Market Overview

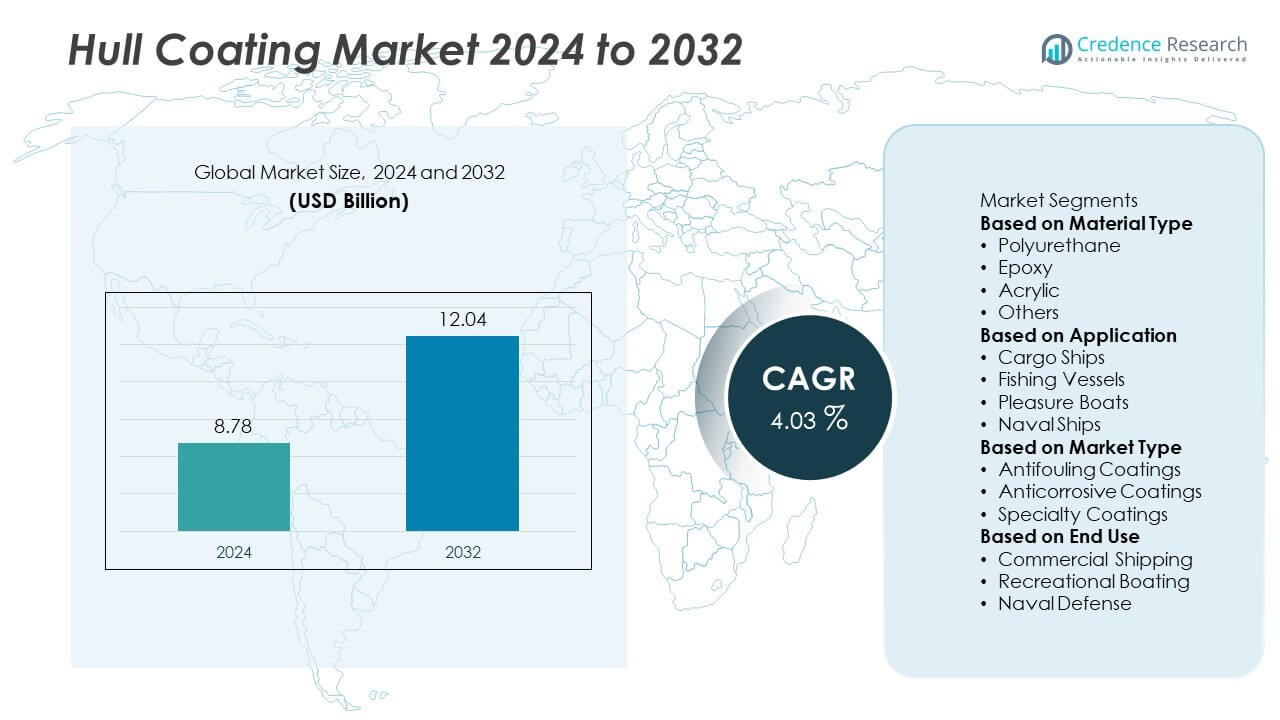

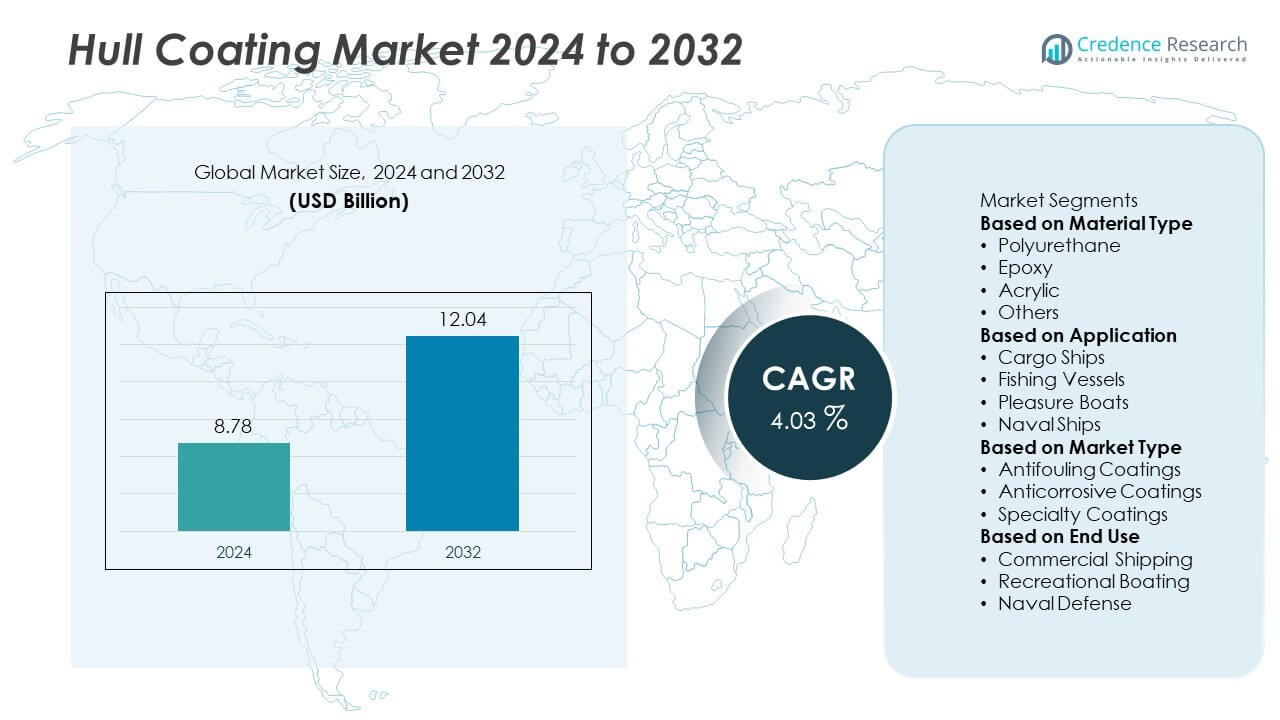

The Hull Coating Market was valued at USD 8.78 billion in 2024 and is projected to reach USD 12.04 billion by 2032, growing at a CAGR of 4.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hull Coating Market Size 2024 |

USD 8.78 Billion |

| Hull Coating Market, CAGR |

4.03% |

| Hull Coating Market Size 2032 |

USD 12.04 Billion |

The Hull Coating Market grows with rising demand for fuel-efficient and eco-friendly coating solutions that reduce drag and enhance vessel performance. Strict IMO regulations on biofouling and emissions compliance push shipowners toward advanced antifouling and foul-release technologies.

Asia-Pacific leads the Hull Coating Market due to strong shipbuilding activity in China, South Korea, and Japan, supported by cost-effective manufacturing and skilled labor availability. The region benefits from rising orders for container ships, LNG carriers, and tankers, driving demand for antifouling and corrosion-resistant coatings. Europe follows with high adoption of eco-friendly and silicone-based foul-release coatings driven by strict EU environmental regulations and a strong ship repair network. North America shows steady demand, supported by its large commercial shipping fleet, naval programs, and advanced dry-docking infrastructure. Latin America and Middle East & Africa are emerging markets, gaining momentum from offshore energy exploration, port expansion projects, and fleet modernization. Key players dominating the market include Jotun, Chugoku Marine Paints, PPG Industries, and AkzoNobel, which focus on innovation, long-life coating solutions, and partnerships with shipyards to strengthen their presence across global shipbuilding and maintenance hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hull Coating Market was valued at USD 8.78 billion in 2024 and is projected to reach USD 12.04 billion by 2032, growing at a CAGR of 4.03% during the forecast period.

- Growth is driven by rising demand for fuel-efficient and eco-friendly coating solutions that reduce drag, enhance vessel speed, and cut operational costs.

- Trends show strong adoption of biocide-free silicone foul-release coatings, nanotechnology-based formulations, and digital monitoring tools for predictive maintenance and performance tracking.

- Competitive landscape includes major players such as Jotun, Chugoku Marine Paints, PPG Industries, AkzoNobel, and Hempel, focusing on innovative coating systems, extended dry-dock intervals, and sustainable solutions.

- Market restraints include high costs of advanced coatings, professional application requirements, and raw material price fluctuations that affect profitability for smaller ship operators.

- Asia-Pacific leads demand due to strong shipbuilding activity in China, South Korea, and Japan, while Europe grows through sustainability-focused adoption of green coating solutions.

- North America maintains steady demand with its large commercial fleet and naval programs, whereas Latin America and Middle East & Africa show potential driven by offshore energy projects and port expansion initiatives.

Market Drivers

Growing Need for Fuel Efficiency and Operational Cost Reduction

The Hull Coating Market grows with rising pressure on shipping companies to cut fuel costs. Advanced coatings reduce hull friction, improving vessel speed and lowering fuel consumption. It supports ship operators in reducing operating expenses while maintaining performance. Lower fuel use also reduces greenhouse gas emissions, aligning with global sustainability targets. Shipping companies invest in premium antifouling coatings to minimize dry-docking frequency and maintenance downtime. It helps improve fleet efficiency and overall profitability.

- For instance, Jotun’s HPS 2.0 system includes the SeaQuantum X200 antifouling coating, which has been verified by DNV to deliver up to 14.7% fuel savings. It has documented significant emissions savings for vessels using its Hull Performance Solutions (HPS).

Stricter Environmental and Regulatory Compliance

Global regulations such as IMO biofouling guidelines and MARPOL standards drive adoption of eco-friendly hull coatings. The Hull Coating Market benefits from demand for biocide-free and silicone-based foul-release coatings that meet safety and environmental norms. It allows shipowners to minimize invasive species transfer and comply with port state controls. Regulatory pressure accelerates replacement of older, toxic coatings with sustainable alternatives. Ship classification societies encourage use of advanced coatings to improve vessel efficiency ratings. It ensures compliance and supports long-term operational readiness.

- For instance, Lloyd’s Register in June 2025 awarded its first Enhanced Antifouling Type Approval to Jotun’s SeaQuantum Skate combined with the HullSkater robotic cleaning system, confirming compliance with biofouling standards for more than 100,000 operating hours of in-water cleaning data.

Rising Global Seaborne Trade and Fleet Expansion

Increasing global trade volumes fuel demand for new shipbuilding and maintenance cycles. The Hull Coating Market gains from higher orders of commercial vessels, tankers, and container ships requiring protective coatings. It benefits from strong ship repair and refurbishment activity in major maritime hubs. Growth in offshore oil and gas activities also supports coating demand for specialized vessels. Expanding naval and defense fleets further contribute to consistent consumption. It positions coatings as a critical factor in vessel lifecycle management.

Technological Advancements in Coating Formulations

Innovation in nanotechnology and surface-active polymers improves coating durability and performance. The Hull Coating Market advances with solutions that offer self-cleaning properties and long-lasting protection against fouling. It reduces the need for frequent reapplication and lowers maintenance costs. Manufacturers focus on faster curing, low-VOC, and easy-to-apply coatings to improve shipyard efficiency. Digital monitoring tools also enable predictive maintenance and optimize coating schedules. It creates opportunities for suppliers to deliver value-added and performance-driven solutions.

Market Trends

Adoption of Eco-Friendly and Biocide-Free Coatings

The Hull Coating Market sees a strong shift toward environmentally safe formulations. Shipowners choose silicone-based and foul-release coatings that reduce invasive species transfer. It helps meet IMO and regional port regulations focused on sustainability. Demand rises for products with low VOC content and minimal impact on marine ecosystems. Coating manufacturers invest in green chemistry solutions to attract environmentally conscious operators. It strengthens compliance and improves shipping companies’ ESG performance.

- For instance, in March 2025, AkzoNobel published a whitepaper highlighting a case study on International’s Intersleek 1100SR biocide-free silicone coating. The study followed three LNG carriers over 60 months and confirmed the coating significantly contributed to maintaining a smooth, clean hull and meeting energy efficiency targets.

Growing Preference for Advanced Antifouling Technologies

Vessel operators adopt next-generation antifouling coatings that provide long-lasting performance. The Hull Coating Market benefits from solutions that reduce drag and improve hydrodynamic efficiency. It supports better fuel savings and reduces greenhouse gas emissions. Self-polishing and nanostructured coatings gain popularity for their superior smoothness and durability. The trend helps shipowners minimize dry-dock intervals and lower maintenance costs. It drives innovation in premium, high-performance product segments.

- For instance, Chugoku Marine Paints’ SEAFLO NEO series, which includes SEAFLO NEO Z, has been applied to various large commercial vessels, including bulk carriers. The series has demonstrated ISO 19030-verified performance over 60-month (five-year) service intervals.

Integration of Digital Monitoring and Performance Tracking

Digital tools are increasingly used to measure coating performance in real time. The Hull Coating Market benefits from data analytics that track hull condition and fouling levels. It allows predictive maintenance and better planning of recoating schedules. Ship operators gain insights on energy efficiency improvements and ROI of coating investments. Integration with fleet management software enhances operational decisions. It creates opportunities for coating suppliers to offer monitoring-enabled service packages.

Rising Demand from Offshore and Specialized Vessels

Growth in offshore energy projects drives coating demand for support vessels and rigs. The Hull Coating Market expands as operators require highly durable, corrosion-resistant products for harsh environments. It ensures long-term protection in extreme weather and saline conditions. Demand also rises from LNG carriers, cruise ships, and naval fleets with high performance requirements. Manufacturers develop specialized coatings for niche applications, including ice-class vessels. It supports diversification of product portfolios and stable market growth.

Market Challenges Analysis

High Cost of Advanced Coatings and Application

The Hull Coating Market faces challenges from the high cost of premium antifouling and foul-release coatings. Many small ship operators delay upgrades due to budget constraints, impacting adoption rates. It also requires professional application in dry-dock facilities, adding labor and downtime costs. Price-sensitive operators may choose cheaper alternatives that offer shorter service life. Fluctuations in raw material costs increase production expenses, pressuring supplier margins. It pushes manufacturers to balance performance with cost-effectiveness to remain competitive.

Regulatory Pressure and Performance Limitations

Strict environmental regulations limit the use of certain biocides, narrowing formulation choices for manufacturers. The Hull Coating Market must meet global and regional compliance standards while maintaining performance levels. It becomes challenging to create products that are both eco-friendly and highly durable. Inconsistent port inspection practices and varying regional rules complicate product approvals. Extreme operating environments may still cause premature coating wear, increasing maintenance frequency. It drives the need for continuous R&D to deliver coatings that meet sustainability and performance demands simultaneously.

Market Opportunities

Rising Demand for Sustainable and High-Performance Coatings

The Hull Coating Market holds strong potential with the global shift toward eco-friendly shipping practices. Shipowners seek coatings that minimize fuel use and reduce carbon emissions to meet IMO decarbonization targets. It creates opportunities for biocide-free and silicone-based foul-release coatings that offer long-term performance. Manufacturers can differentiate with solutions that extend dry-dock intervals and lower lifecycle costs. Growing interest in low-VOC and solvent-free products supports innovation in green chemistry. It positions suppliers to capture demand from both commercial shipping and naval fleets focused on sustainability.

Growth in Shipbuilding and Maintenance Activities

Global trade expansion and fleet renewal programs create consistent opportunities for hull coating suppliers. The Hull Coating Market benefits from rising shipbuilding activity in Asia-Pacific and refurbishment projects for aging vessels. It gains traction in offshore energy sectors where vessels face harsh marine conditions and require durable protection. Cruise and LNG carrier segments present demand for premium coatings that improve efficiency and passenger safety. Partnerships with shipyards and maintenance providers can strengthen market presence. It enables manufacturers to secure long-term contracts and expand into emerging maritime hubs.

Market Segmentation Analysis:

By Material Type

The Hull Coating Market is segmented by material type into epoxy, polyurethane, silicone, and others. Epoxy coatings dominate due to their excellent adhesion, corrosion resistance, and cost-effectiveness for commercial vessels. It is widely used for underwater hull protection and ballast tanks where durability is critical. Polyurethane coatings are preferred for their superior gloss retention and UV resistance, making them suitable for above-water areas. Silicone-based foul-release coatings are gaining traction as an eco-friendly alternative to biocide-containing products. It supports compliance with environmental regulations and offers reduced drag for better fuel efficiency. Demand for hybrid and nanotechnology-based materials is increasing as operators seek longer-lasting and lower-maintenance solutions.

- For instance, PPG’s Amercoat 240 epoxy system was a documented multipurpose coating used for marine applications, including underwater hulls and ballast tanks. It was known for its durability, abrasion resistance, and excellent performance in harsh marine environments, where it provided critical corrosion protection.

By Application

Applications of hull coatings include antifouling, corrosion control, and foul-release solutions. The Hull Coating Market sees maximum demand for antifouling coatings that prevent marine organism growth on ship hulls. It reduces fuel consumption by maintaining smooth surfaces and improving hydrodynamic efficiency. Corrosion control coatings are crucial for offshore vessels, tankers, and navy ships exposed to harsh seawater conditions. Foul-release coatings, though a smaller segment, are growing rapidly due to regulatory pressure on toxic biocides. It helps operators minimize invasive species transfer and meet IMO biofouling guidelines. Increasing dry-docking intervals drive demand for coatings with longer service life and high mechanical strength.

- For instance, Jotun’s SeaQuantum Skate and HullSkater robotic cleaning system helped equip over 30 vessels by May 2025, with Jotun announcing additional commercial agreements throughout the year. The system is remotely operated by hubs, with individual inspection and cleaning missions lasting between 2 and 8 hours.

By Market Type

The market is divided into new shipbuilding and repair & maintenance segments. The Hull Coating Market gains steady demand from new shipbuilding activity in Asia-Pacific, led by China, South Korea, and Japan. It also records strong growth in the repair and maintenance segment, driven by the need to recoat aging fleets and comply with emission regulations. Frequent maintenance of commercial vessels, cruise ships, and naval fleets boosts recurring revenue for coating suppliers. Repair yards invest in faster-curing products to reduce vessel downtime. It ensures consistent demand even during fluctuations in new vessel orders, making maintenance a key revenue stream for manufacturers.

Segments:

Based on Material Type

- Polyurethane

- Epoxy

- Acrylic

- Others

Based on Application

- Cargo Ships

- Fishing Vessels

- Pleasure Boats

- Naval Ships

Based on Market Type

- Antifouling Coatings

- Anticorrosive Coatings

- Specialty Coatings

Based on End Use

- Commercial Shipping

- Recreational Boating

- Naval Defense

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 22% market share in the Hull Coating Market, driven by strong demand for advanced antifouling solutions in commercial shipping and naval fleets. The U.S. leads regional consumption due to its large number of cargo vessels, offshore support ships, and cruise liners. It benefits from strict environmental regulations that encourage adoption of low-VOC and biocide-free coatings. Major ship repair facilities and dry-docking hubs across the Gulf Coast and West Coast further contribute to consistent demand. Rising investments in ship modernization and maintenance support adoption of high-performance coatings with longer service life. It positions North America as a key market for premium hull coating technologies and environmentally compliant products.

Europe

Europe accounts for 25% market share and is a significant contributor to the adoption of sustainable hull coating technologies. Countries such as Norway, Germany, and the U.K. drive demand with strong maritime industries and focus on IMO compliance. The Hull Coating Market benefits from initiatives to reduce greenhouse gas emissions and implement advanced antifouling systems that meet EU regulations. It records increasing use of silicone-based foul-release coatings among operators focused on efficiency and sustainability. Europe’s established ship repair network ensures steady demand for maintenance and recoating projects. It continues to see strong traction from cruise ship operators and offshore energy sectors seeking reliable hull protection solutions.

Asia-Pacific

Asia-Pacific leads with 40% market share, making it the largest regional market for hull coatings globally. High shipbuilding activity in China, South Korea, and Japan fuels significant consumption of epoxy, polyurethane, and antifouling coatings. The Hull Coating Market gains from large-scale production of container ships, tankers, LNG carriers, and bulk carriers. It benefits from competitive manufacturing costs and availability of skilled labor, which support regional growth. Expanding naval programs and offshore exploration projects further boost demand for advanced protective coatings. It remains the most dynamic region, with strong investments in both new ship construction and maintenance activities.

Latin America

Latin America represents 7% market share, with Brazil and Mexico leading regional demand. The Hull Coating Market grows as offshore oil and gas exploration drives the need for corrosion-resistant coatings for support vessels and platforms. It also benefits from ship repair and maintenance facilities serving regional and international fleets. Government initiatives to expand port infrastructure create new opportunities for suppliers. Increasing trade activities and coastal shipping contribute to steady consumption of antifouling coatings. It remains an emerging but strategically important market with potential for long-term growth.

Middle East & Africa

Middle East & Africa hold 6% market share, supported by a growing maritime sector and offshore energy projects. The Hull Coating Market benefits from demand for high-durability coatings that protect vessels operating in extreme temperatures and saline waters. It sees strong consumption in shipyards located in UAE, Saudi Arabia, and South Africa. Investments in new port infrastructure and fleet expansion projects create opportunities for coating manufacturers. Naval modernization programs also add to regional demand for advanced coating solutions. It is expected to grow steadily with rising trade flows and maintenance needs in key shipping routes such as the Suez Canal and Arabian Gulf.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kansai Paint

- Chugoku Marine Paints

- BASF

- Jotun

- PPG Industries

- AkzoNobel

- RustOleum

- Nippon Paint

- Hempel

- Axalta Coating Systems

Competitive Analysis

Competitive landscape of the Hull Coating Market features leading players such as Jotun, Chugoku Marine Paints, Nippon Paint, Hempel, AkzoNobel, Axalta Coating Systems, BASF, RustOleum, Kansai Paint, and PPG Industries. These companies focus on developing advanced antifouling, foul-release, and corrosion-resistant coatings that meet stringent IMO and MARPOL regulations. They invest heavily in research and development to introduce biocide-free, low-VOC, and nanotechnology-based solutions that enhance vessel efficiency and reduce environmental impact. Strategic collaborations with shipyards, fleet operators, and maintenance providers strengthen their global footprint and ensure long-term contracts. Many players expand production facilities near major shipbuilding hubs to meet growing demand from Asia-Pacific and improve delivery timelines. Marketing efforts highlight benefits such as fuel savings, extended dry-dock intervals, and reduced operational costs to attract shipowners. Continuous innovation and sustainability-focused initiatives allow these companies to maintain competitiveness and capture a larger share of the global hull coating market.

Recent Developments

- In July 2025, AkzoNobel’s marine coatings unit announced it is protecting the world’s first sail-assisted Aframax tanker using a coating with linear polishing technology.

- In April 2025, AkzoNobel published a whitepaper via its International brand showing 60-month performance data for LNG vessels coated with Intersleek 1100SR, a biocide-free silicone foul-release coating.

- In May 2024, Kansai Paint Marine began offering five premium antifouling products for large vessels (new-build and dry-dock segments) in Japan, working with I-Tech.

- In 2024, Kansai published its strategy up to 2030, including development of antifouling coatings for hulls, focusing on water-based, low environmental impact coatings.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Market Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hull coatings will grow with rising global shipping activity and fleet expansion.

- Adoption of biocide-free and silicone-based foul-release coatings will increase to meet regulations.

- Nanotechnology-based solutions will gain traction for improved durability and self-cleaning properties.

- Shipowners will focus on coatings that reduce drag and improve fuel efficiency.

- Digital monitoring systems will be used to track coating performance and optimize maintenance cycles.

- Asia-Pacific will remain the dominant region due to strong shipbuilding and repair activities.

- Europe will drive innovation in sustainable coatings aligned with decarbonization targets.

- Partnerships between coating manufacturers and shipyards will expand to secure long-term contracts.

- R&D efforts will focus on faster-curing, low-VOC formulations to reduce downtime and environmental impact.

- Growth in offshore energy projects and cruise ship construction will create additional demand for high-performance coatings.