Market Overview:

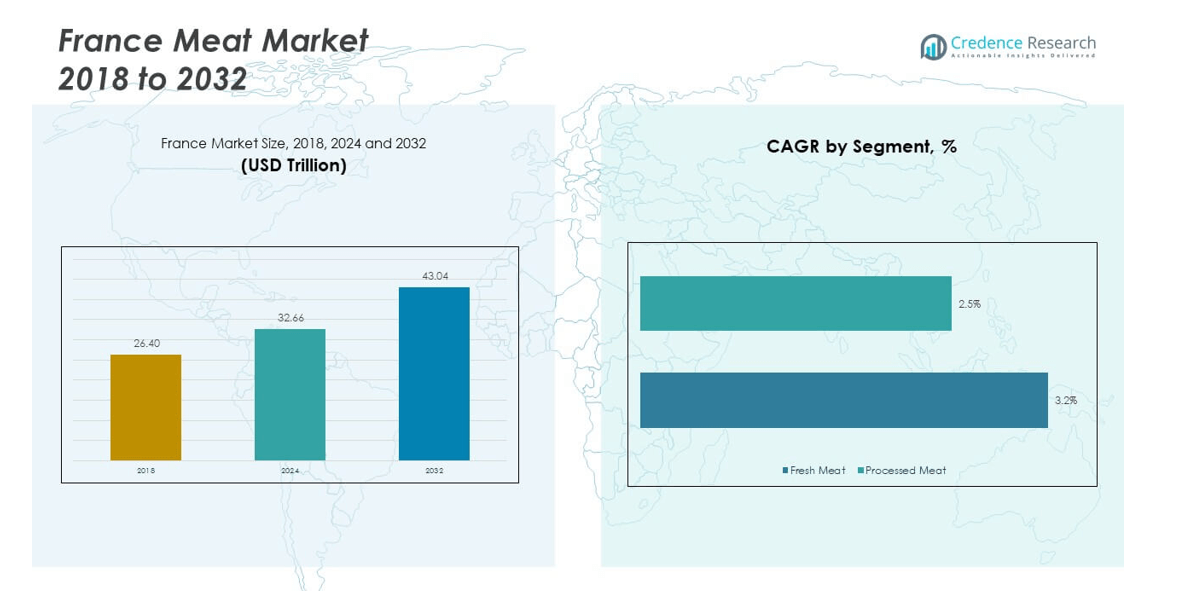

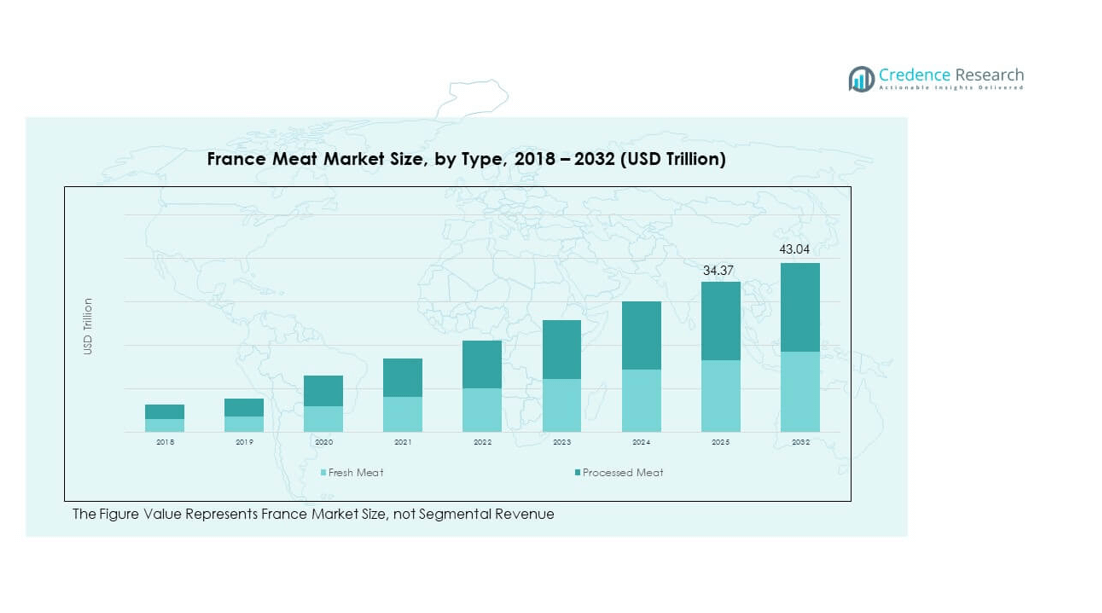

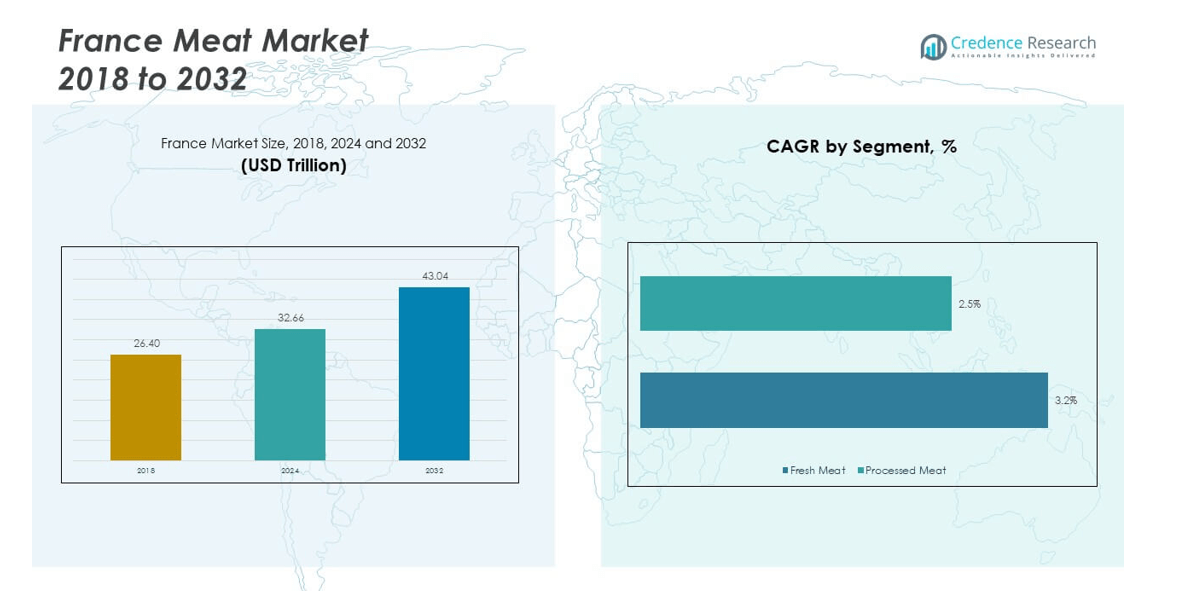

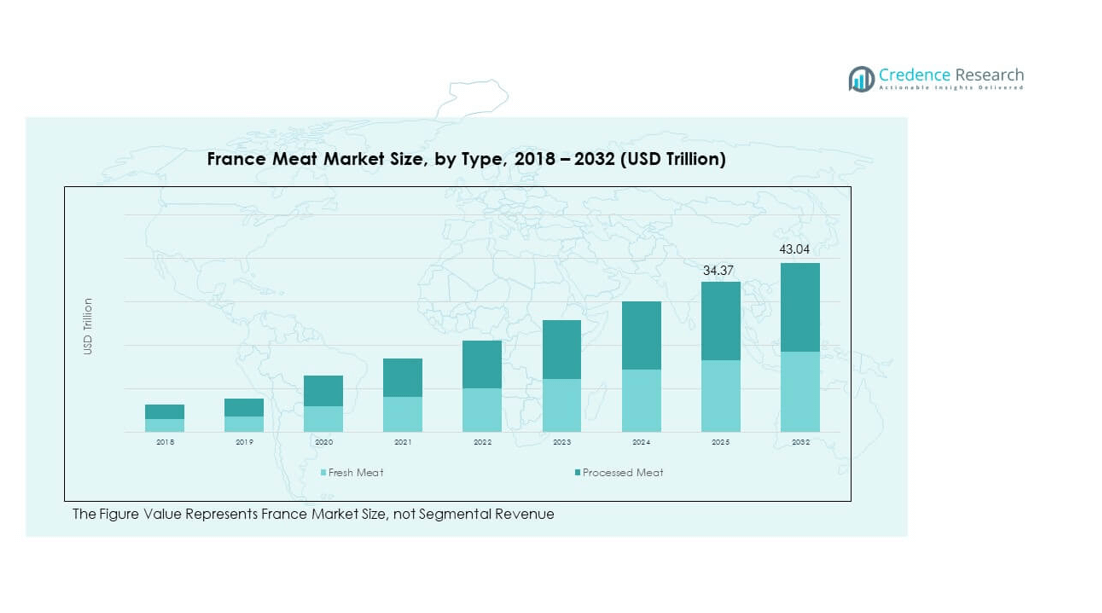

The France Meat Market size was valued at USD 26.40 million in 2018 to USD 32.66 million in 2024 and is anticipated to reach USD 43.04 million by 2032, at a CAGR of 3.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Meat Market Size 2024 |

USD 32.66 million |

| France Meat Market, CAGR |

3.27% |

| France Meat Market Size 2032 |

USD 43.04 million |

The France Meat Market is driven by growing demand for protein-rich diets and strong consumer interest in fresh and organic meat. Increasing preference for ready-to-cook and convenience-oriented products supports retail expansion. Rising health awareness fosters interest in lean meats and sustainable sourcing. Government regulations promoting food safety and traceability encourage market confidence. Technological advancements in cold chain logistics and packaging improve distribution efficiency. Changing lifestyles and urbanization further boost consumption across multiple channels, especially supermarkets and online retail.

Regionally, Western France leads due to a strong agricultural base and advanced processing facilities, with high consumption supported by urban populations. Northern and Eastern regions show solid growth through processed meat production and expanding retail networks. Southern France demonstrates rising demand for specialty meats such as lamb and goat, influenced by regional cuisines and tourism-driven consumption. Central France reflects stable traditional preferences but is gradually shifting toward packaged and organic meat categories. Emerging regional markets are shaped by evolving consumer expectations for sustainability, traceability, and premium quality.

Market Insights

- The France Meat Market was valued at USD 26.40 million in 2018, reached USD 32.66 million in 2024, and is projected to hit USD 43.04 million by 2032, growing at a CAGR of 3.27%.

- Western France leads with 34% share due to its agricultural strength and advanced processing base. Northern and Eastern France together hold 28%, supported by dense populations and strong industrial meat facilities. Southern France contributes 22%, driven by demand for lamb, goat, and regional cuisines.

- Central France, with 16% share, represents the fastest-growing region, supported by gradual adoption of packaged and organic meat products alongside stable traditional consumption.

- Fresh meat dominates the market, supported by strong consumer preference for natural and unprocessed products.

- Processed meat maintains a solid position, driven by growing demand for convenience, packaged, and ready-to-cook offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Consumer Demand For High-Quality Protein-Rich Diets Driving Market Growth

The France Meat Market experiences steady growth due to increasing consumer preference for protein-rich diets. It benefits from heightened awareness of nutritional value and health benefits associated with meat consumption. Consumers show strong interest in lean meats and organic products. Supermarkets and specialty stores expand their offerings to meet this demand. The market sees increased investment in premium and traceable meat products. Foodservice channels incorporate high-quality meat in menus to attract health-conscious customers. It experiences consistent growth due to urbanization and rising disposable income. Consumer focus on balanced diets accelerates product development.

- For example, In December 2023, Arla Foods and Solinest introduced Arla® Skyr and Arla® Protein in France. The products now reach 99% of retail channels and aim to capture growing demand for high-protein dairy.

Advancements In Processing, Packaging, And Cold Chain Logistics Enhancing Product Quality

The market relies on technological progress to maintain product freshness and safety. It leverages innovative packaging solutions to extend shelf life. Cold chain logistics ensure meat reaches consumers without quality degradation. Automation in processing reduces contamination risks and improves efficiency. Producers adopt modern techniques to meet regulatory standards. Traceability systems gain importance for quality assurance. The France Meat Market benefits from safer distribution networks. Retailers invest in advanced storage facilities. Technology adoption strengthens market credibility and consumer trust.

- For example, Charal developed the Hebdopack vacuum packaging, which extends the shelf life of fresh meat to up to 25 days without preservatives. The company operates nine processing facilities and handles more than 200,000 tonnes of beef and 100,000 tonnes of pork

Increasing Preference For Convenience And Ready-To-Cook Meat Products Among Consumers

Consumer lifestyles shift toward convenience and quick meal preparation. It sees strong demand for pre-packaged and ready-to-cook meat products. Supermarkets introduce marinated and pre-portioned items. E-commerce platforms contribute by offering doorstep delivery of fresh meats. Foodservice chains promote convenient meat options to attract busy customers. The market responds with innovative packaging and preservation methods. Urban populations show faster adoption compared to rural regions. Ready-to-cook products help maintain consistent consumption. It fosters market expansion through diverse offerings.

Supportive Government Regulations And Sustainable Farming Practices Promoting Industry Expansion

Government policies encourage sustainable meat production and animal welfare. It benefits from subsidies and incentives for eco-friendly farming. Regulatory frameworks ensure food safety and quality standards. Producers comply with traceability and labeling requirements. Sustainable practices reduce environmental impact and improve market perception. The France Meat Market gains from consumer confidence in certified products. Export opportunities expand through adherence to international standards. Public campaigns promote locally sourced and responsibly raised meat. Market growth aligns with regulatory and sustainability initiatives.

Market Trends

Rising Adoption Of Organic And Free-Range Meat Products Among Health-Conscious Consumers

The France Meat Market sees a shift toward organic and free-range options. It reflects growing consumer interest in natural and chemical-free meat. Retailers expand organic product lines to meet demand. Farm-to-table models gain traction in urban regions. Consumers favor transparent sourcing and ethical animal treatment. Free-range meats command premium pricing due to perceived quality. The trend encourages producers to adopt sustainable practices. It drives innovation in packaging and labeling. Product differentiation enhances market competitiveness.

- For instance, Carrefour launched Europe’s first food blockchain program for free-range Auvergne chicken in France: over one million chickens per year are traceable via blockchain, with consumers able to scan QR codes to access complete information about origin, farm, batch dates, and processor handling. This system provides tamper-proof assurance of animal welfare and organic practices for every product in the Carrefour Quality Line.

Integration Of E-Commerce Platforms For Meat Distribution And Consumer Convenience

Online sales channels gain importance in the France Meat Market. It enables direct-to-consumer sales of fresh and packaged meats. Consumers enjoy flexible delivery schedules and doorstep convenience. Retailers develop digital platforms to expand market reach. Mobile applications provide product information and traceability. E-commerce adoption increases accessibility in suburban and rural areas. It supports smaller producers in reaching larger audiences. Subscription-based models attract loyal customers. The trend reshapes traditional meat distribution networks.

Expansion Of Ready-To-Cook And Value-Added Meat Products In Retail Channels

Consumers show strong preference for convenience and innovation in meat offerings. It promotes development of marinated, seasoned, and portioned products. Retailers enhance in-store displays to attract attention. Packaging improvements ensure freshness and longer shelf life. Ready-to-cook items reduce meal preparation time. The market sees collaboration between producers and foodservice providers. It benefits from product innovation to match evolving consumer tastes. New flavors and regional specialties gain popularity. Market differentiation increases overall competitiveness.

- For example, Heura launched a travelling plant-based butcher shop at E-Leclerc hypermarkets in France in May 2024. The pop-up showcased vegan burgers, mince, nuggets, and ham slices, supported by chef demonstrations, and the brand already reached 1,500 points of sale in France with 2 million products sold in 2023.

Growing Focus On Sustainability And Traceability Influencing Production Practices

Producers respond to consumer demand for environmentally responsible meat production. It invests in traceable supply chains for quality assurance. Sustainable practices reduce waste and energy consumption. Consumers value transparency regarding origin and production methods. Certifications for organic and responsibly raised meat gain prominence. Retailers highlight sustainability through labeling and marketing campaigns. The France Meat Market aligns production practices with environmental regulations. It benefits from increased consumer confidence in verified products. Ethical sourcing strengthens brand reputation and market acceptance.

Market Challenges Analysis

Increasing Production Costs And Raw Material Price Volatility Affecting Market Stability

The France Meat Market faces challenges from rising feed and livestock costs. It experiences margin pressure due to fluctuating raw material prices. Energy and transportation costs further impact profitability. Producers struggle to maintain competitive pricing while ensuring quality. Market consolidation creates pressure on smaller players. Compliance with strict regulations adds operational expenses. Consumers may shift to alternative proteins during price spikes. It demands strategic planning to manage cost volatility. Sustainable sourcing increases production complexity.

Changing Consumer Preferences And Health Awareness Creating Market Uncertainties

The market contends with evolving dietary trends and reduced meat consumption. It experiences rising demand for plant-based protein alternatives. Public perception of meat-related health risks influences buying behavior. Consumers increasingly scrutinize nutritional content and origin. Market adaptation requires investment in new product lines. Retailers face challenges in balancing traditional and alternative offerings. It must address sustainability and ethical concerns to maintain loyalty. Marketing strategies evolve to retain consumer trust. Competitive pressure intensifies due to diversified diet preferences.

Market Opportunities

Expansion Of Premium, Organic, And Free-Range Meat Products To Capture Health-Conscious Segments

The France Meat Market has opportunities in catering to premium and organic segments. It can develop value-added products targeting health-conscious consumers. Retailers can introduce specialty lines highlighting quality and traceability. Growing urban populations create demand for convenient, high-quality options. Partnerships with local farms enhance brand credibility and authenticity. The market can leverage certifications to build consumer trust. E-commerce platforms enable direct access to niche segments. It benefits from rising willingness to pay for ethical and sustainable meat.

Investment In Technology And Innovative Distribution Models To Strengthen Market Reach

Producers and retailers can adopt advanced processing and cold chain technologies. It ensures consistent quality and extended shelf life. E-commerce and subscription services provide new sales channels. Innovative packaging attracts attention and enhances convenience. Investment in traceability systems boosts transparency and trust. Market expansion can focus on regional specialties and local flavors. It supports smaller producers in scaling operations effectively. Strategic technology adoption positions the market for long-term growth.

Market Segmentation Analysi

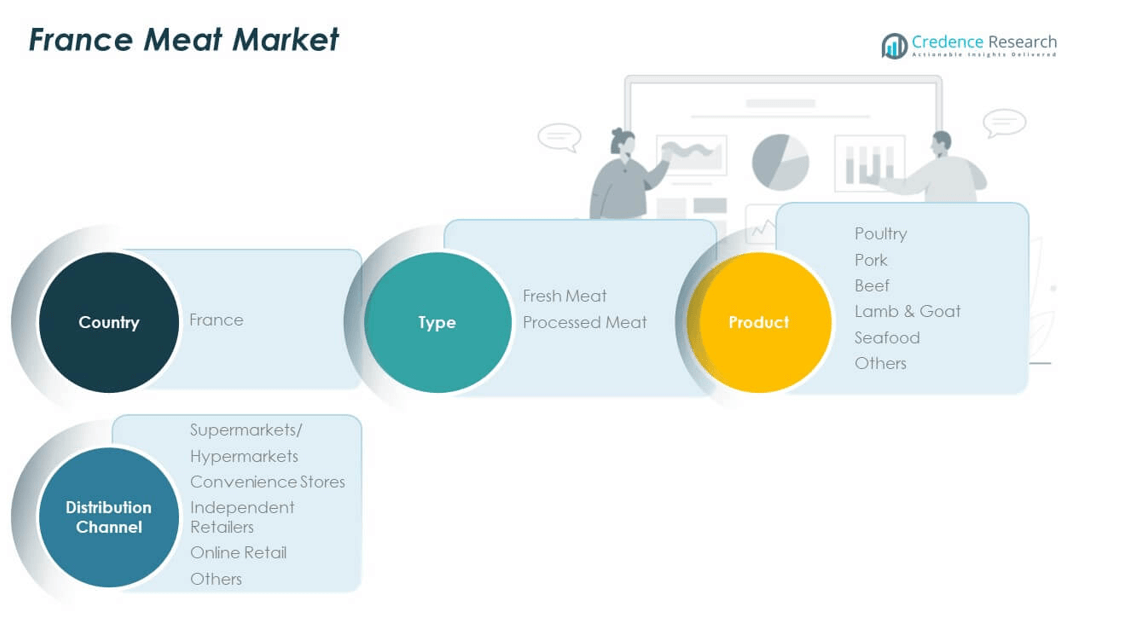

By Type

The France Meat Market is segmented into fresh and processed meat. Fresh meat dominates due to strong consumer preference for natural and unprocessed products. It benefits from cultural reliance on traditional cooking and local sourcing. Processed meat maintains a steady share through packaged, cured, and ready-to-eat options. Increasing demand for convenience and extended shelf life sustains its relevance. Producers diversify product lines to meet shifting consumer habits. Both segments rely on traceability and strict safety regulations.

By Product

Poultry holds the largest share, driven by affordability and versatility in French cuisine. Pork remains significant due to traditional consumption patterns across households and foodservice. Beef maintains premium status, supported by demand for steaks and specialty cuts. Lamb and goat appeal to regional cuisines, especially in southern France. Seafood is gaining ground with rising health awareness and Mediterranean diets. The “Others” category, including game and niche meats, targets specialized consumer groups. The France Meat Market grows through a balanced product portfolio.

- For example, Marel supplies poultry processing lines capable of handling up to 15,000 birds per hour, a benchmark officially documented in its product portfolio. The company’s high-speed systems are used by leading European processors to achieve efficient, automated portioning and deboning at industrial scale.

By Distribution Channel

Supermarkets and hypermarkets dominate distribution, offering wide assortments and competitive pricing. Convenience stores capture urban demand through ready-to-cook and packaged products. Independent retailers remain relevant in rural areas, appealing to loyalty and freshness. Online retail is expanding, offering traceability, subscription services, and home delivery. The “Others” channel includes specialty butchers and farmers’ markets, adding premium value. It benefits from diversified retail strategies and evolving consumer shopping habits. Distribution remains a critical growth driver across segments.

- For example, Chronofresh, a subsidiary of Chronopost, operates France’s largest temperature-controlled last-mile food delivery network. The service guarantees 24-hour nationwide delivery with continuous temperature monitoring, ensuring the safe transport of fresh and perishable products.

Segmentation

By Type

- Fresh Meat

- Processed Meat

By Product

- Poultry

- Pork

- Beef

- Lamb & Goat

- Seafood

- Others

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Retail

- Others

By Country

Regional Analysis

Western France

Western France holds the largest share of the France Meat Market, accounting for 34% of total sales. The region benefits from a strong agricultural base and advanced processing facilities. It shows high consumption due to urban hubs such as Nantes and Rennes. Consumers in this region prefer fresh and locally sourced meat products. Supermarkets dominate the distribution channels, supported by strong logistics networks. It continues to expand through premium meat offerings and sustainable farming practices. Western France sets the benchmark for quality standards across the market.

Northern and Eastern France

Northern and Eastern France collectively capture 28% of the France Meat Market. The regions experience demand growth due to dense populations and industrial meat processing units. Consumers show rising preference for processed and packaged meat. Traditional culinary practices sustain steady pork and beef consumption. Independent retailers and convenience stores contribute significantly to distribution. It strengthens its position through investments in modern slaughterhouses and traceability systems. Rising consumer demand for convenience products supports regional competitiveness.

Southern and Central France

Southern and Central France together account for 22% and 16% of the France Meat Market respectively. Southern France shows strong demand for lamb, goat, and specialty meats driven by regional cuisines. The presence of tourism hubs such as Marseille increases demand in foodservice channels. Central France maintains traditional consumption patterns but is adapting to packaged and organic meat offerings. Consumers in both regions show growing interest in sustainable and organic options. It benefits from government programs supporting local farmers. Rising urbanization and premium product adoption continue to reshape these subregional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bigard Group

- Cooperl Arc Atlantique

- Terrena

- LDC Group (L.d.c. S.a.)

- Sicarev

- Elivia

- Fleury Michon S.A.

- Virbac S.A.

- Socopa Viandes

- Jean Floc’h

Competitive Analysis

The France Meat Market demonstrates a concentrated structure led by established players such as Bigard Group, Cooperl Arc Atlantique, Terrena, LDC Group, Sicarev, and Fleury Michon. These companies dominate due to integrated supply chains, advanced processing capabilities, and strong relationships with supermarkets and foodservice providers. It remains competitive through product differentiation, focusing on premium, organic, and traceable meat offerings. Firms invest in sustainability programs and certifications to align with consumer expectations. Strategic mergers, acquisitions, and product launches help major players secure market share and expand geographically. Emerging regional companies challenge incumbents by targeting niche segments such as free-range and specialty meats. Strong competition ensures innovation in distribution models, packaging, and marketing strategies, reinforcing the dynamic nature of the market.

Recent Developments

- In May 2025, LDC Group completed the acquisition of the Pierre Martinet Group, a leading player in convenience salads and plant-based foods in France. The integration, finalized on May 28, 2025, broadens LDC’s offering in convenience and fresh food categories, positioning it with a 70% presence in supermarket and hypermarket convenience food departments.

Report Coverage

The research report offers an in-depth analysis based on Type, Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and free-range meat will increase, supported by growing health awareness.

- Sustainable production practices will gain more importance, strengthening consumer trust in meat sourcing.

- E-commerce platforms will expand their role in meat distribution, reshaping traditional retail channels.

- Processed and ready-to-cook meat products will see higher demand due to urban lifestyle changes.

- Cold chain infrastructure and logistics will improve, ensuring product safety and longer shelf life.

- Premium meat categories will capture greater attention, driven by rising disposable incomes and tourism.

- Regional cuisines and specialty meats will expand their influence, creating niche growth segments.

- Technological innovations in packaging and preservation will enhance product quality and differentiation.

- Leading companies will increase investments in sustainability certifications and traceability systems.

- Competitive dynamics will intensify, with both established firms and smaller players targeting innovation.