Market Overview

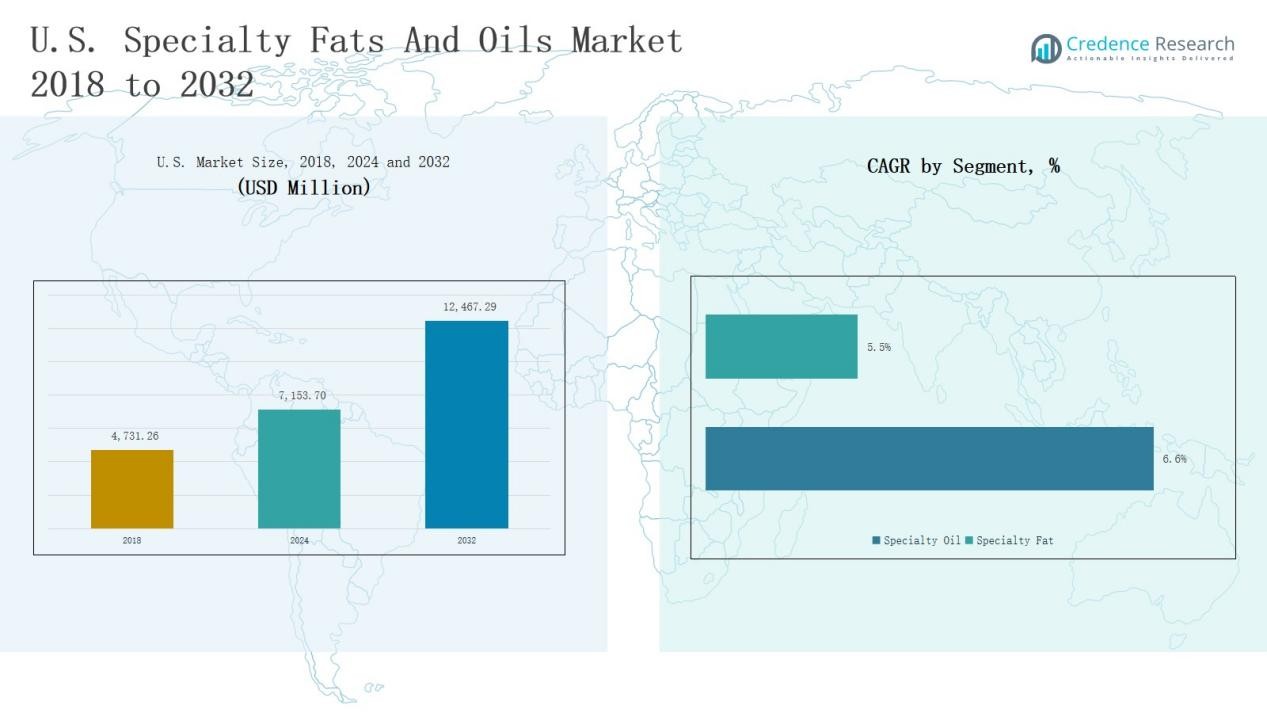

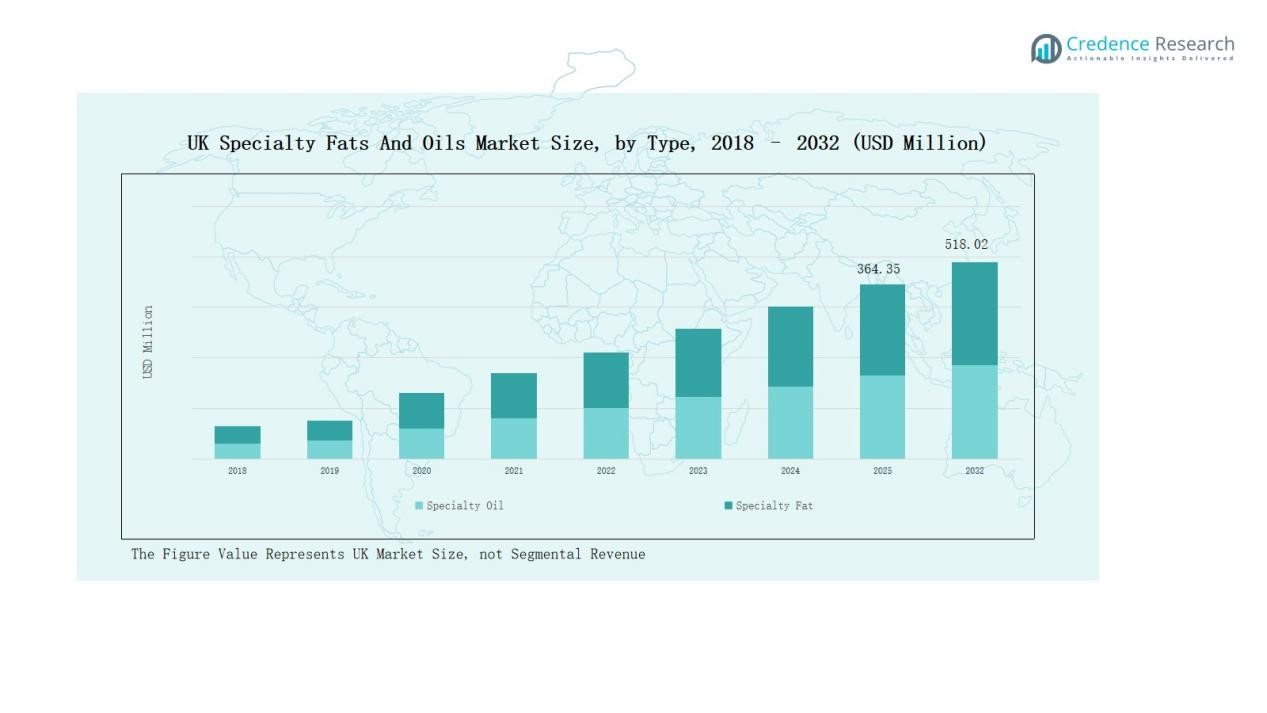

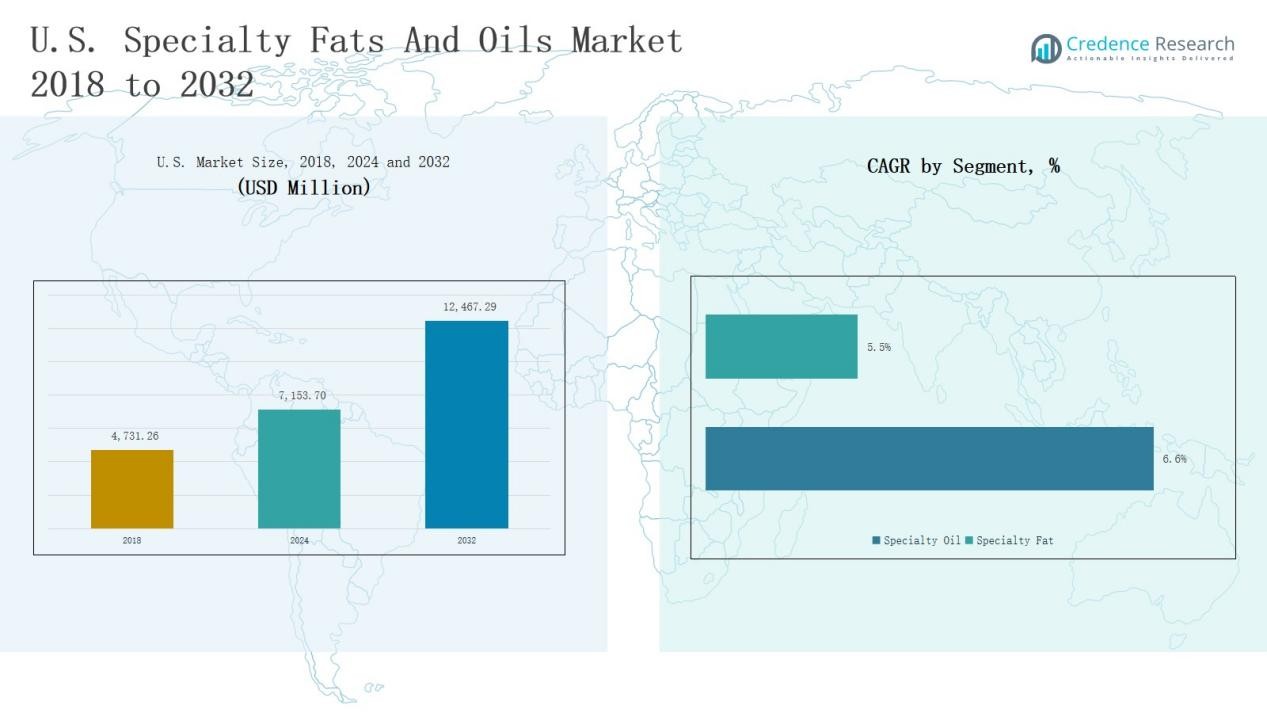

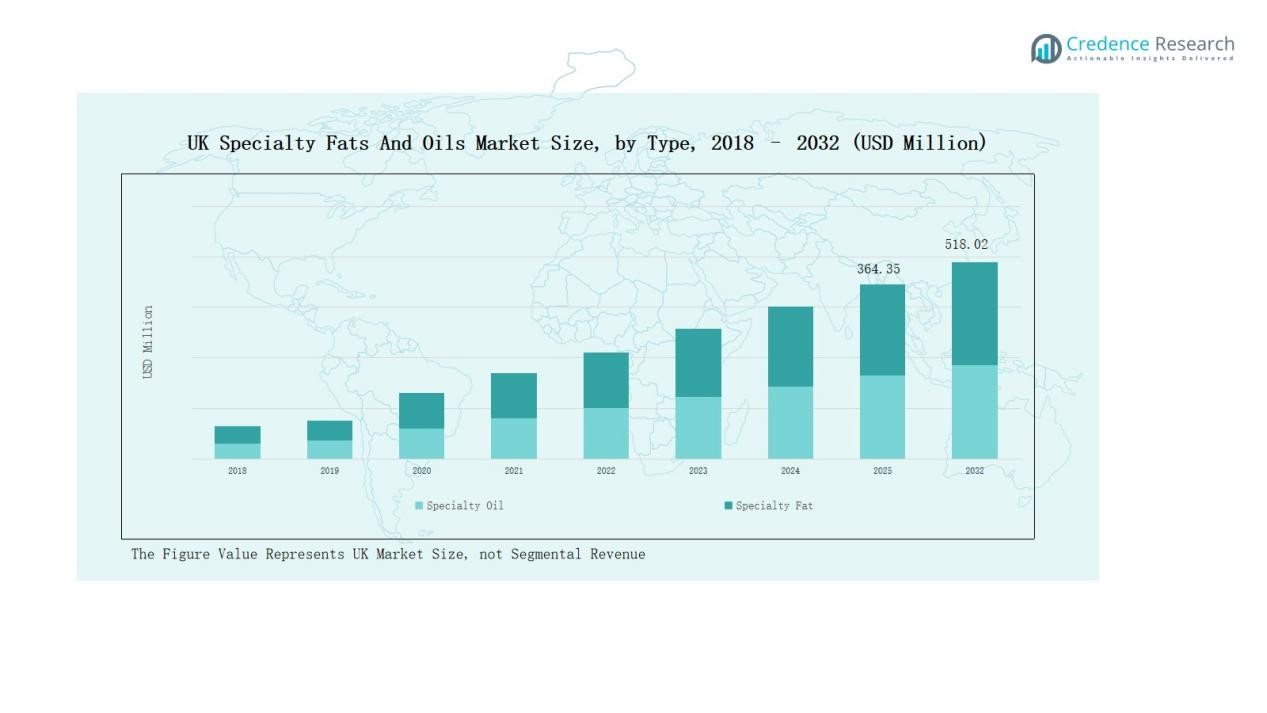

UK Specialty Fats And Oils Market size was valued at USD 241.67 million in 2018 to USD 336.56 million in 2024 and is anticipated to reach USD 518.02 million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Specialty Fats And Oils Market Size 2024 |

USD 336.56 Million |

| UK Specialty Fats And Oils Market, CAGR |

5.16% |

| UK Specialty Fats And Oils Market Size 2032 |

USD 518.02 Million |

The UK Specialty Fats and Oils Market is shaped by global leaders and regional specialists focusing on product innovation, sustainability, and tailored formulations. Key players include Kerry Group, Bunge Loders Croklaan UK, Cargill UK, ABF Ingredients, BBS Specialty Oils, AAK UK Ltd, Wilmar Europe UK, Tate & Lyle PLC, Burmah Castrol, and Croda International plc. These companies strengthen their positions through strong partnerships with food processors, extensive product portfolios, and RSPO-certified sourcing. England leads the market with a 56% share in 2024, supported by its robust bakery, confectionery, and processed food industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Specialty Fats and Oils Market was valued at USD 336.56 million in 2024 and is projected to reach USD 518.02 million by 2032.

- Specialty oils led the type segment with a 62.5% share in 2024, driven by palm oil demand, while bakery fats contributed 14.3% supported by the strong bakery sector.

- The industry application segment dominated with a 53.8% share, followed by restaurants at 22.6% and households at 18.1%, reflecting widespread use across food processing and retail.

- Chocolate held the largest end-user share at 31.4%, while confectioneries and bakery followed with 23.7% and 20.9% respectively, highlighting strong reliance on specialty fats and oils.

- England led regionally with a 56% share in 2024, supported by its robust food processing base, followed by Scotland at 18%, Wales at 14%, and Northern Ireland at 12%.

Market Segment Insights

By Type

In the UK Specialty Fats and Oils Market, specialty oils dominate with a 62.5% share in 2024, led by palm oil usage across processed foods and industrial applications. Palm oil remains cost-effective and versatile, strengthening its lead. Sunflower and olive oils also gain traction in household and restaurant channels, driven by health preferences. Within specialty fats, bakery fats represent a strong 14.3% share, supported by the UK’s robust bakery industry and demand for pastry shortenings, margarine, and functional fat blends.

- For instance, AAK introduced its AkoSun range of sunflower oil solutions in the UK, responding to consumer demand for healthier frying and cooking oils.

By Application

The industry segment holds 53.8% share, highlighting the strong reliance of chocolate, bakery, and confectionery manufacturers on specialty fats and oils for product consistency and texture. Restaurants follow with 22.6% share, supported by quick-service outlets and high frying fat demand. Household use represents 18.1% share, influenced by retail sales of sunflower and olive oils promoted as healthier options. Other applications contribute smaller volumes but are rising due to lifestyle changes and increasing consumption of packaged food products in the UK.

- For instance, Upfield launched Flora Plant Cream in UK retail stores, a sunflower oil–based alternative promoted as a healthier, plant-based option for home cooking and baking.

By End User

Chocolate dominates end-user demand with a 31.4% share in 2024, reflecting the UK’s strong chocolate manufacturing industry and sustained consumer appetite for premium products. Confectioneries follow with 23.7% share, supported by sugar-based products and seasonal demand. Bakery accounts for 20.9% share, with high use of bakery fats in bread, pastries, and cakes. Infant food and culinary segments together hold 15.8% share, reflecting growing demand for specialized nutritional fats. Functional fats and other categories comprise the remainder, showing gradual but steady adoption.

Key Growth Drivers

Rising Demand from Confectionery and Bakery

The UK’s strong confectionery and bakery industries drive demand for specialty fats and oils, particularly cocoa butter substitutes and bakery shortenings. Consumers seek consistent texture, flavor, and extended shelf life in chocolates, cakes, and pastries. With bakery goods forming a staple part of UK diets and premium chocolate demand rising, manufacturers increasingly adopt palm, sunflower, and specialty bakery fats. This reliance strengthens growth prospects, positioning the confectionery and bakery sectors as the core demand engines in the specialty fats and oils market.

- For instance, Cargill launched its new Gerkens® Sweety cocoa powder range in Europe, designed to reduce sugar use in chocolate products while maintaining sweetness, showing the company’s focus on specialty cocoa-based applications.

Growing Focus on Health-Oriented Oils

Rising health awareness among UK consumers fuels adoption of sunflower oil, olive oil, and functional fat blends. These oils are marketed as healthier alternatives to hydrogenated fats, aligning with increasing demand for low-trans-fat and low-cholesterol options. Restaurants and households are substituting traditional frying fats with sunflower and rapeseed oils, supported by government campaigns on healthy eating. This shift towards oils with perceived health benefits creates a strong growth pathway, particularly as consumers prioritize balanced diets and transparent labeling in food and beverages.

- For instance, in June 2023 Upfield expanded its Flora Plant B+tter range in the UK, a dairy-free spread made with sunflower and rapeseed oils, promoted as having 70% lower climate impact than dairy butter and no hydrogenated fats.

Expansion in Processed and Packaged Foods

The UK’s expanding processed and packaged food sector significantly boosts specialty fats and oils consumption. Ready-to-eat meals, snacks, and frozen desserts depend on specialized fats for taste, stability, and extended shelf life. Food processors rely heavily on palm oil, bakery fats, and frying fats to meet these requirements. Growing urbanization, busier lifestyles, and the popularity of convenience foods further expand demand. Manufacturers are integrating tailored fat blends to support innovation, making the processed food industry a key growth catalyst for the specialty fats and oils market.

Key Trends & Opportunities

Innovation in Functional Fats and Oils

Manufacturers in the UK increasingly innovate with functional fats and oils designed to support health benefits such as heart health, improved digestion, and enhanced nutrition. Demand for infant food and functional foods is growing, pushing companies to develop customized formulations. This creates opportunities for producers to strengthen premium product portfolios and cater to evolving consumer preferences. Rising awareness about dietary wellness, combined with ongoing R&D in fat modification technologies, positions functional fats and oils as a major growth opportunity within the UK market.

- For instance, Wilmar International emphasized sustainability and clean-label fats in its UK formulations, aiming for Science Based Targets initiative validation to reduce emissions by 2032, while innovating in functional fat blends for infant food.

Sustainability and Ethical Sourcing

Sustainability and traceability in palm oil and other oils are emerging as key opportunities in the UK market. With consumers and regulators emphasizing deforestation-free supply chains, companies are adopting RSPO-certified palm oil and renewable sourcing practices. Brands promoting ethical sourcing gain stronger market acceptance, especially among environmentally conscious buyers. Retailers and manufacturers increasingly highlight sustainability credentials as part of marketing strategies. This shift aligns with global ESG initiatives, creating opportunities for companies to differentiate themselves through responsible practices while addressing consumer demand for sustainable specialty fats and oils.

- For instance, UK retailer Marks & Spencer achieved 100% Certified Sustainable Palm Oil (CSPO) uptake and funded projects supporting 633 smallholders in Sabah, Malaysia, to maintain or attain RSPO certification.

Key Challenges

Volatility in Raw Material Prices

The UK Specialty Fats and Oils Market faces ongoing challenges due to fluctuations in raw material prices, particularly palm oil and soybean oil. Price volatility stems from global supply chain disruptions, climate variability in producing countries, and geopolitical tensions. These factors create cost uncertainties for manufacturers, affecting profit margins and pricing strategies. UK companies reliant on imports face higher exposure, with cost pass-through to consumers risking demand sensitivity. Managing supply contracts and diversifying sourcing remain crucial challenges in sustaining stable business operations.

Stringent Regulatory Environment

Regulations targeting trans-fat content, labeling, and food safety present significant compliance challenges. The UK government’s focus on public health requires manufacturers to reformulate products while maintaining taste and functionality. Strict labeling laws increase operational complexity, especially for companies exporting to the EU. Small and mid-sized firms often struggle with the financial and technical burden of reformulation. These regulatory requirements, though vital for consumer safety, can slow product development and add cost pressures, challenging long-term competitiveness in the specialty fats and oils market.

Rising Competition from Substitutes

Competition from healthier substitutes, including plant-based oils, butter alternatives, and low-fat spreads, challenges specialty fats and oils adoption. Consumer trends favoring natural, minimally processed products reduce reliance on hydrogenated and processed fats. Start-ups and niche brands offering innovative plant-based fat alternatives are capturing growing attention in the UK. This intensifies competition for established players, who must invest in innovation and marketing to retain consumer loyalty. The challenge lies in balancing demand for functionality and taste while meeting consumer expectations for healthier, more natural products.

Regional Analysis

England

England dominates the UK Specialty Fats and Oils Market with a 56% share in 2024, driven by its extensive food processing industry and high consumption of bakery and confectionery products. The strong presence of multinational manufacturers and a dense retail network supports steady growth. Urban populations in cities such as London and Birmingham fuel demand for convenience foods, ready-to-eat meals, and premium chocolate products. The adoption of palm oil, sunflower oil, and bakery fats remains high across industrial and household use. England continues to lead market expansion through innovation and higher consumer spending.

Scotland

Scotland accounts for 18% share, supported by its growing bakery sector and rising demand for healthier oil alternatives such as rapeseed and sunflower oil. Local food industries, particularly in dairy and confectionery, utilize specialty fats to improve product quality and shelf stability. The hospitality sector further boosts consumption with steady demand for frying fats and culinary oils. Consumer awareness of sustainable sourcing encourages adoption of RSPO-certified palm oil and organic blends. Scotland presents growth opportunities in functional fats as demand for nutritional food products expands.

Wales

Wales represents 14% share, driven by its smaller but growing food processing base and increasing retail sales of specialty oils. Households in Wales show rising preference for olive oil and sunflower oil, reflecting health-driven purchasing behavior. Local bakeries contribute to demand for bakery fats, while confectionery products create a steady end-user market. The restaurant sector, particularly fast-food chains, supports consistent use of frying fats. Wales continues to expand its specialty fats and oils consumption with rising investments in food innovation and regional supply chains.

Northern Ireland

Northern Ireland holds a 12% share, shaped by its export-oriented food industry and strong bakery traditions. Specialty fats play a key role in bread, cakes, and confectionery manufacturing for both domestic and export markets. Olive oil and sunflower oil see increased uptake in households, reflecting lifestyle shifts toward healthier options. Industrial users rely on palm oil for cost-effective solutions, while demand for functional fats is gradually emerging. Northern Ireland benefits from cross-border trade and investments in sustainable sourcing practices, strengthening its role in the overall market.

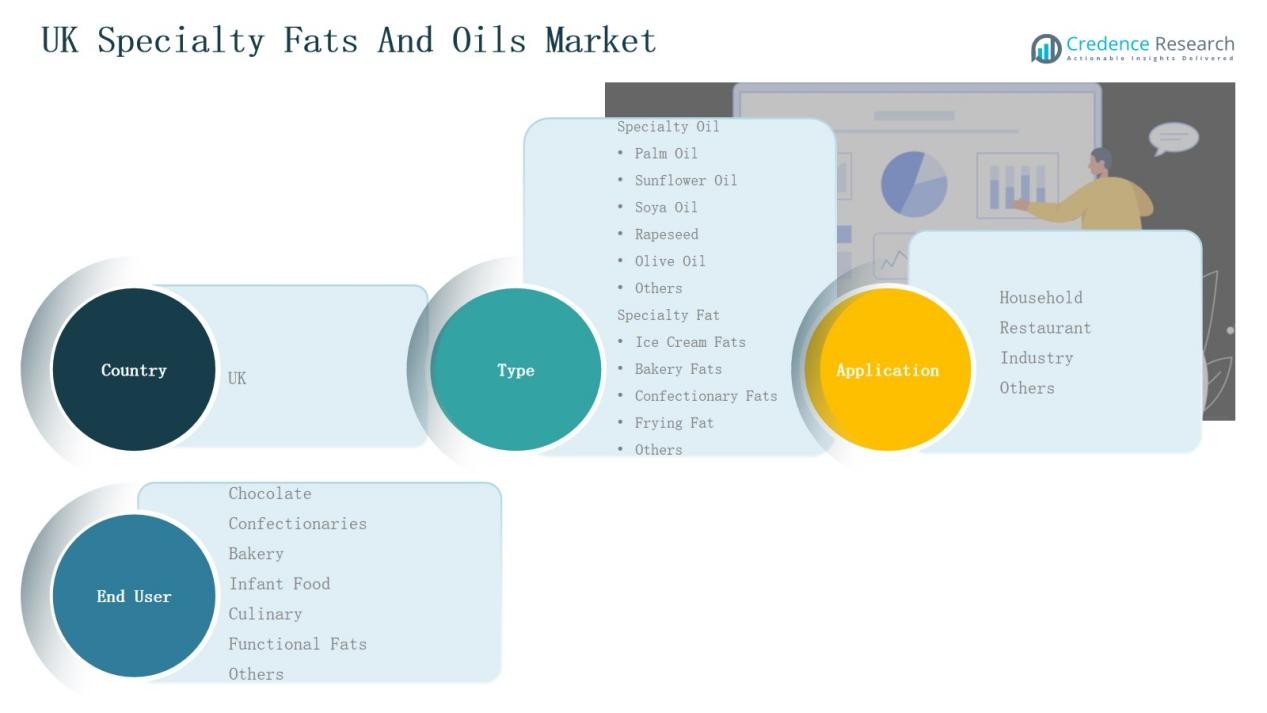

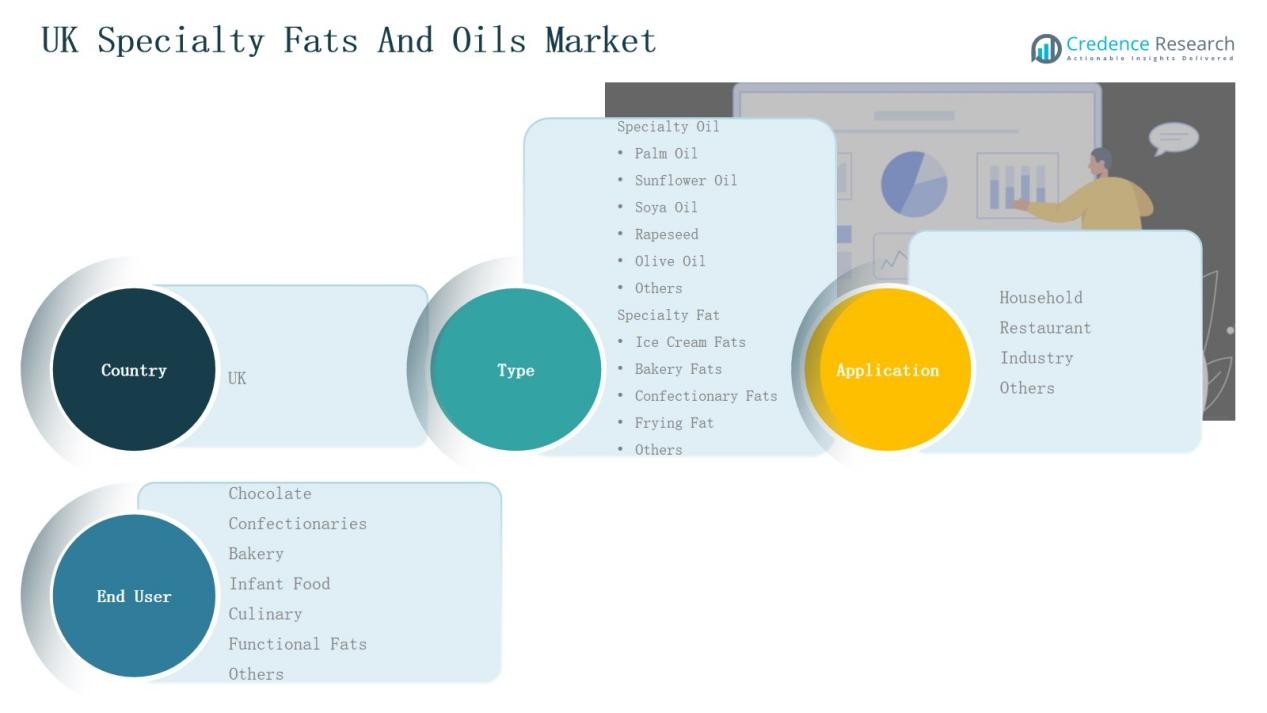

Market Segmentations:

By Type

Specialty Oils

- Palm Oil

- Sunflower Oil

- Soya Oil

- Rapeseed

- Olive Oil

- Others

Specialty Fats

- Ice Cream Fats

- Bakery Fats

- Confectionery Fats

- Frying Fats

- Others

By Application

- Household

- Restaurant

- Industry

- Others

By End User

- Chocolate

- Confectioneries

- Bakery

- Infant Food

- Culinary

- Functional Fats

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Specialty Fats and Oils Market is highly competitive, featuring a mix of global leaders and regional players that focus on innovation, product quality, and sustainable sourcing. Companies such as Kerry Group, Cargill UK, AAK UK Ltd, Bunge Loders Croklaan UK, and Wilmar Europe UK dominate the landscape with extensive product portfolios covering bakery fats, confectionery fats, frying oils, and specialty blends. These firms strengthen their positions through investments in healthier oil alternatives, RSPO-certified palm oil, and customized formulations tailored for confectionery and bakery manufacturers. Regional players, including ABF Ingredients, BBS Specialty Oils, and Tate & Lyle PLC, leverage localized expertise and strong partnerships with food processors to remain competitive. Strategic emphasis on clean-label products, functional fats, and traceable sourcing reflects evolving consumer preferences. Intense competition drives continuous product development, technological upgrades, and collaborations, ensuring the market remains dynamic and innovation-led in both industrial and household applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Kerry Group plc

- Bunge Loders Croklaan UK

- Cargill UK

- ABF Ingredients

- BBS Specialty Oils

- AAK UK Ltd

- Wilmar Europe UK

- Tate & Lyle PLC

- Burmah Castrol

- Croda International plc

Recent Developments

- In April 2025, Whitworths Food Group acquired KTC Edibles Group, a major UK oils and fats supplier. The move expands Whitworths’ portfolio by combining flour milling with edible oils expertise.

- In July 2024, Blommer Chocolate launched a new cocoa butter equivalent product line called Elevate, offering improved texture and rich flavor for confectionery applications.

- In July 2025, Lifecycle Oils launched its first own-brand edible oils range, marking a portfolio expansion.

- In May 2025, the Access to Nutrition Initiative (ATNi) launched the Edible Oil Supplier Index, assessing leading global fats and oils suppliers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for palm oil alternatives will increase due to sustainability concerns.

- Functional fats and oils will gain wider adoption in infant and nutritional foods.

- Chocolate and confectionery manufacturers will drive steady consumption of specialty fats.

- Health-focused oils such as sunflower and olive oil will see higher household uptake.

- Restaurants and quick-service outlets will expand use of frying fats and blended oils.

- Clean-label and non-hydrogenated products will become central to product innovation.

- Food processors will prioritize RSPO-certified palm oil and ethical sourcing initiatives.

- Regional bakeries will strengthen demand for bakery fats across bread and pastry segments.

- Partnerships between global and regional players will expand tailored product offerings.

- Digital marketing and traceable supply chains will enhance consumer trust and brand positioning.