Market Overview:

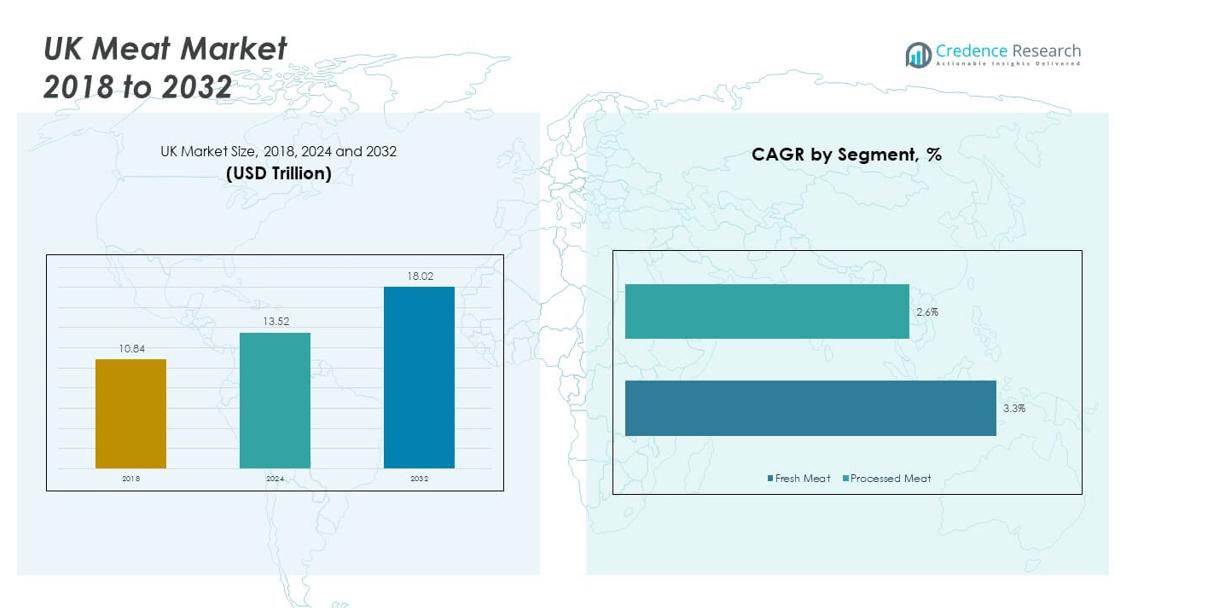

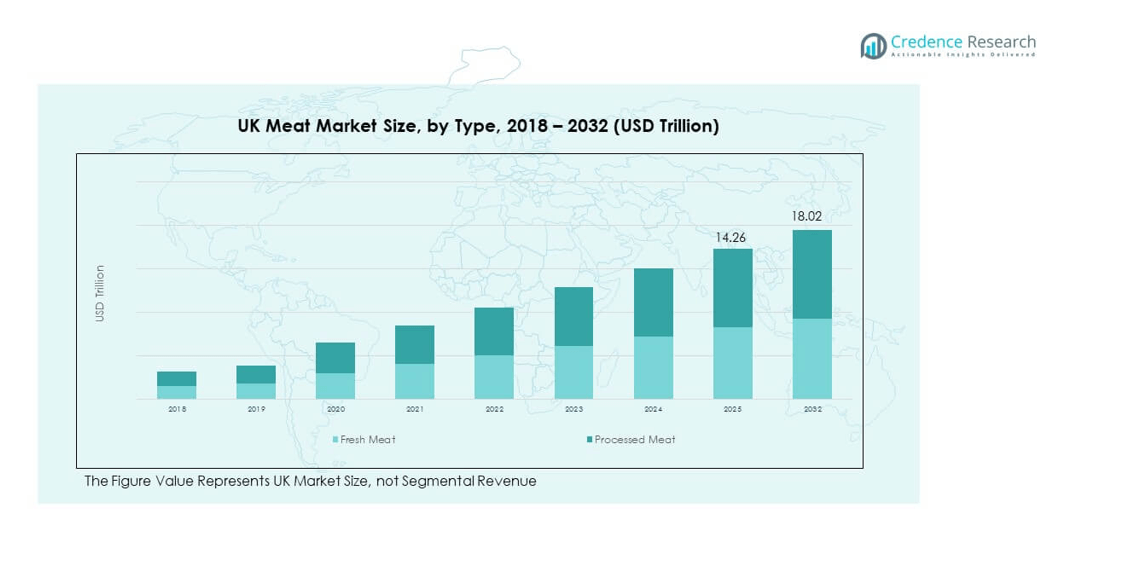

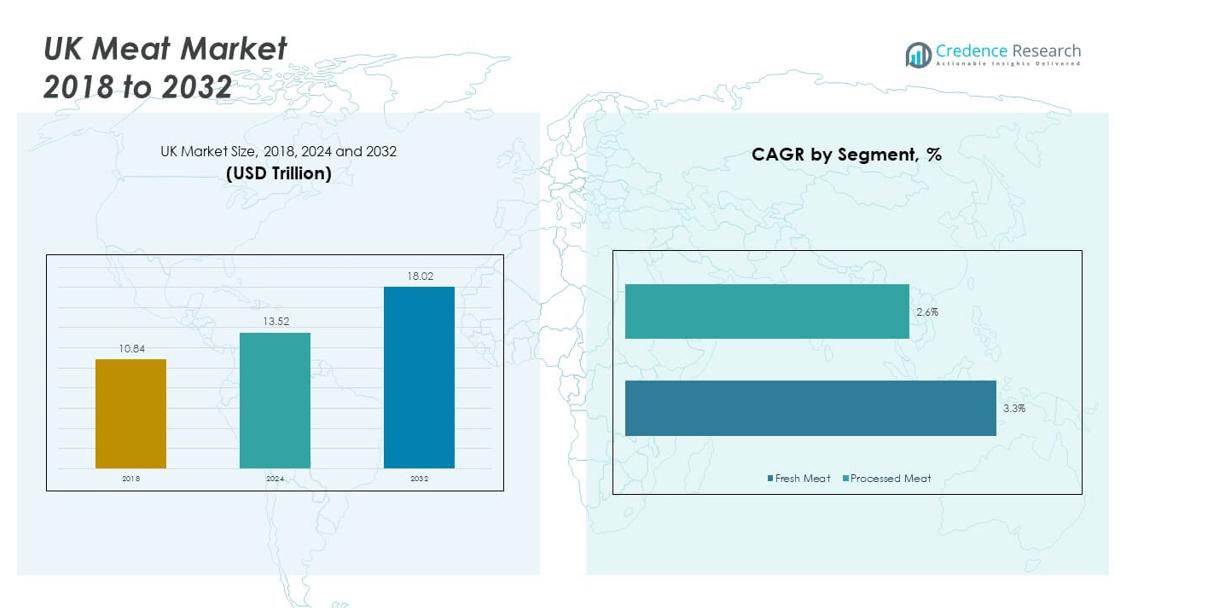

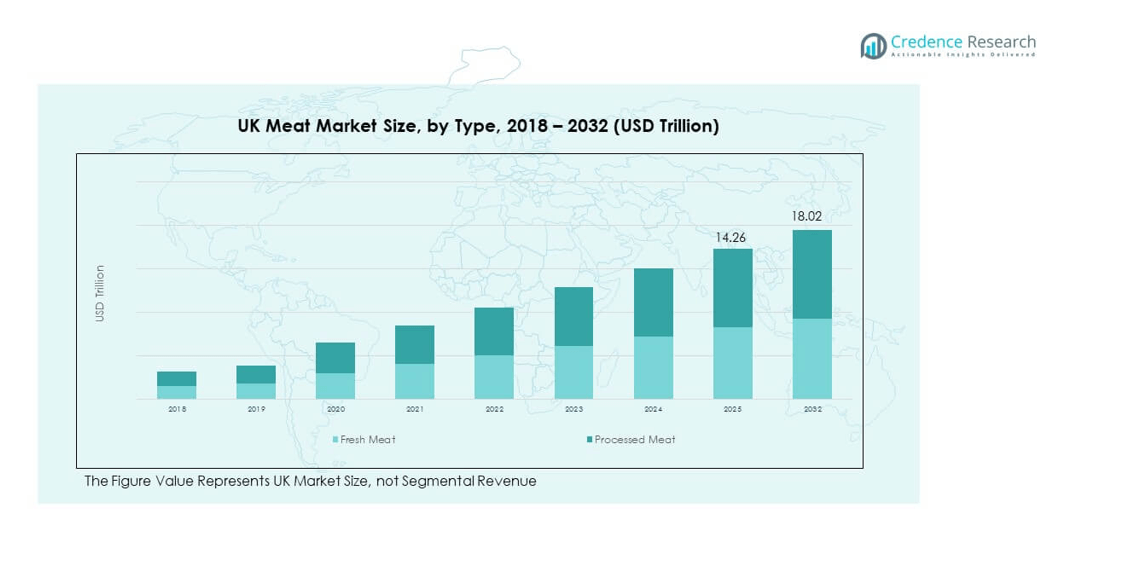

The UK Meat Market size was valued at USD 10.84 million in 2018 to USD 13.52 million in 2024 and is anticipated to reach USD 18.02 million by 2032, at a CAGR of 3.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Meat Market Size 2024 |

USD 13.52 million |

| UK Meat Market, CAGR |

3.40% |

| UK Meat Market Size 2032 |

USD 18.02 million |

The UK Meat Market is driven by rising consumer demand for protein-rich diets and evolving food habits. Growing popularity of fresh and processed meat products supports expansion across retail and foodservice channels. Premiumization trends highlight demand for high-quality cuts, while convenience-driven lifestyles increase sales of ready-to-cook and marinated products. Sustainability and animal welfare standards influence purchasing decisions, encouraging producers to adopt traceable and eco-friendly practices. Innovation in packaging and product diversification strengthens consumer trust and broadens market appeal.

Regionally, England leads the UK Meat Market with strong retail infrastructure, high household consumption, and large-scale foodservice demand. Scotland holds a strong position with premium beef and lamb production supported by strict quality standards and branding. Wales and Northern Ireland contribute through lamb, beef, and pork categories, benefiting from cultural preferences and export activities. Emerging growth is visible in rural and semi-urban areas where convenience formats and online retail are gaining traction. Regional diversity ensures balanced growth across domestic and international demand.

Market Insights

- The UK Meat Market size was valued at USD 10.84 million in 2018, increased to USD 13.52 million in 2024, and is anticipated to reach USD 18.02 million by 2032, at a CAGR of 3.40%.

- England held the largest share at 58% due to strong retail infrastructure and household consumption, followed by Scotland at 22% with premium beef and lamb, and Wales/Northern Ireland together at 20% supported by pork and lamb production.

- The fastest-growing region is Scotland with its 22% share, driven by premium branding of beef and lamb and strong global demand for high-quality exports.

- By type, fresh meat accounted for 64% of the UK Meat Market in 2024, while processed meat held 36%, reflecting growing demand for convenience and marinated formats.

- By distribution, supermarkets and hypermarkets commanded 46% of the market, convenience stores held 22%, independent retailers captured 15%, online retail reached 12%, and others accounted for 5%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Consumer Preference for High Protein and Nutrient-Dense Food Products

The UK Meat Market is driven by the rising importance of protein-rich diets among consumers. People are becoming more aware of the nutritional benefits of meat in supporting muscle growth and overall health. Demand for poultry, beef, and pork has increased across both retail and foodservice channels. Producers are focusing on meeting this requirement by improving product quality and safety standards. Shifts in consumer purchasing habits also reflect preference for premium cuts and convenient options. Marketing campaigns highlight the value of natural protein sources compared to plant alternatives. The widespread appeal of meat in daily meals sustains its relevance. It continues to strengthen its role as a vital part of modern diets.

- For instance, The Compleat Food Group launched Meateors, a ready-to-eat pork meatball snack in October 2024, each 50g bag naturally containing 9g of protein, distributed in Morrisons Daily and SPAR stores to address demand for portable, protein-rich meat snack options.

Expansion of Convenience and Ready-to-Cook Meat Products in Urban Areas

Urbanization and busier work schedules have pushed demand for ready-to-cook and processed meat. Consumers prefer quick-preparation items that fit into fast-paced lifestyles without compromising quality. The UK Meat Market benefits from investments in packaging that ensures extended shelf life. Retailers expand their portfolios with marinated and pre-seasoned cuts to meet growing demand. Supermarkets highlight grab-and-go meat offerings to attract time-conscious buyers. E-commerce platforms also distribute fresh meat through cold-chain logistics. The popularity of ready meals supports steady growth for packaged meat formats. It ensures producers adapt to evolving consumer needs across urban and semi-urban areas.

Focus on Sustainability and Responsible Meat Production Practices

Sustainability has become a key driver shaping consumption behavior in the UK. The UK Meat Market experiences rising pressure from consumers seeking traceability and ethical sourcing. Producers introduce carbon footprint labeling and animal welfare certifications to build trust. Companies adopt greener packaging solutions that reduce environmental impact. Government regulations also encourage sustainable farming practices and responsible meat production. Retailers highlight products with clear environmental credentials to capture attention. These factors align with the preference for transparency in food systems. It positions meat producers as responsible contributors to long-term ecological balance.

Rising Role of Innovation and Value-Added Meat Products in Retail Markets

Innovation supports market growth by bringing diverse, value-added meat products to consumers. Producers invest in developing new flavors, cuts, and cooking formats. The UK Meat Market benefits from high demand for gourmet and premium options. Ready-to-eat and portion-controlled packs attract younger demographics and single households. Foodservice outlets rely on innovative cuts to provide menu variety. Technological advancements in preservation and cold storage enhance product longevity. Investments in automation improve efficiency and reduce labor dependency in processing. It ensures consistent supply while aligning with rising consumer expectations.

- For example, in 2025, OAL Group deployed its AI-powered APRIL™ Eye system at Ilchester Cheese, boosting line capacity by 50% and reducing traceability checks from hours to just 15 minutes. The automation eliminated labeling errors and improved both efficiency and food safety standards.

Market Trends

Adoption of Digital Platforms for Fresh Meat Retail Distribution

The retail landscape is shifting toward digital channels for meat sales. Online platforms expand accessibility for consumers seeking fresh meat delivered at home. The UK Meat Market leverages digital platforms to enhance direct-to-consumer engagement. Subscription-based services for meat boxes gain popularity among households. Mobile apps provide tracking for product sourcing and delivery times. Retailers use technology to showcase transparency in quality and freshness. E-commerce ensures convenience while reaching regions beyond urban areas. It demonstrates how technology adoption shapes modern consumer purchasing patterns.

Premiumization and Growing Appeal of Specialty Meat Varieties

Consumers are showing preference for gourmet and specialty meats with unique qualities. Premiumization is influencing both retail and restaurant offerings. The UK Meat Market reflects demand for organic, grass-fed, and free-range meats. Specialty imports like Wagyu beef and Iberico pork gain attention in urban centers. Chefs and restaurants highlight premium cuts to attract affluent customers. Rising disposable income drives adoption of higher-value meat products. Retailers expand luxury meat sections in supermarkets to cater to niche buyers. It emphasizes the role of premiumization in shaping growth trajectories.

- For example, Waitrose sells a premium No.1 range of British wagyu beef products, sourced from pedigree Wagyu bulls. All products in this range are graded a minimum of 6 on the Beef Marbling Scale (BMS), with the score transparently displayed on the packaging for customers. The retailer offers a variety of wagyu cuts and products within this line.

Integration of Health and Wellness Positioning into Meat Marketing

Health-conscious consumers are seeking meat products with added functional benefits. Producers market lean cuts and low-fat options to appeal to wellness-focused buyers. The UK Meat Market highlights health-driven messaging in promotions and branding. Products enriched with omega-3 and fortified nutrients are expanding on shelves. Clear labeling about calories and fat content attracts informed shoppers. Restaurants include healthy meat choices to align with fitness trends. Brands position meat as part of balanced diets instead of indulgence. It strengthens consumer confidence in meat as a health-supporting choice.

- For example, in 2025, Marks & Spencer expanded its “High Protein” and “Count on Us (COU)” ranges with new prepared meals, including the Naked Green Goddess Chicken Salad offering 39g of protein and under 375 kcals per portion. The launch emphasized omega-3 DHA and low sugar options to appeal to health-conscious consumers.

Influence of Global Culinary Trends on Domestic Meat Consumption

Global cuisines are impacting household and restaurant-level consumption patterns. The UK Meat Market experiences demand for meat suited to international recipes. Dishes inspired by Asian, Mediterranean, and Latin American cuisine drive variety. Retailers introduce spice blends and marinades to cater to diverse tastes. Street food trends increase consumption of smaller, flavorful meat portions. Migration influences cultural meat preferences across communities. Foodservice outlets adapt menus to match global consumer expectations. It illustrates how culinary diversity plays a pivotal role in driving meat innovation.

Market Challenges Analysis

High Pressure from Sustainability Demands and Regulatory Compliance in Meat Processing

The UK Meat Market faces significant pressure due to strict environmental and welfare regulations. Producers must align with sustainability standards that require costly investments in equipment. Maintaining compliance with carbon reduction goals adds financial strain to processing firms. Consumer expectations for traceability demand technological upgrades in supply chains. Adopting eco-friendly packaging also raises costs for mid-sized producers. International trade disruptions further complicate sourcing of raw materials. Meeting these demands without raising consumer prices remains difficult. It reflects how sustainability creates both challenges and opportunities for the sector.

Rising Competition from Alternative Proteins and Shifting Dietary Preferences

The increasing availability of plant-based and lab-grown alternatives poses a major challenge. The UK Meat Market competes with brands promoting ethical and eco-friendly substitutes. Younger consumers are more open to experimenting with meat-free diets. Marketing campaigns by alternative protein companies influence perceptions of sustainability. Traditional producers struggle to balance retaining loyal customers and appealing to new ones. Restaurants adapt menus to include plant-based offerings, affecting meat demand. Economic pressures also push some buyers toward cheaper alternatives. It highlights how evolving diets threaten traditional consumption patterns.

Market Opportunities

Expansion of Export Opportunities in Emerging Global Markets for Meat Products

Producers in the UK can explore export channels to capture international demand. Emerging markets show rising appetite for high-quality imported meat products. The UK Meat Market can strengthen its reach through trade partnerships and certifications. Export strategies focusing on premium and specialty meats gain momentum. Government support for trade expansion provides avenues for industry players. Logistics advancements help ensure freshness across long distances. International branding enhances visibility in overseas markets. It positions UK producers to capitalize on growing global demand.

Innovation in Alternative Cuts and Specialty Processed Meat for Domestic Growth

Innovation remains a strong opportunity for producers targeting evolving consumer needs. The UK Meat Market can focus on alternative cuts, premium processing, and gourmet options. Ready-to-eat meat snacks align with demand from younger demographics. Advances in cold storage help scale nationwide distribution. Processed options like marinated cuts and portion packs address convenience needs. Collaboration with chefs creates unique retail experiences. Adoption of smart packaging ensures freshness and traceability. It strengthens domestic growth potential while addressing changing consumption preferences.

Market Segmentation Analysis

By Type

The UK Meat Market is divided into fresh meat and processed meat. Fresh meat holds a dominant position, supported by strong demand in households and foodservice outlets. Consumers value freshness, traceability, and quality standards, making it a consistent driver of sales. Processed meat shows steady growth due to rising demand for convenience, ready-to-eat, and marinated formats. It appeals to urban consumers with busy schedules, making it a fast-growing category across retail channels.

By Product

Poultry leads the market due to affordability, versatility, and preference for lean protein sources. Pork maintains a strong share, particularly in processed products and exports. Beef holds demand in both premium and mass-market categories, supported by foodservice adoption. Lamb and goat retain importance in regional and cultural consumption patterns, especially in Wales and Scotland. Seafood gains traction with health-conscious buyers seeking alternatives to red meat. Others, including specialty meats, contribute to niche and gourmet segments. The UK Meat Market benefits from this diversity, ensuring broad consumer appeal.

- For example, Moy Park, in partnership with Klöckner Pentaplast, introduced fully recycled (rPET) trays for its chicken lines, including products processed at its Anwick site. The move reduces the company’s plastic use and enhances the recyclability of its packaging, aligning with broader sustainability goals.

By Distribution Channel

Supermarkets and hypermarkets dominate distribution with extensive product availability and established supply chains. Convenience stores capture impulse and ready-to-eat purchases, particularly in urban locations. Independent retailers play an important role in offering locally sourced products and specialty cuts. Online retail expands rapidly, supported by e-commerce platforms and cold chain logistics. Others, including butchers and specialty stores, remain relevant for personalized service and regional loyalty. It ensures multiple touchpoints for consumers across diverse buying preferences.

- For example, major supermarkets, like Tesco, have an extensive and complex supply chain network that includes distribution centers for chilled products. These networks leverage technology and logistics to meet high customer demands for online and in-store fresh and chilled goods.

Segmentation

By Type

- Fresh Meat

- Processed Meat

By Product

- Poultry

- Pork

- Beef

- Lamb & Goat

- Seafood

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Independent Retailers

- Online Retail

- Others

By Country

Regional Analysis

England

England dominates the UK Meat Market with a market share of 58%. The region benefits from strong domestic consumption, advanced processing facilities, and a dense retail network. Major supermarkets and hypermarkets in London, Manchester, and Birmingham drive steady sales of both fresh and processed meats. Foodservice demand remains high, supported by restaurants and catering sectors with diverse meat offerings. Consumers in England display preference for poultry and beef due to affordability and versatility. Innovation in ready-to-cook formats also strengthens retail penetration. It continues to be the leading subregion by value and volume contribution.

Scotland

Scotland holds a 22% share of the UK Meat Market, driven by beef and lamb production. The region has a strong reputation for quality meat products supported by strict welfare and farming standards. Exports play an important role, with Scottish beef and lamb gaining premium recognition in global markets. Domestic demand is supported by tourism and hospitality, particularly in cities like Edinburgh and Glasgow. Supermarkets highlight Scottish meat products as premium categories with regional branding. Local producers emphasize sustainability and traceability to maintain consumer trust. It benefits from both domestic consumption and export opportunities.

Wales and Northern Ireland

Wales and Northern Ireland together account for 20% of the UK Meat Market. Wales is recognized for lamb production, supported by pasture-based farming methods. Northern Ireland contributes through pork and beef exports, benefiting from proximity to European markets. Retailers emphasize locally branded products to build strong regional loyalty. Foodservice outlets promote regional specialties, driving sales in hospitality and restaurants. Demand is supported by both rural household consumption and urban centers. It strengthens the overall diversity of the UK market by contributing specialized product categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The UK Meat Market is highly competitive with the presence of regional and national players. Banham Poultry, Bernard Matthews Foods, and Faccenda Foods maintain dominance in poultry production through integrated supply chains and large-scale processing. Universal Meat Company and Best Meat UK focus on processed and value-added categories that cater to growing urban demand. Grampian Country Foods and Bowyers Ltd emphasize innovation in ready-to-eat and pre-packaged meats. Ginsters leverages strong retail partnerships with convenience stores through its processed meat-based products. Vestey Foods UK Ltd and Weddel Swift Ltd strengthen their market position through international trade channels and diversified portfolios. Competition is defined by scale, product innovation, distribution strength, and brand reputation. It remains dynamic as companies expand product lines and adopt sustainability-focused strategies to align with evolving consumer expectations.

Recent Developments

- In January 2025, Cranswick plc, a major UK-based pig and poultry producer, announced the acquisition of JSR Genetics, a leading pig genetics company. This acquisition included JSR’s pig genetics and pig farming operations, significantly increasing Cranswick’s scale in indoor pig production. Cranswick stated that this move would help secure high-quality pork supplies for its customers and further advance its production efficiency and meat quality for the UK market.

- In February 2025, Meatly launched “Chick Bites”, the world’s first lab-grown meat dog treats, in collaboration with The Pack and Pets at Home. The product mixes cultivated chicken with plant-based ingredients and it began limited release in one Pets at Home location in London.

- In August 2025, Meatable, a cultivated meat technology company, completed an acquisition of the Meat Technology platform. The move aims to enhance research, development and scale-up capacity in cultivated meat technologies. The acquisition supports Meatable’s goal of accelerating production of lab-grown meat products.

Report Coverage

The research report offers an in-depth analysis based on Type, Product and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Meat Market will see steady demand as protein-rich diets continue to support consumption of poultry, beef, and pork, keeping meat central in daily meals.

- Processed and ready-to-cook meat products will expand urban retail sales, meeting consumer needs for quick preparation and convenience-driven lifestyles.

- Online retail platforms will enhance distribution efficiency, providing greater accessibility across urban and rural regions with reliable delivery and quality assurance.

- Sustainability and animal welfare standards will drive innovation in production practices, with producers adopting greener methods and certifications.

- Premiumization trends will encourage rising demand for gourmet and specialty meats, creating opportunities for value-added categories in retail and foodservice.

- International exports will strengthen revenue streams, with high-quality UK meat gaining traction in global markets for its reputation and standards.

- Automation in processing plants will improve efficiency, optimize output, and reduce operational costs for leading producers.

- Cold chain logistics investments will ensure freshness, extend shelf life, and support wider regional distribution networks.

- Regional branding will build consumer loyalty, enhancing premium positioning for meats associated with strong origin identity.

- Shifting lifestyles will drive innovation in portion-controlled, healthy, and wellness-focused meat formats tailored to new dietary needs.