Market Overview

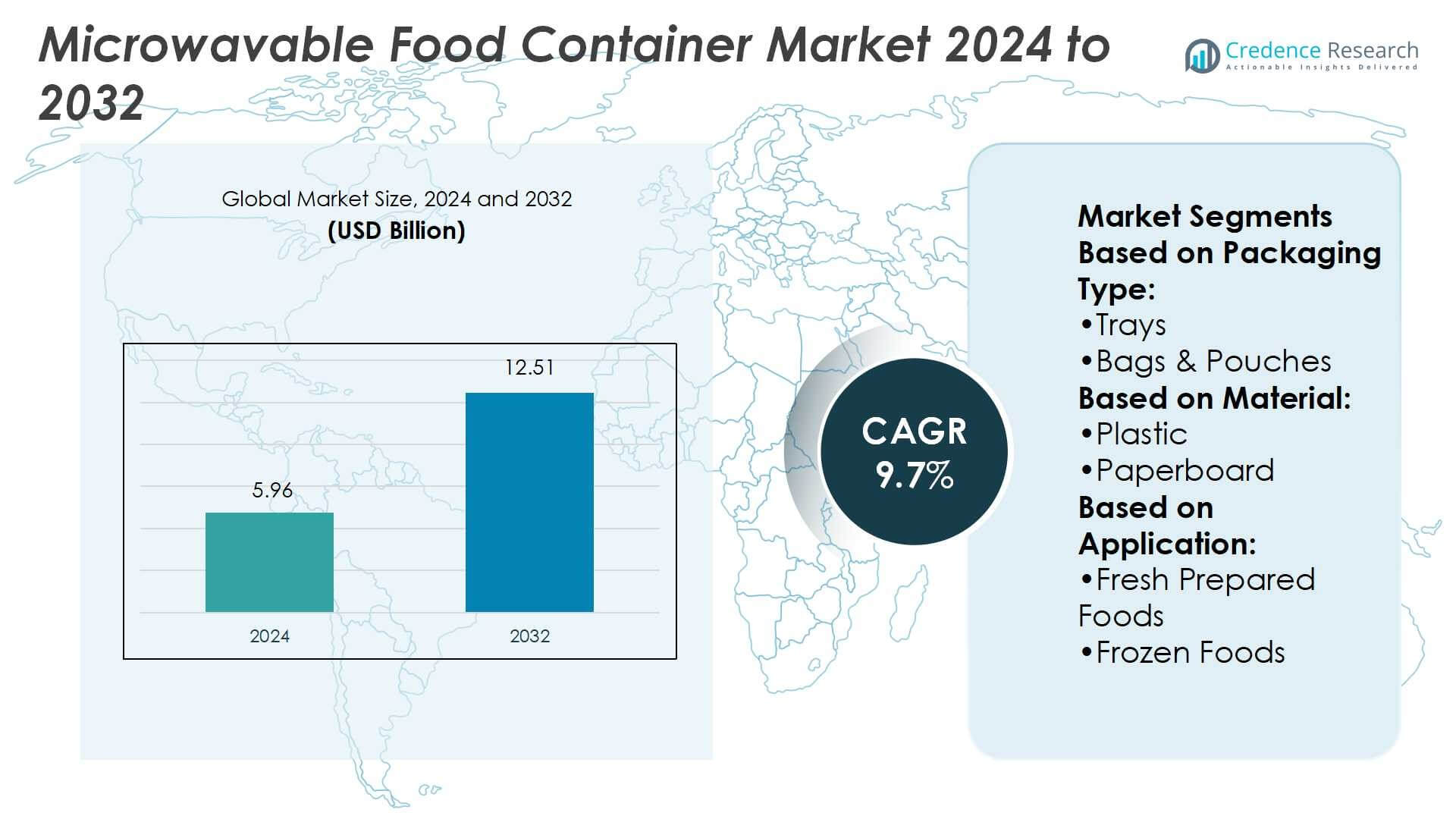

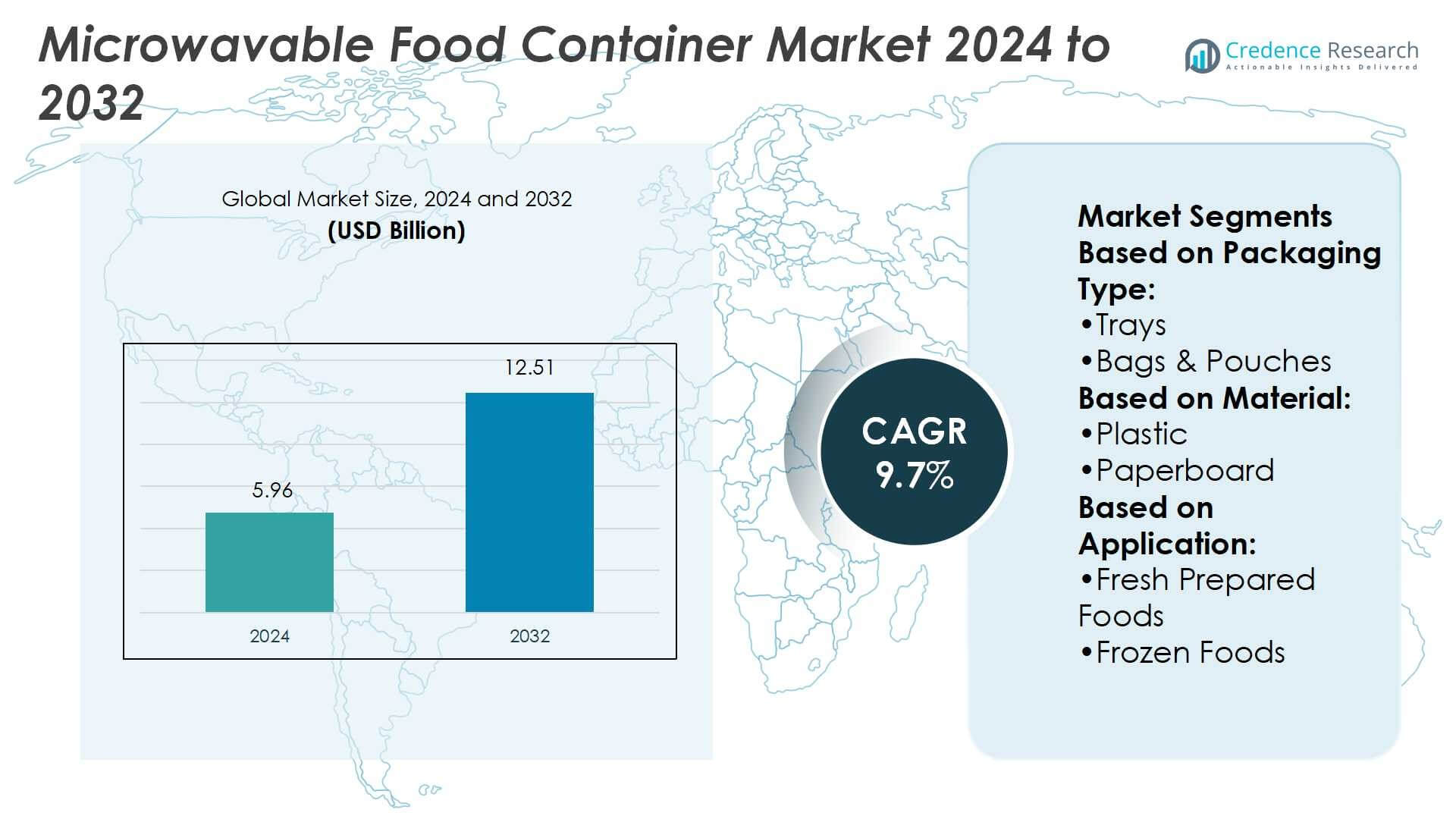

Microwavable Food Container Market size was valued at USD 5.96 billion in 2024 and is anticipated to reach USD 12.51 billion by 2032, at a CAGR of 9.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microwavable Food Container Market Size 2024 |

USD 5.96 Billion |

| Microwavable Food Container Market, CAGR |

9.7% |

| Microwavable Food Container Market Size 2032 |

USD 12.51 Billion |

The Microwavable Food Container Market grows with rising demand for convenience, driven by busy lifestyles and expansion of food delivery services. Strong adoption of ready-to-eat meals supports the need for durable, heat-resistant packaging. Sustainability trends push manufacturers toward recyclable and compostable materials, aligning with regulatory pressures on single-use plastics. Technological advancements, including steam-vented lids and lightweight designs, enhance usability and consumer trust. Branding-friendly and customizable formats strengthen appeal among retailers and foodservice providers. Growing reliance on e-commerce food channels further accelerates container consumption, while eco-conscious innovations and smart packaging features shape long-term market opportunities and competitive differentiation.

The Microwavable Food Container Market shows strong regional presence, with North America leading due to high demand for convenience meals, followed by Europe’s focus on eco-friendly packaging and Asia Pacific’s rapid growth driven by urbanization and food delivery expansion. Latin America and the Middle East & Africa contribute steadily with rising retail and foodservice sectors. Key players strengthen competitiveness through innovation and sustainability, including Amcor, Mondi Group, Huhtamaki Group, Graphic Packaging International, Berry Global Group, Dart Container Corporation, and Plus Pack.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Microwavable Food Container Market was valued at USD 5.96 billion in 2024 and is projected to reach USD 12.51 billion by 2032, at a CAGR of 9.7%.

- Rising demand for convenience and busy lifestyles drive strong adoption of microwave-safe packaging.

- Growth in ready-to-eat meals and food delivery services boosts container consumption worldwide.

- Sustainability trends push manufacturers toward recyclable, compostable, and eco-friendly material innovations.

- Competition remains strong with players focusing on innovation, branding, and sustainable product portfolios.

- High raw material costs and strict environmental regulations act as restraints for market expansion.

- North America leads in share, Europe emphasizes eco-friendly packaging, Asia Pacific shows fastest growth, while Latin America and the Middle East & Africa register steady demand.

Market Drivers

Rising Demand for Convenient Packaging Solutions in a Fast-Paced Lifestyle

The Microwavable Food Container Market benefits from the growing preference for convenience. Consumers with busy work schedules prefer ready-to-eat meals that require minimal preparation. Food containers designed for microwave use support quick heating and allow safe storage. It enhances consumer confidence by offering durability and temperature resistance. Growth in urban populations increases reliance on packaged meals, strengthening this demand. Manufacturers respond by introducing containers with improved safety features and efficient sealing technologies.

- For instance, Mondi’s thermoformable barrier films include products with up to 18 layers of film structure, engineered for pasteurisation, sterilisation, retort, and microwave applications.

Expanding Food Delivery and Takeaway Services Driving High Consumption

The Microwavable Food Container Market experiences steady growth from the global expansion of food delivery services. Restaurants and cloud kitchens rely on microwave-safe packaging to preserve meal quality during transit. It ensures that food maintains taste, texture, and safety upon reheating. The rising popularity of app-based delivery platforms further fuels container consumption. Brands seek packaging solutions that balance functionality with visual appeal to enhance customer experience. This trend supports continuous demand across multiple consumer demographics.

- For instance, Inline’s Safe-T-Fresh 39.9 oz rectangular PET clamshell (Item #INLTS202) has external dimensions 9 1⁄8 × 4 7⁄8 × 3 in to display contents, includes a built-in tear-strip (Safe-T-Gard™) for tamper evidence and requires no shrink band or wrap-around label.

Increasing Focus on Sustainable and Recyclable Packaging Materials

The Microwavable Food Container Market gains momentum from sustainability-focused innovations. Growing awareness of environmental impact leads manufacturers to develop recyclable and biodegradable options. It encourages businesses to align packaging practices with eco-friendly standards. Governments enforce regulations on single-use plastics, pushing suppliers to adopt greener alternatives. Foodservice providers benefit from adopting sustainable containers that enhance brand reputation. Demand for plant-based polymers and compostable packaging materials grows steadily, reshaping market preferences.

Technological Advancements in Packaging Design Enhancing Performance

The Microwavable Food Container Market expands through ongoing innovations in packaging technology. Advanced materials improve heat resistance, reduce chemical leaching risks, and extend shelf life. It offers consumers safer and more reliable solutions that meet modern food habits. Smart packaging features, such as steam-vented lids, optimize heating efficiency. Manufacturers also focus on lightweight structures that lower transportation costs and environmental footprint. These advancements contribute to improved functionality, consumer trust, and long-term market adoption.

Market Trends

Growing Integration of Eco-Friendly Materials to Meet Sustainability Goals

The Microwavable Food Container Market witnesses a strong trend toward eco-friendly packaging. Consumers demand containers made from recyclable, compostable, or biodegradable materials. It encourages manufacturers to adopt plant-based polymers and paper-based composites. Regulations restricting single-use plastics accelerate the adoption of sustainable packaging designs. Food service providers position eco-conscious containers as a value-added offering to customers. This trend strengthens the alignment between consumer preference and corporate sustainability targets.

- For instance, The “Euro Pal” container is part of Plus Pack’s product offering. The container has a volume of 890 ml. Plus Pack’s product information confirms that this aluminium container is safe for use with grill, freezer, microwave, and oven heat sources.

Rising Popularity of Smart Packaging Features to Improve Functionality

The Microwavable Food Container Market benefits from innovations in smart packaging. Steam-vented lids and temperature indicators enhance safety and convenience. It reduces the risk of overheating and maintains food texture. Companies focus on ergonomic designs that improve usability for both delivery and home consumption. Growing urbanization and fast lifestyles push demand for containers that combine speed with reliability. Smart features become a key differentiator in an increasingly competitive marketplace.

- For instance, Huhtamaki’s “Steam Chef” technology features self-venting film which, in trials, allowed a tray of chicken fillet to cook in 5 to 7 minutes in a microwave of 750-850 Watts using double pressure cooking.

Increasing Adoption of Customizable and Branding-Friendly Packaging Solutions

The Microwavable Food Container Market evolves with demand for branding-friendly designs. Restaurants and delivery services use packaging as a marketing tool. It provides opportunities for logos, product information, and sustainability messages. Customizable formats help companies enhance customer engagement and brand recognition. This trend fuels investment in innovative printing and labeling techniques. Strong focus on differentiation drives the popularity of packaging that balances utility with visual appeal.

Expanding Demand from E-Commerce and Food Delivery Ecosystems

The Microwavable Food Container Market sees rising demand from e-commerce-based food channels. Growth in online food delivery platforms supports higher container consumption. It emphasizes durability, leak resistance, and reheating capability during transit. Partnerships between packaging suppliers and delivery services increase product availability. Growing consumer reliance on doorstep meal delivery strengthens this market expansion. This trend underlines the importance of durable, safe, and adaptable packaging solutions for future growth.

Market Challenges Analysis

Environmental Concerns and Stringent Regulations Limiting Material Choices

The Microwavable Food Container Market faces challenges from environmental concerns and strict regulations. Governments impose bans on single-use plastics and enforce tougher sustainability standards. It restricts the availability of cost-effective raw materials and raises production costs. Manufacturers must balance affordability with eco-friendly alternatives to remain competitive. Smaller players struggle with compliance due to high investment requirements for sustainable materials. This regulatory pressure slows adoption of traditional plastic-based solutions and increases reliance on innovation.

Rising Raw Material Costs and Supply Chain Disruptions Affecting Stability

The Microwavable Food Container Market encounters obstacles linked to raw material price volatility. Costs of polymers, paperboard, and plant-based substitutes continue to fluctuate. It creates uncertainty for manufacturers and impacts profit margins. Global supply chain disruptions, driven by transportation delays and trade restrictions, intensify these pressures. Foodservice providers also face inconsistent supply of containers, reducing reliability. These challenges push companies to diversify sourcing strategies and optimize manufacturing processes to sustain long-term growth.

Market Opportunities

Expansion of Sustainable Packaging Creating Long-Term Growth Prospects

The Microwavable Food Container Market holds strong opportunities in sustainable packaging development. Rising consumer awareness of environmental issues drives demand for recyclable and compostable solutions. It allows manufacturers to innovate with plant-based polymers, molded fiber, and biodegradable plastics. Companies that adopt green packaging practices gain an advantage in brand reputation and regulatory compliance. Foodservice chains increasingly favor suppliers offering eco-conscious alternatives to meet customer expectations. This shift opens long-term opportunities for growth and differentiation in global markets.

Growing Demand from Food Delivery, Retail, and Ready-to-Eat Segments

The Microwavable Food Container Market benefits from rising demand across delivery and retail ecosystems. Expanding online food delivery platforms require durable, microwave-safe containers to maintain quality. It strengthens opportunities for suppliers to design leak-proof, heat-resistant, and customizable solutions. Convenience-driven consumers in urban areas continue to increase reliance on ready-to-eat meals. Retailers and quick-service restaurants support this trend by partnering with innovative packaging providers. Expanding demand across multiple sectors creates strong avenues for growth and revenue generation.

Market Segmentation Analysis:

By Packaging Type

The Microwavable Food Container Market by packaging type shows a wide product range addressing diverse consumer needs. Trays hold a leading position due to strong adoption in frozen meals and ready-to-eat food categories. Bags and pouches grow steadily with lightweight formats that enhance portability and reduce storage space. Cups, tubs, and bowls remain essential for soups, noodles, and single-serve items that require convenience and portion control. Cartons find use in shelf-stable and premium packaging where branding opportunities are important. Others, including clamshells and specialty containers, support niche applications within retail and food delivery services. It highlights the versatility of formats designed to suit different consumption patterns.

- For instance, The patterned foil helps manage microwave energy, allowing it to provide quick and even cooking. This process can reduce cooking time by up to 50% for some foods compared to standard paperboard or CPET trays, according to laboratory tests.

By Material

By material, the Microwavable Food Container Market relies strongly on plastic due to its durability, cost-effectiveness, and heat resistance. Plastics continue to dominate across fresh and frozen food categories, supported by innovations in recyclable and microwave-safe grades. Paperboard shows strong momentum, particularly among environmentally conscious consumers seeking sustainable solutions. It aligns with government regulations favoring eco-friendly materials and offers branding opportunities through easy printing. Others, such as biodegradable composites and molded fiber, emerge as alternatives that address sustainability goals. This material mix reflects a balance between performance, affordability, and environmental responsibility.

- For instance, Amcor incorporated over 224,000 metric tons of recycled material across its packaging solutions during fiscal year 2024. The use of recycled content, as part of Amcor’s wider sustainability efforts, helps reduce reliance on virgin materials.

By Application

By application, the Microwavable Food Container Market demonstrates high adoption across fresh prepared foods. Growing urban lifestyles and demand for convenience meals strengthen container usage in this segment. Frozen foods also maintain a significant share, supported by global demand for long shelf life and safe reheating options. Shelf-stable meals contribute consistently, driven by military rations, outdoor foods, and emergency supplies. It creates opportunities for manufacturers to design solutions with extended durability and strong protective qualities. The diversity of applications reinforces the market’s importance across both consumer and institutional settings.

Segments:

Based on Packaging Type:

Based on Material:

Based on Application:

- Fresh Prepared Foods

- Frozen Foods

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest market share of 35% in the Microwavable Food Container Market. The region benefits from high consumer reliance on ready-to-eat meals and frozen foods. It supports widespread adoption of microwave-safe packaging across retail, food delivery, and quick-service restaurants. Stringent regulations regarding food safety and packaging materials further drive innovation in recyclable and BPA-free solutions. It strengthens demand for advanced plastic grades and paperboard alternatives. The U.S. dominates regional consumption due to strong food delivery networks, while Canada contributes steadily with rising urbanization and lifestyle changes. Continuous investment in sustainable packaging solutions consolidates North America’s leadership.

Europe

Europe accounts for 27% of the global share in the Microwavable Food Container Market. Strong emphasis on eco-friendly packaging aligns with the European Union’s strict environmental regulations. It accelerates the shift toward paperboard, molded fiber, and compostable container formats. Foodservice providers prioritize sustainable packaging to enhance consumer trust and meet compliance targets. Demand from frozen food and convenience meal categories remains strong, particularly in Western Europe. Countries such as Germany, France, and the U.K. lead adoption with well-established retail channels and high consumer preference for packaged meals. The market shows steady innovation in lightweight, recyclable formats that balance performance with sustainability.

Asia Pacific

Asia Pacific holds a 22% share of the Microwavable Food Container Market and represents the fastest-growing region. Rapid urbanization, rising disposable incomes, and expansion of food delivery services drive strong demand. It benefits from a growing young population that relies on convenience meals and online ordering platforms. Manufacturers invest heavily in cost-effective plastic solutions while exploring sustainable options to meet future demand. China, Japan, and India dominate the regional market with expanding food processing industries and strong retail presence. Regulatory focus on reducing single-use plastics is expected to accelerate adoption of eco-friendly packaging. The region’s growth potential remains high due to its large consumer base and evolving lifestyle patterns.

Latin America

Latin America contributes 8% of the Microwavable Food Container Market share. The region shows consistent demand growth from rising food delivery services and expanding retail sectors. It emphasizes affordable packaging solutions, with plastic containers dominating due to their cost efficiency. Brazil and Mexico lead adoption with strong urban populations and increasing penetration of quick-service restaurants. It also sees gradual adoption of eco-friendly materials as governments implement sustainability policies. Challenges related to raw material costs and logistics affect growth pace, yet opportunities exist in mid-tier cities and emerging food delivery platforms. The region’s market gradually aligns with global packaging trends, balancing affordability with innovation.

Middle East and Africa

The Middle East and Africa account for 8% of the Microwavable Food Container Market share. Demand is driven by growing urban populations, rising expatriate communities, and expanding retail and hospitality sectors. It benefits from increasing adoption of packaged and frozen meals across major cities. Gulf countries, including the UAE and Saudi Arabia, lead regional consumption due to modern retail structures and strong foodservice industries. African markets show gradual progress, supported by rising disposable incomes and growing supermarket penetration. The region faces challenges from supply chain inefficiencies and limited availability of eco-friendly packaging materials. Despite constraints, opportunities remain strong in premium food packaging and food delivery services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Microwavable Food Container Market players such as Dart Container Corporation, Envaplaster, Mondi Group, Inline Packaging, Plus Pack, Huhtamaki Group, Graphic Packaging International, Amcor, Cube Packaging Solutions, and Berry Global Group. The Microwavable Food Container Market is marked by intense competition, driven by rising demand for convenience packaging and sustainable alternatives. Companies focus on expanding product portfolios that balance durability, safety, and environmental responsibility. It emphasizes innovation in recyclable plastics, biodegradable composites, and paperboard solutions to meet evolving consumer preferences and regulatory pressures. Firms also invest in advanced packaging designs such as steam-vented lids and leak-resistant formats to enhance functionality. Strategic partnerships with foodservice providers and retailers strengthen distribution channels and expand market reach. Continuous investment in research and development supports competitiveness by ensuring improved performance, compliance, and brand differentiation in global markets.

Recent Developments

- In April 2025, Engel unveiled an injection molding machine manufacturing plant in Mexico. With a capacity to produce between 180 and 200 injection molding machines per year.

- In February 2025, the Mitsubishi Chemical Group announced a collaboration with ALBION Co., Ltd. (ALBION), a manufacturer and retailer of luxury cosmetics. Under the collaboration framework, waste plastics generated at ALBION will be transformed into new cosmetic containers through chemical recycling2 by the MCG Group.

- In October 2024, Novolex, a forerunner in packaging options, innovation, and sustainability, is launching new transparent containers that maintain food freshness and safety while providing consumers with reassurance.

- In October 2024, Tupperware Brands Corporation reached a preliminary agreement with a consortium of secured lenders, notably including Stonehill Capital Management Partners and Alden Global Capital. The plan is to restructure the company into The New Tupperware Company, adopting a start-up mentality.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see higher adoption of eco-friendly and recyclable materials.

- Demand will grow with expansion of food delivery and takeaway services.

- Innovation in steam-vented and leak-proof packaging will enhance usability.

- Paperboard and molded fiber containers will gain stronger consumer preference.

- Regulations on single-use plastics will accelerate sustainable packaging investments.

- Frozen and ready-to-eat food categories will continue to drive container demand.

- Smart packaging features will improve reheating safety and food quality.

- Retailers will prefer customizable designs that support branding opportunities.

- Supply chain optimization will become vital to reduce cost fluctuations.

- Emerging markets will contribute significantly with rising urban consumption trends.