Market Overview:

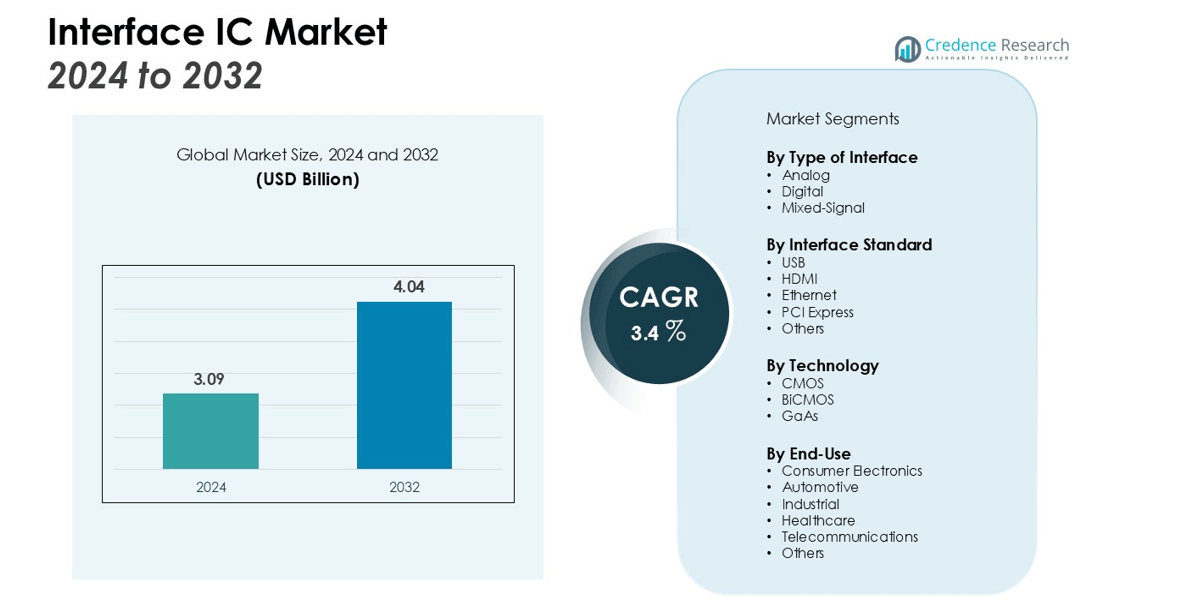

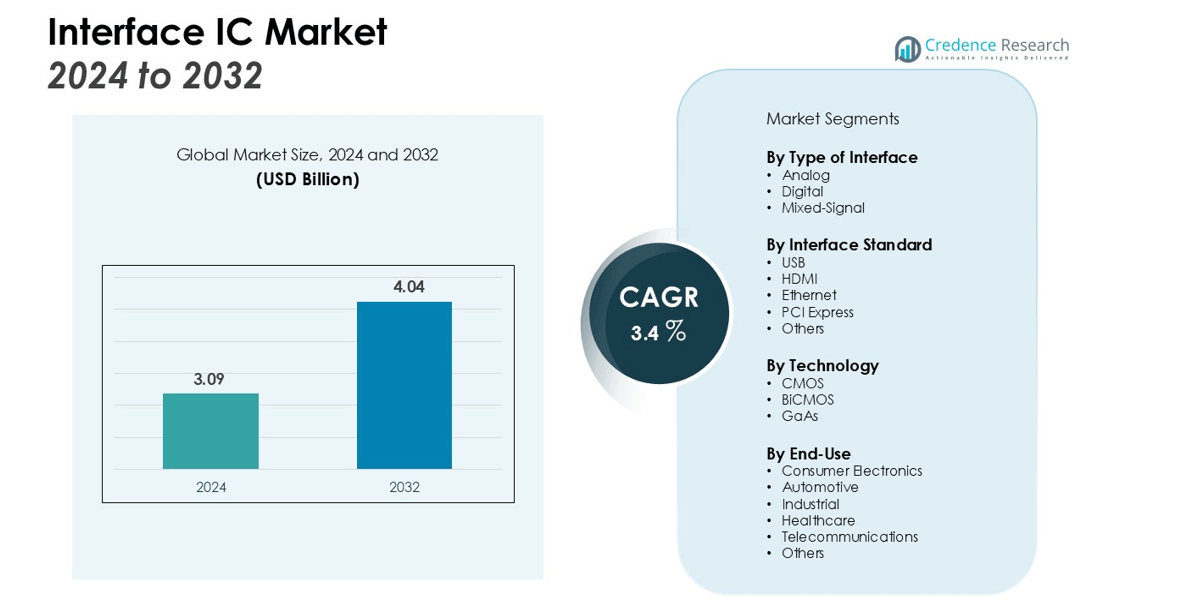

The Interface IC Market size was valued at USD 3.09 billion in 2024 and is anticipated to reach USD 4.04 billion by 2032, at a CAGR of 3.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interface IC Market Size 2024 |

USD 3.09 billion |

| Interface IC MarketCAGR |

3.4% |

| Interface IC Market Size 2032 |

USD 4.04 billion |

The market is driven by strong uptake in consumer electronics such as smartphones, tablets, and wearables. Expanding adoption of electric vehicles and advanced driver-assistance systems is further boosting demand. Industrial automation, IoT connectivity, and the expansion of 5G and telecom networks also contribute significantly to growth. These applications emphasize the need for reliable, low-power, and high-speed data transmission, making interface ICs a core technology.

North America holds the largest market share due to advanced semiconductor R&D, robust automotive electronics, and accelerating 5G deployment. Asia-Pacific is expected to post the fastest growth, led by China, Japan, and India with their expanding electronics manufacturing bases, rising EV adoption, and growing smart device penetration. Europe demonstrates stable growth supported by automotive innovation and industrial automation, while emerging economies in Latin America and the Middle East are gradually adopting interface ICs in expanding technology markets. Growing collaborations between semiconductor companies and research institutions are further strengthening innovation and global competitiveness.

Market Insights:

- The Interface IC Market was valued at USD 3.09 billion in 2024 and is projected to reach USD 4.04 billion by 2032.

- Consumer electronics, including smartphones, tablets, laptops, and wearables, remain the primary growth driver.

- Automotive demand grows with advanced driver-assistance systems, infotainment platforms, and electric vehicle adoption.

- Industrial automation and IoT expansion increase reliance on low-power, high-performance interface IC solutions.

- The rollout of 5G and telecom infrastructure strengthens demand for reliable, high-speed data transfer ICs.

- North America leads the market with 36% share, supported by R&D and 5G deployment.

- Asia-Pacific, holding 31% share, emerges as the fastest-growing hub with strong electronics manufacturing and EV adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Consumer Electronics

The Interface IC Market benefits strongly from the surge in consumer electronics adoption. Smartphones, tablets, laptops, and wearables require advanced interface solutions to ensure seamless communication between system components. The need for compact, power-efficient, and high-speed data transfer capabilities drives steady demand. It supports manufacturers in delivering devices with improved performance, connectivity, and user experience.

Expanding Role in Automotive Electronics

The automotive sector plays a vital role in expanding opportunities for the Interface IC Market. Growing use of advanced driver-assistance systems, infotainment platforms, and electric vehicle power management requires reliable interface solutions. It enables communication between sensors, processors, and control units in modern vehicles. The trend toward electrification and autonomous driving further intensifies reliance on interface ICs.

Industrial Automation and IoT Integration

Industrial automation and the Internet of Things contribute significantly to growth. Smart factories, connected devices, and sensor networks require precise, low-power, and high-performance data exchange. It ensures compatibility across multiple devices and supports the scaling of connected ecosystems. The expansion of smart manufacturing and intelligent monitoring solutions increases the need for robust interface ICs.

- For instance, Analog Devices offers solutions such as a reference design for a 16-channel data acquisition system, which uses two of its AD7606 ICs for high-performance industrial monitoring applications.

Telecom Infrastructure and 5G Expansion

The rollout of 5G and expansion of telecom infrastructure create a strong market driver. High-speed networks require interface ICs capable of supporting reliable and energy-efficient data transfer. It enables efficient communication between advanced processors, memory units, and connectivity modules. Growing demand for bandwidth-intensive applications strengthens the role of interface ICs in telecom and networking equipment.

- For instance, Broadcom’s BCM84884E is a quad-port physical layer transceiver that supports the 5GBASE-T Ethernet standard, enabling high-speed data transfer for advanced 5G networking hardware.

Market Trends:

Advancements in Miniaturization and Power Efficiency

The Interface IC Market is experiencing strong momentum from miniaturization and energy-efficient design. Rising demand for smaller, lightweight devices across consumer electronics and wearables fuels innovation in compact interface ICs. It drives the adoption of low-power technologies that extend battery life without compromising speed or reliability. Manufacturers are prioritizing designs that integrate multiple functionalities into a single IC to reduce footprint and costs. The trend is reinforced by end-user preferences for high-performance products with longer operational cycles. This shift supports continuous investment in advanced semiconductor fabrication and packaging processes.

- For instance, Texas Instruments’ TPS54A20 SWIFT™ step-down converter is designed for high-density power supplies, providing a continuous output current of up to 10 A from an input voltage between 8 V and 14 V.

Integration with Emerging Technologies and Applications

Growing integration of interface ICs with IoT, AI-driven devices, and advanced automotive platforms represents a key trend. The market benefits from their role in enabling communication across smart devices, electric vehicles, and 5G-enabled infrastructure. It supports real-time data transfer essential for industrial automation and intelligent systems. Increasing reliance on cloud computing and edge devices further accelerates demand for high-speed, secure interfaces. The trend highlights a transition toward multi-protocol ICs capable of handling complex connectivity needs. This evolution positions interface ICs as a foundation for next-generation electronics and digital transformation initiatives.

- For instance, NXP’s S32N55 processor enables super-integration for software-defined vehicles by integrating 16 Arm Cortex-R52 processor cores for real-time compute applications.

Market Challenges Analysis:

High Design Complexity and Cost Pressures

The Interface IC Market faces challenges due to growing design complexity and rising production costs. Increasing demand for compact, multi-functional ICs places pressure on manufacturers to balance performance, power efficiency, and size. It requires significant investment in advanced semiconductor processes, which can raise costs and extend development timelines. Frequent product innovations in consumer and automotive electronics further drive the need for continuous upgrades. Smaller players often struggle to compete with larger companies that hold stronger R&D capabilities. This situation creates barriers to entry and limits the pace of innovation across the market.

Supply Chain Disruptions and Reliability Concerns

Global semiconductor supply chain disruptions pose significant risks to the Interface IC Market. Shortages of raw materials and production delays can impact delivery schedules and increase prices. It raises concerns for industries such as automotive, telecom, and industrial automation that depend on consistent component availability. Ensuring high levels of reliability and compliance with safety standards also remains a challenge. Variability in quality across suppliers adds risk to critical applications requiring robust performance. Addressing these challenges demands greater collaboration between manufacturers, suppliers, and end users to build resilient supply networks.

Market Opportunities:

Rising Adoption in Emerging Applications

The Interface IC Market presents strong opportunities through expansion in emerging applications. Rapid growth of electric vehicles, smart homes, and connected healthcare devices increases demand for reliable, low-power interface solutions. It supports seamless communication between sensors, processors, and control units across these systems. Expanding industrial automation and robotics also create prospects for high-speed, energy-efficient ICs. The ongoing deployment of 5G networks further amplifies opportunities by requiring advanced interfaces for data-intensive applications. Growing investment in AI-enabled electronics strengthens the potential for interface ICs in next-generation devices.

Innovation in Multi-Protocol and Integrated Solutions

Integration of multi-protocol and system-on-chip designs creates significant opportunities for manufacturers. Demand for compact devices with enhanced performance is driving innovation in ICs that combine multiple interface standards. It reduces design complexity and lowers costs while improving device functionality. Growing adoption of edge computing and cloud-based platforms further supports this trend. Opportunities also lie in offering customized interface ICs tailored to specific sectors such as automotive, telecom, and industrial equipment. The shift toward sustainable and energy-efficient solutions ensures continuous scope for product development in this market.

Market Segmentation Analysis:

By Type of Interface

The Interface IC Market covers analog, digital, and mixed-signal categories. Analog interface ICs dominate use in automotive sensors, industrial automation, and healthcare devices. Digital interfaces account for strong demand in consumer electronics and computing applications. Mixed-signal ICs integrate analog and digital functions, providing higher efficiency and compact designs. It addresses the need for robust communication across varied hardware platforms. Each type supports specific end-user demands, strengthening adoption across industries.

By Interface Standard

The Interface IC Market includes standards such as USB, HDMI, Ethernet, and PCI Express. USB remains widely adopted in consumer electronics and computing peripherals. HDMI secures demand in display technologies and home entertainment systems. Ethernet continues to serve industrial automation and networking markets with reliability. PCI Express dominates computing, servers, and data centers for high-speed data transfer. It reflects the evolving requirements of industries moving toward higher connectivity and speed.

- For instance, Texas Instruments’ USB Interface Module utilizes National Semiconductor’s USBN9604 chip, a USB 1.1/2.0 compatible controller housed in a 28-pin SOIC package.

By Technology

The Interface IC Market leverages CMOS, BiCMOS, and GaAs-based technologies. CMOS dominates due to low power consumption and cost-effectiveness. BiCMOS enhances performance in high-frequency and analog-intensive applications. GaAs provides superior speed and efficiency in RF and wireless communications. It enables higher performance in next-generation devices, particularly in 5G and aerospace sectors. Each technology supports scalability, allowing manufacturers to address diverse end-market needs with tailored solutions.Top of Form

- For instance, the IDT54/74FCT800 series from Integrated Device Technology (IDT) is built using an advanced dual-metal CMOS technology.

Segmentations:

By Type of Interface

- Analog

- Digital

- Mixed-Signal

By Interface Standard

- USB

- HDMI

- Ethernet

- PCI Express

- Others

By Technology

By End-Use

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Telecommunications

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Strong Market Presence in North America

North America accounted for 36% of the Interface IC Market in the latest assessment. The region benefits from advanced semiconductor R&D and strong presence of key industry players. Robust demand from consumer electronics, telecom, and automotive sectors supports market expansion. It benefits from heavy investment in 5G infrastructure and rapid adoption of advanced driver-assistance systems. The region also emphasizes energy-efficient technologies, which further boosts innovation in interface IC design. Government support for high-tech manufacturing strengthens the market’s competitive edge.

Rapid Growth Across Asia-Pacific

Asia-Pacific held 31% of the Interface IC Market, marking it as the fastest-growing regional hub. Countries such as China, Japan, South Korea, and India play a vital role in production and adoption. It benefits from high penetration of smartphones, consumer devices, and electric vehicles. The region also invests heavily in telecom infrastructure, enabling broader use of high-performance interface ICs. Growing presence of contract manufacturers and semiconductor foundries enhances production capacity. Expanding government initiatives to support local semiconductor ecosystems further accelerate regional growth.

Stable Expansion in Europe and Emerging Regions

Europe captured 24% of the Interface IC Market with steady contributions from automotive and industrial automation sectors. Germany, France, and the UK are key contributors with advanced engineering and technology adoption. It gains momentum from EV adoption and increasing deployment of IoT-enabled solutions. Latin America and the Middle East & Africa hold smaller shares but demonstrate rising demand for consumer electronics and telecom equipment. Gradual adoption of smart devices and connected solutions drives opportunities in these regions. Growing investments in technology infrastructure position them as emerging markets with untapped potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Interface IC Market features strong competition with established semiconductor manufacturers driving innovation and scale. Key players include Analog Devices, Texas Instruments, NXP Semiconductors, Infineon Technologies, and Renesas Electronics. It maintains high entry barriers due to complex design requirements, advanced fabrication needs, and significant R&D investments. Companies focus on developing low-power, high-speed solutions to support applications in consumer electronics, automotive systems, and industrial automation. Strategic partnerships with OEMs and technology providers strengthen supply chains and enhance customer reach. It demonstrates growing competition in regions like Asia-Pacific, where local manufacturers expand production to serve rising electronics demand. Leading players pursue mergers, acquisitions, and collaborations with research institutions to advance interface standards and performance. Competitive differentiation rests on integration capabilities, power efficiency, and compliance with global standards, ensuring long-term positioning in a market driven by rapid technology adoption and evolving connectivity requirements.

Recent Developments:

- In July 2025, Infineon Technologies AG announced advancements in its 300-millimeter GaN (gallium nitride) manufacturing, with customer samples anticipated in the fourth quarter of 2025.

- In March 2025, Infineon Technologies AG launched Drive Core, a software bundle designed to accelerate automotive software development for its AURIX™, TRAVEO™, and PSOC™ microcontrollers.

- In July 2025, Microchip Technology Inc. formed a strategic partnership with Delta Electronics to advance the development of Silicon Carbide (SiC) power management solutions.

Report Coverage:

The research report offers an in-depth analysis based on Type of Interface, Interface Standard, Technology, End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Interface IC Market will expand with rising demand for seamless data connectivity.

- It will gain momentum from the integration of smart devices in consumer electronics.

- Automotive applications will drive growth as vehicles adopt advanced driver-assistance systems.

- Industrial automation will increase reliance on interface ICs for efficient machine communication.

- Healthcare adoption will rise due to connected medical devices requiring secure data transfer.

- Cloud computing and data centers will boost demand for high-speed interface standards.

- It will benefit from 5G deployment, enhancing performance in mobile and telecom infrastructure.

- Energy-efficient technologies will shape product development and encourage broader adoption.

- Regional growth will be strongest in Asia-Pacific, driven by electronics manufacturing expansion.

- Strategic alliances and innovation in IC design will strengthen global market competitiveness.