

Based on End-Use:

- Surveillance & security

- Automotive

- Consumer electronics

- Medical imaging

- Industrial

- Military & defense

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32.4% of the global Low Light Imaging market. The region leads due to early technology adoption, strong defense spending, and widespread use of surveillance infrastructure. The United States continues to drive innovation with support from federal programs focused on smart cities, border security, and automotive safety. Major players such as FLIR Systems, Teledyne, and BAE Systems have extensive R&D activities and product launches in thermal and night vision devices. Law enforcement and homeland security agencies use low light cameras in patrol systems, drones, and fixed monitoring stations. The region also benefits from the presence of automotive OEMs integrating NIR and 3D sensors into ADAS and autonomous vehicle platforms. It maintains strong demand across military, healthcare, and commercial sectors, supported by high consumer spending on smart electronics.

Europe

Europe holds a market share of 24.6%, driven by robust investments in public safety and automotive technologies. Countries like Germany, France, and the United Kingdom lead adoption due to smart infrastructure upgrades and advanced manufacturing bases. The European automotive sector adopts night vision technologies for luxury and electric vehicles to comply with evolving safety regulations. The region also supports innovations in CMOS and NIR sensors through academic and industrial collaborations. European agencies deploy low light imaging in railway surveillance, border monitoring, and environmental research. Healthcare facilities use low-light-enabled diagnostic tools and imaging equipment in minimally invasive surgeries. It benefits from strong regulatory frameworks and the presence of sensor-focused companies including STMicroelectronics and Basler AG.

Asia-Pacific

Asia-Pacific captures 29.1% of the Low Light Imaging market, making it the fastest-growing region. Rapid urbanization, rising defense budgets, and high demand for consumer electronics support its expansion. China, Japan, and South Korea lead sensor manufacturing and camera integration across smartphones, security networks, and automobiles. India invests in public safety and traffic monitoring systems equipped with NIR and thermal imaging. Regional companies develop low-cost modules with CMOS and AI capabilities, improving accessibility. Medical institutions in Japan and South Korea use these systems for precision diagnostics and surgical assistance. It shows robust demand from both consumer-driven and government-backed initiatives across cities, borders, and hospitals.

Latin America

Latin America holds a smaller share of 7.3%, but shows gradual growth due to modernization of security and healthcare infrastructure. Countries such as Brazil, Mexico, and Chile focus on improving public safety through smart surveillance systems in urban areas. Automotive manufacturers adopt low light sensors to meet rising demand for safety features in mid-range vehicles. Healthcare facilities begin integrating imaging modules into diagnostic and endoscopic tools. The region also imports thermal and infrared systems for mining and oil & gas safety inspections. It gains support from foreign investments and public-private partnerships in infrastructure and industrial automation.

Middle East & Africa

The Middle East & Africa region contributes 6.6% to the global market, with demand focused on border security, critical infrastructure, and oil sector operations. Gulf countries deploy advanced low light imaging systems for surveillance of sensitive locations and public spaces. Defense agencies across Israel, Saudi Arabia, and the UAE invest in night vision and thermal imaging solutions. Medical and industrial applications expand gradually, supported by technology transfers and government-backed digital health programs. South Africa and Egypt invest in smart traffic systems with NIR and camera modules. It presents long-term potential as infrastructure projects integrate advanced imaging systems for round-the-clock monitoring.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- OMNIVISION

- BAE Systems plc

- STMicroelectronics N.V.

- Hamamatsu Photonics K.K.

- Teledyne FLIR LLC (Teledyne Technologies Inc)

- Oxford Instruments plc

- Canon Inc.

- Photonis Group S.A.S

- Sony Semiconductor Solutions Corporation (Sony Corporation)

- OnSemi

- ams-OSRAM AG

Competitive Analysis

The Low Light Imaging market features strong competition among key players including OMNIVISION, BAE Systems, STMicroelectronics, Hamamatsu Photonics, Teledyne FLIR, Oxford Instruments, Canon Inc., Photonis Group, Sony Semiconductor Solutions, OnSemi, and ams-OSRAM AG. These companies focus on sensor innovation, wavelength sensitivity, and integration with AI and edge computing platforms. Industry leaders enhance product performance by improving CMOS, sCMOS, and NIR sensor capabilities. Several firms invest in R&D to develop ultra-low noise, high-dynamic-range imaging solutions for defense, healthcare, and automotive markets. OEM partnerships remain crucial, especially with automotive and smartphone manufacturers requiring compact, energy-efficient modules. Defense-oriented firms strengthen their portfolios with ruggedized night vision and thermal imaging systems to meet strict military standards. Players operating in the medical and industrial space prioritize precision and real-time performance in diagnostic and automation tools. Market consolidation occurs through strategic acquisitions to expand product lines and geographic reach. Firms also pursue vertical integration and customization to serve specific use cases such as endoscopy, autonomous vehicles, and smart surveillance. Competition intensifies as startups and regional players enter with specialized or low-cost offerings. Leading companies maintain their edge through patent portfolios, global distribution networks, and continuous sensor miniaturization efforts.

Recent Developments

- In August 2025, Hamamatsu announced acceleration of development toward ultra-high-speed, high-resolution, and high-sensitivity cameras, including prototypes for quantum computing applications over 2025–2027.

- In March 2024, OMNIVISION announced the OX08D10 automotive image sensor with TheiaCel™ technology made compatible with Qualcomm’s Snapdragon® Digital Chassis.

- In April 2023, Canon U.S.A. announced development of the MS-500 ultra-high-sensitivity interchangeable-lens camera with a 3.2MP SPAD sensor enabling superb low-light performance and long-distance monitoring capabilities.

Report Coverage

The research report offers an in-depth analysis based on Sensor Type, Device Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising use in surveillance, automotive, and healthcare sectors.

- Night vision integration in advanced driver assistance systems will expand in premium and mid-range vehicles.

- AI-enabled low light imaging will gain traction across smart city, military, and industrial use cases.

- Demand for NIR and multispectral sensors will increase in agriculture, medical diagnostics, and environmental monitoring.

- Smartphone makers will adopt more powerful low light sensors to enhance mobile photography and AR functions.

- Defense and homeland security agencies will invest more in portable night vision and thermal imaging gear.

- Scientific and space research organizations will use ultra-sensitive imaging systems in deep space and deep-sea missions.

- Wearable low light devices will emerge for law enforcement, firefighting, and rescue operations.

- Sensor miniaturization will drive adoption in drones, robotics, and compact industrial tools.

- Manufacturers will focus on reducing costs and improving energy efficiency for broader market access.