Market Overview

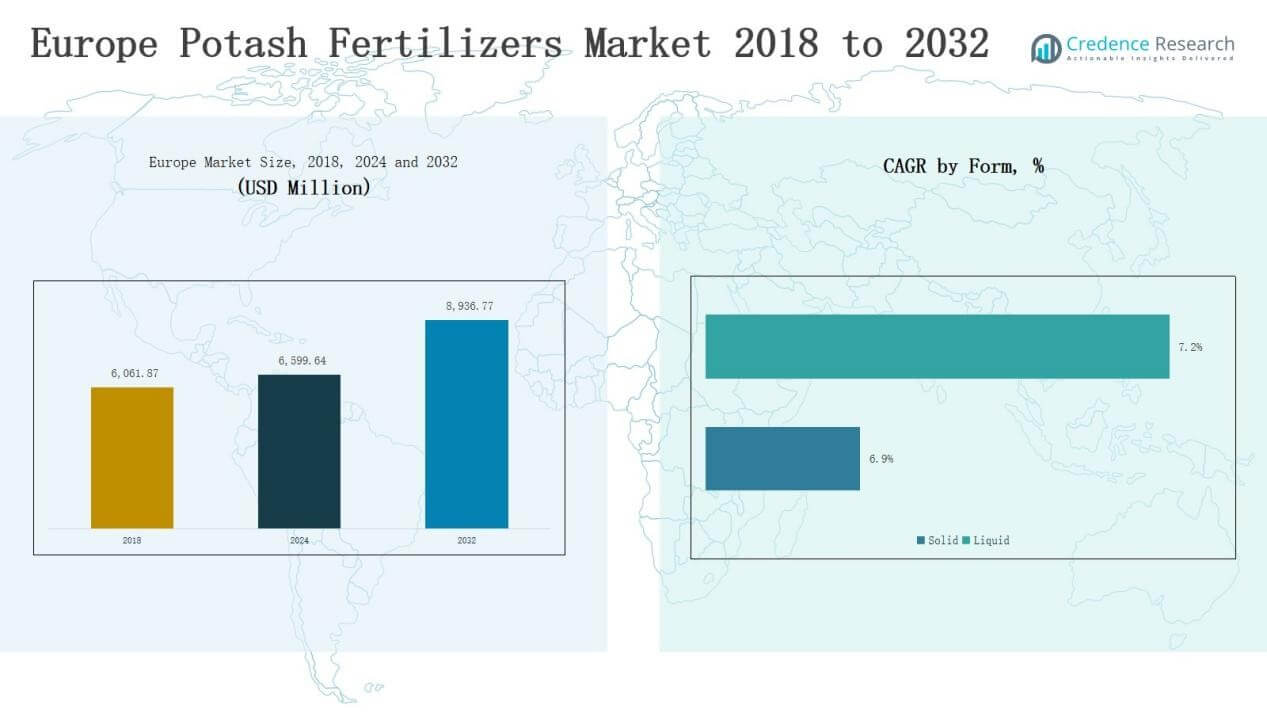

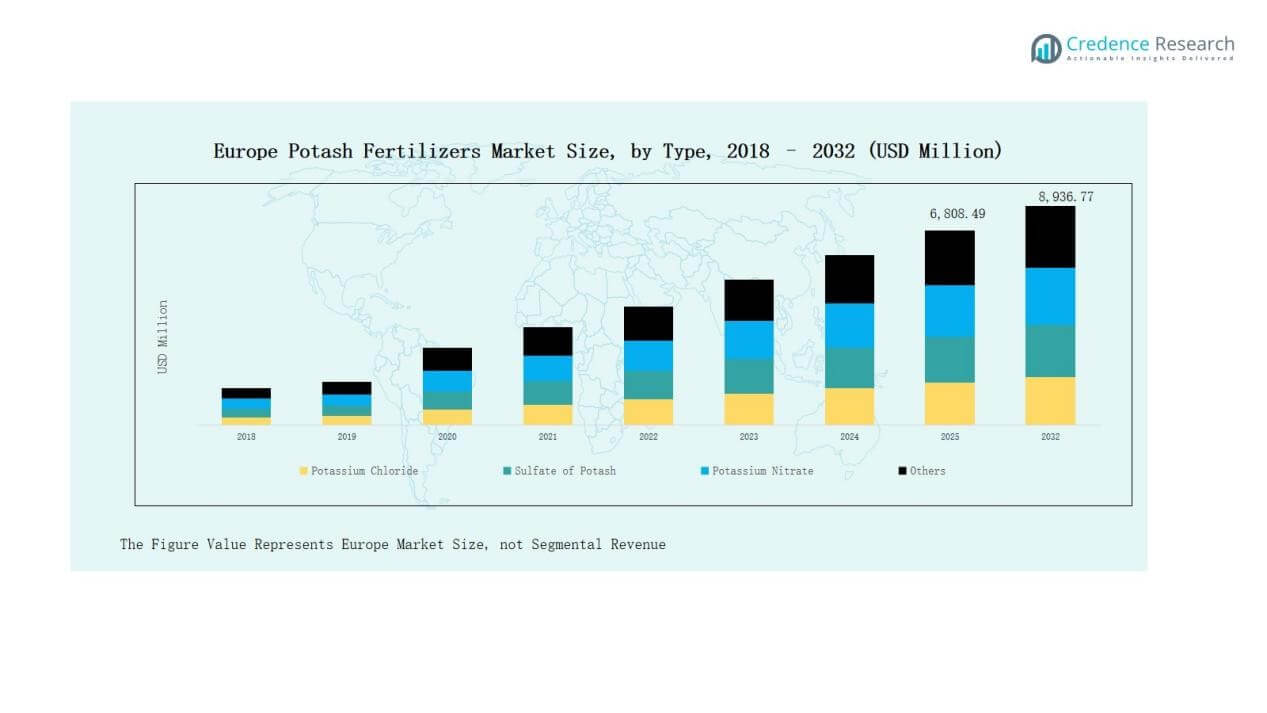

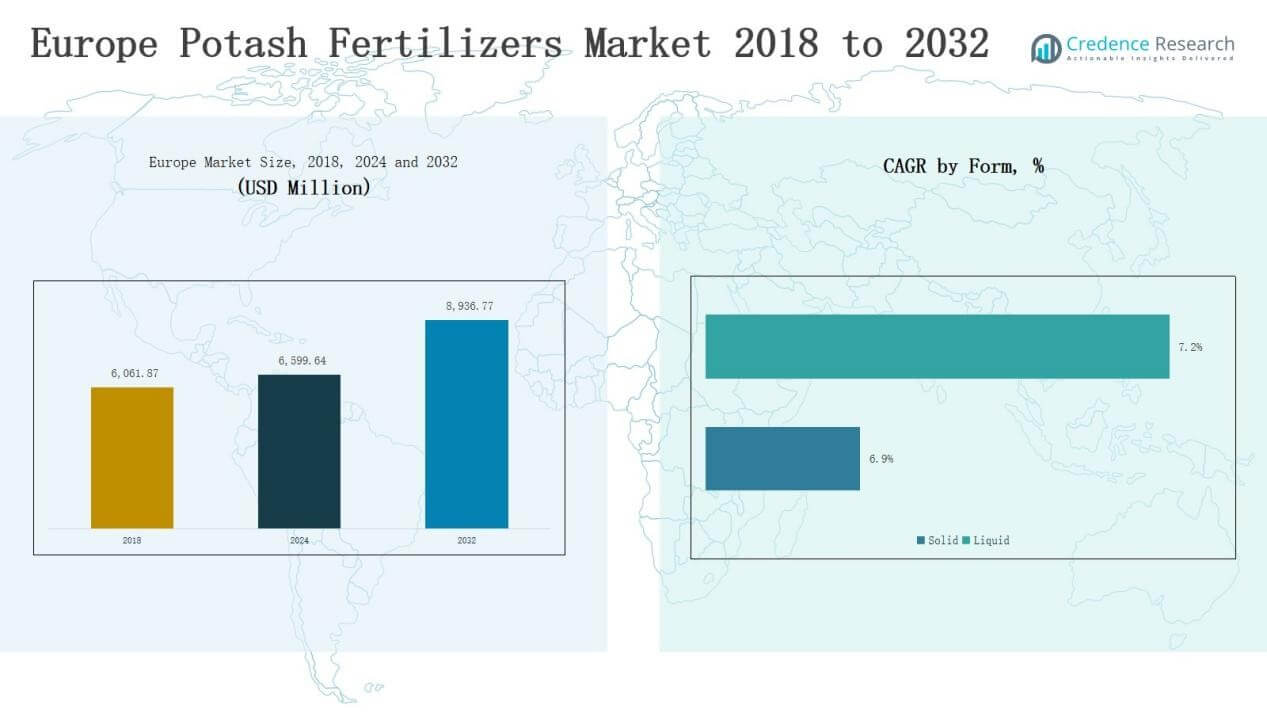

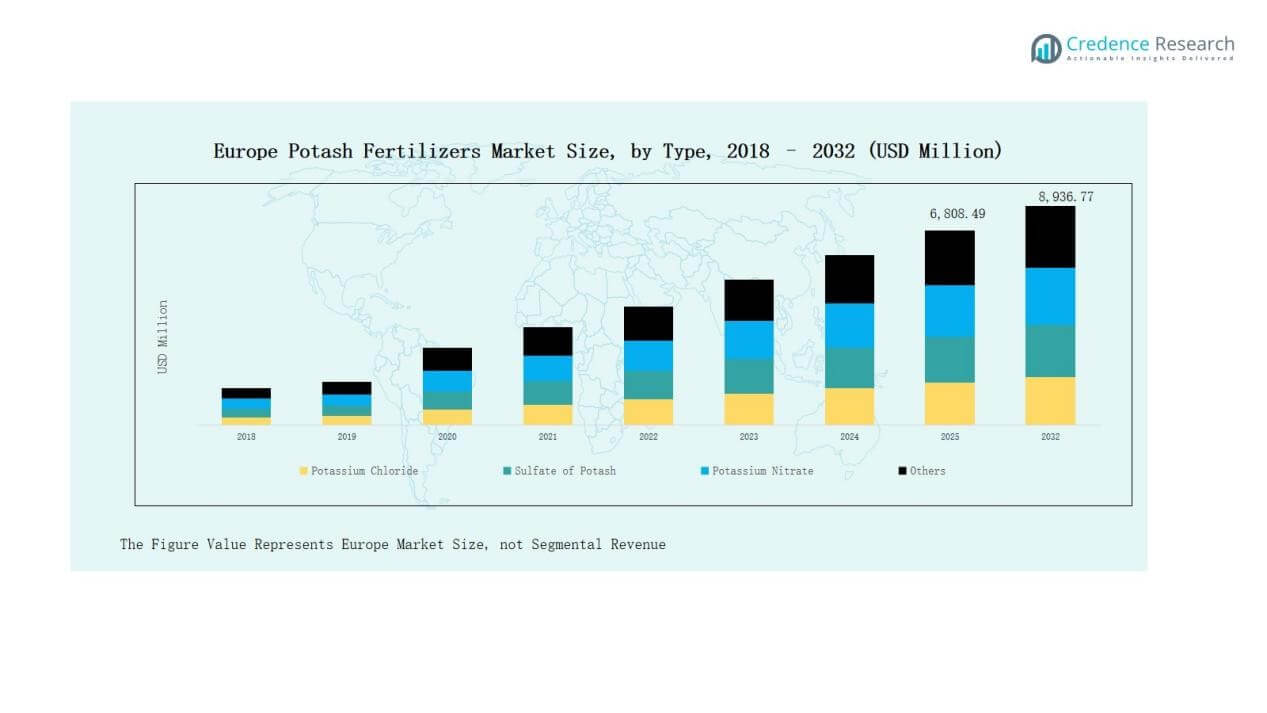

Europe Potash Fertilizers Market size was valued at USD 6,061.87 million in 2018 to USD 6,599.64 million in 2024 and is anticipated to reach USD 8,936.77 million by 2032, at a CAGR of 3.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Potash Fertilizers Market Size 2024 |

USD 6,599.64 Million |

| Europe Potash Fertilizers Market, CAGR |

3.83% |

| Europe Potash Fertilizers Market Size 2032 |

USD 8,936.77 Million |

The Europe Potash Fertilizers Market is shaped by major players including Yara International ASA, EuroChem, K+S AG, Mosaic Company, ICL, Borealis AG, Belaruskali, Uralkali, SQM S.A., Compass Minerals International Ltd., and Israel Chemicals Ltd. (ICL). These companies maintain leadership through integrated supply chains, large-scale production, and investments in sustainable formulations such as sulphate of potash and potassium nitrate. Among regional markets, Russia led with a 20% share in 2024, supported by strong domestic production, grain cultivation, and export capabilities.

Market Insights

- The Europe Potash Fertilizers Market grew from USD 6,061.87 million in 2018 to USD 6,599.64 million in 2024 and is projected to reach USD 8,936.77 million by 2032, expanding at a CAGR of 3.83%.

- Potassium Chloride led with 58% share in 2024, supported by its cost efficiency and strong application in cereals and grains, while Sulphate of Potash gained from fruit and vegetable cultivation.

- Broadcasting dominated application methods with 52% share in 2024 due to ease and low cost in cereals, while fertigation is expanding across horticulture and greenhouse farming systems.

- Solid fertilizers held 71% share in 2024, preferred for storage and field-scale farming, while liquid fertilizers gained momentum in horticulture, greenhouse, and precision farming practices.

- Regionally, Russia led with 20% share in 2024, followed by Rest of Europe at 20%, the UK at 14%, France at 13%, Germany at 12%, Italy at 11%, and Spain at 10%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

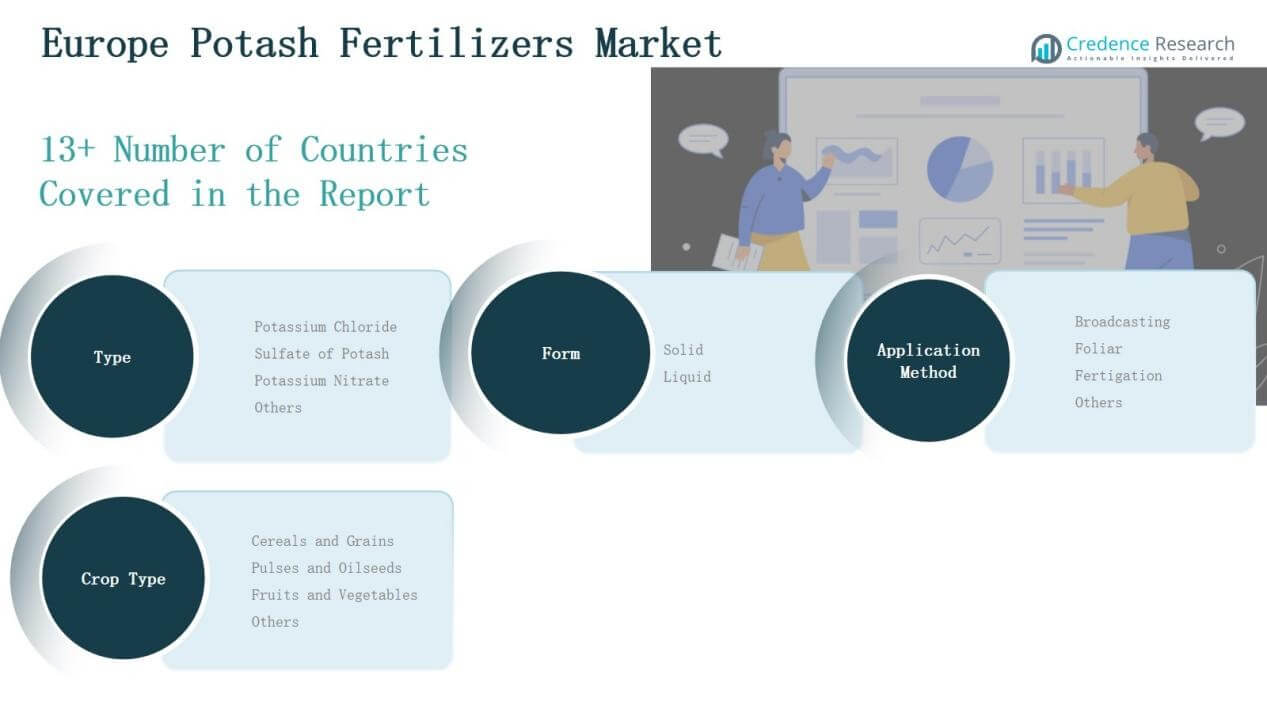

By Type

Potassium Chloride dominated the Europe Potash Fertilizers Market with 58% share in 2024, driven by strong use in cereals and grains. Its cost efficiency and high potassium content make it the preferred option for large-scale farming. Sulphate of Potash is expanding steadily, supported by demand from chloride-sensitive crops such as fruits and vegetables. Potassium Nitrate caters to high-value horticulture, while other specialized potash types address niche requirements in customized crop nutrition.

By Application Method

Broadcasting held the largest share at 52% in 2024, owing to its widespread adoption across cereal cultivation. Farmers prefer broadcasting because of its cost-effectiveness and ease of large-scale application. Fertigation is rising in importance with modern irrigation systems, particularly in fruit and vegetable farming. Foliar feeding remains a smaller but growing segment, valued for its targeted nutrient delivery, quick absorption, and contribution to higher yields in high-value crop production.

For instance, Yara International expanded the use of its YaraVita foliar nutrition products across European vineyards, citing trials that delivered up to 12% higher grape yields.

By Form

Solid fertilizers commanded a 71% share in 2024, dominating due to cost-effectiveness, ease of storage, and suitability for large-scale field applications. Their widespread use in cereals and grains farming supports their leading position. Liquid fertilizers, although smaller in market size, are gaining momentum with precision farming practices. They are increasingly adopted in horticulture and greenhouse cultivation, where uniform nutrient application, higher efficiency, and compatibility with fertigation systems are critical for productivity.

For instance, Nutrien announced the rollout of its enhanced liquid nitrogen solutions tailored for fertigation in greenhouse crops across North America.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Yield Crops

Europe’s increasing food security concerns and growing population are driving demand for high-yield crops. Potash fertilizers play a critical role in improving crop quality, enhancing root strength, and increasing resistance to drought and disease. Cereals and grains remain the largest consumers, as they are staple crops across the region. Farmers are adopting potassium-based solutions to boost productivity while meeting stringent EU agricultural standards. This trend reinforces steady growth in potash fertilizer demand across diverse crop categories.

For instance, ICL Group launched Polysulphate-based potash products in the U.K. market to support sustainable cereal farming, aligning with EU nutrient stewardship regulations.

Expansion of Sustainable Farming Practices

The rising adoption of sustainable farming practices across Europe is fueling potash fertilizer demand. The EU’s Green Deal and Farm-to-Fork strategy emphasize reducing chemical inputs while maintaining productivity. Potash fertilizers improve nutrient efficiency, reduce crop stress, and enhance long-term soil fertility, aligning with sustainable agriculture goals. Farmers are increasingly turning to chloride-free variants, such as sulphate of potash and potassium nitrate, for sensitive crops. This regulatory and environmental push significantly accelerates market expansion and product diversification.

For instance, K+S Minerals and Agriculture GmbH expanded its potassium sulphate production capacity at its German facilities to meet rising demand for chloride-free fertilizers in specialty crop cultivation.

Technological Integration in Agriculture

The adoption of precision farming technologies is boosting potash fertilizer consumption in Europe. Advanced tools, including soil sensors, GPS mapping, and smart irrigation, enable efficient nutrient application. Fertigation and foliar methods are gaining traction, supported by these technologies, as they ensure precise delivery of potassium to crops. Improved crop management practices help farmers achieve higher yields with lower input costs. The combination of digital agriculture and innovative fertilizer formulations is creating new growth opportunities in the market.

Key Trends & Opportunities

Growth in Horticulture and Specialty Crops

Rising consumer demand for fruits, vegetables, and high-value specialty crops in Europe is increasing potash fertilizer usage. Chloride-sensitive crops, such as grapes, berries, and potatoes, are driving the shift toward sulphate of potash and potassium nitrate. These fertilizers enhance fruit quality, sugar content, and shelf life, which are essential for both domestic consumption and exports. With expanding greenhouse and horticulture production, demand for advanced potassium fertilizers is expected to grow significantly, providing new opportunities for producers.

For instance, Yara International introduced its potassium-nitrate foliar fertilizer, Krista-K Plus, across European horticulture markets, targeting improved color and firmness in strawberries and tomatoes.

Increasing Focus on Bio-Based Fertilizers

A growing opportunity lies in the development of bio-based and eco-friendly potash fertilizers. European consumers and policymakers increasingly demand sustainable solutions with lower environmental impact. Manufacturers are investing in water-soluble and bio-enhanced potash formulations that complement organic farming systems. These innovations not only improve nutrient uptake but also meet EU regulations on reducing harmful emissions. Companies that prioritize sustainability through research, innovation, and partnerships are well-positioned to capture market share in this evolving regulatory environment.

For instance, ICL Group introduced its new line of water‑soluble fertilizers under the Nova brand, featuring eco-friendly potash solutions aimed at improving nutrient efficiency in horticulture.

Key Challenges

Key Challenges

Price Volatility in Raw Materials

The Europe potash fertilizers market faces significant challenges from raw material price fluctuations. Potash production depends on mining, and supply chain disruptions, geopolitical tensions, and energy costs often cause price instability. Rising input costs directly impact fertilizer affordability for farmers, particularly smallholders. This volatility creates uncertainty in procurement planning and discourages long-term investments. Stabilizing supply and diversifying sourcing strategies remain essential to mitigate these risks and ensure consistent market growth in the region.

Environmental Regulations and Restrictions

Strict environmental regulations across Europe challenge market growth by imposing limits on fertilizer use. Policies under the EU Green Deal and nitrate directives are designed to minimize soil degradation, leaching, and water pollution. While these rules encourage sustainable practices, they also raise compliance costs for producers and limit farmer flexibility. Companies must invest heavily in research to develop environmentally safe formulations. Balancing productivity with ecological preservation remains a pressing challenge for stakeholders in the potash fertilizers market.

Competition from Alternative Fertilizers

The growing adoption of organic and alternative fertilizers poses a challenge to traditional potash fertilizer demand. Bio-based and micronutrient-rich products are gaining popularity due to consumer preference for chemical-free produce. Farmers, especially in horticulture and greenhouse sectors, are experimenting with alternatives that offer balanced nutrient supply with lower environmental impact. This competitive pressure compels established players to innovate and diversify their portfolios. Failure to adapt to these changing preferences could restrict long-term market expansion in Europe.

Regional Analysis

UK

The UK accounted for 14% share in 2024 of the Europe Potash Fertilizers Market. Demand is led by cereals, oilseeds, and horticulture crops, which require high nutrient efficiency. Farmers prefer Potassium Chloride for grains while Potassium Nitrate gains traction in vegetable and fruit cultivation. The adoption of precision agriculture and greenhouse farming strengthens fertilizer use. Supportive government policies on sustainable farming also encourage chloride-free alternatives. The market continues to adapt to evolving regulatory and sustainability standards.

France

France held a 13% share in 2024, supported by its strong fruit, vegetable, and wine industries. Sulphate of Potash dominates due to chloride sensitivity in vineyards and orchards. Farmers focus on high-value crop production, which boosts the adoption of specialty fertilizers. Broadcasting remains widespread, but fertigation is gaining scale in controlled farming environments. Government incentives for sustainable practices also accelerate demand for eco-friendly fertilizer formulations. The country continues to serve as a leading hub for horticulture-driven growth.

Germany

Germany represented 12% share in 2024, supported by its advanced agricultural infrastructure and high mechanization levels. Cereals and grains drive the bulk of fertilizer demand, with Potassium Chloride remaining the primary type. Farmers are also investing in fertigation and liquid fertilizer systems, particularly in horticulture and greenhouse crops. Germany’s strict environmental regulations promote the use of low-emission fertilizers. Producers are focusing on innovative formulations to meet these sustainability targets. The market reflects a strong balance between scale and compliance.

Italy

Italy contributed 11% share in 2024, driven by its strong fruit, vegetable, and vineyard cultivation. Farmers prefer Sulphate of Potash and Potassium Nitrate to improve fruit quality, sugar content, and shelf life. Greenhouse farming in southern regions boosts the use of fertigation and liquid fertilizers. Cereals also maintain steady demand for traditional potash forms. Italy’s export-oriented horticulture sector continues to influence product choices. The market outlook is positive, supported by high-value crop specialization.

Spain

Spain accounted for 10% share in 2024, fueled by extensive fruit and vegetable cultivation. Greenhouse farming in Almería and Murcia strongly supports fertigation-based potash fertilizer use. Sulphate of Potash is widely used for citrus and grapes, while cereals maintain demand for Potassium Chloride. Farmers are focusing on sustainable practices to meet EU standards. The combination of large-scale horticulture and export focus keeps Spain an important contributor to regional fertilizer demand.

Russia

Russia dominated with a 20% share in 2024, making it the leading country in the Europe Potash Fertilizers Market. It benefits from being a key potash producer while also consuming large volumes for grain cultivation. The dominance of cereals drives high usage of Potassium Chloride. Domestic production capacity ensures supply stability and price advantages. Export-oriented production strengthens the global influence of Russian suppliers. The market remains central to Europe’s potash dynamics due to its production scale and consumption strength.

Rest of Europe

The Rest of Europe collectively accounted for 20% share in 2024, covering smaller but diverse agricultural markets. Countries in Eastern and Northern Europe drive fertilizer use through cereals, oilseeds, and horticulture crops. Adoption of sustainable farming practices is expanding, creating opportunities for eco-friendly potash formulations. Governments are promoting balanced fertilizer application to improve yields while reducing environmental impact. The market reflects a mix of traditional use and emerging demand for modern application methods.

Market Segmentations:

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Potash Fertilizers Market is characterized by strong competition among global and regional players that focus on product innovation, capacity expansion, and sustainability strategies. Leading companies such as Yara International ASA, EuroChem, K+S AG, Mosaic, and ICL maintain significant positions through integrated supply chains and diversified portfolios. Russian producers like Uralkali and Belaruskali strengthen the market with large-scale production and export capabilities, ensuring supply stability across the region. Specialty producers, including SQM and Compass Minerals, cater to high-value horticulture crops with chloride-free formulations. Companies are investing in eco-friendly products such as sulphate of potash and potassium nitrate to align with Europe’s sustainability goals and strict environmental regulations. Strategic partnerships, R&D investments, and mergers remain central growth strategies. The market reflects consolidation trends while leaving space for niche entrants offering bio-based and specialty fertilizers, supported by rising demand from horticulture, precision farming, and organic production segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Yara International ASA

- EuroChem

- K+S AG

- ICL (via Boulby Mine)

- Borealis AG

- Mosaic Company

- Belaruskali

- Uralkali

- SQM S.A.

- Israel Chemicals Ltd. (ICL)

- Compass Minerals International Ltd.

Recent Developments

- In August 2024, ICL signed a five-year agreement with AMP Holdings Group Co. Ltd., one of China’s largest agricultural distributors, valued at approximately USD 170 million, to expand its Growing Solutions product offerings and presence in major end markets.

- In December 2023, Yara International ASA acquired Italy’s Agribios Italiana to expand its organic-based fertilizer portfolio in Europe.

- In January 2025, K+S AG introduced its C:LIGHT product line, delivering CO₂-reduced potassium and magnesium fertilizers to the European market.

- In July 2023, Borealis AG completed the sale of its nitrogen business, including fertilizers, to AGROFERT for EUR 810 million.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Method, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chloride-free fertilizers will expand with growth in fruits, vegetables, and vineyards.

- Precision farming adoption will increase reliance on liquid potash fertilizers and fertigation methods.

- Russia will continue to dominate supply due to strong production and export capacity.

- Sustainability regulations will drive innovation in eco-friendly and bio-based formulations.

- Specialty fertilizers will gain traction in horticulture and greenhouse cultivation.

- Consolidation among key players will strengthen supply chains and market stability.

- Digital agriculture solutions will optimize nutrient application and reduce wastage.

- Rising consumer demand for organic food will push alternative potash formulations.

- Government policies promoting sustainable farming will encourage advanced product adoption.

- Regional diversification will create growth opportunities in smaller Eastern and Northern European markets.

Key Growth Drivers

Key Growth Drivers Key Challenges

Key Challenges Market Segmentations:

Market Segmentations: