Market Overview

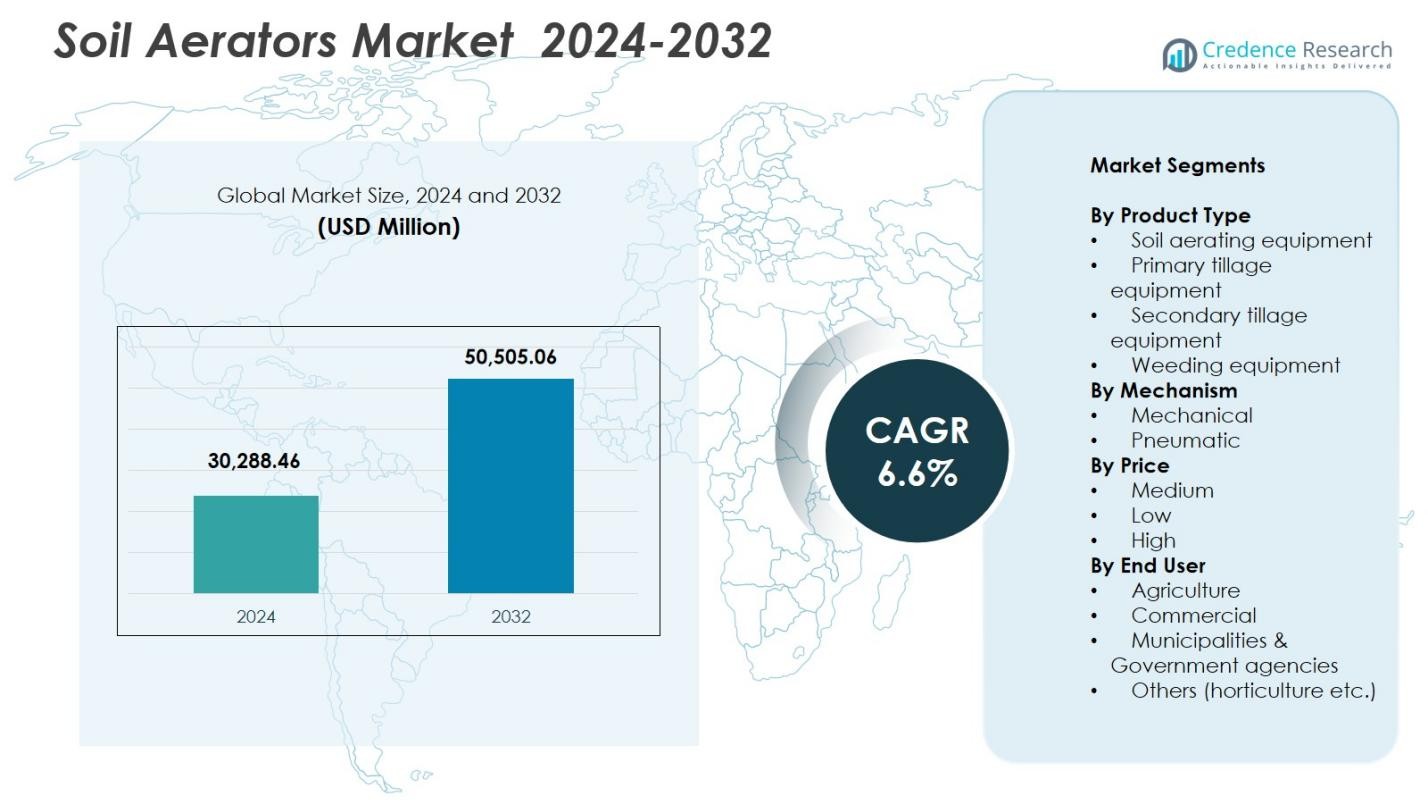

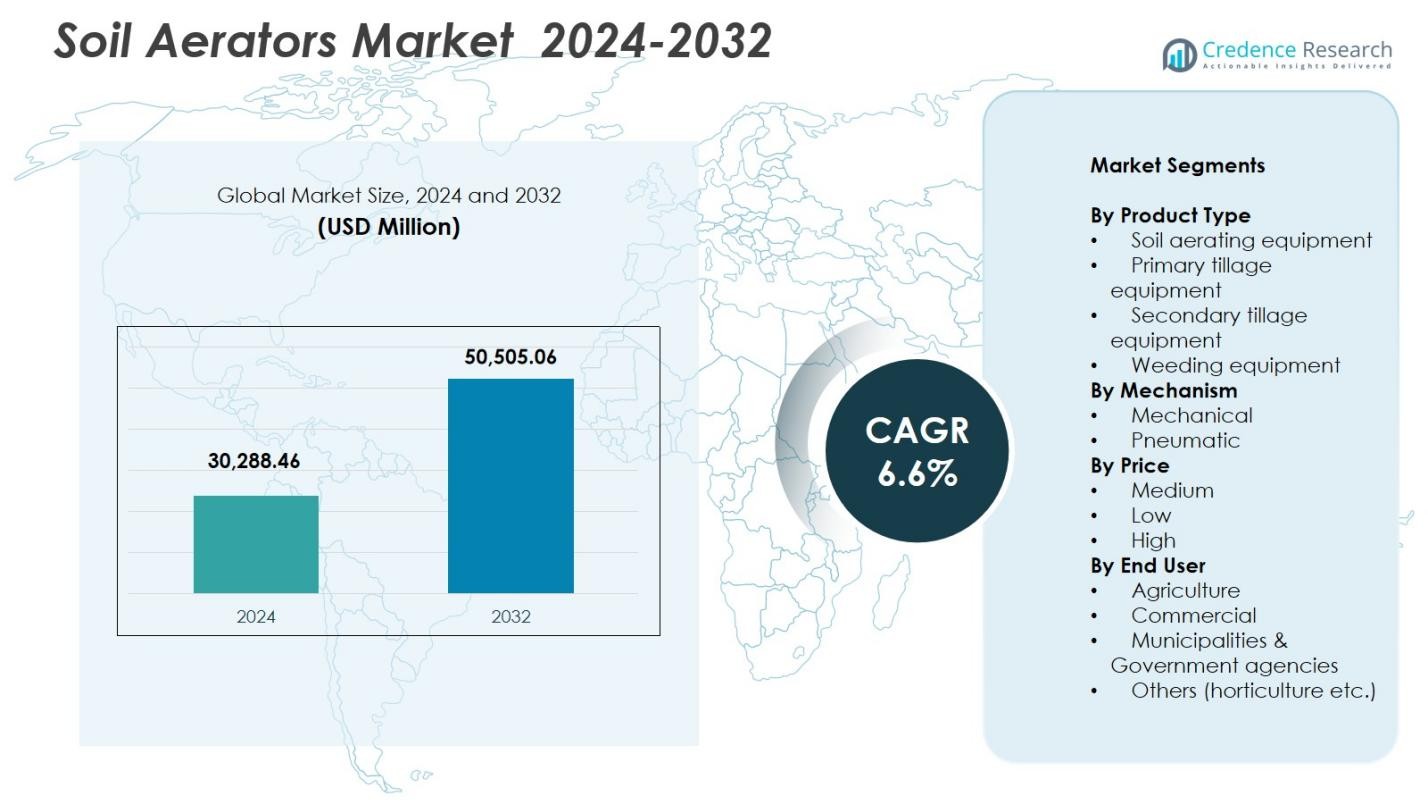

Soil Aerators Market size was valued at USD 30,288.46 Million in 2024 and is anticipated to reach USD 50,505.06 Million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soil Aerators Market Size 2024 |

USD 30,288.46 Million |

| Soil Aerators Market , CAGR |

6.6% |

| Soil Aerators Market Size 2032 |

USD 50,505.06 Million |

The Soil Aerators market is dominated by key players such as Deere, Toro, Kubota, Bobcat, Alamo, Salford, Orthman, Evers Agro, Kondex, Lemken, Bucher, Rata Industries, Northstar Attachments, Kenney Machinery, and Briggs & Stratton. Deere and Toro lead with advanced mechanical and pneumatic aerators, offering high efficiency and precision, while Kubota and Bobcat focus on versatile, cost-effective solutions suitable for medium and small-scale farms. North America holds the largest regional share at 32.5%, driven by widespread mechanization and adoption of precision farming. Europe follows with 28.1%, supported by sustainable agriculture practices and regulatory frameworks. Asia-Pacific accounts for 22.4%, fueled by rapid agricultural modernization, while Latin America and Middle East & Africa hold 9.3% and 7.7% shares, respectively, benefiting from government initiatives and expanding commercial farming operations. The market growth is shaped by innovation, regional expansion, and strong distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Soil Aerators Market size was valued at USD 30,288.46 Million in 2024 and is projected to reach USD 50,505.06 Million by 2032, growing at a CAGR of 6.6%.

- Rising adoption of mechanized farming, focus on soil health, and government subsidies for farm modernization are driving market growth globally.

- Integration with precision agriculture technologies, development of mechanical and pneumatic aerators, and increasing demand for medium-priced equipment are key trends creating growth opportunities.

- Deere, Toro, Kubota, Bobcat, Alamo, Salford, Orthman, Evers Agro, Kondex, Lemken, Bucher, Rata Industries, Northstar Attachments, Kenney Machinery, and Briggs & Stratton dominate the market with strong product portfolios and regional presence.

- North America leads with 32.5% share, Europe holds 28.1%, Asia-Pacific accounts for 22.4%, Latin America 9.3%, and Middle East & Africa 7.7%; soil aerating equipment is the dominant sub-segment with 42.8% share, and mechanical aerators lead with 57.3% share.

Market Segmentation Analysis

By Product Type

The Soil Aerators market, segmented by product type, is led by soil aerating equipment, which accounted for 42.8% of the market in 2024. This dominance is driven by the increasing adoption of precision farming techniques and the growing need to improve soil fertility and crop yields. Primary tillage equipment and secondary tillage equipment also contribute significantly, supporting efficient soil preparation. Weeding equipment is witnessing gradual uptake, particularly in regions emphasizing sustainable and labor-efficient practices. The rising focus on mechanized farming and reduction of manual labor costs continues to propel demand across all product types.

- For Instance, Plug-core aerators alone held about 40% of the global soil-aerators market in 2024, reflecting strong demand for efficient soil compaction relief and improved water infiltration.

By Mechanism

Within the mechanism segment, mechanical soil aerators dominate with a 57.3% market share in 2024, owing to their simplicity, lower maintenance requirements, and widespread adoption among small and medium-scale farmers. Pneumatic soil aerators are gaining traction in commercial farms due to higher efficiency and uniform soil perforation. The growth of mechanical aerators is supported by cost-effectiveness and ease of integration with existing tractors and farm implements. Regional government subsidies and initiatives promoting mechanized farming further strengthen the preference for mechanical systems over pneumatic alternatives in emerging agricultural economies.

- For instance, India’s tractor and machinery schemes under the Sub-Mission on Agricultural Mechanization offer subsidies of around 50%-80% on tractors and associated implements, making PTO-driven tools like mechanical soil aerators more affordable for small and marginal farmers and accelerating the shift toward mechanized field operations.

By Price

The price segment of the Soil Aerators market is dominated by the medium-priced equipment, capturing 48.6% of the market in 2024. This segment appeals to mid-sized farms that seek an optimal balance between affordability and performance. Low-priced equipment attracts smallholders but often lacks advanced features, while high-priced models are preferred by large commercial farms for their enhanced durability and efficiency. The medium-priced segment benefits from increasing farm mechanization, supportive financing options, and rising awareness about productivity gains, making it the preferred choice for farmers aiming to enhance soil health without significant capital expenditure.

Key Growth Drivers

Rising Demand for Mechanized Farming

The Soil Aerators market is primarily driven by the increasing adoption of mechanized farming practices worldwide. Farmers are seeking advanced equipment to enhance soil fertility, improve crop yields, and reduce manual labor dependency. Mechanized soil aeration ensures uniform soil perforation, better water infiltration, and improved nutrient absorption, which directly contribute to higher productivity. Government initiatives, subsidies, and favorable agricultural policies supporting mechanization further accelerate adoption, particularly in emerging economies. Additionally, the growing prevalence of medium and large-scale commercial farms, combined with the need for operational efficiency, reinforces the reliance on modern soil aerators. This trend encourages manufacturers to innovate and expand their product portfolios, catering to diverse farm sizes and soil types. Overall, mechanization acts as a critical growth lever, propelling market expansion while fostering sustainable and efficient farming practices.

- For instance, John Deere’s Frontier CA Series aerators are documented to enhance water infiltration and root development through consistent core removal, helping farms improve overall soil structure.

Focus on Sustainable Agriculture and Soil Health

Increasing awareness of sustainable agriculture practices and soil health management is a significant growth driver in the Soil Aerators market. Soil aeration improves oxygenation, microbial activity, and water retention, contributing to long-term soil productivity and environmental sustainability. Governments and agricultural organizations are promoting eco-friendly practices, encouraging farmers to adopt equipment that reduces chemical dependency and enhances soil quality. Organic farming and regenerative agriculture trends create additional demand for soil aerators, particularly in regions with nutrient-depleted or compacted soils. Farmers and commercial agribusinesses are investing in tools that align with sustainable cultivation methods, driving the market forward. Manufacturers are responding by offering innovative solutions that balance efficiency, cost, and environmental impact, thereby positioning soil aerators as essential equipment in modern, responsible agriculture systems.

- For instance, Rodale Institute’s regenerative farming trials highlight that aerated soils show improved microbial biomass and better water infiltration, reinforcing the role of aeration in sustainable systems.

Technological Advancements in Equipment Design

Technological innovation in soil aerators is a key growth driver, enabling higher efficiency, durability, and ease of use. Advanced designs incorporate features such as adjustable tines, modular configurations, and compatibility with tractors of various sizes, enhancing operational flexibility. Integration with GPS-guided and precision farming systems allows optimized field coverage and reduces labor and fuel costs. Innovations in materials and engineering improve equipment longevity, reducing maintenance requirements and total cost of ownership. These advancements appeal to both smallholders and commercial farms seeking reliable, high-performance tools for soil management. The continuous introduction of innovative soil aeration solutions ensures that manufacturers can address diverse farming needs, driving market growth and reinforcing the strategic importance of technology in agricultural mechanization.

Key Trends & Opportunities

Integration with Precision Agriculture

A prominent trend in the Soil Aerators market is the integration of equipment with precision agriculture technologies. GPS-enabled and sensor-based systems allow real-time monitoring of soil conditions, ensuring precise aeration and optimized resource use. This not only enhances crop yield and soil health but also minimizes operational costs by reducing fuel and labor requirements. The opportunity lies in offering smart aerators that provide data-driven insights for soil management, appealing to tech-savvy farmers and large agribusinesses. Companies investing in IoT-enabled and AI-driven soil aerators can capture market share by providing tools that align with modern, efficient, and sustainable farming practices. The convergence of soil aeration with precision agriculture presents a significant avenue for growth and innovation in the coming years.

- For instance, Sensoterra’s IoT soil moisture sensors deliver 99.5% data accuracy in calibrated soils, providing real-time infiltration insights that guide aeration timing for better oxygen flow.

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and Africa offer substantial opportunities for Soil Aerators market growth. Rapid urbanization, rising disposable income, and expanding commercial agriculture sectors drive demand for mechanized soil management solutions. Governments in these regions are promoting agricultural modernization through subsidies, training programs, and supportive policies, which encourage adoption of soil aerators. Additionally, the increasing prevalence of medium-scale and large-scale farms creates demand for equipment that balances cost-effectiveness with operational efficiency. Market players can capitalize on these opportunities by providing affordable, durable, and locally adapted products. Expanding distribution networks, partnerships with local dealers, and awareness campaigns further enhance market penetration, positioning emerging economies as key growth hotspots for the Soil Aerators industry.

- For instance, Brazil’s Moderfrota credit program has significantly increased investment in mechanized farm implements, enabling growers to shift from manual soil preparation to tractor-compatible aeration systems.

Key Challenges

High Initial Capital Investment

One of the primary challenges in the Soil Aerators market is the high upfront cost of mechanized equipment, which can deter small-scale farmers from adoption. While medium and large commercial farms can invest in advanced soil aerators, smallholders often face financial constraints, limiting market penetration. Even with financing options or government subsidies, the perceived risk of investing in high-cost equipment remains a barrier. Additionally, maintenance, spare parts availability, and operational training contribute to the total cost of ownership, further impacting adoption rates. Manufacturers must address this challenge by offering cost-effective solutions, modular designs, and rental or leasing models to make mechanized soil aeration accessible across diverse farm segments.

Variability in Soil Types and Farm Conditions

Soil heterogeneity and differing farm conditions pose a significant challenge to the effectiveness of soil aerators. Equipment optimized for one soil type may underperform in compacted, clay-rich, or rocky terrains, limiting universal applicability. Farmers in regions with diverse soil profiles may require multiple models or adjustable configurations, increasing complexity and cost. Additionally, climatic factors such as rainfall patterns and seasonal variations can affect soil aeration efficiency. Addressing these challenges requires manufacturers to design versatile, durable, and adaptable soil aerators, with adjustable mechanisms suitable for varying soil conditions. Failure to accommodate this variability can hinder adoption and reduce the overall growth potential of the market.

Regional Analysis

North America

North America dominated the Soil Aerators market in 2024, holding a 32.5% share, driven by advanced agricultural practices, widespread mechanization, and high adoption of precision farming technologies. The United States and Canada lead the region, supported by government initiatives promoting sustainable soil management and farm modernization. Large-scale commercial farms prefer high-performance and technologically advanced soil aerators to enhance crop yields and soil health. The presence of established manufacturers, availability of financing options, and strong distribution networks further bolster market growth. Increasing awareness of soil degradation and the need for productivity improvements continue to sustain demand in this mature agricultural market.

Europe

Europe accounted for a 28.1% share of the Soil Aerators market in 2024, led by countries such as Germany, France, and the UK. The market growth is supported by extensive mechanized farming, strict soil conservation regulations, and adoption of sustainable agriculture practices. European farmers are increasingly investing in medium- and high-priced aerators that offer efficiency and durability, driven by environmental mandates and organic farming trends. Technological advancements, such as precision aerators integrated with GPS and IoT systems, further enhance adoption. Additionally, subsidies and grants provided by the European Union to promote soil health and mechanization strengthen the market landscape.

Asia-Pacific

The Asia-Pacific region held a 22.4% share of the Soil Aerators market in 2024, fueled by rapid agricultural modernization, mechanization, and increasing commercial farm operations in countries like China, India, and Australia. Government initiatives, subsidies, and financial assistance for farm equipment adoption accelerate market growth. Rising awareness of soil fertility management and sustainable farming practices drives demand for mechanical and pneumatic soil aerators. The growth of medium-scale farms, coupled with increasing investments by local and international manufacturers, further boosts market penetration. The region presents significant growth potential due to a combination of favorable policies, large arable land, and increasing focus on crop productivity.

Latin America

Latin America contributed 9.3% to the Soil Aerators market in 2024, supported by expanding agricultural activities in Brazil, Argentina, and Mexico. The region’s growth is driven by mechanization trends, rising commercial farming, and increased awareness of soil conservation practices. Medium- and high-priced soil aerators are preferred by commercial farms to improve operational efficiency and soil productivity. Government programs promoting agricultural modernization and export-oriented farming encourage the adoption of advanced soil management equipment. Additionally, partnerships between local distributors and international manufacturers enhance accessibility. Challenges such as varied soil conditions are being addressed through equipment customization, supporting steady growth in the region.

Middle East & Africa

The Middle East & Africa accounted for a 7.7% share of the Soil Aerators market in 2024, driven by initiatives to modernize agriculture and improve food security. Countries such as South Africa, Egypt, and the UAE are adopting mechanized soil aerators to enhance productivity and optimize water and nutrient management in arid and semi-arid regions. Government subsidies and support for farm mechanization encourage investment in medium- and high-priced aerators. Additionally, international collaborations and local manufacturing partnerships improve equipment availability. Despite challenges like harsh soil conditions and limited infrastructure, the region shows steady growth due to rising commercial farming activities and increasing awareness of sustainable soil management practices.

Market Segmentations

By Product Type

- Soil aerating equipment

- Primary tillage equipment

- Secondary tillage equipment

- Weeding equipment

By Mechanism

By Price

By End User

- Agriculture

- Commercial

- Municipalities & Government agencies

- Others (horticulture etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Soil Aerators market features a mix of global and regional players competing to offer innovative, efficient, and durable solutions. Key players include Deere, Toro, Kubota, Bobcat, Alamo, Salford, Orthman, Evers Agro, Kondex, Lemken, Bucher, Rata Industries, Northstar Attachments, Kenney Machinery, and Briggs & Stratton. These companies focus on product development, technological advancements, and strategic partnerships to expand market share. Deere and Toro lead with high-performance equipment and precision aerators, while Kubota and Bobcat are recognized for their versatile and cost-effective solutions. Strategic initiatives such as mergers, acquisitions, and regional partnerships strengthen distribution networks and support market penetration. Additionally, investments in R&D enable manufacturers to offer mechanical and pneumatic aerators compatible with varying soil types and farm sizes. The competitive landscape is shaped by product innovation, regional expansion, and a focus on sustainable and efficient soil management, driving continuous market growth and differentiation among key players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toro

- Kubota

- Evers Agro

- Alamo

- Bobcat

- Salford

- Orthman

- Deere

- Kondex

- Lemken

Recent Developments

- In January 2024, Z Turf Equipment launched the “Z-Aerate 50” a multifunctional soil aerator with a 50-inch, 12-row aeration head capable of aerating up to three acres/hour and featuring a built-in broadcast spreader for simultaneous granular material application.

- In July 2023, John Deere acquired Smart Apply, Inc., expanding its offerings related to precision sprayers and supporting aeration / agricultural-equipment synergies.

- In March 2023, Bobcat launched a new line of turf-aerators (among other turf-maintenance equipment) targeting the Europe, Middle East & Africa (EMEA) market.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mechanism, Price, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of mechanized farming will continue to drive demand for soil aerators globally.

- Technological innovations in mechanical and pneumatic aerators will enhance efficiency and precision.

- Integration with GPS and IoT-enabled precision agriculture systems will increase market penetration.

- Medium-priced soil aerators will remain preferred among small and mid-sized farms.

- Sustainable agriculture practices will support the use of soil aerators for improved soil health.

- Expansion in emerging economies will create new growth opportunities for manufacturers.

- Strategic partnerships and regional distribution networks will strengthen market presence.

- Manufacturers will focus on durable and versatile equipment suitable for diverse soil types.

- Increasing awareness about soil productivity and crop yield optimization will boost adoption.

- R&D investments will drive product innovation and competitive differentiation in the market.