Market Overview:

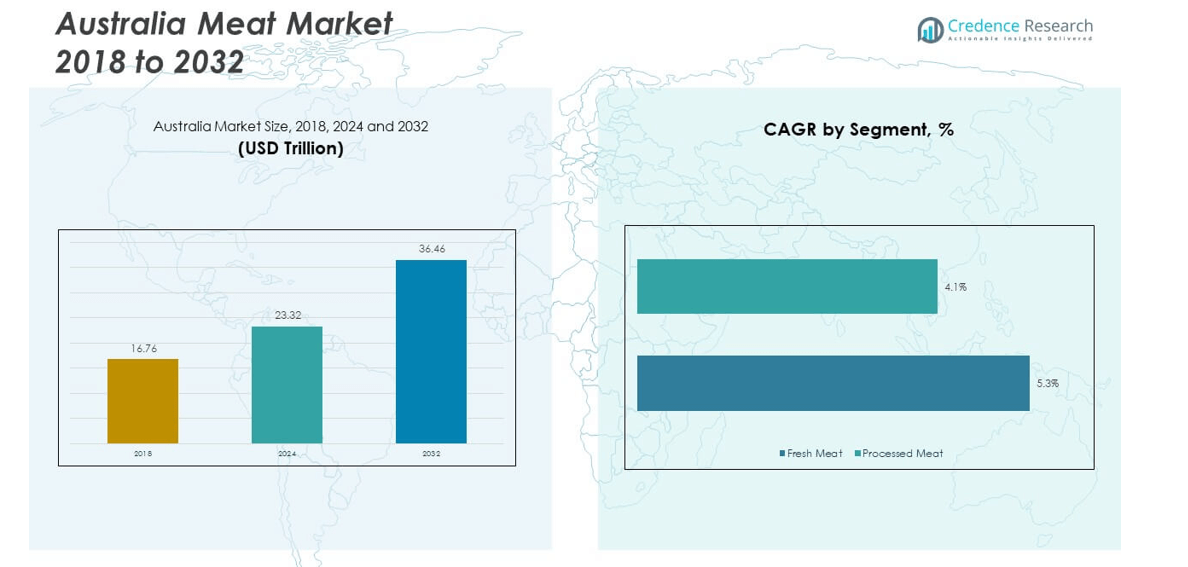

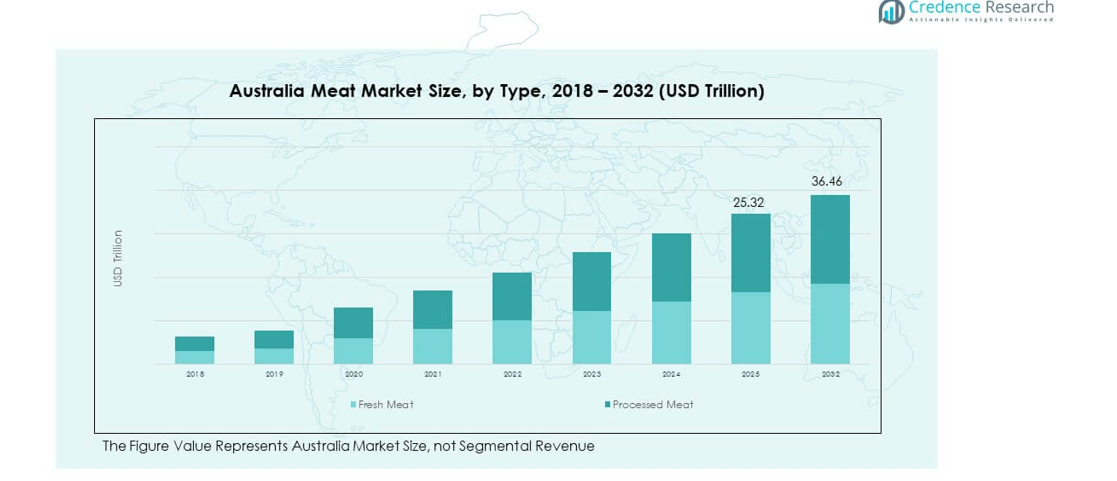

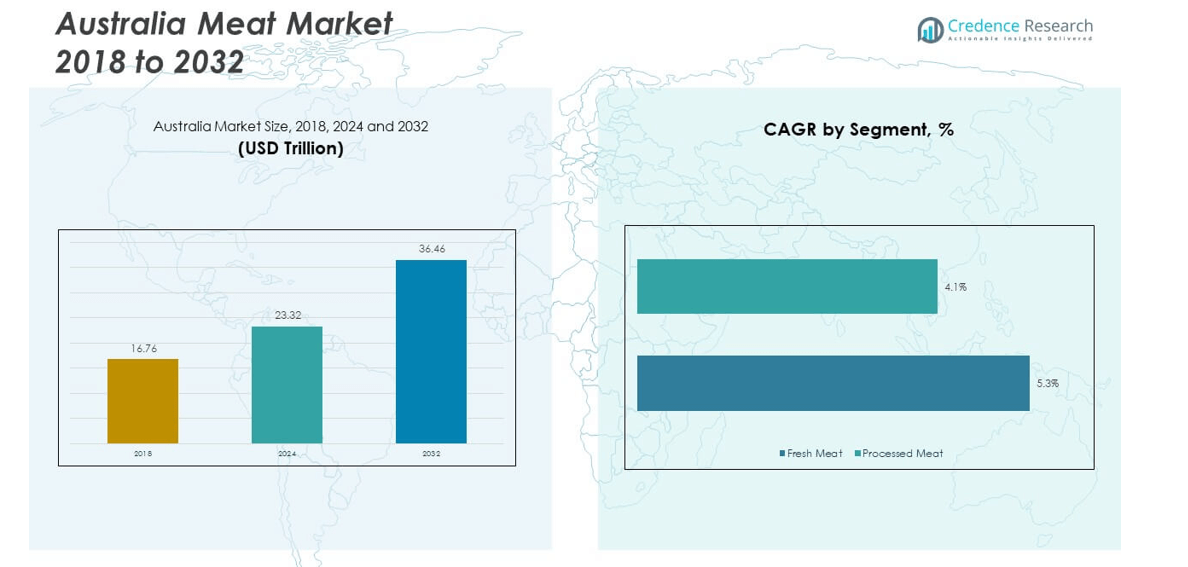

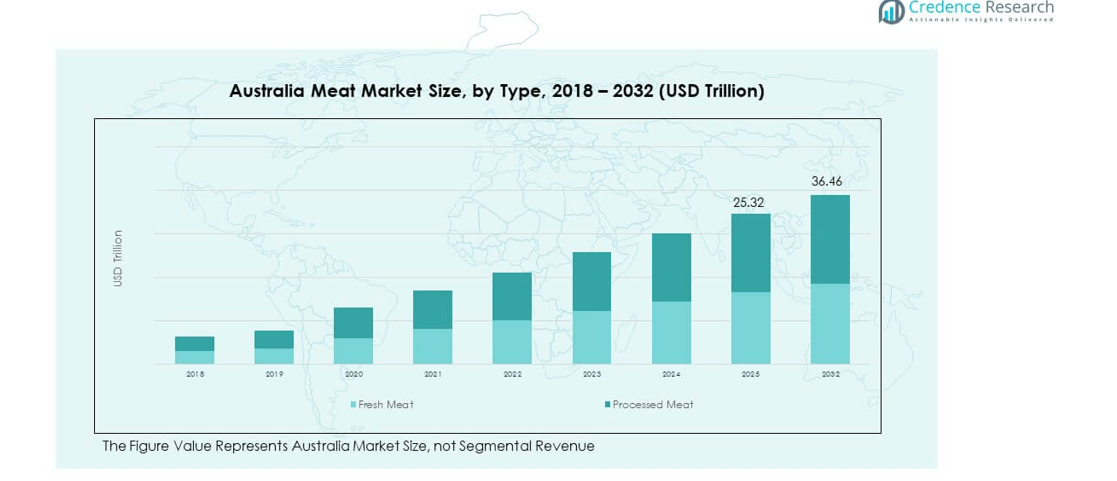

The Australia Meat Market size was valued at USD 16.76 million in 2018 to USD 23.32 million in 2024 and is anticipated to reach USD 36.46 million by 2032, at a CAGR of 5.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Meat Market Size 2024 |

USD 23.32 million |

| Australia Meat Market, CAGR |

5.35% |

| Australia Meat Market Size 2032 |

USD 36.46 million |

The Australia Meat Market is driven by strong domestic consumption, supported by cultural preference for red meat, poultry, and lamb. Demand for high-protein diets continues to rise, while premium beef and organic lamb attract consumers seeking quality and traceability. Export opportunities expand through free trade agreements, particularly with Asia-Pacific, while technological advancements in processing, cold-chain logistics, and packaging enhance efficiency. Sustainability practices, including grass-fed systems and eco-certifications, further strengthen the market’s reputation and consumer trust.

Regionally, Eastern Australia leads with dominant livestock production and well-established processing facilities that support both domestic supply and exports. Southern Australia shows strong performance through lamb and beef output and efficient port infrastructure serving international markets. Western and Northern Australia are emerging growth corridors, driven by live cattle exports, large-scale grazing systems, and proximity to Asia-Pacific buyers. These regions benefit from government investment in logistics and transport corridors, enhancing their long-term role in the meat supply chain

Market Insights

- The Australia Meat Market size was valued at USD 16.76 million in 2018, grew to USD 23.32 million in 2024, and is anticipated to reach USD 36.46 million by 2032, expanding at a CAGR of 5.35%.

- Eastern Australia led with 45% share due to livestock concentration and processing hubs, Southern Australia followed with 30% supported by lamb and beef supply chains, while Western and Northern together held 25% driven by grazing systems and export proximity.

- Northern and Western Australia represent the fastest-growing subregions with a combined 25% share, benefiting from live cattle exports, large grazing lands, and infrastructure investments aimed at expanding international access.

- By type, fresh meat commanded 60% of the market share in 2024, supported by strong household consumption and preference for natural cuts.

- Processed meat accounted for 40% of the market in 2024, driven by urban lifestyles, packaged product demand, and the growth of quick-service restaurants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Domestic Demand and Cultural Preference for Meat Consumption

The Australia Meat Market benefits strongly from entrenched dietary habits across households and foodservice establishments. Meat remains a core part of Australian cuisine, with red meat and poultry consumption consistently high. Demand for high-protein diets sustains growth across retail and restaurants. It gains further traction from premium segments such as grass-fed beef and organic lamb. Local consumers also seek convenience, boosting packaged and ready-to-cook options. Quick-service restaurants and catering services create consistent offtake. Health-focused buyers view lean cuts as essential to balanced diets. Domestic preference builds resilience against global fluctuations in supply chains.

- For instance, in August 2025, Grill’d (an Australian premium burger chain) launched its first-ever retail range of burger patties exclusively at Coles supermarkets nationwide. This partnership brought Grill’d’s chef-developed beef patties into over 800 Coles stores, demonstrating surging domestic demand for high-quality, ready-to-cook Australian meat products in retail channels.

Export Growth Supported by Trade Agreements and Market Access

International trade plays a central role in expanding the reach of the Australia Meat Market. Free trade agreements strengthen exports to Asia-Pacific, North America, and the Middle East. China, Japan, and South Korea remain leading destinations for beef and lamb shipments. Grain-fed and halal-certified products address specific international market requirements. It benefits from stringent food quality and safety standards that enhance global trust. Middle Eastern nations provide growing opportunities through rising halal demand. Government policies further support livestock farmers in achieving export targets. Export resilience offsets domestic demand variations and boosts sector stability.

Advancements in Processing, Packaging, and Supply Chain Efficiency

Technological investments continue to strengthen the operational foundation of the Australia Meat Market. Modern slaughtering and deboning systems enhance yield efficiency across large-scale facilities. Cold-chain logistics provide extended shelf life and product safety across distribution networks. Vacuum packaging and modified atmosphere solutions maintain freshness during long-distance shipments. It creates opportunities for premium branding of Australian meat in global markets. Robotics and automation reduce reliance on manual labor and ensure hygiene standards. Processing plants integrate smart monitoring to improve throughput and cost-effectiveness. Improved technology also enables traceability that reassures consumers globally.

- For example, Australian red meat processors achieved direct sales revenue of AUD 25.452 billion in 2023-24, and the industry supported 189,487 full-time equivalent jobs across Australia. Export shipments reached over 50 countries, reflecting strong global demand

Sustainability Practices and Animal Welfare Programs

Sustainability initiatives underpin the long-term credibility of the Australia Meat Market. Grass-fed livestock systems support natural resource efficiency and reduced environmental footprint. Farmers implement water conservation and rotational grazing methods to align with eco-standards. Certified programs assure buyers about the humane treatment of animals. It strengthens the reputation of Australian meat in international markets where transparency is valued. Retailers highlight eco-labeling and carbon-neutral certifications to attract environmentally conscious consumers. Government policies also encourage sustainability through industry partnerships and funding. Such practices not only protect resources but also add brand differentiation in premium categories.

Market Trends

Premiumization and Expansion of High-Value Meat Segments

The Australia Meat Market reflects an accelerating shift toward premium product categories. Consumers increasingly favor marbled beef, organic lamb, and specialty poultry options. Premium cuts gain strong positioning in supermarkets, butcher chains, and export markets. It responds to rising disposable income and preference for superior dining experiences. Foodservice operators highlight quality differentiation by sourcing branded Australian meat. International buyers often associate Australian labels with trusted standards of quality. Marbled beef, in particular, secures high demand in East Asia’s luxury dining segment. Premium positioning contributes to stronger margins across the supply chain.

- For example, Stone Axe Pastoral Company’s Margaret River Wagyu won the Open Crossbred Steak Champion title at the 2024 Wagyu Branded Beef Competition, achieving a marbling score of 9+. Meat & Livestock Australia confirmed that grainfed Australian beef exports reached a record 375,195 tonnes in 2024.

Evolving Consumer Lifestyle and Growth of Ready-to-Eat Meat Products

Changing lifestyles encourage greater consumption of convenient, ready-to-eat, and value-added meat options. The Australia Meat Market sees demand rise in packaged cold cuts, sausages, and marinated products. Busy urban consumers prefer products that reduce preparation time without compromising nutrition. It allows retailers to diversify offerings across chilled and frozen categories. Meal kit providers also integrate Australian meat as core ingredients. Processors introduce innovative flavors and portion sizes tailored to modern households. Expansion of e-commerce platforms accelerates delivery of ready-to-cook products nationwide. These changes signal a sustained long-term trend in consumer behavior.

Adoption of Digital Platforms and E-Commerce in Meat Distribution

Digital transformation is reshaping the retail and distribution framework of the Australia Meat Market. E-commerce platforms deliver chilled and frozen meat with real-time cold-chain monitoring. Urban buyers increasingly use mobile apps for direct purchases from suppliers. It ensures improved transparency and better pricing for households and foodservice clients. Logistics firms enhance last-mile delivery capacity to serve fresh meat demand. QR code-enabled traceability offers information on farm origin and handling methods. Online subscription models expand recurring purchases across urban regions. Such digital adoption strengthens industry competitiveness against global suppliers.

- For example, Gundagai Meat Processors, collaborating with MLA and Trust Provenance, implemented the TPmeat traceability platform in a project covering lamb producers and processors. The system uses critical tracking events and unique QR codes on red meat packaging, allowing consumers to scan and see origin, quality metrics, farm of origin, and other info.

Innovation in Alternative Proteins and Hybrid Meat Solutions

The Australia Meat Market witnesses the rise of hybrid meat options combining plant and animal protein. Food companies invest in research to meet consumer interest in sustainable nutrition. Plant-based additives enrich processed meat to reduce fat and cholesterol content. It allows manufacturers to target health-focused and flexitarian consumers. Hybrid offerings create new product categories in retail and export markets. Innovation also reduces environmental concerns linked to meat production. Meat processors collaborate with startups to design scalable hybrid solutions. This trend diversifies revenue channels while preserving demand for traditional categories.

Market Challenges Analysis

Climate Change Impacts and Volatility in Livestock Supply

The Australia Meat Market faces mounting risks from climate change and weather variability. Droughts and floods reduce grazing land productivity and strain water resources. It leads to fluctuating livestock numbers and inconsistent supply for processors. Feed costs also escalate during adverse seasons, raising production expenses. Farmers encounter difficulties in maintaining consistent animal health and nutrition. Rising temperatures increase disease outbreaks that affect livestock yield. Processors must manage variable supply while meeting international commitments. Long-term climate resilience remains a critical concern for industry stakeholders.

Regulatory Pressures, Labor Shortages, and Global Competition

Regulatory demands and operational challenges constrain the long-term expansion of the Australia Meat Market. Stringent animal welfare and environmental laws increase compliance costs across production chains. Skilled labor shortages in rural areas limit efficient operation of advanced plants. It forces greater reliance on automation and imported labor. International competition from South American exporters intensifies in premium beef and lamb segments. Global trade disruptions create further instability in shipping timelines. Exchange rate fluctuations also impact export margins negatively. Such combined pressures challenge profitability and competitiveness for local producers.

Market Opportunities

Expansion into Emerging Asian Markets and Halal Meat Demand

The Australia Meat Market is well-positioned to expand in Asia’s rapidly growing economies. Rising urban populations in Southeast Asia increase demand for beef, lamb, and poultry imports. It benefits from Australia’s close geographic proximity and reliable logistics channels. Halal-certified products create opportunities in Muslim-majority nations with expanding middle classes. Trade agreements continue to ease access to new buyers across regional hubs. Branded exports with quality certifications strengthen Australia’s competitive advantage. Emerging consumer segments prefer trusted suppliers, reinforcing Australia’s strong image. These factors combine to provide stable growth avenues for exporters.

Leveraging Sustainability and Traceability for Premium Branding

The Australia Meat Market can leverage sustainability programs to capture environmentally conscious buyers. Carbon-neutral certifications and grass-fed farming systems enhance product differentiation. It enables Australian producers to command premium pricing in international markets. Retailers highlight traceable origin and eco-labeling to attract younger demographics. Digital tools allow customers to verify farm-to-fork transparency with ease. Exporters integrate eco-practices into branding strategies to secure long-term partnerships. Partnerships with foodservice companies further promote sustainable credentials. This creates consistent opportunities to build brand equity across domestic and global markets.

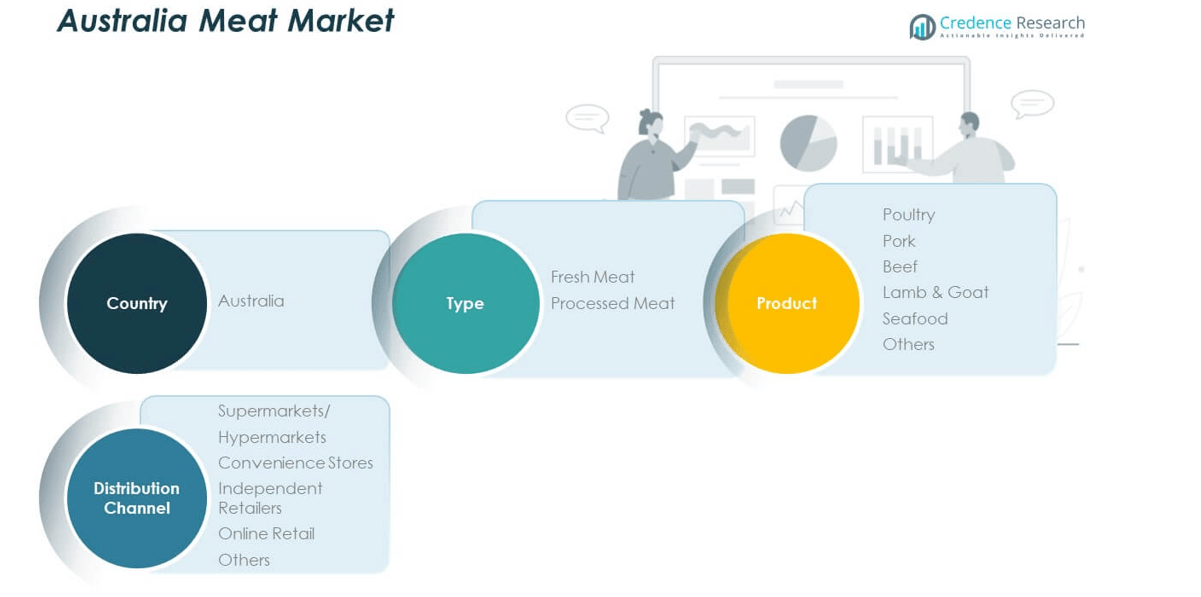

Market Segmentation Analysis

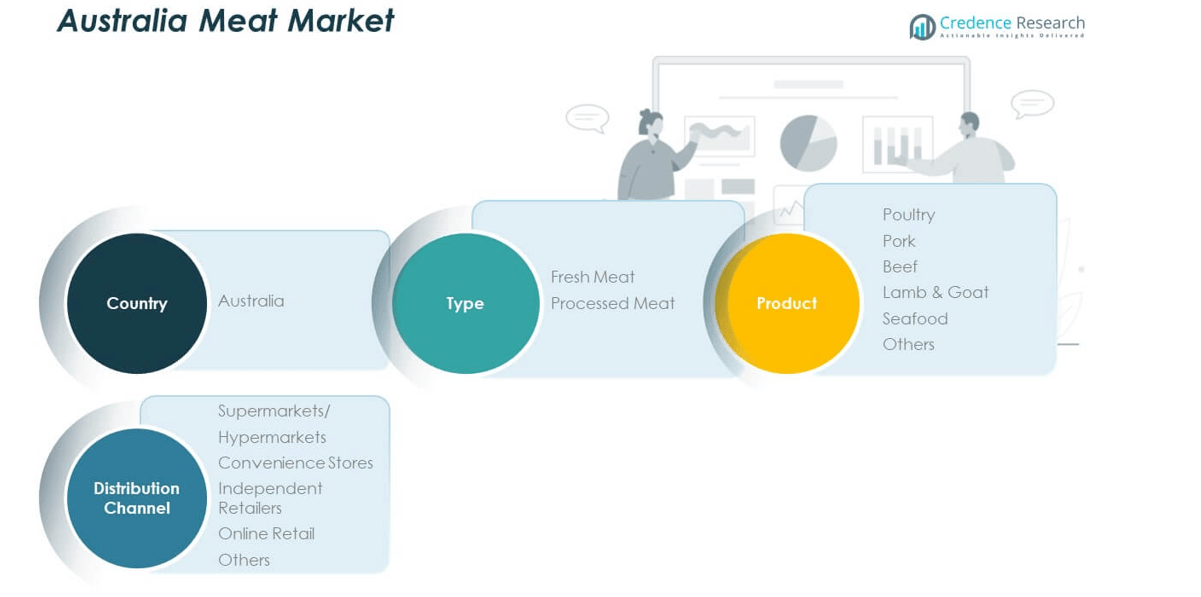

By Type, the Australia Meat Market is divided into fresh meat and processed meat. Fresh meat dominates due to high consumer preference for natural cuts, supported by strong domestic livestock production. Processed meat records steady growth with rising demand for sausages, cold cuts, and packaged meals. It benefits from busy urban lifestyles and expansion in quick-service restaurants. The balance between fresh and processed offerings ensures stability in supply and demand across both household and foodservice channels.

- For instance, Thomas Foods International is constructing a new Murray Bridge processing facility with an initial beef processing capacity of up to 600 head per day, with full completion expected to allow 1,200 head of beef and 15,000 head of smallstock processed daily. Their facility also integrates fully automated carton chilling, freezing, and storage systems, optimizing efficiency and supply chain integrity.

By Product, the market spans poultry, pork, beef, lamb and goat, seafood, and others. Poultry leads with broad affordability and frequent household purchases. Beef remains a premium category with strong export traction, particularly in Asia. Lamb and goat hold significant appeal in both domestic and international markets, supported by Australia’s grazing systems. Seafood contributes to diversification, led by aquaculture companies targeting local and overseas buyers. Pork maintains steady demand, supported by processed meat products. It reflects consumer preferences shaped by culture, income, and dietary diversity.

- For instance, Gundagai Meat Processors launched the world’s first value-based pricing grid for lamb, enabled by commercial DEXA systems deployed across the company’s lamb abattoirs, allowing producers to be paid according to precise lean, fat, and bone compositions measured in each carcass.

By Distribution Channel, supermarkets and hypermarkets account for the largest share due to wide product availability and brand visibility. Convenience stores and independent retailers serve regional and rural demand with accessible pricing. Online retail grows quickly, supported by digital adoption and cold-chain delivery networks. Foodservice operators and institutional buyers strengthen off-take across bulk channels. It ensures that both modern trade and traditional outlets play a vital role in meeting consumer needs, making distribution a competitive edge in the market.

Segmentation

By Type

- Fresh Meat

- Processed Meat

By Product

- Poultry

- Pork

- Beef

- Lamb & Goat

- Seafood

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Retail

- Others

Regional Analysis

Eastern Australia – Dominant Market Hub

Eastern Australia accounts for the largest share of the Australia Meat Market, holding 45% of total revenue. This dominance is driven by high livestock production in Queensland and New South Wales, supported by strong export-oriented infrastructure. The subregion benefits from extensive grazing land and a concentration of processing facilities. It also maintains leading export channels for beef and lamb to Asia-Pacific markets. Rising urban populations in Sydney and Brisbane contribute to steady domestic consumption. It demonstrates resilience due to a balance between export flows and household demand.

Southern Australia – Strong Export Base with Diverse Offerings

Southern Australia contributes 30% of the Australia Meat Market, supported by Victoria and South Australia’s well-established meat supply chains. The subregion excels in dairy-beef integration and lamb production, catering to both domestic and export markets. Major ports in Melbourne and Adelaide ensure efficient international distribution. It benefits from diversified offerings across beef, lamb, and processed meat categories. Local demand is strengthened by higher per capita consumption in urban areas. Sustainability programs in Southern Australia also attract global buyers focused on eco-compliance.

Western and Northern Australia – Emerging Growth Corridors

Western and Northern Australia together represent 25% of the Australia Meat Market, driven by expanding production and rising export demand. Western Australia plays a key role in lamb and live cattle exports to Middle Eastern markets. Northern Australia leverages large-scale grazing systems and government investment in transport corridors. It holds growing potential due to increasing demand from Asian neighbors and strategic export proximity. Urbanization in Perth adds to meat consumption across retail and foodservice sectors. It is gradually evolving into a strong growth corridor with significant opportunities for expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JBS Foods Australia

- Primo Foods

- Teys Australia

- Australian Meat Company

- Ralphs Meat Company

- Huon Aquaculture

- R. Johnston

- Andrews Meat Industries

- Thomas Foods International

- Coles Group

Competitive Analysis

The Australia Meat Market is highly competitive, with a mix of multinational processors, domestic producers, and integrated retailers. Leading players such as JBS Foods Australia, Teys Australia, and Thomas Foods International dominate the industry through extensive processing capacity and strong export linkages. It gains competitiveness from their ability to manage large-scale supply chains, diversify product portfolios, and meet stringent international standards. Retailers like Coles Group strengthen market presence by offering private-label meat lines and maintaining direct partnerships with processors. Smaller companies such as Ralphs Meat Company, D.R. Johnston, and Andrews Meat Industries compete by focusing on niche segments, premium quality, and regional distribution. Huon Aquaculture supports diversity within the sector through its seafood specialization, aligning with consumer demand for varied protein sources. It fosters innovation in sustainability and traceability, enhancing value for environmentally conscious buyers. Strategic initiatives such as mergers, capacity expansions, and branded product launches define the competitive landscape. The balance between export-led growth and domestic consumption enables players to navigate fluctuating demand cycles. Intense rivalry among producers ensures continuous improvement in efficiency, quality, and product innovation within the market.

Recent Developments

- In June 2025, Cargill announced the acquisition of 100% ownership of Teys Investments, which includes Teys Australia and Teys USA. Previously, these companies had been operated under a 50-50 partnership between Cargill and the Teys family since 2011. The deal is expected to close in the second half of 2025, pending regulatory approvals, and will see Cargill appoint a new CEO for Teys and continue to serve the Australian meat market with a focus on high-quality beef products.

Report Coverage

The research report offers an in-depth analysis based on Type, Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Meat Market will see consistent growth driven by strong domestic demand and high-protein dietary preferences.

- Export expansion into Asia-Pacific markets will strengthen revenue streams, supported by long-standing trade agreements.

- Premiumization trends in beef, lamb, and poultry will create higher margins for producers and retailers.

- Advances in processing and cold-chain logistics will enhance efficiency and extend shelf life across supply chains.

- Sustainability initiatives such as grass-fed systems and carbon-neutral certifications will attract environmentally conscious buyers.

- Digital transformation through e-commerce and traceability platforms will expand consumer trust and market access.

- Ready-to-eat and value-added meat products will witness greater adoption across urban and time-constrained consumers.

- Hybrid meat innovations combining plant and animal protein will diversify product offerings in retail and exports.

- Regional strengths in Eastern and Southern Australia will continue to anchor production and exports globally.

- Intensifying competition will encourage investment in automation, product differentiation, and long-term branding strategies.