Market Overview

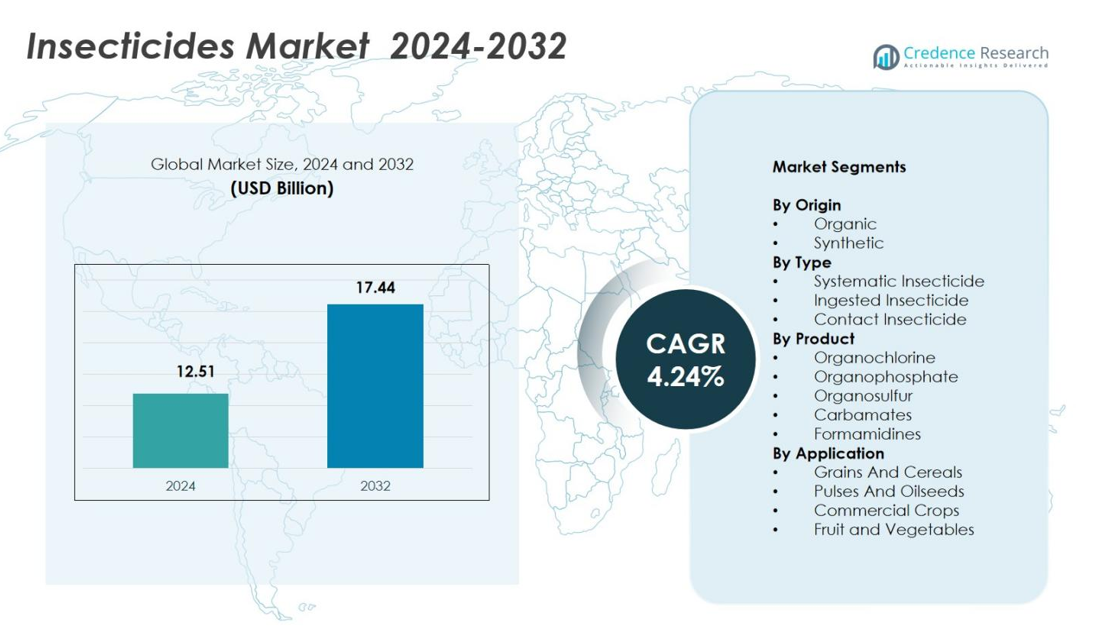

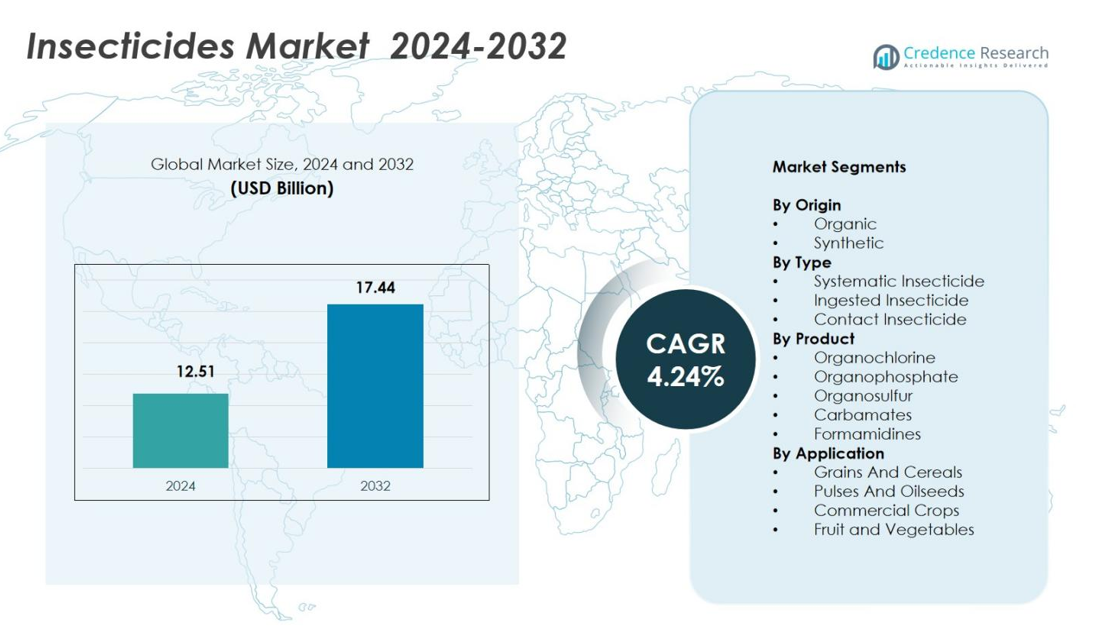

Insecticides Market size was valued at USD 12.51 Billion in 2024 and is anticipated to reach USD 17.44 Billion by 2032, at a CAGR of 4.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Insecticides Market Size 2024 |

USD 12.51 Billion |

| Insecticides Market, CAGR |

4.24% |

| Insecticides Market Size 2032 |

USD 17.44 Billion |

Insecticides Market features leading players such as Syngenta Group, Bayer AG, BASF SE, FMC Corp., Corteva Agriscience, UPL Ltd., Nufarm Ltd., AMVAC Chemical Corp., and Bioworks Inc., each strengthening their portfolios through advanced formulation technologies and expanded bio-insecticide offerings. These companies focus on innovation, sustainability, and region-specific product strategies to address evolving pest pressures and regulatory requirements. Asia-Pacific remained the leading region with 42.6% share in 2024, driven by its extensive agricultural base and high adoption of crop-protection inputs, followed by North America and Europe, which continue to prioritize technologically advanced and eco-friendly insecticide solutions.

Market Insights

- Insecticides Market reached USD 12.51 Billion in 2024 and will reach USD 17.44 Billion by 2032, expanding steadily at a CAGR of 4.24% overall.

- Market growth is driven by rising pest pressure, expanding crop cultivation, and strong adoption of synthetic insecticides holding 68.4% share due to high efficacy and broad application.

- Key trends include increasing demand for bio-insecticides, sustainable farming practices, and stricter residue regulations encouraging safer, modern crop-protection solutions across fruits, vegetables, cereals, and commercial crops.

- Major players like Syngenta Group, Bayer AG, BASF SE, FMC Corp., and UPL Ltd. focus on innovation, enhanced formulations, and region-specific strategies while navigating regulatory and resistance challenges.

- Asia-Pacific led with 42.6% share, followed by North America at 21.4% and Europe at 18.7%, supported by precision agriculture adoption and expanding integrated pest-management practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Origin

The Insecticides Market by origin is led by the Synthetic segment, which accounted for 68.4% share in 2024, driven by strong efficacy, rapid knockdown action, and wide compatibility with large-scale commercial farming. Synthetic insecticides remain preferred for high pest-pressure crops such as cereals, cotton, and horticulture, supporting consistent yield protection. The Organic segment, holding 31.6% share, is expanding steadily as growers adopt bio-based solutions to meet residue-free standards and sustainability certifications. Rising regulatory restrictions on chemical formulations and growing consumer demand for safer produce further strengthen the shift toward organic alternatives without reducing the dominance of synthetic products.

- For instance, BATIK WG from Bacillus thuringiensis var. Kurstaki serves organic cotton farmers by producing insecticidal proteins toxic to lepidopteran larvae like bollworms, enabling effective pest control without synthetic residues.

By Type

The Insecticides Market by type is dominated by Systematic insecticides, which held 44.7% share in 2024, driven by their ability to penetrate plant tissues and offer long-lasting, internal protection against pests. Their effectiveness in managing hidden or sap-sucking insects boosts adoption in grains, vegetables, and fruit crops. Contact insecticides, accounting for 33.1% share, continue to register strong usage due to fast action. Ingested insecticides, with 22.2% share, grow steadily with increased use in integrated pest-management (IPM) programs. Rising pest resistance and demand for targeted safety-focused solutions primarily propel systematic insecticide uptake.

- For instance, Bayer’s Admire (imidacloprid) offers systemic control for sucking pests like aphids, jassids, and thrips in vegetables including tomatoes, potatoes, and okra, plus grains like paddy, by absorbing through roots or foliage to target the insects’ nervous systems.

By Product

By product, the market is led by Organophosphate insecticides, which captured 36.9% share in 2024, supported by their broad-spectrum activity, cost-effectiveness, and strong relevance in developing agricultural economies. Carbamates followed with 22.4% share, attributed to reliable performance against chewing and sucking pests. Organochlorines, holding 15.7% share, maintain limited but stable usage in restricted applications. Formamidines accounted for 13.2% share, while Organosulfur insecticides held 11.8% share, driven by rising adoption in fruits and vegetables. Continued demand for high-efficacy chemical classes amid pest outbreaks reinforces the dominance of organophosphates.

Key Growth Drivers

Rising Global Food Demand and Intensifying Pest Pressure

The Insecticides Market grows significantly as rising global food demand increases the need for high-yield agricultural output. Expanding cultivation of cereals, oilseeds, and commercial crops exposes farms to more frequent and severe pest infestations, driving reliance on effective insect-control solutions. Climate change further accelerates pest proliferation, forcing farmers to adopt advanced chemical and biological insecticides to minimize crop losses. Governments in emerging economies promote modern crop protection practices, boosting the adoption of both synthetic and organic formulas and reinforcing long-term market expansion.

- For instance, BASF introduced Cimegra® insecticide in Indonesia, providing farmers with long-duration protection against tough insect pests across various crops, following successful deployments in China and India.

Advancements in Formulation Technologies and Product Innovation

Continuous innovation in formulation technologies supports strong market growth by improving insecticide efficacy, environmental safety, and residue management. Manufacturers increasingly invest in nano-formulations, controlled-release technologies, and targeted active ingredients that enhance penetration, reduce application frequency, and minimize non-target impact. These advancements enable better pest resistance management and help growers meet stringent regulatory and quality standards. The introduction of newer active molecules with improved toxicological profiles strengthens adoption across high-value crops, ensuring the sector transitions toward safer, high-performance insect-control solutions.

- For instance, Syngenta’s Demand CS employs iCAP microencapsulation technology with lambda-cyhalothrin, where smaller capsules provide immediate pest knockdown and larger ones ensure residual control up to 90 days across more than 30 pests including ants and cockroaches.

Expansion of Integrated Pest Management (IPM) Practices

The growing adoption of IPM frameworks drives demand for insecticides that complement biological controls, pheromone traps, and cultural practices. Farmers prefer selective and systemic insecticides that deliver strong efficacy while maintaining ecological balance and preserving beneficial insects. IPM-aligned products reduce environmental risk, support sustainable farming certifications, and enable compliance with export regulations. With global supply chains emphasizing residue-free produce and traceability, IPM-compatible insecticides play a critical role in securing crop quality and marketability. This shift strengthens long-term insecticide demand rooted in balanced, science-driven pest-control strategies.

Key Trends & Opportunities

Rapid Adoption of Bio-Insecticides and Sustainable Crop Protection

A significant trend shaping the market is the rapid shift toward bio-insecticides driven by regulatory pressure, consumer preference for chemical-free produce, and sustainability goals. Companies increasingly develop microbial, botanical, and pheromone-based insecticides that reduce toxicity and improve environmental compatibility. This transition creates strong opportunities in organic farming, horticulture, and export-oriented agriculture. The combination of biological and low-toxicity synthetic products in hybrid pest-management programs further expands market potential, enabling safer alternatives without compromising yield outcomes.

- For instance, Bioceres Crop Solutions gained approval in Brazil for three new bioinsecticidal solutions derived from inactivated cells of its proprietary Burkholderia platform.

Digital Agriculture and Precision Insecticide Application

Precision agriculture technologies open new opportunities by optimizing insecticide application based on real-time pest monitoring, weather insights, and field mapping. Drones, remote-sensing tools, and AI-driven decision-support systems enable farmers to apply insecticides accurately, improving efficacy while reducing chemical waste and cost. This trend accelerates adoption of sophisticated formulations compatible with variable-rate spraying. As digital platforms integrate predictive analytics for pest outbreaks, demand for targeted insecticide solutions increases, supporting higher productivity and sustainability across large-scale farming operations.

- For instance, Garuda Aerospace deploys drones for automated pesticide spraying in agriculture, integrating AI to target crop areas efficiently and cut labor dependency in large fields.

Key Challenges

Stringent Regulatory Frameworks and Active Ingredient Restrictions

The Insecticides Market faces major challenges due to increasingly strict regulatory frameworks governing chemical toxicity, environmental impact, and residue levels. Many countries impose bans or usage restrictions on specific active ingredients, limiting product availability and requiring costly reformulation efforts from manufacturers. Compliance with evolving safety standards raises development timelines and investment burdens. These constraints also pressure farmers to transition toward alternative solutions, reducing the market potential for several traditional chemical insecticides and complicating supply-chain planning for global producers.

Growing Pest Resistance and Reduced Efficacy of Conventional Molecules

Rising pest resistance to widely used insecticide classes, including organophosphates, pyrethroids, and carbamates, poses a significant barrier to market performance. Frequent and repeated applications accelerate resistance buildup, diminishing product effectiveness and increasing crop-loss risks. Overcoming resistance requires continuous R&D investments in novel modes of action, integrated pest-management strategies, and rotation-based application protocols. However, limited availability of new active molecules and high development costs intensify the challenge, pushing growers to seek diversified and technologically advanced pest-control solutions.

Regional Analysis

North America

North America accounted for 21.4% share of the Insecticides Market in 2024, driven by large-scale adoption of advanced crop protection technologies and strong demand from high-value crops such as soybeans, maize, and fruits. The region benefits from precision agriculture, drone spraying, and integrated pest-management (IPM) programs that promote selective and systemic insecticides. Regulatory pressure encourages innovation in low-toxicity and bio-based formulations, while rising pest resistance pushes growers toward next-generation active ingredients. Strong R&D activity in the U.S. and expanding sustainable farming initiatives continue to support steady market development across the region.

Europe

Europe held 18.7% share in 2024, shaped by stringent regulatory frameworks, rapid transition toward bio-insecticides, and rising emphasis on residue-free agricultural output. The region implements some of the world’s strictest chemical safety norms, prompting farmers to adopt eco-friendly insecticides aligned with the European Green Deal and Farm to Fork Strategy. Growth is strongest in horticulture, vineyards, and organic production systems. Increasing pest incidence driven by climatic shifts reinforces the demand for targeted, low-impact insecticides. Expanding investments in biological crop protection, coupled with technological innovation in sustainable farming, drive long-term market progression across Europe.

Asia-Pacific

Asia-Pacific dominated the market with 42.6% share in 2024, supported by its expansive agricultural base, high pest infestation levels, and strong dependence on crop protection chemicals for staple crops such as rice, wheat, and cotton. The region experiences rapid growth due to rising food demand, increased farm mechanization, and growing awareness of yield-enhancing inputs. Countries like China, India, and Japan drive innovation, promoting both synthetic and bio-based insecticides. Government programs supporting modern farming and IPM adoption further accelerate usage. Emerging climate-related pest outbreaks reinforce the need for high-efficacy solutions, strengthening the region’s leading position.

Latin America

Latin America captured 9.8% share in 2024, driven by extensive cultivation of export-oriented crops such as soybeans, sugarcane, fruits, and coffee. Brazil and Argentina lead market demand due to high pest pressure and year-round crop cycles that require robust insecticide application. Adoption of systemic and broad-spectrum insecticides is strong, supported by advanced agribusiness operations. Expanding precision farming and digital monitoring tools enhance application efficiency. However, rising regulatory scrutiny and environmental concerns encourage a gradual shift toward safer formulations. Increasing investment from global agrochemical companies strengthens growth prospects across Latin America.

Middle East & Africa

The Middle East & Africa region accounted for 7.5% share in 2024, supported by expanding agricultural activities, growing cultivation of cereals and horticulture crops, and increasing pest challenges due to erratic climate conditions. Countries in Sub-Saharan Africa show rising adoption of insecticides to reduce post-harvest losses and improve food security. Government-backed farming programs and international aid initiatives promote modern pest-control solutions. Growth in the Middle East is driven by greenhouse farming and high-value fruit production. Limited domestic manufacturing creates opportunities for global suppliers, while expanding IPM awareness supports sustainable, long-term market development.

Market Segmentations

By Origin

By Type

- Systematic Insecticide

- Ingested Insecticide

- Contact Insecticide

By Product

- Organochlorine

- Organophosphate

- Organosulfur

- Carbamates

- Formamidines

By Application

- Grains And Cereals

- Pulses And Oilseeds

- Commercial Crops

- Fruit and Vegetables

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Insecticides Market features leading players such as AMVAC Chemical Corp., UPL Ltd., Bayer AG, BASF SE, FMC Corp., Corteva Agriscience, Nufarm Ltd., Bioworks Inc., and Syngenta Group, each strengthening their portfolios through innovation and strategic expansion. The competitive landscape is shaped by continuous investments in new active ingredients, bio-insecticide development, and advanced formulation technologies designed to improve efficacy and environmental safety. Companies increasingly prioritize sustainable solutions aligned with regulatory expectations, driving rapid growth in microbial and botanical insecticides. Partnerships with agricultural research institutes, digital farming platforms, and distribution networks enhance product reach and farmer engagement. Major players emphasize region-specific strategies to address varying pest profiles, resistance patterns, and crop requirements. The rising adoption of precision agriculture further pushes manufacturers to develop targeted, IPM-compatible insecticides that support long-term performance. Collectively, these strategies reinforce strong market positioning and foster innovation across global crop-protection ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Syngenta Group

- Bioworks, Inc.

- UPL Ltd.

- BASF SE

- Nufarm Ltd.

- Corteva Agriscience

- Bayer AG

- FMC Corp.

- AMVAC Chemical Corp.

- Sumitomo Chemical Co., Ltd.

Recent Developments

- In October 2025, BASF SE announced a strategic partnership with Nissan Chemical Corporation to commercialize its new active ingredient Prexio® Active for rice growers in Japan.

- In 2025, Bayer AG introduced Camalus, a dual-action insecticide for chewing and sucking pests, aimed primarily at the horticulture segment in India.

- In August 2025, Insecticides India Ltd in partnership with Corteva Agriscience launched a new broad-spectrum insecticide named SPARCLE targeting brown plant hopper infestations in rice crops.

Report Coverage

The research report offers an in-depth analysis based on Origin, Type, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increased adoption of bio-insecticides as sustainability regulations intensify and farmers shift toward residue-free crop protection.

- Synthetic insecticides will continue to evolve with safer molecules and targeted formulations that align with global compliance standards.

- Precision agriculture technologies will drive more efficient insecticide usage through data-driven application and predictive pest analytics.

- Climate change will heighten pest outbreaks, increasing demand for advanced and long-lasting insect-control solutions.

- Integrated pest management frameworks will encourage the use of selective and systemic insecticides that support ecological balance.

- R&D investment will accelerate the development of novel modes of action to address rising pest resistance.

- Emerging economies will expand market growth through increasing agricultural modernization and higher crop-protection spending.

- Digital farming platforms will enhance insecticide decision-making and promote adoption of tailored application programs.

- High-value horticulture and export-oriented crops will strengthen demand for premium and low-toxicity insecticides.

- Strategic collaborations among agrochemical companies, research bodies, and technology firms will drive innovation and expand product portfolios.