Market Overview

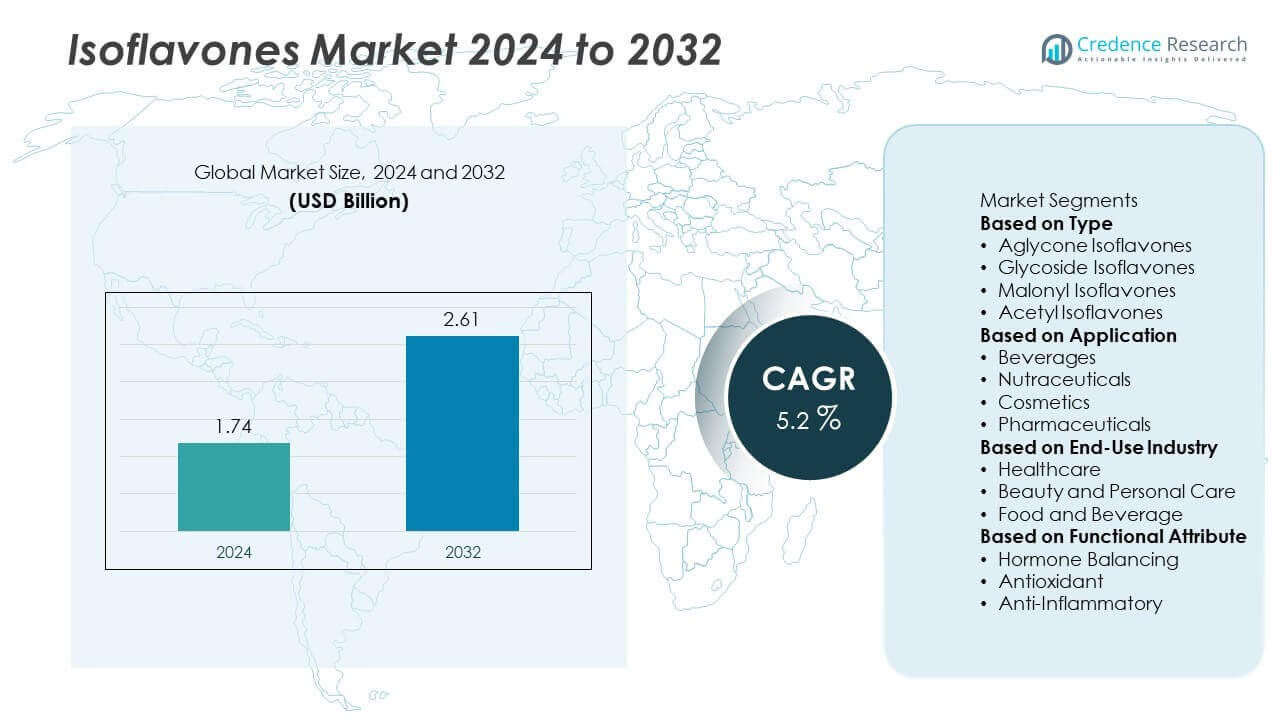

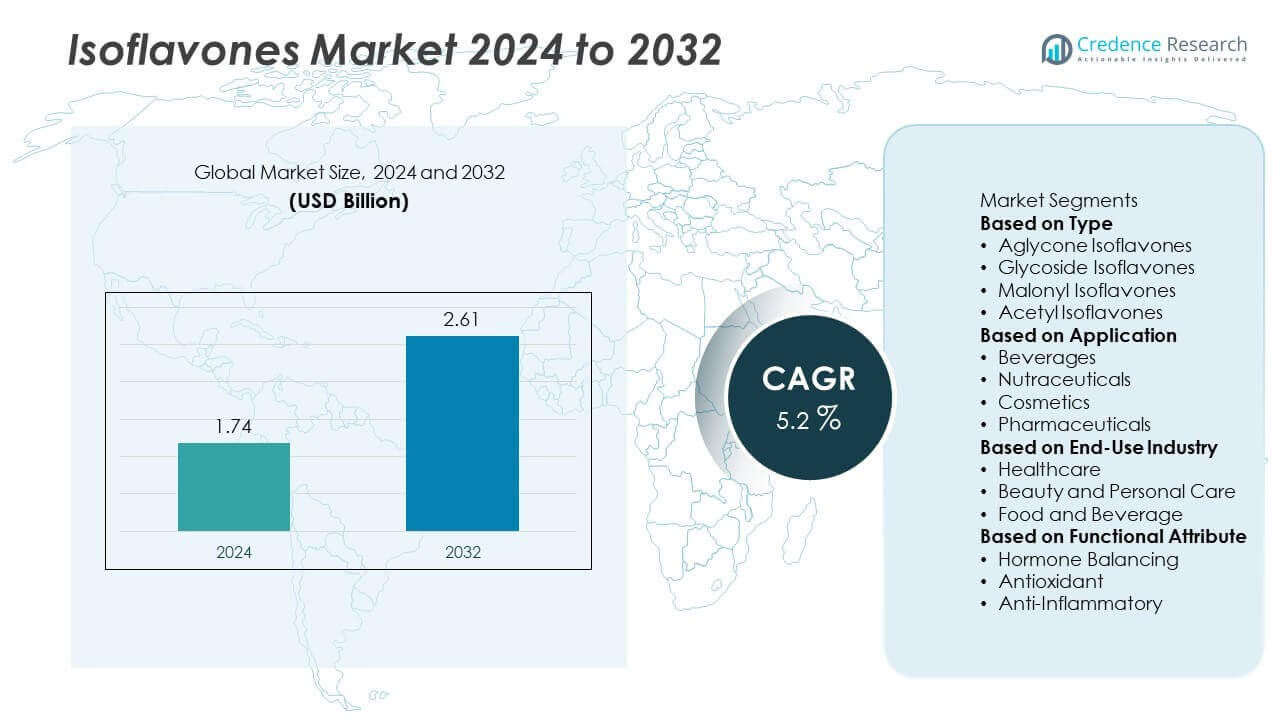

The Isoflavones Market was valued at USD 1.74 billion in 2024 and is projected to reach USD 2.61 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isoflavones Market Size 2024 |

USD 1.74 Billion |

| Isoflavones Market, CAGR |

5.2% |

| Isoflavones Market Size 2032 |

USD 2.61 Billion |

The Isoflavones Market grows with rising demand for plant-based, hormone-supportive, and antioxidant-rich ingredients. Consumers seek natural alternatives for managing menopause, bone health, and heart conditions, driving interest in soy and red clover extracts.

Asia Pacific leads the Isoflavones Market due to high soy consumption, traditional use of botanical remedies, and strong domestic production across Japan, China, and South Korea. North America follows with growing demand for menopause support supplements and functional foods, driven by aging populations and interest in clean-label alternatives. Europe shows steady adoption through red clover-based formulations and regulatory support for plant-derived health products. Latin America and the Middle East & Africa are emerging regions with increasing awareness of women’s health and preventive wellness. Product availability in these regions is expanding through e-commerce and wellness retail chains. Leading companies such as ADM, Glanbia plc, Indena S.p.A, and Kemin Industries are focusing on plant-based ingredient innovation, strategic partnerships, and expanding their footprint in functional food, supplement, and cosmetic applications. These key players invest in clinically supported formulations and regional marketing to capture demand across both developed and emerging health-conscious consumer markets.

Market Insights

- The Isoflavones Market was valued at USD 1.74 billion in 2024 and is projected to reach USD 2.61 billion by 2032, growing at a CAGR of 5.2%.

- Rising demand for natural hormone support, especially during menopause, drives growth in supplements and nutraceuticals.

- Functional foods, fortified beverages, and clean-label cosmetics increasingly feature soy and red clover isoflavones.

- Key players such as ADM, Glanbia plc, Indena S.p.A, and Kemin Industries focus on plant-based innovations and clinically supported formulations.

- Allergen concerns with soy and consumer misconceptions around phytoestrogens limit adoption in certain regions and demographics.

- Asia Pacific dominates due to traditional use and high soy intake, while North America and Europe show strong growth in supplements and skincare.

- Latin America and the Middle East & Africa present emerging opportunities through online channels and rising interest in natural wellness products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Consumer Awareness of Plant-Based and Functional Ingredients

Consumers increasingly seek plant-based and naturally derived ingredients in food, supplements, and cosmetics. Isoflavones, derived mainly from soy and red clover, offer antioxidant and phytoestrogen benefits. The Isoflavones Market benefits from rising demand for clean-label and functional health products. Consumers associate isoflavones with improved heart health, bone density, and hormone balance. This drives adoption in both nutritional supplements and fortified foods. It supports steady volume growth across health-conscious and aging populations.

- For instance, ADM’s Novasoy® soy isoflavone concentrate is utilized by 125 supplement brands as a natural alternative to hormone therapy.

Rising Prevalence of Hormonal Imbalances and Menopausal Disorders

Global incidence of hormone-related conditions, particularly among women over 40, boosts demand for isoflavone-based products. Isoflavones help manage menopausal symptoms such as hot flashes, night sweats, and mood fluctuations. The Isoflavones Market grows with increased use of natural alternatives to hormone replacement therapy. Healthcare providers recommend isoflavone supplements for women seeking safe, plant-based options. Product portfolios now include capsules, powders, and blends tailored for hormonal support. It positions isoflavones as a vital ingredient in women’s health formulations.

- For instance, Indena’s SoySelect® extract is standardized to 13–17% isoflavone glycosides (genistein and daidzein). The extract has demonstrated a significant reduction in hot flashes over a 12-week period in clinical trials.

Expansion of Nutraceutical and Functional Food Applications

The global nutraceuticals industry continues expanding, with strong demand for ingredients that offer both preventive and therapeutic effects. Isoflavones meet this demand through their anti-inflammatory, antioxidant, and estrogen-like properties. The Isoflavones Market expands into sports nutrition, dietary supplements, and dairy alternatives. Manufacturers integrate isoflavones into protein shakes, snack bars, and functional beverages targeting wellness and longevity. It supports product differentiation and aligns with health-driven consumer trends. Food brands adopt isoflavones to boost nutritional profiles and appeal to label-conscious buyers.

Increased Demand for Natural Ingredients in Cosmetics and Personal Care

Beauty and personal care sectors adopt isoflavones for their anti-aging, collagen-boosting, and skin-soothing benefits. Formulators use them in creams, serums, and hair care products targeting mature and sensitive skin types. The Isoflavones Market sees opportunity through clean beauty trends and plant-based skincare demand. Brands promote isoflavone-infused products for wrinkle reduction, skin elasticity, and moisture retention. Consumer trust in natural actives fuels brand positioning in wellness-driven cosmetic markets. It opens new sales channels through online platforms and specialty retailers.

Market Trends

Rising Demand for Isoflavone-Enriched Functional Foods and Beverages

Consumers prefer convenient nutrition formats that support daily wellness goals. Food and beverage manufacturers now incorporate isoflavones into products such as yogurt, plant-based milk, and fortified snacks. The Isoflavones Market benefits from this trend as producers target health-conscious buyers with clean-label claims. Brands highlight isoflavones for heart health, hormone balance, and anti-aging benefits on packaging. Innovation focuses on improving taste, solubility, and stability of isoflavone formulations in ready-to-eat formats. It enables broader product launches across both premium and mainstream categories.

- For instance, ADM supplies Novasoy® concentrates standardized up to 70% isoflavones, which are integrated into soy-based dairy alternatives for applications including fortified plant-based beverages for global food brands.

Increased Focus on Women’s Health Formulations Using Plant-Based Actives

Nutraceutical and supplement companies focus on women’s health categories, especially around menopause support. Isoflavones offer natural estrogenic properties that appeal to consumers avoiding synthetic hormones. The Isoflavones Market tracks growth in products addressing bone health, mood stability, and hormonal regulation. New launches include tablets, gummies, and herbal blends using soy or red clover extract. Companies market these products using clinical evidence and plant-origin positioning. It drives growth across both direct-to-consumer and pharmacy distribution channels.

- For instance, Indena’s SoySelect® extract, standardized to 13–17% isoflavone glycosides, has been clinically tested in a double-blind, randomized, placebo-controlled trial on postmenopausal women. In one such trial, supplementation with 50 mg/day of isoflavones from SoySelect® significantly reduced the frequency of hot flashes within 6 weeks, with continued relief over 12 weeks of use.

Clean Beauty Brands Integrate Isoflavones for Anti-Aging and Skin Repair

The personal care industry shifts toward natural actives with proven cosmetic benefits. Isoflavones find applications in anti-aging creams, skin firming serums, and scalp treatments. The Isoflavones Market grows with rising use of phytoestrogens in cosmeceuticals targeting elasticity and hydration. Brands focus on soy-based isoflavones to appeal to vegan and eco-conscious consumers. Innovation in extraction and delivery systems improves skin absorption and bioavailability. It supports high-margin product categories in premium beauty.

Expansion of Red Clover Extracts as an Alternative Isoflavone Source

Red clover is gaining traction as a non-soy source of isoflavones, especially among soy-allergic consumers. Manufacturers extract active compounds like genistein and daidzein for use in dietary supplements. The Isoflavones Market diversifies with demand for allergen-free, non-GMO, and organic sources. Red clover-based products target the same therapeutic areas as soy, including menopause and cardiovascular health. Product innovation includes tinctures, capsules, and tea blends for natural wellness users. It supports niche market expansion in Europe and North America.

Market Challenges Analysis

Regulatory Uncertainty and Varying Health Claims Limit Market Expansion

Global inconsistencies in health claim approvals challenge product positioning across regions. Regulatory bodies in the U.S., EU, and Asia differ on the extent of permitted claims regarding bone health, menopause, or cardiovascular benefits. The Isoflavones Market faces hurdles in marketing products that rely on therapeutic positioning without unified clinical validation. Companies must navigate complex approval processes and labeling restrictions, which delay new product launches. This limits consumer trust and slows adoption in regulated segments like dietary supplements and functional foods. It places pressure on manufacturers to invest in country-specific studies and compliance strategies.

Allergen Concerns and Misconceptions About Hormonal Effects Restrain Adoption

Soy-based isoflavones raise allergen concerns, especially among consumers with dietary sensitivities or autoimmune conditions. Misconceptions around phytoestrogens and hormonal imbalance create hesitation among certain user groups. The Isoflavones Market experiences resistance in populations wary of endocrine disruptors, despite clinical data supporting safety. Consumer education gaps make it harder to communicate benefits without triggering skepticism. This impacts demand in key segments like pregnancy supplements, male health, and pediatric nutrition. It requires clear science-backed messaging and alternative ingredient sourcing to overcome perception barriers.

Market Opportunities

Growing Focus on Healthy Aging and Preventive Wellness Supports Demand Expansion

Rising global interest in longevity and proactive health management creates strong potential for isoflavone-based products. Consumers over 40 increasingly seek natural ingredients that support hormone balance, bone density, and cardiovascular function. The Isoflavones Market stands to benefit from this shift, especially in segments like anti-aging supplements and bone health formulas. Brands can develop targeted blends using soy or red clover extracts to serve aging demographics. It creates room for premium positioning, personalized nutrition, and science-backed claims. Health-conscious consumers look for alternatives to synthetic hormone therapies, boosting appeal of natural isoflavones.

Clean Label and Plant-Based Trends Open New Application Channels

Demand for clean-label, plant-derived ingredients is rising across functional food, beverage, and personal care sectors. Isoflavones align with these preferences due to their botanical origin and versatile functionality. The Isoflavones Market can expand through applications in vegan supplements, fortified drinks, and natural cosmetics. Growth in organic and non-GMO certifications enhances product credibility and supports marketing claims. Emerging markets in Asia Pacific and Latin America present untapped opportunities for brands offering localized, plant-based health solutions. It encourages innovation in delivery formats such as gummies, sachets, or topical gels targeting modern wellness buyers.

Market Segmentation Analysis:

By Type:

The Isoflavones Market is segmented by type into soy isoflavones, red clover isoflavones, and others. Soy isoflavones dominate the market due to their wide availability, proven efficacy, and established use in supplements and functional foods. Genistein and daidzein are the most researched compounds, offering antioxidant and estrogenic effects that support hormonal health. Red clover isoflavones serve as an alternative for consumers avoiding soy, especially in Europe and North America. They are favored in menopause relief products and herbal formulations targeting bone and cardiovascular health. Other types such as kudzu or chickpea-based isoflavones hold smaller shares but offer diversification in niche markets.

- For instance, ADM’s Novasoy® Daily 50 formulation is used to produce 600 mg tablets containing 50 mg of soy isoflavones. This controlled-release form supports sustained delivery of active compounds in supplement formats

By Application:

Key applications include dietary supplements, functional foods and beverages, cosmetics and personal care, and pharmaceuticals. Dietary supplements represent the largest segment due to widespread use for hormone support, bone health, and menopause symptom relief. The Isoflavones Market grows in functional food and beverage applications such as fortified juices, dairy alternatives, and health snacks, especially in Asia and North America. Cosmetic applications are expanding through anti-aging creams, skin-firming serums, and haircare products using phytoestrogens. Pharmaceutical use remains limited but shows potential in long-term therapies for osteoporosis and cardiovascular protection. It creates opportunities for science-backed innovation in regulated health products.

- For instance, ADM’s marketing materials and case studies show that the company’s Novasoy® concentrate is incorporated into concepts such as a “Poached Pear Chocolate Pecan Nutrition Bar” and a “Women’s Chocolate Coconut Vanilla Shake,” demonstrating its use in functional, ready-to-eat formats designed for menopause support. These materials, which are distinct from an independent scientific study, illustrate how ADM promotes its ingredients for use in food and beverage concepts.

By End-Use Industry:

End-use industries include healthcare, food and beverage, personal care, and nutraceuticals. The healthcare sector uses isoflavones in clinical nutrition and therapeutic supplements, mainly targeting menopausal and cardiovascular conditions. The Isoflavones Market sees strong demand from the food and beverage industry due to clean-label trends and demand for plant-based actives. Personal care brands use isoflavones in anti-aging and moisture-retention skincare lines targeting mature consumers. The nutraceutical industry continues to lead in consumption, with high growth in capsule, powder, and gummy formulations. It reflects demand from both retail and practitioner-based channels for natural hormone balance solutions.

Segments:

Based on Type

- Aglycone Isoflavones

- Glycoside Isoflavones

- Malonyl Isoflavones

- Acetyl Isoflavones

Based on Application

- Beverages

- Nutraceuticals

- Cosmetics

- Pharmaceuticals

Based on End-Use Industry

- Healthcare

- Beauty and Personal Care

- Food and Beverage

Based on Functional Attribute

- Hormone Balancing

- Antioxidant

- Anti-Inflammatory

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for approximately 32% of the global Isoflavones Market share in 2024. The region benefits from high consumer awareness of functional foods, plant-based diets, and clean-label supplements. Strong demand for menopause-related nutritional products and heart health supplements drives steady market growth. The United States remains the largest contributor, with established retail and e-commerce channels for dietary supplements and beauty products. Isoflavones derived from soy and red clover are widely accepted, with increasing penetration in fortified beverages and wellness-focused snacks. Canada shows growing interest in natural women’s health products and skincare solutions featuring botanical actives. Regulatory clarity and preference for scientifically supported ingredients further strengthen market development.

Europe

Europe held nearly 27% of the global market share in 2024. The region emphasizes plant-derived nutraceuticals and herbal products supported by clinical research and health claim approvals. Germany, France, and the UK lead demand for soy and red clover-based supplements focused on hormone balance, skin health, and aging support. The Isoflavones Market benefits from favorable regulations under the EU’s Novel Food guidelines and high adoption of non-GMO and organic products. Functional beverages and herbal tinctures featuring isoflavones are growing in pharmacy and wellness retail channels. Local brands expand product portfolios to target menopause and cardiovascular wellness without synthetic hormones. Rising popularity of natural personal care products using phytoestrogens also supports growth.

Asia Pacific

Asia Pacific captured around 30% of the Isoflavones Market share in 2024. The region has a strong tradition of soy consumption and botanical-based healing systems, particularly in Japan, China, and South Korea. Japan leads in functional food innovation using soy isoflavones in dairy alternatives, nutraceuticals, and skincare formulations. In China, demand for isoflavone-rich herbal medicine and wellness products continues to rise with urban health trends. South Korea integrates isoflavones into cosmeceuticals and dietary supplements targeting hormonal balance and skin repair. India is showing early growth in red clover supplements and women’s health products. The region benefits from domestic production capacity and cultural acceptance of plant-derived therapies.

Latin America

Latin America contributed about 6% to the global market in 2024. Brazil and Mexico are the main contributors due to their expanding nutraceutical and personal care sectors. The Isoflavones Market in the region is driven by growing interest in hormone support, bone health, and anti-aging products. Herbal and soy-based supplements are gaining traction in urban areas through pharmacies and online channels. Regulatory support for natural remedies and clean-label ingredients enables regional manufacturers to enter niche wellness categories. Product availability remains moderate but is expanding with support from international health brands entering the market.

Middle East and Africa

The Middle East and Africa held roughly 5% of the market share in 2024. The region is at an early stage of adoption but shows rising demand for herbal supplements and natural beauty products. The Isoflavones Market is gaining visibility in countries like the UAE, South Africa, and Israel through wellness retail chains and e-commerce. Growth is supported by increasing awareness of women’s health needs and interest in non-synthetic skincare. Limited local production and import dependency restrict broader expansion. Education campaigns, regulatory alignment, and strategic partnerships are essential to unlock long-term potential in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADM

- IsoGenics

- Kemin Industries

- Shandong Freda Biopharm Co., Ltd.

- Xi’an Lyphar Biotech Co., Ltd.

- Indena S.p.A

- Changzhou Eucare Pharmaceutical Co. Ltd.

- Naturex SA

- Glanbia plc

- Shandong Yuwang Pharmaceutical Co., Ltd.

Competitive Analysis

Competitive landscape of the Isoflavones Market includes key players such as ADM, Glanbia plc, Indena S.p.A, Kemin Industries, IsoGenics, Naturex SA, Xi’an Lyphar Biotech Co., Ltd., Shandong Yuwang Pharmaceutical Co., Ltd., Changzhou Eucare Pharmaceutical Co. Ltd., and Shandong Freda Biopharm Co., Ltd. These companies compete through product quality, plant source variety, clinical backing, and regional reach. Leading players focus on developing soy and red clover-based isoflavones for dietary supplements, functional foods, and cosmeceuticals. Manufacturers invest in research to support health claims related to menopause relief, bone density, and heart health. They leverage proprietary extraction techniques and quality control to improve purity and bioavailability. Strategic moves include partnerships with supplement brands, expansion into Asia and Latin America, and innovation in delivery formats like gummies, powders, and serums. Clean-label positioning, regulatory compliance, and certifications such as non-GMO and organic also drive market differentiation. Competition remains high due to growing demand and the need for ingredient transparency.

Recent Developments

- In 2025, Indena S.p.A. launched new botanical combination concepts focused on chronic pain relief and beauty-from-within solutions at Vitafoods Europe 2025.

- In 2024, Indena S.p.A. presented its high-standard nutraceuticals focused on metabolic and brain health at SupplySide West 2024.

- In 2024, Glanbia acquired Flavor Producers, a company specializing in natural, organic, and plant-based extracts—strengthening Glanbia’s portfolio in functional nutrition, with isoflavone-containing applications possible in sports and health supplements.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Industry, Functional Attribute and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural hormone-balancing supplements will continue to grow among aging populations.

- Soy and red clover extracts will gain wider use in functional foods and women’s health products.

- Clean-label and non-GMO certification will become key factors in consumer product selection.

- Skincare and cosmeceutical brands will expand use of isoflavones in anti-aging formulations.

- Red clover isoflavones will gain traction as a soy-free alternative in allergen-sensitive markets.

- Clinical studies will support broader health claims and drive trust in isoflavone-based products.

- Emerging economies will increase adoption through e-commerce and local nutraceutical expansion.

- Innovation in delivery formats like gummies, sprays, and dissolvable powders will enhance user appeal.

- Strategic partnerships between ingredient suppliers and supplement brands will shape new product pipelines.

- Regulatory clarity and safety approvals will influence market entry and regional expansion plans.