Market Overview:

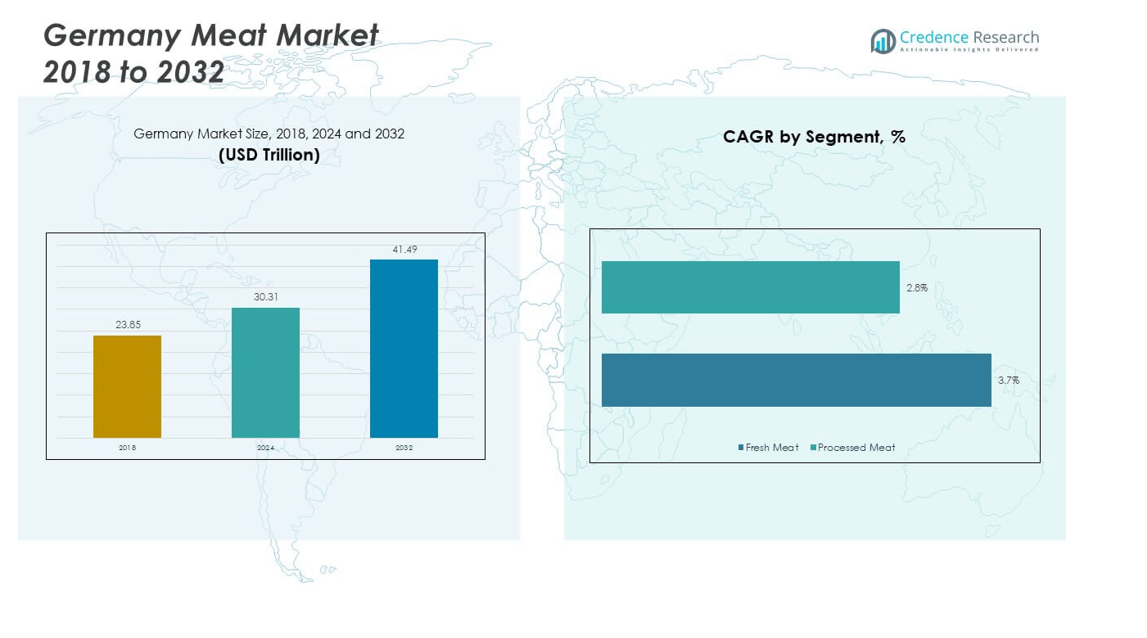

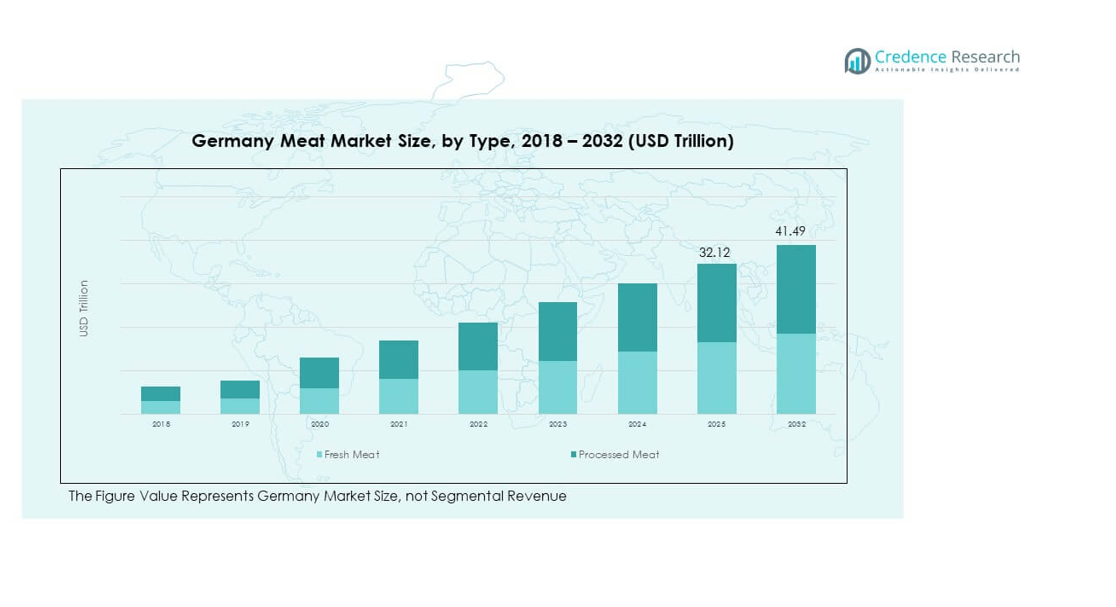

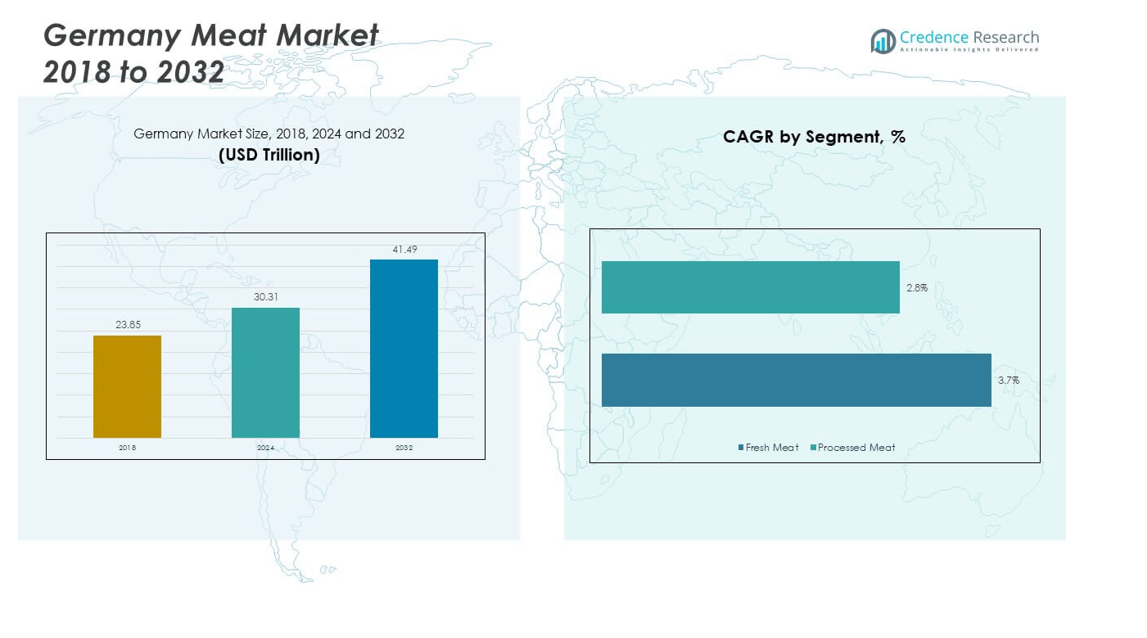

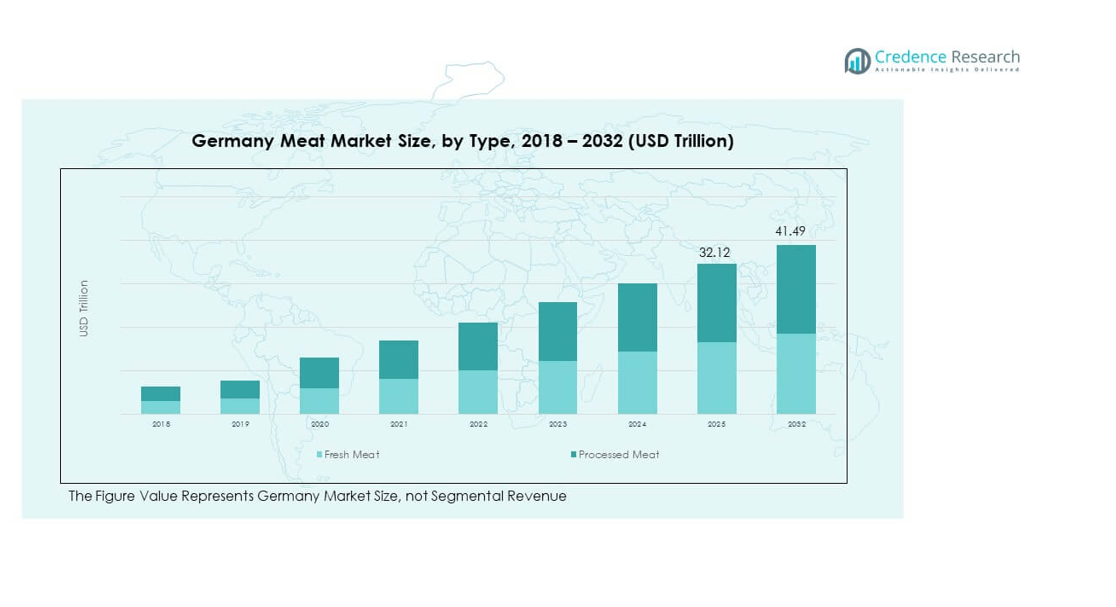

The Germany Meat Market size was valued at USD 23.85 million in 2018 to USD 30.31 million in 2024 and is anticipated to reach USD 41.49 million by 2032, at a CAGR of 3.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Meat Market Size 2024 |

USD 30.31 million |

| Germany Meat Market, CAGR |

3.72% |

| Germany Meat Market Size 2032 |

USD 41.49 million |

The market grows steadily, driven by rising protein demand across pork, poultry, and beef categories. Consumers prefer fresh and processed formats, with strong adoption of ready-to-cook and convenience products. Retail modernization enhances product availability, while foodservice expansion boosts volumes through quick-service outlets. Regulations enforcing welfare and traceability improve consumer trust. Producers invest in cold-chain logistics, automation, and packaging innovation to stabilize supply. Sustainability initiatives such as waste reduction and eco-friendly plants further support industry resilience. It strengthens the overall consumption and production ecosystem.

Northern and Western Germany lead the market due to concentrated livestock farming and advanced processing infrastructure. Lower Saxony and North Rhine-Westphalia dominate with major slaughterhouses and logistics corridors. Southern states, particularly Bavaria and Baden-Württemberg, focus on premium and welfare-certified meat with strong regional branding. Eastern Germany emerges as a growing hub supported by modern facilities and improved distribution networks. Neighboring EU partners, including Denmark and the Netherlands, reinforce trade integration through imports and exports. It reflects a market shaped by regional strengths, traditional farming practices, and growing modernization across new production zones.

Market Insights

- The Germany Meat Market size was valued at USD 23.85 million in 2018, reached USD 30.31 million in 2024, and is projected to hit USD 41.49 million by 2032, growing at a CAGR of 3.72%.

- Northern and Western Germany hold 45% share, driven by strong livestock farming and advanced processing, while Southern Germany accounts for 30% with premium and welfare-certified products, and Eastern Germany contributes 25% through modernized facilities.

- Eastern Germany is the fastest-growing subregion with 25% share, supported by infrastructure upgrades, new processing units, and competitive production costs.

- Fresh meat dominates with 60% share, reflecting consumer preference for traditional cuts and everyday cooking practices.

- Processed meat represents 40% share, fueled by demand for ready-to-eat formats, convenience, and extended shelf life.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Protein Consumption Across Multiple Demographics

The Germany Meat Market benefits from strong protein demand across age groups and lifestyles. Households prioritize fresh pork, poultry, and beef to support daily nutrition. Consumers focus on high-quality protein sources as part of balanced diets. The demand strengthens through retail and foodservice outlets offering diverse product formats. Growing urban populations prefer convenient portions, expanding packaged and ready-to-cook offerings. Foodservice recovery enhances consumption through fast food and casual dining categories. Local supply chains ensure consistent availability to meet dietary needs. It reinforces long-term stability in domestic consumption volumes.

Expansion of Retail Channels and Strengthened Supply Chains

Retail modernization supports steady growth in the Germany Meat Market through expanded hypermarkets and discounters. Private labels deliver affordable and consistent quality for households, increasing trust. Major chains invest in advanced cold-chain facilities to ensure freshness and safety. Automated processing units stabilize output and reduce labor dependence. Strong distribution logistics improve product availability across both urban and rural locations. Enhanced packaging technologies extend shelf life and reduce wastage. Online grocery platforms further boost access to meat products for time-sensitive buyers. It enhances consumer confidence by ensuring reliability and convenience.

- For instance, METRO LOGISTICS operates one of Germany’s largest multi-temperature retail logistics centers in Marl, handling up to 1,000 pallets of fresh and ultra-fresh food products daily (as of 2025), with six temperature zones and overnight cross-docking to supply over 30 German regional food delivery hubs, directly supporting the nationwide distribution of both fresh meat and ready-to-eat solutions.

Government Regulations Driving Welfare and Traceability Standards

Regulatory frameworks influence the Germany Meat Market through mandatory animal welfare and traceability policies. Producers invest in upgrading farming systems to align with EU welfare laws. Stricter rules on antibiotics limit overuse and safeguard food safety. Certification programs help build transparency and attract informed buyers. Digital tracking solutions allow consumers to verify origin and handling processes. Compliance investments strengthen brand value in competitive domestic markets. Export opportunities grow as German products meet strict EU and international requirements. It drives consistent upgrades across supply and processing units.

Sustainability Goals Reinforcing Industry-Wide Adaptations

Sustainability drives innovation across the Germany Meat Market through eco-friendly practices. Producers integrate energy-efficient plants that lower carbon emissions and operating costs. Waste valorization solutions transform byproducts into value-added items. Recyclable packaging options gain adoption to address consumer concerns over plastic waste. Retailers emphasize climate-conscious labeling to influence buyer decisions. Green procurement policies favor suppliers with certified sustainability standards. Export partners prefer sustainable sourcing, enhancing Germany’s trade advantage. It strengthens resilience of the domestic industry while meeting consumer expectations for environmental accountability.

- For instance, in 2024 Vion Food Group completed installation of energy-efficient heat pumps and cooling systems at key German processing sites, reducing Scope 1 and 2 greenhouse gas emissions, and partnered with Wageningen University to transform manure into fertilizer as part of a pilot circularity program while also ensuring that 92.3% of its externally sold volume comes from sites with IFS Product Integrity Assessment (PIA) certification.

Market Trends

Increasing Preference for Premium and Organic Meat Offerings

The Germany Meat Market records rising consumer interest in premium and organic meat segments. Households prefer products free from synthetic additives and chemical preservatives. Demand for grass-fed and free-range categories strengthens in urban regions. Organic labels appeal to health-conscious consumers valuing natural production methods. Higher disposable incomes encourage spending on specialty and regional meats. Retailers expand organic meat assortments in both online and offline channels. Foodservice chains integrate premium menus to attract affluent diners. It reinforces the market’s evolution toward healthier and differentiated offerings.

- For instance, Der Grüne Weg GmbH (subsidiary of Vion Food Group) officially launched its first all-German organic pork supply chain in Thuringia in 2023, delivering pork of German origin that meets the “5 x German” criteria (birth, rearing, finishing, slaughtering, and processing all within Germany) and supplying several major German retailers. The operation relies on a network of approximately 110 farmers supplying 2,300 organic pigs weekly to meet rising demand for certified organic meat.

Shift Toward Plant-Based Alternatives and Hybrid Proteins

The Germany Meat Market adapts to consumer interest in plant-based substitutes and hybrid proteins. Flexitarian diets gain momentum, reducing per-capita traditional meat intake. Blended meat products with plant ingredients balance taste and sustainability goals. Manufacturers diversify portfolios to capture both meat and alternative protein demand. Younger demographics experiment with hybrid offerings available in retail chains. Foodservice menus integrate alternative proteins alongside conventional categories. Marketing strategies highlight sustainability and nutritional benefits of blended products. It creates competition but also new avenues for category expansion.

Technological Integration in Processing and Packaging Operations

The Germany Meat Market advances through adoption of digital and automated systems in processing plants. Robotics improve efficiency and consistency in cutting and deboning tasks. Sensor-based monitoring ensures quality and compliance with hygiene standards. Smart packaging solutions extend shelf life with vacuum-sealed and modified-atmosphere formats. Digital labeling provides detailed product information and strengthens consumer trust. Blockchain-based platforms enable full supply chain transparency. Automation reduces production downtime while ensuring cost control. It enhances overall competitiveness by combining efficiency with higher safety standards.

- For instance, robotic automation from Stäubli such as the TX2-160 HE series has been deployed at multiple German meat processing plants, like in Heilbronn, where the robots handle pre-cutting, deboning, packaging, and intralogistics with autonomous guided vehicles and 3D vision systems for identifying bone positions. This robotics enable hygienic handling, precise cutting, and efficient sealing of thermoformed trays, improving throughput and reducing manual intervention.

E-Commerce Growth and Direct-to-Consumer Meat Delivery Models

The Germany Meat Market experiences growth through expanding e-commerce channels. Online platforms provide wider access to fresh and frozen meat assortments. Subscription services deliver pre-portioned and curated boxes to households. Cold-chain logistics investments ensure safety and freshness during transport. Niche platforms highlight regional specialties and premium cuts. Younger consumers embrace digital platforms for convenience and product variety. Retailers integrate digital loyalty programs to strengthen customer engagement. It accelerates distribution reach while diversifying sales channels beyond traditional retail outlets.

Market Challenges Analysis

Rising Pressure from Environmental Concerns and Dietary Shifts

The Germany Meat Market faces challenges from rising environmental debates around livestock farming. Climate-conscious consumers limit meat intake due to emissions from large-scale production. Plant-based diets reduce growth potential in traditional meat categories. NGOs pressure producers with campaigns against intensive farming practices. Regulatory discussions intensify on carbon taxes and emission reduction targets. Producers struggle to balance cost control with sustainability compliance. Shifts in eating habits influence younger demographics more strongly than older groups. It forces adaptation while pressuring margins across supply chains.

Volatility in Input Costs and Supply Chain Disruptions

The Germany Meat Market encounters risks from rising feed and energy costs. Volatile commodity prices strain profitability for livestock farmers. Energy-intensive slaughterhouses and processors face cost fluctuations impacting pricing. Global supply chain issues affect imports of feed and packaging materials. Disease outbreaks among livestock disrupt supply consistency in certain states. Retail pricing pressures discourage full pass-through of costs to consumers. Export competitiveness weakens when input volatility reduces stability in output volumes. It creates long-term uncertainty requiring financial resilience and flexible sourcing strategies.

Market Opportunities

Expanding Scope for Value-Added and Convenience Meat Products

The Germany Meat Market offers strong opportunities in value-added segments. Consumers prefer ready-to-cook, marinated, and pre-seasoned portions for quick meals. Retailers expand assortments of easy-to-use packaged products. Growing urban populations with limited cooking time drive consistent demand. Foodservice channels leverage value-added items to optimize preparation efficiency. Producers invest in innovation to introduce new flavors and cuts. Modern packaging extends shelf life, supporting retail expansion. It creates strong margins while diversifying revenue streams beyond traditional fresh categories.

Opportunities in Export Growth and Sustainable Brand Positioning

The Germany Meat Market benefits from export growth opportunities within the EU and global markets. Premium and welfare-certified products gain traction among foreign buyers. Producers highlight traceability and animal welfare to strengthen brand equity. Sustainability positioning improves competitiveness against lower-cost imports. Strategic trade agreements expand access to emerging destinations. Global demand for high-quality processed meats opens new pathways. German suppliers leverage advanced production and compliance standards as differentiators. It enhances long-term growth potential while aligning with evolving global preferences.

Market Segmentation Analysis

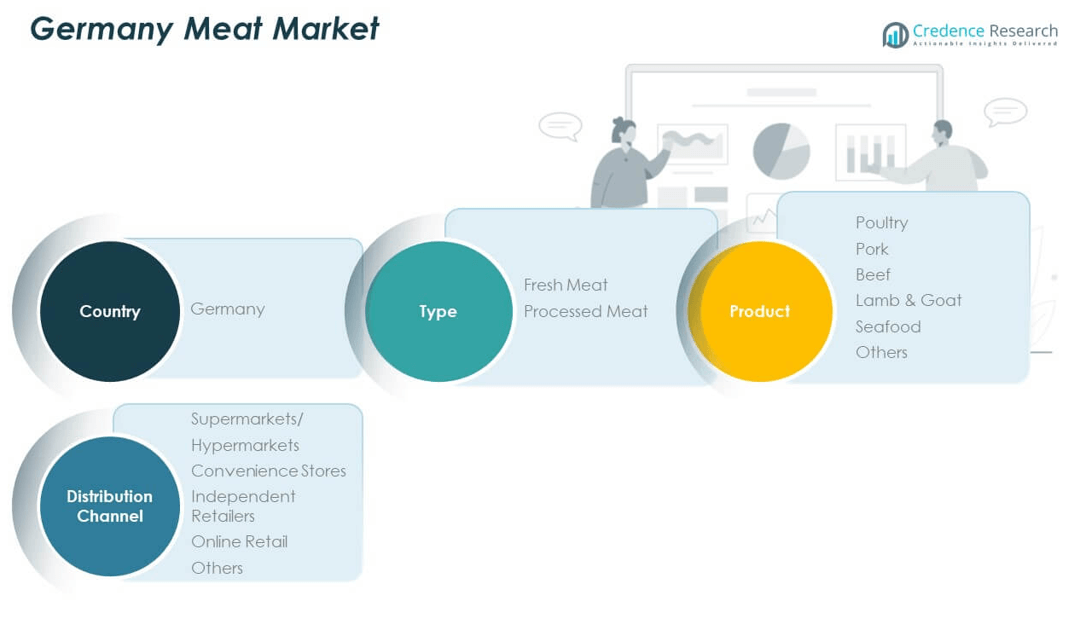

By Type, the Germany Meat Market divides into fresh meat and processed meat. Fresh meat remains dominant, supported by consumer preference for traditional cuts and daily cooking. Processed meat shows steady growth, driven by demand for convenience, ready-to-eat meals, and longer shelf life products. It gains traction among urban households and foodservice operators seeking efficiency.

- For instance, Vion Food Group undertook its “Change that Matters” operational transformation, delivering €90 million in annual savings through site automation and portfolio optimization at German facilities—this helped maintain stable throughput despite sector headwinds in 2024–2025. Processed meat shows steady growth, driven by demand for convenience, ready-to-eat meals, and longer shelf life products.

By Product, pork holds the leading position in the Germany Meat Market, reflecting strong domestic production and cultural preference. Poultry records consistent growth, favored for affordability, versatility, and healthier perception. Beef maintains a significant share through premium and specialty categories. Lamb and goat contribute on a smaller scale, appealing to niche consumers. Seafood strengthens with imports and rising health awareness, while others include specialty and regional meat varieties supporting diversity.

By Distribution Channel, supermarkets and hypermarkets lead the Germany Meat Market due to wide product assortments and strong retail penetration. Convenience stores remain relevant for small pack purchases in urban locations. Independent retailers maintain customer loyalty through regional products and personalized service. Online retail grows quickly, supported by digital adoption and cold-chain advancements. Others, including specialty butcher shops, contribute to premium and organic offerings. It demonstrates a balanced network where modern and traditional channels coexist to meet varied consumer needs.

- For instance, REWE Group opened Europe’s largest computer vision-based supermarket in Hamburg in July 2024, utilizing Trigo’s technology across over 20,000 items including meat, with all purchases tracked via AI-powered smart cameras and four payment modes. Convenience stores remain relevant for small pack purchases in urban locations.

Segmentation

By Type

- Fresh Meat

- Processed Meat

By Product

- Poultry

- Pork

- Beef

- Lamb & Goat

- Seafood

- Others

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Retail

- Others

Regional Analysis

Northern and Western Germany

Northern and Western regions dominate the Germany Meat Market with nearly 45% share. Lower Saxony and North Rhine-Westphalia lead due to dense livestock farming and advanced processing infrastructure. These regions host major slaughterhouses and distribution hubs that supply both domestic and export channels. Strong logistics corridors enhance product movement across supermarkets and foodservice outlets. Investments in cold-chain facilities strengthen efficiency and food safety. It remains the core hub of production, supported by large-scale farms and established retail networks.

Southern Germany

Southern Germany accounts for nearly 30% of the Germany Meat Market, with Bavaria and Baden-Württemberg as key contributors. Bavaria’s beef and pork farming traditions ensure a strong regional identity for premium products. Baden-Württemberg emphasizes high-quality, animal-welfare-focused production that supports specialty and organic categories. The region benefits from strong consumer preference for regional labels in local retail. Export activities also rely on these states for high-value cuts. It strengthens its position through quality branding and consumer loyalty.

Eastern Germany

Eastern Germany represents nearly 25% share of the Germany Meat Market, with Saxony-Anhalt, Brandenburg, and Thuringia emerging as growth corridors. These states invest in modern processing plants and integrated farming systems. Improved highway and rail infrastructure supports efficient distribution into national supply chains. Lower production costs attract new investments in poultry and pork facilities. The region’s rising role strengthens its share in domestic supply and EU exports. It reflects long-term growth potential driven by modernization and infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tönnies

- PHW Group

- Westfleisch

- Vion Food Germany

- Rothkötter Group

- Heristo AG

- Danish Crown Germany

- Müller Fleisch GmbH

- Edeka Südwest Fleisch

- OSI Group

Competitive Analysis

The Germany Meat Market remains highly consolidated, with leading companies controlling significant shares. Tönnies dominates with strong capacities in pork and beef, supported by extensive processing plants. PHW Group focuses on poultry, leveraging integrated supply chains and growing export reach. Westfleisch and Vion Food Germany strengthen their position through cooperative structures and diversified product portfolios. Rothkötter Group expands capacity in poultry processing, while Heristo AG emphasizes branded convenience and processed offerings. Danish Crown Germany maintains competitiveness through premium and welfare-certified products. Regional players like Müller Fleisch GmbH and Edeka Südwest Fleisch add value through localized strategies and private labels. OSI Group contributes with global scale and partnerships with fast-food chains. It remains a competitive landscape shaped by scale, efficiency, and strategic product diversification.

Recent Developments

- In June 2025, The Premium Food Group acquired The Family Butchers, a German sausage and ham producer. This move serves as a strategic partnership aimed at stabilizing The Family Butchers amid challenging market dynamics. As part of the agreement, The Family Butchers will be separated from its previous owner, InFamily Foods Holding, with The Premium Food Group taking over shares previously held by Hans-Ewald Reinert. The transaction still requires approval from local antitrust authorities.

- In September 2024, Vion Food Group reached a principal commercial agreement with Tönnies Group for the acquisition of most of Vion’s German beef activities. This transaction involves the transfer of several major facilities, including beef operations in Buchloe, Crailsheim, and Waldkraiburg, as well as associated deboning and hide processing sites.

Report Coverage

The research report offers an in-depth analysis based on Type, Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany Meat Market will continue expanding through rising consumer demand for convenient and value-added products.

- Sustainability will remain central, with stricter regulations and eco-friendly practices shaping long-term operations.

- Premiumization will increase, as consumers prioritize organic, grass-fed, and welfare-certified categories.

- Digital platforms will strengthen direct-to-consumer sales and reshape distribution strategies across the country.

- Export growth will gain momentum, supported by compliance with EU standards and high-value product categories.

- Plant-based and hybrid proteins will intensify competition, encouraging diversification of product portfolios.

- Investments in automation and digital traceability will enhance efficiency and consumer trust in supply chains.

- Regional differentiation will deepen, with Southern states focusing on quality branding and Northern hubs on scale.

- Retail dominance will expand through supermarkets, discounters, and private labels strengthening customer loyalty.

- Long-term growth will depend on balancing cost management with environmental accountability and consumer expectations.