Market Overview:

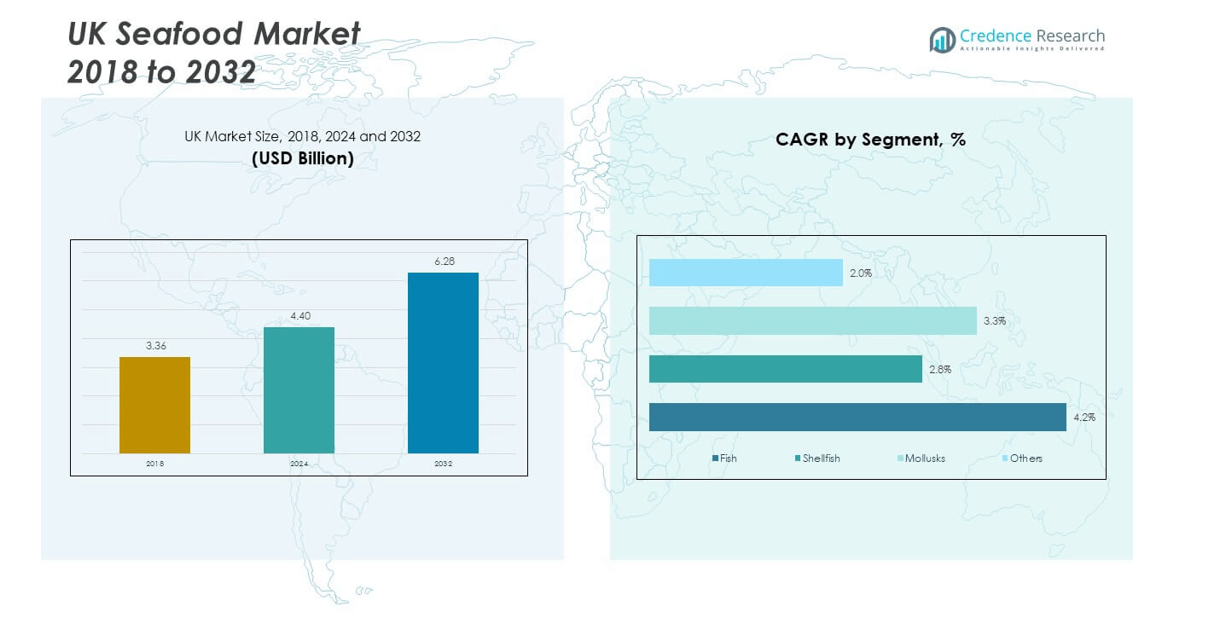

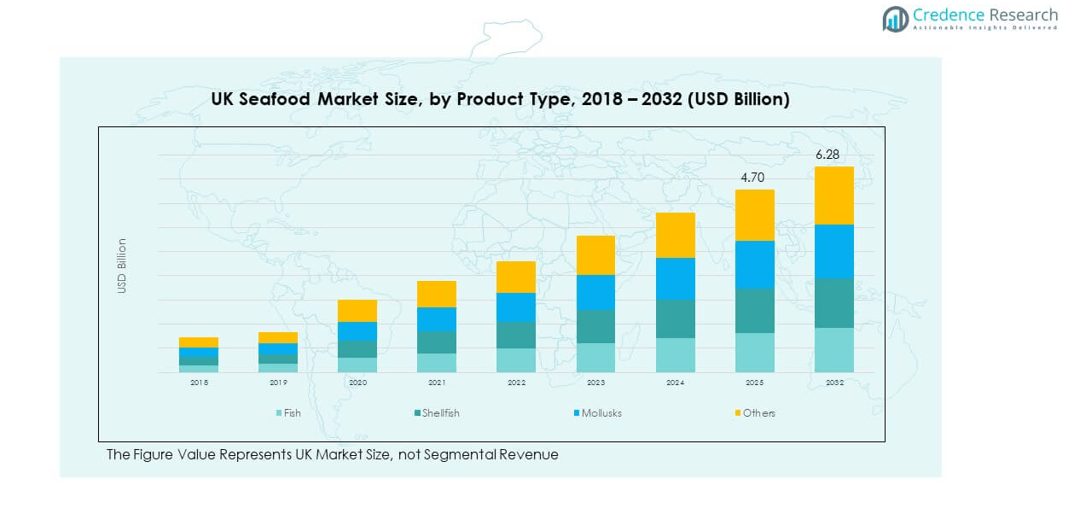

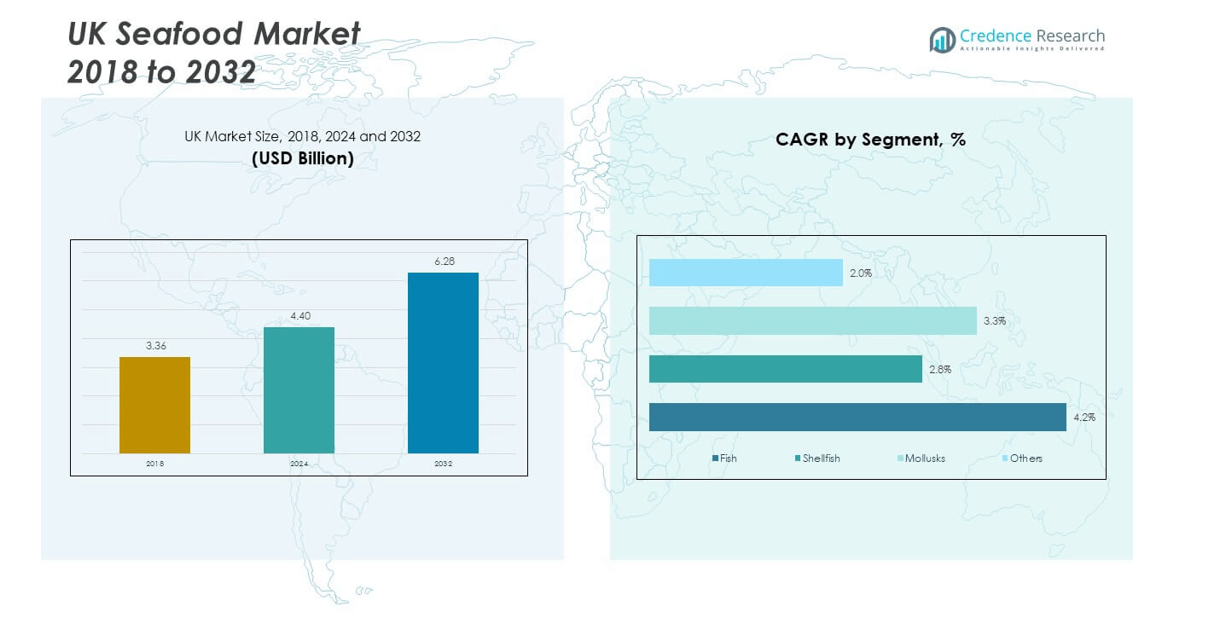

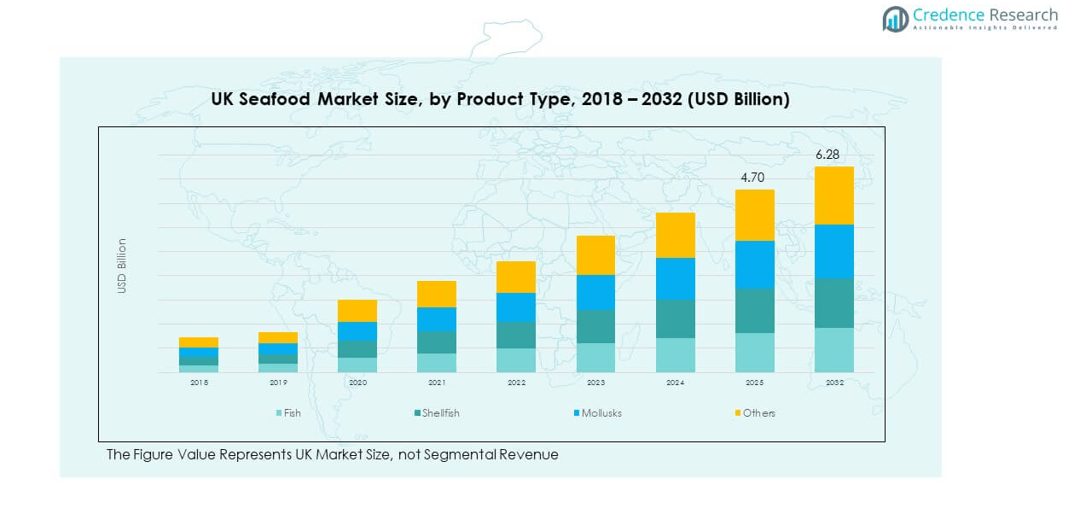

The UK Seafood Market size was valued at USD 3.36 billion in 2018 to USD 4.40 billion in 2024 and is anticipated to reach USD 6.28 billion by 2032, at a CAGR of 4.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Seafood Market Size 2024 |

USD 4.40 billion |

| UK Seafood Market , CAGR |

4.24% |

| UK Seafood Market Size 2032 |

USD 6.28 billion |

The UK. Seafood Market grows due to increasing consumer demand for protein-rich diets and sustainable food sources. Rising health awareness encourages households and restaurants to prioritize fish, shellfish, and mollusks. Technological advancements in seafood processing and packaging improve product safety and shelf life, supporting wider availability. Government regulations promoting traceability and eco-friendly sourcing strengthen consumer confidence. Expanding online platforms and retail channels create easier access for urban buyers. Growing exports of premium seafood varieties boost the sector’s global reputation. These factors collectively strengthen long-term industry performance.

Regionally, Scotland leads the UK. Seafood Market with strong aquaculture infrastructure and high salmon production. Northern England plays a vital role through processing facilities and frozen seafood supply. Southern England drives demand from urban centers where restaurants and supermarkets dominate consumption. Wales contributes significantly through shellfish production and trade links. Northern Ireland continues to strengthen its market presence with aquaculture and export growth. Emerging coastal hubs expand supply capacity, supported by better logistics and cold-chain networks. Each region adds unique strengths that balance production and consumption nationwide.

Market Insights

- The UK. Seafood Market size was valued at USD 3.36 billion in 2018, reached USD 4.40 billion in 2024, and is anticipated to hit USD 6.28 billion by 2032, registering a CAGR of 4.24% during the forecast period.

- Scotland leads with 28% share due to advanced aquaculture, Northern England holds 15% driven by strong processing facilities, and Southern England captures 22% supported by high urban consumption.

- Northern Ireland, with 12% share, is the fastest-growing region, driven by aquaculture expansion and export strength.

- By product type, fish remains the most dominant segment, supported by high domestic consumption and export demand.

- By form, fresh seafood holds the leading position, reflecting strong retail and restaurant demand across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Awareness Towards Nutritional Benefits Of Seafood

Consumers in the UK increasingly prioritize diets rich in protein and omega-3 fatty acids. It drives higher seafood demand across retail and foodservice channels. Health campaigns and media coverage highlight seafood’s role in cardiovascular and brain health. Supermarkets emphasize labeling for nutritional content to attract informed buyers. It also encourages households to include seafood in weekly meal plans. Growing preference for sustainable and ethically sourced seafood enhances market trust. Retailers respond by expanding product variety and improving packaging quality. Export markets benefit from premium UK seafood reputation. It maintains steady market growth and consumption trends.

- For example, the Marine Stewardship Council’s 2024 UK & Ireland Market Report indicated strong sales of MSC-labelled preserved and canned seafood in 2023/2024. Growth was largely propelled by tuna sales, demonstrating rising consumer interest in certified, traceable seafood in the UK market.

Technological Advancements In Seafood Processing And Cold-Chain Logistics Enhancing Market Supply

Innovations in freezing, vacuum packing, and preservation extend seafood shelf life. It ensures quality retention from catch to consumer. Efficient cold-chain infrastructure reduces spoilage and maintains freshness in urban centers. Processing plants implement automation for faster handling and uniform product output. It improves operational efficiency while meeting safety standards. Traceability systems gain prominence for product authenticity verification. It increases consumer confidence in seafood purchases. Retailers and distributors leverage technology for faster supply replenishment. Investments in processing technology strengthen market competitiveness.

Increasing Demand From Foodservice And Restaurant Sectors Driving Market Expansion

Seafood consumption in restaurants, hotels, and fast-food chains rises steadily. It diversifies demand beyond household purchases. Menu innovations include premium seafood dishes to attract urban consumers. It strengthens partnerships between local fisheries and hospitality providers. Delivery platforms facilitate seafood availability for online ordering. It supports higher volume orders and consistent revenue streams. Chefs emphasize sustainable and locally sourced ingredients to appeal to diners. It encourages seasonal menu planning aligned with seafood availability. Restaurant demand complements retail growth and broadens market reach.

- For example, Whitby Seafoods is recognized as the UK’s largest scampi supplier, holding close to 90% of the domestic foodservice scampi market. The company produces and sells about 52 million portions of scampi each year. Its dominance is supported by strong partnerships with UK pub and restaurant operators, where scampi continues to be a popular menu item in both casual and premium dining segments.

Government Policies And Sustainability Regulations Supporting Market Growth

UK regulatory frameworks promote sustainable fishing and aquaculture practices. It ensures long-term resource availability and environmental protection. Compliance with traceability requirements enhances market transparency. It encourages responsible consumption among buyers. Fisheries receive incentives for adopting eco-friendly practices. It drives investment in modern equipment and sustainable aquaculture. Industry standards maintain high-quality seafood production. It mitigates illegal or unregulated fishing activities. Policies enhance market stability and consumer confidence.

Market Trends

Growth Of Online Retail And Direct-To-Consumer Seafood Sales In The United Kingdom

Online grocery platforms and e-commerce apps expand seafood accessibility. It allows consumers to purchase fresh products without visiting stores. Subscription-based seafood delivery gains popularity in urban areas. It encourages trial of premium and exotic seafood varieties. Cold-chain logistics support timely home delivery of perishable goods. It strengthens brand loyalty through consistent quality and service. Retailers leverage data analytics to predict consumer preferences. It fosters direct engagement with customers and tailored marketing strategies. Online platforms redefine traditional seafood buying patterns.

Rising Preference For Value-Added And Ready-To-Cook Seafood Products Among Consumers

Pre-packaged fillets, marinated portions, and meal kits gain market traction. It reduces preparation time for busy households. Convenience drives product innovation in supermarkets and specialty stores. It targets working professionals and urban families seeking healthy meals. Premium packaging highlights quality, safety, and freshness. It encourages repeat purchases through easy handling. Retailers expand frozen and chilled seafood segments to meet demand. It stimulates new product development and diversified offerings. Consumer lifestyle changes fuel the trend toward convenience-focused seafood.

Adoption Of Sustainable And Eco-Friendly Fishing Practices Enhancing Market Perception

Sustainable aquaculture and MSC-certified fisheries gain prominence. It ensures responsible sourcing for ethical consumer choices. Eco-labeling and certification increase product appeal in retail shelves. It aligns with global sustainability awareness and environmental campaigns. Major retailers highlight sustainability to differentiate products. It encourages investment in technology for traceability and waste reduction. Market perception improves through transparent sourcing practices. It supports premium pricing for eco-conscious consumers. Sustainability trends reinforce long-term market resilience.

- For instance, Sainsbury’s led the market in 2023/24, offering 187 MSC-labelled products and certifying 79% of its own-label wild seafood range, including a return to 100% MSC certification for its own-label tuna line setting a national sustainability benchmark and winning the MSC UK “Supermarket of the Year 2024 Gold Award”.

Integration Of Advanced Packaging And Cold-Chain Technology Supporting Seafood Quality

Modified atmosphere packaging and high-pressure processing maintain freshness and safety. It reduces microbial growth and prolongs shelf life. Cold-chain expansion supports nationwide and international distribution. It allows suppliers to meet urban demand without quality compromise. Smart packaging includes temperature and freshness indicators. It strengthens consumer confidence in product integrity. Retailers adopt technology for inventory management and stock optimization. It supports export opportunities to premium markets. Advanced packaging trends modernize the UK Seafood Market supply chain.

- For instance, in 2023/24, Birds Eye became the first UK brand to introduce MSC-certified silver smelt (Argentina silus) in its fish finger range, made available through major retailers and leveraging the latest in cold-chain and packaging innovation to ensure certified sustainable and traceable supply from the Northeast Atlantic

Market Challenges Analysis

Rising Operational Costs And Supply Chain Volatility Impacting Seafood Accessibility

Fluctuating fuel and energy costs increase operational expenses. It affects pricing for fresh and processed seafood products. Unstable weather patterns disrupt catch volumes and aquaculture yields. It results in irregular supply and potential shortages. Transportation delays challenge urban and rural distribution networks. It pressures margins for both fisheries and retailers. Regulatory compliance adds financial burdens for small operators. It limits ability to scale operations efficiently. Market faces persistent challenges from cost volatility.

Impact Of Environmental Factors And Regulatory Constraints On Seafood Production

Climate change alters fish migration and breeding patterns. It reduces catch reliability in traditional fishing areas. Regulatory measures limit overfishing and enforce quotas. It ensures long-term sustainability but constrains short-term output. Pollution and ocean acidification affect quality and availability. It requires investment in monitoring and sustainable practices. Seasonal fluctuations impact both domestic and imported supply. It challenges market participants to maintain consistent product availability. Environmental and regulatory pressures remain significant hurdles.

Market Opportunities

Expansion Opportunities In Sustainable And Value-Added Seafood Products Across The United Kingdom

The UK Seafood Market can capitalize on increasing consumer focus on sustainability and convenience. It can develop premium ready-to-cook options and eco-certified products to attract health-conscious buyers. Retailers can partner with local fisheries to strengthen supply chain transparency. It enables direct engagement and loyalty-building strategies. Emerging urban markets show strong interest in seafood subscriptions and meal kits. It offers potential for digital sales channels and targeted marketing campaigns. Investment in packaging and cold-chain infrastructure supports expansion. Opportunities include introducing innovative seafood variants to meet evolving tastes.

Leveraging Export Potential And Technological Innovations To Strengthen Market Position

Export demand for premium UK seafood creates new revenue streams. It can target Europe and global markets with high-quality offerings. Adoption of advanced processing and packaging technology enhances product shelf life. It ensures compliance with international safety standards and consumer expectations. Fisheries benefit from improved operational efficiency and traceability systems. It encourages partnerships with technology providers and logistics companies. Market positioning strengthens through differentiation and premium branding. Opportunities include expanding into niche markets and value-added seafood segments.

Market Segmentation Analysis

By product type, fish dominates the UK. Seafood Market due to its high consumption and strong export presence. It remains central in both fresh and processed categories, while shellfish holds significant demand in premium dining and export supply. Mollusks serve niche segments with steady growth in coastal areas. Others, including specialty seafood, continue to expand through culinary diversification and rising consumer interest.

- For instance, in 2023, UK retail sales through supermarkets and major retailers included 63,100 tonnes of salmon, 60,800 tonnes of tuna, 45,200 tonnes of cod, and 35,200 tonnes of pollock, according to Seafish’s official “Seafood retail data and insight.” Salmon overtook tuna as the nation’s favorite fish by volume, maintaining its dominant role in both fresh and processed fish retail.

By form, fresh seafood leads the market, supported by robust retail and restaurant demand. Frozen seafood holds a strong share as it ensures year-round availability and longer shelf life. Canned seafood maintains a loyal consumer base seeking convenience and affordability. Processed seafood grows with the popularity of ready-to-cook meals among urban households. Others, including dried and preserved products, cater to ethnic markets and selective demand.

- For instance, in 2023, UK shoppers purchased a total of 381,371 tonnes of seafood across all retail channels, with 36% of the volume attributed to frozen products. Major contributors included Birds Eye Ltd and Young’s Seafood Ltd, both leading the provision of branded frozen seafood across UK supermarkets.

By distribution channel, retail stores capture the largest share, driven by supermarkets and hypermarkets with wide product assortments. Foodservice demonstrates steady growth, supported by restaurants, hotels, and catering sectors focusing on seafood innovation. Online retail gains traction, offering convenience and premium home-delivery services. Wholesale and bulk distribution serve institutional buyers and international trade partners. Others include specialty seafood outlets that enhance product diversity and consumer reach. It creates a balanced market structure across sales channels and product categories.

Segmentation

By Product Type

- Fish

- Shellfish

- Mollusks

- Others

By Form

- Fresh Seafood

- Frozen Seafood

- Canned Seafood

- Processed Seafood

- Others

By Distribution Channel

- Retail Stores

- Foodservice

- Online Retail

- Wholesale/Bulk

- Others

Regional Analysis

Northern UK: Scotland and Northern England Driving Seafood Production

Scotland leads the Northern UK seafood market with a 28% share, primarily due to its extensive coastline and advanced aquaculture industry. It produces high volumes of salmon, shellfish, and whitefish for domestic and export markets. Northern England contributes 15% to the regional share, focusing on processed seafood and frozen products. It maintains strong distribution networks linking fishing ports to urban retail hubs. It benefits from government support for sustainable fisheries. The region attracts investments in cold-chain infrastructure. It strengthens overall market stability and consistent supply.

Southern UK: England and Wales Supporting Urban Consumption

Southern England captures 22% of the UK. Seafood Market through high consumer demand in metropolitan areas. It offers diverse seafood options in supermarkets, restaurants, and online platforms. Wales contributes 10%, emphasizing high-quality shellfish and fish exports. It benefits from proximity to major shipping ports for efficient trade. It supports growth in ready-to-cook and value-added products. Retailers and distributors leverage the region’s urban density. It enhances market penetration for premium seafood brands. The region also drives innovation in packaging and delivery solutions.

Eastern and Western UK: Northern Ireland and Coastal Trade Hubs

Northern Ireland holds 12% market share, with strong domestic seafood production and export capabilities. It supplies both fresh and frozen seafood to key UK cities. Western coastal hubs contribute 13%, focusing on mollusks and niche seafood varieties. It supports both local consumption and specialized international markets. Regional infrastructure improvements facilitate supply chain efficiency. It strengthens the balance between traditional fishing communities and modern retail channels. Investment in processing and sustainable practices enhances overall market competitiveness. These subregions collectively support market growth through diverse product offerings and strategic trade routes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Seafresh Group

- Direct Seafoods

- M&J Seafood

- Young’s Seafood Ltd.

- Aquascot Ltd.

- New England Seafood International

- Whitby Seafoods Ltd.

- Thistle Seafoods

- Caistor Seafoods

- Dawnfresh Seafoods

Competitive Analysis

The UK. Seafood Market features a mix of large-scale integrated players and regional specialists. Key companies include Seafresh Group, Direct Seafoods, M&J Seafood, Young’s Seafood Ltd., Aquascot Ltd., New England Seafood International, Whitby Seafoods Ltd., Thistle Seafoods, Caistor Seafoods, and Dawnfresh Seafoods. It demonstrates competition across product types, from fish and shellfish to mollusks and value-added processed seafood. Companies focus on product innovation, sustainable sourcing, and expanding distribution channels to strengthen market position. It witnesses mergers, acquisitions, and strategic partnerships to increase production capacity and geographic reach. Leading players leverage cold-chain technology and packaging innovations to maintain freshness and ensure compliance with regulations. It fosters a competitive environment driving efficiency, premium product offerings, and regional dominance. Investment in digital retail and export markets further differentiates major players. It maintains robust growth prospects through strategic expansion and continuous market adaptation.

Recent Developments

- In September 2025, the Marine Stewardship Council (MSC) UK launched its flagship annual campaign, “Sustainable Seafood September 2025,” with a new concept focused on promoting the consumption of responsibly sourced fish in the UK and Ireland. The campaign is centered around the idea of “Buy Blue, Protect Dinner,” encouraging consumers to make sustainable seafood choices and raising awareness for certification standards within the UK seafood market.

- In August 2025, Bidfresh a prominent seafood supplier announced the acquisition of Hodgson Fish and Sailbrand. This strategic acquisition further strengthens Bidfresh’s position within the UK seafood supply chain by expanding its wholesale distribution capabilities and service reach to restaurants and catering businesses.

- In April 2025, Chapmans of Sevenoaks entered into a new joint venture partnership with Ocean Fish Group to consolidate and expand the British seafood supply chain. The partnership aims to leverage Chapmans’ premium service reputation and Ocean Fish’s extensive processing and procurement infrastructure, offering over 50 species of British fish and enhancing supply chain efficiency for chefs and hospitality across the UK.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK. Seafood Market will expand through rising demand for fresh and processed seafood.

- Sustainable fishing practices and aquaculture investment will drive long-term growth.

- Retail and online channels will gain importance, enhancing product accessibility.

- Innovation in packaging and cold-chain logistics will improve product quality and shelf life.

- Value-added products and ready-to-cook seafood will attract urban consumers and younger demographics.

- Export opportunities will grow, especially to EU and Asia-Pacific markets.

- Technological adoption in processing and distribution will increase operational efficiency.

- Regulatory support and environmental compliance will reinforce sustainable growth practices.

- Product diversification, including premium and niche seafood varieties, will strengthen market positioning.

- Strategic partnerships and mergers will enhance market consolidation and competitive advantage.