Market Overview

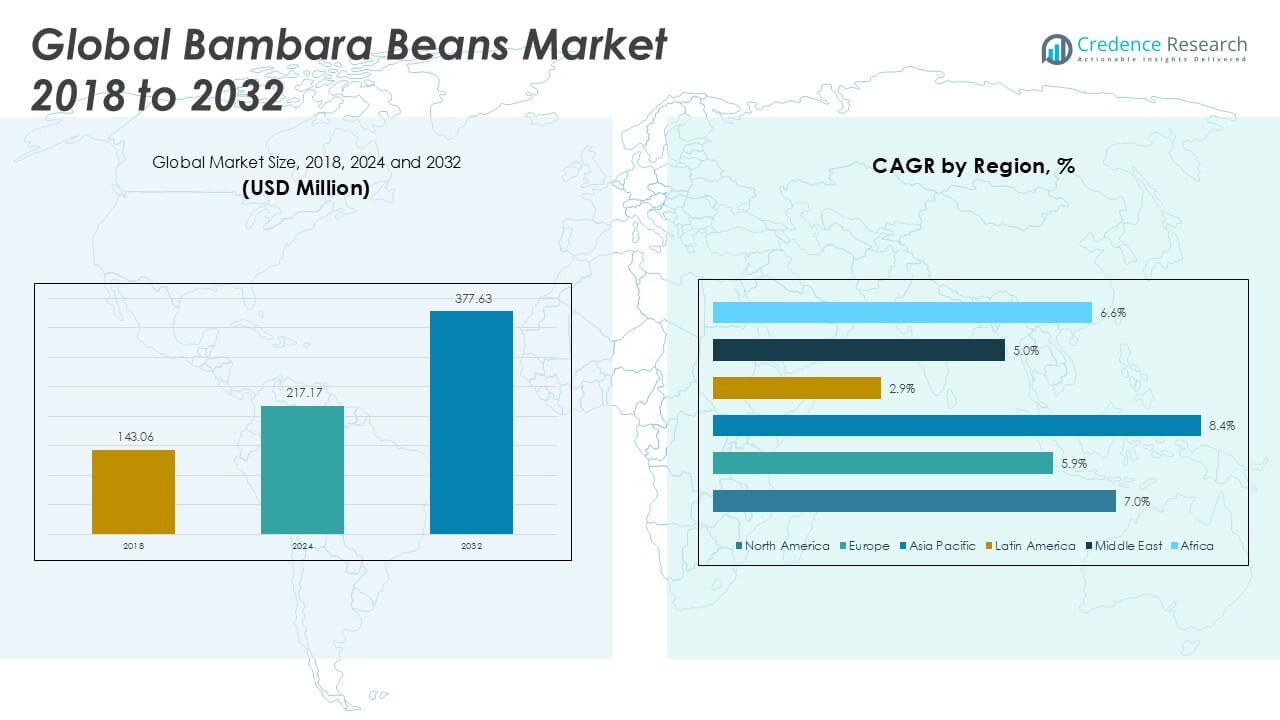

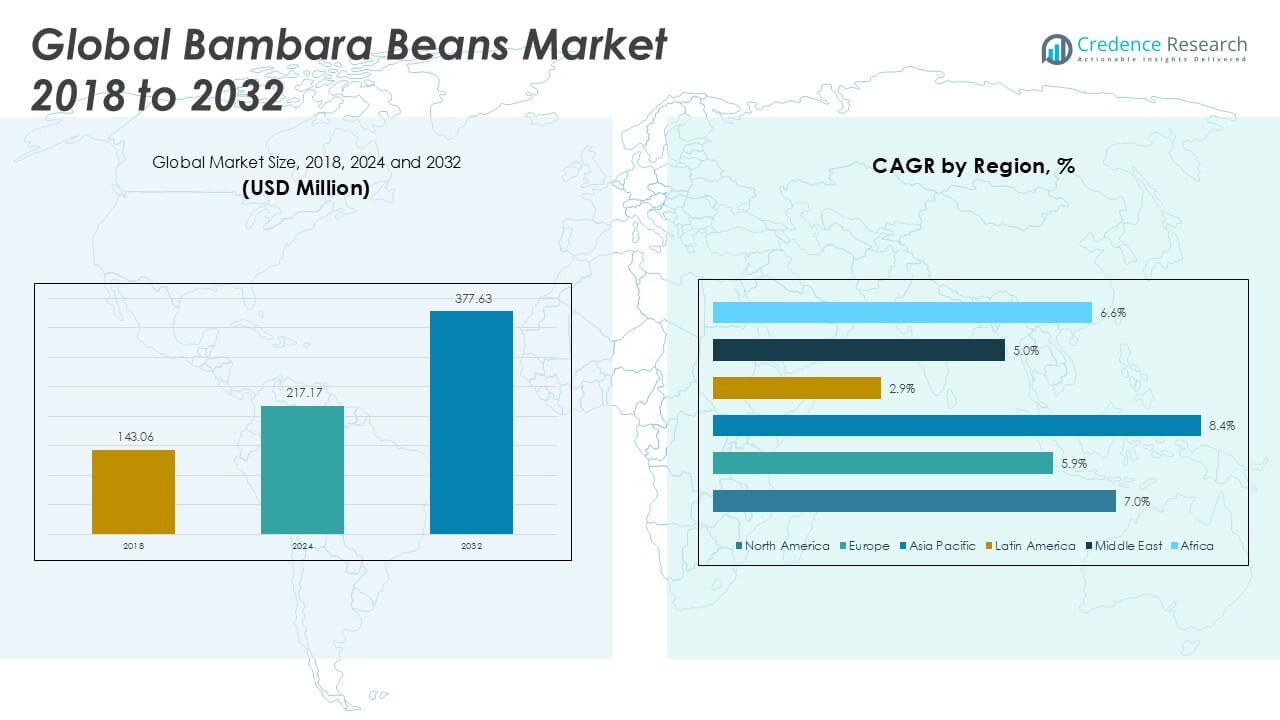

The Bambara Beans market size was valued at USD 143.06 million in 2018, increased to USD 217.17 million in 2024, and is anticipated to reach USD 377.63 million by 2032, at a CAGR of 6.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bambara Beans Market Size 2024 |

USD 217.17 Million |

| Bambara Beans Market, CAGR |

6.67% |

| Bambara Beans Market Size 2032 |

USD 377.63 Million |

The Bambara Beans market is led by key players such as African Flavour’s, Oro Seeds, Earth Expo Company, Khushbu Trades, and BUSH’S, which focus on processing, trading, and export of Bambara beans across domestic and international markets. These companies leverage regional sourcing partnerships and value-added processing to meet rising demand for plant-based protein and sustainable crops. Africa remains the dominant regional market, accounting for 42.0% of the global market share in 2024, driven by traditional cultivation, favorable agro-climatic conditions, and strong local consumption. Europe follows with 27.7% market share, supported by a growing preference for gluten-free and allergen-free foods. Emerging opportunities in Asia Pacific and North America continue to attract investment in processing and distribution, with rising awareness and demand for nutrient-rich legumes fueling long-term growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bambara Beans market was valued at USD 217.17 million in 2024 and is projected to reach USD 377.63 million by 2032, growing at a CAGR of 6.67% during the forecast period.

- Rising demand for plant-based protein, especially among vegan and health-conscious consumers, is driving the market, with processed Bambara beans holding the largest segment share due to convenience and longer shelf life.

- The market is witnessing trends like increased application in gluten-free and allergen-free food products, with growing popularity in functional foods and ethnic cuisines across global markets.

- Key players such as African Flavour’s, Oro Seeds, and Earth Expo Company are expanding their reach through improved sourcing, organic certifications, and distribution strategies, though the market remains moderately fragmented.

- Africa led the market with 42% share in 2024, followed by Europe at 27.7% and Asia Pacific at 19.3%; however, challenges like limited processing infrastructure and low awareness outside Africa restrain growth.

Market Segmentation Analysis:

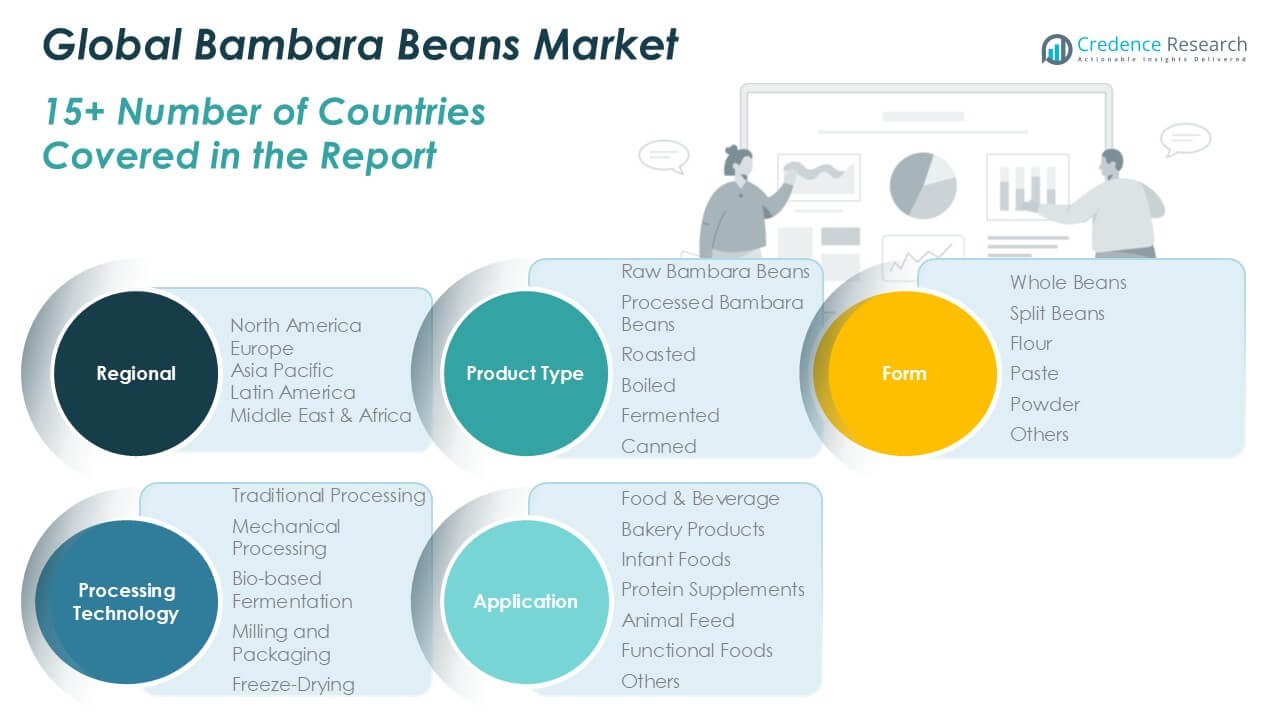

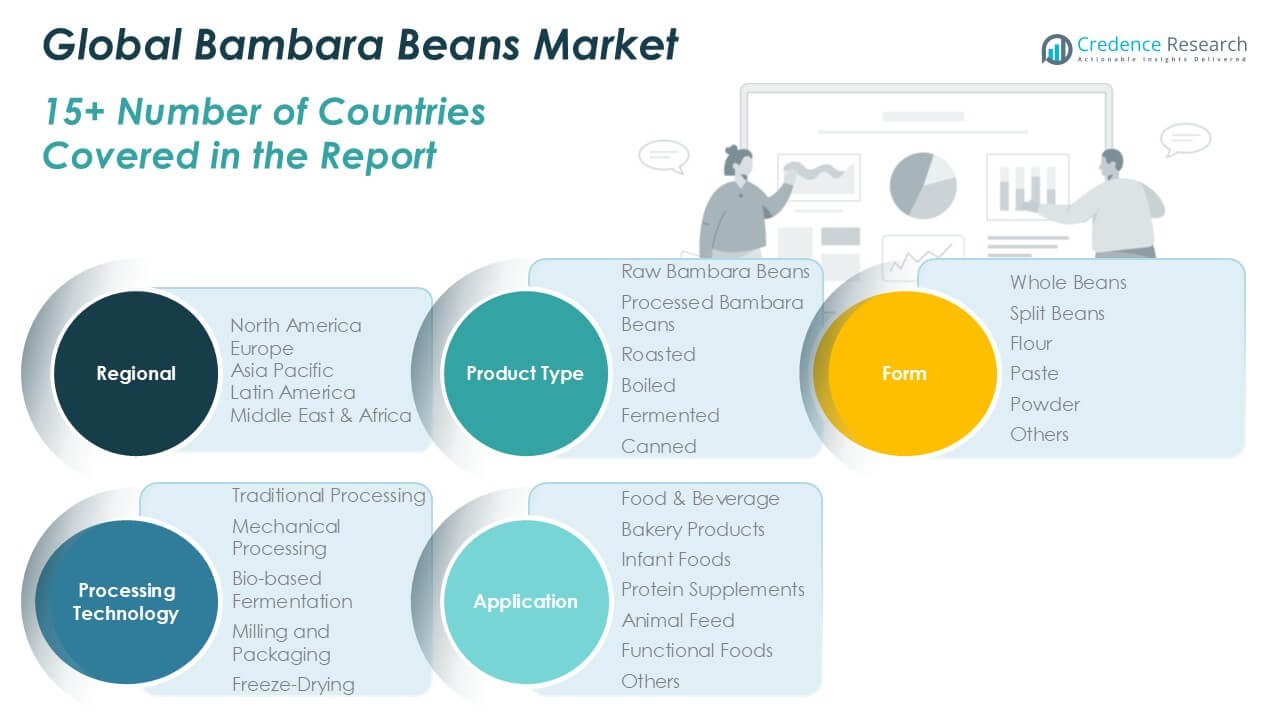

By Product Type:

In the Bambara Beans market, Processed Bambara Beans emerged as the dominant sub-segment, accounting for the largest market share in 2024. This category includes roasted, boiled, fermented, and canned beans, offering convenience and extended shelf life to consumers. The demand for processed forms is driven by increasing urbanization, evolving dietary patterns, and rising consumer awareness of nutritional benefits. Among these, roasted and fermented variants are gaining popularity due to their enhanced flavor profiles and digestibility. Growing health trends and expanding applications in plant-based diets continue to support the growth of this segment globally.

- For instance, Amafu Stock Trading in South Africa has scaled its roasted Bambara bean processing facility to a capacity of 1.2 metric tons per day, enabling consistent supply to retail chains and exports to 4 countries in Southern Africa.

By Form

Whole Beans held the largest market share under the form segment, primarily due to their extensive use in traditional cooking and minimal processing requirements. Their dominance is supported by widespread acceptance in both household consumption and local food processing industries. Additionally, whole beans offer longer shelf life and flexibility for end-use, making them a preferred choice in emerging markets. However, flour and paste forms are experiencing steady growth, fueled by their suitability for convenience foods and nutritional applications such as gluten-free bakery products and high-protein diets, reflecting a shift toward functional and value-added food products.

- For instance, Oro Seeds has established a milling line dedicated to Bambara bean flour with an output of 750 kilograms per hour, supplying regional food manufacturers producing gluten-free bread and protein bars.

By Processing Technology

Traditional Processing continues to dominate the Bambara Beans market in terms of processing technology, holding the highest market share in 2024. This segment benefits from its widespread practice in rural regions where manual processing remains cost-effective and culturally significant. Traditional methods are favored for preserving the nutritional content and maintaining local flavor profiles. Nonetheless, mechanical processing and bio-based fermentation are gaining momentum, driven by technological advancements and increasing demand for standardized, high-quality products. These modern methods enhance efficiency, reduce labor dependency, and improve the scalability of production, supporting market expansion in both domestic and export-oriented sectors.

Key Growth Drivers

Rising Demand for Plant-Based Protein

The global shift toward plant-based diets is significantly driving the demand for Bambara beans due to their high protein content and balanced amino acid profile. Consumers seeking alternatives to animal protein are increasingly incorporating legumes like Bambara beans into their meals. Their nutritional density, particularly in protein, fiber, and essential minerals, makes them a favorable choice for vegan and vegetarian consumers. Food manufacturers are also leveraging this trend by developing protein-enriched products using Bambara bean flour, further amplifying market demand.

- For instance, Earth Expo Company introduced a Bambara-based protein blend in 2023 with 18.2 grams of protein per 100 grams, now used by over 22 regional brands across India in vegan meal kits and fortified snacks.

Climate Resilience and Suitability for Marginal Lands

Bambara beans are drought-tolerant and well-suited for cultivation in arid and semi-arid regions, making them an important crop in the context of climate change. Their ability to thrive in poor soils with minimal input positions them as a sustainable crop for food security in Africa and other regions facing agricultural limitations. Governments and NGOs are promoting their cultivation through agricultural initiatives, leading to increased production and commercialization, especially in regions like Sub-Saharan Africa where food resilience is critical.

- For instance, under a joint project, Esapa Holdings and the Nigerian Ministry of Agriculture distributed 96,000 improved Bambara bean seedlings across 10 dryland districts in 2023, boosting yields by up to 1.8 tons per hectare in areas previously producing below 1.0 ton per hectare.

Expanding Applications in Food and Beverage Industry

The versatility of Bambara beans across various applications—such as snacks, bakery products, gluten-free flour, infant food, and functional beverages—is fueling their adoption in the food and beverage industry. Their adaptability in different forms (whole, paste, flour) allows manufacturers to innovate and develop diverse product offerings. With growing consumer interest in clean-label, allergen-free, and nutrient-dense ingredients, Bambara beans are gaining traction as a multifunctional input in value-added food products, contributing to broader market growth.

Key Trends and Opportunities

Growth of Functional and Ethnic Foods

The rising interest in functional foods and ethnic cuisines is opening new avenues for Bambara beans. Their traditional use in African dishes is gaining global attention, aligning with the growing consumer preference for authentic, nutrient-rich, and culturally diverse food options. Moreover, their perceived health benefits such as aiding digestion and controlling blood sugar are positioning them well in the functional food space. Manufacturers have an opportunity to innovate with Bambara-based products tailored to both traditional markets and global health-conscious consumers.

- For instance, Bambara Nut Company launched a line of ready-to-eat Bambara bean soups in 2024, distributing 120,000 retail-ready packs across Kenya, Rwanda, and Uganda in the first quarter alone, driven by demand for culturally familiar, high-fiber meals.

Opportunities in Gluten-Free and Allergen-Free Products

With rising cases of gluten intolerance and food allergies, there is strong demand for alternative ingredients that are safe and nutritious. Bambara bean flour is naturally gluten-free and hypoallergenic, making it an ideal substitute for wheat in baked goods and snacks. This opens up opportunities in the booming gluten-free food segment. Food processors and product developers can capitalize on this trend by creating Bambara-based products that cater to sensitive consumers while meeting the demand for natural and minimally processed ingredients.

- For instance, Khushbu Trades collaborated with a health foods bakery chain in Gujarat to supply Bambara flour for a gluten-free cookie line, producing over 1.6 million units annually since the 2022 rollout, with zero reported allergen incidents from verified batches.

Key Challenges

Limited Commercial Processing Infrastructure

Despite its agricultural potential, the Bambara beans market faces a bottleneck due to the lack of large-scale processing facilities. Most production remains informal and small-scale, restricting its capacity to meet rising global demand. Inadequate post-harvest technologies lead to inefficiencies in cleaning, drying, and storage, affecting the quality and shelf life of the beans. Investments in infrastructure, standardization, and supply chain modernization are essential to support the transition from subsistence to commercial-scale production.

Low Consumer Awareness Outside Africa

A significant challenge for the market is the limited awareness and recognition of Bambara beans in non-African regions. Unlike other legumes such as chickpeas or lentils, Bambara beans are relatively unknown to consumers in North America, Europe, and Asia. This lack of familiarity affects demand, retail presence, and inclusion in mainstream product development. Strategic marketing campaigns, educational outreach, and inclusion in sustainable food narratives are necessary to build global awareness and acceptance.

Variability in Yield and Seed Quality

Yield inconsistency due to the use of traditional farming methods and poor-quality seeds remains a major challenge. The absence of improved seed varieties, along with pest and disease susceptibility, impacts productivity and farmer profitability. Research and development efforts aimed at breeding high-yielding, pest-resistant Bambara bean varieties could help overcome this limitation. Enhancing access to certified seeds and extension services can significantly improve production outcomes and overall market reliability.

Regional Analysis

North America

The North America Bambara Beans market was valued at USD 8.20 million in 2018 and reached USD 11.47 million in 2024. It is projected to grow to USD 20.39 million by 2032, registering a CAGR of 7.0% during the forecast period. North America accounted for approximately 5.3% of the global market in 2024. The region’s growth is driven by increasing consumer demand for plant-based protein, expanding vegan populations, and interest in alternative, sustainable crops. Rising health awareness and innovations in functional food products also support market expansion. However, relatively low awareness compared to traditional legumes poses a mild restraint.

Europe

Europe held a market value of USD 41.11 million in 2018, increasing to USD 60.18 million in 2024, and is anticipated to reach USD 98.61 million by 2032, growing at a CAGR of 5.9%. Europe represented around 27.7% of the global market share in 2024. The region’s growth is propelled by increasing adoption of gluten-free and allergen-free ingredients, especially in Germany, France, and the UK. Consumer preference for clean-label and ethnic foods is further strengthening demand. Supportive regulations promoting sustainable agriculture and plant-based foods also contribute to growth, although supply chain limitations and sourcing consistency remain key challenges.

Asia Pacific

In 2018, the Asia Pacific market for Bambara Beans was valued at USD 25.36 million, rising to USD 41.99 million in 2024, with projections indicating a value of USD 83.46 million by 2032, at a robust CAGR of 8.4%. Asia Pacific captured approximately 19.3% of the global market share in 2024. The region benefits from rapid urbanization, increasing interest in functional and traditional foods, and government support for legume farming in countries like India and China. Rising demand for affordable, nutrient-rich food sources is expanding market opportunities, although limited local awareness and processing infrastructure may restrict faster adoption.

Latin America

The Bambara Beans market in Latin America was valued at USD 3.20 million in 2018 and grew to USD 4.72 million by 2024. It is expected to reach USD 6.19 million by 2032, with a modest CAGR of 2.9%. Latin America held just about 2.2% of the global market share in 2024. The region’s growth is constrained by low consumer awareness, limited commercial cultivation, and scarce promotional activities around underutilized legumes. Nonetheless, growing food security initiatives and increased research interest in drought-resistant crops offer some potential. Greater emphasis on sustainable farming may improve adoption in future years.

Middle East

The Middle East Bambara Beans market was worth USD 5.34 million in 2018 and reached USD 7.59 million in 2024. It is forecasted to rise to USD 11.68 million by 2032, at a CAGR of 5.0%. The region accounted for approximately 3.5% of the global market in 2024. Increasing interest in high-protein crops, food diversification strategies, and enhanced import channels are supporting market development. Governments in countries like the UAE and Saudi Arabia are encouraging food security programs, which could benefit lesser-known pulses like Bambara beans. However, dependence on imports and lack of awareness among consumers limit current growth.

Africa

Africa dominated the Bambara Beans market in 2024, with a value of USD 91.22 million, up from USD 59.86 million in 2018. It is anticipated to reach USD 157.30 million by 2032, growing at a healthy CAGR of 6.6%. The region accounted for the largest global market share at 42.0% in 2024. Africa’s leadership is driven by the crop’s origin, traditional usage, and adaptability to dry climates. Countries such as Nigeria, Ghana, and Burkina Faso are major producers. Despite strong cultural integration and production potential, lack of commercial-scale processing and limited export capability hinder broader market expansion.

Market Segmentations:

By Product Type

- Raw Bambara Beans

- Processed Bambara Beans

- Roasted

- Boiled

- Fermented

- Canned

By Form

- Whole Beans

- Split Beans

- Flour

- Paste

- Powder

- Others

By Processing Technology

- Traditional Processing

- Mechanical Processing

- Bio-based Fermentation

- Milling and Packaging

- Freeze-Drying

By Application

- Food & Beverage

- Bakery Products

- Infant Foods

- Protein Supplements

- Animal Feed

- Functional Foods

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The Bambara Beans market features a moderately fragmented competitive landscape, with a mix of regional producers and emerging global players. Key companies such as African Flavour’s, Oro Seeds, Khushbu Trades, and Earth Expo Company focus on sourcing, processing, and exporting Bambara beans to both domestic and international markets. Local enterprises in Africa, including GOLDWIN Groundnuts Production and Bambara Nut Company, dominate the supply chain due to the crop’s indigenous presence and traditional cultivation practices. These companies often collaborate with smallholder farmers and government-led agricultural programs to scale production. Meanwhile, firms like TH and NH Trading Pty Ltd. and Esapa Holdings are expanding their reach through strategic trade partnerships and certifications focused on organic and sustainable practices. Competitive strategies in the market revolve around product differentiation, improved processing capabilities, and establishing robust distribution networks. As consumer demand for plant-based and climate-resilient crops grows, companies are investing in value-added product innovations to strengthen market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- African Flavour’s

- Khushbu Trades

- Oro Seeds

- BUSH’S

- TH and NH Trading Pty Ltd.

- Earth Expo Company

- Amafu Stock Trading

- Bambara Nut Company

- GOLDWIN GROUNDNUTS PRODUCTION

- Esapa Holdings

Recent Developments

- In April 2025, Khushbu Trades is recognized for its leadership in the processed beans sector, which is currently the largest in the market. The company is also actively expanding into the rapidly growing non-dairy milk alternatives and protein supplements markets. This strategic move positions them to capitalize on the increasing consumer demand for plant-based products.

- In June 2023, Council for Scientific and Industrial Research launched bambara beans project in Ghana. It provided training to the farmers related to advanced high yield methods and developed improved varieties of the bambara beans. Further, the project is also helped in the commercialization of these beans through providing platforms to the farmers.

- In July 2022, Sacoma, renowned for its innovative take on African superfoods, launched a line of bambara bean snacks in Europe, garnering acclaim for their nutritional advantages and distinct flavor. Concurrently, U.S.-based Specialty Produce broadened its offerings by adding Bambara beans, responding to the surging demand from health-focused consumers.

Market Concentration & Characteristics

The Bambara Beans Market demonstrates moderate market concentration, with a blend of regional suppliers and a few emerging international players. It is characterized by fragmented production, primarily dominated by smallholder farmers in Sub-Saharan Africa where the crop originates. The market’s informal nature limits scalability and standardization, though growing demand for plant-based protein is pushing producers toward semi-commercial and commercial models. It is driven by the crop’s nutritional value, drought tolerance, and increasing relevance in sustainable agriculture. Regional players often focus on traditional processing, while exporters are beginning to adopt improved packaging, certification, and quality controls to meet international standards. The market remains price-sensitive, influenced by seasonal availability and yield variability. It is gradually evolving with increased interest from health-conscious consumers, food manufacturers, and sustainability advocates, but low awareness outside Africa and limited investment in large-scale processing infrastructure continue to constrain its full commercial potential.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Processing Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Bambara Beans market will witness steady growth driven by rising demand for plant-based and nutrient-rich food sources.

- Climate resilience of Bambara beans will position them as a sustainable crop amid growing concerns about food security.

- Consumer interest in gluten-free and allergen-free products will boost demand for Bambara bean flour in functional foods.

- Africa will continue to dominate production, while regions like Europe and Asia Pacific will expand their consumption base.

- Technological advancements in processing and packaging will enhance product quality and global market accessibility.

- Investment in commercial-scale farming and supply chain infrastructure will improve production efficiency and export potential.

- Growing awareness campaigns and health-focused marketing will increase global recognition of Bambara beans.

- Partnerships between government bodies, NGOs, and agri-tech firms will support farmer training and value chain development.

- Product diversification in the form of snacks, flours, protein blends, and ready-to-eat meals will create new market opportunities.

- Regulatory support for sustainable agriculture and indigenous crops will strengthen market positioning over the forecast period.