Market Overview

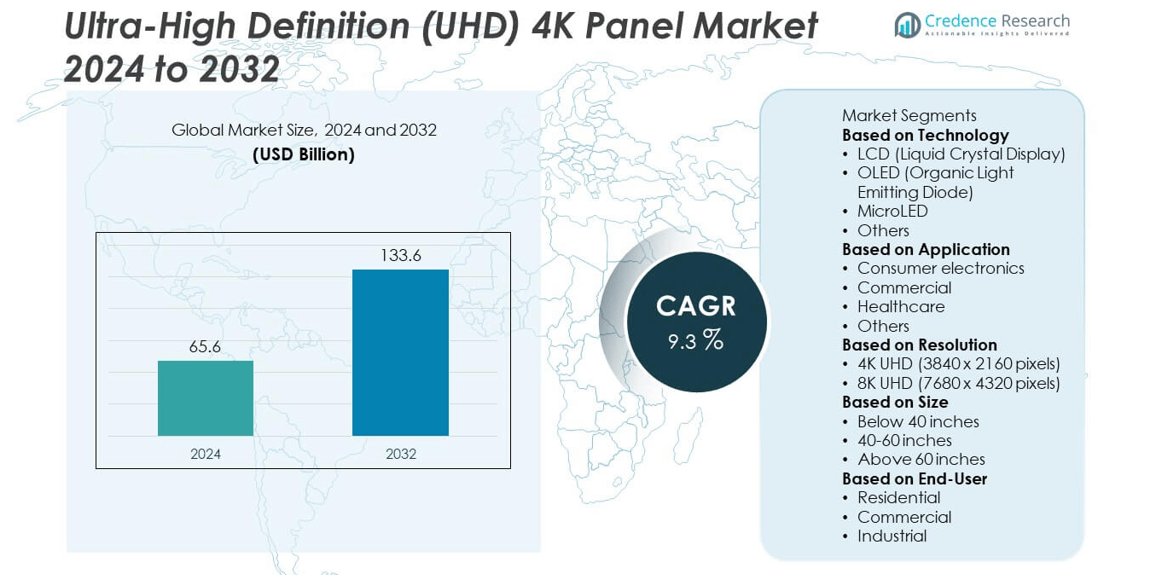

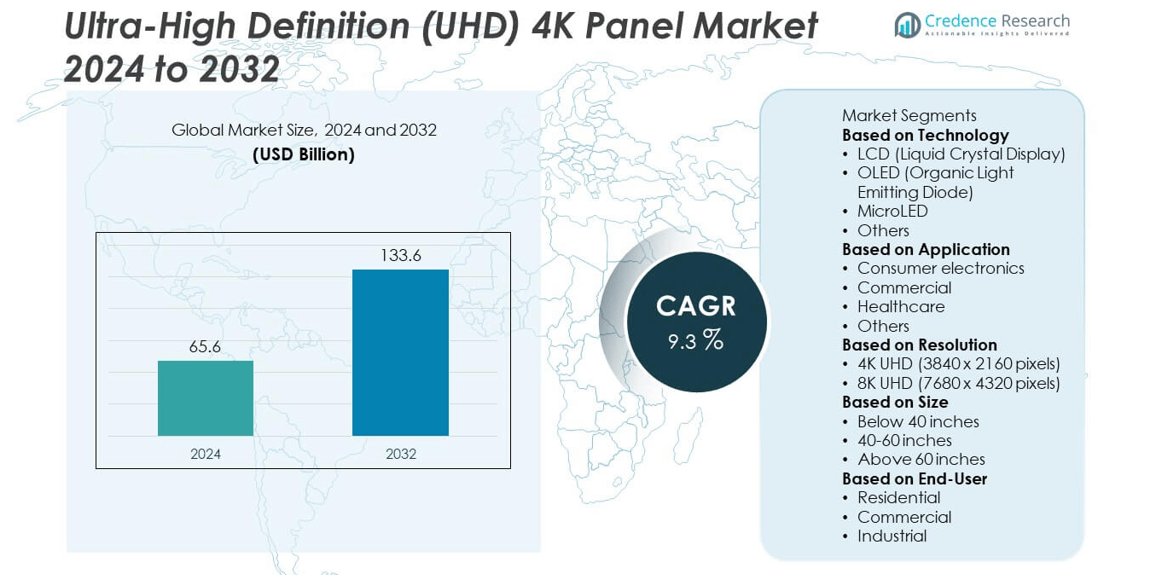

The Ultra-High Definition (UHD) 4K Panel Market was valued at USD 65.6 billion in 2024 and is anticipated to reach USD 133.6 billion by 2032, expanding at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultra-High Definition (UHD) 4K Panel Market Size 2024 |

USD 65.6 billion |

| Ultra-High Definition (UHD) 4K Panel Market, CAGR |

9.3% |

| Ultra-High Definition (UHD) 4K Panel Market Size 2032 |

USD 133.6 billion |

Ultra-High Definition (UHD) 4K Panel Market grows with rising consumer demand for superior visual quality, driven by the expansion of streaming services, gaming, and immersive entertainment. Adoption increases across televisions, monitors, and laptops as falling panel prices make 4K more accessible to mass markets.

North America leads the Ultra-High Definition (UHD) 4K Panel Market with strong adoption across consumer electronics, healthcare imaging, and enterprise applications, supported by high availability of 4K content from streaming platforms and gaming ecosystems. Europe follows with widespread adoption in countries such as Germany, the UK, and France, where demand is driven by broadcasters investing in 4K-ready production and growing use in digital signage and education. Asia-Pacific emerges as the fastest-growing region, powered by rising disposable incomes in China and India and innovation leadership from Japan and South Korea, which also serve as major manufacturing hubs for display technologies. Latin America and the Middle East & Africa show steady growth through expanding e-commerce, urbanization, and rising demand for premium home entertainment systems. Key players such as Samsung, BOE Technology Group Co., Ltd., LG Display Co., Ltd., and Hisense Group Co., Ltd. strengthen their global presence with product innovation and regional expansions.

Market Insights

- Ultra-High Definition (UHD) 4K Panel Market was valued at USD 65.6 billion in 2024 and is projected to reach USD 133.6 billion by 2032, expanding at a CAGR of 9.3% during the forecast period.

- The market grows with rising consumer demand for high-resolution displays across televisions, monitors, laptops, and gaming devices, supported by the expansion of streaming services and immersive entertainment platforms.

- Trends highlight advancements in OLED, QLED, and mini-LED technologies that improve brightness, contrast, and energy efficiency while offering thinner and more durable panel designs to attract premium buyers.

- Leading players including Samsung, BOE Technology Group Co., Ltd., LG Display Co., Ltd., and Hisense Group Co., Ltd. compete through innovation, manufacturing scale, and regional expansion to capture growing demand.

- Market restraints include high production costs, pricing pressures due to intense competition, and limited 4K content availability in some regions, which slow adoption in cost-sensitive markets.

- North America leads with high penetration of 4K content and strong adoption in consumer and professional sectors, Europe benefits from strong broadcaster investments and demand for digital signage, while Asia-Pacific emerges as the fastest-growing region driven by affordability and innovation.

- Latin America and the Middle East & Africa show gradual but steady adoption supported by expanding e-commerce platforms, rising disposable incomes, and increasing demand for premium home entertainment solutions across urban populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand for High-Resolution Displays

Ultra-High Definition (UHD) 4K Panel Market grows with rising consumer preference for sharper, more detailed visuals. Televisions, monitors, and laptops equipped with 4K panels deliver enhanced clarity that appeals to entertainment, gaming, and professional users. Streaming platforms offer 4K content, encouraging households to upgrade devices. Growing interest in immersive experiences drives demand across both personal and commercial applications. It highlights the strong role of visual quality in shaping consumer purchasing decisions.

- For instance, Samsung Display introduced a 27-inch UHD QD-OLED monitor panel operating at a 240 Hz refresh rate in early 2025. At its release, several brands, including Samsung’s own electronics division, announced monitors with this panel, and other manufacturers also introduced 27-inch, 4K, 240 Hz QD-OLED models based on it. The company did announce a production expansion in March 2025, targeting its total QD-OLED monitor panel shipments to exceed 1.4 million units that year, which represents a 50% increase from the previous year.

Expanding Adoption Across Multiple Industries

The professional sector accelerates demand for advanced display technologies. Ultra-High Definition (UHD) 4K Panel Market benefits from usage in education, healthcare, and corporate environments where clarity and detail improve efficiency. Hospitals rely on 4K displays for imaging and diagnostics, while businesses adopt them for video conferencing and presentations. Retailers and advertisers use 4K panels for digital signage to capture consumer attention. It underscores the versatility of 4K displays in diverse applications beyond consumer electronics.

Technological Advancements and Product Innovation

Advancements in display technology strengthen growth opportunities across the industry. Ultra-High Definition (UHD) 4K Panel Market leverages improvements in OLED, QLED, and mini-LED panels to deliver higher brightness, better contrast, and energy efficiency. Declining production costs also make 4K devices more accessible to mass markets. Gaming consoles and graphics cards optimized for 4K performance further drive demand. It reinforces the role of innovation in sustaining adoption across evolving applications.

- For instance, the Samsung 27-inch Odyssey OLED G81SF monitor features a 240 Hz refresh rate, 0.03 ms response time (GtG), and a glare-reducing display, making it highly appealing for professional gaming and creative work that demands fast performance and vibrant colors.

Growing Penetration in Emerging Economies

Rising disposable incomes and expanding digital infrastructure in emerging economies support strong adoption of 4K panels. Ultra-High Definition (UHD) 4K Panel Market gains momentum as middle-class consumers in Asia-Pacific, Latin America, and the Middle East demand premium televisions and monitors. E-commerce platforms expand access to advanced electronics in these regions. Local content creators increasingly produce 4K material, driving relevance for higher-resolution displays. It creates opportunities for global manufacturers to target new customer bases with affordable offerings.

Market Trends

Growing Popularity of 4K Content and Streaming Platforms

Ultra-High Definition (UHD) 4K Panel Market benefits from the rapid growth of streaming services that deliver 4K content. Platforms such as Netflix, Amazon Prime, and Disney+ encourage consumers to upgrade their devices for optimal viewing. Gaming platforms also support 4K resolution, attracting younger demographics. Content creators and broadcasters invest in 4K-ready production equipment, expanding the availability of ultra-high-definition material. It accelerates consumer demand for displays that match content quality standards.

- For instance, Hisense introduced the E7Q Pro 4K QLED TV, which is available in screen sizes up to 100 inches. The TV features a 4K resolution QLED panel and targets streaming and gaming audiences with advanced features

Adoption of Advanced Display Technologies in Panels

The transition toward OLED, QLED, and mini-LED technologies reshapes market dynamics. Ultra-High Definition (UHD) 4K Panel Market integrates these advancements to improve brightness, contrast, and energy efficiency. OLED panels gain popularity for their superior color accuracy, while mini-LED enhances performance in gaming and professional displays. Manufacturers differentiate through innovation in panel design and thin form factors. It strengthens the role of technology upgrades in driving product replacement cycles.

- For instance, BOE Technology has unveiled a 31.5-inch 4K Mini-LED display with 4,608 backlights and 1,152 dimming zones, delivering a 1,000,000:1 contrast ratio and a 144 Hz refresh rate, which is intended for professional gaming and content creation.

Rising Integration in Professional and Enterprise Applications

Beyond consumer markets, enterprises expand adoption of 4K panels in workplaces and public spaces. Ultra-High Definition (UHD) 4K Panel Market grows with applications in digital signage, healthcare imaging, and education. Businesses deploy 4K panels for video conferencing and collaborative work environments. Hospitals rely on precision imaging for diagnostics, while universities integrate 4K screens for virtual learning. It highlights a trend where professional sectors increasingly adopt high-resolution displays to improve efficiency and engagement.

Expansion Across Emerging Economies Through Affordable Offerings

Emerging markets experience strong demand for affordable 4K panels supported by rising disposable incomes. Ultra-High Definition (UHD) 4K Panel Market benefits from local production facilities and e-commerce channels that expand accessibility. Brands introduce budget-friendly models to capture middle-class buyers in Asia-Pacific, Latin America, and Africa. Local content producers adapt to 4K standards, increasing consumer motivation to upgrade displays. It positions emerging economies as growth engines for future global adoption.

Market Challenges Analysis

High Production Costs and Pricing Pressures

Ultra-High Definition (UHD) 4K Panel Market faces challenges linked to high production costs and pricing competition. Advanced display technologies such as OLED, QLED, and mini-LED require expensive manufacturing processes. Price-sensitive consumers in emerging economies limit premium adoption, forcing brands to balance quality and affordability. Declining panel prices benefit consumers but reduce profit margins for manufacturers. Supply chain disruptions and volatility in raw material costs further increase operational risks. It creates a challenging environment for producers to sustain profitability while expanding adoption globally.

Limited 4K Content Availability and Compatibility Barriers

Content availability continues to influence demand for 4K panels worldwide. Ultra-High Definition (UHD) 4K Panel Market encounters barriers in regions where 4K streaming or broadcasting infrastructure is limited. High bandwidth requirements restrict streaming quality in rural or underdeveloped areas. Compatibility challenges with older devices and networks discourage some consumers from upgrading. Broadcasters and content providers face high costs in shifting to 4K-ready production. It slows the pace of adoption despite growing awareness of visual quality improvements.

Market Opportunities

Rising Demand from Entertainment and Gaming Industries

Ultra-High Definition (UHD) 4K Panel Market presents strong opportunities through the entertainment and gaming industries. Streaming platforms and broadcasters continue to expand their 4K content libraries, motivating consumers to upgrade devices. Gaming consoles and graphics systems optimized for 4K resolution create new demand among younger demographics. Virtual reality and augmented reality applications further support the adoption of high-resolution displays. Manufacturers can leverage this demand by offering panels with higher refresh rates and superior visual performance. It highlights strong potential for growth in sectors driven by immersive digital experiences.

Expansion Across Commercial and Emerging Economy Applications

Commercial applications and emerging markets open new pathways for market expansion. Ultra-High Definition (UHD) 4K Panel Market benefits from growing use in digital signage, healthcare imaging, and education, where precision and clarity add measurable value. Emerging economies in Asia-Pacific, Latin America, and Africa experience rising disposable incomes, encouraging middle-class households to adopt affordable 4K televisions and monitors. E-commerce platforms improve accessibility, broadening product reach. Local content creators adopting 4K standards further reinforce consumer demand. It provides manufacturers with an opportunity to scale production and strengthen global footprints.

Market Segmentation Analysis:

By Technology

Ultra-High Definition (UHD) 4K Panel Market is segmented by technology into LED, OLED, QLED, and others. LED panels dominate due to cost efficiency and wide adoption across televisions, monitors, and laptops. OLED technology gains traction with its superior color accuracy, contrast ratio, and thin form factor, attracting premium buyers. QLED panels expand adoption by offering high brightness and energy efficiency, making them popular in large-sized televisions. Emerging technologies such as mini-LED enhance performance for gaming and professional displays. It demonstrates how advancements in panel technology shape consumer choice and product positioning.

- For instance, Panasonic launched its 2025 flagship Z95B OLED TV series in 55-inch, 65-inch, and 77-inch sizes. It is equipped with a 144 Hz refresh rate and a Primary RGB Tandem panel, boosting both brightness and longevity compared with conventional OLEDs.

By Application

Segmentation by application includes consumer electronics, digital signage, healthcare, education, and others. Consumer electronics represent the largest share, supported by rising demand for 4K televisions, monitors, and laptops. Ultra-High Definition (UHD) 4K Panel Market also benefits from rapid adoption in digital signage, where retailers and advertisers use high-resolution displays for improved visibility and engagement. Healthcare facilities employ 4K panels in diagnostic imaging, surgery visualization, and patient monitoring. Educational institutions integrate them into classrooms and virtual learning systems. It highlights the diverse use of 4K panels across both personal and professional environments.

- For instance, BOE Technology introduced a 75-inch 4K display with a 165 Hz refresh rate and its UB Cell 4.0 technology, designed specifically for healthcare and enterprise environments to deliver consistent clarity across wide viewing angles.

By Resolution

Ultra-High Definition (UHD) 4K Panel Market is further segmented by resolution into 3840 x 2160 and higher configurations. The 3840 x 2160 resolution dominates, offering a balance of cost and performance suitable for mass consumer adoption. Higher resolutions beyond 4K, including 5K and 8K readiness, emerge in professional and niche applications. These include gaming monitors, medical imaging, and large digital signage requiring advanced clarity. Demand for higher resolutions grows with technological advancements in graphics processing and content creation. It reflects how resolution improvements continue to expand application potential while reinforcing 4K as the current mainstream standard.

Segments:

Based on Technology

- LCD (Liquid Crystal Display)

- OLED (Organic Light Emitting Diode)

- MicroLED

- Others

Based on Application

- Consumer electronics

- Commercial

- Healthcare

- Others

Based on Resolution

- 4K UHD (3840 x 2160 pixels)

- 8K UHD (7680 x 4320 pixels)

Based on Size

- Below 40 inches

- 40-60 inches

- Above 60 inches

Based on End-User

- Residential

- Commercial

- Industrial

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 33% of the Ultra-High Definition (UHD) 4K Panel Market in 2024, making it the leading regional segment. Strong demand arises from high penetration of 4K televisions, monitors, and gaming consoles across the United States and Canada. Households increasingly upgrade to UHD panels to enjoy 4K content from major streaming platforms such as Netflix, Amazon Prime, and Disney+. The region also benefits from advanced gaming ecosystems that emphasize high-resolution displays. Professional adoption in healthcare, education, and corporate environments further drives regional growth. It reflects the combination of strong consumer spending and advanced infrastructure supporting premium display technologies.

Europe

Europe represents 28% of the global market share in 2024, driven by a mature consumer electronics market and widespread availability of 4K content. Countries such as Germany, the UK, and France lead adoption with strong demand for UHD televisions and digital signage solutions. Broadcasters in the region invest heavily in 4K-ready production and distribution, ensuring higher content availability. The healthcare sector expands usage of 4K panels for diagnostic imaging, while educational institutions integrate them into digital learning platforms. Strong regulatory focus on quality standards further enhances product acceptance. It positions Europe as a competitive hub with broad applications for 4K panels.

Asia-Pacific

Asia-Pacific holds 26% of the market share in 2024, making it the fastest-growing regional market. Large populations, rising disposable incomes, and expanding middle-class households drive adoption of UHD televisions and monitors in China, India, and Southeast Asia. Japan and South Korea lead in technological innovations, contributing to global supply chains with advanced OLED and QLED production facilities. Local content creators increasingly produce 4K material, which supports device upgrades among consumers. E-commerce platforms accelerate accessibility to affordable UHD panels across the region. It highlights Asia-Pacific as a central driver of global growth with both production capacity and rising demand.

Latin America

Latin America accounts for 7% of the Ultra-High Definition (UHD) 4K Panel Market in 2024, with growth primarily concentrated in Brazil and Mexico. Rising interest in high-resolution televisions and gaming consoles supports steady adoption among middle-income households. Retail expansion and improved access to e-commerce platforms help increase product penetration across urban areas. Broadcasters and streaming providers introduce 4K content, creating opportunities for households to upgrade. Economic volatility and high import costs remain challenges, but local demand for premium entertainment experiences sustains growth. It reflects a developing market with strong long-term potential as affordability improves.

Middle East & Africa

Middle East & Africa represent 6% of the market share in 2024, supported by growing investments in premium consumer electronics. Gulf countries such as Saudi Arabia and the UAE lead adoption, driven by high purchasing power and demand for luxury home entertainment systems. Africa shows gradual growth as internet penetration improves and streaming platforms expand. Commercial applications such as digital signage and hospitality industries also increase demand for UHD panels. Limited infrastructure and affordability challenges slow widespread adoption in parts of the region. It demonstrates steady growth prospects supported by urban development and rising digital engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hisense Group Co., Ltd.

- Samsung

- Sharp Corporation

- Haier Group

- Optronics Corporation

- BOE Technology Group Co., Ltd.

- Innolux Corporation

- Panasonic Corporation

- Display Co., Ltd.

- Koninklijke Philips N.V.

Competitive Analysis

Competitive landscape of the Ultra-High Definition (UHD) 4K Panel Market features leading players such as Hisense Group Co., Ltd., Samsung, Sharp Corporation, Haier Group, U. Optronics Corporation, BOE Technology Group Co., Ltd., Innolux Corporation, Panasonic Corporation, LG Display Co., Ltd., and Koninklijke Philips N.V. These companies compete by advancing OLED, QLED, and mini-LED technologies to deliver superior brightness, contrast, and energy efficiency, meeting consumer and professional demand for high-resolution displays. Strong investments in research and development allow them to introduce innovative designs and thinner form factors that enhance product appeal in televisions, monitors, and laptops. Expanding adoption of 4K content in entertainment, gaming, and streaming services drives aggressive marketing and global expansion strategies. Manufacturers also focus on scaling production facilities to meet rising demand in Asia-Pacific while targeting mature markets in North America and Europe with premium offerings. Competitive intensity is shaped by pricing strategies, brand positioning, and supply chain capabilities, compelling players to balance affordability with advanced features. It reflects a dynamic market where technology leadership, product diversity, and regional penetration define long-term competitiveness and enable firms to capture growth across both consumer and enterprise applications.

Recent Developments

- In June 2025, BOE Technology Group Co., Ltd. Demonstrated a 31.5″ 8K LCD monitor panel at SID Display Week capable of 120 Hz refresh rate at 8K resolution, and up to 240 Hz refresh rate when operating at 4K, with plans for mass production later in the year.

- In January 2025, Sharp Corporation Introduced a new line of QLED 4K UHD TVs, equipped with the Xumo TV operating system.

- In 2025, Samsung Display Announced plans to ship 1.43 million units of QD-OLED monitor panels during the year, marking a notable ramp-up in its display production scale.

- In May 2024, LG Display showcased a wide array of next-generation OLED and advanced display innovations at SID Display Week 2024 in San Jose, California. LG Display offered the opportunity to explore its latest OLED technologies, including OLEDoS for virtual reality, large-sized OLED panels pushing the boundaries of picture quality, and automotive display solutions tailored for Software Defined Vehicles (SDV)

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, Resolution, Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for UHD 4K panels will grow with increasing consumer preference for premium visual quality.

- Streaming platforms and gaming ecosystems will accelerate adoption of 4K-enabled devices.

- OLED, QLED, and mini-LED technologies will drive innovation and performance improvements.

- Enterprises will expand use of 4K panels in healthcare, education, and corporate sectors.

- Affordable 4K televisions and monitors will increase penetration in emerging economies.

- Digital signage and advertising applications will continue to boost commercial demand.

- Local content creators in developing regions will encourage faster consumer upgrades to 4K devices.

- Competition will intensify as manufacturers balance cost efficiency with advanced features.

- E-commerce platforms will enhance accessibility of 4K products to wider audiences.

- Global manufacturers will strengthen regional supply chains to meet rising demand sustainably.